Smart Cooling Systems Market Size and Forecast 2025 to 2034

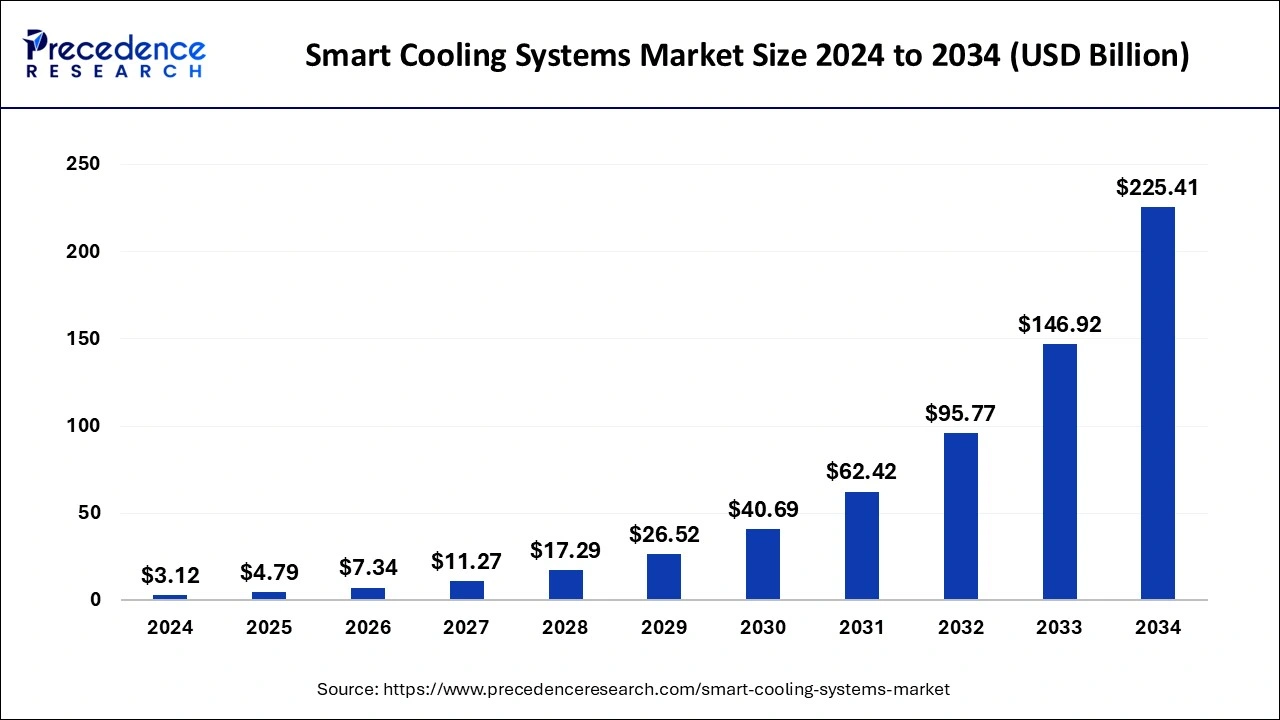

The global smart cooling systems market size was calculated at USD 3.12 billion in 2024 and is predicted to reach around USD 225.41 billion by 2034, expanding at a CAGR of 53.42% from 2025 to 2034. The market growth is attributed to the increasing demand for energy-efficient and sustainable cooling solutions across residential, commercial, and industrial sectors.

Smart Cooling Systems Market Key Takeaways

- North America dominated the smart cooling systems market in 2024.

- Asia Pacific is projected to grow at the fastest CAGR during the coming years.

- By type, the smart split ACs segment held a dominant presence in 2024.

- By type, the smart chillers segment is expected to grow at the fastest rate in the market during the forecast period.

- By application, the residential segment accounted for a considerable share in 2024.

- By application, the commercial segment is anticipated to grow with the highest CAGR during the years studied.

Impact of Artificial Intelligence (AI) on the Smart Cooling Systems Market

Organizations use artificial intelligence (AI) to control the smart cooling systems market products, and it has the added benefit of lowering costs. AI for predictive maintenance avoids possible failures, therefore allowing for a seamless system run. Using real-time data, cooling output is adjusted to the current demand through artificial intelligence, thus increasing sustainability. AI systems work perfectly as part of the Internet of Things (IoT) devices, as this empowers distant command and surveillance, which in turn enhances the psychological preference of clients. Moreover, AI modifies conventional cooling concepts and contributes to worldwide environmental conservation efforts through enhanced energy efficiency.

Market Overview

An increase in the global energy crisis and growing concern for energy-efficient and sustainable smart cooling systems are also set to propel the growth of the smart cooling systems market. Bureaucracies in various countries are shifting their focus to energy conservation and the promotion of efficient energy utilization in different segments. The U.S. Department of Energy, for instance, has set ambitious energy-saving targets, with projections that implementing more efficient cooling technologies could reduce U.S. building sector energy consumption by up to 30% by 2030.

