January 2025

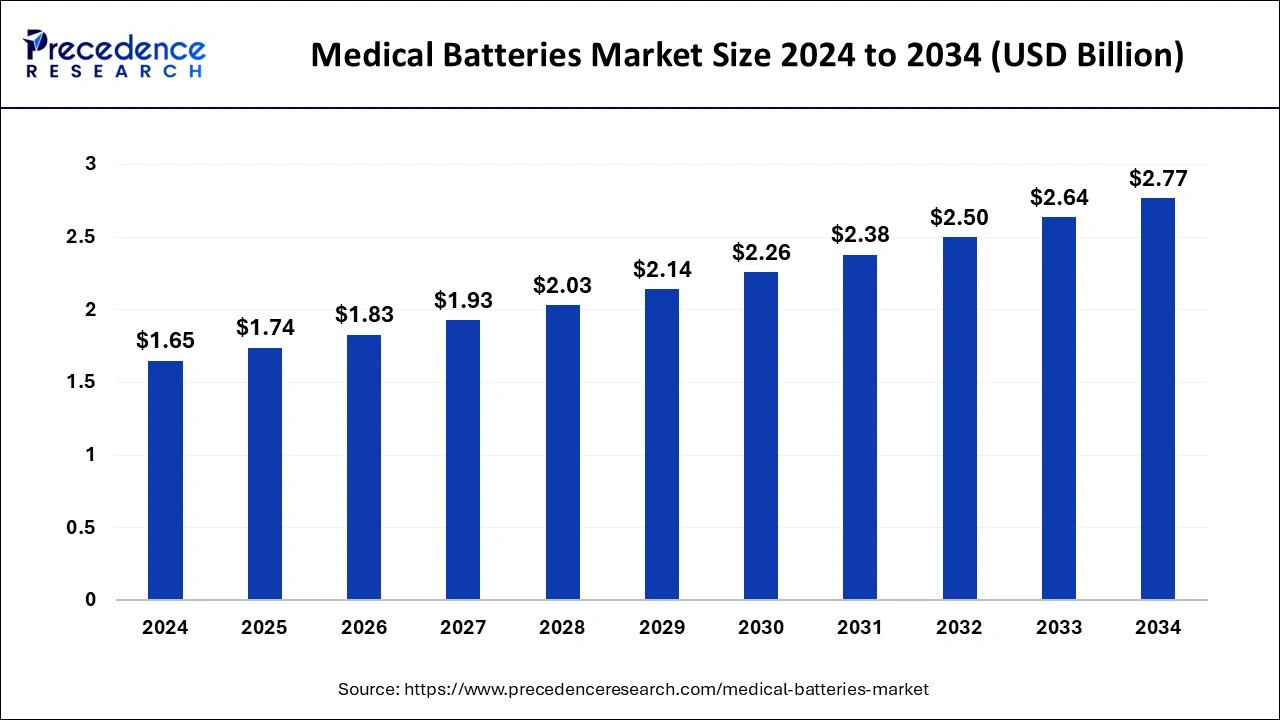

The global medical batteries market size is calculated at USD 1.74 billion in 2025 and is forecasted to reach around USD 2.77 billion by 2034, accelerating at a CAGR of 5.31% from 2025 to 2034. The North America medical batteries market size surpassed USD 610 million in 2024 and is expanding at a CAGR of 5.27% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global medical batteries market size was estimated at USD 1.65 billion in 2024 and is predicted to increase from USD 1.74 billion in 2025 to approximately USD 2.77 billion by 2034, expanding at a CAGR of 5.31% from 2025 to 2034. The medical battery market is anticipated to witness growth opportunities by producing specialized power solutions that fulfill stringent government regulations.

