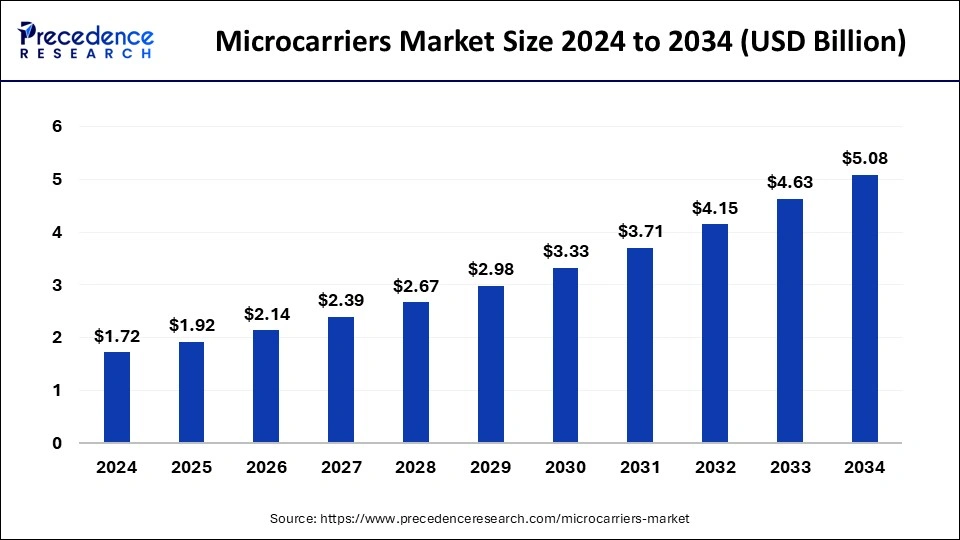

The global microcarriers market size is calculated at USD 1.92 billion in 2025 and is forecasted to reach around USD 5.08 billion by 2034, accelerating at a CAGR of 11.44% from 2025 to 2034. The North America microcarriers market size surpassed USD 720 million in 2024 and is expanding at a CAGR of 11.51% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global microcarriers market size was estimated at USD 1.72 billion in 2024 and is predicted to increase from USD 1.92 billion in 2025 to approximately USD 5.08 billion by 2034, expanding at a CAGR of 11.44% from 2025 to 2034. The microcarriers market is driven by the growing interest in vaccinations based on cells.

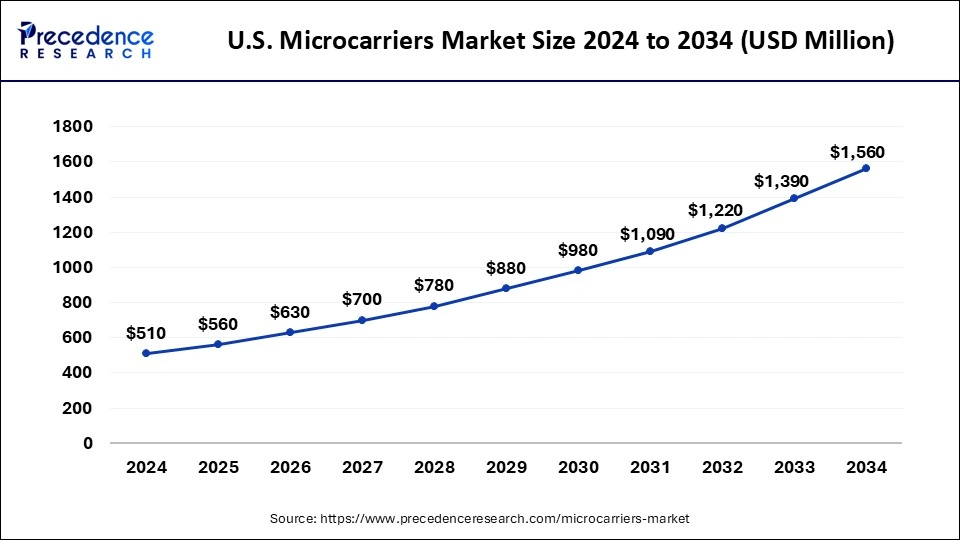

The U.S. microcarriers market size was exhibited at USD 510 million in 2024 and is projected to be worth around USD 1,560 million by 2034, poised to grow at a CAGR of 11.83% from 2025 to 2034.

