August 2024

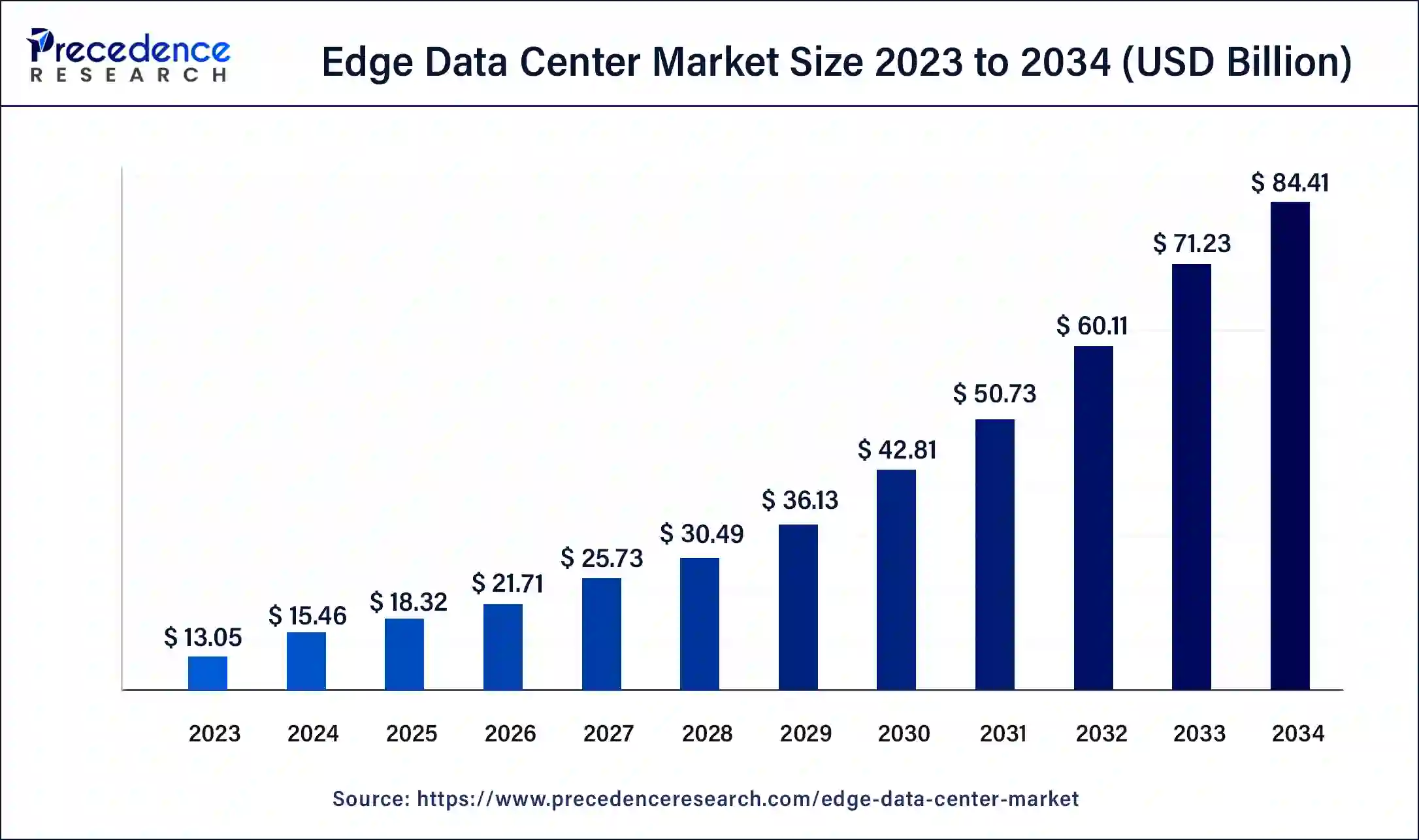

The global edge data center market size was USD 13.05 billion in 2023, calculated at USD 15.46 billion in 2024 and is projected to surpass around USD 84.41 billion by 2034, expanding at a CAGR of 18.5% from 2024 to 2034.

