May 2024

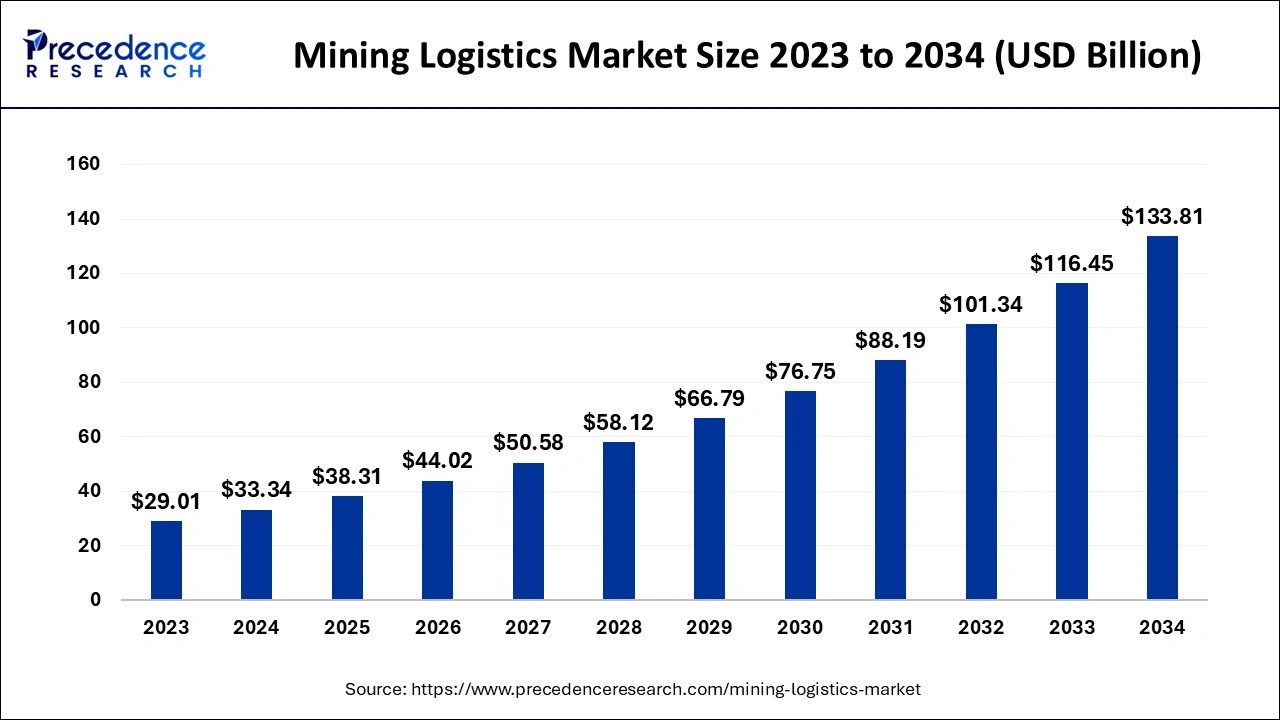

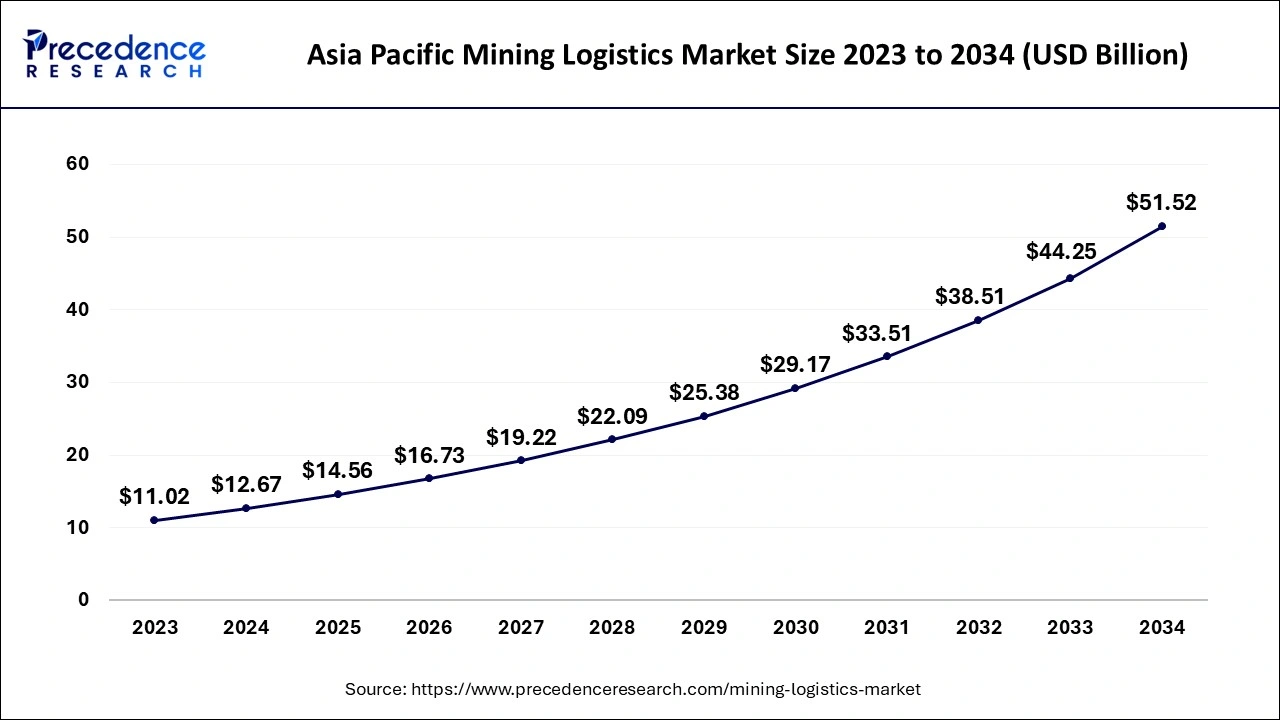

The global mining logistics market size accounted for USD 33.34 billion in 2024, grew to USD 38.31 billion in 2025 and is expected to be worth around USD 133.81 billion by 2034, registering a healthy CAGR of 14.91% between 2024 and 2034. The Asia Pacific mining logistics market size is calculated at USD 12.67 billion in 2024 and is expected to grow at a CAGR of 15.05% during the forecast year.

The global mining logistics market size is calculated at USD 33.34 billion in 2024 and is projected to surpass around USD 133.81 billion by 2034, expanding at a CAGR of 14.91% from 2024 to 2034. The mining logistics market is increasing due to new technologies, infrastructure development, sustainable developments, and the extension of mining services.

The Asia Pacific mining logistics market size is evaluated at USD 12.67 billion in 2024 and is anticipated to be worth around USD 51.52 billion by 2034, growing at a CAGR of 15.05% from 2024 to 2034.

