January 2025

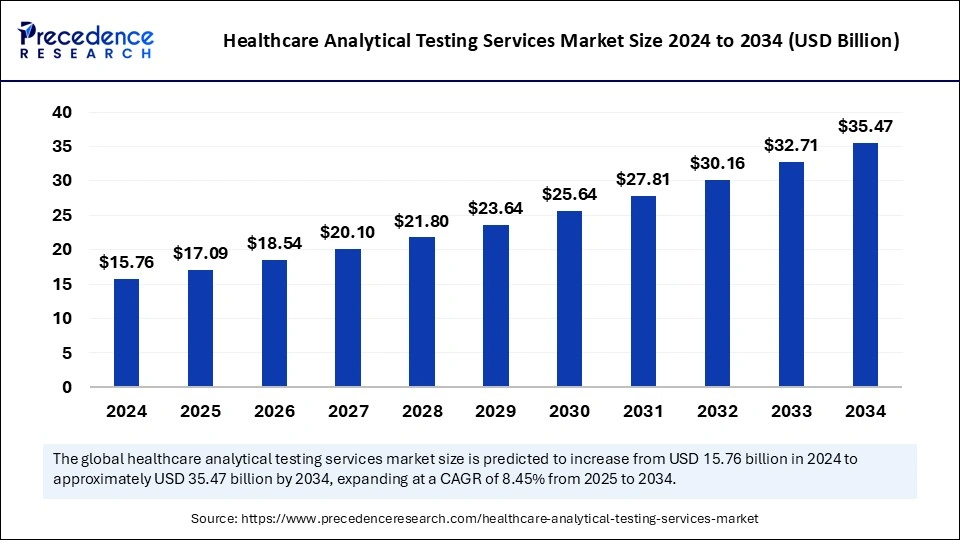

The global healthcare analytical testing services market size is evaluated at USD 17.09 billion in 2025 and is forecasted to hit around USD 35.47 billion by 2034, growing at a CAGR of 8.45% from 2025 to 2034. The North America market size was accounted at USD 6.15 billion in 2024 and is expanding at a CAGR of 8.58% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year

The global healthcare analytical testing services market size was estimated at USD 15.76 billion in 2024 and is predicted to increase from USD 17.09 billion in 2025 to approximately USD 35.47 billion by 2034, expanding at a CAGR of 8.45% from 2025 to 2034. The market is driven by the increase in outsourcing businesses of analytical testing services by pharmaceutical or medical device firms.

The presence of large datasets and substantial improvements in ArtificiaI Intelligence-powered medical algorithms extend beyond diagnostics. In the healthcare analytical testing services market, ArtificiaI Intelligence applications also reshape patient care management, healthcare administration, and drug discovery. In patient care, AI-driven chatbots, and virtual health assistants offer 24/7 support and monitoring, improving patient engagement and adherence to treatment plans. In drug discovery, AI speeds up drug development by anticipating how different drugs will react in the body, significantly reducing clinical trial time and cost.

The growth of AI in the healthcare analytical testing services market has been a steady journey driven by technological progress and the rising demand for improved healthcare services. Incorporating AI into medicine has transformed traditional practices, enhancing efficiency, accuracy, and personalized care. With the ongoing evolution of AI technology, its influence in healthcare is poised to expand, reinforcing its role as a crucial asset in contemporary medicine.

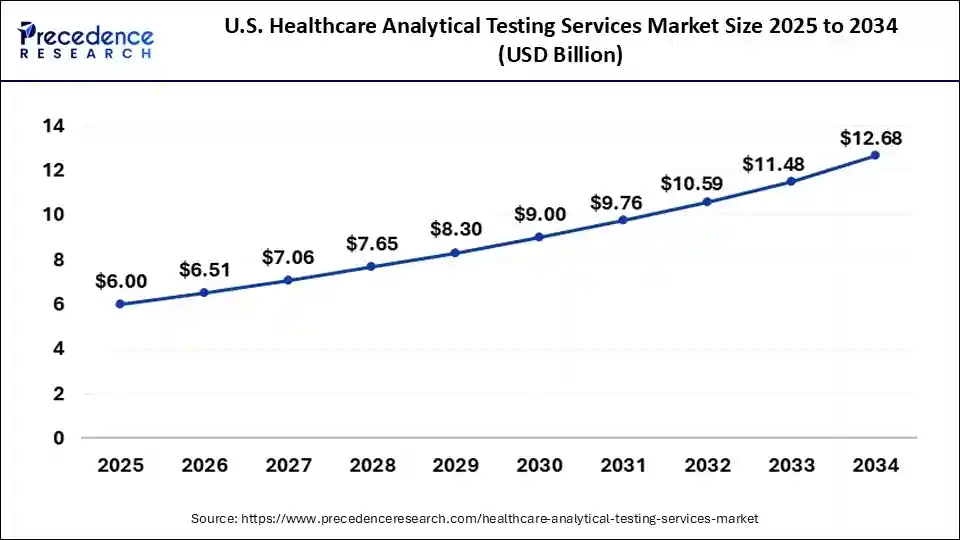

The U.S. healthcare analytical testing services market size was exhibited at USD 15.76 billion in 2024 and is projected to be worth around USD 35.47 billion by 2034, growing at a CAGR of 6,53% from 2025 to 2034.