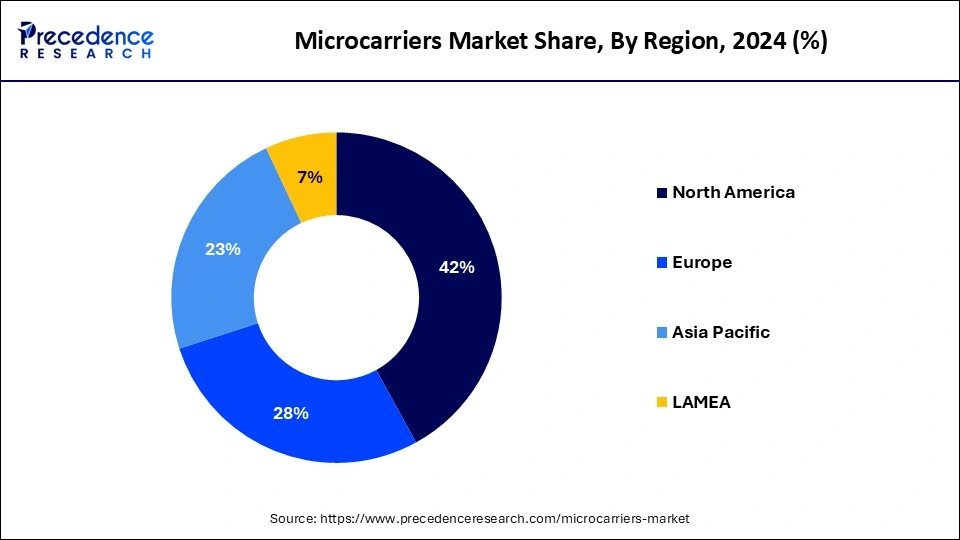

North America dominated in the microcarriers market in 2024. This is due to the increasing cell and gene therapy research in the region and the associations supporting it. Likewise, the American Society of Gene and cell Therapy is accountable for the funding of the research, and this society is forcing the biotechnology and biopharmaceutical companies to enhance their R&D. The United States microcarrier enterprise is dynamic and influential across the broader biotechnology and pharmaceutical landscape. It is well known for its innovation and technological improvements, and this enterprise plays a pivotal role in the cellular way of life, bioprocessing, and regenerative remedy applications.

Asia-Pacific is the fastest growing in the microcarriers market during the forecast period. This region is owing to the growing numbers of key players and the rapidly increasing adoption of microcarriers. The technological advancements in the healthcare field and the growing need for cell therapies in the region are significant driving factors for the growth of the microcarriers market.

Microcarriers are microscopic particles or beads mainly utilized in bioreactors to culture adherent cells. They offer a greater surface area for cell development than conventional two-dimensional techniques. Biological materials can be coated on microcarriers to improve cell adhesion and proliferation. These materials include glass, dextran, and different types of polymers.

Microcarriers are essential to produce vaccinations, monoclonal antibodies, and other therapeutic proteins on a large scale. To address the increasing demand for biopharmaceuticals, they enable the effective growth of cells in bioreactors. Microcarriers can improve the uniformity and quality of cell cultures. Sustaining homogeneity in cell populations is essential for producing dependable biopharmaceutical products and can be achieved by offering a regulated growing environment for cells.

| Report Coverage | Details |

| Market Size by 2034 | USD 5.08 Billion |

| Market Size in 2025 | USD 1.92 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 11.44% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Consumables, Application, End-user, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

High demand of cell-based vaccines & therapeutics

Cell-based vaccinations frequently have greater efficacy than conventional egg-based vaccinations, mainly when targeting virus strains. Faster production of these vaccinations is significant since pandemics are emergencies when time is of the essence. Microcarriers make manufacturing more scalable and efficient by enabling the large-scale synthesis of cells needed for various treatments and vaccinations.

Production systems based on microcarriers are more cost-effective because of their efficiency and scalability. As a result, cell-based vaccinations and treatments become more affordable, increasing their accessibility. This drives towards the growth of the microcarriers market.

High cost associated with serum-free media

Growth factors, specified components, and recombinant proteins are examples of raw ingredients frequently costly when utilized in serum-free media. Sophisticated manufacturing procedures are needed to produce serum-free media while upholding strict purity and quality standards. This often entails strict quality control procedures, aseptic processing, and sophisticated filtering.

The substantial initial cost of serum-free media for microcarrier cultures may deter companies from adopting them. This may reduce the industry's rate of adopting serum-free microcarrier technologies.

Huge investments for the development of innovative therapies

Research and development on cell and gene therapies is receiving significant financing from the governmental and corporate sectors. For instance, the possibility of cell and gene therapy to treat cancer, genetic disorders, and chronic diseases has attracted billions of dollars in investment to the global market. One important consideration is the creation of cells' scalability. The need for mass-producing therapeutic cells is met by microcarriers, which allow for the large-scale generation of cells in bioreactors.

