April 2025

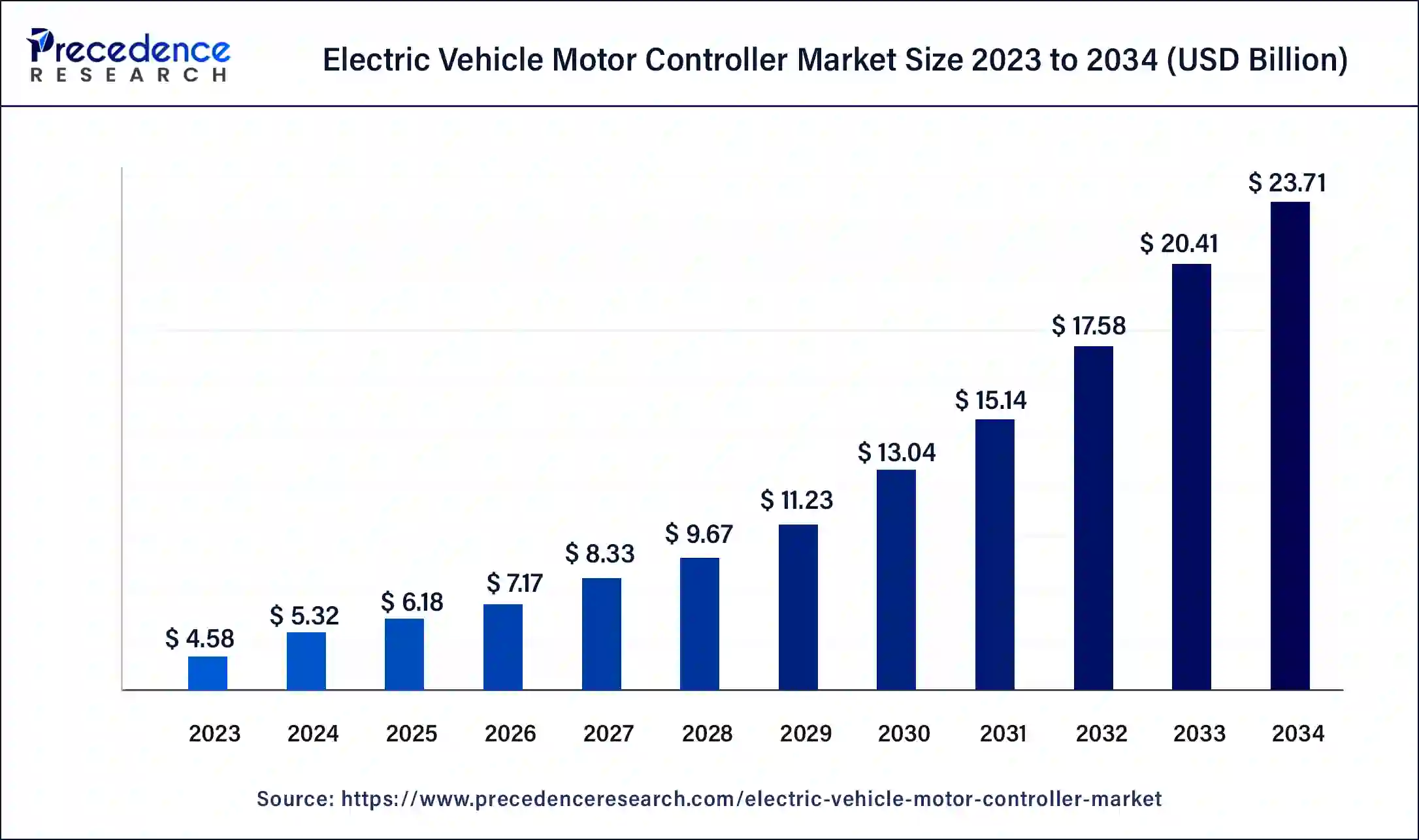

The global electric vehicle motor controller market size was USD 4.58 billion in 2023, calculated at USD 5.32 billion in 2024 and is expected to be worth around USD 23.71 billion by 2034. The market is slated to expand at 16.12% CAGR from 2024 to 2034.