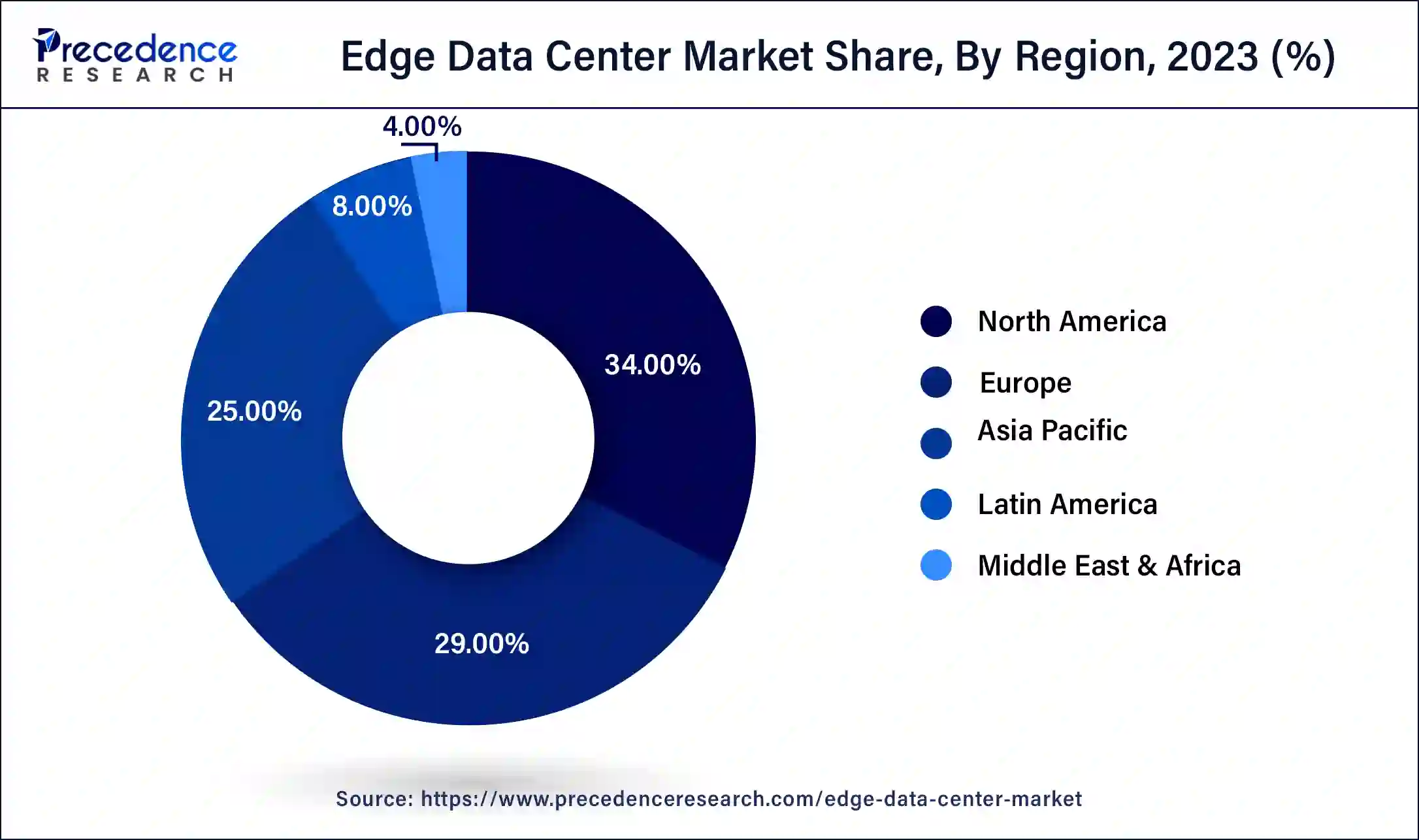

The global edge data center market size accounted for USD 15.46 billion in 2024 and is expected to be worth around USD 84.41 billion by 2034, at a CAGR of 18.5% from 2024 to 2034. The North America edge data center market size reached USD 4.44 billion in 2023.