Investments in biopharmaceutical facilities and technology increase the demand for sophisticated microcarrier solutions. Large sums of money are spent on bioprocess optimization, where microcarriers are essential. Improved microcarrier designs can lower expenses, increase yield, and ensure consistent quality in biopharmaceutical production.

The microcarrier beads segment dominated in the microcarriers market in 2024. Microcarrier beads can manufacture vast amounts of cells due to the large surface area they provide, which could be applied to produce, for example, viruses for vaccines. It is a convenient 3D model that is easily set up by simply mixing cells with microcarrier beads. The growing awareness about the applications of cell-based vaccines, growing regulatory approvals for cell-based vaccines, and a focus on commercial expansion of cell-based vaccines are contributing to the growth of the microcarriers market.

The biopharmaceutical production segment dominated in the microcarriers market in 2024. For most pathogens, such as the novel coronavirus, large-scale vaccine production is very important for global disease control and eradication because the high mutation rate of the virus might lead to a decrease in the protection offered by the vaccines. Moreover, research on the production and culture of virus vaccines, especially exploration at the laboratory scale, is urgently needed where the biopharmaceutical industries play a major role.

The versatility and scalability of microcarriers make them a preferred desire for production cell healing procedures, along with stem cell-based cures, immunotherapies, and tissue engineering applications. With increasingly more clinical trials and approvals for cellular therapies, the demand for microcarriers is surging.

The regenerative medicine segment shows a notable growth in the microcarriers market during the forecast period. Regenerative medicine is concentrated on developing and applying new treatments to heal tissues and organs and restore functions lost due to aging, damage, disease, or defects. Regardless of the precise strategy used for reconstruction, restoration, or repair of the tissue/organ of interest, cells, and biomaterials (i.e., scaffolds) provide the basic constituents needed for developing new tissue.

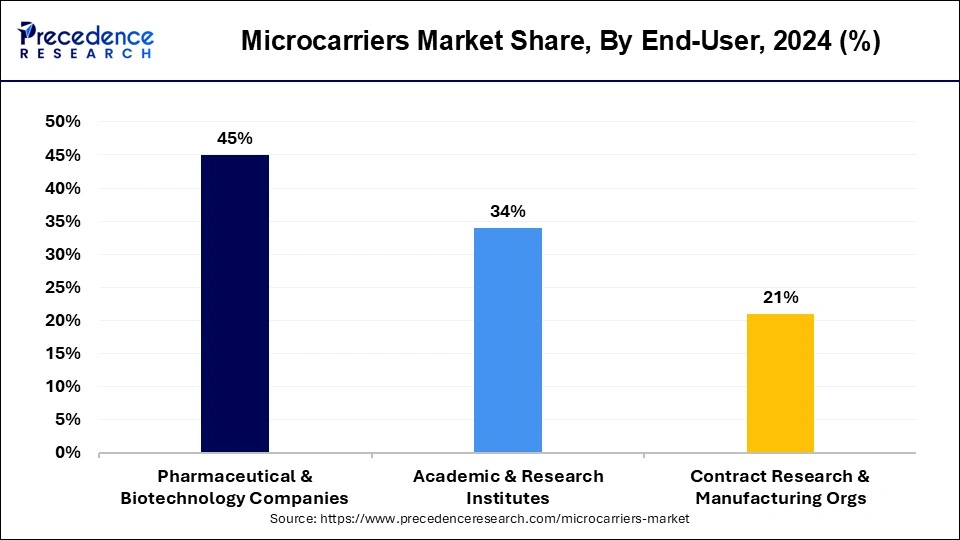

The pharmaceutical & biotechnology companies segment dominated in the microcarriers market in 2024. To produce protein-based vaccines, the coding gene of the protein can be put into the plasmid and altered into the host cell (e.g., E. coli or mammalian cells), which can then express that gene into protein. The protein manufactured is then harvested, purified, and formulated into a vaccine. The manufacturing of this type of vaccine is corresponding more complex as it requires extra operation, but it can produce a high level of antigen titer. These firms provide the required environment for mass production.

The academic & research institutes segment is observed to be the fastest growing in the microcarriers market during the forecast period.

Employing bioreactors to culture cells to manufacture antigens, antibodies, and other products is the core technology underpinning the large-scale production of biological products. The combination of fine process control in biotechnology and the screening and domestication of high-expression cell lines can enhance production efficiency and product quality. Based on laboratory-scale experiments, we can optimize some conventional physical and chemical parameters and obtain a perfect training program on a larger scale in advance, which saves time during subsequent industrialization. Laboratory-scale experiments can provide pilot-scale conditions for the latest biological products, especially in the research and development of new vaccines, to maximize the yield and quality.

By Consumables

By Application

By End-user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client