The global electric vehicle motor controller market size is projected to be worth around USD 23.71 billion by 2034 from USD 5.32 billion in 2024, at a CAGR of 16.12% from 2024 to 2034. With the increasing adoption of EVs worldwide, the need for fuel-efficient engines for sustainable driving practices is the major driving factor of the electric vehicle motor controller market.

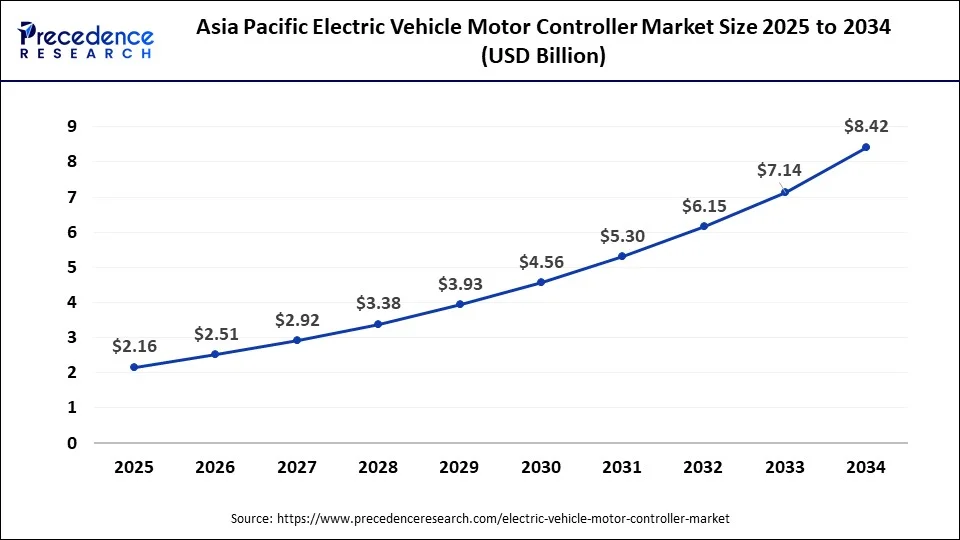

The Asia Pacific electric vehicle motor controller market size was exhibited at USD 1.60 billion in 2023 and is projected to be worth around USD 8.42 billion by 2034, poised to grow at a CAGR of 16.29% from 2024 to 2034.

