April 2025

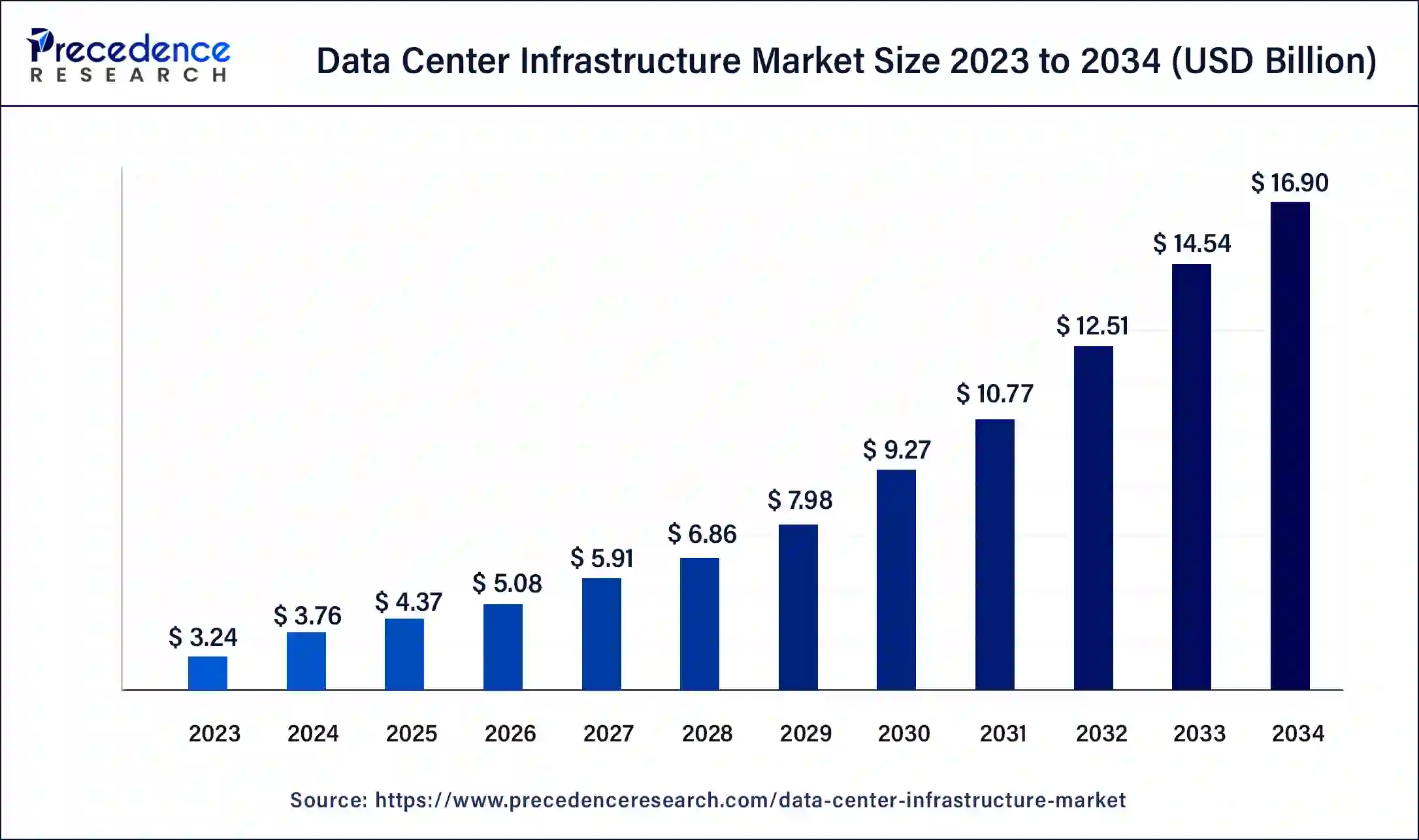

The global data center infrastructure market size accounted for USD 3.76 billion in 2024, grew to USD 4.37 billion in 2025, and is projected to surpass around USD 16.90 billion by 2034, representing a healthy CAGR of 16.2% between 2024 and 2034. The North America data center infrastructure market size is calculated at USD 1.30 billion in 2024 and is expected to grow at the fastest CAGR of 16.25% during the forecast year.

