November 2024

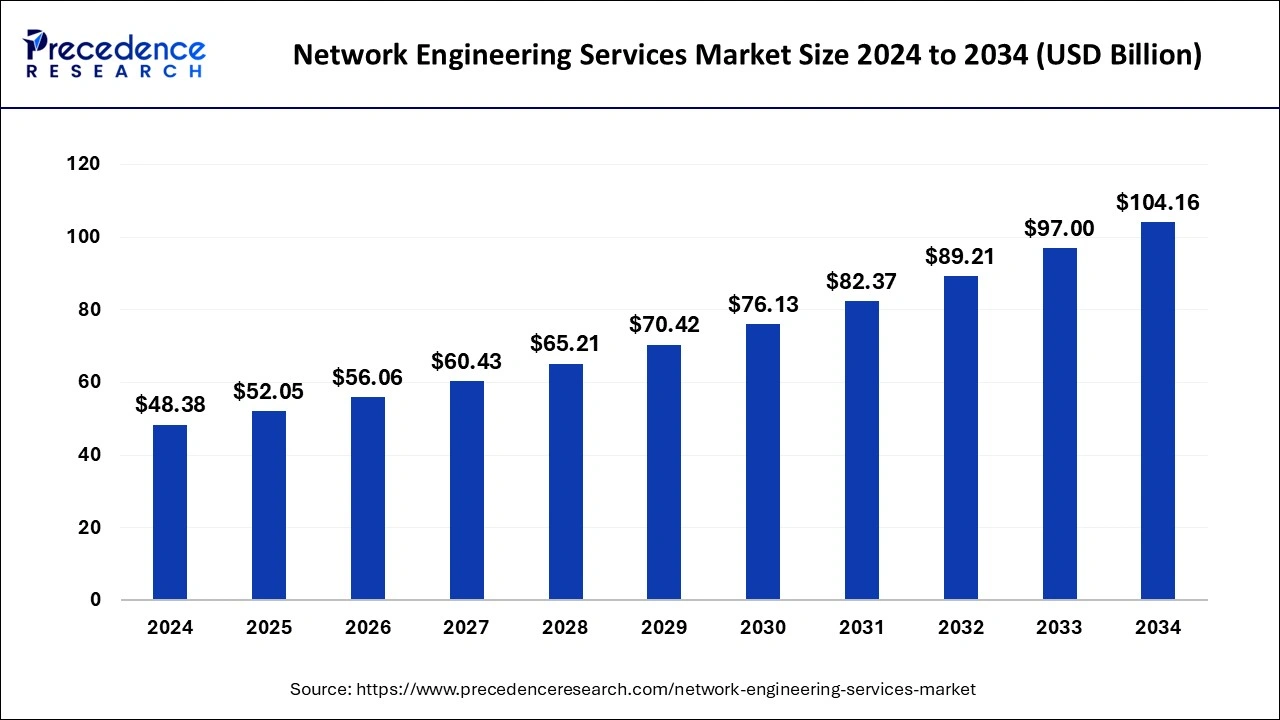

The global network engineering services market size is calculated at USD 52.05 billion in 2025 and is forecasted to reach around USD 104.16 billion by 2034, accelerating at a CAGR of 7.97% from 2025 to 2034. The North America network engineering services market size surpassed USD 15.48 billion in 2024 and is expanding at a CAGR of 7.97% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global network engineering services market size was estimated at USD 48.38 billion in 2024 and is predicted to increase from USD 52.05 billion in 2025 to approximately USD 104.16 billion by 2034, expanding at a CAGR of 7.97% from 2025 to 2034.