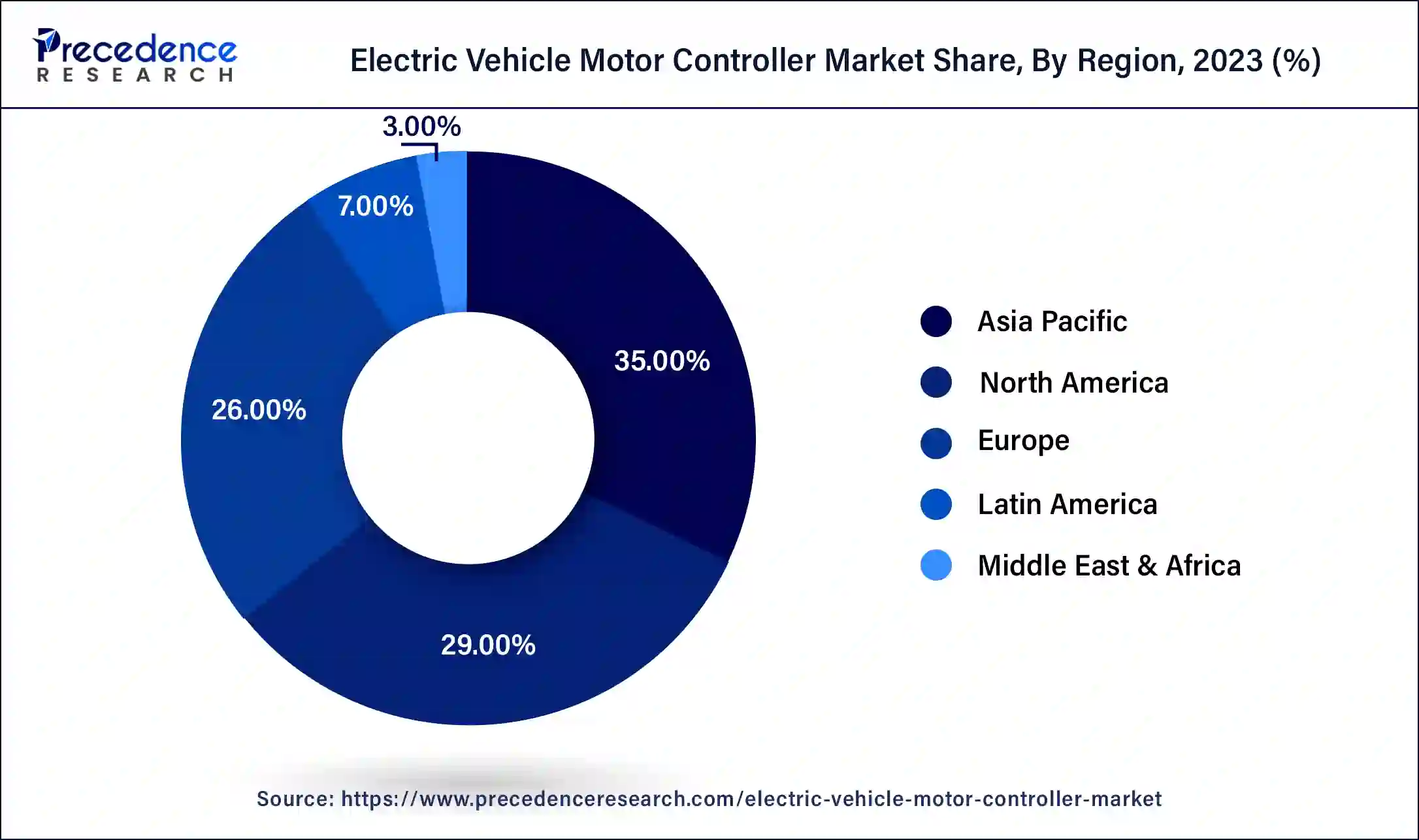

Asia Pacific dominated the electric vehicle motor controller market in 2023. Asia Pacific is experiencing rapid growth in the electric vehicle motor controller market due to proactive government initiatives and rapid urbanization. Countries like China, Japan, and South Korea offer substantial subsidies, tax incentives, and regulatory support to promote EV adoption. China's aggressive policies, including the New Energy Vehicle (NEV) mandate, significantly boost EV production and sales.

Additionally, the region's rapid urbanization and increasing environmental concerns drive demand for cleaner transportation alternatives. Major investments in EV infrastructure, such as widespread charging networks, also contribute to market expansion. The presence of leading EV manufacturers and a growing consumer base further accelerates the market's growth in the region.

North America is observed to grow at a significant rate in the electric vehicle motor controller market during the forecast period. North America dominates the electric vehicle motor controller market due to robust government support and significant technological advancements. The U.S. government, in particular, has implemented various policies and incentives to promote the adoption of electric vehicles (EVs). These include tax credits, grants, and subsidies for EV buyers and manufacturers, as well as investments in electric vehicle charging infrastructure. Programs like the Federal EV Tax Credit and state-specific incentives encourage consumers to purchase EVs, thereby driving market growth.

Additionally, North America is home to several leading technology companies and automakers that are at the forefront of EV innovation. Companies like Tesla, General Motors, and Ford invest heavily in research and development, creating cutting-edge motor controller technologies that enhance EV performance and efficiency. The region's strong emphasis on sustainability and reducing carbon emissions further propels the market. The presence of a well-established automotive industry, coupled with a supportive regulatory environment and a focus on technological advancements, positions North America’s notable growth in the upcoming years.

