October 2024

PVDF Membrane Market (By Material: Hydrophilic PVDF Membrane, Hydrophobic PVDF Membrane; By Technology: Microfiltration (MF) PVDF Membrane, Ultrafiltration (UF) PVDF Membrane, Nanofiltration (NF) PVDF Membrane; By End use: Pharmaceutical & Biotechnology, Food & Beverage, Electronics & Semiconductor, Water & Wastewater Treatment, Chemical Processing, Oil & Gas, Automotive) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

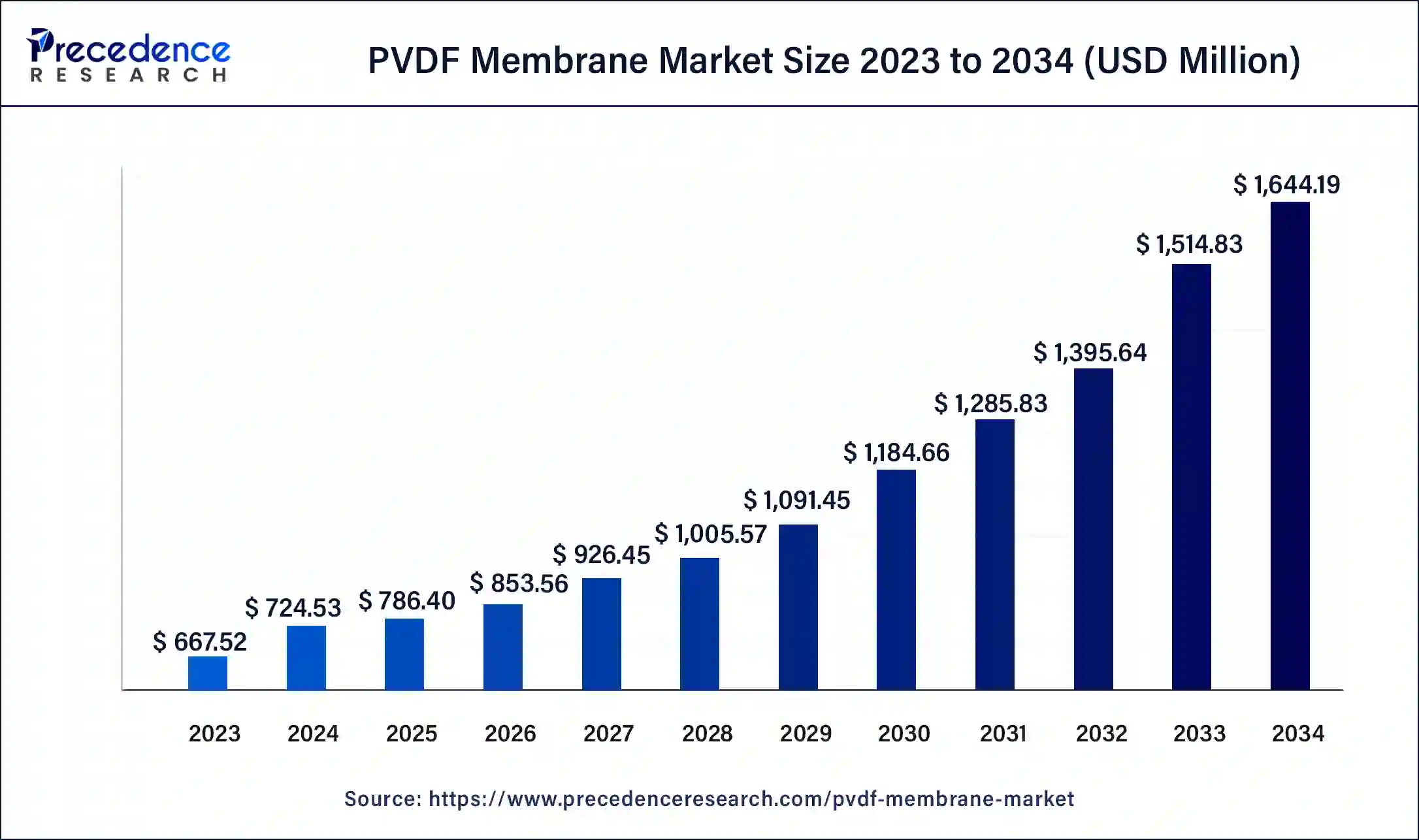

The global PVDF membrane market size was USD 667.52 million in 2023, calculated at USD 724.53 million in 2024 and is expected to reach around USD 1,644.19 million by 2034, expanding at a CAGR of 8.54% from 2024 to 2034. The PVDF membrane market is renowned for its exceptional chemical resistance and durability has been pushed by the need for clean water and effective wastewater management.

