April 2025

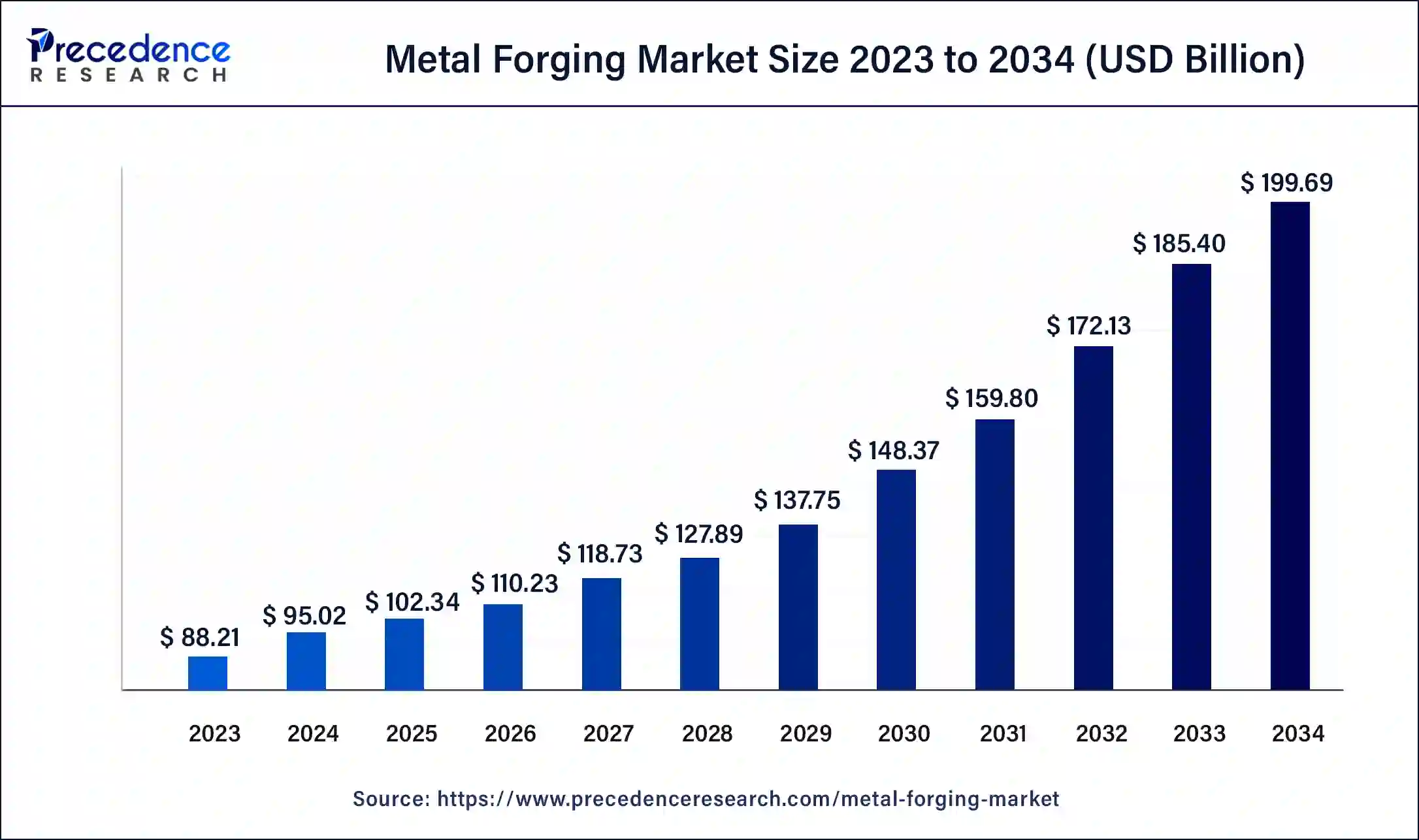

The global metal forging market size surpassed USD 88.21 billion in 2023 and is estimated to increase from USD 95.02 billion in 2024 to approximately USD 199.69 billion by 2034. It is projected to grow at a CAGR of 7.71% from 2024 to 2034.

The global metal forging market size is projected to be worth around USD 21.93 billion by 2034 from USD 12.34 billion in 2024, at a CAGR of 5.92% from 2024 to 2034. The increasing demand for metal-forged parts from the aerospace industry is propelling aircraft production and benefiting the metal forging market growth.

