January 2025

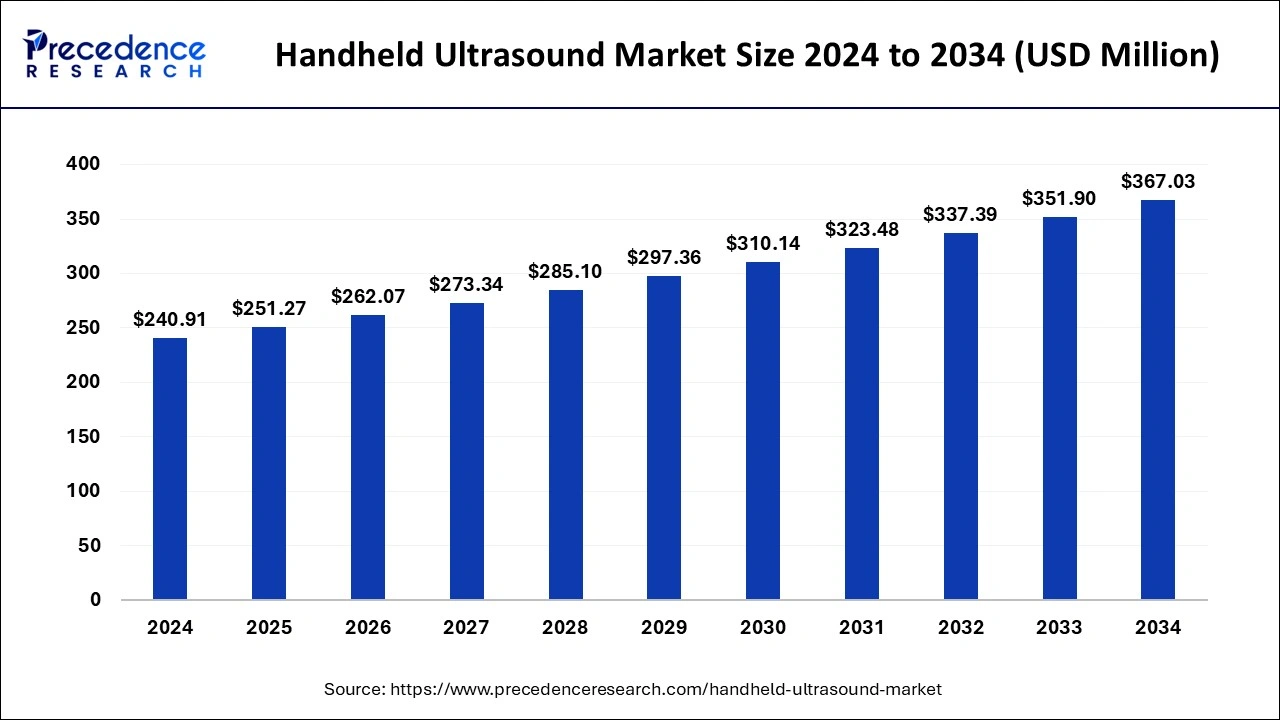

The global handheld ultrasound market size is calculated at USD 251.27 million in 2025 and is forecasted to reach around USD 367.03 million by 2034, accelerating at a CAGR of 4.30% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global handheld ultrasound market size was estimated at USD 240.91 million in 2024 and is anticipated to reach around USD 367.03 million by 2034, expanding at a CAGR of 4.30% from 2025 to 2034. The handheld ultrasound market is thriving owing to the increased use for portable ultrasound scanners in healthcare sector, advancements in developing convenient, cost-effective and efficient ultrasound units integrated with innovative technologies, rising trend of point-of-care diagnostics and the growing demand for real-time, non-invasive diagnostic tools.

The rising innovations in developing AI-enabled tools and software for portable ultrasound devices is assisting clinicians for real-time diagnosis with improved efficacy and accuracy. AI integration in handled ultrasound applications is improving access to healthcare, helping in enhancing image quality, in prenatal care and for research in obstetrics and gynaecology field.

Handheld ultrasound devices are less costly than ultrasound units and convenient for professionals. The global handheld ultrasound market revolves around the innovation, development and distribution of handheld ultrasound devices for the healthcare sector across the globe. The market growth is driven by factors such as the rising prevalence of chronic diseases, the need for clinical trials, and the adoption of new patient care and treatment technologies.

| Report Coverage | Details |

| Market Size in 2025 | USD 251.27 Million |

| Market Size by 2034 | USD 367.03 Million |

| Growth Rate from 2025 to 2034 | CAGR of 4.30% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Technology, By Application, and By End-user |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Instant and quick estimation offered by handheld ultrasound devices

When there is a risk of failed diagnosis through imaging tools, physicians are often made to make decisions without ultrasound. Medical practitioners in small clinical settings can associate physical test findings with visual findings with this handheld ultrasound equipment instead of sending patients to a radiology lab. Similarly, emergency physicians use these mobile devices for instant and quick estimation. Moreover, the initial investment in handheld ultrasound devices is comparatively less complicated, which is beneficial for small-scale clinics to invest.

High cost of initial investment

The high-resolution ultrasound imaging equipment generates a large quantity of information at a higher rate to provide high-resolution imaging for various biomedical applications, which has been a trade between image quality and device price and hinders the usage of ultrasound imaging with good-resolution pictures at an affordable price. It needs intensive computational resources and high-speed data transfer links, making the machine heavy and power-consuming, resulting in a lack of portability and deployment of the system in remote locations where the power budget is limited, further restricting healthcare accessibility.

