January 2025

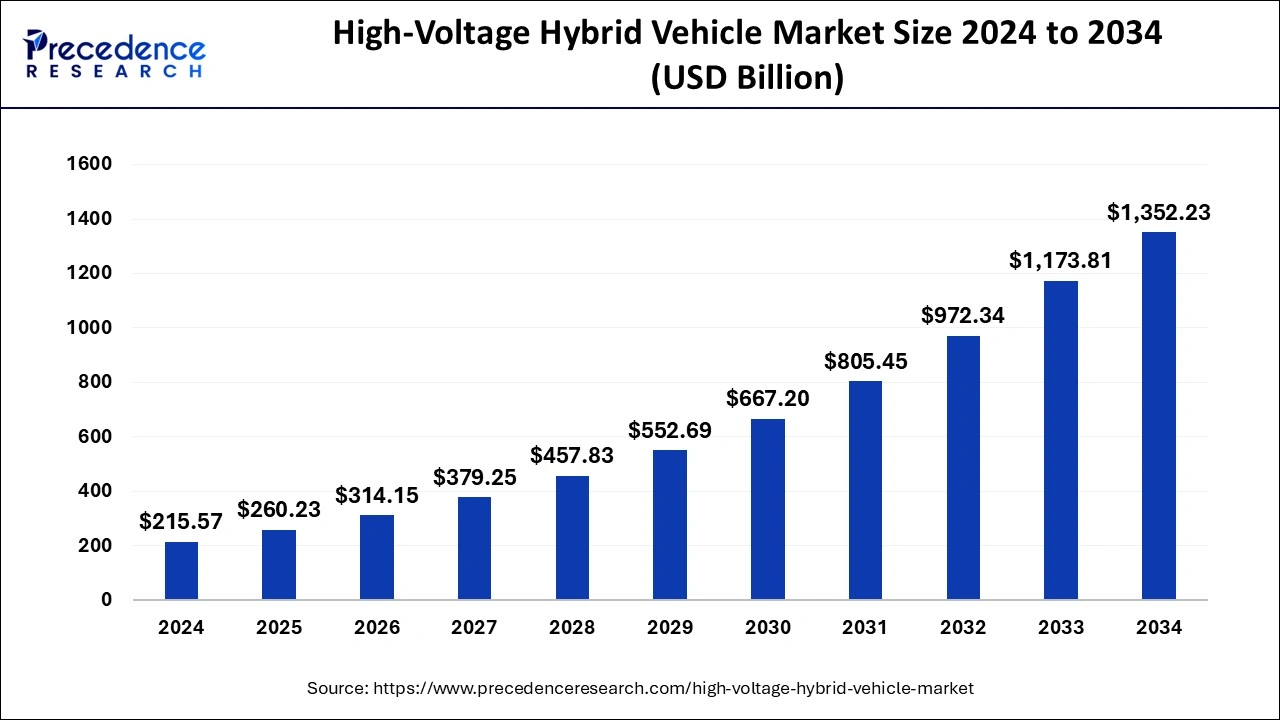

The global high-voltage hybrid vehicle market size is calculated at USD 260.23 billion in 2025 and is forecasted to reach around USD 1,352.23 billion by 2034, accelerating at a CAGR of 20.15% from 2025 to 2034. The Asia Pacific high-voltage hybrid vehicle market size surpassed USD 140.52 billion in 2025 and is expanding at a CAGR of 20.28% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global high-voltage hybrid vehicle market size was estimated at USD 215.57 billion in 2024 and is predicted to increase from USD 260.23 billion in 2025 to approximately USD 1,352.23 billion by 2034, expanding at a CAGR of 20.15% from 2025 to 2034. High-voltage hybrids and other alternative fuel cars are becoming more and more popular among consumers as a result of rising fuel prices and worries about the stability and long-term availability of fossil fuel supply.