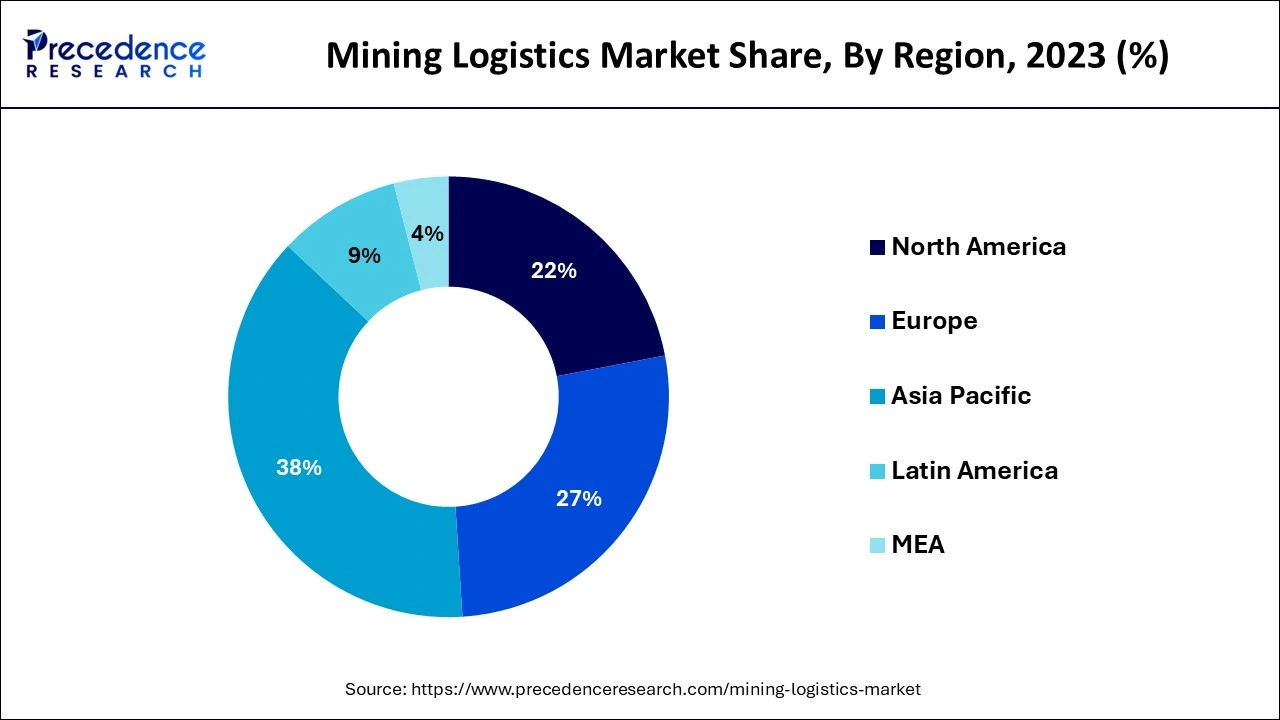

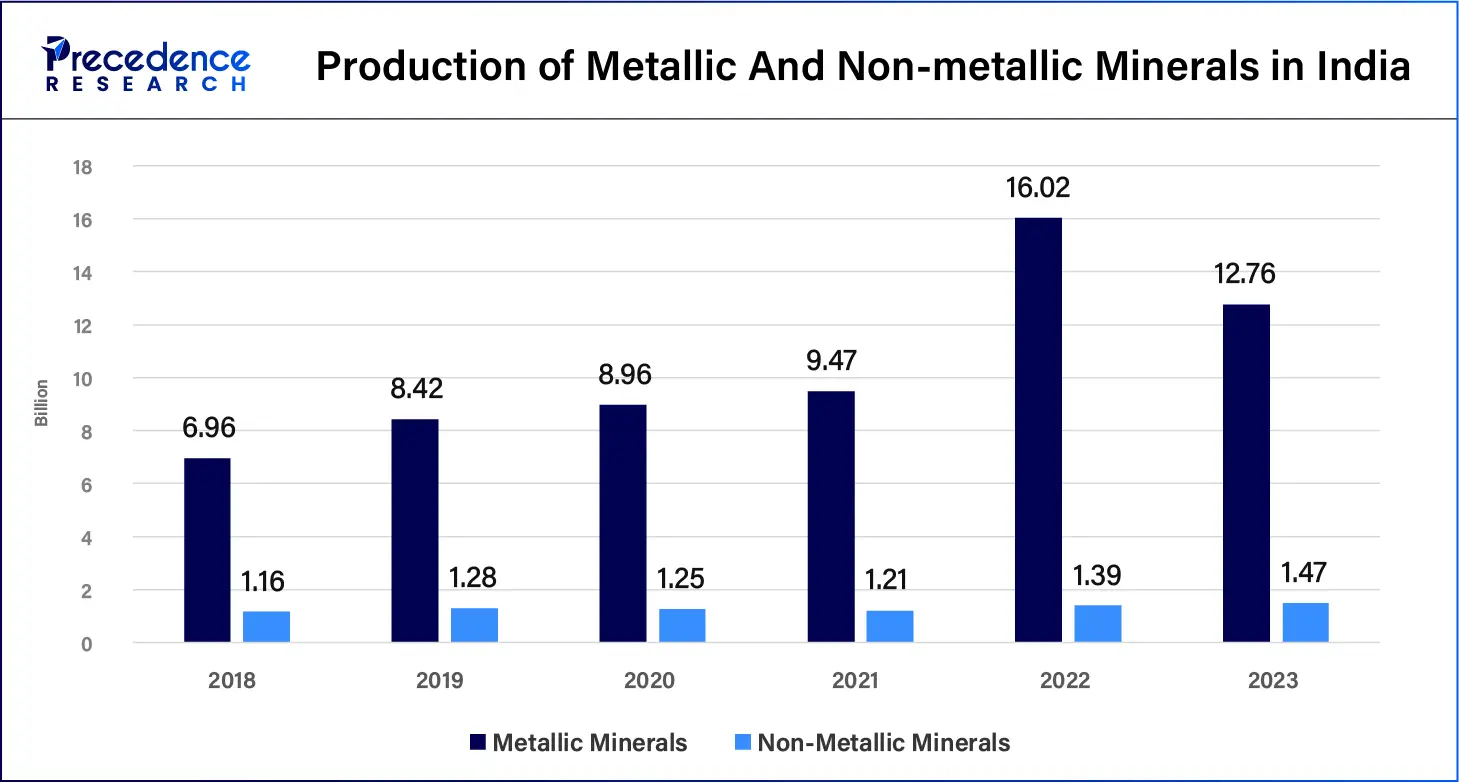

Asia Pacific led the global mining logistics market with the largest market share in 2023. Due to the development of infrastructures, especially real estate in China and India, the demands for raw materials and logistic services have increased dramatically. Australia, China, and India are investing in sustainable mining technologies that address challenges in waste management, energy consumption, and water utilization.

Supportive government policies boosting mining activities offer a favorable environment for market growth. As regions progress further on their industrialization and urbanization course, the transportation and logistic requirements in mining also gain importance. The operations that take place within the market incorporate a blend of conventional and innovative ideas on logistics, and business organizations incorporate advances in technology to enhance functionality, minimize accidents, and cut costs.

North America is expected to host the fastest-growing mining logistics market throughout the forecast period. North America has a high growth rate for the mining logistics market due to the availability of mineral resources and the increasing importance of metals and minerals. The social considerations have led mining firms to embrace green mining to be environmentally friendly as well as use available resources efficiently. Fundamental strategies like technology, automation, and investment in infrastructure enhance operation capability.

The mining logistics market is managing the supply chain network for the mining and mineral extraction industries. The freight forwarding industry is a sub-sector of the mining industry that deals with the movement, management, and warehousing of unprocessed minerals, ores, and mining equipment. Mining industries also need specialized transportation services to transport equipment, machinery, and spares to mine sites, but service providers offer cost-effective means of transporting mined commodities such as coal, ores, metals, and minerals. Truck, rail, and sea transportation make the connection between mining suppliers and consumers through the complex global chain.

How AI Influences Mining Logistics Market

Combining Artificial Intelligence (AI) and machine learning with supply chain management allows companies to optimize logistics by forecasting demand, managing inventory, and detecting potential disruptions in real-time. Logistics has aided the use of new technologies and big data analysis in logistics to improve decision-making, routes, and inventory management. AI is also being used to monitor and manage the environment of mining and metals companies. The mining logistics market stands to benefit from the implementation of AI, which will improve exploration, sustainability, safety, and implementation issues.

| Report Coverage | Details |

