April 2025

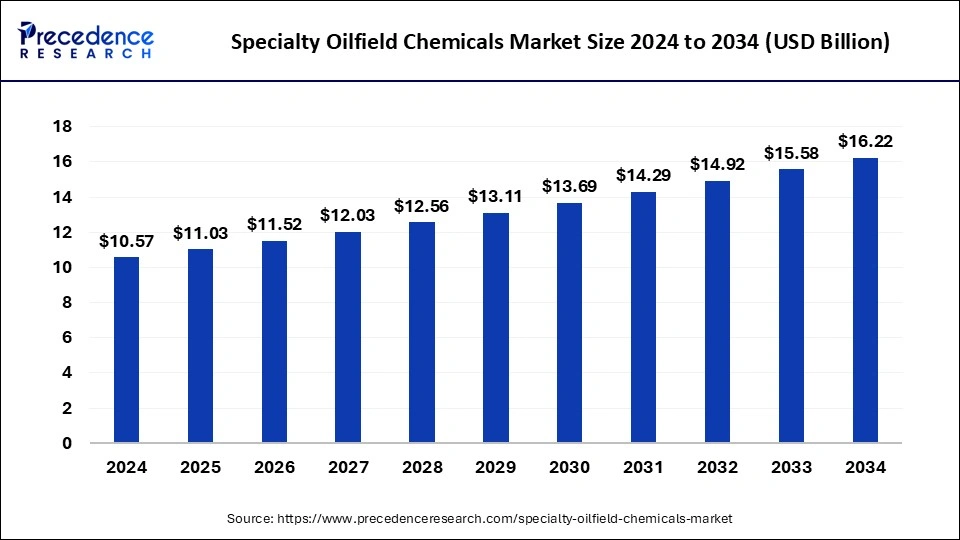

The global specialty oilfield chemicals market size is calculated at USD 11.03 billion in 2025 and is forecasted to reach around USD 16.22 billion by 2034, accelerating at a CAGR of 4.38% from 2025 to 2034. The North America specialty oilfield chemicals market size surpassed USD 4.44 billion in 2024 and is expanding at a CAGR of 4.41% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global specialty oilfield chemicals market size was estimated at USD 10.57 billion in 2024 and is predicted to increase from USD 11.03 billion in 2025 to approximately USD 16.22 billion by 2034, expanding at a CAGR of 4.38% from 2025 to 2034. The growth of the specialty oilfield chemicals market is attributed to the increasing crude oil production, coupled with growing demand from the enhanced oil recovery application.

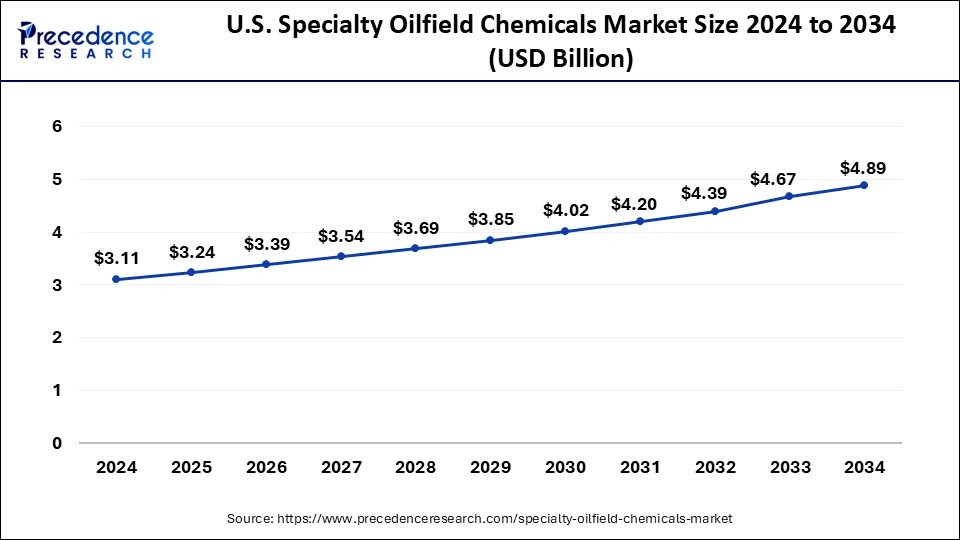

The U.S. specialty oilfield chemicals market size was exhibited at USD 3.11 billion in 2024 and is projected to be worth around USD 4.89 billion by 2034, poised to grow at a CAGR of 4.63% from 2025 to 2034.