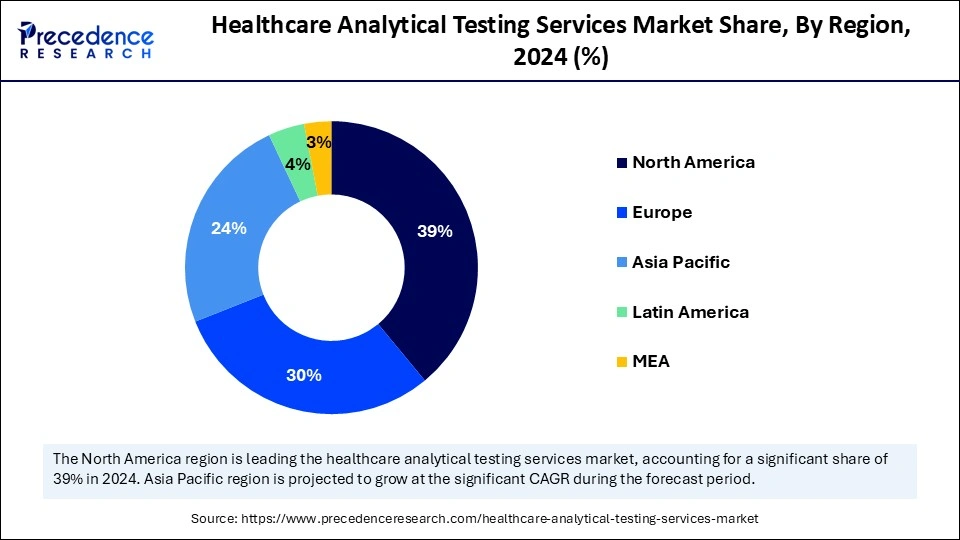

North America held the largest share of the healthcare analytical testing services market in 2024. This is due to its advanced healthcare infrastructure and significant investment in research and development. North America has well-established pharmaceutical and biotechnology industries that boost a high need for analytical testing services to support the development of drugs, clinical trials, and regulatory compliance.

Asia Pacific is observed to host the fastest-growing healthcare analytical testing services market during the forecast period. The rising healthcare demands, a growing focus on drug development, clinical research, and economic development in the region are boosting the market growth. The increasing regulatory and quality control needs significantly contributed to the market's expansion in Asia-Pacific.

As the biopharmaceutical industries grow, so does the demand for compliance with stringent international and local regulations standards enhancing. This has improved regulatory scrutiny necessitates comprehensive and reliable analytical testing services to guarantee that products meet safety, efficacy, and quality benchmarks before reaching the market.

The healthcare analytical testing services market involves numerous diagnostic and investigative methods aimed at assessing disease conditions, evaluating patient health, and measuring treatment efficacy. These services employ sophisticated analytical technologies alongside various healthcare indicators to facilitate testing, prognosis, monitoring, and disease detection and to enhance informed clinical decision-making and personalized patient care. This service also supports drug development processes, spanning from discovery and clinical trials to the commercial use of medications.

| Report Coverage | Details |

| Market Size by 2034 | USD 35.47 Billion |

| Market Size in 2025 | USD 17.09 Billion |

| Market Size in 2024 | USD 15.76 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.45% |

| Leading Region/ Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Increasing number of clinical trials

There is a rise in the number of deadly diseases, like cancer, which has created a demand to increase the production of drugs and develop new drugs to lessen the burden on existing ones. These factors raise pharmaceutical and biotechnology firms' demand for high-quality healthcare analytical testing services market services and have raised the number of clinical trials for different types of drugs. This is because they are required to focus more on their core competencies and the scientific aspects of the drugs. For smooth functioning, the pharmaceutical and biotechnology industry partners with vendors offering analytical testing services to ensure the product is not adversely impacted and the manufacturing facilities do not face regulatory compliance issues.

Lack of skilled professionals

As the need for testing services grows across different industries, including food and beverage and pharmaceuticals, there is a growing demand for skilled individuals proficient in operating analytical testing equipment and accurately interpreting analytical results. Further, a lack of experienced professionals can hamper the healthcare analytical testing services market and lead to a slowdown in R&D activities, regulatory compliance efforts, and quality control processes.

Innovations and development of new products

Emerging technologies in the healthcare analytical testing services market have streamlined communication within medical organizations. A majority of healthcare professionals are utilizing tools such as video conferencing, AR/VR, real-time meetings, and various online platforms to engage with one another and enhance knowledge sharing in the field. These innovations enable providers to gain insights into patients' health, recognize potential risks, and recommend preventive strategies. Physicians can also rely on applications to spot medication errors and promote patient safety. Electronic health records (EHRs) allow doctors to readily access a patient’s complete medical history to make well-informed decisions.

The pharmaceutical analytical testing services segment dominated the global healthcare analytical testing services market in 2024. Manufacturers can verify that their products comply with purity and composition regulations by testing samples before release. This process assists in adhering to public health standards and minimizes risks linked to medications containing unknown ingredients or potency levels. Additionally, it helps producers maintain consistent product quality over time by monitoring for changes during production or storage. Furthermore, routine testing allows manufacturers to make necessary adjustments when variations happen during these processes, ensuring users are not exposed to unforeseen hazards.

The medical device analytical testing services segment will witness significant growth during the forecast period. Medical devices utilized for diagnosis, surgeries, and other medical procedures generally undergo rigorous biocompatibility testing in accordance with global regulatory standards to evaluate the biological risks associated with the device’s contact with a patient. Medical device performance testing examines how a device operates under various conditions. This service aids manufacturers in assessing risks, preventing failures, and understanding the stresses a product may encounter throughout its lifespan. Additionally, performance testing offers manufacturers valuable insights for pinpointing and improving any weaknesses in the development process, enabling them to launch safe and effective products more swiftly.

By Type

By Regions

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

December 2024

February 2025

April 2024