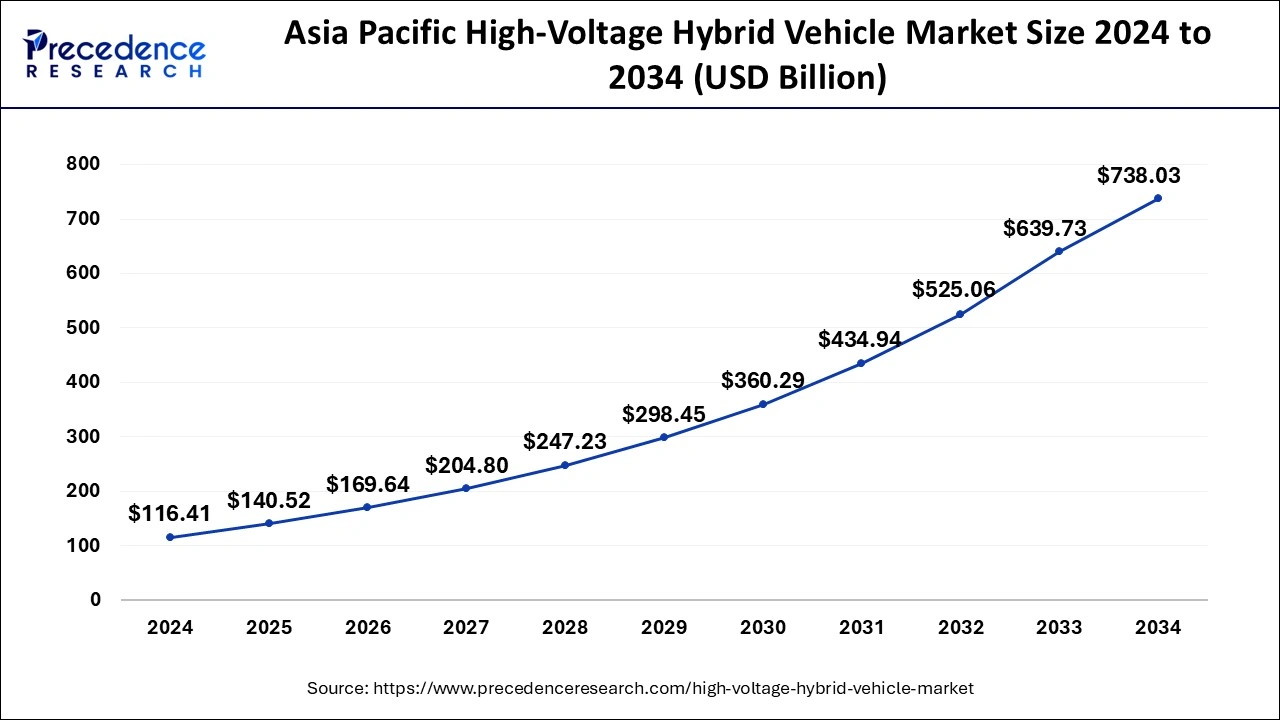

The high-voltage hybrid vehicle market was valued at USD 116.41 billion in 2024 and is expected to be worth around USD 738.03 billion by 2034, at a CAGR of 20.28% from 2025 to 2034.