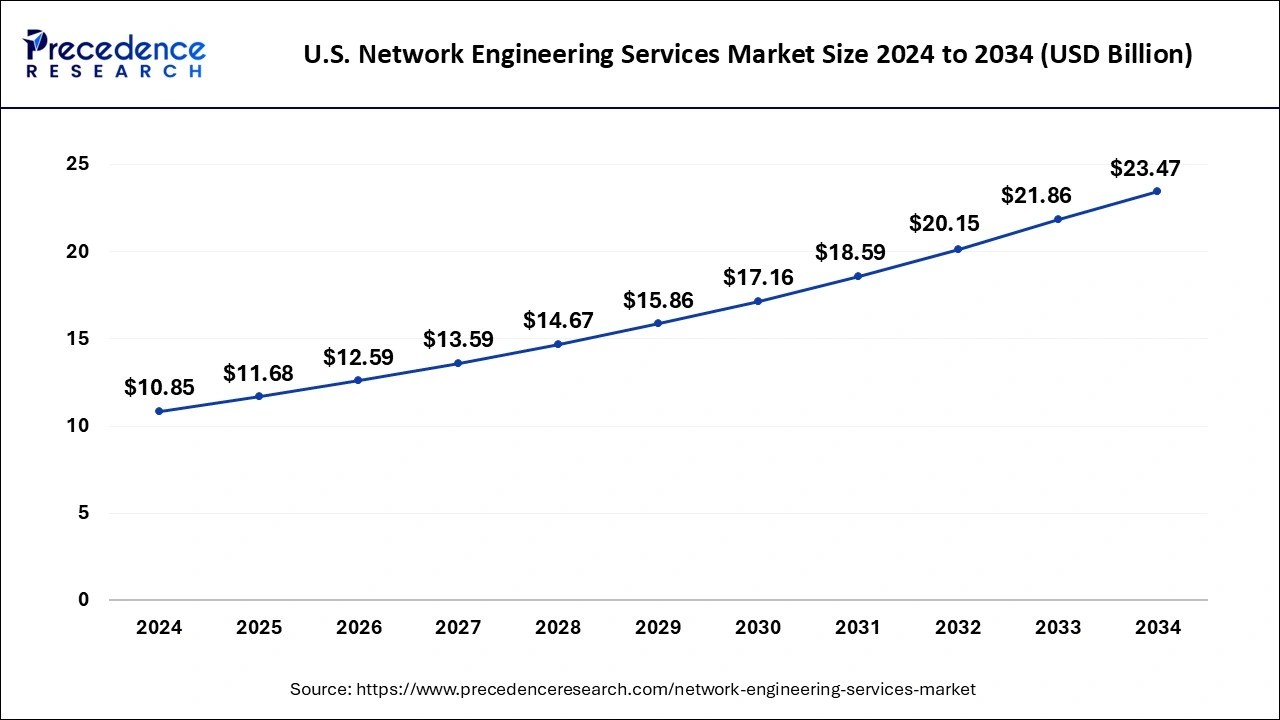

The U.S. network engineering services market size was valued at USD 10.85 billion in 2024 and is expected to reach around USD 23.47 billion by 2034, growing at a CAGR of 8.02% from 2025 to 2034.

