February 2025

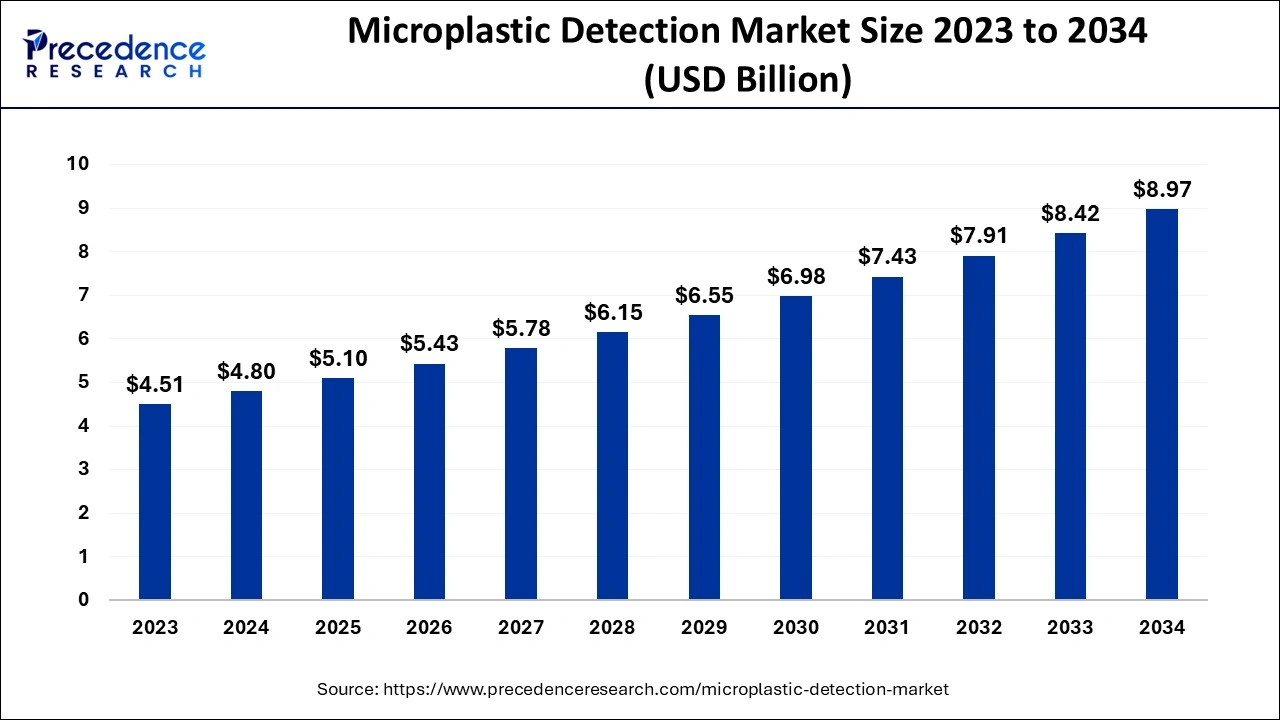

The global microplastic detection market size accounted for USD 4.80 billion in 2024, grew to USD 5.10 billion in 2025 and is estimated to hit around USD 8.97 billion by 2034, representing a CAGR of 6.46% between 2024 and 2034. The North America microplastic detection market size is evaluated at USD 1.73 billion in 2024 and is expected to grow at a CAGR of 6.59% during the forecast year.

The global microplastic detection market size is calculated at USD 4.80 billion in 2024 and is predicted to reach around USD 8.97 billion by 2034, expanding at a CAGR of 6.46% from 2024 to 2034. The microplastic detection market is driven by the rising worries about pollution in the environment and how it can affect human health.

Convolutional neural networks (CNNs) are AI algorithms that interpret images taken by camera systems or microscopy. By separating microplastics from other particles according to their size, color, shape, and texture, these algorithms can recognize and categorize microplastics in environmental samples. It is used to check for microplastics in vast bodies of water in combination with satellite photography and aerial drones. Machine learning algorithms can analyze images to find trends and abnormalities that point to microplastic pollution.