| Market Size by 2034 | USD 133.81 Billion |

| Market Size in 2024 | USD 33.34 Billion |

| Market Size in 2025 | USD 38.31 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 14.91% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, & Africa |

Rising demand for metal and minerals

The requirements for mineral consumption have been developed, especially for the growing economies that need to enhance the mining logistics. The global demand for metals and minerals has risen significantly since the drive towards clean energy transitions. Due to the push for using clean energy, minerals such as Lithium, Nickel, Cobalt, Graphite, and rare earth elements are growing at a rapid pace. These minerals are used in applications of clean technologies like windmills, electric vehicles, and the electricity network. To some extent, this is due to an increase in population, level of urbanization, and per capita income.

Regulatory challenges

The regulatory problem in the mining logistics market is that, with the growing severity of environmental regulation, their application to this activity is limited. Mineral processing companies are bound by government and regulatory authorities to reduce the negative effects of mining industries on the environment, hence the need for innovation. This includes waste disposal and handling, medical waste disposal, and emission stages that reduce air and water pollution. The implementation of these regulations makes it necessary for those businesses to spend money on research and development of sustainable solutions.

Sustainability initiatives

Efficiency and sustainable solutions in the mining logistics market have become more important as companies aim to reduce their carbon footprint and improve overall sustainability. Utilizing the shortest ways of transport, using energy-efficient equipment in the production line, and including renewable energy in the utilization process. Large firms are also using technology for optimal waste disposal and recycling management. Mining companies are increasingly adopting sustainable logistics practices to minimize their environmental impact, which is driven by consumer demand and regulatory pressures.

The transportation service segment has contributed the largest mining logistics market share in 2023. Lithium, copper, and cobalt are all used in electric vehicles, as well as renewable energy, which require transportation services. Logistic & supply chain services cover transportation and storage of ores and minerals and equipment, machinery, and other consumables from mines to processing plants and port markets. Road transportation by truck, railway transport, and shipping are other important modes of transportation in the mining industry's supply chain. Planning and the implementation of effective end-to-end logistics solutions not only provide a competitive advantage but also lead to time and cost savings.

