April 2025

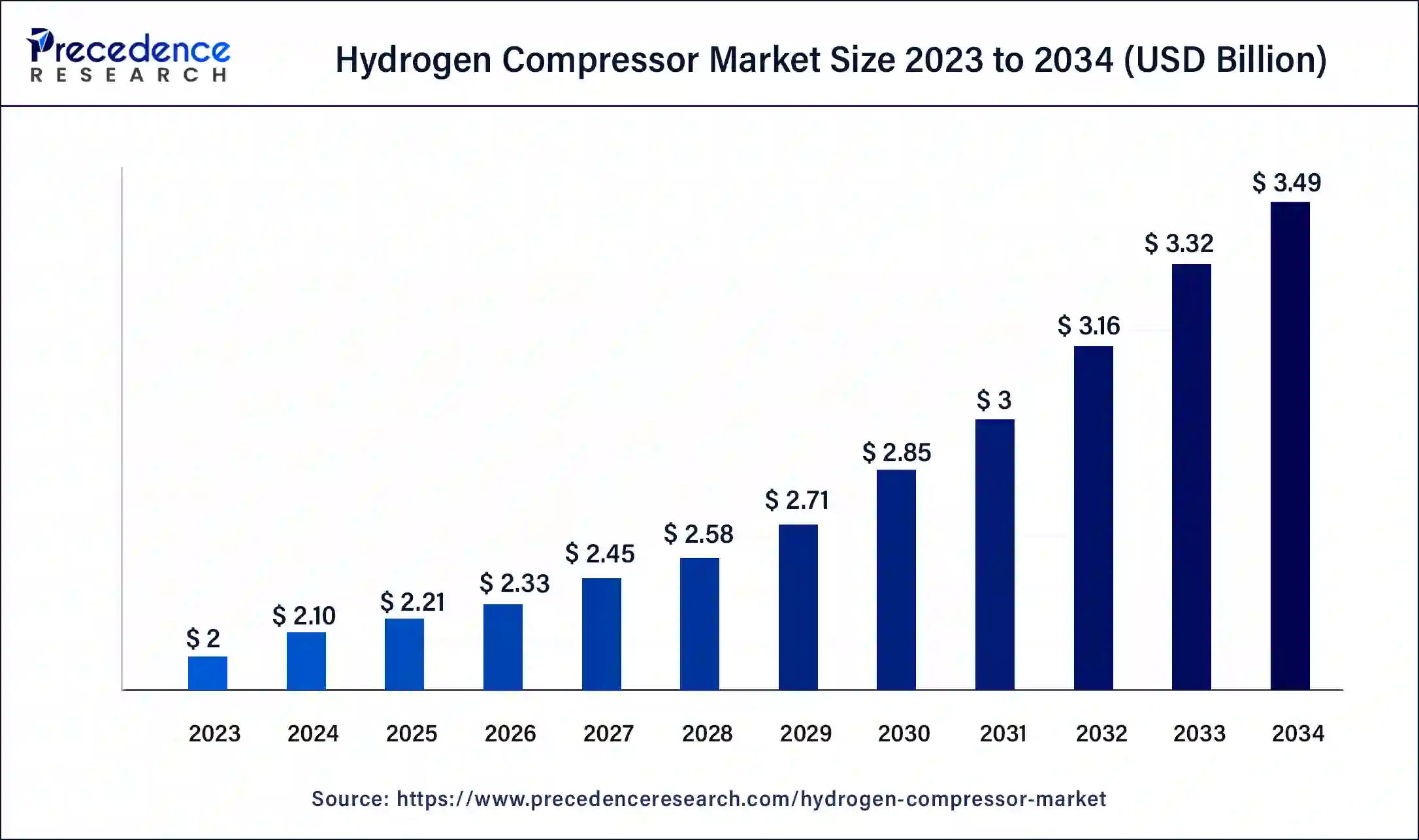

The global hydrogen compressor market size surpassed USD 2 billion in 2023 and is estimated to increase from USD 2.10 billion in 2024 to approximately USD 3.49 billion by 2034. It is projected to grow at a CAGR of 5.21% from 2024 to 2034.

