August 2024

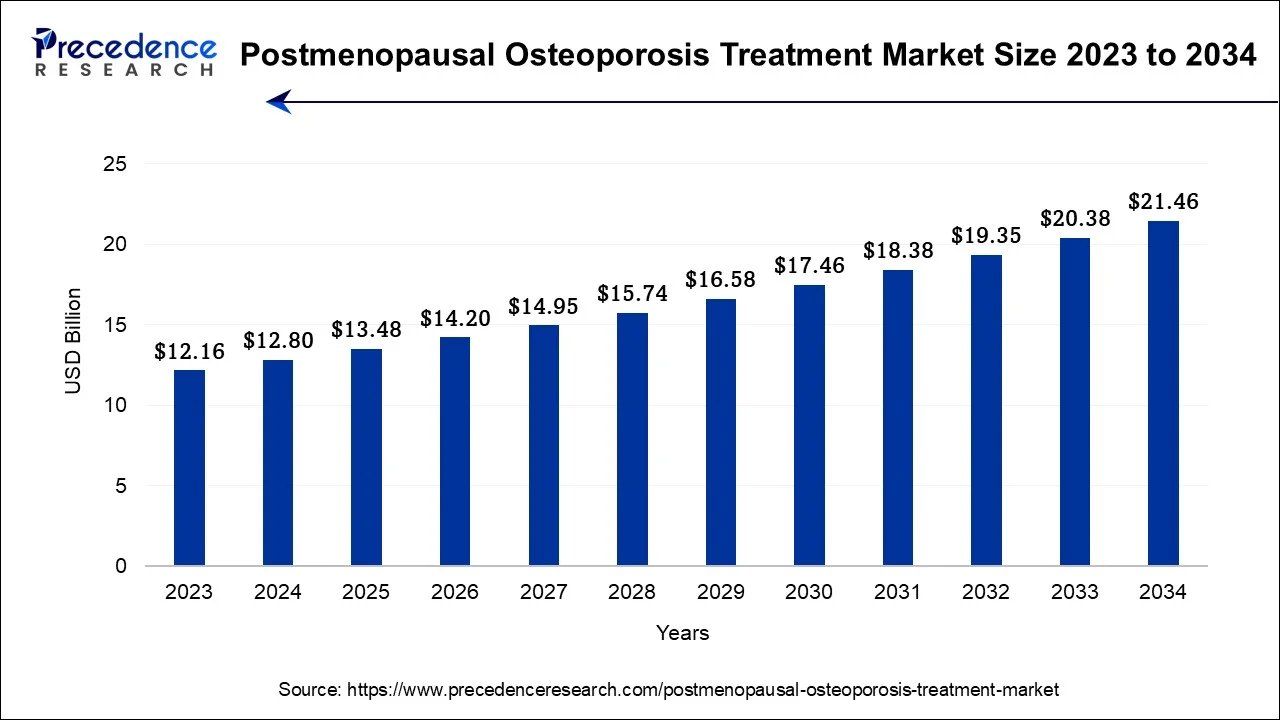

The global postmenopausal osteoporosis treatment market size accounted for USD 12.8 billion in 2024, grew to USD 13.48 billion in 2025 and is projected to surpass around USD 21.46 billion by 2034, representing a healthy CAGR of 5.30% between 2024 and 2034.

The global postmenopausal osteoporosis treatment market size is estimated at USD 12.8 billion in 2024 and is anticipated to reach around USD 21.46 billion by 2034, representing a notable CAGR of 5.30% between 2024 and 2034.

