January 2025

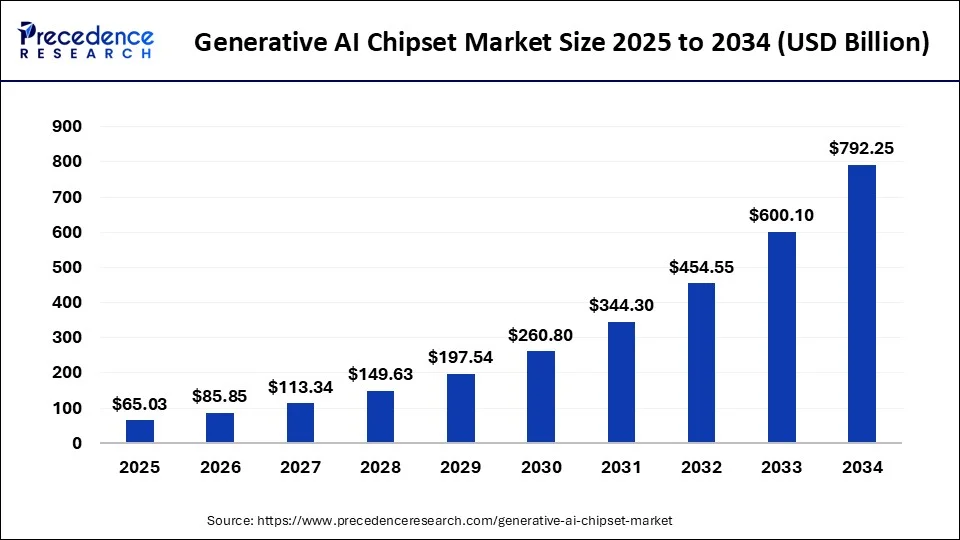

The global generative AI chipset market size is calculated at USD 49.26 billion in 2024, grew to USD 65.03 billion in 2025 and is projected to surpass around USD 792.25 billion by 2034. The market is representing a CAGR of 32.02% between 2024 and 2034. The North America generative AI chipset market size is evaluated at USD 21.67 billion in 2024 and is estimated to grow at a fastest CAGR of 32.15% during the forecast period.

The global generative AI chipset market size accounted for USD 49.26 billion in 2024 and is anticipated to reach around USD 792.25 billion by 2034, expanding at a CAGR of 32.02% from 2024 to 2034. The increasing popularity of AI technology and its pervasion in every sector like healthcare, finance, consumer electronics, and automotive creates lucrative opportunities to expand; moreover, the rise of big data analytics and 5G technology needs robust hardware chips fuelling the growth of the generative AI chipset market globally.

