Micropump Market (By Product: Mechanical Micropump, Non-mechanical Micropump; By Application: Drug Delivery, In-vitro Diagnostics, Medical Devices, Others; By End-user: Biotechnology & Pharmaceutical Companies, Hospitals & Diagnostic Centers, Academic & Research Institutes) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2033

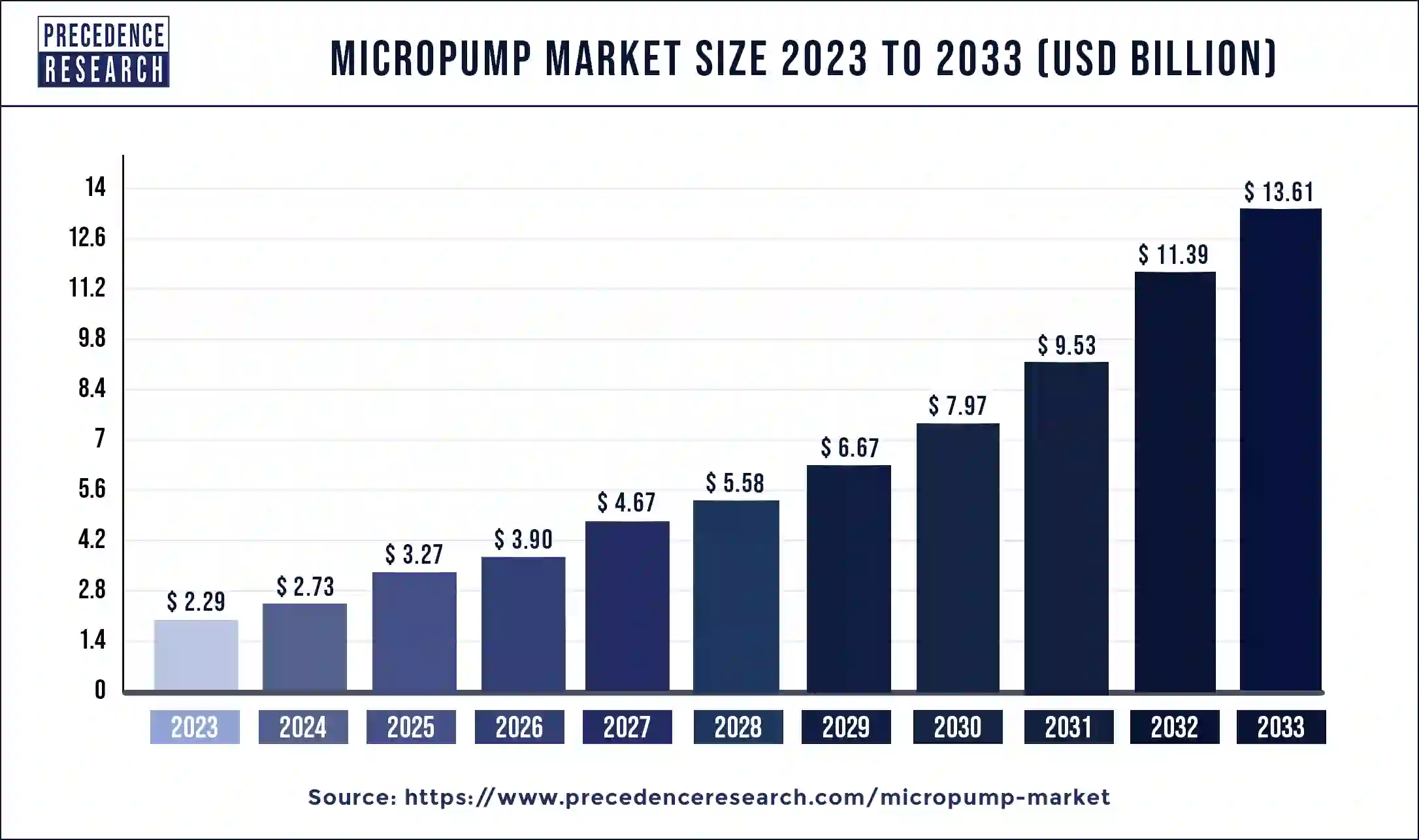

The global micropump market size was USD 2.29 billion in 2023, calculated at USD 2.73 billion in 2024, and is expected to reach around USD 13.61 billion by 2033. The market is expanding at a solid CAGR of 19.53% over the forecast period 2024 to 2033. The need for drug delivery systems that use micropumps to precisely distribute medication is growing due to the rising prevalence of chronic diseases, which raises the demand for the micropump market.