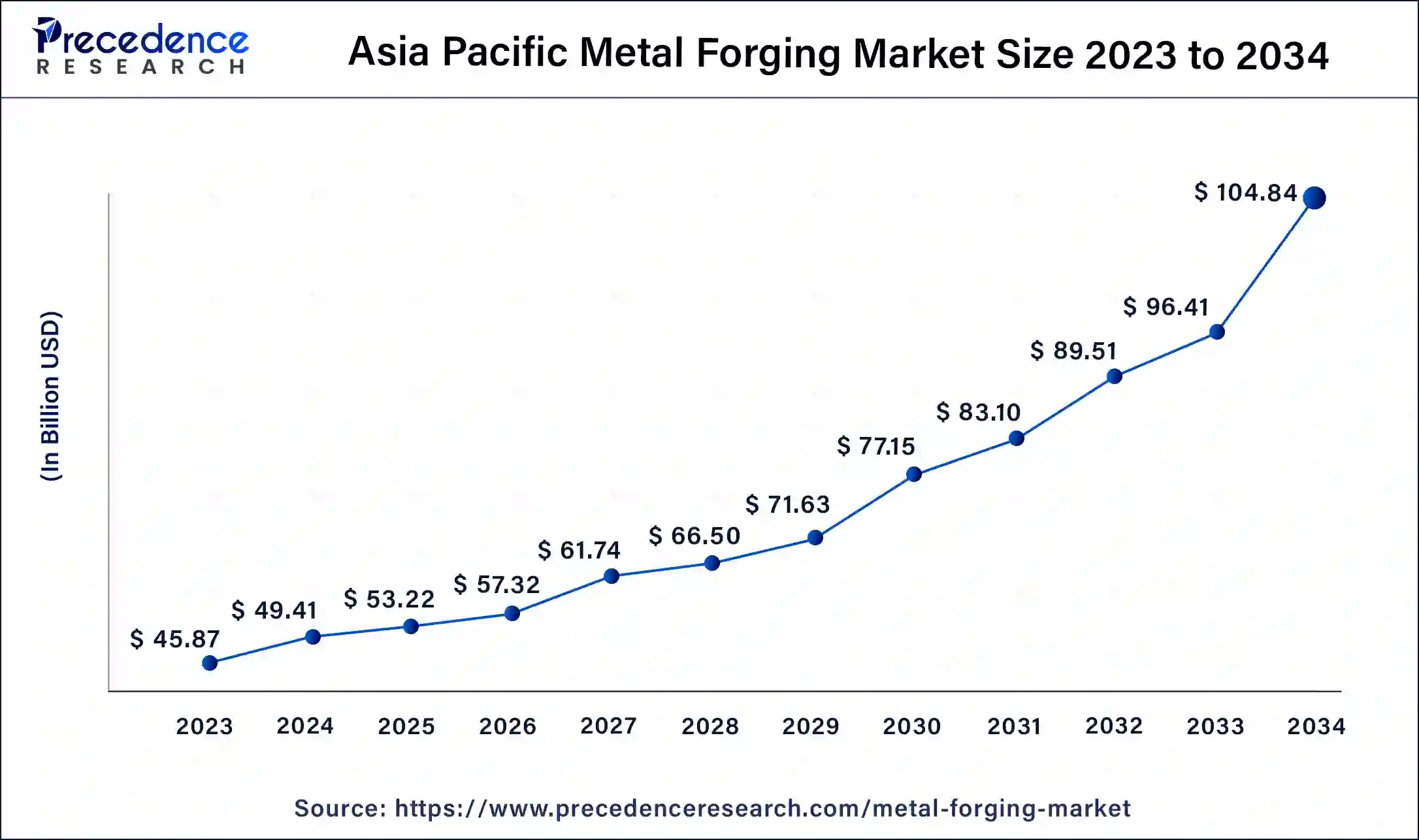

The Asia Pacific metal forging market size was exhibited at USD 45.87 billion in 2023 and is projected to be worth around USD 104.84 billion by 2034, poised to grow at a CAGR of 7.8% from 2024 to 2034.