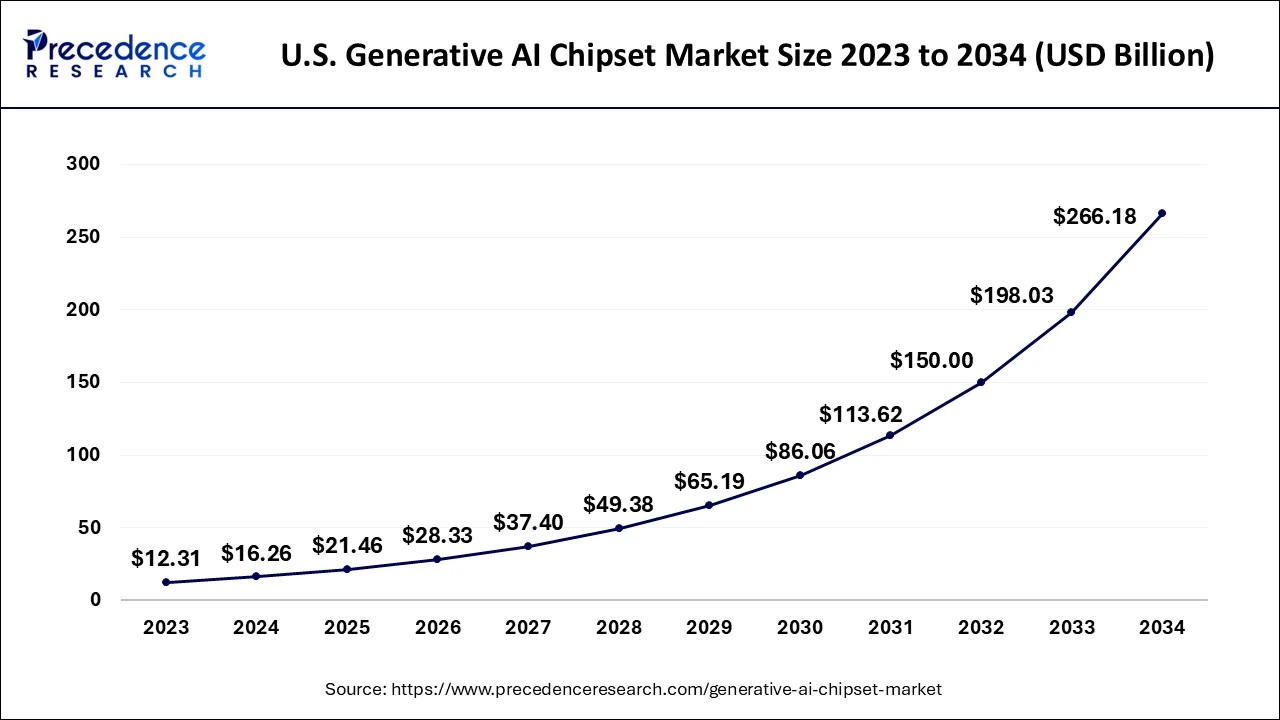

The U.S. generative AI chipset market size is exhibited at USD 16.26 billion in 2024 and is predicted to be worth around USD 266.18 billion by 2034, growing at a CAGR of 32.23% from 2024 to 2034.

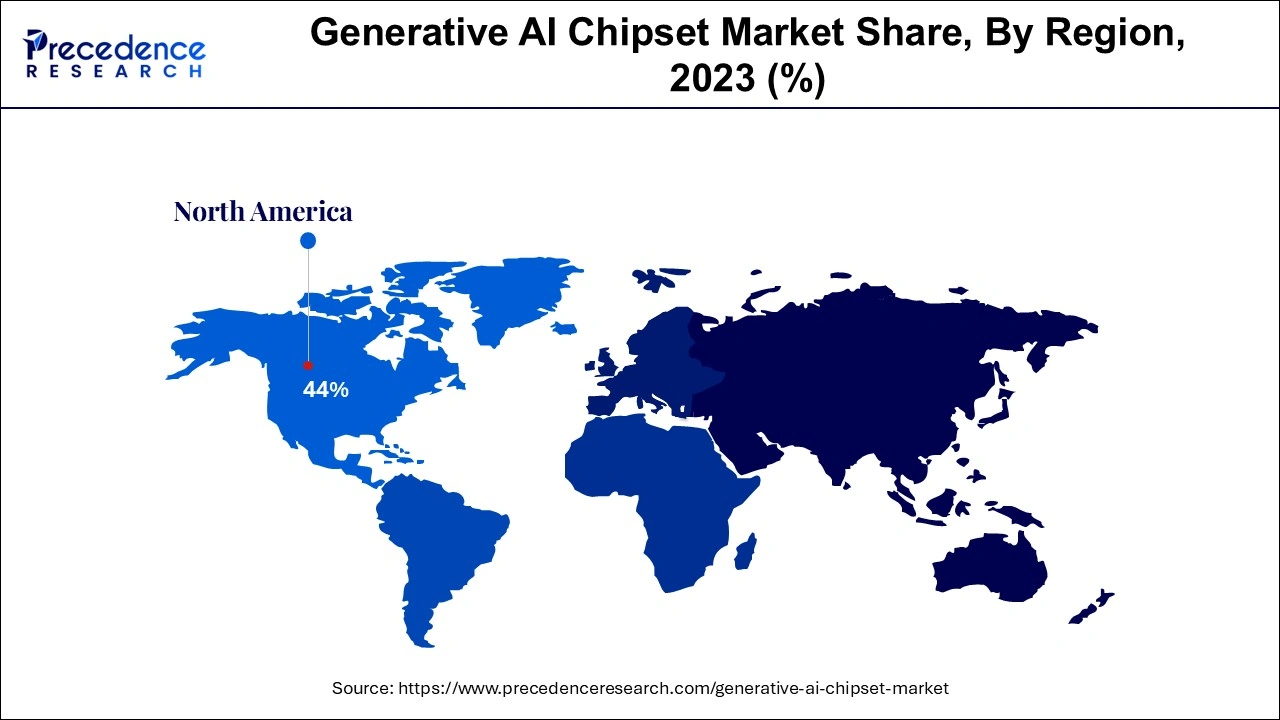

North America held the dominant share of the global generative AI chipset market in 2023. The growth of this region is due to the presence of major tech companies like NVIDIA, intel etc. are well established in the North America along with significant investment in the research and development of AI and its application in various field.

