January 2025

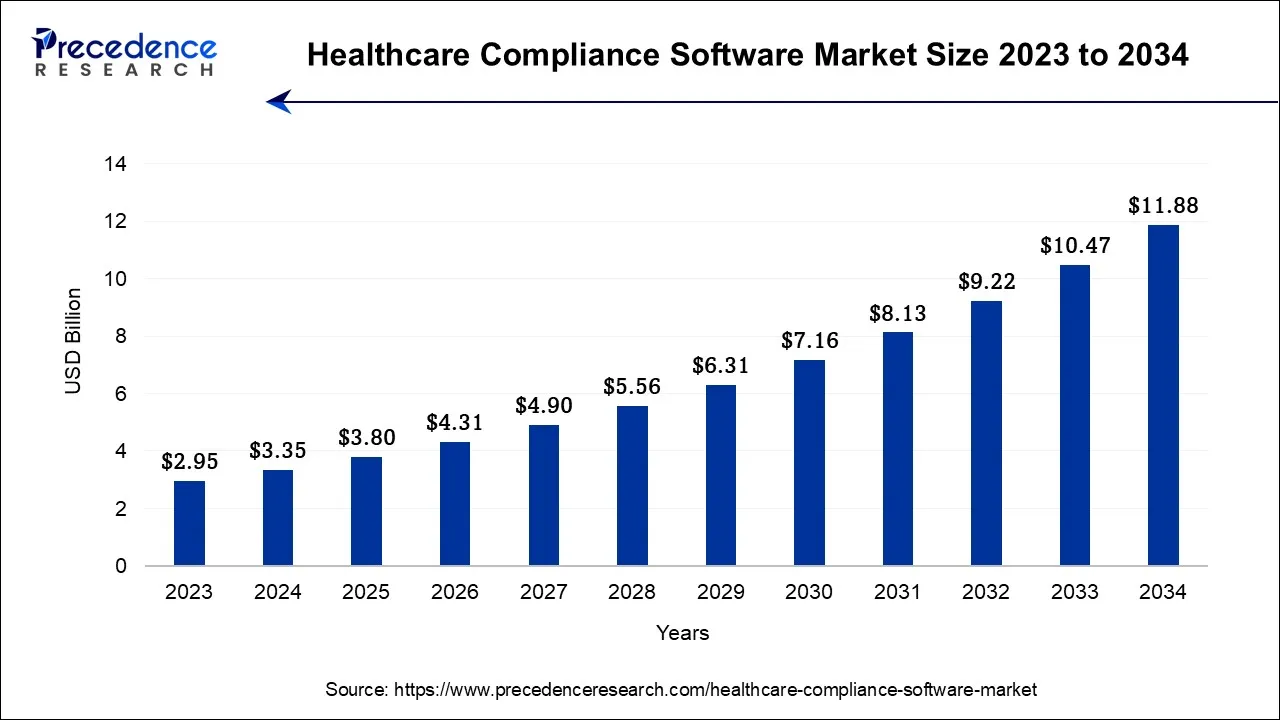

The global healthcare compliance software market size is calculated at USD 3.35 billion in 2024, grew to USD 3.80 billion in 2025, and is predicted to hit around USD 11.88 billion by 2034, poised to grow at a CAGR of 13.5% between 2024 and 2034. The North America healthcare compliance software market size accounted for USD 1.74 billion in 2024 and is anticipated to grow at the fastest CAGR of 13.6% during the forecast year.

The global healthcare compliance software market size is expected to be valued at USD 3.35 billion in 2024 and is anticipated to reach around USD 11.88 billion by 2034, expanding at a CAGR of 13.5% over the forecast period from 2024 to 2034.