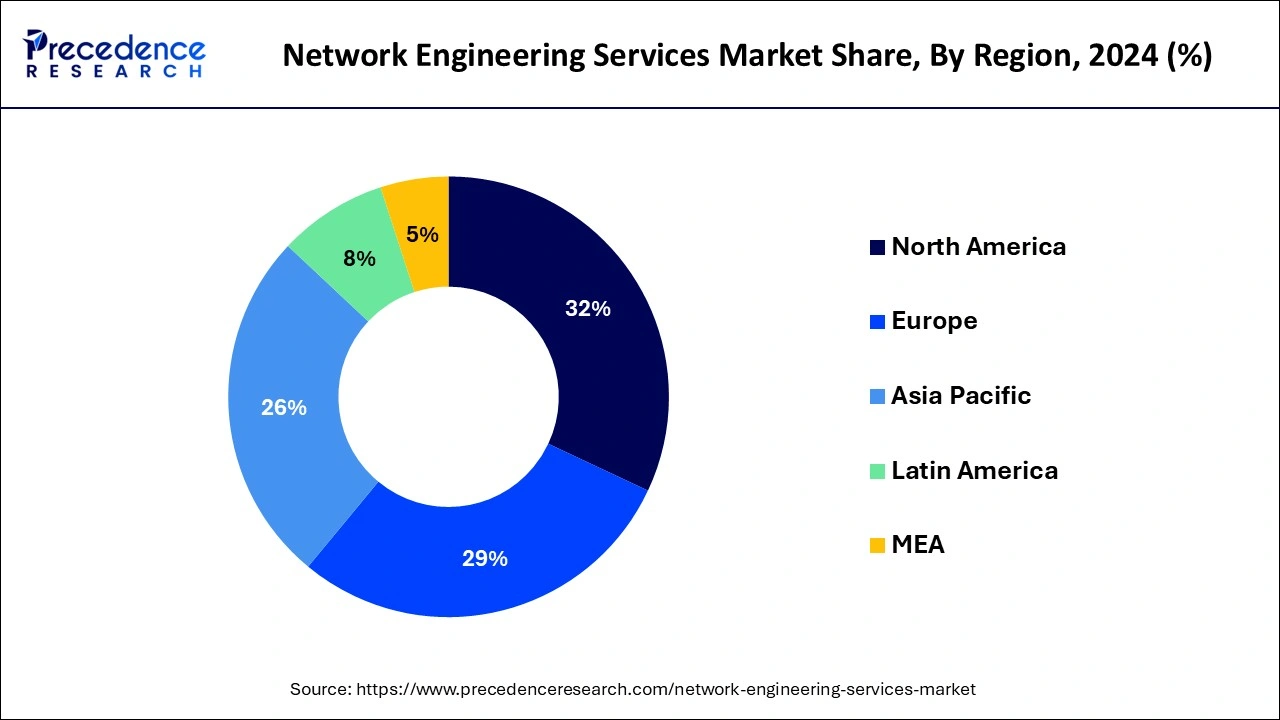

North America holds the largest share of 32% in 2024 due to advanced technological adoption, a robust IT infrastructure, and widespread digitization in various industries. The region's proactive approach to incorporating innovations like 5G, IoT, and cloud services fuels the demand for specialized network engineering solutions. Additionally, a high awareness of cyber security and stringent data protection regulations further propels the need for sophisticated network architecture. North America's leadership in these technological aspects positions it as a major contributor to the market's substantial share, driven by continuous advancements and a mature IT landscape.

Asia-Pacific is poised for rapid growth in the network engineering services market due to several factors. The region's burgeoning digital economy, increasing investments in advanced technologies, and a surge in network infrastructure development to support 5G deployments are driving the demand for specialized network engineering expertise. Additionally, a growing number of enterprises and businesses in the region are embracing digital transformation, further fueling the need for robust and scalable network solutions, positioning Asia-Pacific as a key growth hub for network engineering services.

Meanwhile, Europe is experiencing notable growth in the network engineering services market due to several factors. The region is witnessing increased investments in advanced technologies, such as 5G and IoT, leading to a surge in demand for expert network engineering solutions. Additionally, the emphasis on cybersecurity, digital transformation initiatives, and the modernization of network infrastructure contribute to the expanding market. European businesses recognize the importance of robust and secure networks in today's digital landscape, driving the growth of the network engineering services market.

Network engineering services involve the design, implementation, and maintenance of computer networks, ensuring efficient and reliable communication between devices. Professionals in this field, known as network engineers, play a crucial role in establishing secure and seamless connections for businesses and organizations. They assess the specific needs of clients, plan network architectures, and deploy the necessary hardware and software components. Network engineers troubleshoot issues, optimize performance, and stay updated on emerging technologies to enhance network functionality. These services are vital for ensuring that information flows smoothly within an organization, supporting various activities such as data sharing, internet access, and collaborative work, ultimately contributing to the overall efficiency and productivity of an enterprise.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 7.97% |

| Market Size in 2025 | USD 52.05 Billion |

| Market Size by 2034 | USD 104.16 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Service Type, By Connection Type, and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing demand for network security

The escalating threat landscape in the digital realm has propelled a surge in demand for network security, contributing significantly to the increased market demand for network engineering services. As businesses and organizations confront ever-evolving cyber threats, the role of network engineering becomes pivotal in fortifying digital infrastructures. Network engineering services are crucial for implementing robust security measures, including firewalls, intrusion detection systems, and encryption protocols, safeguarding sensitive data and ensuring the integrity of network operations. With cyber attacks becoming more sophisticated, organizations seek expertise to design and manage secure networks.