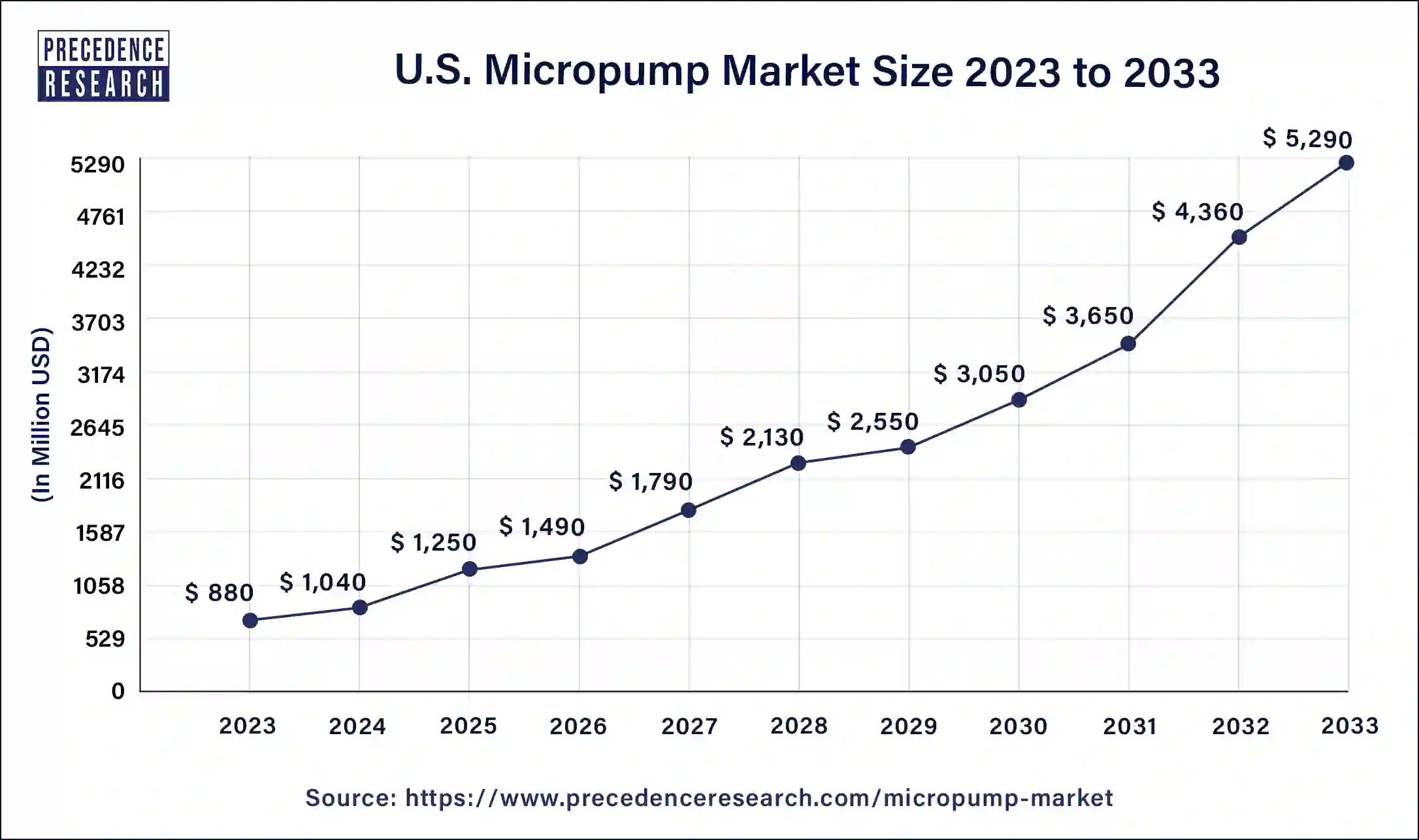

The U.S. micropump market size surpassed USD 880 million in 2023 and is projected to attain around USD 5,290 million by 2033, poised to grow at a CAGR of 19.64% from 2024 to 2033.