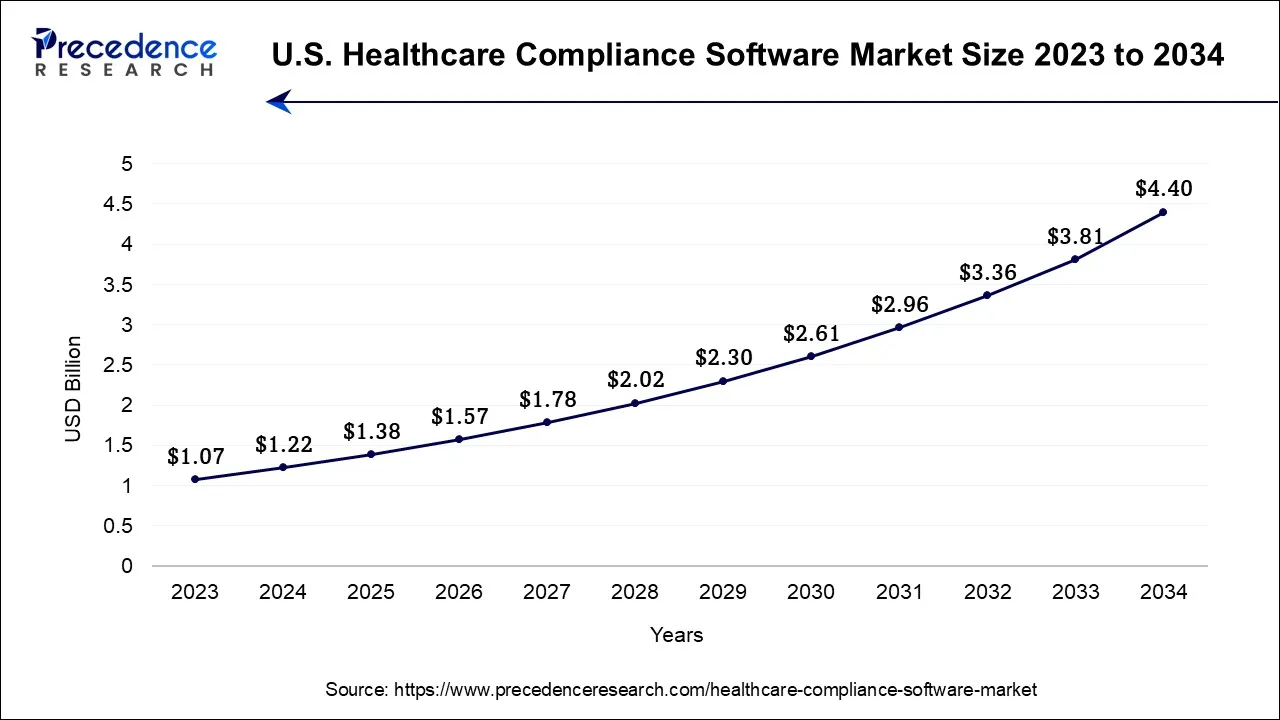

The U.S. healthcare compliance software market size is accounted for USD 1.22 billion in 2024 and is projected to be worth around USD 4.40 billion by 2034, poised to grow at a CAGR of 13.68% from 2024 to 2034.