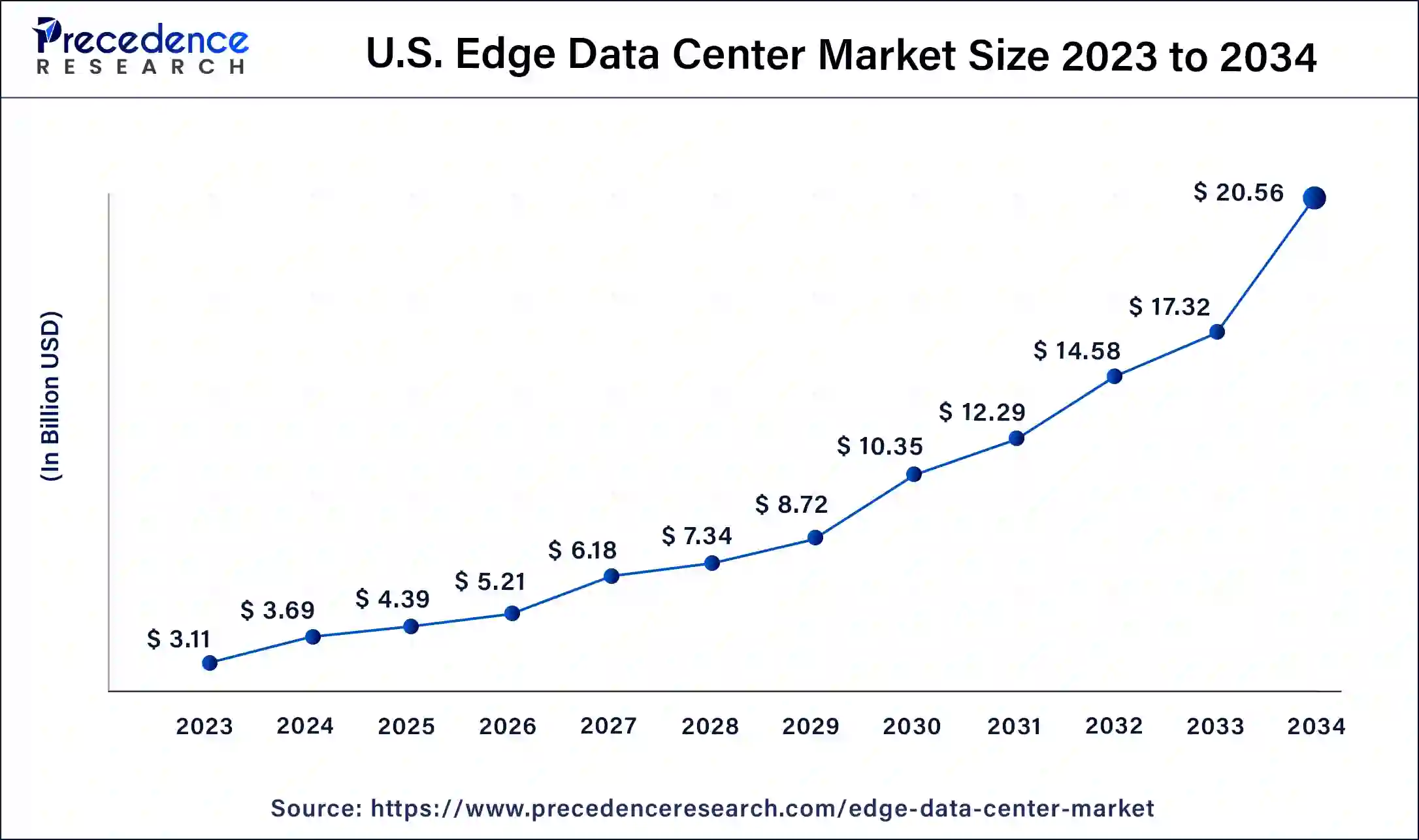

The U.S. edge data center market size was estimated at USD 3.11 billion in 2023 and is predicted to be worth around USD 20.56 billion by 2034, at a CAGR of 18.7% from 2024 to 2034.

North America has the largest market share of 34% in 2023. The primary driver of the market expansion in this area is the increased uptake of edge data center services and solutions. North America is a potential location for the market since it also includes well-known edge data center solutions and service providers. Due to the increasing commercialization and rollout of 5G networks, the region is probably going to experience rapid growth. The expansion of edge data centers in North America is ascribed to several factors, including the necessity of supporting upcoming technologies like 5G, internet of things (IoT), and artificial intelligence (AI), which require high bandwidth connections and low latency. By providing end users with direct access to data processing and storage capabilities, edge data centers may significantly improve application and service performance by reducing latency.

Besides, the Asia Pacific is expected to grow at the fastest CAGR during the forecast period. The expansion of end-use sectors, the surge in IT sector investments, and the increasing number of edge computing firms like Huawei Technologies Co., Ltd. and Fujitsu are driving this region's market for edge data centers. The Asia Pacific region's massive population and fast urbanization are two of the main factors driving the deployment of edge data centers in the area. As more people move into cities and choose digital services, there is an increasing need for faster and more reliable connectivity. By putting storage and processing capacity closer to end users, cutting latency, and enhancing the quality of software and services, edge data centers can meet demand.