The global data center infrastructure market size is expected to be valued at USD 3.76 billion in 2024 and is anticipated to reach around USD 16.90 billion by 2034, expanding at a CAGR of 16.2% over the forecast period 2024 to 2034.

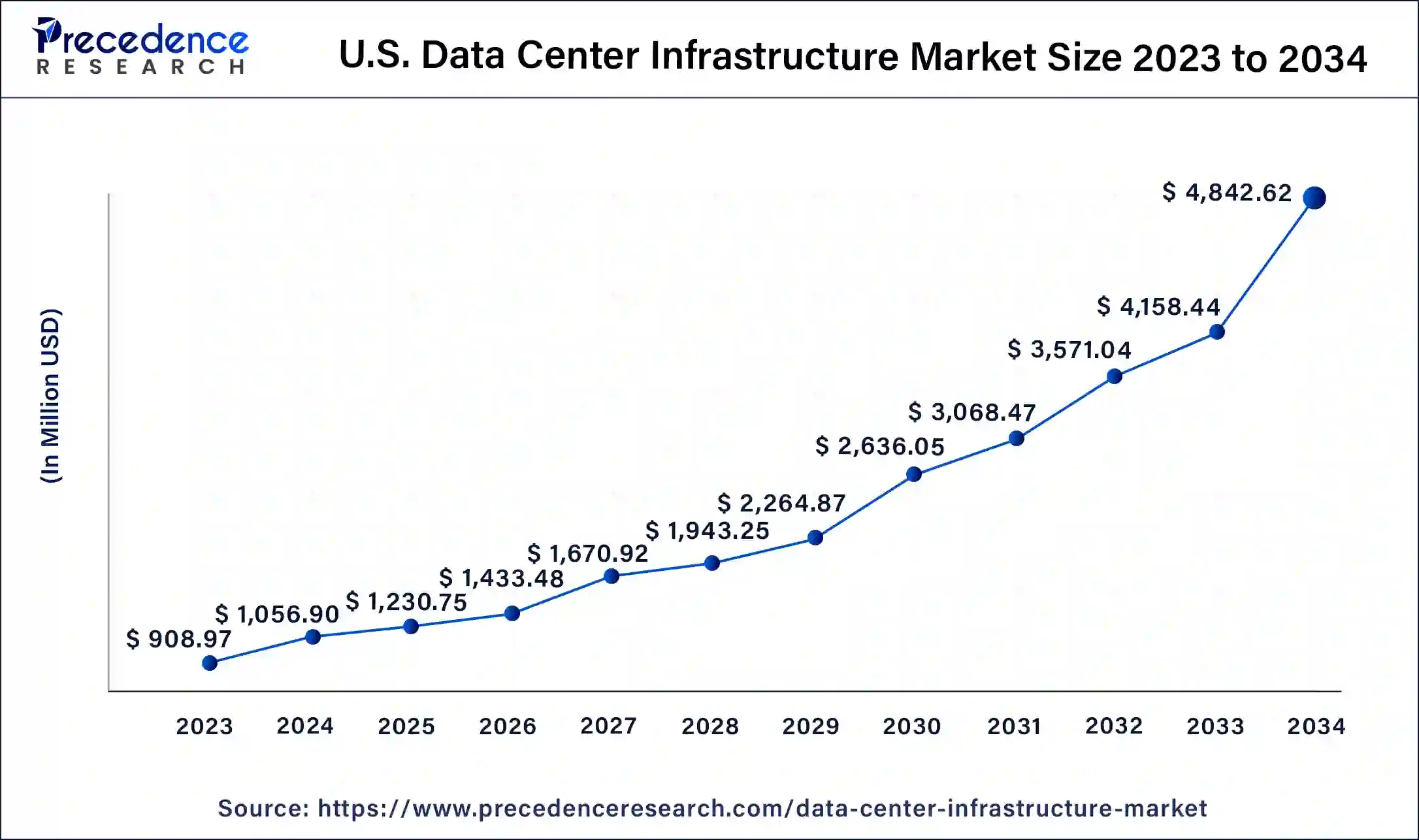

The U.S. data center infrastructure market size is calculated at USD 1,230.75 million in 2024 and is projected to be worth around USD 4,842.62 million by 2034, poised to grow at a CAGR of 16.4% from 2024 to 2034..