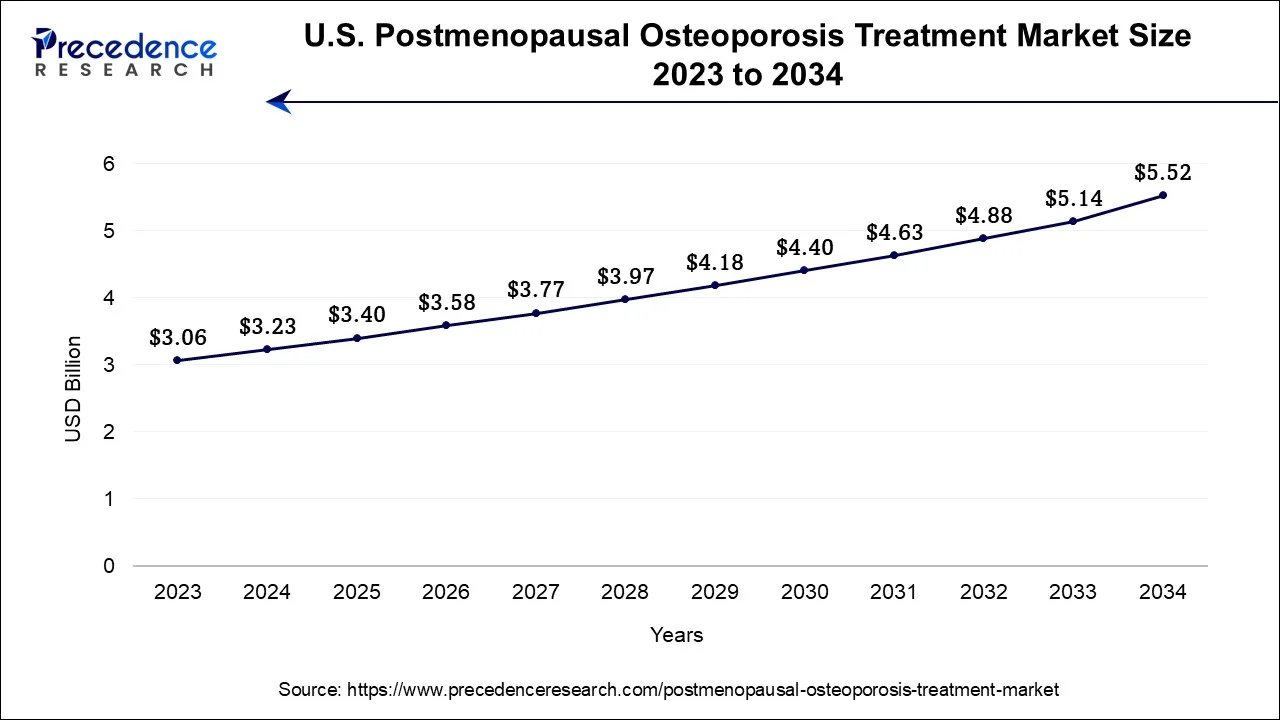

The U.S. postmenopausal osteoporosis treatment market size accounted for USD 3.23 billion in 2024 and is estimated to reach around USD 5.52 billion by 2034, growing at a CAGR of 5.50% from 2024 to 2034.

