December 2024

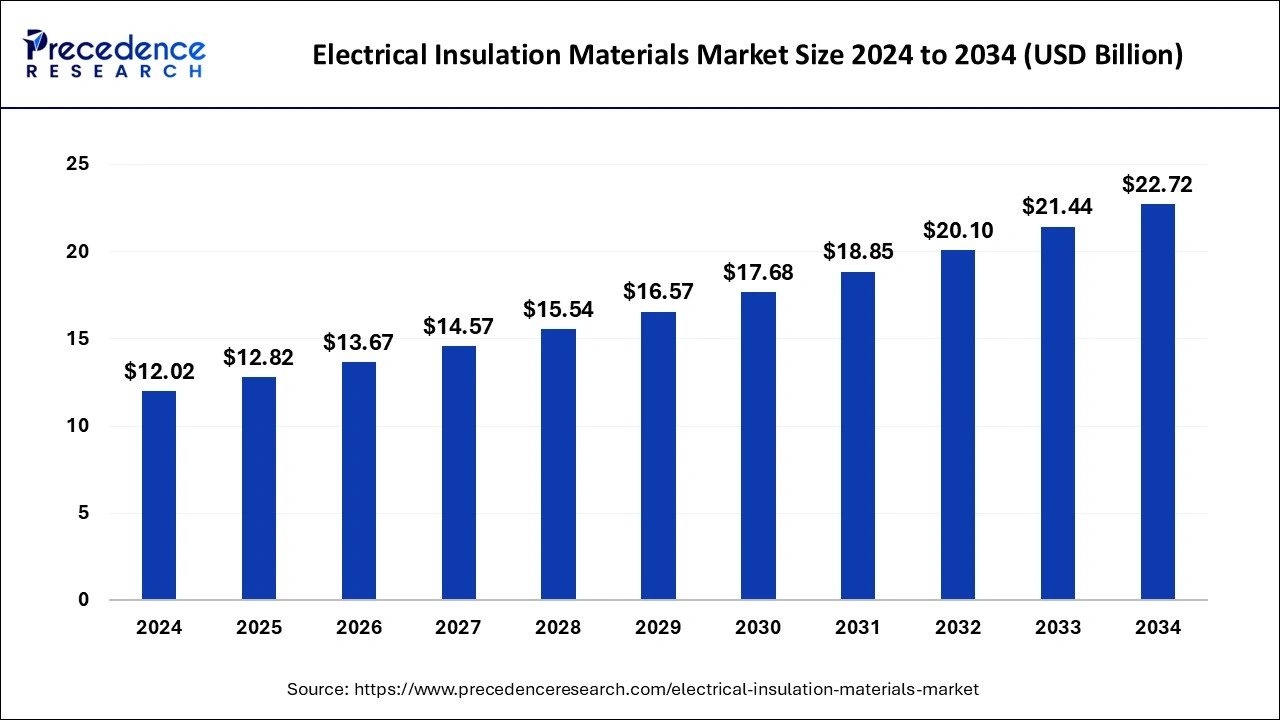

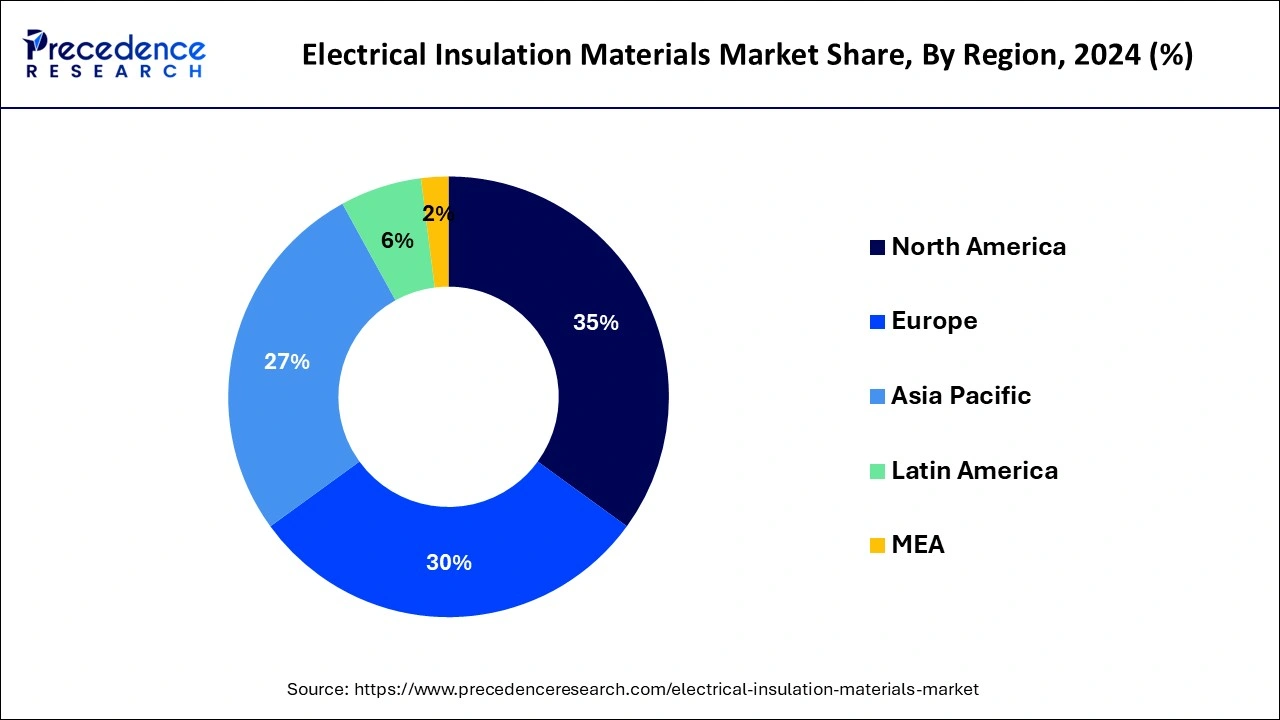

The global electrical insulation materials market size is calculated at USD 12.82 billion in 2025 and is forecasted to reach around USD 22.72 billion by 2034, accelerating at a CAGR of 6.57% from 2025 to 2034. The North America electrical insulation materials market size surpassed USD 4.21 billion in 2024 and is expanding at a CAGR of 6.58% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global electrical insulation materials market size was valued at USD 12.02 billion in 2024 and is anticipated to reach around USD 22.72 billion by 2034, growing at a CAGR of 6.57% from 2025 to 2034. The expansion of power-producing industries and the rise in global electricity consumption are major growth factors in the electrical insulation materials market.