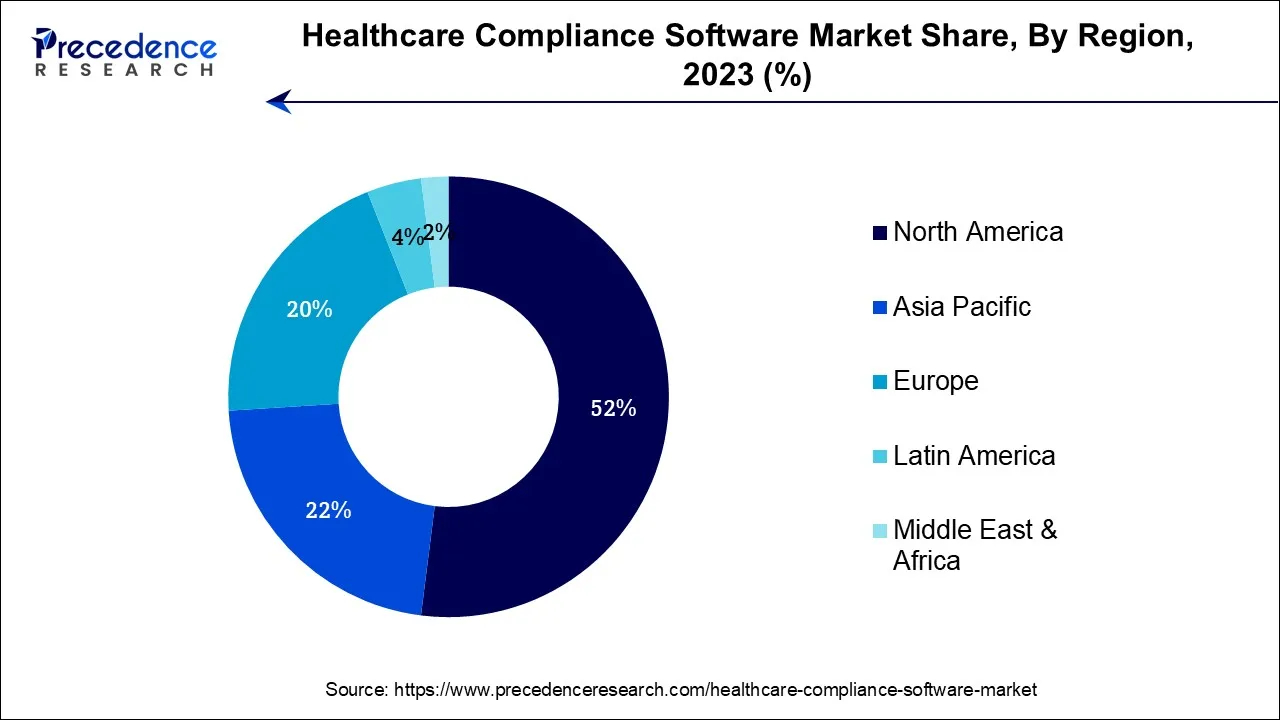

North America has held the largest revenue share 52% in 2023. In North America, the healthcare compliance software market is characterized by several prominent trends. The region witnesses a strong focus on data security and patient privacy, aligning with stringent regulations like HIPAA. The market also experiences substantial growth due to the region's advanced healthcare infrastructure and the rapid adoption of digital health technologies. The COVID-19 pandemic has accelerated the need for compliance solutions, particularly in infectious disease reporting. Additionally, the growing importance of telemedicine and electronic health records (EHRs) further fuels the demand for robust compliance software solutions in North America.

Asia-Pacific is estimated to observe the fastest expansion In the Asia-Pacific region, the healthcare compliance software market is witnessing several noteworthy trends. With the growing healthcare industry and increased regulatory scrutiny, there is a rising demand for compliance software to manage complex healthcare regulations effectively. Additionally, the adoption of digital health solutions and electronic medical records is bolstering the need for robust data security and privacy compliance tools. The post-COVID-19 era has further emphasized the importance of healthcare compliance software in the region as healthcare systems seek to enhance data protection and regulatory adherence.

The healthcare compliance software market encompasses software solutions designed to assist healthcare organizations in adhering to regulatory standards, guidelines, and best practices. These solutions facilitate the management of compliance-related tasks, data, and documentation, ensuring that healthcare providers and institutions operate in accordance with legal and industry requirements.

The market is characterized by a focus on data security, privacy, and the need to address evolving healthcare regulations, making healthcare compliance software an integral component in maintaining regulatory compliance and safeguarding patient data and care quality.

Several key trends and growth drivers propel the healthcare compliance software market forward, including the continuous evolution of healthcare regulations and privacy laws, exemplified by HIPAA in the United States and GDPR in Europe, drives the adoption of compliance software. These solutions are essential for healthcare organizations to effectively manage and monitor adherence to complex and ever-changing compliance requirements. Second, the growing emphasis on data security and privacy, particularly in light of the rising instances of healthcare data breaches, amplifies the demand for robust compliance solutions. These software tools play a pivotal role in safeguarding sensitive patient information and ensuring strict compliance with data protection standards.

Additionally, the healthcare industry's digital transformation, with the proliferation of electronic health records (EHRs) and telemedicine, amplifies the need for comprehensive compliance tools. Furthermore, the ongoing global pandemic has accentuated the importance of healthcare compliance, with increased scrutiny on infectious disease reporting and data protection, creating further opportunities for compliance software providers.

Despite its growth potential, the healthcare compliance software market faces challenges. Keeping up with the rapid pace of regulatory changes, ensuring interoperability with existing healthcare systems, and addressing resource constraints within healthcare organizations are significant hurdles. Moreover, the complexity of healthcare compliance requirements, varying from region to region, poses a challenge for software providers striving to offer comprehensive solutions. Additionally, healthcare providers may encounter resistance from staff when integrating compliance software into their workflows. In this dynamic market, numerous business opportunities emerge.

Companies can invest in research and development to create agile compliance solutions capable of adapting to evolving regulations. Partnerships with healthcare organizations to offer tailored compliance solutions can be mutually beneficial. The expansion into emerging markets with growing healthcare sectors, where compliance requirements are becoming increasingly stringent, is another avenue for growth. Additionally, offering training and support services for healthcare staff to effectively use compliance software presents a valuable opportunity.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 13.5% |

| Market Size in 2024 | USD 3.35 Billion |

| Market Size by 2034 | USD 11.88 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Base Year | 2024 to 2034 |

| Segments Covered | By Product Type, By Category, and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Healthcare compliance is facing heightened scrutiny from regulatory bodies, government agencies, and the public. The ever-evolving and stringent regulations demand robust compliance solutions to manage and track adherence effectively. Regulatory violations can result in severe penalties and damage to an organization's reputation. Healthcare compliance software provides the necessary tools to ensure strict adherence to these regulations, helping organizations avoid fines and legal issues. This increased scrutiny underscores the critical role of compliance software in modern healthcare.