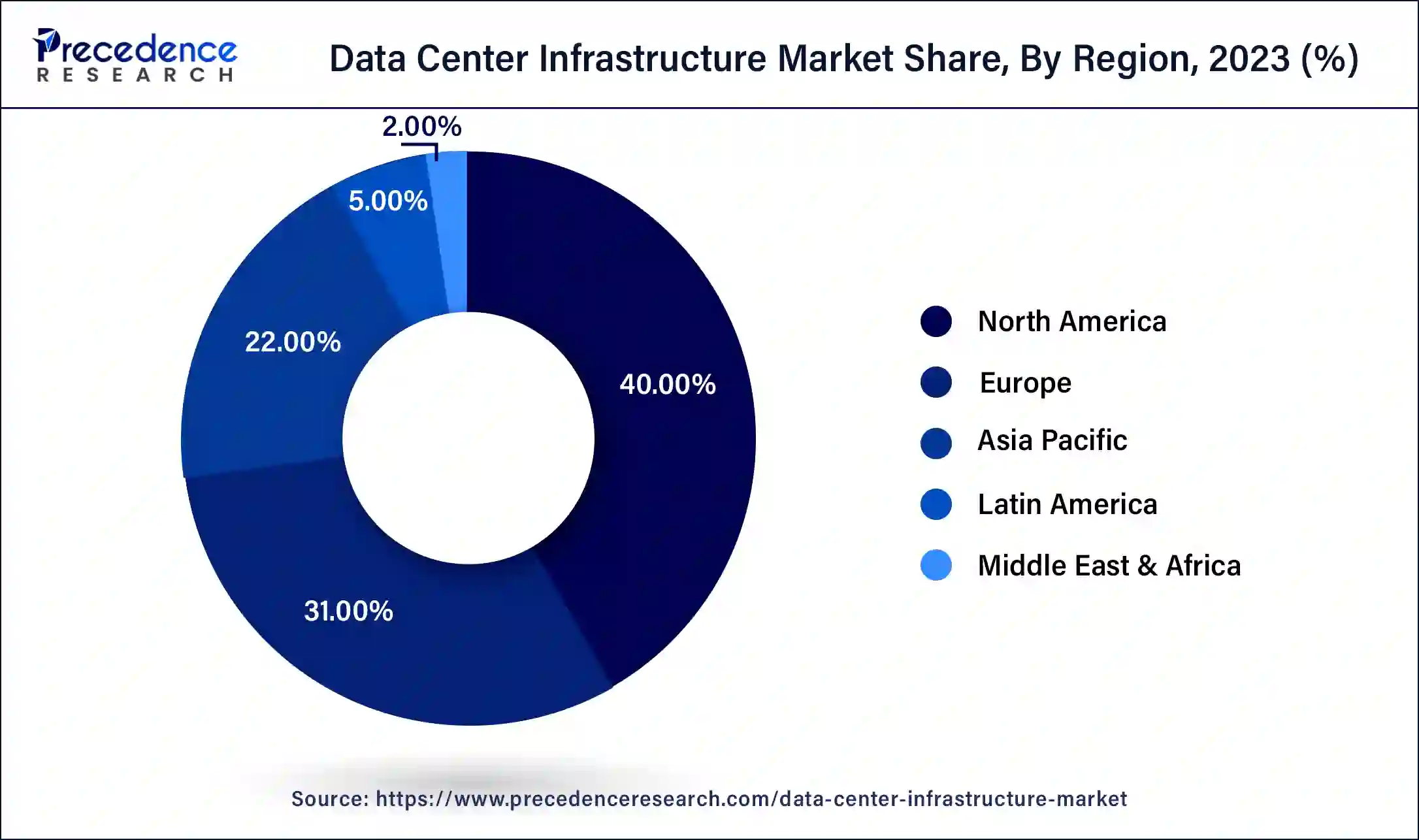

North America has held the largest revenue share of 40% in 2023. In North America, the data center infrastructure market is characterized by a strong emphasis on innovation and sustainability. The region is witnessing a growing trend in green data centers, focusing on renewable energy sources, energy-efficient cooling systems, and environmentally responsible practices. There's a substantial movement towards edge computing to reduce latency for real-time applications, such as IoT and 5G.