AI technologies are revolutionizing the electrical insulation materials market. Integrating AI technologies in the manufacturing processes of insulation materials significantly enhances the quality of materials by improving the quality control process. AI-driven technologies automate manufacturing processes and reduce errors, enhancing production efficiency. AI also helps in developing better insulation materials that meet stringent regulations.

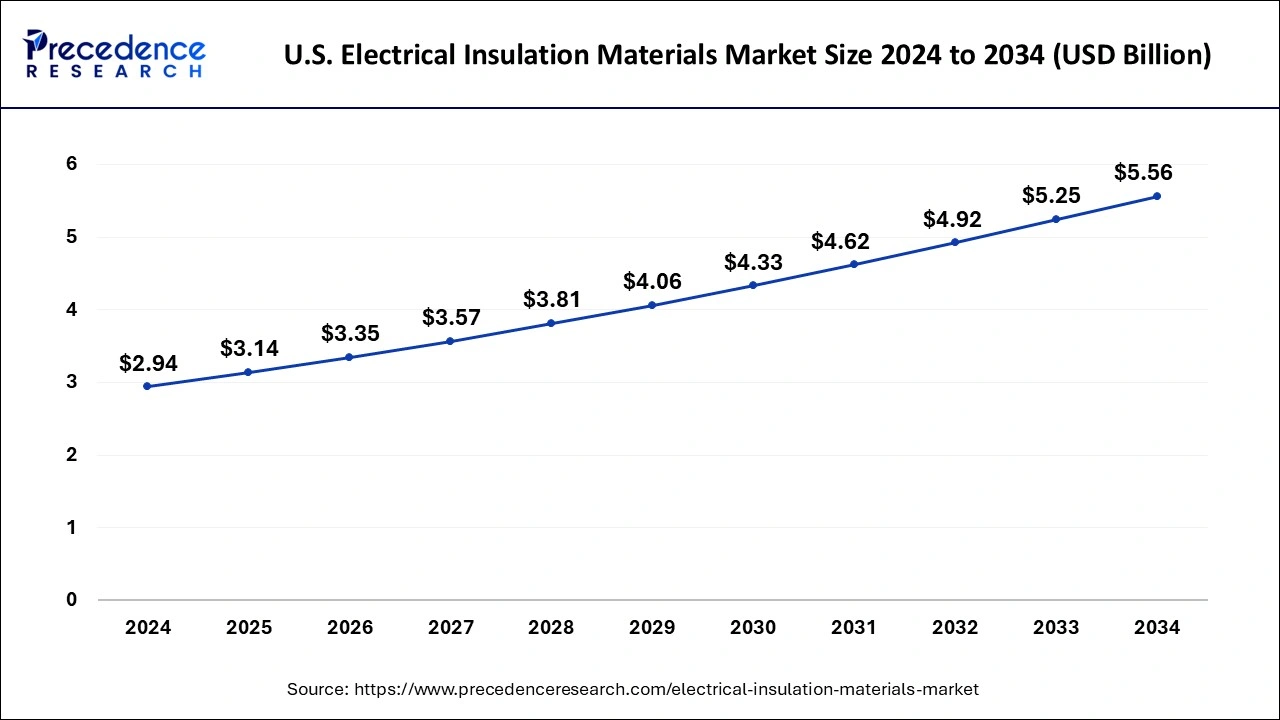

The U.S. electrical insulation materials market size was estimated at USD 2.94 billion in 2024 and is projected to surpass around USD 5.56 billion by 2034 at a CAGR of 6.60% from 2025 to 2034.

