April 2025

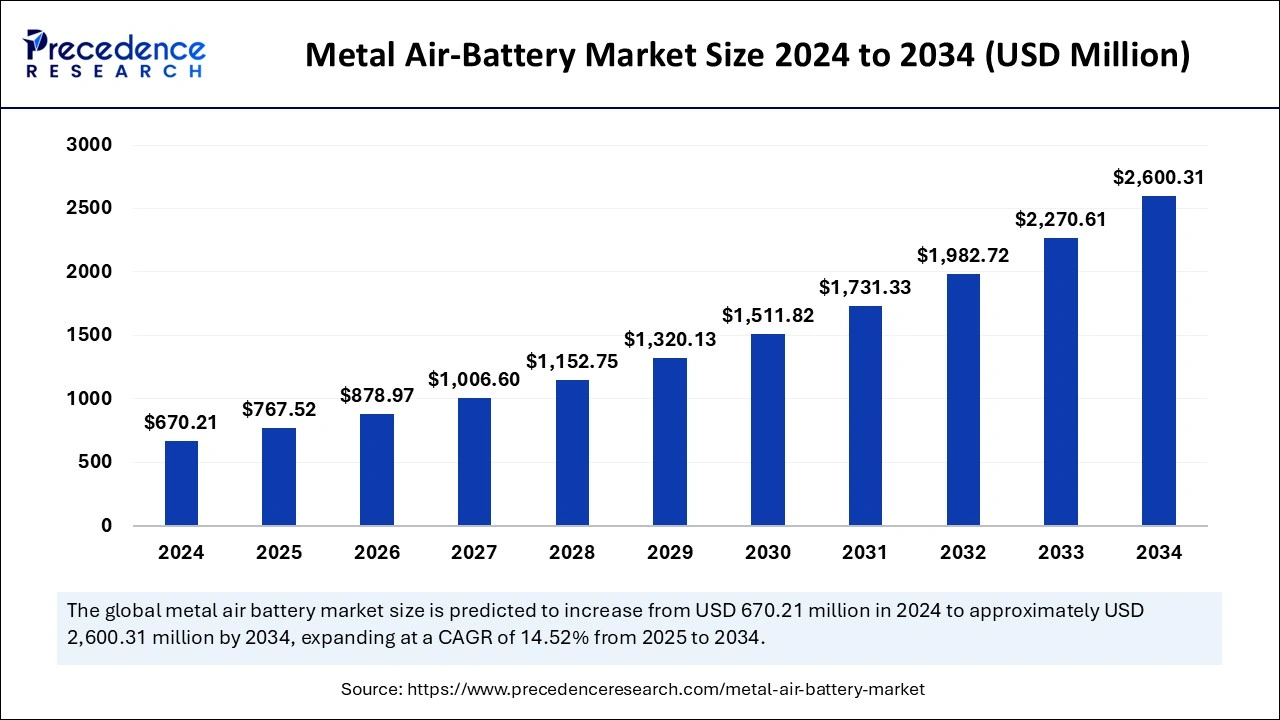

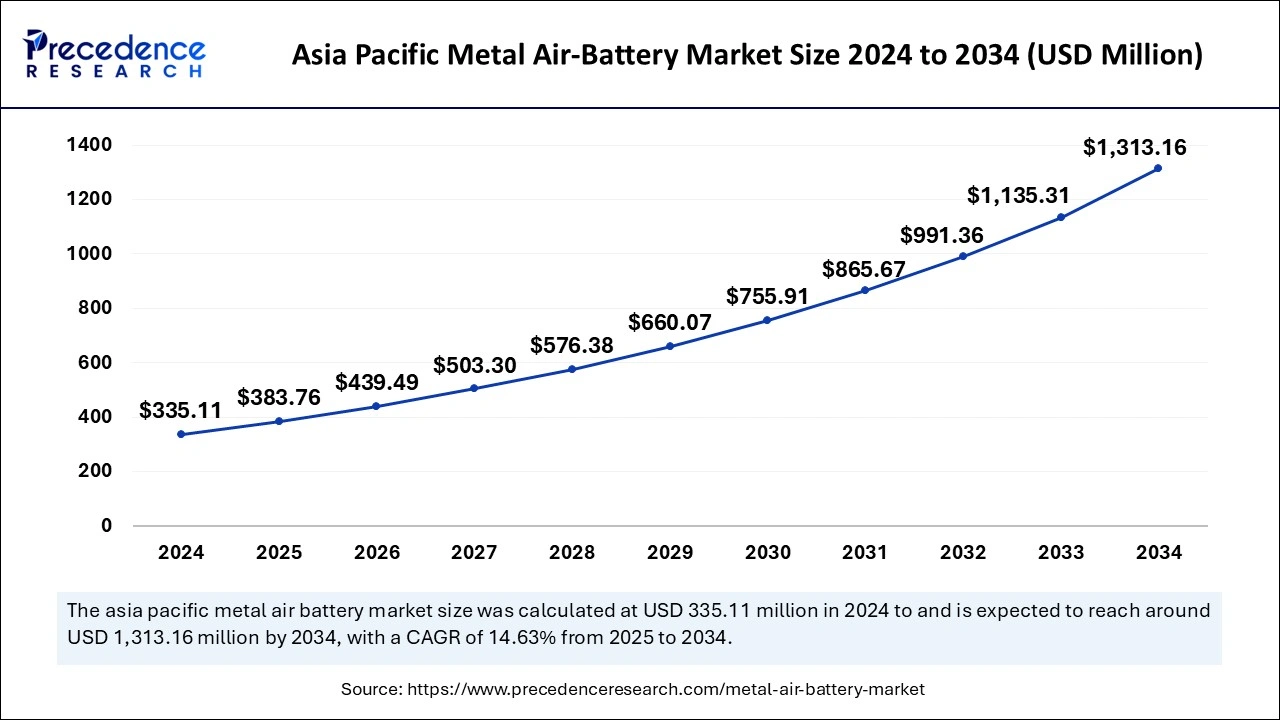

The global metal air-battery market size is accounted at USD 767.52 million in 2025 and is forecasted to hit around USD 2,600.31 million by 2034, representing a CAGR of 14.52% from 2025 to 2034. The Asia Pacific market size was estimated at USD 335.11 million in 2024 and is expanding at a CAGR of 14.63% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global metal air-battery market size was estimated at USD 670.21 million in 2024 and is predicted to increase from USD 767.52 million in 2025 to approximately USD 2,600.31 million by 2034, expanding at a CAGR of 14.52% from 2025 to 2034. The market growth is attributed to the increasing demand for high-energy-density, sustainable battery solutions across electric vehicles, renewable energy storage, and portable electronics.

The use of artificial intelligence helps revolutionize the metal air-battery market technology by making all steps in product development and optimization better. Using AI technology algorithms helps researchers find better electrode materials that boost both the battery's stored power and endurance. AI analyzes electrochemical data to see how chemical events affect batteries and adds strength to battery technology through improved design choices. Machine learning systems help us use materials better in production and enable productive scaling. The system uses artificial intelligence technology to manage power more efficiently and make batteries work longer. AI power enhancements make metal-air batteries better suited for renewable energy storage and electric vehicle use while remaining environmentally friendly.

The Asia Pacific metal air-battery market size was exhibited at USD 335.11 million in 2024 and is projected to be worth around USD 1,313.16 million by 2034, growing at a CAGR of 14.63% from 2025 to 2034.