The global hydrogen compressor market size is anticipated to reach around USD 3.49 billion by 2034 from USD 2.10 billion in 2024, at a CAGR of 5.21% from 2024 to 2034. The market growth is attributed to growing investments in hydrogen infrastructure development, including refueling stations and production facilities.

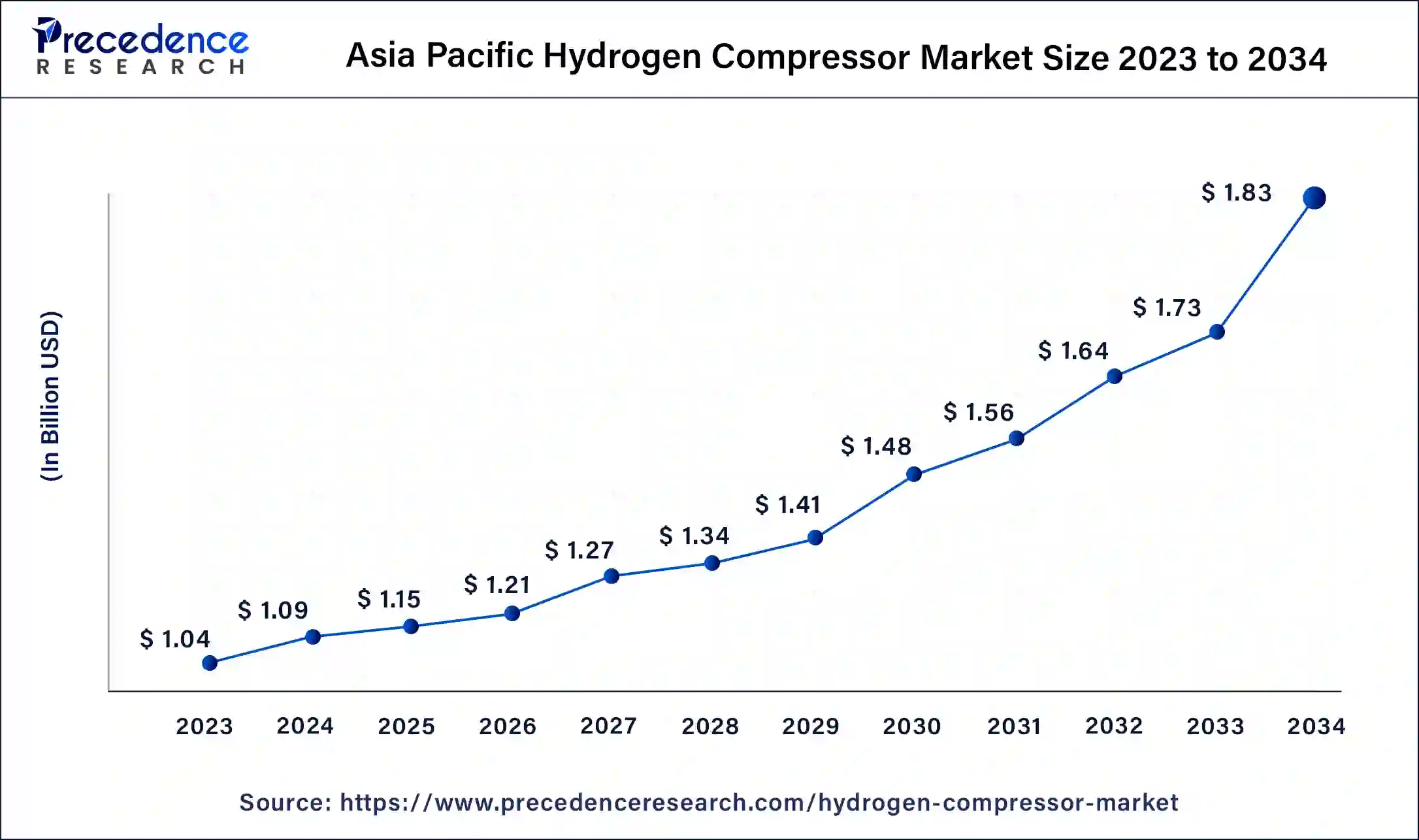

The Asia Pacific hydrogen compressor market size was exhibited at USD 1.04 billion in 2023 and is projected to be worth around USD 1.83 billion by 2034, poised to grow at a CAGR of 5.27% from 2024 to 2034.

