September 2024

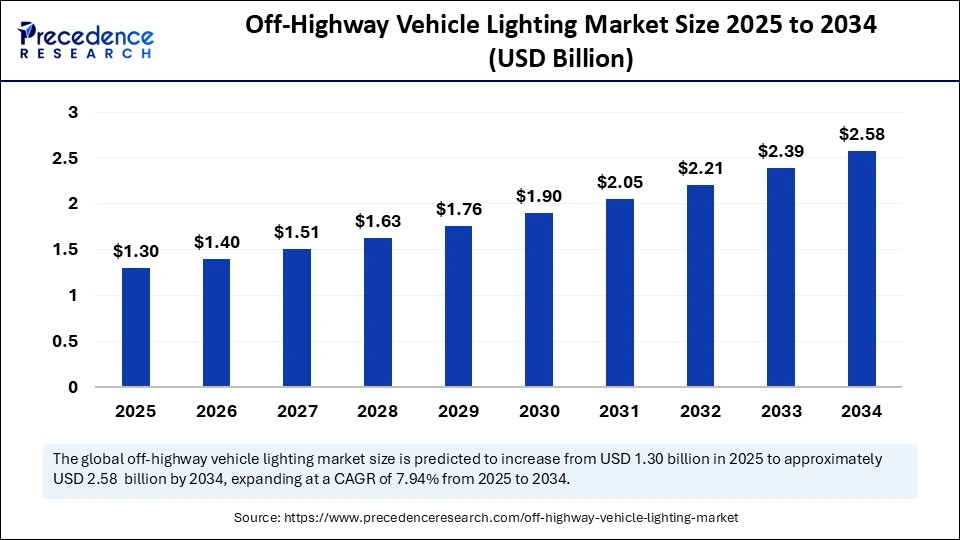

The global off-highway vehicle lighting market size is calculated at USD 1.3 billion in 2025 and is forecasted to reach around USD 2.58 billion by 2034, accelerating at a CAGR of 7.94% from 2025 to 2034. The Asia Pacific market size surpassed USD 396 billion in 2024 and is expanding at a CAGR of 8.12% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global off-highway vehicle lighting market size accounted for USD 1.20 billion in 2024 and is predicted to increase from USD 1.30 billion in 2025 to approximately USD 2.58 billion by 2034, expanding at a CAGR of 7.94% from 2025 to 2034. The demand for heavy construction equipment is driving the market. Rapid urbanization and infrastructure developments are driving the need for off-highway vehicle lighting. Stricter environmental regulations and safety standards are contributing to market expansion.

Artificial intelligence is a revolutionary tool for improving the off-highway vehicle lighting market's efficiency, safety, and visibility. AI advanced adaptive lighting and provided quick and accurate hazard detection ability. Technological advancements like AI integration with off-highway vehicle lighting are significant steps toward improving the capabilities and features of this lighting. Additionally, the growing sustainability trend is creating ways for AI to enter off-highway vehicle lighting. AI optimization reduces energy consumption and provides data-driven decision-making abilities to reduce carbon footprints. Manufacturing industries increased their emphasis on AI implementation in order to comply with stringent regulatory requirements and compliance.

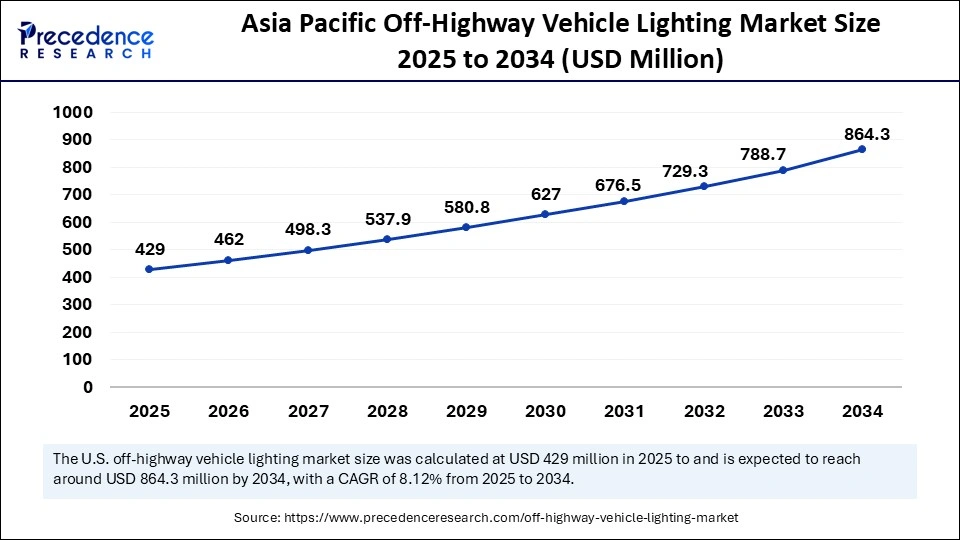

The Asia Pacific off-highway vehicle lighting market size was exhibited at USD 396 billion in 2024 and is projected to be worth around USD 864.3 billion by 2034, growing at a CAGR of 8.12% from 2025 to 2034.