Asia Pacific is expected to host the fastest-growing generative AI chipset market in the forecasted years. The growth of this region is due to the strong emergence of sectors like consumer electronics and automotive, where applications of AI are indispensable, along with rapid industrialization in economically evolving countries like India, Japan, and China. In particular, China is investing heavily in the research and development of AI and its integration with various technologies. Moreover, emerging startups focusing on innovative AI integrate ideas in various sectors.

The generative AI chipset market is proliferating due to various reasons, such as rising demand for AI-based solutions in every sector like healthcare, finance, consumer electronics, etc., along with rapid digital transformation among various countries like India and China, which further supports the market to grow exponentially on a large scale. In data centers and edge devices, the growth of cloud computing is fuelling the demand for AI-based solutions.

Artificial Intelligence (AI) algorithms are becoming very advanced since the datasets become complex, which need to be managed effectively to gain insights to make forward decisions. Autonomous vehicles and robotics need real-time processing solutions, which can be achieved by AI-powered features. Region-wise, North America dominates the global generative AI chipset market; on the contrary, the Asia Pacific region is considered to be the fastest-growing region in the foreseeable future.

AI Impact on the Generative AI Market

Artificial Intelligence (AI) can significantly improve the production of the generative AI chipset market with the help of tools to improve the design and functionality of the AI chipsets. Processes can also be faster and more efficient if AI is used in the manufacturing of chipsets by automatic features. It reduces time, which increases business efficiency and enhances chip performance. AI also plays an important role in interfacing optimization and model training for the chips, offering them the ability to handle more complicated tasks in a more efficient way, which further improves the performance of chips.

| Report Coverage | Details |

| Market Size by 2034 | USD 792.25 Billion |

| Market Size in 2024 | USD 49.26 Billion |

| Market Size in 2025 | USD 65.03 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 32.02% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Chipset Type, Application, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Rise of generative AI

The major driving factor for the generative AI chipset market is the rise of generative AI, like the recent launch of ChatGPT, which has become immensely popular. With such a rising popularity, AI chipsets should also be available in proportion to that. Since AI chipsets are widely used in a range of products like smartphones, wearables, healthcare tools, etc, manufacturers acknowledged this trend, and the production of AI chipsets also witnessed a sudden surge in the past years, propelling the market globally. Another factor is the increasing prevalence of big data analytics, which is the major reason for the market's growth. The rising need to handle huge datasets using Natural Language Processing (NLP) and predictive maintenance requires robust and highly configured AI chips.

Substantial investment

The major restraining factor for the generative AI chipset market is the substantial initial invested needed to integrate innovative and evolving AI technology into existing infrastructures. Also, skilled workforce requires to manage such complex tasks is limited. Development and implementation are crucial part of the AI technology, restraining the markets growth despite of having number of benefits.

Implementation of AI in smartphones

The significant opportunity that the generative AI chipset market holds is the implementation of AI in smartphones. Technical advancements in AI have resulted in the integration of AI chipsets into smartphones. Apple, Samsung, and other manufacturers are also adopting this trend, propelling the market due to the integration of AI chipsets, which provides better security and privacy for data transmission, and sensitive data cannot be easily decrypted by unauthorized accessor. AI chipset also reduces overall power consumption and increases the efficiency and performance of smartphones.

The GPU segment accounted for the largest share of the generative AI chipset market in 2023 and is expected to maintain its position throughout the forecast period. In industries like gaming, autonomous systems, and entertainment, GPUs are widely used due to their capacity to handle parallel tasks efficiently. Therefore, GPUs are the preferred choice in many industries for running a complex AI model. Their flexibility, along with high computational power, fuelled the demand further as they are used to deploy and train AI models.

The ASIC segment will grow rapidly in the generative AI chipset market over the studied period. The growth of this segment is attributed to various factors like the rising demand for customized AI solutions in various sectors like finance, healthcare, and edge computing, where efficient use of energy is a critical aspect that needs to be considered largely. Moreover, ASIC provides superior performance ability and energy efficiency as compared to the traditionally used processors.