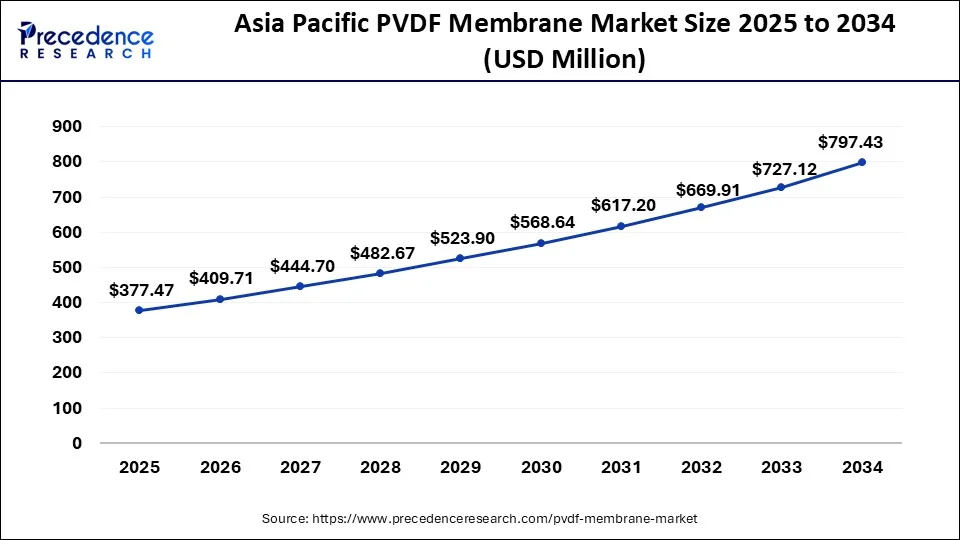

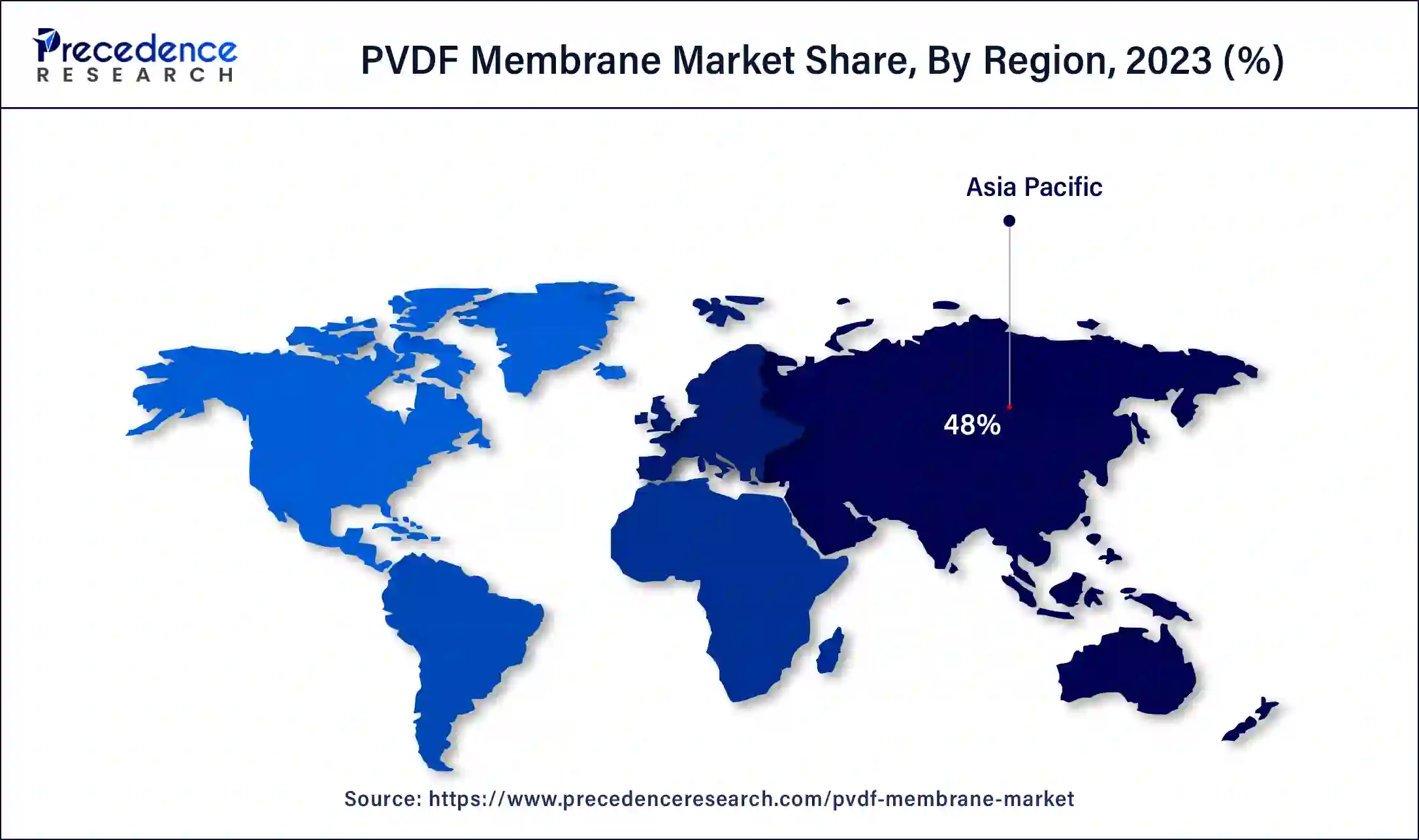

The Asia Pacific PVDF membrane market size was exhibited at USD 320.41 million in 2023 and is projected to be worth around USD 797.43 million by 2034, poised to grow at a CAGR of 8.64% from 2024 to 2034.

Asia Pacific held the largest share of the PVDF membrane market. The rising industrialization of nations like China, India, and Japan is driving PVDF membrane demand. These nations' uses for PVDF membranes include chemicals, water treatment, and pharmaceuticals. PVDF membranes are becoming more and more cost-effective as a result of ongoing research and development in membrane technology, which is also accelerating their use.

The region's fast urbanization and growing population are driving up the need for effective waste management and clean water, which in turn is driving the market. The adoption of advanced filtration technologies, such as PVDF membranes, is encouraged by government policies that support clean water and environmental sustainability. The Asia Pacific PVDF membrane market is expected to grow significantly due to industrial expansion, technological advancements, and rising environmental awareness.

North America is expected to witness the fastest growth in the PVDF membrane market over the studied period. PVDF membrane demand is fueled by the growing need for effective water and wastewater treatment solutions. These membranes are crucial for industrial and municipal water treatment facilities because of their exceptional efficacy in filtration and separation procedures. The North American biotechnology and pharmaceutical sectors are growing, which is driving up demand for high-performance filtration membranes.

PVDF membranes are becoming more robust and efficient as a result of ongoing research and development. Advancements in membrane technology are augmenting its efficacy, durability, and scope of application, hence bolstering the market expansion. The significance of employing ecologically friendly products and sustainability are topics of increasing public awareness. PVDF membranes are increasingly being chosen for environmentally friendly filtration solutions due to their longevity and capacity for recycling.