Asia-Pacific is estimated to observe the fastest expansion. The Asia-Pacific region is marked by rapid growth and increasing investment in data center infrastructure. This region is embracing 5G technology, driving the need for advanced infrastructure to support the network. Asia-Pacific is witnessing a growing focus on cost-effective solutions to cater to its diverse and expanding markets. In addition, there is a pronounced interest in modular and prefabricated data centers to meet the demand for scalability and rapid deployment.

The data center infrastructure market encompasses the worldwide sector responsible for providing the essential physical components and technology required for the functioning of data centers. These components comprise servers, storage devices, networking equipment, power and cooling systems, and security solutions.

As the demand for digital services and data storage continues to surge, this market has witnessed substantial expansion. It encompasses various players, from hardware manufacturers to software providers and service companies, all contributing to the development and maintenance of data center facilities. The market continues to evolve to meet the expanding needs of businesses for reliable and efficient data processing and storage solutions.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 16.2% |

| Market Size in 2024 | USD 3.76 Billion |

| Market Size by 2034 | USD 16.90 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Component, By Data Center Type, By Application, By Enterprise Size, and By End User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Digital transformation and cloud computing

The rise of cloud computing, offering flexible, on-demand access to computing resources, has instigated a fundamental transformation in how data is stored and processed. Cloud service providers are driving substantial demand for data center infrastructure to support the expanding array of virtual machines, storage capacities, and networking resources they provide to businesses. This demand has prompted data center operators to undertake extensive expansions and upgrades to their facilities, in turn, propelling the market's growth in response to the burgeoning need for cloud services.

IoT and big data, on the other hand, have brought about an explosion of connected devices and data generation. IoT devices continuously collect and transmit data, while big data analytics necessitate significant computing power to derive valuable insights.

As businesses harness these technologies to gain a competitive edge, data center infrastructure is essential to store and process this data efficiently, further escalating the demand for data centers equipped with the latest hardware, advanced networking, and robust security features. Together, cloud computing, IoT, and big data have transformed the data center landscape, making it a critical and expanding sector in today's digital economy.

High energy consumption and complex cooling requirements

High energy consumption and complex cooling requirements are significant restraints for the demand for the data center infrastructure market. Data centers are known for their substantial energy demands, and as they expand in size and capabilities, their need for electricity increases. This results in not only significant operational expenses but also environmental apprehensions related to the carbon emissions linked to power generation.

The imperative to curtail energy consumption and meet sustainability targets is compelling data center operators to invest in energy-efficient infrastructure, a process that can be both expensive and time-intensive to establish.

Additionally, the complex cooling requirements in data centers are a critical challenge. To maintain the optimal operating temperature for servers and equipment, intricate cooling systems are essential. These systems can be expensive to install and maintain, and they often consume a significant portion of the overall energy usage in a data center. The intricate network of cooling infrastructure also adds to the complexity of data center management, requiring specialized expertise and resources. As such, these challenges pose hurdles in terms of cost, energy efficiency, and operational complexity, restraining the market demand for data center infrastructure.

AI, automation and edge computing expansion

The data center infrastructure market is experiencing a substantial surge in demand driven by the rapid expansion of AI, Automation, and edge computing. AI applications demand extensive computing power for tasks like machine learning and data analytics. As AI becomes increasingly integrated into various industries, data centers must be equipped with the latest hardware to meet computational requirements. This is propelling the need for high-performance servers, advanced networking equipment, and efficient cooling solutions, thus driving market growth.

Automation, another transformative technology, relies on data center infrastructure for seamless operations. Data centers underpin the remote management and orchestration of resources, enhancing operational efficiency. Furthermore, as businesses automate their processes, the need for reliable data storage and backup solutions grows, further stimulating demand.

Edge computing, which involves processing data closer to its source, demands decentralized data center infrastructure. Data centers at the edge need to be compact, energy-efficient, and highly responsive to deliver real-time processing capabilities. This trend is pushing data center providers to develop innovative solutions tailored to edge computing requirements, creating new opportunities for growth in the market. In essence, AI, Automation, and edge computing are at the forefront of reshaping data center infrastructure, catalyzing demand for more advanced, scalable, and efficient solutions.