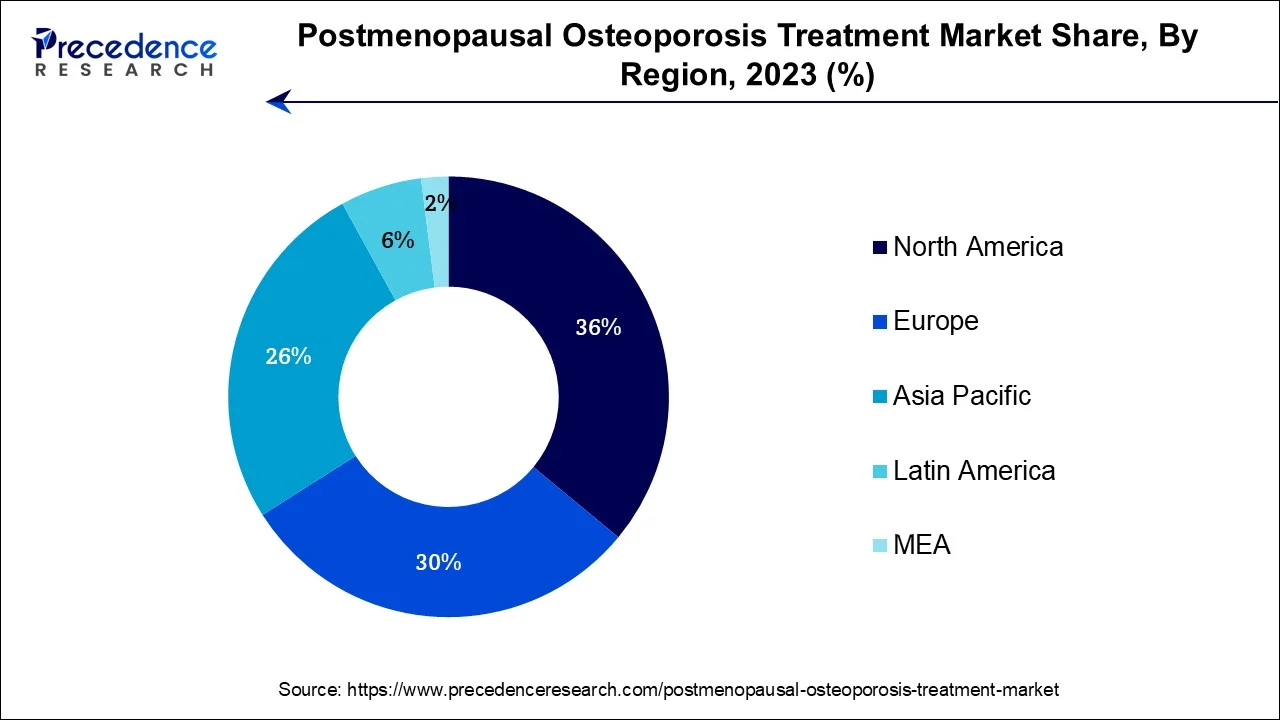

North America held the largest revenue share 36% in 2023. In North America, the postmenopausal osteoporosis treatment market is characterized by robust research and development efforts, leading to the introduction of advanced therapies. Increasing awareness about bone health, a growing aging population, and improved healthcare infrastructure are driving market growth. Telehealth and digital health solutions are also gaining prominence, facilitating patient access to treatment and monitoring, while ensuring more comprehensive care for postmenopausal osteoporosis.

Asia-Pacific is estimated to observe the fastest expansion. In the Asia-Pacific region, the postmenopausal osteoporosis treatment market is experiencing robust growth driven by the aging population, particularly in countries like Japan and China. Rising healthcare awareness, increased access to medical services, and adoption of advanced therapies are notable trends. Additionally, pharmaceutical companies are focusing on tailored approaches to address genetic and lifestyle factors unique to the region, reflecting a shift towards personalized medicine in osteoporosis management.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 5.3% |

| Market Size in 2024 | USD 12.8 Billion |

| Market Size by 2034 | USD 21.46 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Drug Type and By Distribution Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The ascent of biopharmaceuticals has notably increased demand in the postmenopausal osteoporosis treatment market through the introduction of innovative, precision therapies. Monoclonal antibodies and other biological agents demonstrate heightened effectiveness and fewer side effects when contrasted with conventional treatments, alluring both patients and healthcare providers to this evolving landscape.

Moreover, combination therapies in the postmenopausal osteoporosis treatment market are driving increased demand by offering a more comprehensive and effective approach to managing the condition. These therapies amalgamate various medications with complementary modes of action, elevating treatment effectiveness while diminishing fracture risks. Both patients and healthcare providers are increasingly acknowledging the advantages of these integrated treatments, resulting in heightened market demand. This surge is propelled by the potential to achieve superior outcomes, mitigate adverse effects, and ultimately enhance the well-being of postmenopausal women vulnerable to complications associated with osteoporosis.

Patient education and adherence initiatives play a pivotal role in boosting market demand for postmenopausal osteoporosis treatment. Increasing awareness about the seriousness of the disease and the importance of timely treatment encourages more patients to seek medical care. This increased demand for treatment, driven by patient education and adherence, enhances the market's growth potential as healthcare providers and pharmaceutical companies prioritize comprehensive patient support programs.

Generic competition can significantly restrain the market demand for postmenopausal osteoporosis treatment. When patents for existing medications expire, generic versions become available at lower prices, reducing the revenues of pharmaceutical companies. This can discourage innovation and investment in new treatments. Patients and healthcare providers may opt for more cost-effective generic options, limiting the market potential for newer, potentially more effective therapies. As a result, the competitive landscape can lead to pricing pressures and slower market growth in the postmenopausal osteoporosis treatment sector.

Moreover, Limited treatment options in the postmenopausal osteoporosis treatment market can restrain market demand by failing to meet the diverse needs of patients. With a one-size-fits-all approach, some individuals may not respond well to available therapies, leading to dissatisfaction and reduced treatment adherence. This limitation underscores the urgent need for more innovative and personalized treatment options to address varying patient profiles effectively. Insufficient treatment choices can result in unmet medical needs and hinder the market's potential for growth and expansion.

The increasing global aging population significantly drives market demand for postmenopausal osteoporosis treatment. As more individuals enter the postmenopausal stage, the prevalence of osteoporosis rises, creating a substantial patient pool. This demographic shift fuels the demand for effective treatments to prevent fractures and maintain bone health. Healthcare providers and pharmaceutical companies are well-positioned to benefit from this expanding market by catering to the distinctive healthcare requirements of the elderly.