Increased Urbanization and Industrialization Projects in the Asian Market

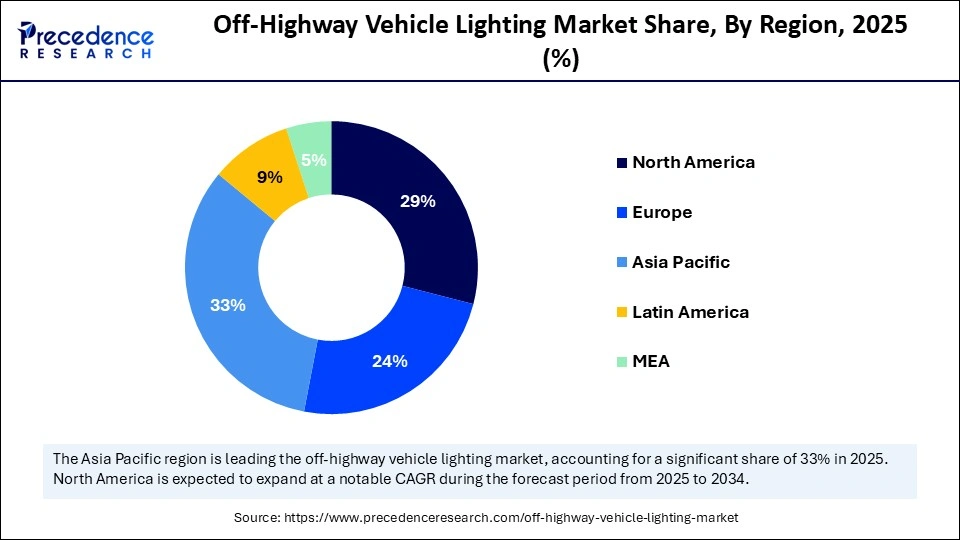

Asia Pacific dominated the off-highway vehicle lighting market in 2024 due to various factors, including the existence of a strong automotive industry, rapid urbanization and industrialization, electric vehicle growth, and government initiatives. Rapid urbanization and industrial development are the key factors contributing to the high demand for higher vehicle lighting solutions in the region. Will establish automotive industry and government initiatives in promoting the adoption of electric vehicles, boosting the demand for energy-efficient lighting solutions. Manufacturers are developing sophisticated lighting systems to comply with regulatory requirements and complaints. Countries like Japan, India, and South Korea are high adopters of LED lighting solutions.

China is leading the regional market; growth is driven by the existence of a robust electrical ecosystem and government initiatives for vehicle electrification. China is the home of the construction machinery and earthmoving equipment manufacturing base. Growing urbanization and infrastructure initiatives are driving demand for off-highway vehicles in China, driving demand for advanced and sustainable lighting solutions.

Technological Advancements Focus on Fuelling European Market Expansion

Europe is projected to host the fastest-growing off-highway vehicle lighting market in the coming years, contributing to innovation and the development of advanced highway vehicle lighting solutions. Strict regulations regarding vehicle safety and emissions are driving demand for advanced lighting solutions. The growing construction industry and the presence of a strong automotive industry are driving manufacturers to emphasize the production of advanced off-highway vehicles and lighting solutions.

Countries like Germany, France, and the UK are contributing a significant share to regional market growth. A strong automotive industry, infrastructure developments, and growing construction industries are driving the need for cutting-edge off-highway vehicle lighting in these countries. The UK is anticipated to lead the market in the upcoming period due to an increased focus on LED lighting advancements for improved visibility, safety capabilities, and machine performance.

Manufacturers' Efforts to Boost the North American Market

The North American off-highway vehicle lighting market is expected to witness significant growth in the foreseeable future, driven by growth in the construction, agriculture, and mining industries. The well-established automotive industry of the region empowers manufacturers' production of off-highway vehicles and lighting solutions. Growing sustainability is driving demand for energy-efficient solutions. Additionally, the presence of key market vendors developing innovative lighting technologies like LED and adaptive lighting contributes to regional market growth.

The United States is leading the market in North America, driven by rapid construction industry growth and technological advancements. The existence of major off-highway vehicle manufacturers contributes to the innovation and development of advanced lighting solutions. Safety regulations are pushing manufacturers to adopt lighting technologies like adaptive driving beam systems and matrix LED headlights to improve visibility and reduce accidents.

The off-highway vehicle lighting market refers to the utilization of vehicles for public roads or highways, like construction, mining, agriculture, or recreational off-roading. Off-highway vehicle lighting ensures safety and visibility standards for operations in off-road environments. The rapid industrialization and urbanization are driving the adoption of these vehicles. The growing construction, mining, and agriculture industries are high adopters of off-highway vehicles, driving demand for advanced lighting solutions.