Network engineering services not only address current security challenges but also adapt and evolve to meet the dynamic nature of cyber threats. This heightened focus on network security as a priority investment area has elevated the importance of skilled network engineers, driving the market demand for their services to create and maintain resilient, secure, and future-ready network architectures.

Shortage of skilled professionals

The shortage of skilled professionals poses a significant restraint on the market demand for network engineering services. As the demand for advanced networking solutions continues to rise, there is a notable gap in the availability of qualified and experienced network engineers. This scarcity can lead to challenges in meeting the growing needs of businesses seeking to enhance their digital infrastructure. The shortage not only results in increased competition for skilled professionals but also has the potential to cause delays in the implementation of network engineering projects.

Organizations may face difficulties in finding experts capable of navigating the complexities of emerging technologies, impacting their ability to deploy and manage sophisticated network architectures. Addressing the shortage requires a concerted effort in training and education to build a more robust workforce, enabling businesses to fully leverage the benefits of network engineering services for improved connectivity, security, and overall operational efficiency.

Digital transformation initiatives

Digital transformation initiatives are creating significant opportunities in the network engineering services market by driving the need for modernized and adaptive network infrastructures. As businesses embrace digital transformation, they seek to integrate emerging technologies like cloud computing, artificial intelligence, and the Internet of Things (IoT) into their operations. Network engineering services play a crucial role in this process, offering expertise in designing and implementing networks that can seamlessly accommodate these advanced technologies.

Moreover, as organizations digitize their processes and services, the demand for secure, scalable, and high-performance networks intensifies. Network engineering services enable businesses to navigate the complexities of digital transformation by providing tailored solutions that enhance connectivity, data transfer speeds, and overall network efficiency. This trend not only fosters innovation but also positions network engineering as a fundamental component in ensuring the success of digital initiatives across various industries.