The global electric vehicle motor controller market is experiencing robust growth, driven by the rising adoption of electric vehicles (EVs) due to environmental concerns and regulatory mandates. Technological advancements in motor controllers enhance EV performance, efficiency, and reliability, attracting significant investments. Key players are focusing on innovation and strategic collaborations to expand their market presence.

Asia Pacific, led by China, dominates the electric vehicle motor controller market due to high EV production and sales, while North America and Europe follow. The market faces challenges such as high initial costs and complex technology. However, government incentives and advancements in semiconductor technology are expected to propel market growth in the coming years.

Role of Artificial Intelligence (AI) in Electric Vehicle Optimization

With the expanding implementation of artificial intelligence in overall every sector, the electric vehicle industry has also stepped ahead. The AI-based solutions are being heavily implemented in electric vehicles, especially into the motor optimization to improve the transformative capabilities of the vehicle.

AI tools, such as machine learning algorithms, can simulate and model the performance of various motor designs under different conditions. By analyzing vast datasets, AI can identify the most efficient motor designs, optimizing parameters like torque, efficiency, cooling, and weight. This results in motors that are better suited to specific vehicle types or driving conditions.

| Report Coverage | Details |

| Market Size by 2034 | USD 23.71 Billion |

| Market Size in 2023 | USD 4.58 Billion |

| Market Size in 2024 | USD 5.32 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 16.12% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product Type, Application, Power Output, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Government regulations and incentives

Governments worldwide are implementing stringent emission norms and offering substantial incentives to promote the adoption of electric vehicles (EVs). These measures aim to reduce carbon footprints and combat climate change. For instance, many countries offer tax rebates, grants, and subsidies to both manufacturers and consumers of EVs. Policies such as zero-emission vehicle mandates, fuel economy standards, and investment in charging infrastructure significantly boost the electric vehicle motor controller market.

In Europe, the EU Green Deal aims for zero emissions from new cars by 2035, while in the U.S., various states offer incentives and rebates. These regulatory frameworks and financial incentives lower the initial costs and ownership expenses of EVs, making them more attractive to consumers and manufacturers. This governmental support is a crucial driver, accelerating the shift towards electric mobility and spurring growth in the electric vehicle motor controller market.

Technological advancements

Rapid technological advancements in electric vehicle motor controllers are crucial drivers of the electric vehicle motor controller market growth. Innovations are focused on improving the efficiency, reliability, and performance of motor controllers, which are vital components in EVs. Advanced motor controllers offer better energy management, leading to extended battery life and enhanced vehicle range. Developments such as silicon carbide and gallium nitride semiconductors have significantly increased the efficiency and thermal performance of these controllers.

Moreover, advancements in software algorithms allow for more precise motor control, improving acceleration and overall drivability. Leading companies are investing heavily in research and development to introduce next-generation motor controllers that support higher voltages and currents, catering to the evolving demands of modern EVs. These technological improvements not only enhance the appeal and functionality of EVs but also reduce production costs over time, thereby driving the electric vehicle motor controller market.

Complexity of the technology

One of the major restraints in the electric vehicle motor controller market is the high initial costs and the complexity of the technology involved. Motor controllers for electric vehicles are sophisticated devices that require advanced materials and precision engineering. The use of cutting-edge components, such as silicon carbide and gallium nitride semiconductors, though beneficial for performance, significantly drives up manufacturing costs. Additionally, developing and integrating advanced software algorithms for optimal motor control further adds to the expense.

This high cost is a barrier for both manufacturers and consumers in the electric vehicle motor controller market. Manufacturers face increased production costs, which can affect their pricing strategies and profit margins. For consumers, the higher cost of EVs, partly due to expensive motor controllers, can deter adoption, especially in price-sensitive markets. Moreover, the complex technology requires specialized skills and knowledge for maintenance and repair, potentially limiting widespread adoption. Addressing these challenges of cost and complexity is essential for the broader acceptance and growth of the electric vehicle motor controller market.