The PVDF membrane market is expanding because of its extensive use in a variety of sectors, including water treatment, biotechnology, food and beverage, and pharmaceuticals. PVDF (Polyvinylidene fluoride) membranes are renowned for their exceptional resilience to chemicals, robustness, and toughness in challenging conditions. These characteristics make them appropriate for use where dependability and high purity are required, and they are used in desalination, purification, and wastewater treatment because of their efficient contaminant removal capabilities.

PVDF membranes are becoming more and more popular in water treatment applications due to the growing demand for clean water and strict environmental restrictions. The biotechnology and pharmaceutical industries are seeing an increase in demand for the PVDF membrane market due to the growth in biopharmaceutical production and research activities. Because of their well-established water treatment infrastructure and robust biopharmaceutical industries, North America and Europe are important markets.

PVDF membranes are used in the production of dairy goods and drinks for concentration, sterilization, and clarification. Utilized in a variety of industrial settings where the filtration of gases, oils, and chemicals is necessary. Membrane fouling and cleaning problems can reduce operational effectiveness and cause a call for specialist maintenance. It is anticipated that further advancements in membrane technology will increase effectiveness, lower expenses, and broaden the range of applications. The demand for eco-friendly filtration solutions and the growing emphasis on sustainability are projected to fuel the PVDF membrane market expansion.

| Report Coverage | Details |

| Market Size by 2034 | USD 1,644.19 Million |

| Market Size in 2023 | USD 667.52 Million |

| Market Size in 2024 | USD 724.53 Million |

| Market Growth Rate from 2024 to 2034 | CAGR of 8.54% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Material, Technology, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Expansion of industrial applications

Acids, bases, and organic solvents are just a few of the many substances to which PVDF membranes exhibit exceptional resistance. Because of this, they are perfect for usage in abrasive chemical situations where other materials could break down or fail. PVDF membranes are appropriate for applications involving high temperatures because they retain their characteristics over a broad temperature range. For industrial operations that run in harsh environments, this thermal stability is crucial.

The PVDF membrane market finds extensive application in a range of filtering and separation procedures, including ultrafiltration, nanofiltration, and microfiltration. Chemical processing, food and beverage, pharmaceutical, and water and wastewater treatment are just a few of the sectors that depend on these procedures.

High production costs

In comparison to other polymers, PVDF resin, which serves as the main raw material for these membranes, is somewhat costly. PVDF resin is expensive because of the intricate chemical processes and strict quality control involved in its production. Energy is a major component of PVDF membrane manufacture. Costs are further increased by the high energy used in the production process for heating, cooling, and maintaining particular climatic conditions. Strict quality control procedures are needed to guarantee PVDF membranes' excellent performance and dependability. This involves thorough testing and inspection, which can be expensive and time-consuming. To run the sophisticated machinery and oversee the production procedures, skilled staff is needed. The high cost of production is further increased by the high wages of trained personnel. This hinders the growth of the PVDF membrane market.

Energy sector

Lithium-ion battery manufacture makes substantial use of PVDF membranes, especially as an electrode binder material. PVDF membrane demand is rising as a result of the growing need for energy storage systems and electric vehicles (EVs), which are fueling the expansion of lithium-ion batteries. PVDF membranes are used in photovoltaic (solar) modules, especially in the back sheets that shield the solar cells from the environment and offer structural support. The demand for the PVDF membrane market is rising as a result of the global expansion in solar energy installations. PVDF membranes find application in the oil and gas industry's filtration and separation procedures. They are used in a variety of upstream and downstream processes because of their chemical resistance and endurance, which make them appropriate for hostile conditions.

Outstanding fuel-cell performance at high temperatures (100–120 C), great chemical stability with minimal degradation, stable rupture energy at different humidity levels, and very stable mechanical properties from zero to 60% relative humidity at 80 C.