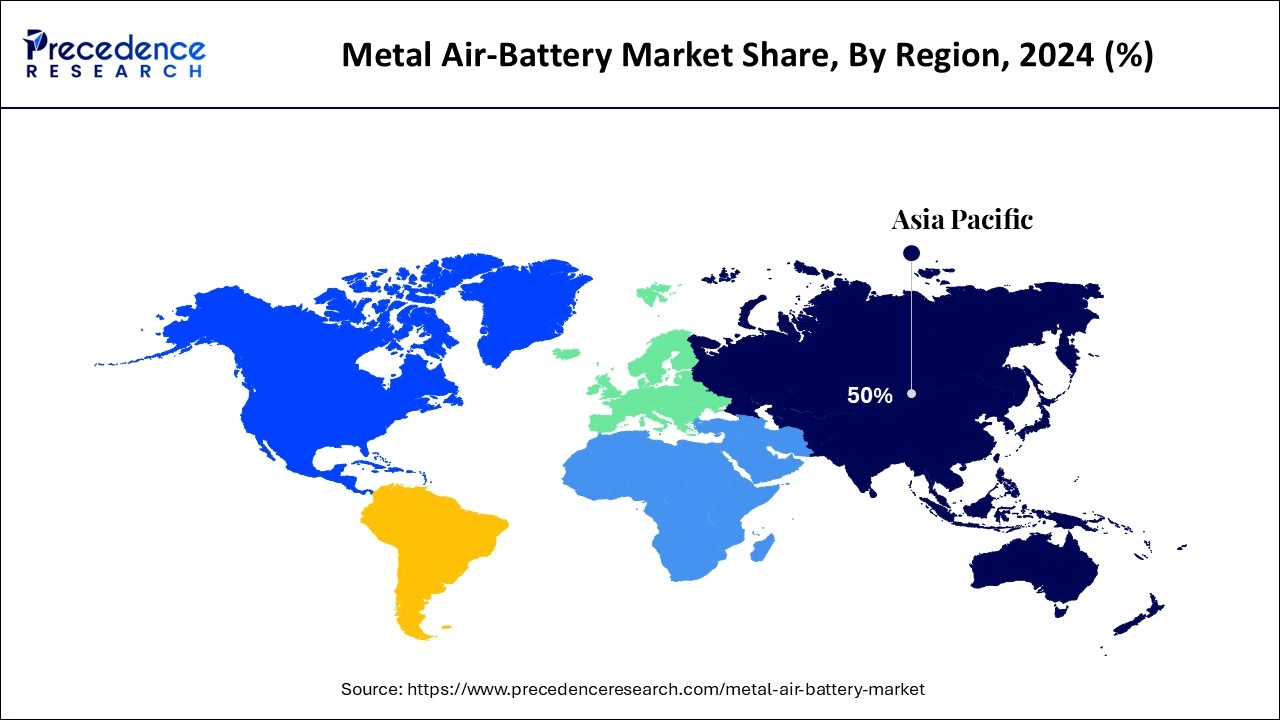

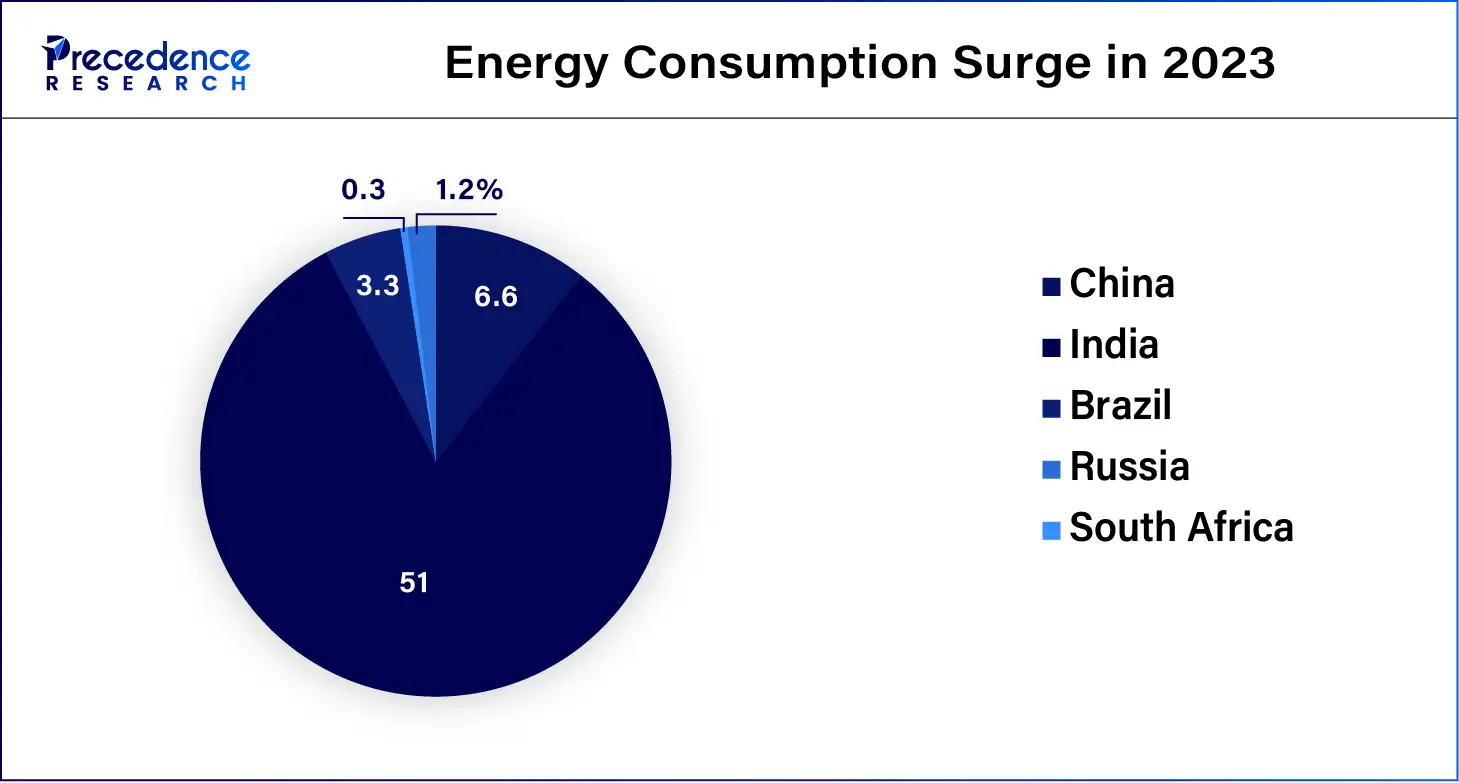

Asia Pacific dominated the global metal air-battery market in 2024., owing to the strong demand for energy solutions in China, Japan, and South Korea, which drives this growth. The region's leading nations now drive electronics production while leading EV production and renewable energy usage worldwide. The Asian Development Bank shows China made half of worldwide EVs during 2023 while growing demand for metal-air battery solutions.

The continuous driving of energy-efficient research while India expands its investment in affordable storage solutions further boosts the market in this region. According to the International Energy Agency (IEA), in September 2023, the Indian Ministry of Power allocated funding for a project grant scheme aimed at supporting the development of Battery Energy Storage Systems (BESS).

North America is projected to host the fastest-growing metal air-battery market in the coming years due to the increasing desire for electric vehicles, plus the need for storage in renewable power projects drives market expansion. Companies, including General Motors and Tesla, incorporate metal-air batteries into electric car designs as U.S. automakers plan to increase production of advanced batteries. Moreover, the energy storage needs from grid stabilization and renewable power adoption in this region.

The demand for better energy storage systems and the growing trend towards renewable energy options facilitate the utilization of the metal air-battery market services. People consider metal-air batteries, most especially zinc-air, and lithium-air batteries, to be the best because they offer greater energy density than classical lithium-ion batteries. EVs, together with solar and defense sectors, benefit from metal batteries that store energy using metal components as one electrode and oxygen from air as another. Metal-air technologies gain support directly from renewable energy grids' storage requirements and EV and defense demand.

| Report Coverage | Details |

| Market Size by 2024 | USD 670.21 Million |

| Market Size in 2025 | USD 767.52 Million |

| Market Size in 2034 | USD 2,600.31 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 14.52% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Metal, Voltage, Type, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing demand for high-energy-density storage solutions

Rising global energy demands are anticipated to drive the adoption of the metal air-battery market services due to their superior energy density compared to traditional lithium-ion batteries. The expanding need for energy worldwide pushes metal-air batteries forward as they deliver higher power per unit than lithium-ion versions.