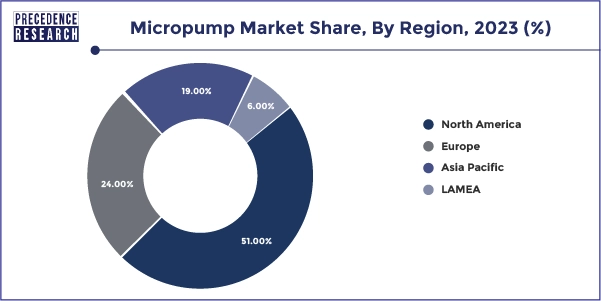

North America dominated the micropump market by region in 2023. North America boasts a very sophisticated healthcare system, especially in the United States. This entails making significant investments in medical infrastructure and technologies, encouraging innovation, and the uptake of cutting-edge medical devices like micropumps. Research and development for a number of high-tech industries, such as biotechnology, pharmaceuticals, and medical devices, is concentrated in this region. The public and private sectors provide sizable funding to encourage innovation and micropump technology advancements.

Asia Pacific is expected to grow at the highest CAGR in the micropump market by region during the forecast period. The demand for innovative medical equipment, including micropumps, is being driven by rising expenditures in healthcare infrastructure and rising healthcare spending by the public and private sectors in countries like China, India, and Japan. The need for drug delivery systems that use micropumps to distribute medication precisely is growing due to the rising prevalence of chronic illnesses, including diabetes, heart disease, and cancer. The micropump market is expanding due to the quick development of novel micropump designs and advances in the field of microelectromechanical systems (MEMS) technology. The leading producers of semiconductors and electronics, many of whom are based in the area, contribute significantly to the advancement of MEMS technology.

The micropump market refers to the reduced pump that is intended to manage minuscule fluid volumes, typically within the microliter (µL) or nanoliter (nL) range. These devices are essential for many applications, such as microfluidics, lab-on-a-chip systems, and medical devices. They work by precisely moving fluids through the application of mechanisms such as piezoelectric, electrostatic, or thermal effects. The important uses of micropumps include medical devices, such as insulin pumps, implantable devices, and drug delivery systems. The micropumps are necessary for managing tiny fluid samples for diagnostic and research purposes. The micropumps are essential to point-of-care diagnostics and lab-on-a-chip systems. The micropumps are regarded for their precision, dependability, and low power consumption, which makes them appropriate for wearable and portable devices.

| Report Coverage | Details |

| Market Size by 2033 | USD 13.61 Billion |

| Market Size in 2023 | USD 2.29 Billion |

| Market Size in 2024 | USD 2.73 Billion |

| Market Growth Rate from 2024 to 2033 | CAGR of 19.53% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Product, Application, End-user, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growing need for portable medical gadgets and home healthcare

The growing need for portable medical gadgets and home healthcare can boost the micropump market. People are becoming more and more dependent on medical devices to manage their health outside of conventional hospital settings. These devices, which allow for precise and regulated drug delivery at home, are not complete without micropumps.

Growing aging population

The growing aging population can grow the micropump market. As a result of the aging population, there is a greater need for medical interventions and life-improving technologies like medication delivery micropumps and other medical applications.

Complex manufacturing process

The complex manufacturing process may slow down the micropump market. The higher production cost results from the need for sophisticated technology, specialized machinery, and skilled labor in complex manufacturing processes. This may raise the cost of micropumps and lessen their ability to compete in the market.

Advancement in materials and manufacturing process

The advancement in the material and manufacturing process of micropumps can be the opportunity to grow the micropump market. The manufacturing of more effective and compact micropumps is made possible by continuous advancement in manufacturing technologies, such as Micro-Electro-Mechanical Systems (MEMS). The rising production of MEMS (Micro-Electro-Mechanical Systems) can be an opportunity to grow the micropump market.