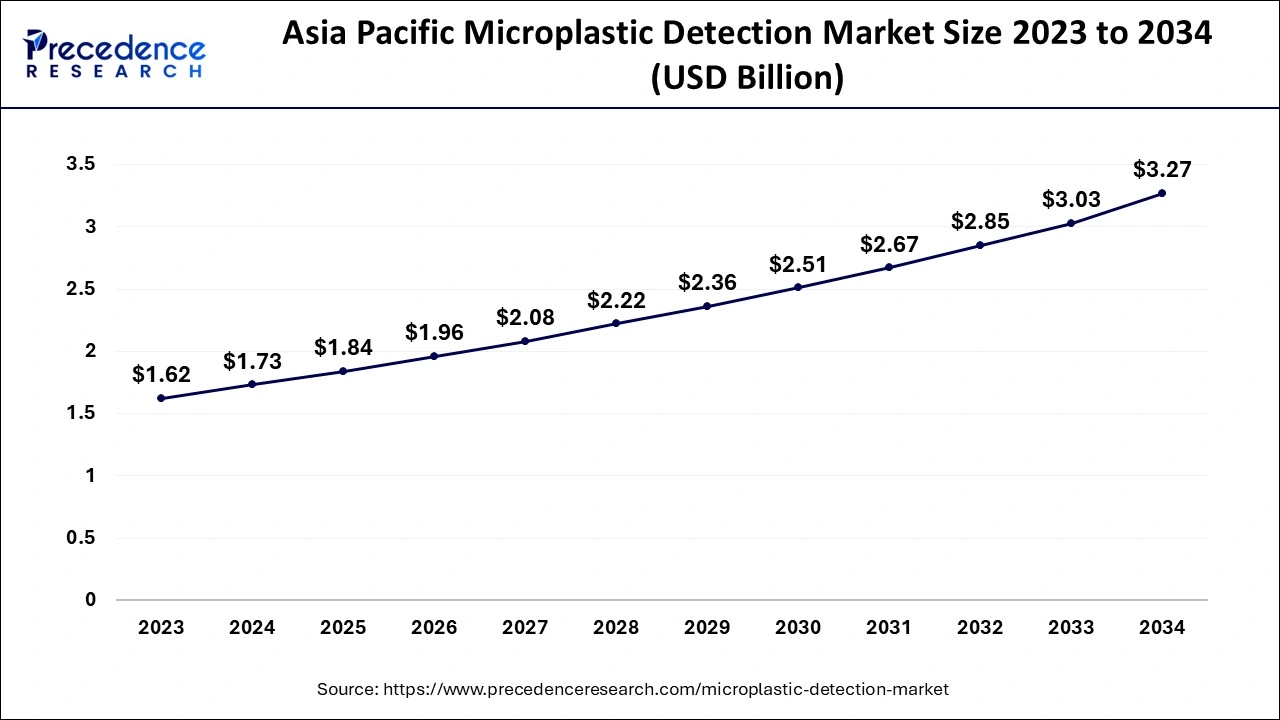

The Asia Pacific microplastic detection market size is exhibited at USD 1.73 billion in 2024 and is expected to be worth around USD 3.27 billion by 2034, growing at a CAGR of 6.59% from 2024 to 2034.