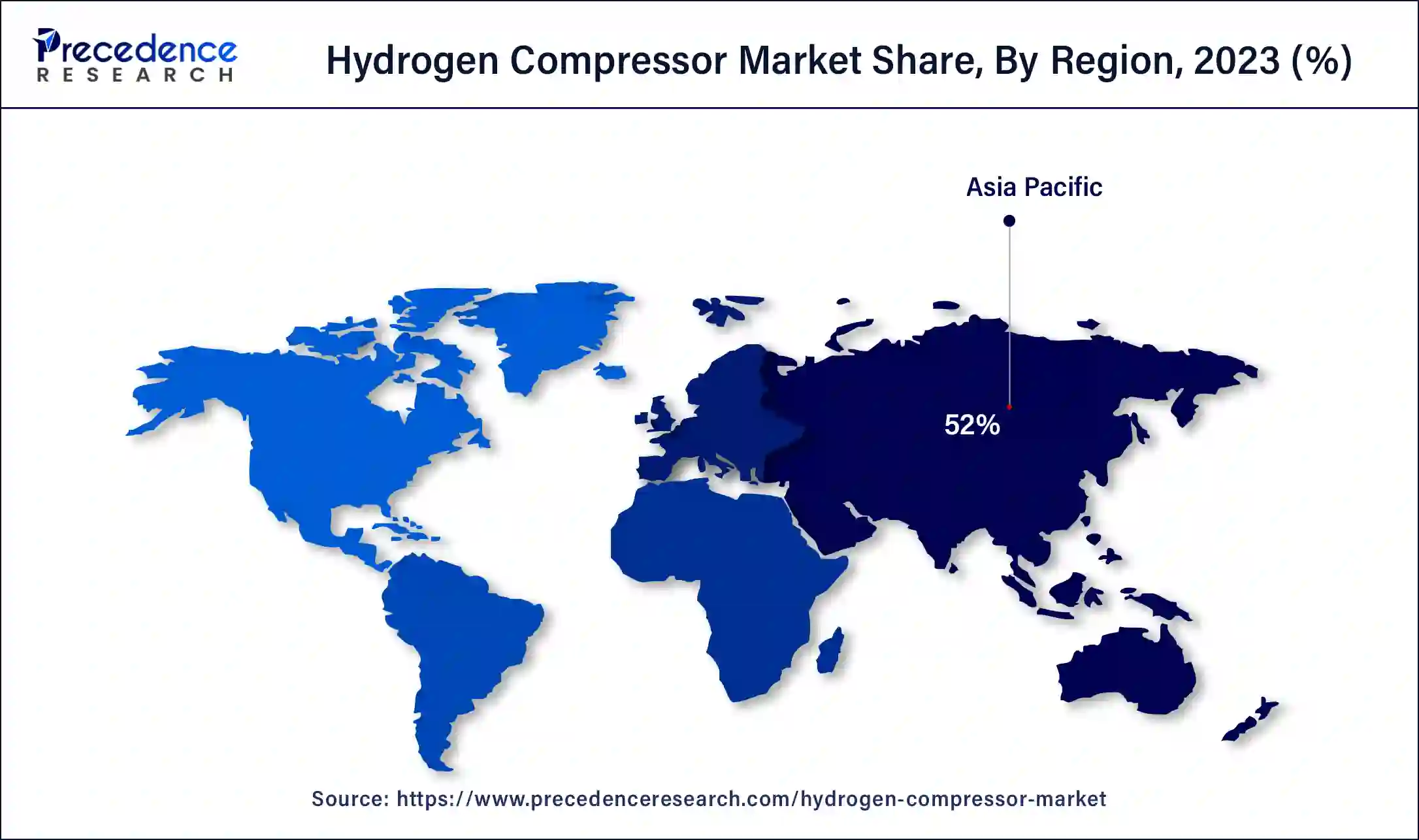

Asia Pacific led the hydrogen compressor market, capturing the largest market share in 2023. Countries, including Japan, South Korea, and China are anticipated to remain as the leaders in adopting hydrogen with their goal of cutting down their carbon footprint and ensuring energy security. Favorable governmental policies for the production of clean energy sources have resulted in increased investments by this region in hydrogen refueling stations, power generation, and industrial uses, which consequently correspond to the demand for hydrogen compressors. The rapidly growing automotive industry across the region especially the development of hydrogen fuel cell vehicles also positively affects the market. Also, favorable government policies, strong financial incentives, and partnerships between the public and private domain boost the market in Asia Pacific.

Europe is observed to grow at a significant rate during the forecast period. European Union’s Green Deal and several other national policies focus on attaining clean energy, which increases investments in efficient hydrogen technologies aggressively. Potential applications in Europe may include hydrogen refueling stations, power plants, industries, and many others, which will create demand for better hydrogen compressors. Due to abundant government incentives for hydrogen projects along with active participation of Europe to decrease greenhouse emissions, this segment is driving the market. Also, the focus of the region on development of technology and renewable sources of energy also put Europe forth as a major market to drive future demands of the market of hydrogen compressors.

High adoption rates in industries such as oil and gas, chemical, and power generation are anticipated to contribute to the growth if the hydrogen compressor market, as these sectors seek to improve energy efficiency and sustainability. Hydrogen compressors are specific equipment utilized for enhancing the pressure of elemental hydrogen for storage, transportation, and more. Piston compressors incorporate reciprocating piston type which is suitable for high pressure such as the refueling stations.