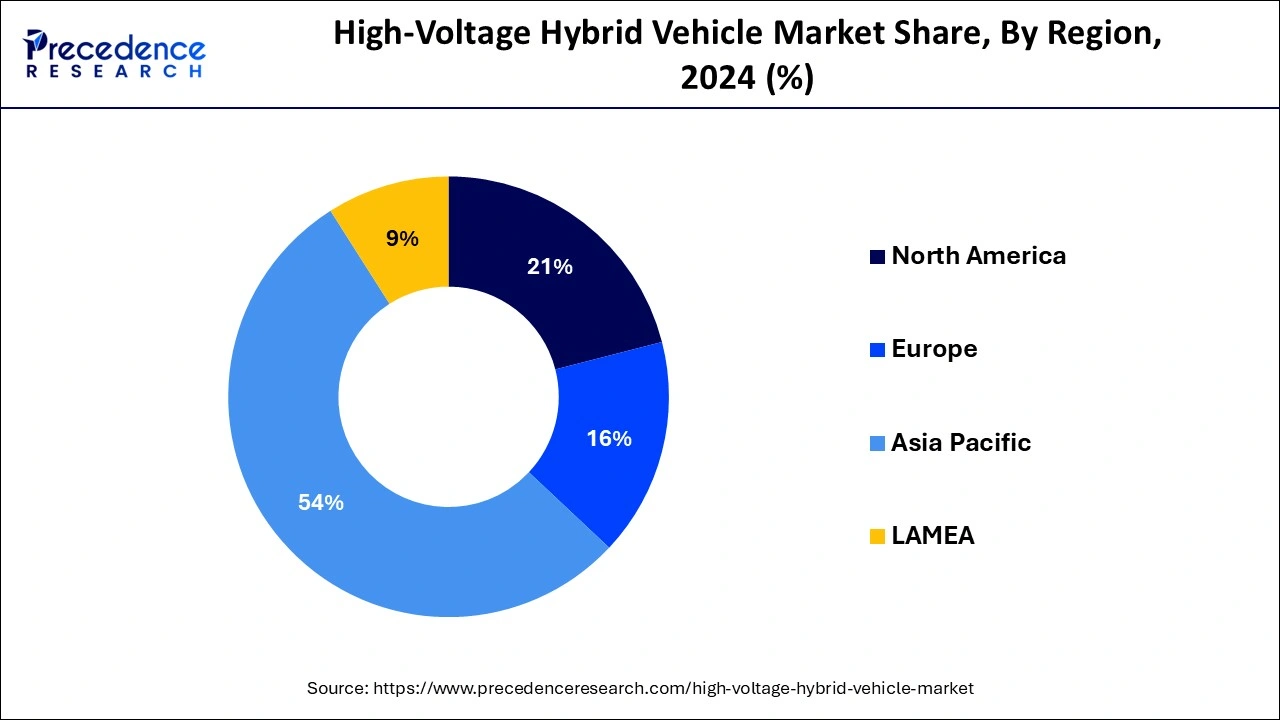

Asia Pacific dominated the high-voltage hybrid vehicle market in 2024. The economic growth in Asia Pacific has led to a rising middle class with increased purchasing power. This demographic is more inclined to invest in advanced automotive technologies, including hybrid vehicles, which are seen as a status symbol and a commitment to environmental sustainability.

Governments in the region have implemented stringent regulations on emissions and fuel efficiency, pushing the adoption of hybrid vehicles. Incentives such as subsidies, tax breaks, and reduced registration fees make hybrid vehicles more attractive to consumers. Rapid urbanization and rising pollution levels in major cities have increased awareness and demand for cleaner, more fuel-efficient vehicles. High-voltage hybrid vehicles, which combine internal combustion engines with electric motors, offer a significant reduction in emissions and better fuel economy.

North America held a considerable share of the high-voltage hybrid vehicle market in 2024. The governments of the United States and Canada have launched a number of programs to encourage the use of electric and hybrid cars. These consist of substantial expenditures in EV infrastructure as well as tax credits and subsidies. For example, California's laws require more electric truck sales, which is anticipated to increase the high-voltage hybrid vehicle market.

The need to cut greenhouse gas emissions and increase public awareness of climate change is driving both automakers and consumers toward the high-voltage hybrid vehicle market. High-voltage hybrid car adoption is mostly being driven by advancements in battery technology and longer vehicle range. To increase consumer appeal, manufacturers are concentrating on cutting expenses and improving vehicle performance.

Europe is expected to host the fastest-growing high-voltage hybrid vehicle market during the forecast period. Europe has a wide range of vehicle types on the market for high-voltage hybrid vehicles, including lorries, buses, and passenger automobiles. Full hybrid electric vehicles (HEVs) and plug-in hybrid electric vehicles (PHEVs), which provide different degrees of range on electricity alone and fuel efficiency, are the focus of much attention.

In the high-voltage hybrid vehicle market, vehicle performance and range are being improved by advancements in battery technology, especially with regard to the development of lithium-ion and solid-state batteries. Enhancements in electric motor systems are also helping to improve driving pleasure and fuel economy. The growing consciousness of consumers regarding fuel economy and ecological implications is propelling the demand for hybrid automobiles. These cars are becoming more and more popular because of their improved performance and lower fuel consumption.

One kind of hybrid electric vehicle (HEV) that runs on a higher voltage battery system—typically above 200 volts—is the high-voltage hybrid vehicle (HVHV). These cars cut pollution and improve fuel economy by combining an internal combustion engine (ICE) with one or more electric motors. In order to comply with strict pollution standards and environmental restrictions, automakers are being forced to employ hybrid technology.

Constant improvements in power electronics, electric motor efficiency, and battery technology are increasing the viability and consumer appeal of HVHVs. Consumer interest is being fueled by rising environmental awareness as well as the advantages of hybrid cars, such as lower fuel costs and a smaller carbon footprint, is driving the high-voltage hybrid vehicle market.

The high-voltage hybrid vehicle market is expanding as a result of government subsidies and incentives for electric and hybrid automobiles. Cost-conscious buyers are drawn to HVHVs because they are more fuel-efficient than traditional ICE cars. ADAS is being added to HVHVs more frequently in order to enhance driving safety and enjoyment. PHEVs, which provide the flexibility of combining electric and conventional driving, are becoming more and more popular.

IoT and connected automobile technologies are integrated into HVHVs to improve user experience. Creation of longer-lasting and more effective battery systems to save money and boost range. Growing consumer demand for eco-friendly and fuel-efficient automobiles, along with technology advancements and environmental laws, are driving the high-voltage hybrid vehicle market, which offers significant potential opportunities.

| Report Coverage | Details |

| Market Size by 2034 | USD 1,352.23 Billion |

| Market Size in 2025 | USD 260.23 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 20.15% |

| Largest Market | Asia- Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Fuel efficiency and cost savings

The automotive industry is witnessing a surge in the popularity of high-voltage hybrid vehicles (HVHVs) owing to their fuel efficiency and possible cost benefits. These cars combine an electric motor that is driven by a high-voltage battery pack with an internal combustion engine. By combining these two power sources, HVHVs can minimize pollution and maximize fuel efficiency. In order to support the internal combustion engine during acceleration and other times of high demand, HVHVs use an electric motor. As a result, the engine runs with less strain, using less fuel. Because the electric motor in an HVHV can manage different power demands, the internal combustion engine often runs at maximum efficiency. When compared to conventional automobiles, this leads to improved fuel efficiency.