The International Energy Agency projects electricity usage worldwide is estimated to increase steadily in the coming years, as metal-air batteries offer remarkable energy storage capability. Metal-air batteries, particularly lithium-air variants, deliver a superior 3,458 Wh/kg energy density ideal for EVs, drones, and renewable energy systems. The light design of these batteries improves vehicle performance at higher distances to benefit from energy efficiency progress.

According to the International Energy Agency forecasts, 2024 will bring 4% global electricity demand growth compared to 2.5% in 2023, marking the fastest annual rise since 2007.

Environmental and recycling challenges

Environmental and recycling challenges are likely to hamper the growth of the metal air-battery market. Spent batteries cause dangerous problems for nature, as they contain toxic substances and heavy metals that go into making batteries. Efforts to recycle these battery types have slow development and demand large energy inputs, which has lessened their environmental advantage. Regulatory agencies and governments are creating tough standards to handle environmental problems in batteries, which leads to added operating expenses for businesses. Toothless recycling procedures create adoption barriers for metal air-battery technologies across environmentally responsible markets.

Rising technological advancements and research investment

Rising technological advancements and increased research investment provide substantial opportunities for the growth of the metal air-battery market. Researchers enhance metal air-battery technology by improving its rechargeability and lifespan to make it better suited for different industrial uses. Both public and private funders support research efforts to design better batteries from new materials while building improved production techniques. Improved technologies are making metal-air batteries work better and reliably at lower costs across multiple industries.

The zinc segment held a dominant presence in the metal air-battery market in 2024, as they work well economically while delivering more energy per unit at zero environmental impact. Zinc-air batteries deliver more extended power output while being less expensive to make compared to lithium-based energy storage solutions. They suit various tasks effectively, including grid storage power packs and EV batteries, plus small devices like hearing instruments. Furthermore, the advancement in zinc battery technology for low-cost production and increased durability further fuels the market. These batteries aim to support energy cost reduction, integration of renewable energy, and improved power quality.

The lithium segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034, owing to the rise of lithium batteries for their higher energy capacity plus ongoing technology development. The development of metal-air batteries using lithium shows promise as they deliver more energy storage per unit weight than standard lithium-ion batteries. Electric car makers benefit from this development since EV designs depend on high range and small size. Furthermore, electric vehicle production will continue to support lithium's segment growth in the coming years.

The low (<12V) segment accounted for a considerable share of the metal air-battery market in 2024 due to the strong demand for consumer electronics, hearing aids, and smaller portable devices. Low-power commercial operations adopt zinc-air batteries, as these systems create a cost-effective solution with high energy density capabilities for small-scale applications. The world's low-voltage battery market shows a positive growth trajectory due to the ongoing miniaturization of consumer electronics and rising demand for sustainable, eco-friendly alternatives.

The medium (12-35V) segment is anticipated to grow with the highest CAGR during the studied years, owing to its use in electric vehicles (EVs), drones, and other mobile applications. Medium-voltage battery solution adopters expect annual demand to increase, as these batteries deliver high energy density, which enhances both range capability and operational efficiency in vehicles. Furthermore, this voltage range supports metal-air batteries with 1,200 Wh/kg energy density, making these batteries highly attractive for electric vehicles and drone applications.