The edge data center market offers facilities that are designed to process and store data closer to the location where it is generated, rather than relying on a centralized data center. The concept of edge computing involves bringing computing resources closer to the "edge" of the network, where data is generated and used, to reduce latency, improve performance, and enhance the overall efficiency of data processing. Edge Data Centers are particularly well-suited for applications that require real-time processing, such as autonomous vehicles, smart cities, industrial automation, and healthcare applications. By distributing computing resources closer to where data is generated, edge data centers contribute to more efficient and responsive data processing, making them a critical component in the evolving landscape of computing infrastructure.

Growing digitalization in various industries

Strong data management infrastructure is now more important than ever as digital transformation is becoming a strategic necessity for companies across many industries. Digital tools and platforms are being used by several industrial sectors, including healthcare, for telemedicine, digital health records, and remote patient monitoring. This necessitates fast and reliable data services. Additionally, the retail industry is using digital platforms for inventory tracking, customer data management, and e-commerce. This is driving up the demand for edge data centers to handle and store data efficiently. Additionally, the manufacturing sector's rising embrace of Industry 4.0 methods and the increasing penetration of automated technologies and connected gadgets that produce massive volumes of data are helping to increase the edge data center market.

Security concerns and infrastructure challenge

Distributing data processing closer to the edge raises security concerns. Edge devices may be more vulnerable to physical attacks, and securing numerous distributed data centers poses additional challenges compared to a centralized cloud model. In addition, establishing edge data centers requires significant investment in physical infrastructure. The deployment and maintenance of these facilities can be complex, especially in remote or challenging locations. Thus, the security concern and infrastructure challenges might be a major restraining factors for the edge data center market over the forecast period.

The increasing proliferation of advanced technologies such as IoT, big data, and AI

The emergence of big data, AI, and IoT technologies has led to the creation of enormous amounts of data that need to be processed and analyzed quickly. This has increased the demand for edge data centers. Particularly, IoT devices constantly produce data that must be processed right away to maximize functionality and produce real-time insights. Furthermore, rapid data availability is necessary for AI and machine learning systems to facilitate effective learning and decision-making. In addition, growing big data applications in a variety of industries, including retail, healthcare, finance, and others, are having a beneficial effect on market expansion. Additionally, because edge data centers are close to the data sources, they are the best option for meeting these growing needs because they offer faster data processing rates and reduced latency. Thus, this is expected to offer an attractive opportunity for the edge data center market during the forecast period.

Based on the component, the solution segment led the edge data center market in 2023 with the largest share. Networking equipment, IT racks and enclosures, data center infrastructure management (DCIM) software, and data center analytics solutions are examples of hardware and software solutions included in the solution category. The need for edge data center solutions is being driven by several factors, including the introduction of next-generation DCIM services, the increase in data center workloads during COVID-19, and the requirement to increase data center energy efficiency. Hardware solutions are customized to meet the specific needs of a business and installed on-site or in a third-party data center. In edge data centers, the software controls and arranges processing and data storage. Applications that allow real-time data processing, data analytics tools, and software-defined networking systems can all fall under this category.