Moreover, the healthcare industry is experiencing a transformation towards patient-centric care models. Patients today expect greater control over their health data and care decisions. Compliance software plays a crucial role in ensuring data privacy and security while enabling patient engagement and access to their health information. It helps healthcare providers maintain patient trust by safeguarding sensitive data and complying with privacy laws such as HIPAA and GDPR. As patient-centric care becomes a central focus, the demand for compliance software that facilitates this shift continues to surge.

The cost of implementing healthcare compliance software can be a significant restraint. While these solutions offer crucial benefits, the initial investment, including software licenses, staff training, and system integration, can be substantial. Smaller healthcare providers and organizations with limited budgets may find these costs challenging to bear. This financial barrier can hinder adoption and limit access to advanced compliance tools, impacting the broader market demand for healthcare compliance software.

Moreover, Integration challenges pose a significant restraint on the healthcare compliance software market. The complexity of integrating compliance software with existing healthcare systems and workflows can be daunting. Compatibility issues, data migration complexities, and the need for seamless interoperability can slow down adoption. Healthcare organizations may hesitate due to concerns about potential disruptions and the resources required for effective integration, impacting the market's growth potential.

Interoperability solutions are a potent driver of demand in the healthcare compliance software market. As healthcare systems increasingly emphasize data exchange and collaboration across diverse platforms and providers, compliance software capable of seamless data sharing and privacy management becomes crucial. These solutions enable healthcare organizations to navigate complex regulatory requirements while ensuring the secure and efficient flow of patient data. The ability to address interoperability challenges propels the adoption of compliance software, driving market growth.

Artificial intelligence (AI) and machine learning (ML) are catalysts for the healthcare compliance software market. They empower advanced analytics, real-time monitoring, and predictive insights, enabling proactive compliance management and threat detection. AI and ML enhance data security, automate compliance tasks, and optimize regulatory reporting. Their ability to adapt to evolving regulations and identify compliance anomalies not only ensures robust adherence but also drives the demand for cutting-edge healthcare compliance software in an era of heightened data privacy and complex regulations.

According to the product type, the cloud-based segment held 56.3% revenue share in 2023. Cloud-based healthcare compliance software is a type of compliance management solution hosted on remote servers and accessible via the internet. It offers scalability, flexibility, and cost-effectiveness, allowing healthcare organizations to efficiently manage regulatory compliance and data security from any location. Cloud-based solutions continue to gain prominence due to their accessibility and remote collaboration capabilities. These solutions also benefit from advancements in AI and ML, enabling predictive analytics and real-time monitoring to enhance compliance management in the ever-evolving healthcare regulatory landscape.

The On-premises segment is anticipated to expand at a significant CAGR of 15.8% during the projected period. On-premises healthcare compliance software refers to solutions installed and operated directly on a healthcare organization's local servers and computer systems. It provides greater control over data and security but requires substantial IT infrastructure and maintenance. Despite the growth of cloud-based solutions, on-premises software remains relevant in healthcare compliance. Organizations with stringent data security needs and legacy systems favor on-premises solutions. However, a shift towards hybrid models, combining on-premises and cloud elements, is emerging to balance control and scalability.

Based on the Category, policy and procedure management segment is anticipated to hold the largest market share of 25.4% in 2023. Policy and procedure management in healthcare compliance software refers to the systematic creation, distribution, and tracking of policies and procedures within healthcare organizations. This category streamlines the development and maintenance of compliance-related documentation, ensuring that staff members have access to up-to-date guidelines. Recent trends in Policy and procedure management include the integration of AI for document automation, real-time compliance tracking, and customization features to align policies with evolving healthcare regulations. These advancements enhance efficiency and accuracy in maintaining compliance.

On the other hand, the medical billing and coding segment is projected to grow at the fastest rate over the projected period. Medical billing and coding within the healthcare compliance software market pertains to the process of translating healthcare services into standardized codes for billing and reimbursement purposes. These codes ensure accuracy, transparency, and compliance with regulatory requirements, such as ICD-10 and CPT. Trends in this category include the integration of AI and ML for coding automation, reducing errors, and improving billing efficiency. Additionally, blockchain technology is emerging to enhance data security and transparency, while telehealth billing solutions address the evolving landscape of virtual care. Compliance software tailored for medical billing and coding continues to evolve to meet the changing needs of the healthcare industry.