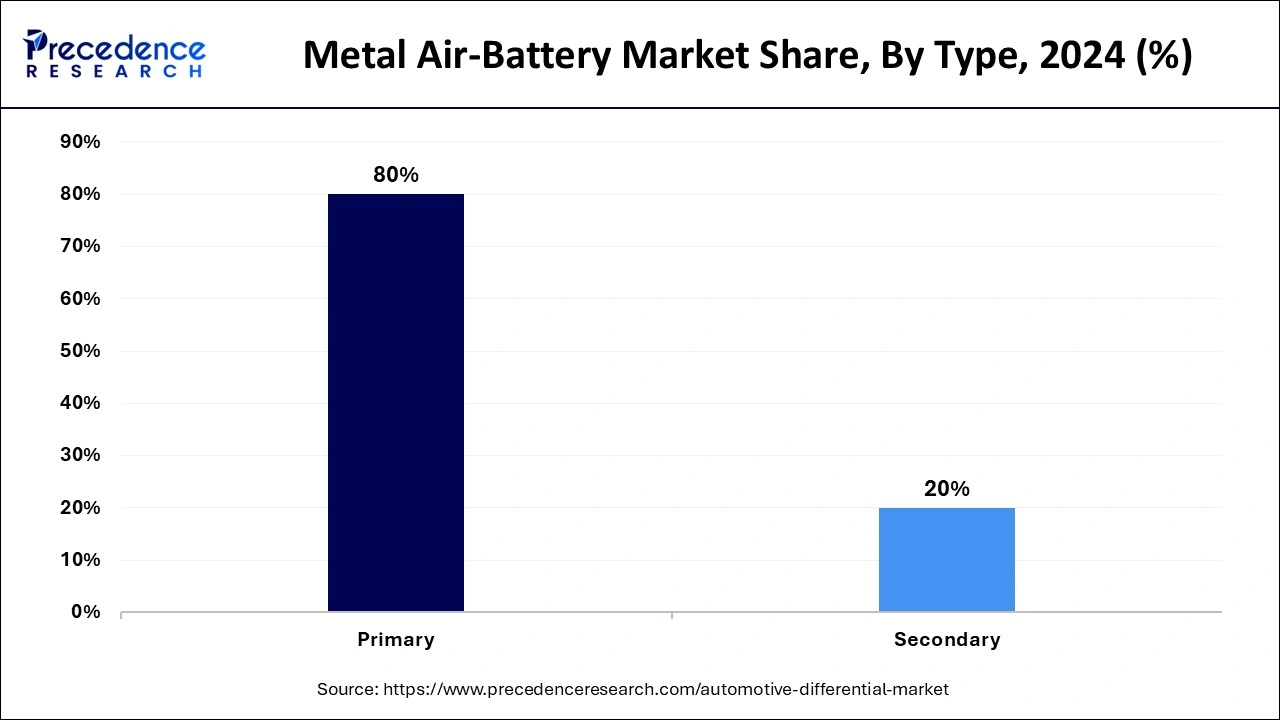

The primary segment led the global metal air-battery market due to the growing demand for non-rechargeable batteries to power their devices in consumer electronics, medical equipment, and hearing instruments. Zinc-air batteries provide both strong power and affordability, which make them popular. Furthermore, the small portable energy storage needs, but their market share continues to rise, especially in medical and consumer applications.

The secondary segment is projected to expand rapidly in the coming years, owing to the increased Rechargeable technology needs, as businesses use batteries in electric vehicles and renewable energy systems. People see these batteries as strong competitors for secondary lithium-ion batteries, as they store more energy and last longer which further contributes to fuelling the segment in the coming years.

The electric vehicles segment dominated the global metal air-battery market in 2024, as manufacturers need advanced energy solutions for better vehicle electricity storage and performance. Zinc-air and lithium-air batteries receive higher levels of interest as better energy density options instead of lithium-ion batteries. Metal-air batteries entering the EV market are increasing, as these batteries provide greater range and lighter weight.

The stationary power segment is projected to grow at the fastest rate in the future years, owing to the rising need for efficient power storage solutions in the renewable energy sector. Research suggests using metal-air batteries for big-scale energy storage systems, as they hold power at lower prices than typical lithium-ion parts. Furthermore, the Industries that want to switch to clean energy are investing in stationary power stations.

January 2025 – SES AI Corporation

CEO – Qichao Hu

Announcement - SES AI Corporation (NYSE: SES), a global leader in AI-enhanced high-performance Li-Metal and Li-ion batteries, introduced an innovative AI-enhanced 2170 cylindrical cell tailored for emerging humanoid robotics applications at the 2025 CES Show in Las Vegas, Nevada. Founder and CEO Qichao Hu explained that the company was approached by several original equipment manufacturers (OEMs) to develop an electrolyte that would address issues like gassing and poor low-temperature cycling and rate performance that were prevalent in traditional Li-ion 2170 cells used in high-energy applications.

By Metal

By Voltage

By Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

January 2025

January 2025

September 2024