Expansion in emerging markets

Emerging economies like China, India, and Southeast Asian countries present significant growth opportunities for the electric vehicle motor controller market. With rapid urbanization, increasing disposable incomes, and growing environmental awareness, these regions are witnessing a surge in EV adoption. Government initiatives in these countries, such as subsidies, tax incentives, and infrastructure development for EVs, further bolster market growth.

China's aggressive policies and substantial investments in EV infrastructure have positioned it as a global leader in EV adoption. Similarly, India's FAME (Faster Adoption and Manufacturing of Hybrid and Electric Vehicles) scheme aims to accelerate EV penetration. These emerging markets, with their large consumer bases and supportive regulatory frameworks, offer a fertile ground for the expansion of electric vehicle motor controllers, driving global market growth.

Advancements in autonomous vehicles

The development and adoption of autonomous vehicles (AVs) create a significant opportunity for the electric vehicle motor controller market. AVs rely heavily on sophisticated motor controllers for precise navigation, acceleration, and braking. As AV technology evolves, the demand for advanced motor controllers with high efficiency and reliability increases. Companies are investing in research and development to create motor controllers that can handle the complex requirements of autonomous driving.

Enhanced features such as real-time data processing, improved safety mechanisms, and seamless integration with autonomous systems are crucial. With major automotive and tech companies like Tesla, Waymo, and Uber pushing the boundaries of AV technology, the rising interest and investments in autonomous vehicles present a lucrative opportunity for growth in the electric vehicle motor controller market.

The AC permanent magnet synchronous motor controller segment held a substantial share of the electric vehicle motor controller market in 2023. These controllers are specifically manufactured for Permanent magnet synchronous motors; hence, they provide precise control with high efficiency. These product types have enhanced efficiency and smooth power supply capabilities that are ideal for electric cars.

The DC motor controller segment is expected to grow at the fastest growing rate in the electric vehicle motor controller market during the forecast period. The DC motor controller segment is experiencing rapid growth due to increasing demand for precise control in various applications such as automotive, robotics, and industrial automation. Advances in technology and the need for energy-efficient, high-performance solutions are driving this expansion, enhancing operational efficiency and performance.

The full hybrid electric vehicle segment dominated the global electric vehicle motor controller market in 2023. The growth of this segment is attributed to the fuel-efficient factors provided by full hybrid electric vehicles. These vehicles are manufactured with electric motors, built-in batteries, and ICE-internal combustion engines. It helps the engine accelerate at a higher rate and drive at a relatively slower speed, which in turn enhances fuel efficiency.

The mild hybrid electric vehicles segment is expected to witness notable growth in the global electric vehicle motor controller market during the forecast period. The mild hybrid electric vehicle (MHEV) segment is showing notable growth due to its ability to offer enhanced fuel efficiency and reduced emissions without the high cost of full hybrid or electric vehicles. MHEVs combine a small electric motor with a traditional internal combustion engine, providing improved power performance and reduced fuel consumption. Additionally, government incentives and stricter emissions regulations are encouraging the adoption of MHEVs. Their affordability, coupled with the growing consumer demand for greener technologies, drives the segment's expansion in the automotive market.

The 41-80kW segment held the largest share of the electric vehicle motor controller market in 2023. The 41 to 80 kW power output segment dominates the market due to its optimal balance between power and efficiency, making it ideal for a wide range of applications. This power range is suitable for various vehicles, including compact cars and light commercial vehicles, offering enough performance while maintaining fuel efficiency and lower emissions. Additionally, the cost-effectiveness of engines within this range, combined with regulatory support for efficient technologies, reinforces its strong market presence.

The above 80kW segment is expected to grow at the fastest growing rate in the electric vehicle motor controller market during the forecast period. The above 80 kW power output segment is growing rapidly due to increasing consumer demand for high-performance vehicles and advancements in technology. These engines offer superior power and efficiency, meeting the needs of premium and performance-oriented models. The rise in electric and hybrid vehicles also contributes to this growth, as higher power outputs enhance the driving experience and vehicle capabilities, aligning with evolving automotive trends and regulations.

Recent Developments

Segments Covered in the Report

By Product Type

By Application

By Power Output

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

January 2025

January 2025

September 2024