January 2025

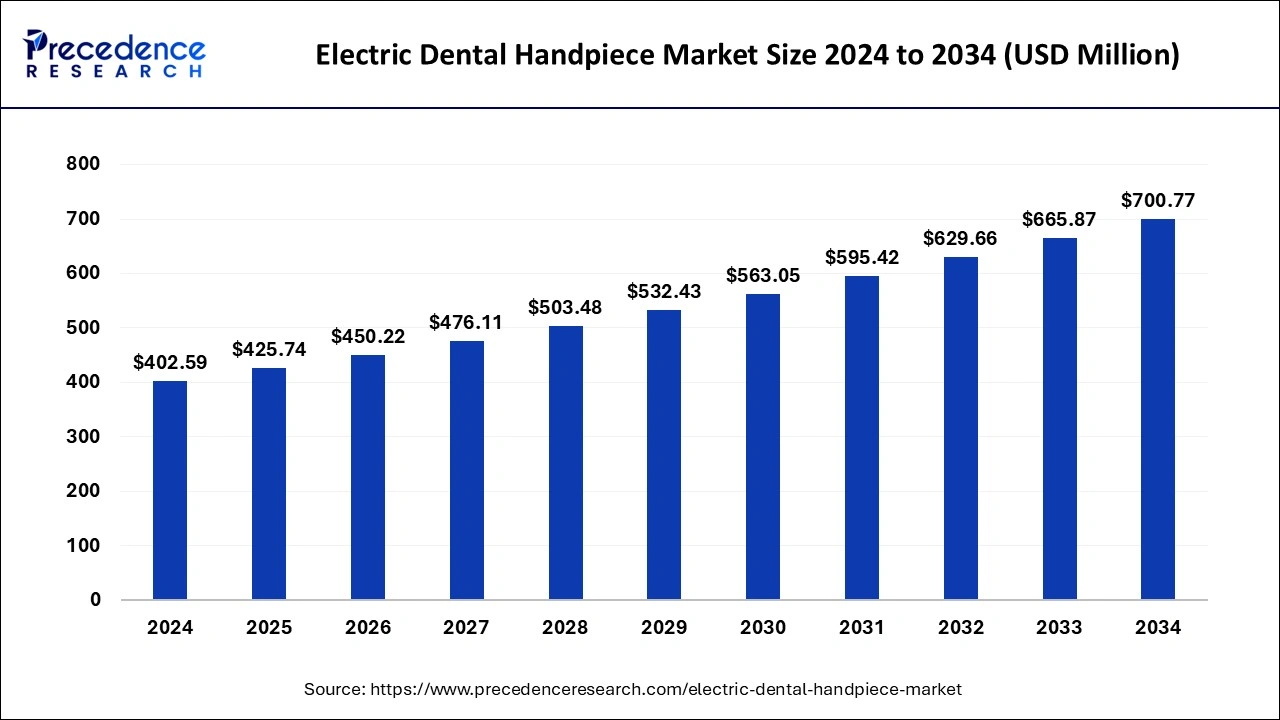

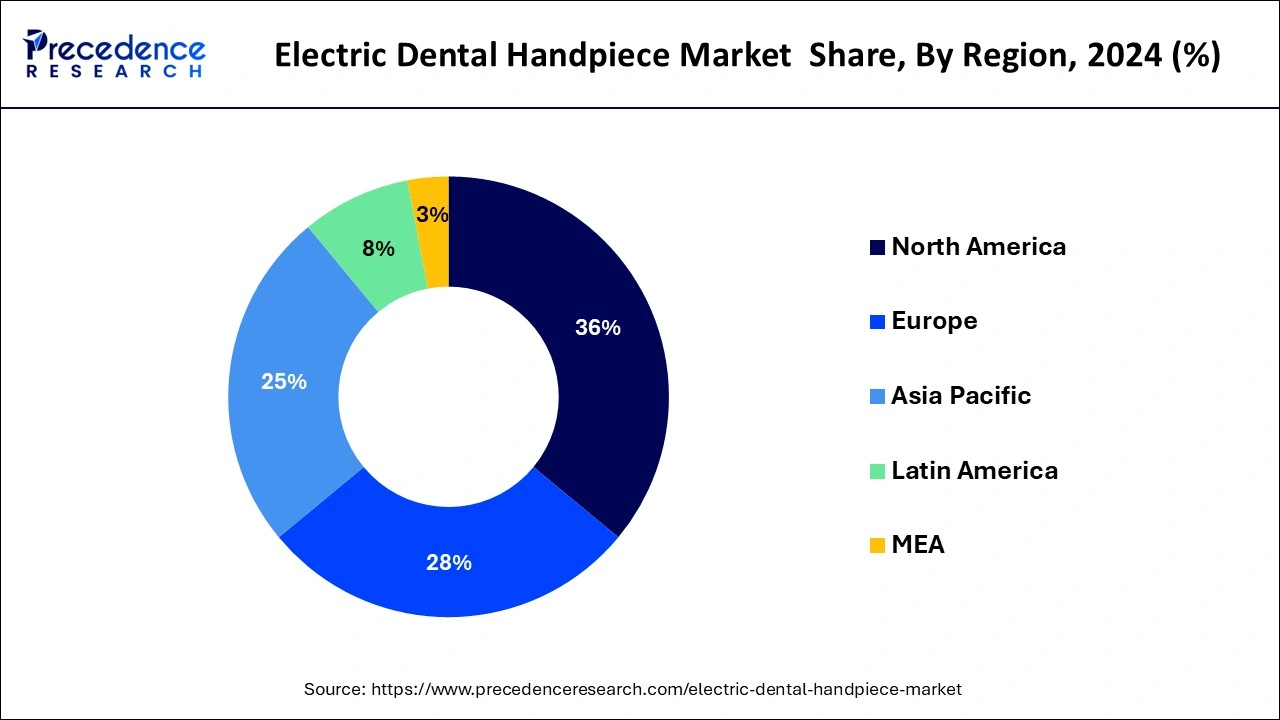

The global electric dental handpiece market size is calculated at USD 425.74 million in 2025 and is forecasted to reach around USD 700.77 million by 2034, accelerating at a CAGR of 5.70% from 2025 to 2034. The North America electric dental handpiece market size surpassed USD 144.93 million in 2024 and is expanding at a CAGR of 5.73% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global electric dental handpiece market size was valued at USD 402.59 million in 2024 and is anticipated to reach around USD 700.77 million by 2034, growing at a CAGR of 5.70% from 2025 to 2034. Growing cases of periodontal diseases and optimal precision provided by the electric dental handpiece during dental surgeries is a key growth factor for the electric dental handpiece market.

Machine learning-based solutions make dental practices more accurate, time-effective, and dependable. A high level of dental care is achieved through adopting AI algorithms, which help control dental handpieces by varying the speed and the torque for every procedure. Such developments advance the general state of treatment and minimize or eliminate the effects of human factors to enhance patient safety. Furthermore, through the use of AI-based predictive analysis, dental professionals predict issues they are likely to encounter in the course of the treatments, thereby increasing efficiency and possible eradication of unnecessary demographics in the course of treatments.