The value-added service segment is expected to show considerable growth in the mining logistics market over the forecast period. Value-added logistics is a function within the supply chain that creates value added to the product in the supply chain. This growth is a result of market players giving much consideration to minimizing waste, improving packaging, and adopting green measures in operations. Mining logistics involves other services like moving, distribution, supply, and management of risks.

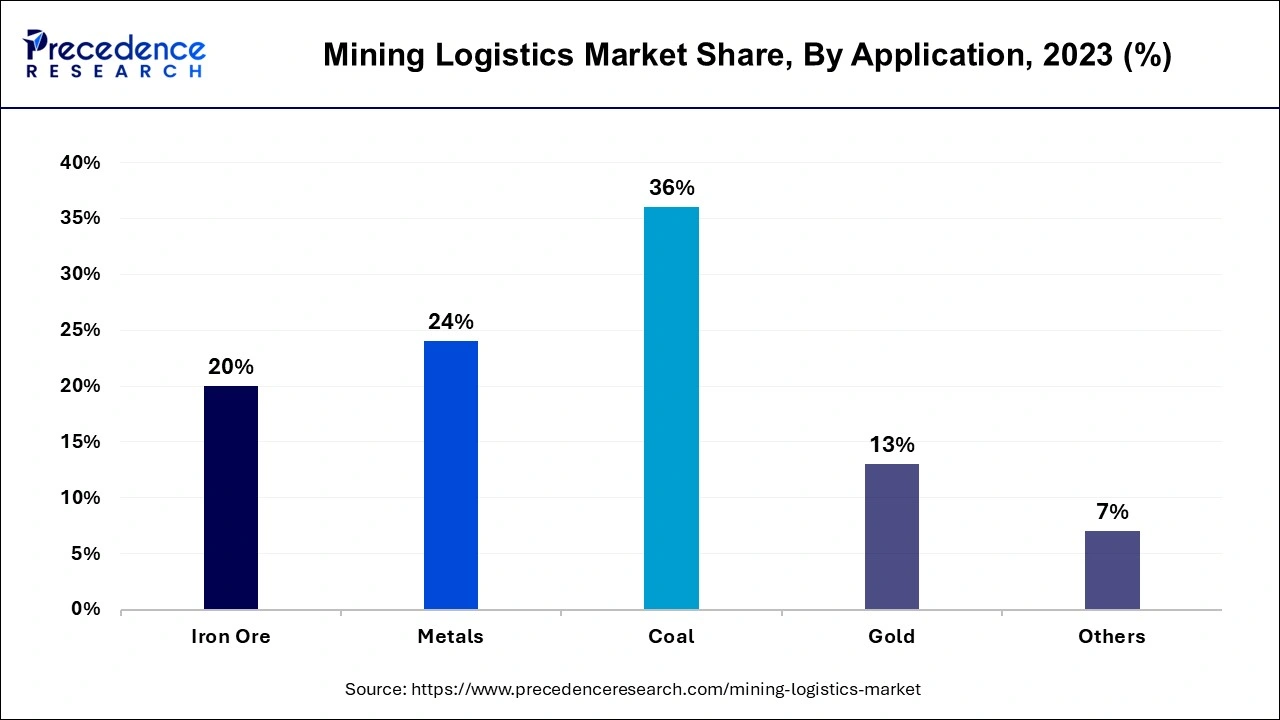

The coal segment accounted for the largest share of the mining logistics market in 2023. The key factors are needed for power generation all over the world, with specific reference to the developing nations relying on coal energy for power generation. Due to the increasing demand for electricity and heat, coal mining is one of the most vital mining activities that have been carried out. Coal movement is the process of moving coal from the source, the mining areas, to a variety of users, including power generation industries like thermal power plants, consumption by industries in the form of steel plants, cement factories, and dry cleaners, among others.

The metals segment is anticipated to witness significant growth in the mining logistics market over the studied period. There is an increasing demand for raw materials in the construction industries, automobile industries, electronics industries, and renewable energy industries. Mining logistics is defined as the flow of particular required materials or supplies within the consumption areas of the metal mining and mineral extraction industry. It involves moving and keeping raw minerals, ores, and mining machinery. Higher population rates, greater urbanization, and higher per capita income lead to greater demand for structures, vehicles, and consumer durables, which in turn implies higher demand for mining products as part of this growth.

Segments Covered in the Report

By Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

May 2024

July 2024

July 2024