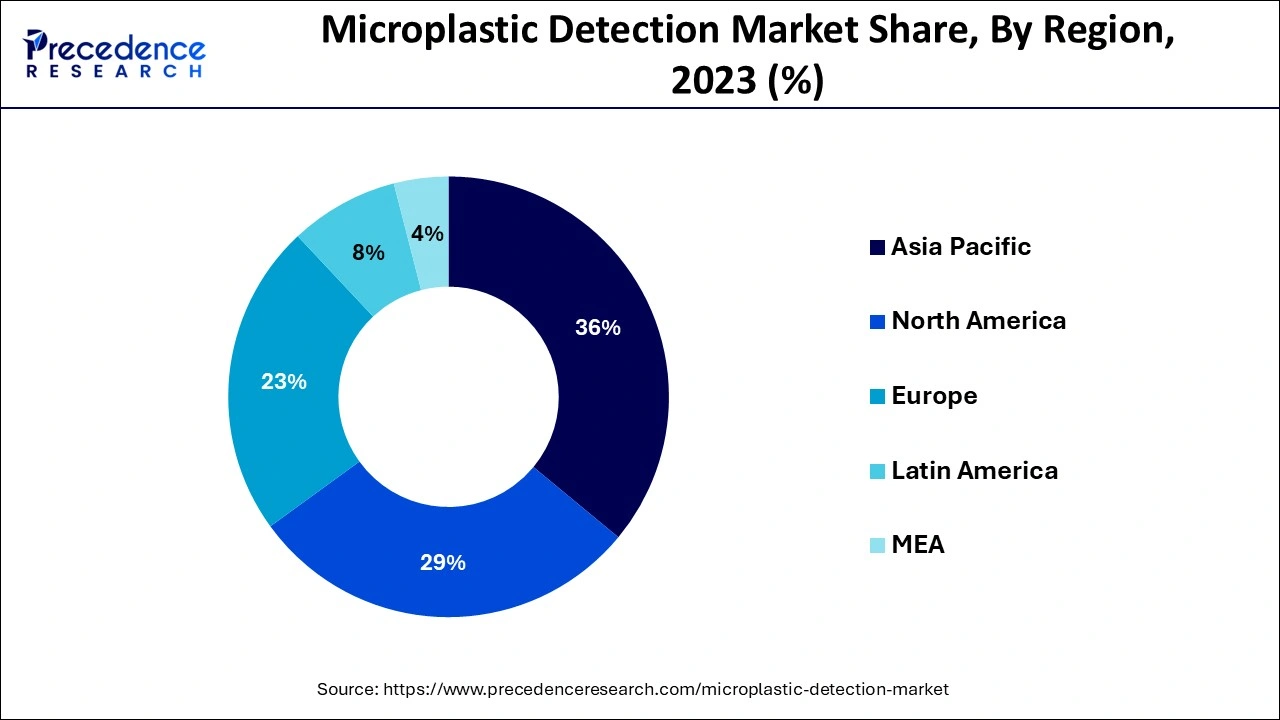

Asia-Pacific held the largest share of the microplastic detection market in 2023. Consumers in the area are calling for safer and cleaner food, drink, and personal care goods due to growing awareness of the health hazards of microplastic contamination. Microplastic detection devices have been adopted by the food, water purification, and cosmetics industries due to this change. The tendency is particularly potent in nations with sizable middle classes that value health and safety and are growing more ecologically sensitive.

North America is observed to grow at the fastest rate in the microplastic detection market during the forecast period. Many research institutes, academic institutions, and businesses that focus on cutting-edge analytical technologies such as Fourier-Transform Infrared Spectroscopy (FTIR), Raman Spectroscopy, may be found in North America. These technologies are essential for accurately detecting and evaluating microplastics in various situations. In North America, collaborations between private businesses, university institutions, and environmental organizations are typical. This partnership promotes faster adoption of improved detection techniques across businesses and speeds up the commercialization of research findings.

Microplastics are microscopic particles roughly the size of a sesame seed and have a diameter of less than five millimeters. Researchers can keep an eye on pollution levels in various habitats, such as soils, rivers, and oceans, by using techniques for detecting microplastics. Assessing the health of these settings and their ecosystems is made easier by knowing the location and amount of microplastics. Accurate microplastic detection methods fuel research advancements and the creation of novel materials and technology. Better waste management techniques and the creation of biodegradable substitutes for traditional plastics may result from this.

| Report Coverage | Details |

| Market Size by 2034 | USD 8.97 Billion |

| Market Size in 2024 | USD 4.80 Billion |

| Market Size in 2025 | USD 5.10 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 6.46% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Size, Medium, Technology, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing awareness of the environmental impact of microplastics on ecosystems and human health

As the need for microplastic monitoring grows, several businesses and academic organizations are creating the latest detection technology. These include sophisticated imaging tools, spectroscopy, and chemical analysis techniques to detect and measure microplastics in various settings. The need for these technologies is driven by industry and environmental agencies looking to evaluate cleanup operations and determine contamination levels.

Increased funding from governments, research institutions, and private organizations

Increased financing encourages collaboration between government agencies, businesses, and academia. Multidisciplinary research projects can result in exchanging data, assets, and skills, hastening the development of microplastic detection techniques. Funding can speed up the commercialization process and enable the scaling up of successful technology as research produces new detection techniques. This lab-to-market shift is important for broad acceptance, and it has the potential to significantly expand the market for microplastic detection.

High costs of advanced equipment

Detecting microplastics with advanced technology frequently requires large upfront capital expenditures. The cost of scanning electron microscopy (SEM), Raman spectroscopy, and Fourier Transform Infrared (FTIR) spectroscopy can range from tens to hundreds of thousands of dollars. Smaller labs, research institutes, and poor nations that could lack the required funds may find this hefty initial expenditure to be a deterrent. Exorbitant expenses may discourage funding for developing novel detection techniques or technologies. Without a clear route to profitability, businesses may be reluctant to invest in research and development, which could cause the industry to stagnate.

Investment in sustainable practices

Governments and corporations are creating a market for detection solutions in response to increased media focus on pollution and environmental deterioration, particularly the effects of microplastics. Funding research and development for cutting-edge detection techniques like spectroscopy, microscopy, and sensor technologies improve the precision and effectiveness of microplastic detection.

The polyethylene segment dominated the microplastic detection market in 2023.