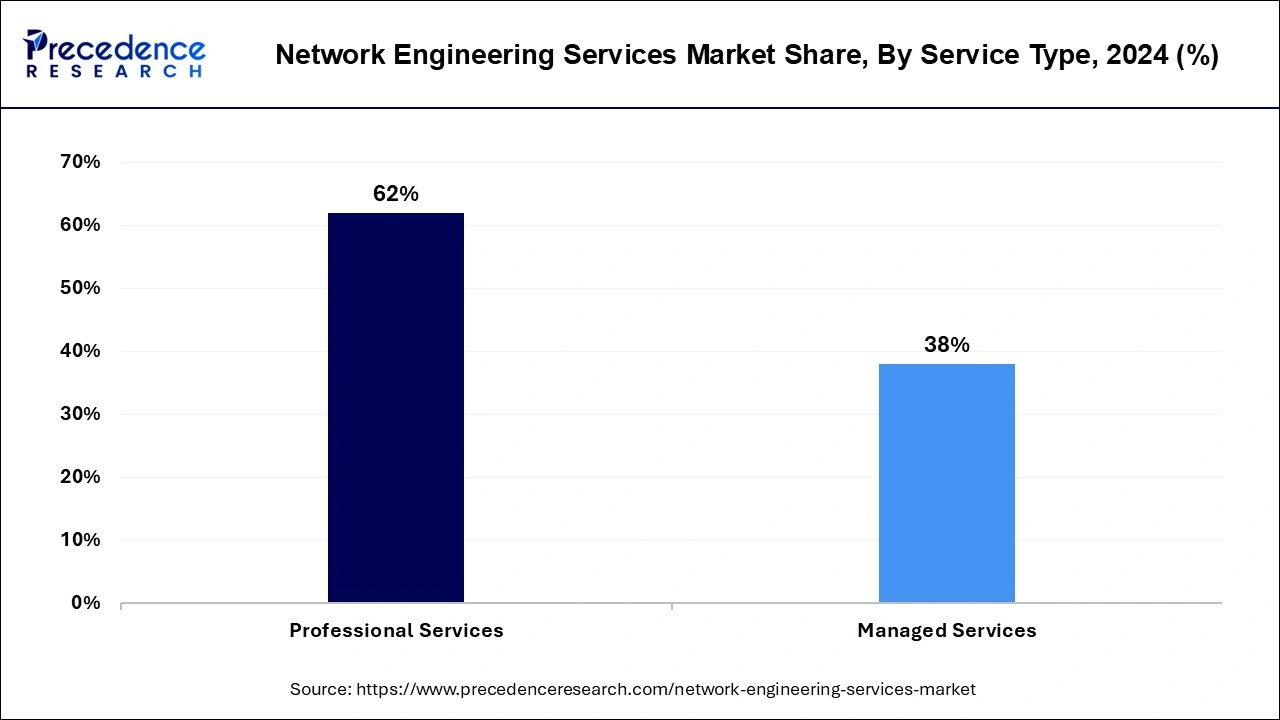

The professional services segment held the highest market share of 62% in 2024. In the network engineering services market, the professional services segment encompasses specialized expertise provided by skilled professionals. This includes network design, implementation, optimization, and troubleshooting. Trends in this segment reflect a growing demand for tailored solutions, with an emphasis on cybersecurity, cloud integration, and advanced technologies like 5G and IoT. Network engineers offering professional services are instrumental in assisting businesses with the strategic planning and execution of robust, secure, and efficient network architectures, aligning with evolving technological landscapes and organizational needs.

The managed services segment is anticipated to witness rapid growth at a significant CAGR of 18.7% during the projected period. In the network engineering services market, the managed services segment refers to the outsourcing of network management tasks to a specialized provider. This includes monitoring, maintenance, and optimization of network infrastructure. A notable trend in this segment is the increasing adoption of managed services by businesses looking to streamline their operations. Companies are leveraging managed services to offload the complexity of network management, ensuring enhanced reliability, security, and performance, while focusing on their core business activities. This trend reflects a growing recognition of the value and efficiency offered by outsourced network management solutions.

The wired segment has held a 58% market share in 2024. In the network engineering services market, the wired segment refers to connectivity solutions that utilize physical cables for data transmission. This includes Ethernet cables, fiber optics, and other wired technologies. The wired segment is witnessing a continued demand for robust and reliable connections, especially in critical applications where stability is paramount. As industries prioritize low latency and high bandwidth, wired connections remain a staple in network engineering services, ensuring consistent and secure data transfer, particularly in environments where wireless connectivity may face limitations or interference.

The wireless segment is anticipated to witness rapid growth over the projected period. The wireless segment in the network engineering services market pertains to the design, implementation, and optimization of wireless networks. This includes Wi-Fi, cellular, and other wireless technologies. A notable trend in this segment is the increasing demand for robust wireless infrastructure to support the proliferation of mobile devices, IoT, and the transition to 5G. Network engineering services focused on the wireless domain are crucial for creating efficient, high-performance wireless networks that meet the demands of today's connected and mobile-centric environments.

The communication service providers segment held 66% market share in 2024. The communication service providers (CSPs) segment in the network engineering services market refers to companies offering telecommunication services. This includes mobile and fixed-line operators, internet service providers, and other communication service providers. A notable trend in this segment involves CSPs increasingly investing in network engineering services to enhance their infrastructure, optimize network performance, and prepare for the integration of advanced technologies like 5G. The goal is to ensure reliable and high-quality communication services, meeting the evolving demands of a digitally connected world.

The enterprises segment is anticipated to witness rapid growth over the projected period. In the network engineering services market, the "enterprises" segment refers to businesses and organizations across various industries that leverage network services for their operational needs. A key trend in this segment involves enterprises increasingly adopting advanced network solutions to support digital transformation, enhance cybersecurity, and facilitate seamless connectivity. As these enterprises prioritize efficient and secure network infrastructures, the demand for network engineering services continues to grow, providing tailored solutions to meet the evolving connectivity and security requirements of modern businesses.

By Service Type

By Connection Type

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

January 2025

November 2024

January 2025