February 2025

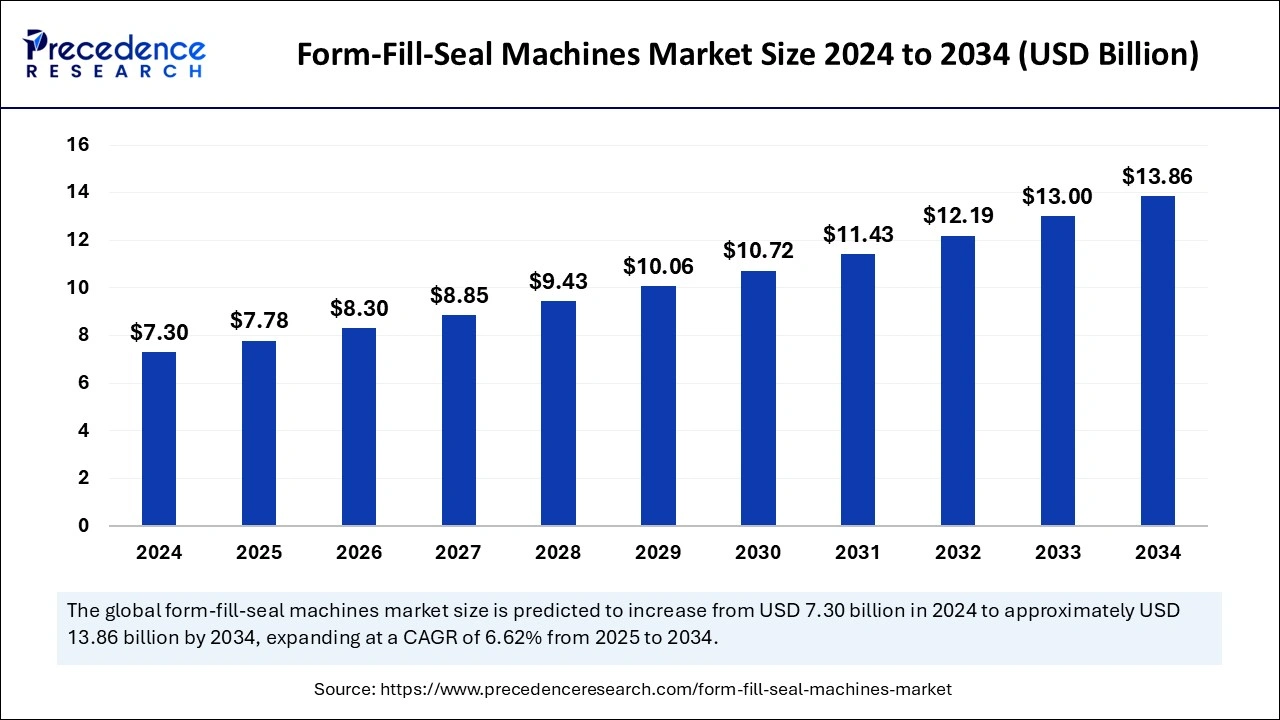

The global form-fill-seal machines market size is calculated at USD 7.78 billion in 2025 and is forecasted to hit around USD 13.86 billion by 2034, representing a CAGR of 6.62%% from 2025 to 2034. The Asia Pacific market size was estimated at USD 2.70 billion in 2024 and is expanding at a CAGR of 6.77% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global form-fill-seal machines market size accounted for USD 7.30 billion in 2024 and is predicted to increase from USD 7.78 billion in 2025 to approximately USD 13.86 billion by 2034, expanding at a CAGR of 6.62% from 2025 to 2034.The rising consumer demand for packaged products across many industries is the key factor driving market growth. Also, the increasing demand for automation in packaging processes coupled with the escalating trend towards smaller portions can fuel market growth further.

Artificial intelligence in industrial engineering uses deep learning to improve overall process efficiency, decrease downtime, and optimize real-time decisions. Furthermore, AI in additive production processes identifies detection, improves real-time monitoring, and facilitates processes through Machine Learning techniques. It enables predictive maintenance and design automation, enhancing quality, scalability, and efficiency.