More than one-third of all plastics are made of polyethylene. It is mostly found in packaging materials swiftly discarded after only one usage, such as plastic bags, bottles, and films. Because of its high rate of consumption and disposal, PE is a significant source of plastic pollution and a key target for detecting microplastics. The identification and measurement of microplastics, including PE, have become simpler due to spectroscopy developments (including FTIR and Raman) and microscopy. The ability of these technologies to recognize polymer types is essential for targeted detection in polyethylene-focused research. These techniques offer specific data necessary for environmental impact assessments and regulatory compliance.

The PTFE segment is observed to be the fastest growing in the microplastic detection market during the forecast period. PTFE is a very resilient polymer because of its low friction coefficient, great temperature stability, and resistance to chemicals. Because of these characteristics, it is a material of choice in complicated settings, like wastewater treatment facilities, labs, and industrial settings, where microplastic detection is required. Because of its resistance to severe chemicals and a broad range of temperatures, PTFE stays stable and doesn't break down or obstruct sensitive detection procedures. To combat pollution, governments and organizations in developing nations are implementing PTFE-based microplastic detection methods as environmental and health consciousness grows. As businesses and governments engage in PTFE-based solutions to handle and lessen the effects of microplastics, growth in these markets is anticipated to further contribute to the PTFE segment's high growth rate.

The 1-3 MM segment shows significant growth and sustained a notable growth rate in the microplastic detection market during the forecast period. The detection accuracy of microplastics in the 1-3 mm range has increased due to advancements in microplastic detection methods, including Raman spectroscopy, Fourier-transform infrared (FTIR) spectroscopy, and sophisticated imaging systems. Scientific research and regulatory compliance depend on these technologies' ability to precisely identify the kind, size, and distribution of particles.

Microplastic pollution is also a concern for the food and beverage, textile, and cosmetics industries. To satisfy consumer and regulatory requirements, these industries are investing increasingly in detecting technologies that can detect microplastic particles as small as 1-3 mm.

The water segment dominated the microplastic detection market in 2023. It is often acknowledged that microplastics pose a severe threat to water bodies across the globe. They endanger human health after having an impact on aquatic life and ecosystems. The need for precise microplastic detection in water has increased as people become more conscious of these effects. These developments make them useful instruments for thorough water testing since they increase detection reliability and assist in locating tiny particles that were previously challenging to detect. Due to technological advancements, water-focused microplastic detection is now more effective and widely available.

The land segment holds the second largest share in the microplastic detection market during the forecast period. Global microplastic contamination is significantly influenced by land-based sources, such as agricultural activities, urban runoff, and the dumping of plastic trash. These sources impact ecosystems and may affect human health by releasing microplastics into the soil and, ultimately, into water systems. On-site testing is now possible in various terrestrial situations, which includes urban areas and agricultural fields, thanks to the development of portable and more reasonably priced detection technologies. These developments enable government, researchers, and private organizations to carry out extensive and ongoing surveillance, increasing the land segment's market share.

The FTIR spectroscopy segment holds a significant share of the microplastic detection market in 2023. Certain polymer types, including polyethylene, polypropylene, polystyrene, and others, frequently present in microplastic pollution can be identified using FTIR spectroscopy. FTIR provides a comprehensive chemical "fingerprint," allowing for accurate identification even in complicated combinations by examining the distinct infrared absorption spectra of each polymer. Due to its effectiveness, FTIR spectroscopy is commonly used in environments including water treatment plants, environmental monitoring organizations, and university research labs where quick identification of microplastics is required.

The water treatment segment dominated the microplastic detection market in 2023. Tiny plastic particles called microplastics, usually less than 5 mm, have been found in rivers, seas, and even drinking water supplies worldwide. Many people worry about how this will affect human and wildlife health. Thus, using cutting-edge detection and filtering technology, the water treatment sector has emerged as a critical actor in combating microplastic contamination. Microplastics are often found in high concentrations in industrial wastewater, particularly from the manufacturing, textile, and plastic processing sectors. These industries now have to release wastewater to regulations. As a result, industrial wastewater treatment plants are now incorporating microplastic detection.

The food & beverage segment is observed to be the fastest growing in the microplastic detection market during the forecast period. Concern over the effects of microplastics on human health is growing as research shows that they are present in food products, especially in seafood, salt, and even bottled water. According to research, microplastics can build up in the human body and may have long-term negative effects. The food and beverage sector has been forced to use sophisticated detection techniques to monitor contamination due to the growing customer demand for transparency and safer food products.

Further, R&D expenditures are raising the detection technologies' sensitivity and accuracy. By resolving existing constraints and simplifying compliance with new standards, efforts to improve the analytical capability of existing technologies will enable better identification of smaller and more varied forms of microplastics in food samples.

Recent Developments

By Type

By Size

By Medium

By Technology

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025