The hydrophilic PVDF membrane segment held the largest share of the PVDF membrane market in 2023. A substantial portion of the market for PVDF membranes is made up of hydrophilic membranes. Because of these membranes' intrinsic qualities such as their strong mechanical construction, great chemical resistance, and thermal stability they are employed extensively. Because of their minimal protein-binding characteristics, these membranes are utilized in the biopharmaceutical industry for sterile filtering, clarifying, and cell culture media filtration.

The market for hydrophilic PVDF membranes is being driven by rising environmental consciousness as well as the need for sustainable filtering solutions. In the upcoming years, the hydrophilic PVDF membrane market is anticipated to increase significantly due to advances in membrane technology, a growing need for superior filtration products, and a growing focus on ecologically friendly and sustainable practices.

The hydrophobic PVDF membrane segment is expected to grow at the fastest rate in the PVDF membrane market during the forecast period. In the PVDF membrane market, hydrophobic PVDF membranes are essential for a number of uses. These membranes are frequently utilized in filtering procedures where it is necessary to separate water or aqueous solutions from other substances because of their ability to reject water.

High chemical resistance and durability are required in a variety of industries, including biopharmaceuticals, food and beverage, water treatment, and more. Their ability to repel water guarantees effective performance when separating liquids and gasses.

The microfiltration (MF) PVDF membrane segment held the largest share of the PVDF membrane market in 2023. The market's microfiltration (MF) sector is experiencing growth owing to its superior filtration efficiency and longevity. Because of their well-known capacity to separate particles with sizes between 0.1 and 10 micrometers, MF PVDF membranes are used in a variety of processes, including food and beverage processing, pharmaceutical and biotechnological procedures, and water treatment. More expansion in the MF PVDF membrane segment of the market is anticipated due to the growing need for clean water, stricter laws governing water quality, and developments in membrane technology. Their application across several sectors is broadened by their use in both aqueous and non-aqueous conditions.

The nanofiltration (MF) PVDF membrane segment is expected to grow at the fastest rate in the PVDF membrane market during the forecast period. The capacity of PVDF membranes for nanofiltration (NF) to separate ions and molecules according to size and charge makes them important. They are especially useful in processes like food processing, medicines, and water treatment that need exact filtering and separation. Because of their outstanding chemical resistance and high flux rates, NF PVDF membranes are well-suited for a wide range of industrial and environmental applications.

The water & wastewater treatment segment held the largest share of the PVDF membrane market in 2023. PVDF membranes are found to be extensively used in the water and wastewater treatment industry. Polyvinylidene fluoride, or PVDF, membranes are highly prized for their exceptional resilience to chemicals, robustness, and capacity to function throughout a broad pH range.

These membranes are essential to desalination procedures, industrial wastewater treatment, and drinking water purification. Because of their durability, they can handle difficult water sources and different types of feedwaters with ease. Their use contributes to the achievement of high-quality treated water standards needed for various municipal and industrial applications. Removing colloids, macromolecules, and bigger molecules through filtering. Removing smaller particles, organic materials, and divalent ions.

The chemical processing segment is expected to grow at the fastest rate in the PVDF membrane market during the forecast period. PVDF membranes are usually produced by phase inversion techniques, in which the structure and porosity of the membrane are manipulated by chemical agents such as additives and solvents. The mechanical strength, surface shape, and pore size distribution of the membrane are all impacted by this process. PVDF membranes can have their surface characteristics altered chemically to improve selectivity, fouling resistance, and hydrophilicity.

Methods such as functional group coating or graft polymerization can be used to customize the membrane surface for water treatment or pharmaceutical filtering, among other uses. PVDF membrane performance requires chemical cleaning procedures to be maintained over time. For example, antimicrobial substances or nanoparticles can increase the resistance to fouling or provide catalytic qualities for particular chemical reactions.

Segment Covered in the Report

By Material

By Technology

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

October 2024

July 2024

March 2025