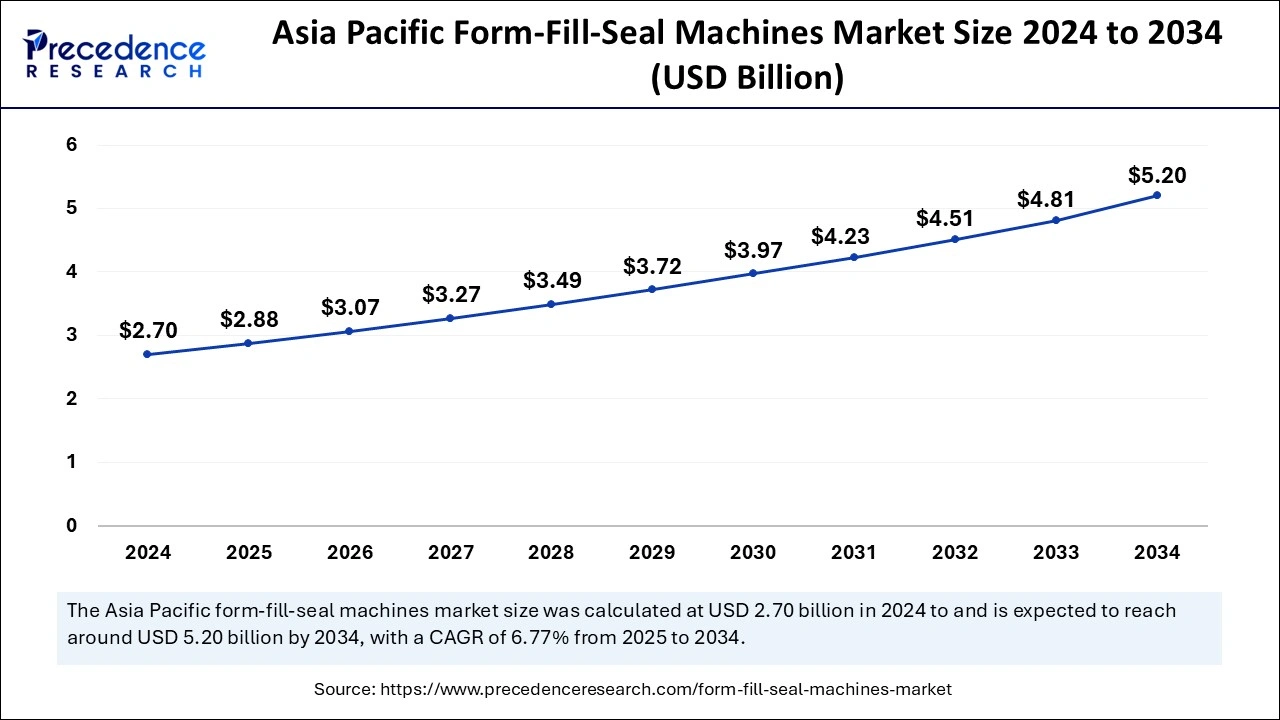

The Asia Pacific form-fill-seal machines market size was exhibited at USD 2.70 billion in 2024 and is projected to be worth around USD 5.20 billion by 2034, growing at a CAGR of 6.77% from 2025 to 2034.