There is an emerging trend of incorporation of efficiencies such as smart technologies, such as artificial intelligence, sensors, and even machine learning that help in the smart cooling systems market, decrease operation costs, and even increase sustainability. Furthermore, smart cooling systems utilizing artificial intelligence for optimal airflow in data centers are proving to decrease energy usage significantly.

Smart Cooling Systems Market Growth Factors

- Rising consumer demand for energy-efficient and eco-friendly cooling systems.

- Increased government regulations mandating energy-saving solutions across industries.

- Growing urbanization and the construction of energy-efficient buildings.

- Technological advancements in artificial intelligence and machine learning for optimized cooling.

- Increasing need for cooling solutions in high-tech sectors, such as data centers and cloud computing.

- Expanding smart home adoption, integrating cooling systems into automated environments.

- Heightened awareness of climate change, prompting businesses and consumers to adopt smart cooling systems market solutions.

Market Scope

| Report Coverage | Details |

| Market Size by 2024 | USD 3.12 Billion |

| Market Size in 2025 | USD 4.79 Billion |

| Market Size in 2034 | USD 225.41 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 53.42% |

| Leading Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Application, and Regions |

| Regions Covered | Covered North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Energy efficiency

Increasing focus on energy efficiency is expected to drive the smart cooling systems market growth as industries and governments strive to reduce environmental impact and operational costs. State-of-the-art cooling techniques help to minimize the consumption of electricity at peak hours and slow down the stress on the electric supply network. This sets the stage for industries to implement integrated smart cooling systems. Additionally, the increase in the regulatory mandate for energy-wake-effective cooling solutions promotes the growth of innovative cooling systems in different industries.

- According to the IEA report, global electricity demand is projected to grow at an accelerated pace over the next three years, increasing by an average of 3.4% annually through 2026, highlighting its growing significance worldwide.

- Deep-learning solutions for cooling data center facilities reduced energy consumption by 40% in 2023, according to the World Economic Forum.

- The revised 2023 directive increases the EU's energy efficiency target, requiring EU countries to collectively achieve an additional 11.7% reduction in energy consumption by 2030.

Restraint

High initial costs

Hamper adoption is due to high initial costs, which are expected to deter potential buyers in the smart cooling systems market. The consideration of IoT sensors, AI, and machine learning clearly boosts the preliminary costs of smart cooling systems compared to conventional combinations. Companies in a rather compromised financial situation or SMEs rarely invest in such systems due to the lack of capital. Installation of solar panels also needs highly skilled personnel to carry out, which also increases the costs, hence making it hard to penetrate the market. The latter is a long-term benefit that, in the end, provides cost savings in maintenance; however, the primary obstacle remains a high initial cost.

Opportunity

Surging data center investments propel smart cooling innovations

The proliferation of cloud computing, edge computing, and AI-driven services is driving the construction of energy-intensive data facilities, which further creates growing opportunities for the smart cooling systems market. Smart cooling systems make sure these infrastructures work within the right temperatures so that they don't overheat and cause malfunctions. Contemporary cooling layouts, including liquid immersion and AI-managed airflow systems, address the current needs of hyperscale computing centers, which today consume more power than conventional facilities. Furthermore, with the increased investment from major players, including Amazon, Google, Microsoft, Equinix, and other colocation providers, there are significant opportunities to provide new-generation cooling solutions to this segment.

- According to the IEA, the demand for digital services is growing rapidly. Since 2010, the number of internet users worldwide has more than doubled, and global internet traffic has surged by 25 times.

- According to the U.S. Department of Energy (DOE), data centres consumed about 2% of total electricity in the United States in 2023, which emphasizes the significance of cooling systems.

Type Insights

The smart split ACs segment held a dominant presence in the smart cooling systems market in 2024 due to its great use in residential and commercial markets. Smart split ACs are meant to provide effective cooling with energy-saving and additional options, including remote control, Wi-Fi connection, and compatibility with voice assistants, such as Alexa and Google. Furthermore, the standard of energy consumption, like energy conservation in countries including India and United States, has enforced the implementation of these systems in new constructions and in refurbishing buildings.

The smart chillers segment is expected to grow at the fastest rate in the smart cooling systems market during the forecast period of 2025 to 2034. Smart chillers are utilized for their attributes, such as accuracy in specifying the temperature and energy usage management system based on real-time monitoring and artificial intelligence. Especially with the development of artificial intelligence, the cloud service industry gradually gets a higher demand for cooling as industrialization enhances, and smart chillers are expected to have a strong demand.

- According to a report by CBRE, cumulative investment commitments in Indian data centers are expected to exceed USD 100 billion by the end of 2027, with a significant portion of this investment directed towards advancements in cooling solutions, including smart chillers.