According to the component, the disposables segment has held 78% revenue share in 2023. Solutions in the market encompass the physical and virtual components required for data center operation. This includes servers, storage systems, networking equipment, power and cooling solutions, and security systems. Software-defined data centers (SDDC) are also gaining prominence, enabling greater agility and automation through virtualization and centralized management.

The service segment is anticipated to expand at a significantly CAGR of 18.5% during the projected period. Services represent the range of support offerings, including installation, maintenance, consulting, and managed services. The trend in services is towards increased automation and remote management, as well as a growing emphasis on security and energy efficiency services, aligning with the evolving needs of data center operators.

Based on the data center type, the enterprise data centers segment held the largest market share of 38% in 2023. Enterprise data centers are privately owned facilities dedicated to an organization's data processing and storage needs. These data centers are typically on-premises and serve as the core IT infrastructure for a single business. A key trend in this space is the move towards more energy-efficient and sustainable operations, with enterprises increasingly adopting green technologies and practices to reduce environmental impact while enhancing cost-efficiency and reliability.

On the other hand, the cloud and edge data centers segment is projected to grow at the fastest rate over the projected period. Cloud and edge data centers are part of the broader trend towards decentralized computing. Cloud data centers, hosted by service providers, offer scalable resources for businesses, while edge data centers are located closer to end-users for low-latency processing. In the market, the trend is toward optimizing these data centers for rapid data processing, often integrating renewable energy sources, and enhancing security to support the growth of cloud services and edge computing applications.

In 2023, the asset management segment had the highest market share of 43% based on the application. In the data center infrastructure market, asset management refers to the systematic monitoring, tracking, and optimization of physical components such as servers, storage devices, and networking equipment. This helps in maximizing their lifespan and efficiency. A key trend is the adoption of AI-driven asset management, allowing predictive maintenance, reducing downtime, and optimizing resource allocation. Asset management solutions are increasingly integrated with data center infrastructure to ensure optimal use of assets, reducing operational costs, and enhancing reliability.

The BI and analytics segment is anticipated to expand at the fastest rate over the projected period. Business Intelligence (BI) and analytics in data centers involve processing and analyzing large volumes of data for insights and decision-making. The trend is toward integrating advanced analytics capabilities directly within data center infrastructure to support real-time data processing and reporting. This ensures that businesses can extract valuable insights faster and more efficiently, enabling data-driven decision-making and enhancing overall operational efficiency and competitiveness in the market.

In 2023, the large-sized enterprises segment had the highest market share of 69% based on Enterprise. Large enterprises, often defined by their substantial workforce and extensive operations, have a growing need for robust data center infrastructure to support their complex IT environments. This includes advanced servers, storage solutions, and networking equipment to ensure seamless data processing and storage. Trends in this segment focus on scalability, security, and energy efficiency, as large enterprises seek to accommodate increasing data demands while mitigating environmental impact.

The small and medium enterprises (SMEs) segment is anticipated to expand at the fastest rate over the projected period. Small and medium enterprises (SMEs) are characterized by their smaller scale and workforce. Their data center infrastructure requirements tend to prioritize cost-effectiveness and simplicity. Trends for SMEs revolve around the adoption of cloud-based services and managed data center solutions to minimize capital expenses and reduce operational complexity, enabling them to compete effectively in the digital landscape.

In 2023, the IT sector segment had the highest market share of 37% based on end-user. In the IT sector, the data center infrastructure market caters to organizations that rely on extensive data processing and storage. This sector includes enterprises, cloud service providers, and technology companies. They demand scalable, high-performance data center solutions to support their digital operations, which often involve cloud computing, virtualization, and big data analytics. A notable trend is the growing adoption of hyper-converged infrastructure, reducing hardware complexity and enhancing agility in IT operations.

The healthcare and life science segment is anticipated to expand at the fastest rate over the projected period. In the healthcare sector, data center infrastructure is vital for managing electronic health records, medical imaging, and telemedicine. Data centers in healthcare require robust security, compliance with data privacy regulations, and high availability. A prominent trend is the integration of edge computing solutions to process patient data closer to the source, ensuring real-time monitoring and critical decision-making. Additionally, the sector is witnessing an upsurge in hybrid cloud adoption to optimize data storage and improve scalability in healthcare IT systems.

Segments Covered in the Report

By Component

By Data Center Type

By Application

By Enterprise Size

By End User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

January 2025

March 2025

January 2025