Technological advancements such as adaptive lighting, automatic high beams, smart lighting, and matrix lighting are trending in the market. Additionally, innovations and developments in LED lighting are gaining recognition due to their energy efficiency, durability, and visibility characteristics. Innovations in halogen lighting are creating spectacular opportunities.

| Report Coverage | Details |

| Market Size by 2034 | USD 2.58 Billion |

| Market Size in 2025 | USD 1.3 Billion |

| Market Size in 2024 | USD 1.2 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.94% |

| Dominated Region | Asia Pacific |

| Fastest Growing Market | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Vehicle, Application, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Increased demand for construction, agriculture, and mining equipment

Rapid growth in the construction, agriculture, and mining industries is a significant increase in demand for the off-highway vehicle lighting market. Vehicle lighting. Growing constructions are driven by public infrastructure development, increasing demand for heavy construction, and increasing demand for heavy construction equipment like loaders and dump trucks. The agriculture industry is witnessing significant growth, driving demand for advanced machinery and lighting solutions.

Growth in the mining industry is driven by increased demand for critical minerals. The mining industry requires heavy equipment with advanced lighting systems for high safety and visibility. Government initiatives in vehicle safety and workplace illumination are driving demand for advanced lighting solutions in off-highway vehicles. Rapid urbanization and infrastructure development also contribute to high demand for equipment.

High cost of LED lights

The demand for LED lights has been high due to their flexibility, energy efficiency, and durable nature. However, the high cost of LED lights is hampering their adoption as off-highway vehicle lighting solutions. LED lights are made up of the materials indium gallium nitride and aluminum gallium arsenide, which are quite expensive. The high cost of these lights increases production and manufacturing costs. It restarts the adoption rate of off-highway vehicle lighting solutions.

Sustainability and innovations

The off-highway vehicle lighting market is anticipated to witness significant growth due to rising demand for sustainability and innovation factors. The government's strict environmental regulations and sustainability training have driven high demand for energy-efficient lighting. Manufacturers are focusing on reducing carbon footprints by using eco-friendly and recyclable materials and production processes. Emerging innovations of reusable lighting components are creating significant opportunities for the manufacturing industry. Technological advancements in lighting, such as smart lighting solutions and the integration of cutting-edge technologies, are fueling the sustainability and innovation approaches.

The halogen segment held a dominant presence in the off-highway vehicle lighting market in 2024, driven by cost-effectiveness and wide availability. Halogen products are cost-effective compared to LED lighting technologies. Full stop. Cost-effective compared to LED lighting technologies. Wide availability of halogen products makes it easy to replacements them and reduces downtime. Strong supply chain with major manufacturers and suppliers providing a wide range of halogen writing solutions, contributing to segment growth.

However, the LED segment is expected to grow at the fastest rate during the forecast period of 2025 to 2034. LED products provide energy efficiency, durability, and high visibility. High costs associated with LED lighting were restraining its adoption rate. However, the rapid trend towards sustainability has pushed technological advancements in LED lighting technologies to make it more cost-effective, projected to expand its adoption range in the forecast.

The tractor segment led the global off-highway vehicle lighting market in 2024, driven by rapid utilization in construction and agriculture projects. These industrial growths are driving demand for robust, reliable, and increasingly technologically advanced lighting solutions in tractors. The increasing trend of mechanization and modernization in the agriculture sector is driving the demand for tractors. The need for high safety and visibility features is contributing to the increased implementation of high-quality lighting solutions in tractors.

The dump trucks segment is projected to expand rapidly in the coming years due to the increased demand for high-quality lighting solutions in dump trucks for the construction and mining industries. Construction and mining projects are processes in harsh working environments that drive the need for improved visibility and safety features in dump trucks. Regulatory requirements of dump trucks to be equipped with high-quality lighting solutions and demand for continuous heavy-duty vehicles push manufacturers to innovation and advancements in lighting solutions.

The headlamp segment dominated the global off-highway vehicle lighting market in 2024 and is projected to continue this dominance over the forecast period. A headlamp provides illumination and visibility in low-light and night conditions. These are the crucial safety systems for off-highway vehicles. Headlamps offer the ability to navigate uneven terrain and adverse weather, making them ideal for off-highway vehicles. Stringent regulatory requirements regarding safety require off-highway vehicles to be equipped with advanced headlamps. Additionally, technological advancements in lighting technology, like LED and HID lighting, enable improved efficiency and performance of headlamps.

The construction segment accounted largest off-highway vehicle lighting market share in 2024. The world has witnessed rapid growth in construction and infrastructure development projects like roads, bridges, and buildings. The need for construction equipment has increased. The industry requires the transport of heavy and dangerous instruments, driving demand for off-highway vehicles. Construction projects are often performed in hazardous areas. The industry has increased demand for safety and visibility improvements of off-highway vehicle lighting solutions.

On the other hand, the agriculture/farming/forestry segment is expected to account for a significant rate in the forecast period. Growing industrial expansion and demand for advanced machinery and automation are driving market expansion. The increased population and demand for food production are driving efficient and productive agricultural practices. The utilization of off-highway vehicles is high in this industry, driven by the high need for heavy equipment and vehicles like tractors. The agriculture/farming/forestry process requires vehicle utilization in low-light conditions or nighttime conditions, driving demand for high-quality lighting solutions for safety and visibility standards.

By Product

By Vehicle

By Application

By End-use

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

April 2025

January 2025

January 2025