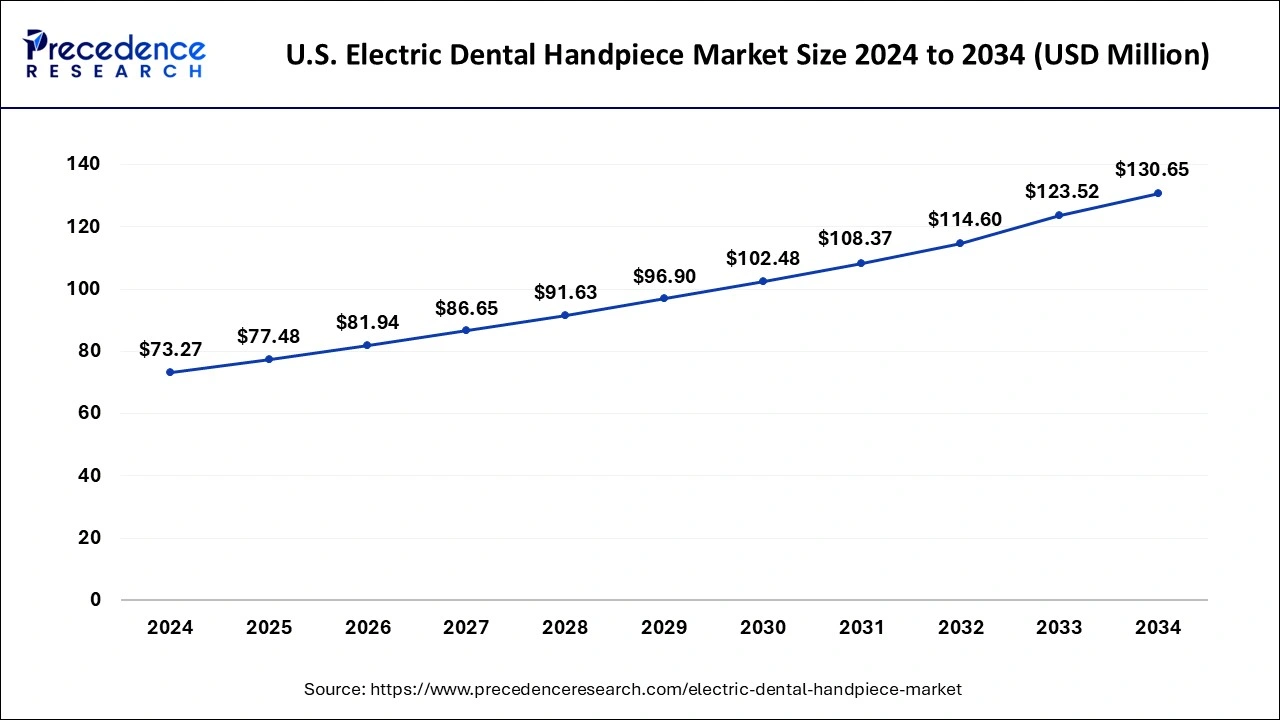

The U.S. electric dental handpiece market size reached USD 73.27 million in 2024 and is expected to be worth around USD 130.65 million by 2034 at a CAGR of 5.95% from 2025 to 2034.

North America dominated the market in 2024. The dental industry in this region is experiencing rapid growth due to several factors, including increasing patient numbers and higher healthcare spending by both the public and private sectors. Moreover, advancements in dental equipment technology, along with public awareness of the importance of oral hygiene, are driving market expansion. Furthermore, the growth of health insurance coverage and rising demand for dental care are expected to continue driving the electric dental handpiece market in North America.

Asia Pacific is expected to experience the fastest growth in the electric dental handpiece market, with Japan, India, and China leading the way. This growth is driven by the rising prevalence of dental issues and the expansion of healthcare infrastructure across the region. Governments in developing countries are also taking steps to establish new and advanced healthcare facilities to meet the needs of growing populations. As a result, there is a growing demand for innovative medical treatments, which is expected to further boost the electric dental handpiece market in Asia Pacific.

Electric dental handpieces are advanced tools used by dentists to perform various dental procedures with precision and control. They utilize electric motors connected to a shaft through gears and burs, which are responsible for the cutting process. These handpieces are versatile and can be employed in a wide range of dental procedures, including cleaning, polishing, restorative work, and endodontic treatments. While some handpieces are designed for specific tasks, such as surgical procedures, others are more general-purpose and can be used for routine dental care. Examples of complete handpieces include speed handpieces, electric handpieces, and surgical handpieces.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 5.70% |

| Global Market Size in 2025 | USD 425.74 Million |

| Global Market Size by 2034 | USD 700.77 Million |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | By Type, By Technology, and By End-use |

| Segments Covered | 2025 to 2034 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing demand for cosmetic dentistry