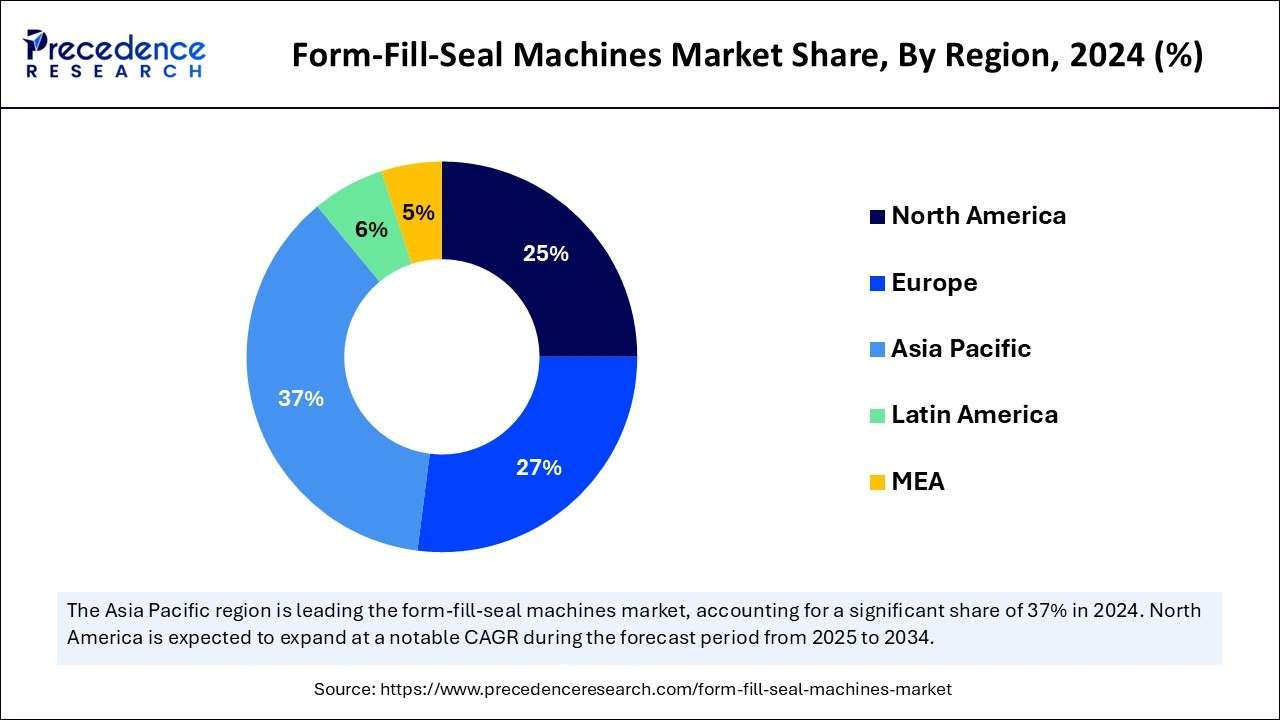

Asia Pacific dominated the global form-fill-seal machines market in 2024. The dominance of the region can be attributed to rapid urbanization and industrialization, along with the increasing demand for packaged food and beverages. Also, innovations in automation and packaging technology are improving production efficiency. Moreover, the increasing disposable incomes and the region's huge populations contribute to the need for convenient packaging solutions, impacting market growth positively.

North America is expected to grow at the fastest rate in the form-fill-seal machines market over the studied period. The growth of the region can be credited to the booming beverage and food industry. The rising consumer preferences for ready-to-eat products and convenient food are impelling market players to invest in innovative packaging solutions. In North America, the U.S. led the market owing to the advancements in sustainable packaging materials.

Form fill seal (FFS) is a small machinery that is made with a flat type of plastic that involves polypropylene and polyethylene sheets to manufacture packaging products like pouches. This equipment depends on computer-operated technology for manufacturing various packages and decreasing the prevalence of contamination during the production process. It has low operational costs and provides product information utilizing film printing. The form-fill-seal machines market services are largely utilized in the food and beverage industry for the packaging of extruded snack food, beverages, granulates, and spices.

| Report Coverage | Details |

| Market Size by 2034 | USD 13.86 Billion |

| Market Size in 2025 | USD 7.78 Billion |

| Market Size in 2024 | USD 7.30 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.62% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Packaging,Technology, End use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Increasing sustainable packing solutions

Regulatory authorities and consumers across the globe are concerned regarding the environmental effects of packaging waste. Hence, there is an increasing preference for sustainable packaging designs and materials. The form-fill-seal machines market is leveraging this trend by integrating features that facilitate the use of eco-friendly materials, decreasing overall packaging waste. Market players are heavily investing in FFS machines that can work with biodegradable films.

Incompatibility with other material

There is a certain limitation to the material handled by these machines, which is the major factor hampering the form-fill-seal machines market. Paper is the most significant incompatible material. However, sustainability is a key concern in the packaging industry. There are rising sanctions and disdain over the utilization of plastic. Also, form-fill-seal machines are not suitable for liquid packaging. Therefore, a vast majority of the food market is deducted from the customer base.

Application in the pharmaceutical sector

Just like the food and beverage items, there is a strong focus on decreasing pollutants during the packaging process for pharmaceutical products. Hence, form-fill machines are appropriate for this purpose. Furthermore, pharmaceutical products such as capsules, powders, and tablets are increasingly being packaged with the help of these machines. FFS machines are also used in the pharmaceutical industry to package IV infusion bottles.