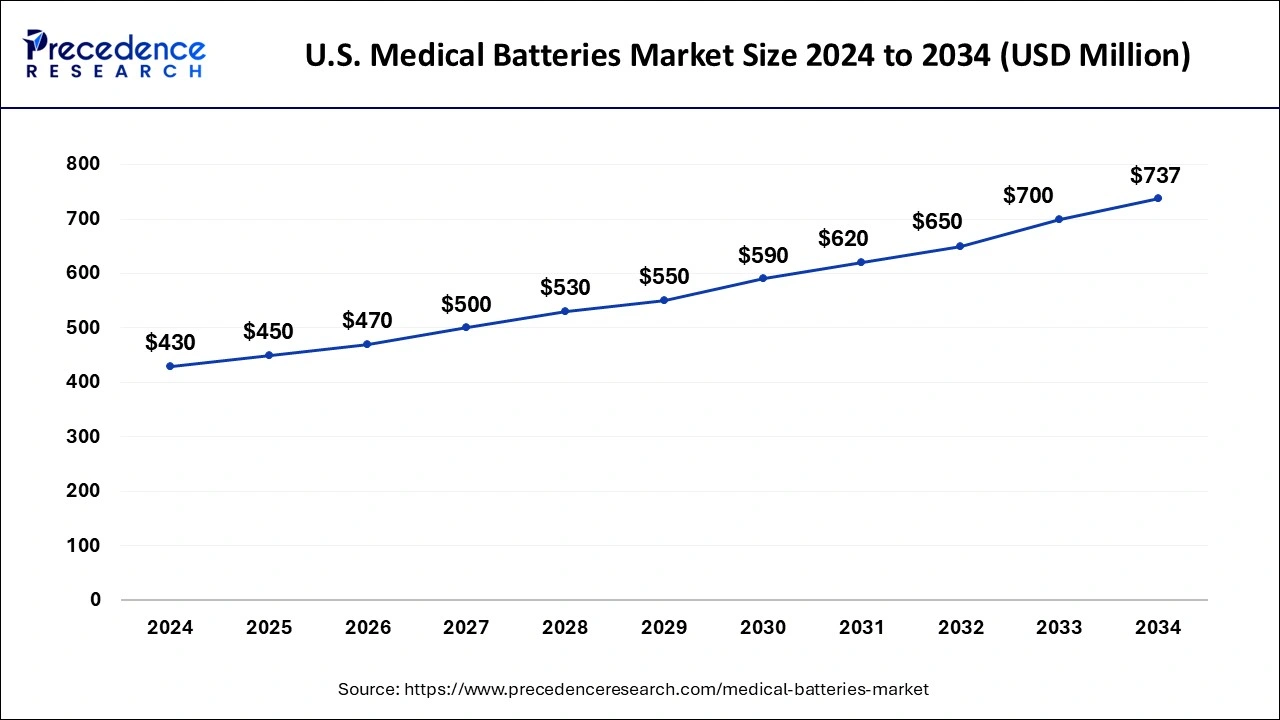

The U.S. medical batteries market size surpassed USD 430 million in 2024 and is projected to attain around USD 737 million by 2034, poised to grow at a CAGR of 5.53% from 2025 to 2034.

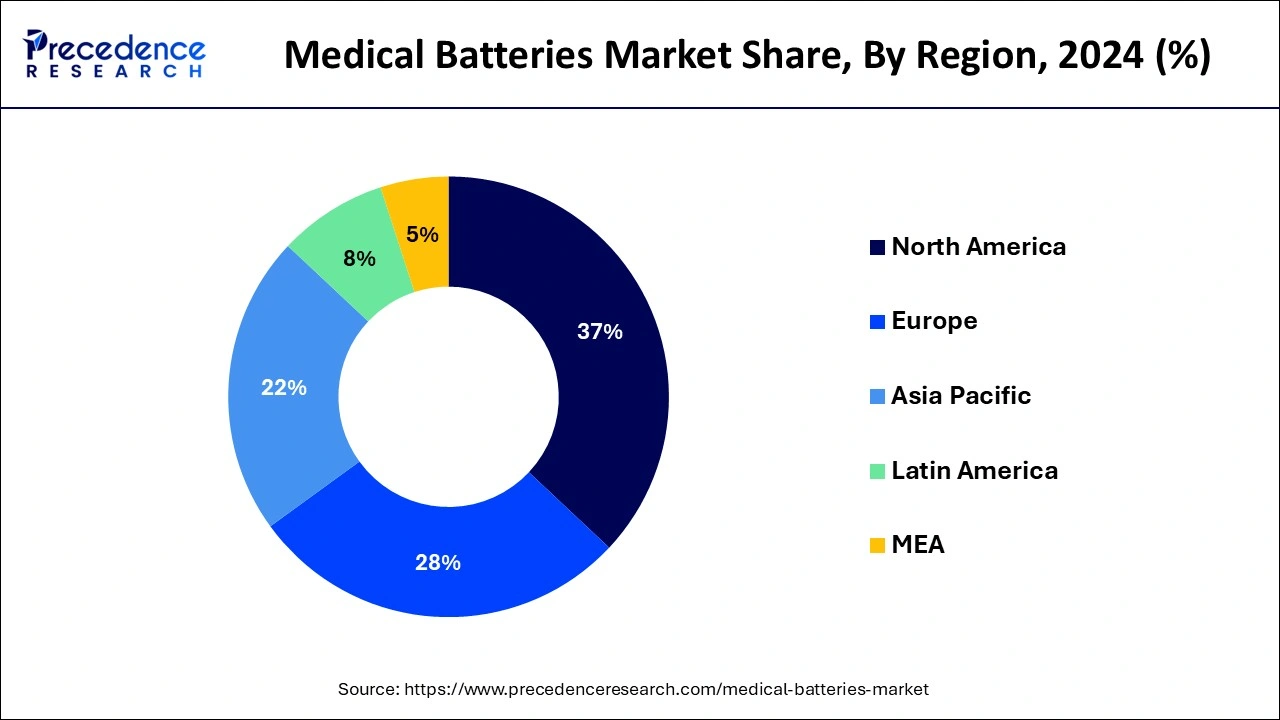

North America dominated the global medical batteries market in 2024. The rapid advancement of medical technology is a major factor driving the increasing importance of medical batteries in North America. As medical equipment becomes more advanced and mobile, there is a growing need for reliable and effective power sources. The healthcare sector's ongoing adoption of state-of-the-art technology drives the demand for medical batteries to power a wide range of devices, including implanted medical technologies and portable diagnostic equipment.