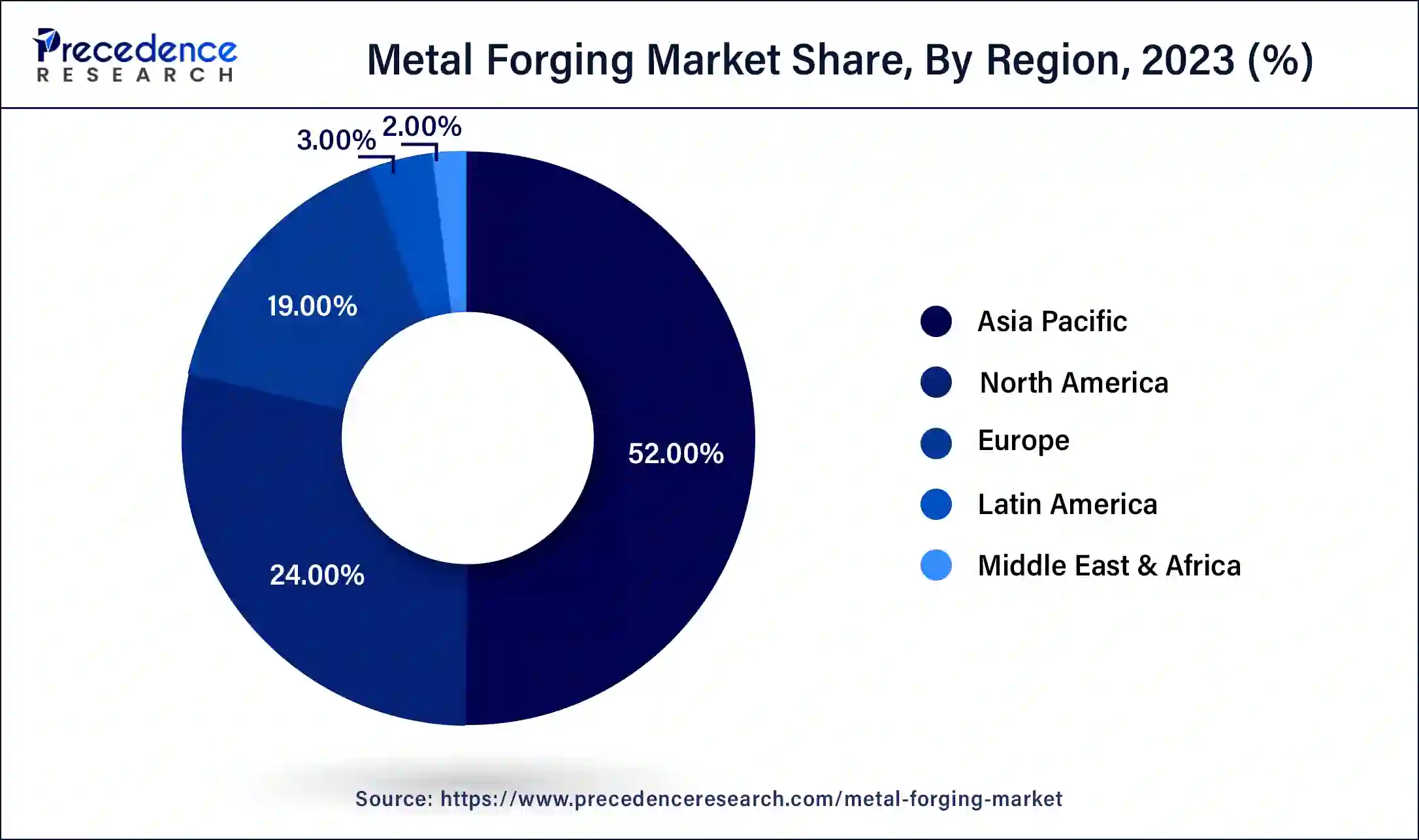

Asia Pacific dominated the metal forging market in 2023. The automotive industry is a significant consumer of forged metal components, including engine parts, axles, and chassis components. Moreover, several countries in the region are experiencing rapid urbanization and infrastructure development, which includes the construction of bridges, buildings, and transportation networks. Forged steel components are important for these infrastructure projects due to their durability and strength. Also, the growing demand from the energy sector is projected to propel market growth in APAC throughout the forecast period.

North America is projected to show the fastest growth in the metal forging market over the studied period. Investment in renewable energy within the region is anticipated to drive up demand for the product. The emphasis on improving infrastructure, combined with rising investments in aerospace and defense, boosts the need for high-quality forged components.

In North America, stringent regulatory standards related to emissions and safety are pushing the automotive industry towards the use of lightweight and high-strength materials, which benefits the industry significantly. Additionally, the market's growth is supported by the presence of key players in the metal forging market and advancements in forging technologies.

Metal forging involves shaping and forming metal through compressive forces. This process can be done at room temperature, known as cold forging, or at elevated temperatures, called hot forging. Forged metal exhibits a well-aligned grain structure, which enhances its strength, reduces brittleness, and increases durability. These characteristics make forged metal ideal for demanding applications across various industries, including automotive, aerospace, railways, marine, and industrial machinery. Forging has been a traditional method of metal forming and shaping for centuries, effectively producing components capable of withstanding high pressure, force, and temperature.

What Are the Benefits of AI in the Metal Manufacturing Industry?