Considering North America, the U.S. was estimated to be the largest contributor to the electrical insulation materials market in 2024. The United States is ready to witness growing infrastructure investments, with a focus on innovating its old electrical grids and expanding its energy resources. These will also fuel the demand for advanced electrical insulation materials. Moreover, the rising emphasis on energy efficiency combined with the market's rising focus on environment-friendly insulation solutions can drive market growth.

Asia Pacific is expected to show notable growth in the global market during the projected period. The region's growth is fueled by rapid urban development, rising energy usage, and the expansion of electrical infrastructure. Increased demand for high-voltage equipment, renewable energy initiatives, and advancements in technology are driving market growth. Moreover, strict safety standards and the requirement for dependable power distribution systems are also contributing to the demand for effective electrical insulation materials in the region.

Electrical insulation materials are barriers for electric current, stopping it from flowing where it shouldn't and ensuring electrical systems work safely and efficiently. These materials have special qualities like being strong against electricity, not conducting electricity well, and staying stable even at high temperatures. They're important because they keep wires and parts separate, preventing problems like short circuits or leaks. Plus, they can handle changes in temperature, exposure to chemicals or water, and physical stress.

Electrical insulation materials are crucial in many areas, from transmitting power to electronics, cars, and planes, making sure electricity works reliably, and protecting people and equipment from electrical dangers. Surge protection devices are also important, they're guards that shield electrical setups from sudden changes in voltage, and they use insulation materials to do their job. Most of the materials used in these devices are also common in household applications.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 6.57% |

| Global Market Size in 2025 | USD 12.82 Billion |

| Global Market Size by 2034 | USD 22.72 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Type and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising interest in electric cars

Electrical insulation materials play a crucial role in electric vehicles (EVs) by shielding electronic parts and reducing electrical conductivity. The demand for EVs is rising due to the focus on fuel efficiency, emissions targets, and shifting consumer preferences toward sustainability. These materials are essential as they prevent electricity from leaking out of power lines, thereby averting potentially catastrophic electric shocks. This creates a steady demand for the electrical insulation materials market.

Each year, electric shocks cause nearly 1,000 fatalities in the United States alone, leading to severe conditions like brain paralysis and heart muscle failure. Also, increased government investment in electric infrastructure construction, such as poles, towers, switches, and transformers, is driving the growth of the electrical insulation materials market.

Stringent government regulations

The growth of the electrical insulation materials market is impeded due to strict environmental regulations and sustainability concerns. Industries are focusing more on adopting environmentally friendly practices and materials as general awareness related to environmental issues intensifies. This shift leads to the limited use of insulation materials, which contain hazardous chemicals and have a negative ecological impact globally during generation, use, or disposal.

Materials used for electrical insulation production include ceramics, mica, cellulose, and others. Some of them are crude oil-based products; hence, their high cost can also affect the manufacturing of electrical insulators, which can hamper the growth of the electrical insulation materials market.

Rapid urbanizations

The electrical insulation materials market is experiencing growth due to rapid urbanization and the expansion of construction industries. North America and Europe are expected to see increased demand for re-insulation, which boosts market growth globally. The expansion of transmission and distribution networks is also driving market growth, as these networks facilitate the smooth flow of electricity through various devices like generators and transformers.

Another significant factor contributing to the growth of the electrical insulation materials market is the rise in production and adoption of protection devices. Moreover, the expansion of power generation sectors and the growing use of electricity worldwide are also fueling demand for electrical insulation materials.

The thermoplastic segment dominated the electrical insulation materials market share in 2023 and is expected to continue this dominance over the forecast period. These materials can be molded into different shapes and extruded into films and fibers. This is because of the physical properties of these materials, such as low melting point, moldable, flexible, strong, recyclable, and durable. Examples of thermoplastic materials are polyesters, polyvinyl chloride, polyamides, polyethylene, and polystyrene.

The power transformers segment dominated the electrical insulation materials market in 2024 and is predicted to grow at a lucrative pace over the forecast period. This is attributed to rising infrastructural spending, increasing investment by market players in the expansion of transmission, and growing electricity demand. Additionally, the increase in focus on renewable electric power generation and the replacement of current old power transformers are some major factors anticipated to fuel segment growth over the forecast period.

In the electrical insulation materials market, the electrical motors and generators segment is expected to show notable growth during the projected period. The rise in supply and demand for electricity is augmenting the segment's growth. Also, the improved efficiency and inexpensive services provided by electric generators are boosting the segment's growth further during the forecast period.

By Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

December 2024

November 2024

August 2024

September 2024