The deep learning segment dominated the global generative AI chipset market in 2023. The growth of this segment is fuelled by the widespread adoption of deep learning modules by various sectors like finance and healthcare, where time-sensitive operations have taken place. Deep learning can be used to process complex tasks like image recognition, speech recognition, predictive analytics, and natural language processing. All this is possible due to the high-performance AI chipsets.

The generative adversarial networks (GANs) segment is projected to grow at a significant CAGR in the generative AI chipset market over the forecast period. The growth of this segment is attributed to its incredible applications in the creative industries and in cybersecurity. GAN has a significant ability to generate realistic data like images and videos, which is efficiently used in the creative areas.

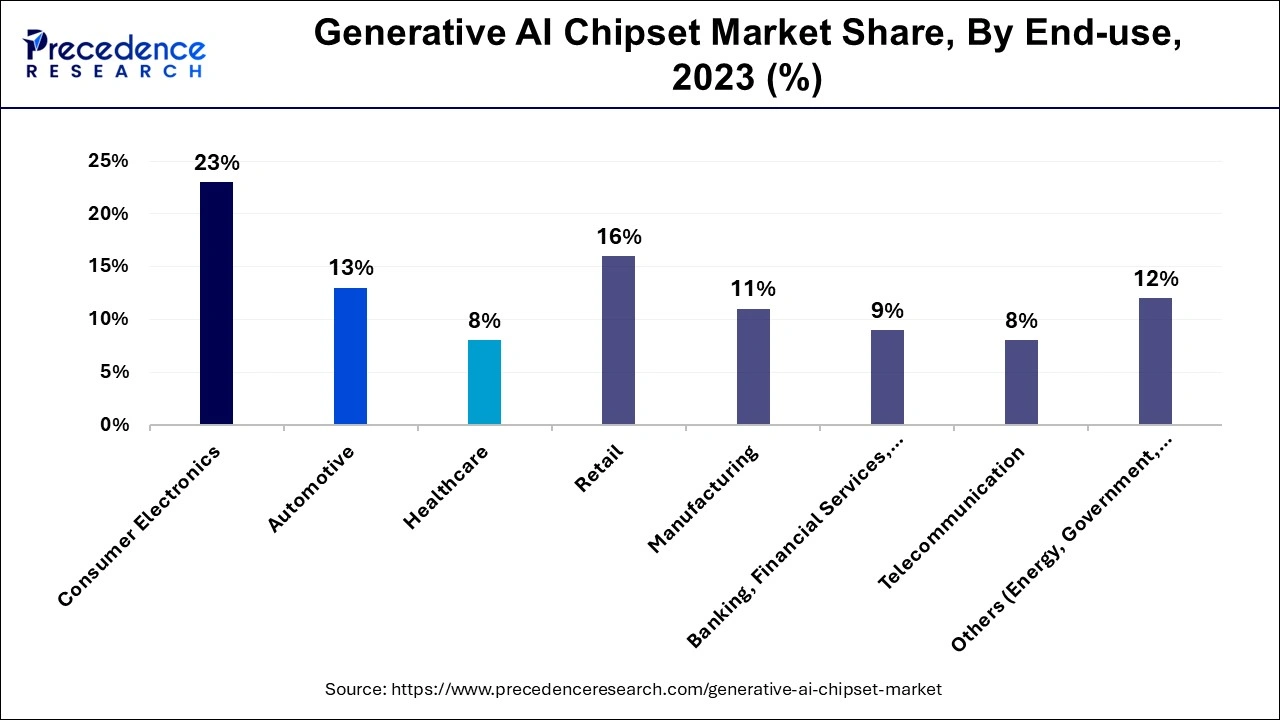

The consumer electronics segment led the global generative AI chipset market. The growth of this segment is due to the increasing dependency on AI for various features like voice assistance, customized recommendations, and speech and image recognition in smart devices like smartphones, smart homes, and wearables.

The automotive segment will register the fastest growth in the generative AI chipset market over the forecast period. The growth of this segment is due to the manufacturers investing heavily in the integration of AI into existing and rapidly evolving technologies. By doing this, vehicle makers want to enhance the efficiency of the vehicle at its highest level, fuelling the segment's growth further. Also, systems like ADAS are increasingly being used in the automobile industry, which requires high-performance AI chipsets.

Segments Covered in the Report

By Chipset Type

By Application

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

July 2024

September 2024

January 2025