Battery limitations

Plug-in hybrids (PHEVs) and full hybrids, which are high-voltage hybrid vehicles, primarily depend on battery technology to generate electricity and enhance fuel efficiency. Nevertheless, the batteries that are utilized in these cars have a number of drawbacks. When compared to gasoline or diesel fuels, the batteries in high-voltage hybrid vehicles usually have lower energy densities. This results in heavier battery packs since they store less energy per unit of weight. One of the primary causes of the higher initial cost of hybrid vehicles relative to traditional internal combustion engine (ICE) vehicles is the high cost of batteries. Infrastructure for fast and readily available charging is sometimes scarce, particularly for plug-in hybrid vehicles, which need frequent charging in order to maximize their electric range.

Infrastructure development

The success and wider adoption of high-voltage hybrid vehicles (HVHVs) depend heavily on the development of infrastructure in the market. This encompasses a number of crucial aspects, such as manufacturing capacity, research and development, regulatory frameworks, and charging infrastructure. It is imperative that high-capacity charging facilities be expanded. This covers both private and public charging stations, emphasizing fast-charging innovations suitable for high-voltage hybrid cars and establishing a reliable supply chain for vital components needed to produce batteries, such as cobalt and lithium. investing in R&D to develop battery technologies that are more affordable, long-lasting, and efficient. Solid-state batteries and other cutting-edge technologies fall under this category.

The hybrid electric vehicle segment held the largest share of the high-voltage hybrid vehicle market in 2024. In the high-voltage hybrid vehicle market, the hybrid electric vehicle (HEV) category has been a major player, providing a middle ground between conventional internal combustion engine vehicles and fully electric vehicles. Internal combustion engines (ICEs) and electric propulsion systems are commonly combined in hybrid electric vehicles (HEVs), which store energy produced by regenerative braking and other sources in a high-voltage battery. The popularity of HEVs can be attributed to their superior fuel efficiency and lower emissions when compared to regular cars. These cars frequently run in series-parallel or parallel configurations, allowing the ICE and electric motor to each produce propulsion in turn or concurrently, according to the driving situation.

The plug-in hybrid electric vehicle segment will grow rapidly in the high-voltage hybrid vehicle market over the forecast period. These cars combine electric and internal combustion engine (ICE) power to give drivers the option of using the ICE's larger range for longer trips and the flexibility of using solely electricity for shorter ones. PHEVs are attractive because they can lower fuel consumption and greenhouse gas emissions when compared to conventional internal combustion engine vehicles. This is especially true for drivers who have access to electric charging infrastructure. Because they have an internal combustion engine (ICE) for backup, they provide the ease of daily journeys on electric power alone, without the range anxiety that comes with pure electric cars (EVs).

Passenger vehicles dominated the high-voltage hybrid vehicle market in 2024. Within the high-voltage hybrid vehicle sector, passenger cars account for a sizeable portion of the car industry. These cars use an electric propulsion system in conjunction with an internal combustion engine (usually a gasoline or diesel engine), storing and supplying electricity to the drivetrain through the use of a high-voltage battery. High-voltage hybrid cars contribute to environmental sustainability by producing fewer emissions than conventional gasoline or diesel cars because they run more on electricity. High-voltage hybrid systems' electric components can improve the car's overall performance by delivering instant torque for rapid acceleration and more comfortable driving. As a compromise between conventional internal combustion engines and electric vehicles, high-voltage hybrid vehicles are becoming more and more popular due to rising fuel prices and growing public awareness of environmental issues.

Commercial vehicles segment is expected to show the fastest growth in the high-voltage hybrid vehicle market during the forecast period. Compared to passenger cars, commercial vehicles must meet certain requirements, such as greater payload capacity, longer driving ranges, and more rigorous duty cycles. An internal combustion engine, an electric motor, and a battery system are combined in hybrid technology to provide the required power and efficiency for commercial applications. With hybrid systems, fuel efficiency is increased over conventional internal combustion engines by making the best use of both conventional fuel and electric power. Electric motors are advantageous for commercial applications such as stop-and-go driving in urban areas because they produce instant torque, which improves acceleration and overall performance. An important development in the automobile industry is the incorporation of hybrid technology into commercial vehicles, which is motivated by the need for increased efficiency, sustainability, and regulatory compliance.

By Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

December 2024

December 2024

November 2024