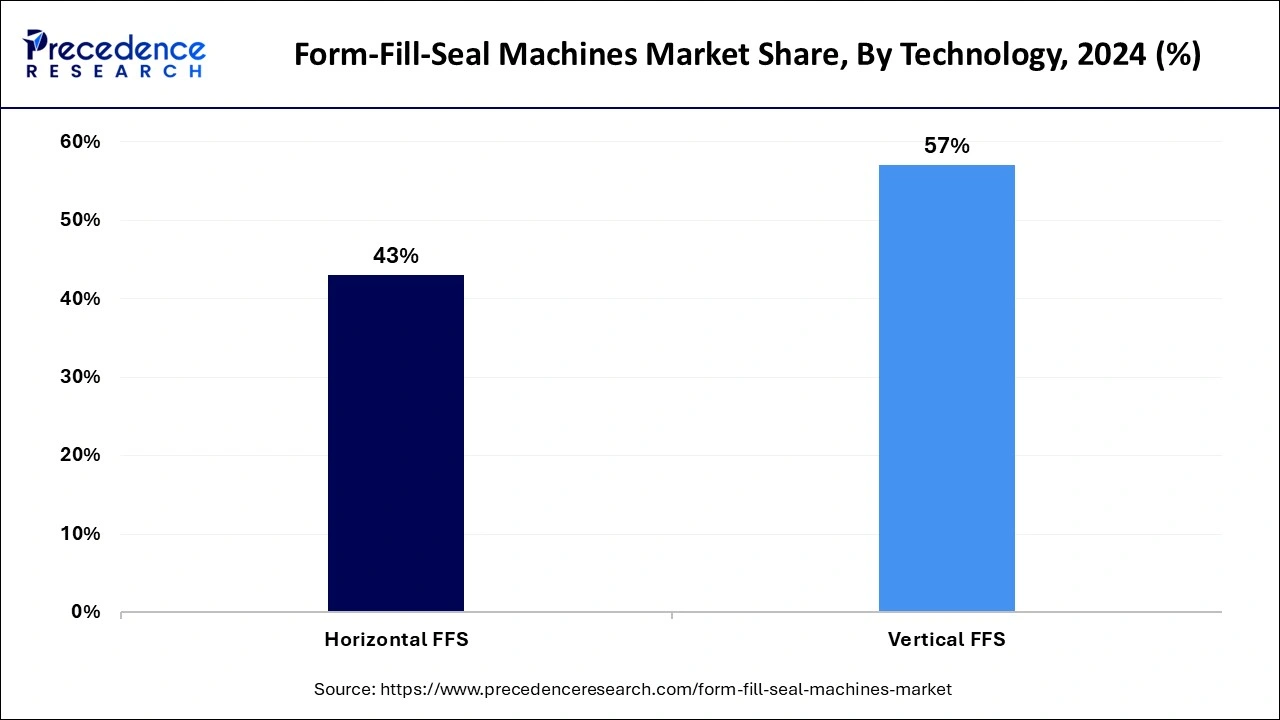

The vertical form-fill-seal (VFFS) segment dominated the form-fill-seal machines market in 2024. The dominance of the segment can be attributed to their versatility and cost-effectiveness. Also, these machines are proffered for their capability to offer superior protection against moisture, oxygen, and UV light, which makes them crucial for packaging consumer goods and food products. Additionally, the increasing need for automation in many industries improves their appeal further in the market.

The horizontal form-fill-seal (HFFS) is anticipated to grow at the fastest rate over the forecast period. The growth of the segment can be linked to the increasing use of HFFS machines in various sectors due to their efficiency and speed. These machines are favored for their ability to handle various packaging types, such as heavy bags and stand-up pouches, making them convenient for an extensive range of applications.

The bags and pouches packaging type segment held the largest share of the form-fill-seal machines market in 2024. The segment's dominance can be credited to the growing consumer preference for economical and lightweight packaging solutions. In addition, the demand for retort pouches and stand-up pouches has increased as they offer improved shelf appeal and convenience, especially in the food and beverage industry. Also, the diversity of bags and pouches carrying many products fuels their growth further.

The blister packaging type segment is projected to grow at the fastest rate during the forecast period. The growth of the segment can be driven by increasing demand for tamper-proof and secure packaging solutions, especially in the consumer goods and pharmaceutical sector. Moreover, blister packaging gives strong protection against contamination and moisture, which is crucial for keeping product integrity.

In 2024, the food segment dominated the form-fill-seal machines market by holding the largest share. The dominance of the segment is due to the rising consumer demand for ready-to-eat and convenient packaging solutions. Safety is the top priority for these companies before packaging food products. These machines safeguard food from being unaltered and contamination in packaging. The food sector commonly depends on sealed and form-filled packaging for various products.

The pharmaceutical segment is anticipated to grow at the fastest rate during the projected period. The growth of the segment is because of the strict laws & regulations regarding integrity and safety packaging. Furthermore, the rising trend towards hygienic and single-use formats aligns with consumers' choice for convenience and safety, making form-fill-seal machines a key element in pharmaceutical manufacturing processes.

By Technology

By Packaging Type

By End Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

February 2025

September 2024

October 2024