The mechanical micropump segment dominated the micropump market by product in 2023. For applications like chemical processing and medical devices that need precise dosing and metering, mechanical micropumps provide exact control over fluid flow rates. These micropumps can handle many different fluids, including gases and liquids with different viscosities. Because of their adaptability, they can be used in a wide range of fields, such as industrial applications, environmental monitoring, and biomedicine. The foundation of mechanical micropumps is established theories and methods. Because of their maturity, they have undergone extensive testing and refinement, which has resulted in high performance and reliability.

The non-mechanical micropump segment is expected to grow at the highest CAGR in the micropump market during the forecast period. The non-mechanical micropumps are perfect for portable and small devices because they are easier to integrate into microfluidic and lab-on-a-chip systems. The non-mechanical micropumps have fewer moving parts, making them more dependable and long-lasting. They require less upkeep and have a longer lifespan because they are less prone to wear and tear. These micropumps provide accurate fluid flow control, which is crucial for uses in chemical analysis, drug delivery, and medical diagnostics.

The medical devices segment dominated the micropump market by application in 2023. The numerous medical equipment that are used for medication administration, diagnostic procedures, and therapeutic treatments depend on micropumps. They are extremely significant in the medical profession because of their adaptability in applications, including insulin pumps, infusion pumps, and implanted drug delivery systems.

The performance, dependability, and integration potential of micropumps in medical devices have been greatly enhanced by the ongoing developments in microfluidics and Micro-Electro-Mechanical Systems (MEMS) technology. Their use in complex medical applications has expanded as a result of this. Chronic disorders, including diabetes, heart disease, and cancer, are becoming more common, which has increased demand for medical devices that use micropumps to administer medication continuously and precisely.

For example, a significant portion of diabetes treatment insulin pumps rely on micropump technology. The compact and accurate micropumps are in higher demand due to the trend toward less invasive medical procedures and therapies. Numerous minimally invasive technologies, such as implanted medication delivery systems and micro-infusion pumps, employ these pumps.

The drug delivery segment is expected to grow at the highest CAGR in the micropump market during the forecast period. Targeted and long-term medication administration strategies are required due to the growth in chronic illnesses such as diabetes, cancer, and cardiovascular diseases. For this kind of continuous and regulated medicine delivery, micropumps offer the precision required.

The need for sophisticated medication delivery systems is being driven by the emergence of complicated biologics and biosimilars, which call for exact dosage and regulated distribution. Delivering these delicate biological treatments precisely and effectively requires micropumps. Minimally invasive and non-invasive medication delivery techniques are becoming increasingly popular. By providing exact control over medication delivery without the need for intrusive procedures, micropumps make these techniques possible.

The hospitals & diagnostic centers segment dominated the micropump market by end-user in 2023. Due to the huge volume of patients that hospitals and diagnostic centers see, there is an increased need for micropumps in a variety of medical applications, including medication distribution, diagnostic processes, and therapeutic treatments. These facilities have cutting-edge medical infrastructure, which makes it possible to integrate and employ cutting-edge devices like micropumps. The deployment and efficient operation of micropump devices in clinical settings are supported by this infrastructure. Hospitals and diagnostic facilities employ micropumps for a number of purposes, such as tests for diagnosis, pain management, infusion treatment, chemotherapy, and insulin administration for diabetic patients. Their great demand in these environments stems from their adaptability.

The biotechnology & pharmaceutical companies segment is expected to grow at the highest CAGR in the micropump market by end-user during the forecast period. In order to produce innovative medications and treatments, biotechnology and pharmaceutical firms make significant investments in research and development (R&D). The demand in this market is driven by the critical function that micropumps play in the accurate and regulated delivery of investigational medications during clinical trials. In order to increase the effectiveness and safety of pharmaceuticals, these businesses are concentrating on creating cutting-edge drug delivery methods. These systems require micropumps, particularly for applications involving controlled release and focused drug administration. The market for micropumps is growing as biologics and bio-similar become more popular. These drugs frequently need complex delivery systems. To handle delicate biological goods, bio-pharmaceutical businesses require micropumps that are precise and dependable.

Segment Covered in the Report

By Product

By Application

By End-user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client