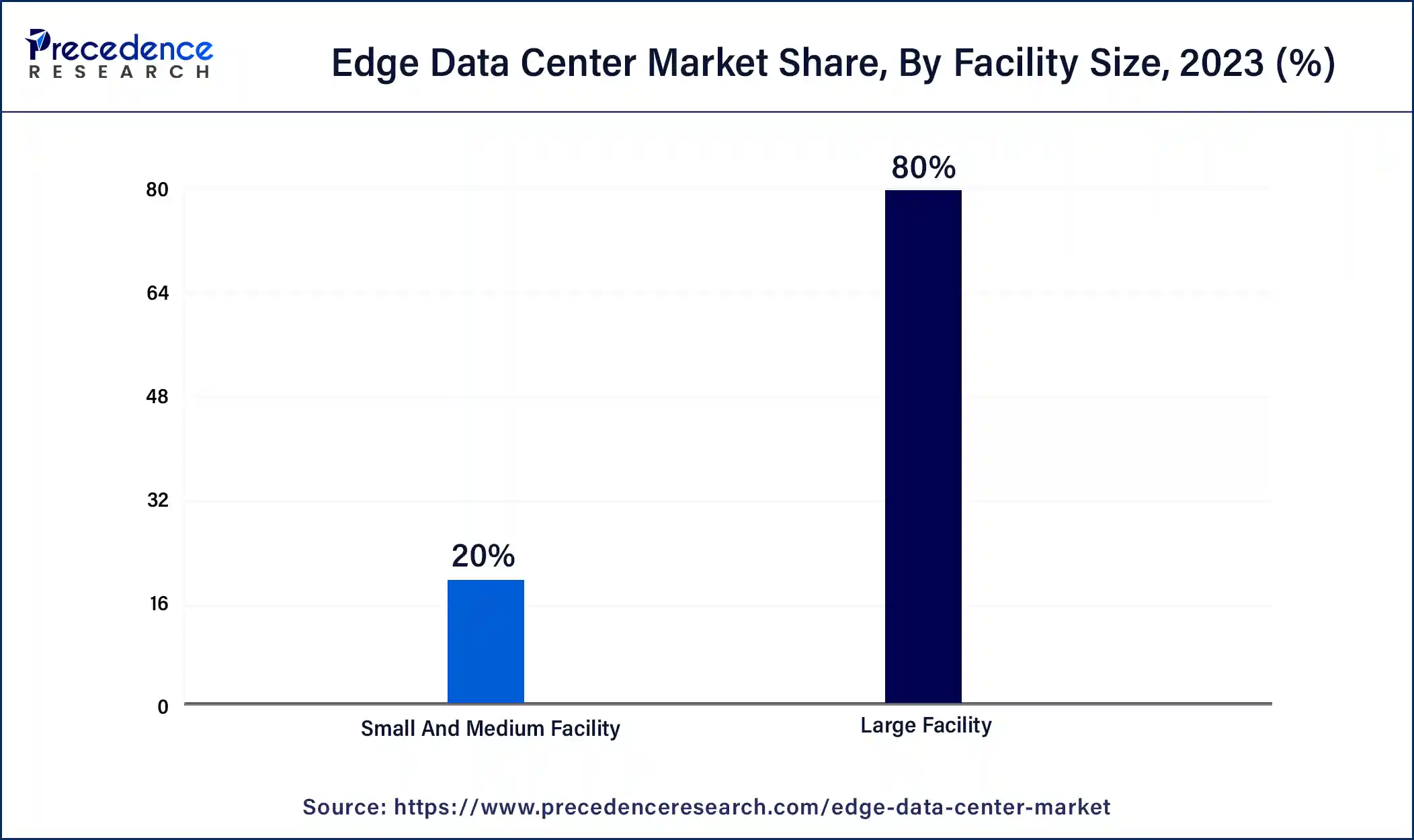

Based on the facility size, the large facility segment held the largest share of the edge data center market in 2023. Low-latency processing and storage capabilities closer to the source are becoming more and more necessary as a result of the explosive rise of data-intensive applications and technologies like 5G networks, AI, and the Internet of Things.

Simultaneously, a major growth-inducing element is the increasing adoption of products in small and medium-sized facilities to meet local or regional data processing requirements, enable quicker data processing, reduce network congestion, and enhance application performance. This is especially important for applications like smart cities, linked cars, and industrial automation that need real-time analytics, autonomous systems, and localized data storage. Additionally, the market is expanding due to the rising demand for cloud computing, streaming services, and content delivery.

Based on the end-use industry, the IT and telecom segment dominated the edge data center market in 2023. Growing to meet the demands of huge data processing and low latency in the IT & telecom industry. Technologies like IoT, 5G, augmented and virtual reality, and AI/ML have all contributed to this rise. Edge data centers are becoming more and more in demand as a result of the change that IT and telecom data centers are going through to accommodate low latency and high data volume requirements.

Besides, the manufacturing & automotive segment is expected to grow at a rapid rate over the forecast period in the edge data center market. The primary driver of the segment's growth is the automobile industry's growing embrace of technologies like edge computing and 5G, which can deliver mobile apps securely and dependably together with high bandwidth and low latency. Edge data centers provide real-time monitoring and control of linked equipment and systems, which advances automation in the automotive and industrial industries. This can enhance safety, boost productivity, and get rid of human mistakes. The automotive and industrial sectors can benefit from enhanced supply chain management through the use of edge data centers. For instance, by analyzing data from sensors and other connected devices in real-time, edge data centers may offer insights into the location of various objects, their condition, and performance, enabling businesses to optimize logistics and reduce cost.

Segments Covered in the Report

By Component

By Facility Size

By End-use Industry

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024

September 2024

March 2025

April 2025