Diaphragm type of compressors work with flexible diaphragms meant for uncompromising oil free and fresh compression appropriate for the industries that handle highly purified hydrogen. Centrifugal compressors are characterized by high handling capacity through rotating impellers which suitable for hydrogen production central plants and pipelines. Newer types of piston compressors employing ionic liquids for compression are known as ionic liquid piston compressors or ILPCs. The development of new materials, sealing and cooling solutions improves these compressors’ function and durability while boosting the hydrogen economy potential.

How AI Can be Used for Hydrogen Production?

AI can significantly enhance hydrogen production by optimizing processes, reducing costs, improving efficiency, and ensuring safety. AI algorithms can optimize the electrolysis process, where water is split into hydrogen and oxygen. By analyzing real-time data, AI can adjust parameters such as voltage, temperature, and pressure to maximize hydrogen yield while minimizing energy consumption. AI-driven models can accelerate the discovery and optimization of catalysts used in hydrogen production. By simulating various materials and conditions, AI helps identify the most efficient and cost-effective catalysts for processes like steam methane reforming or electrolysis.

| Report Coverage | Details |

| Market Size by 2034 | USD 3.49 Billion |

| Market Size in 2023 | USD 2 Billion |

| Market Size in 2024 | USD 2.10 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 5.21% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Increasing demand for hydrogen as a clean energy source

Increasing demand for hydrogen as a clean energy source is anticipated to drive market expansion. Hydrogen as a zero-emission fuel replace other carbon emitting fuels in sectors, including transportation, electricity production, and industries. The transition toward hydrogen-based energy systems furthers the international targets of dematerialization, thus increasing the demand for effective hydrogen compression solutions. Such demand is especially high in the areas with high requirements to emissions and goals to increase the share of renewable energy sources.