Artificial intelligence is making waves in the metal forging industry in numerous ways. AI-based algorithms are being used to analyze data from metal forming processes to identify defects and opportunities for improvement. AI models are also being trained to map out production processes from input to output to improve optimization and reduce costs. AI-based predictive analytics are also being used to enhance supply chain management by predicting market movements and helping businesses improve inventory management.

| Report Coverage | Details |

| Market Size by 2034 | USD 199.69 Billion |

| Market Size in 2023 | USD 88.21 Billion |

| Market Size in 2024 | USD 95.02 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 7.71% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Raw Material, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Surging demand for both passenger as well as commercial vehicles

The growing demand for both passenger and commercial vehicles is driving the increased need for the metal forging market. Passenger vehicles, such as cars, SUVs, and other personal transport options, along with commercial vehicles like trucks, buses, and vans used for logistics and transportation, are seeing a surge in demand. Several factors contribute to this increase. Population growth, urbanization, and rising living standards are leading to greater mobility needs, which results in higher rates of car ownership and a greater number of commercial vehicles for transporting goods. Moreover, rapid economic development in the emerging metal forging market, particularly in Asia and Latin America, is fueling a rise in vehicle demand. The expansion of industrialization and infrastructure projects also boosts the need for commercial vehicles.

2023 Global Vehicle Production Statistics

| Country | Cars | Commercial Vehicles | Total |

| Argentina | 304,783 | 305,942 | 610,725 |

| Austria | 102,291 | 46,944 | 114,191 |

| Belgium | 1,781,612 | 543,226 | 332,103 |

| Brazil | 1,781,612 | 543,226 | 2,324,838 |

| Canada | 376,888 | 1,176,138 | 1,553,026 |

| China | 26,123,757 | 4,037,209 | 30,160,966 |

| Czech Republic | 1,397,816 | 6,685 | 1,404,501 |

| Finland | 30,191 | 30,191 | |

| France | 1,026,690 | 478,386 | 1,505,076 |

The capital-intensive nature of metal

Forging, establishing, and running metal forging facilities requires substantial capital investments. The considerable expenses related to acquiring forging equipment, machinery, and skilled labor can pose challenges for new entrants or smaller manufacturers, which can potentially hinder market expansion. Additionally, the constraints of the metal forging process are expected to impede the metal forging market growth in the future.

High demand for advanced materials and alloys

The rising demand for high-performance materials with enhanced strength, durability, and corrosion resistance is driving the development and use of advanced alloys. These materials enable metal forging companies to produce components with improved properties created to meet specific industry requirements. Furthermore, advanced materials and alloys offer superior attributes compared to traditional ones, which makes them highly sought after for various applications across different sectors. Industries such as aerospace, automotive, and energy require components capable of withstanding extreme conditions, including exceptional strength and durability. As a result, these factors positively influence the metal forging market by leading to anticipated growth during the forecast period.

The carbon steel segment dominated the metal forging market in 2023. Carbon steel is divided into three grades based on carbon content: low, medium, and high. Due to its lower material cost compared to stainless steel, carbon steel forgings are frequently used in the oilfield and automotive industries. These carbon-forged parts are used in various products, including automobiles, tractors, aircraft, energy missiles, drilling equipment, and ships.

The aluminum forgings segment is expected to grow at a significant rate in the metal forging market over the forecast period. The growth of the segment is driven by the increasing need for lightweight materials in the automotive sector. Car manufacturers have long sought to reduce vehicle weight to enhance fuel efficiency, boost performance, and cut carbon emissions. As the new, stricter regulations come into play, automotive companies will likely be compelled to incorporate more lightweight materials, which creates new opportunities for the product throughout the forecast period. Additionally, the rising demand for new defense aircraft is anticipated to further stimulate the market expansion.

The automotive segment led the global metal forging market in 2023. This can be attributed to the increasing disposable income, a growing urban population, and the expanding boundaries of cities. Automotive components and parts must endure severe weather conditions, high torque, force, pressure, and temperature, which requires the use of forging in their production. Also, the segment is witnessing notable growth driven by rising demand for both commercial and passenger vehicles, as well as the growing adoption of electric vehicles (EVs). This surge in the automotive industry is expected to drive up the need for forged metal parts by contributing to market expansion.

The power generation segment is anticipated to grow at the fastest rate in the metal forging market during the forecast period. In wind and hydroelectric power plants, a range of forging components, including turbine blades, sleeves, motor ends, flanges, rings, seals, locks, stators, diaphragms, impellers, covers, spacers, casings, and rotors, are utilized. As investments in the power generation sector continue to rise, this is expected to boost the growth of the segment in the coming years.

Segment Covered in the Report

By Raw Material

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

January 2025

January 2025

January 2025