Cosmetic dentistry is experiencing rapid growth, emerging as the fastest-growing sector in the dental field. This surge is largely fueled by an increased desire among patients of all ages for cosmetic procedures. Millennials and baby boomers are particularly driving this demand, with millennials forming a significant portion of the demographic. Media, especially television, plays a significant role in shaping societal beauty standards, which influences the demand for aesthetic dental treatments. Furthermore, consumers are increasingly willing to invest in enhancing their appearance, driving the demand for various cosmetic dental services. The electric dental handpiece market is also propelled by the growing popularity of procedures such as implants, teeth whitening, veneers, orthodontics, and tooth-colored fillings, among others.

Slowdown in dental procedures during the pandemic

During the pandemic, there was a noticeable slowdown in the electric dental handpiece market to reduce the risk of viral transmission. Temporary closures of dental clinics, prompted by the virus's spread, indirectly led to a decline in non-essential dental treatments. Financial constraints and limited market players' ability to upgrade or innovate new dental devices can impact the market negatively. Additionally, dental professionals prioritized emergency and urgent care over non-urgent or elective. Procedures during this period resulted in reduced adoption of dental handpieces and directly affected market growth.

Rising number of dental practitioners across the globe

The growth of the global electric dental handpiece market will be propelled by an increasing number of dental practitioners in developed countries like Germany, France, Japan, and the US. This growth is attributed to the expansion of dental institutions and the prevalence of dental issues. Another notable trend in the market is the emergence of online sales channels, which are expected to gain prominence. Vendors are focusing on boosting sales through direct and online platforms, which reduces promotional and operational expenses. Many distributors are also opting for direct sales of electric dental handpieces via websites.

The high-speed handpieces segment dominated the electric dental handpiece market in 2024. High-speed handpieces are typically air-driven and can reach speeds ranging from 200,000 to 400,000 revolutions per minute (rpm). The speed of these handpieces is determined by factors such as the air pressure, turbine size, and turbine configuration, including the impeller, spindle, and bearings. Many manufacturers offer high-speed handpieces in both small and large head versions. Smaller versions are advantageous for better visibility and easier access, especially when treating children, while larger versions provide higher torque and better cutting power.

The low-speed handpieces segment is expected to witness the fastest growth over the forecast period. Low-speed dental handpieces are favored for many dental procedures over high-speed ones. Operating at speeds ranging from 100 to 40,000 revolutions per minute (rpm), low-speed electric dental handpieces find applications in dental caries, dental implants, prosthetics, endodontic removal, and prophylaxis.

The push-button dental turbine handpiece segment dominated the electric dental handpiece market in 2024. The push-button dental turbine handpiece is powered by high-speed compressed gas, rotating cutting burs at around 500,000 rotations per minute (RPM). It's commonly utilized for dental procedures like drilling and grinding on teeth. This handpiece is known for its lightweight design, comfort, reliability, and ease of use and maintenance.

The fiber optic led handpiece segment is projected to be the fastest growing over the projected period. These handpieces utilize optical fiber bundles to carry light from a source to the treatment area, enabling dental procedures to be performed faster and more efficiently. This setup not only reduces the risk of infection but also ensures clear visibility of the treatment area, aiding in precise dental work. With integrated LED illumination, the treatment area is well-lit, allowing for accurate diagnostics and procedural success, making it efficient light transmission facilitated by fiber optic technology.

The dental clinics segment dominated the electric dental handpiece market and is expected to sustain this position through the forecast period. This is because patients are drawn to clinics with skilled and professional staff who prioritize individual care and employ advanced dental instruments for treatments. These clinics offer cost-effective and efficient solutions, which drive market growth by emphasizing advancements and improved patient care.

The hospital segment is expected to grow rapidly during the period studied, given their size and multiple operation theaters, demand equipment in large quantities. With numerous wards, each containing over ten beds, hospitals are often the preferred choice for patients seeking diagnosis and treatment for health conditions. This preference for hospitals contributes significantly to the growth of this segment in the global electric dental handpiece market.

By Type

By Technology

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

January 2025

May 2024