Increasing growth of telemedicine and remote monitoring

The growing factors such as remote collaboration, efficient triaging of patients, and expert consultations are stimulating for expanding the handheld ultrasound market. The increasing usage of telemedicine and remote monitoring has allowed healthcare providers to remotely assess and monitor patients. There is a reduction in in-person visits and mainly massive use in rural or underdeveloped areas. The growing need for remote healthcare services, mainly during the COVID-19 pandemic and the shift towards patient-customized and value-based care, has raised the need for telemedicine.

The 3D scanner is expected to increase rapidly during the forecast period. A physical product can be scanned into a digital layout using a 3D scanner, and then prototypes can be built using the digital model and 3D printers; the increasing granularity of scan data decreases the manual time required to generate a solid model, the high level of precision made manageable by high-quality 3D scanners considerably accelerates this procedure.

Furthermore, the various medical applications such as detailed fetal imaginng during pregnancy, real-time visualization of internal organs for diagnosis and guiding procedures among others with improved efficacy and detailed imaging in complex anatomical areas is boosting the market growth of this segment.

The 2D scanner segment is expected to grow rapidly during the forecast period. The growth of this segment can be attributed to the ability of point-of-care applications of this scanner allowing clinicians for quick evaluation of body areas, in acute care, cardiology, gynaecology and in case of emergency medicine for rapid identification of potential complications. Additionally, the potential benefits of 2D handheld ultrasound such as portability, convenience, real-time imaging, user-friendly interface and cost-effectiveness is increasing the adoption of these devices thereby significantly driving the market growth in the upcoming years.

The gynecology segment is the maximum contributor to the handheld ultrasound market. The commercially available number of ultrasound devices for prenatal diagnosis and ultrasonography promotes the growth of the segment. Moreover, the rapid adoption of portable ultrasound devices by pregnant women highlights the development of the overall market.

Considering the demand of handheld ultrasound devices from the gynecology sector, market players are focused on the advancements of handheld ultrasound devices. For instance, Vscan Extend, developed by engineers at GE Healthcare, United States, is a pocket-friendly ultrasound tool that allows gynecologists to speed up treatment decisions. Further, it can execute fetal position, heart checks, and measure fluid levels, assess maternal health, and picture uterine fibroids. And it is easy to operate to show a visual heartbeat to the concerned mother. It serves various outcomes, such as clinical, operational, and financial.

The urology segment shows attractive growth during the forecast period. The ultrasound system generally visualizes the pelvis, urinary tract, and abdomen by assisting with percutaneous nephrolithotomy, renal biopsy, catheterization, BPH residual urine, and prostate. The rising cases of urinary tract infection is promoting the application of handhold ultrasound in the urology sector. Portable ultrasound machines are light in weight and small, making them handy for casualties or patients who can rarely happen to travel. The image quality generated is clear. It can help diagnose problems such as urinary tract infections, kidney stones, and bladder tumors, even used for biopsies.

The hospital is the dominating segment with the highest revenue during the forecast period. This growth can be approved to the wide range of hospital ultrasound devices and the increased number of patients visiting hospitals with different ways of living disorders. Introducing portable systems is projected to fuel the demand for ultrasound equipment in OPD and in-patient departments.

Diagnostic Centers show lucrative growth in the handheld ultrasound market during the predicted period. This segment is developing as there is a growing need for diagnostic centers, and there is a wide range of increasing applications, such as in cardiology and oncology. The increasing prevalence of various lifestyle-related disorders and technological advancement are boosting the need for this segment's growth. The presence of different diagnostic devices is fueling the market.

North America is dominating the handheld ultrasound market during the forecast period. The United States, with high grant funding support, is considered a prime contributor for research and development in chronic diseases sector. Furthermore, major medical institutes' involvement, easy approval for clinical trials, and the vigorous rate of initiating research and development initiatives to develop therapeutic options for chronic diseases are predicted to support market growth in North America.

For instance, in January 2023, headquartered in the United States, Sound Technologies and GE HealthCare announced a deal to distribute the Vscan Air. This wireless pocket-sized ultrasound gives whole-patient scanning competence, crystal clear image quality, and intuitive software to veterinary applications in the United States.

Asia-Pacific is the fastest-growing segment in the handheld ultrasound market during the predicted period. The increased adoption of diagnostic imaging drives the growth of the market as healthcare professionals and patients across Asia-Pacific increasingly adopt minimally invasive therapies and image-guided procedures. The higher occurrence of chronic diseases such as cancer, neurological stroke, and cardiovascular diseases, the excellent death rates in these countries, and the increasing knowledge among the population for early detection are fueling the market expansion in Asia.

The rapid adoption of advanced technologies and well-established healthcare infrastructure along with the presence of potential key players in the country have promoted the growth of the market in Japan. The Japanese market players are even more focused on the development of innovative diagnosis products. New product development in the country is observed to fuel the growth of the market during the forecast period. In January 2022, The Japanese contributor of TechsoMed Ltd generated ultrasound-based picture evaluation software systems for tissue detriment monitoring and to control in multi-clinical applications.

By Technology

By Application

By End-user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

December 2024

November 2024

November 2024