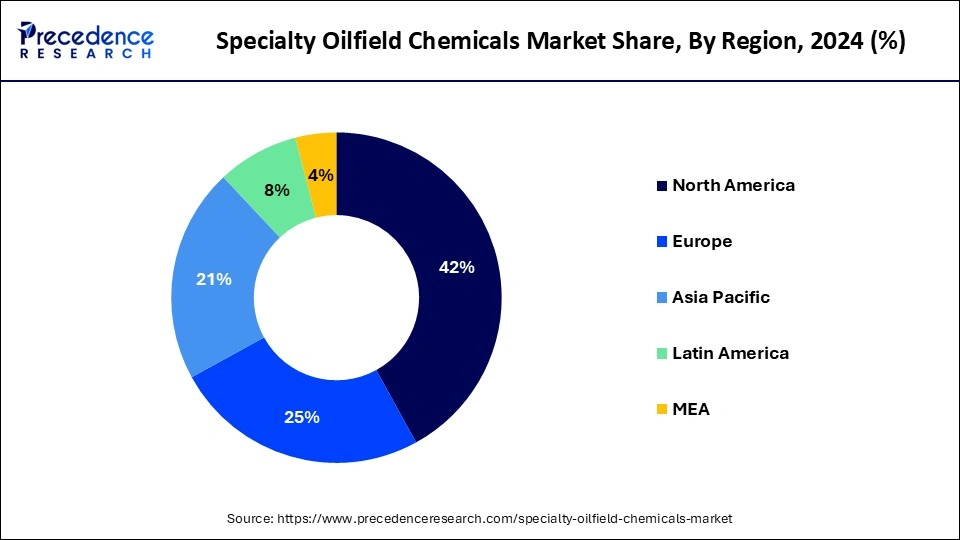

North America dominated the specialty oilfield chemicals market in 2024. The increase in oil and gas operations, driven by advancements in hydraulic fracturing and drilling processes, is boosting regional growth. Technological innovations and a rise in drilling activities are expected to further enhance this growth during the forecast period. The expanding exploration and production of shale gas in the U.S. are anticipated to increase the demand for oil-based chemicals. As the U.S. produces more crude oil to meet the rising demand for petroleum, LPG, and diesel, the region's well-established and mature industry benefits from its extensive use in workover, completion, and production activities.

Asia Pacific is expected to host the fastest-growing specialty oilfield chemicals market during the forecast period. The region's industry expansion is driven by growing urbanization, a rising population, and increased shale gas demand across various sectors. Additionally, the technological advancements in environmental-friendly products and solutions will further expand the future growth of the specialty oilfield chemicals market. The regional market's growth is primarily due to heightened exploration and development activities in Southeast Asian countries, India, Mainland China, and the South China Sea. This growth is further supported by the rising global demand for petroleum and crude oil, along with significant economic investments in the energy sector.

Specialty oilfield chemicals refer to a diverse group of substances specifically designed for use in various oil and gas exploration and production processes. These chemicals serve multiple purposes, including mitigating environmental impacts, improving production efficiency, increasing oil recovery, and ensuring the integrity and reliability of oilfield equipment and infrastructure.

The specialty oilfield chemicals market can be categorized based on their functions and applications. Common types include biocides, friction reducers, surfactants, corrosion inhibitors, scale inhibitors, demulsifiers, and drilling fluids. The wider use of fracking has significantly propelled oil and gas production, reshaping the energy landscape and unlocking vast reserves previously deemed economically unviable.

| Report Coverage | Details |

| Market Size by 2034 | USD 16.22 Billion |

| Market Size in 2025 | USD 11.03 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 4.38% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising use of eco-friendly oilfield chemicals

Rapid growth and investment by global and regional oilfield service companies will increase oilfield service activities and the demand for the specialty oilfield chemicals market. In addition to this, the discovery of new oil and gas resources in various locations and the increase in shale gas and enhanced oil recovery activities are expected to boost growth prospects. Chemicals with reduced flammability, lower bioaccumulation, more excellent biodegradability, and sustainability in production are examples of green solutions in the oil fields.

Regulatory barriers

The specialty oilfield chemicals market can significantly impact the environment, and various regulations are in place to restrict their use, which can limit market growth and profitability. Additionally, specialty oilfield chemicals are expensive, and their high cost can hinder adoption in some markets, further impacting growth and profitability. Manufacturers of these chemicals may face challenges in complying with stringent safety regulations and environmental laws. New or amended regulations may restrict the types of chemicals allowed in oilfield operations and increase compliance costs.

Petrochemicals to increase global oil demand

Plastics such as polyethylene, polypropylene, and polystyrene account for a significant portion of global petrochemical production. Over the past few decades, these plastics have become more popular in key end-use industries like food and commercial packaging, a trend that is expected to continue, particularly in developing regions like Asia Pacific and Latin America.

During the forecast period, petrochemicals are expected to dominate oil consumption due to increasing demand. The rising purchasing power and standard of living in emerging economies will further boost the demand for petrochemicals, contributing to the growth of the specialty oilfield chemicals market. The low weight and long shelf life of plastics help reduce food waste and fuel consumption, providing immediate economic benefits and aiding resource optimization, which is crucial for emerging economies. Oil-producing nations are building petrochemical complexes to take advantage of inexpensive raw materials.

The production segment dominated the specialty oilfield chemicals market in 2024. The crucial role of specialty oilfield chemicals lies in enhancing the efficiency and lifespan of oilfield operations, fixing smooth oil transportation, and preserving wellbores. These chemicals are precisely formulated to meet the specific requirements of each oilfield, with compositions that may vary over time and according to operational conditions. Their applications range from facilitating oil transportation to preventing corrosion in pipelines by highlighting their significant role in the production process.

The oil recovery segment is expected to grow in the specialty oilfield chemicals market during the forecast period. These chemicals are specially formulated to tackle specific challenges in oil recovery, including reservoir heterogeneity, fluid displacement, and formation damage. Specialty oilfield chemicals play a crucial role in enhancing oil recovery processes, optimizing production efficiency, and increasing yields in the oil and gas industry.

The inhibitors segment was the dominant force in the specialty oilfield chemicals market in 2024. This was because of their crucial role in slowing down specific chemical reactions. For instance, corrosion inhibitors protect metal surfaces such as pipelines and storage tanks from the damaging effects of corrosive substances found in oilfield fluids. These inhibitors are able to tackle various challenges, including corrosion, scale formation, and maintaining fluid stability. By creating a protective layer on these surfaces, they effectively reduce corrosion and ensure the durability and efficiency of the equipment.

The surfactant segment is expected to grow rapidly in the specialty oilfield chemicals market over the projected period. The addition of surfactants can reduce the interfacial tension between oil and water, promote emulsification, decrease the solubility of oil in water, increase the rock absorption of crude oil, and reduce crude oil viscosity. They are crucial in optimizing treatment fluid recovery, preventing downhole emulsions, and improving both initial production (IP) rates and long-term production after fracturing.

By Product

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

November 2024

January 2025

November 2024