Application Insights

The residential segment accounted for a considerable share of the smart cooling systems market in 2024, as buyers have begun to accept the need for more efficient and comfortable cooling systems within their homes. Wireless active air conditioning systems, and cooling systems that are regulated with a smartphone or other remote device. Connect with and be operated in coordination with other smart home devices, and are more energy efficient, which have received a lot of attention. Furthermore, there is an increased population in urban areas and increased awareness of energy-efficient products.

- According to the Department of Economic and Social Affairs, 55% of the world's population currently lives in urban areas, and this proportion is projected to rise to 68% by 2050.

The commercial segment is anticipated to grow with the highest CAGR in the smart cooling systems market during the studied years, owing to the need for organizations to cut energy usage in their operations to minimize rising concerns with global warming. Commercial structures ' ventilation and air conditioning systems, such as offices, malls, and hotels, may opt for smart cooling systems to minimize energy consumption and, thus, the general costs of running the structures. The exponential progression of smart building units that incorporate heating, ventilation, air conditioning, and lighting control along with other BMS on a single network is predicted to boost the demand for efficient cooling solutions.

Regional Insights

North America dominated the smart cooling systems market in 2024, capturing the largest revenue share in 2023 due to technological innovation and enhanced legislation in energy conservation and management. The U.S. and Canada are the most advanced in adopting innovative cooling solutions with the existing developed infrastructure of smart homes and businesses. Increased focus on carbon emissions and energy efficiency within the region further facilitates demand for smart cooling systems in both the residential and commercial sectors.

- The U.S. DOE was funding over USD 500 million in efficiency programs in 2025, specifically in the area of cooling.

Asia Pacific is projected to host the fastest-growing smart cooling systems market in the coming years, owing to the increasing urbanization, industrialization, and rising middle-income population. According to a report by the World Economic Forum, by 2030, two-thirds of the world's middle-class population will be in Asia. Counties, including China, India, and Japan, recorded a steady development in the construction of apartment, business, and industrial structures, hence increasing the need for air conditioning systems.

Emphasizing the importance of environmental problems and energy usage has led to the investment in better technology in the Asia Pacific smart cooling systems market. Furthermore, favorable government policies and supportive legislation make the region an essential segment of smart cooling solutions.

Smart Cooling Systems Market Companies

- Voltas Ltd

- Daikin Industries Ltd

- Fujitsu General Ltd

- Videocon Industries Ltd

- Samsung Electronics Co. Ltd

- Mitsubishi Electric Corporation

- Electrolux AB

- LG Electronics Ltd

- Friedrich Air Conditioning Co. Ltd

- Blue Star Ltd

Latest Announcements by Industry Leaders

- December 18, 2024 – Ventiva

- CEO – Carl Schlachte

- Announcement - Ventiva, a leader in thermal solutions, today announced that its ICE9 thermal management suite can now cool laptops with a Thermal Design Power (TDP) of up to 40 watts. This breakthrough allows for thinner, faster, and completely silent computing devices without the limitations of traditional fan-based cooling systems. The ICE9 solution is capable of cooling the powerful CPUs required for the next generation of feature-rich, AI-enabled, high-performance laptops. “Our ICE technology is transforming the electronics market by enabling a new wave of silent, intelligent heat-transferring thermal management solutions,” said Carl Schlachte, Chairman, President, and CEO of Ventiva. “Originally demonstrated in the ‘thin and light' laptop category at around 15W TDP, the ICE9 device now allows laptop manufacturers to extend these benefits to higher-performance systems, paving the way for the launch of entire product families of silent computing products.”

Recent Developments

- In May 2023, Delta T Systems, a leading provider of innovative process cooling solutions, announced the launch of its latest product, the Free Cooling System (also known as a fluid cooler or dry cooler). This high-performance system is designed to provide energy-efficient cooling for a wide range of industrial and commercial applications.

- In October 2024, Tata Power Trading Company Limited, a wholly owned subsidiary of Tata Power, one of India's largest integrated power companies, and Keppel, a Singapore-headquartered global asset manager and operator with expertise in sustainability-related solutions, entered into a collaboration to launch sustainable Cooling-as-a-Service (CaaS) solutions in India.

- In October 2024, Hewlett Packard Enterprise (NYSE: HPE) unveiled the industry's first 100% fanless direct liquid cooling systems architecture aimed at improving energy and cost efficiency for large-scale AI deployments. The company introduced this innovation at its AI Day, showcasing its leadership in AI solutions for enterprises, sovereign governments, service providers, and model builders.

Segments Covered in the Report

By Type

- Smart Split ACS

- Smart Chillers

- Smart AHU

- Smart Windows ACS

By Application

- Residential

- Commercial

- Industrial

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting