March 2025

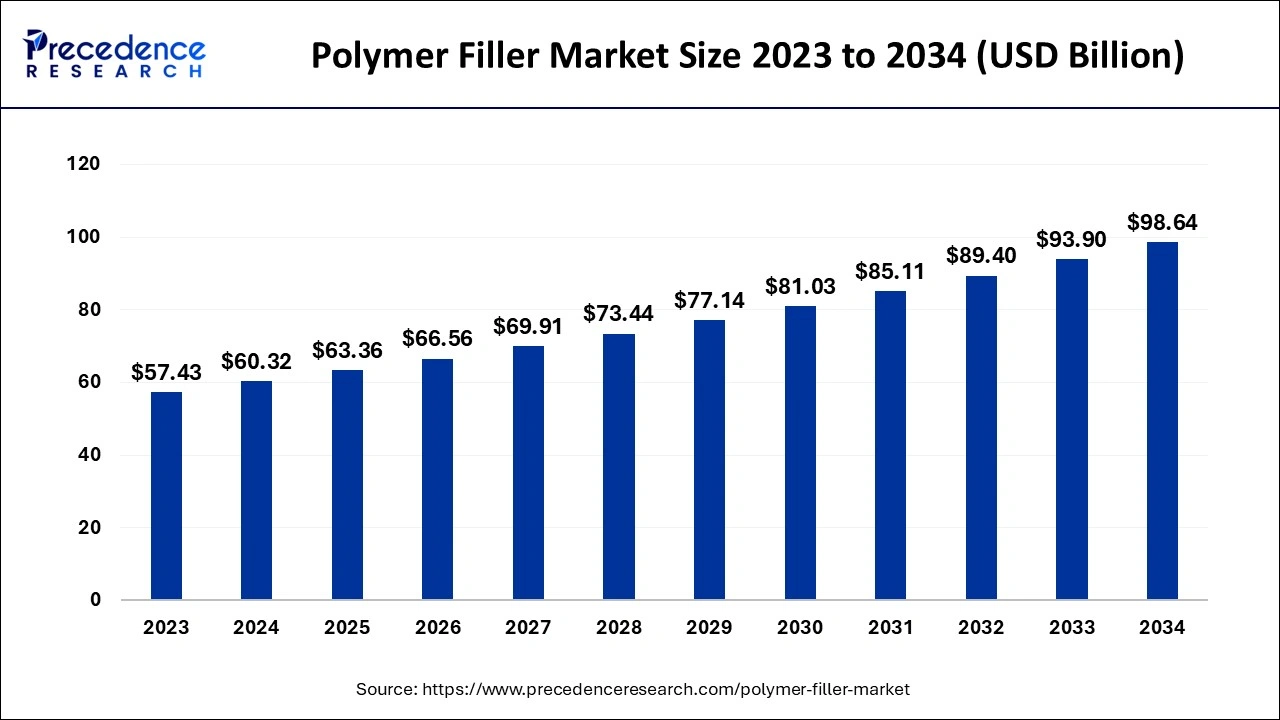

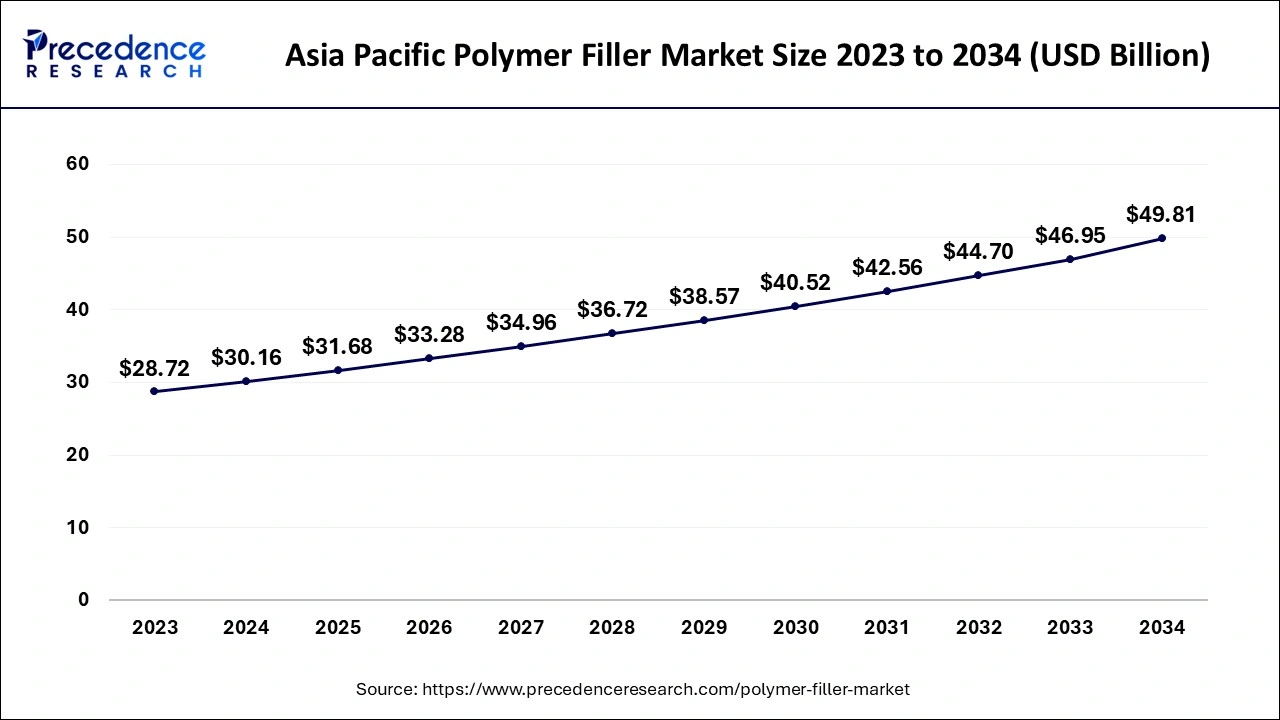

The global polymer filler market size is calculated at USD 60.32 billion in 2024, grew to USD 63.36 billion in 2025 and is projected to reach around USD 98.64 billion by 2034. The market is expanding at a CAGR of 5.04% between 2024 and 2034. The Asia Pacific polymer filler market size is evaluated at USD 30.16 billion in 2024 and is expected to grow at a CAGR of 5.13% during the forecast year.

The global polymer filler market size accounted for USD 60.32 billion in 2024 and is predicted to hit around USD 98.64 billion by 2034, growing at a CAGR of 5.04% from 2024 to 2034. Rising demand for high strength and lightweight materials in various industries is the key factor driving the market growth. Also, the easy availability of natural fibers like cellulose and wood, coupled with the increasing demand for sustainable materials, can propel market growth shortly.

The Asia Pacific polymer filler market size is exhibited at USD 30.16 billion in 2024 and is anticipated to be worth around USD 49.81 billion by 2034, growing at a CAGR of 5.13% from 2024 to 2034.

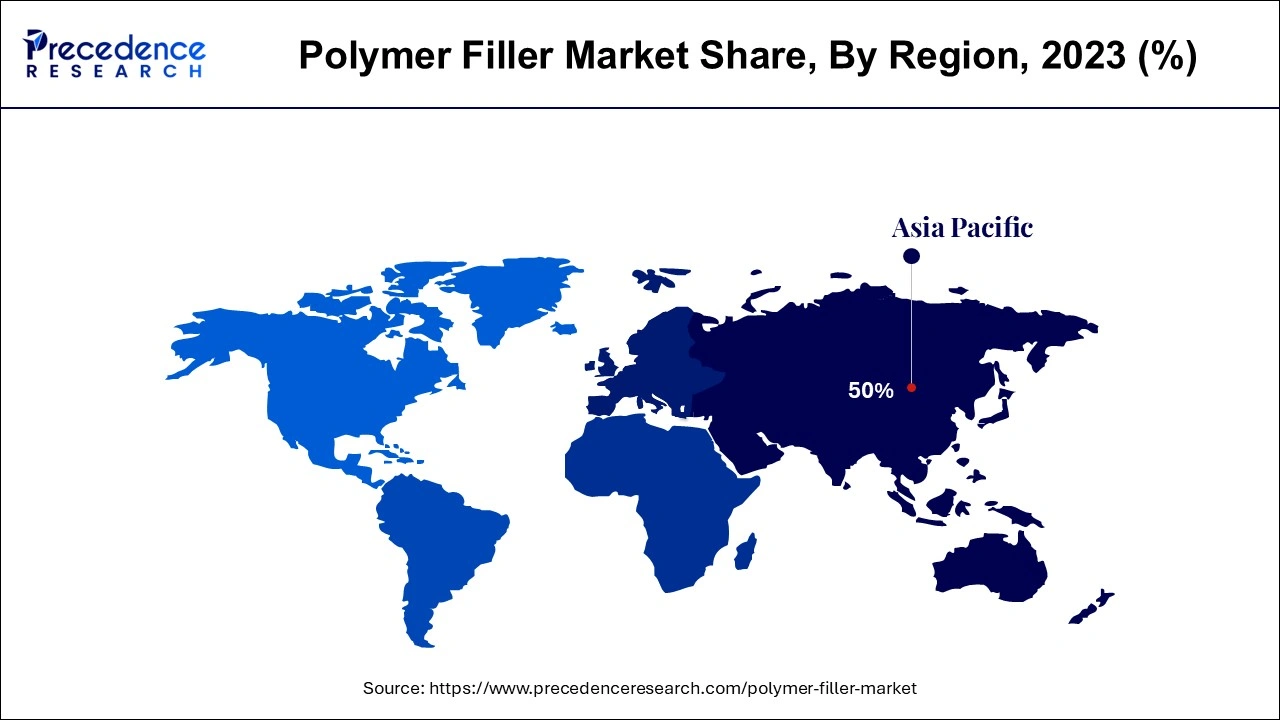

Asia Pacific dominated the polymer filler market in 2023. The dominance of the segment can be attributed to the rapid industrialization, rising manufacturing activities, and urbanization in the region. India, China, and Japan are witnessing substantial expansions in construction, automotive, and packaging. Furthermore, the increase in infrastructure development also propels the demand for building materials with enhanced properties.

North America is expected to witness significant growth over the forecast period. The growth of the region can be driven by developing infrastructure projects that are creating the demand for polymer fillers to enhance the properties of insulation, concrete, and other building materials. However, the increasing construction and automotive industries in the countries like US are driving the polymer filler market growth in the region.

Polymer filler is an additive that can be added to polymer devising to decrease costs and enhance the chemical and physical properties by replacing costly resins. The filler can be solid, liquid, or gas and is generally used to enhance the stability, moldability, and strength of composites. Polymer filler also possesses material properties like decreased polymerization shrinkage and reduced thermal expansion. It can be organic or inorganic and involves various kinds of organic polymer fillers like carbon fibers, carbon black, and carbon nanotubes.

Top 10 Countries That Produce the Most Plastic Waste (tons) in 2024

| Country | Plastic Consumption (in tons) |

| China | 37.6M |

| United States | 22.9M |

| India | 7.4M |

| Brazil | 4.9M |

| Mexico | 4M |

| Japan | 3.8M |

| German | 3.6M |

| Indonesia | 3.4M |

| Thailand | 3.4M |

| Italy | 3.3M |

Role of AI in the Polymer Filler Market

AI can help researchers discover and design new polymers with different properties and can process vast amounts of data to draw patterns and predict the characteristics of new polymers. Furthermore, AI can also help researchers predict the physical, chemical, and mechanical features of polymers and can enhance the consistency, efficiency, and quality of polymer production processes. However, the precision of AI predictions relies highly on the quality of the data provided to the algorithms.

| Report Coverage | Details |

| Market Size by 2034 | USD 98.64 Billion |

| Market Size in 2024 | USD 60.32 Billion |

| Market Size in 2025 | USD 63.36 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 5.04% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, End Use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, & Africa |

Increasing demand for polymer fillers in the aerospace industry

There is a growing demand for polymer fillers like graphite, graphene oxide, carbon nanotubes, and nano clay from the aerospace industry, as polymer fillers are chosen structural constituents for airplanes because of their compatible mechanical properties and lightweight nature. Additionally, polycarbonate (PC) is a thermoplastic polymer that possesses high impact resistance, exceptional transparency, and thermal stability, which are preferred over other fillers due to its extensive range of properties.

High processing cost

The processing techniques utilized in the production of these fillers are not financially viable such as electrospinning and solvent processing. However, the cost rate of polymer processing is much higher as it involves a high loading of fillers for property improvements, which leads to hurdles in processing and melt movement because of the high viscosity of the materials filled, which can constrain polymer filler market growth.

Increasing demand for plastic polymer fillers

Plastic fillers offer a more cost-effective and sustainable solution to the polymer industry as compared to conventional polymer fillers. Plastic fillers improve the thermal, mechanical, and flow properties of polymers. They can also enhance the toughness, heat resistance, and tensile strength of the material. There are two main types of plastic fillers: inorganic and organic. Furthermore, PCC and GCC fillers are utilized in polymers like polypropylene, polyethylene, and polyvinyl chloride, which makes plastic parts opaque.

Smart polymer fillers are a new market trend

The utilization of smart polymer fillers is an emerging trend in the polymer filler market. These polymers are in demand in the medical industry. They are used in artificial body parts, biosensors, etc. In addition, they are utilized on a wide scale due to their flexibility and strength. The biocompatible property of smart polymers will fuel the overall market growth soon. Apart from this, producers of polymers have started to use enhanced technology in chemical and mechanical procedures. The main benefit of f polymer recycling is that it cuts the overall production cost by reducing the utilization of fresh or new raw materials. Later, it will help maintain a more sustainable environment.

The inorganic segment led the polymer filler market in 2023. The dominance of the segment can be attributed to the more cost-effective solutions provided by inorganic polymers over organic ones. The inorganic segment is further divided into salts, silicates, oxides, hydro-oxides, and metals. Additionally, the utilization of inorganic fillers, including talc, calcium, gypsum, and others, improves the material's mechanical properties, such as strength, elasticity, impact resistance, etc.

The organic segment is anticipated to grow at the fastest rate in the polymer filler market over the forecast period. The growth of the segment can be linked to the increasing demand for ultraviolet resistance. Organic fillers like natural fibers, cellulose, and starch-based materials provide numerous benefits like biodegradability, lightweight properties, and enhanced mechanical functions of polymers. Moreover, the increasing focus on sustainability and decreasing environmental effects will also impact product demand as they are obtained from renewable resources.

The automotive segment dominated the polymer filler market in 2023 by holding the largest market share. The dominance of the segment can be credited to the increasing demand for high-strength, low-weight materials is boosting the sales of polymer fillers in the automotive industry. The plastic utilized in automobiles is derived from polymers like polyamides and PVC. Furthermore, Fillers are added to enhance the characteristics of these plastics, decreasing the price of the vehicle and enhancing fuel efficiency and overall strength.

The packaging segment is anticipated to grow at the fastest rate in the polymer filler market during the forecast period. The growth of the segment can be driven by the increasing use of polymer fillers in packaging materials because these fillers are easy to seal and allow the material to remain fresh for a longer duration of time. Also, lower weight in packaging optimizes for raised product capacity, which results in lesser environmental impact and lower logistics expenses, leading to segment growth during the forecast period.

Segments Covered in the Report

By Product

By End Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2025

January 2025

January 2025

December 2024