Asia Pacific is projected to host the fastest-growing medical batteries market over the forecast period. Regional growth is driven by the expansion of healthcare infrastructure, increased healthcare expenditures, and growing public awareness of advanced medical innovations. China dominates the market in this region. This dominance is linked to the fact that the Chinese medical battery market largely depends on imports or products manufactured locally through multinational partnerships, especially in high-end technology sectors. If regulatory reforms are successful and rural healthcare inadequacies are effectively addressed, the large number of previously untapped consumers makes China an attractive market opportunity.

Medical batteries are designed to provide extended operational time and higher energy output for healthcare devices. These specialized power sources meet the specific requirements of medical applications, powering a wide range of devices from basic portable tools to complex, life-saving equipment. Unlike conventional batteries, medical batteries are engineered for reliability, safety, and longevity, which are essential for the proper functioning of critical healthcare instruments.

| Report Coverage | Details |

| Market Size in 2025 | USD 1.74 Billion |

| Market Size by 2034 | USD 2.77 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.31% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Battery Type, Application, End-user, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Advancement in medical device technology

The global rise in chronic diseases such as diabetes, cardiovascular diseases, and respiratory disorders requires continuous monitoring and management facilitated by battery-powered medical devices. Devices like glucose monitors, cardiac monitors, and nebulizers rely on batteries for portability and sustained operation. Additionally, the aging global population, which often requires ongoing healthcare and monitoring, further drives the demand for the medical batteries market.

Advancements in medical device technology, including the integration of advanced features, increased automation, connectivity, and miniaturization, aim to enhance the performance, precision, and efficiency of these devices. Hence, the medical batteries market is expected to expand rapidly in the coming years.

Battery failures

Balancing the demand for smaller batteries with the need for adequate energy storage is a delicate challenge that researchers and engineers continue to address. The risk of leakage or rupture remains a significant concern for medical batteries. Although technological advancements have reduced these risks, battery failures still occur. A battery leak in implanted devices can cause serious tissue damage and potentially endanger the patient's life. These factors are expected to constrain the growth of the medical batteries market in the coming years.

Government initiatives

Although ventilators typically run on electricity, battery backups ensure their continuous operation during power outages. Medical batteries are crucial for ventilators. Electric Fuel, a smart battery and charger company, was selected to supply rechargeable Li batteries to an Israeli company for automatic ventilators to support COVID-19 efforts. Furthermore, state initiatives to improve healthcare infrastructure in many countries are creating significant growth opportunities for the medical batteries market. Programs encouraging medical device start-ups are also providing substantial growth prospects for the medical batteries market.

The medical batteries market in 2024 was dominated by the lithium-ion batteries segment. This growth is due to the fact that lithium-ion batteries offer one of the highest energy densities among modern battery technologies. They provide significant energy in a compact and lightweight form, making them ideal for medical devices where space and weight are critical considerations. These attributes will drive up demand in the market, which is particularly beneficial for frequently used medical equipment as it reduces the need for frequent battery replacements.

The nickel metal hydride batteries segment is expected to witness the fastest growth in the medical batteries market over the forecast period. Nickel-metal hydride (Ni-MH) batteries are commonly used in medical equipment such as infusion pumps and portable diagnostic devices due to their safety and long cycle life. Ni-MH batteries offer a versatile and environmentally friendly energy storage solution and feature advanced principles, various types, well-structured components, and broad applications. As technology continues to progress, Ni-MH batteries play a crucial role in providing reliable and sustainable power sources in the medical batteries market.

The implantable medical devices segment dominated the medical batteries market in 2024. The global increase in chronic diseases like cardiovascular disorders, neurological conditions, and chronic pain has boosted the use of implantable medical devices for managing and treating these conditions. This has led to a higher demand for medical batteries to power these devices, driving the growth of the medical batteries market.

The portable and wearable medical devices segment is expected to experience significant growth in the medical batteries market during the forecasted period. Wearable medical devices allow direct access to a patient's health status, potentially leading to life-saving interventions. These devices quickly detect changes in the patient's body. The increasing prevalence of chronic conditions, the expansion of wearable health technology, and the growing demand for portable medical devices in home healthcare are expected to drive segment growth in the near future.

The hospitals & clinics dominated the medical batteries market in 2024. The integration of medical batteries is crucial for the efficient functioning of advanced medical equipment. These technologies, ranging from cutting-edge imaging devices to portable diagnostic kits and telemedicine setups, depend on a steady and reliable power source. Medical batteries ensure compatibility with the latest healthcare technologies, enabling hospitals and clinics to keep pace with medical advancements. As healthcare institutions prioritize sustainability, the adoption of rechargeable and environmentally friendly medical batteries aligns with these goals.

The ambulatory surgical center (ASCs) segment will show rapid growth over the projected period. Ambulatory surgery centers (ASCs) are a critical sector in healthcare, offering outpatient surgeries that are both cost-effective and convenient. The growth of the ambulatory surgical center segment is driven by factors such as a rise in surgical procedures, an increase in chronic disease prevalence, and a growing elderly population.

By Battery Type

By Application

By End-user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

March 2025

August 2024

January 2025