Collaborative research initiatives in the postmenopausal osteoporosis treatment market can significantly boost market demand. By bringing together pharmaceutical companies and research institutions, these collaborations accelerate the development of innovative therapies, potentially leading to breakthrough treatments. This fosters competition, increases treatment options, and enhances overall patient care, creating greater demand as patients and healthcare providers seek access to cutting-edge solutions. Additionally, collaborative research can expedite regulatory approvals, ensuring quicker market entry for novel treatments, further stimulating demand in a dynamic and evolving healthcare landscape.

Impact of COVID-19

The COVID-19 pandemic has had a multifaceted impact on the postmenopausal osteoporosis treatment market. Initially, the market faced disruptions as healthcare resources were diverted toward pandemic management, delaying diagnosis and treatment for many osteoporosis patients. Social distancing measures also hindered patient access to healthcare facilities, including bone density scans and consultations, potentially leading to underdiagnosis.

On the supply side, pharmaceutical companies experienced disruptions in production and supply chains, which affected drug availability. These disruptions also impacted clinical trials and research efforts focused on developing new osteoporosis treatments. Healthcare providers and patients have adapted to remote consultations and monitoring, potentially expanding the market's reach and driving demand for innovative therapies.

According to the drug type, the bisphosphonates segment has held 39% revenue share in 2023. Bisphosphonates, a category of medications employed in treating postmenopausal osteoporosis, work by suppressing bone resorption, ultimately boosting bone density. While bisphosphonates have historically been a fundamental element of osteoporosis treatment, current trends suggest a transition towards more contemporary biopharmaceuticals and precision-targeted therapies. While bisphosphonates remain widely prescribed due to their established efficacy, market trends reveal an increasing preference for innovative treatments with potentially fewer side effects and improved patient outcomes. This shift reflects the ongoing pursuit of more tailored and advanced solutions for postmenopausal osteoporosis.

The hormone replacement therapy (HRT) segment is anticipated to expand at a significantly CAGR of 8.1% during the projected period. This therapy is a pharmaceutical approach employed in the treatment of postmenopausal osteoporosis. It encompasses the introduction of hormones, predominantly estrogen, either alone or in combination with progestin. This therapy serves the purpose of replenishing the hormonal levels that naturally decrease during the menopausal phase. HRT aims to alleviate symptoms like hot flashes and vaginal dryness, as well as to prevent bone loss associated with postmenopausal osteoporosis.

In recent trends, HRT has experienced shifts in usage due to evolving medical guidelines and safety concerns. While it was once commonly prescribed to manage postmenopausal symptoms and prevent osteoporosis, its use has become more selective. The focus is now on personalized medicine, where HRT is considered for those with severe symptoms or high fracture risk. Research continues to refine the dosage and duration of HRT to maximize benefits while minimizing potential risks like breast cancer and cardiovascular issues, reflecting the dynamic landscape of postmenopausal osteoporosis treatment.

The retail pharmacy segment held the largest market share of 39% in 2023. Retail pharmacies in the postmenopausal osteoporosis treatment market serve as essential distribution channels, offering patients convenient access to prescribed medications and related products while also playing an increasingly pivotal role in healthcare.

Recent trends in retail pharmacy include a shift towards patient-centric care, integration of e-commerce platforms for online access, the rise of telepharmacy services for virtual consultations, personalized medication packaging for improved adherence, expanded offerings encompassing health and wellness products, close collaboration with healthcare providers to ensure coordinated care, integration of digital health tools for monitoring and support, and the stocking of over-the-counter (OTC) options to provide patients with a wider range of choices for managing osteoporosis. These evolving trends reflect retail pharmacies' commitment to meeting diverse patient needs in the evolving healthcare landscape.

On the other hand, the hospital pharmacy sector is projected to grow at the fastest rate over the projected period. Hospital pharmacies, within the context of the postmenopausal osteoporosis treatment market, serve as integral distribution channels. These pharmacies are healthcare facilities situated within hospitals, responsible for the procurement, storage, and dispensation of osteoporosis medications to both inpatients and outpatients.

Notable trends in hospital pharmacies encompass the establishment of specialized bone clinics for comprehensive osteoporosis management, the integration of clinical decision support systems to optimize medication choices, increased pharmacist involvement in bone health assessments and patient counseling, a focus on medication reconciliation to ensure smooth transitions in care, quality assurance measures to enhance medication safety, the adoption of tele pharmacy services for extended patient access, collaboration with outpatient providers to ensure continuity of care, and the integration of electronic health records to facilitate seamless data sharing and care coordination, collectively contributing to more effective postmenopausal osteoporosis treatment within the hospital setting.

Segments Covered in the Report:

By Drug Type

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024

January 2025

May 2024

February 2025