Additionally, there are improved solutions to produce hydrogen, including electrolysis using renewable sources of power and, thus, hydrogen costs are reducing. Increased usage of hybrid electric vehicles particularly in the transportation systems, requires refueling stations and the components involve hydrogen fuel cell. These all factors further boost the market during the forecasting period.

Competition from alternative technologies

The competition from rapidly growing and improving advanced technologies in clean energy batteries and the renewable energy market are projected to restrain the market. All these alternatives are expected to attract investors and consumers’ attention, which may equally repel focus from hydrogen-based systems. This only indicates that the fast-growing and finally implemented combative technologies are a major problem to the hydrogen compressor market, as these generally entail lower costs and easier infrastructure solutions. Such a competitive structure does not allow for large market shares and profitable growth within the market of hydrogen compressors.

Growing investment in renewable hydrogen production

Growing investment in renewable hydrogen production, such as electrolysis using solar and wind energy, is anticipated to boost the growth of the hydrogen compressor market. Clean hydrogen, generated from sustainable sources, caters directly to worldwide decarbonization objectives and improves the hydrogen energy systems’ value matrix. Such a surge in green hydrogen production is believed to push for requirement of enhanced compression solutions in an attempt to accommodate storage and transportation hence presenting considerable market prospects. The emphasis on sustainability and its role in reducing environmental effects drives investment and advancements in the area of hydrogen compressors.

The reciprocating compressors segment dominated the hydrogen compressor market 2023. It was deemed that reciprocating compressors maintain the largest market share in the near future due to the capability to compress hydrogen to very high pressures required in hydrogen refueling stations and industries. High efficiency and operational reliability, reciprocating compressors are applied in places with high-performance characteristics.

These factors include their capacity to deliver a precise interlocking and compression which, apart from being relatively more uniform than other popular shingles, provides relatively simpler means of maintenance and repair hence enhanced popularity. Moreover, the requirement of hydrogen in transportation and electric power generation supports the utilization of reciprocating compressors.

The centrifugal compressors segment is observed to grow at a significant rate during the forecast period. Increase in larger compression systems for hydrogen generation and distribution is expected to increase demand for centrifugal compressors. Such compressors are expected to find market demand as they are characterized by high flow rates and operating in a continuous mode in various applications including hydrogen production plants and pipelines.

The trend of client organizations to reduce overall utilization costs and augment the effectiveness of the operating system dovetails well with the capabilities of centrifugal compressors. On the basis of the operational stability and relatively lower tendencies for maintenance these performers are favourably positioned for the future market demands.

The hydrogen refueling stations segment held the largest market share in the hydrogen compressor market during the forecasting period. The expansion of hydrogen refueling infrastructure is expected to continue driving market growth, as governments and private enterprises invest heavily in establishing comprehensive refueling networks. Hydrogen refueling stations require high-pressure compressors to efficiently refuel vehicles and ensure a steady supply of hydrogen. The increasing adoption of hydrogen fuel cell vehicles and supportive government policies, such as subsidies and incentives for clean transportation, contribute to the dominance of this segment.

Power plants sub-segment is projected to lead the market in the coming years. The shift further low-emission energy solutions lead to higher demand of the hydrogen power plants that involve the application of efficient methods for hydrogen compression for its utilization as a fuel. The demand for massive hydrogen compression stations especially in the power plant settings is expected to increase as such facilities plans to use hydrogen as a back up or an addition to the hydrocarbon. This focus on the improvement of energy intensity, decreasing in the amount of greenhouse gas emissions, and attaining sustainability objectives creates the need for high-performance hydrogen compressors in this sector. Moreover, there are prospects for expanding the hydrogen-based power generation technologies and continuously increasing the favourable policies of clean energies.

Segments Covered in the Report

By Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

May 2024

March 2025

March 2025