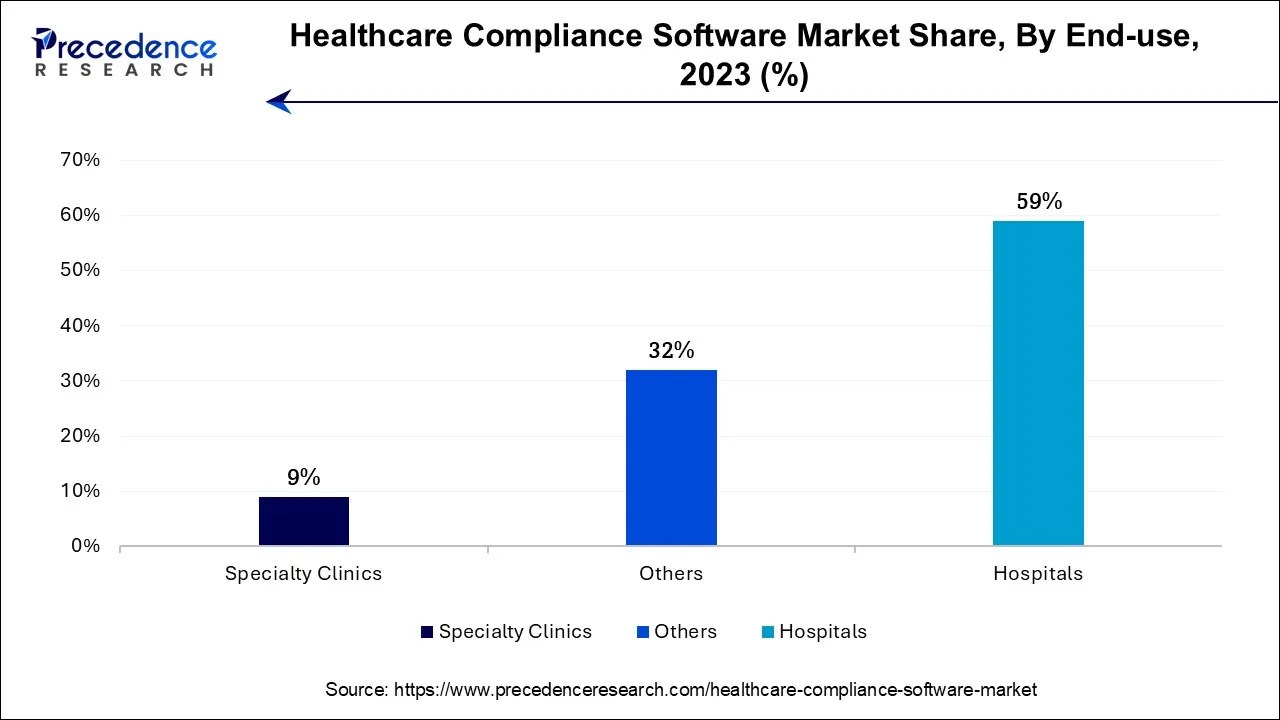

In 2023, the hospital segment had the highest market share of 59% on the basis of the installation. Hospitals are a crucial segment of the healthcare compliance software market, where compliance solutions are deployed to ensure adherence to regulatory standards, data security, and privacy. Hospitals are increasingly adopting advanced compliance software to manage complex compliance requirements, protect patient information, and streamline regulatory reporting. Key trends in this sector include the integration of AI and ML for predictive compliance analytics, enhanced interoperability with electronic health records (EHRs), and the pursuit of comprehensive, patient-centric compliance solutions that align with evolving healthcare regulations and data protection laws.

The Specialty clinics are healthcare segment is anticipated to expand at the fastest rate over the projected period. Specialty clinics are healthcare facilities that focus on specific medical disciplines or patient populations. In the healthcare compliance software market, specialty clinics demand tailored solutions to navigate unique compliance challenges in their respective fields. Trends include the adoption of compliance software customized for specialties like cardiology, orthopedics, or dermatology. These solutions cater to specialty-specific regulations and reporting requirements, ensuring adherence while optimizing patient care. As healthcare becomes increasingly specialized, compliance software providers are innovating to address these distinct needs, driving growth in this niche segment.

Segments Covered in the Report

By Product Type

By Category

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

December 2024

February 2025

April 2024