January 2025

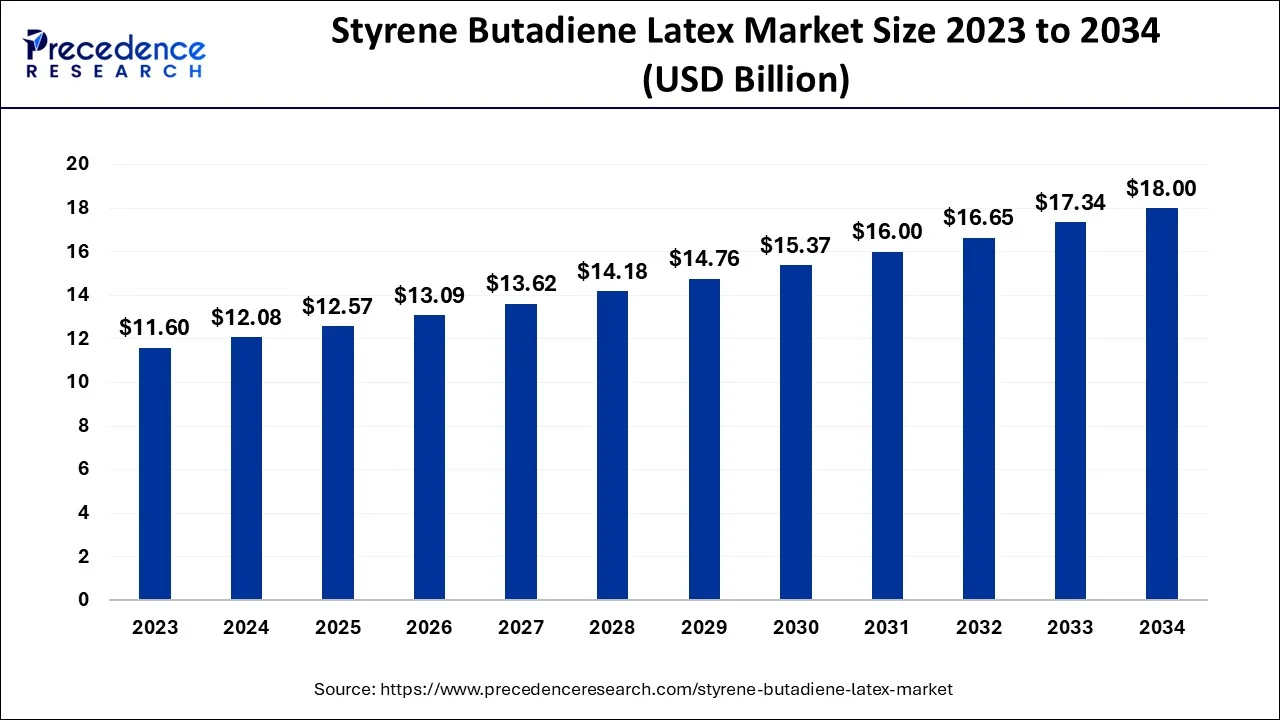

The global styrene butadiene latex market size was USD 11.60 billion in 2023, estimated at USD 12.08 billion in 2024 and is anticipated to reach around USD 18 billion by 2034, expanding at a CAGR of 4.07% from 2024 to 2034.

The global styrene butadiene latex market size is calculated at USD 12.08 billion in 2024 and is predicted to reach around USD 18 billion by 2034, growing at a CAGR of 4.07% from 2024 to 2034.

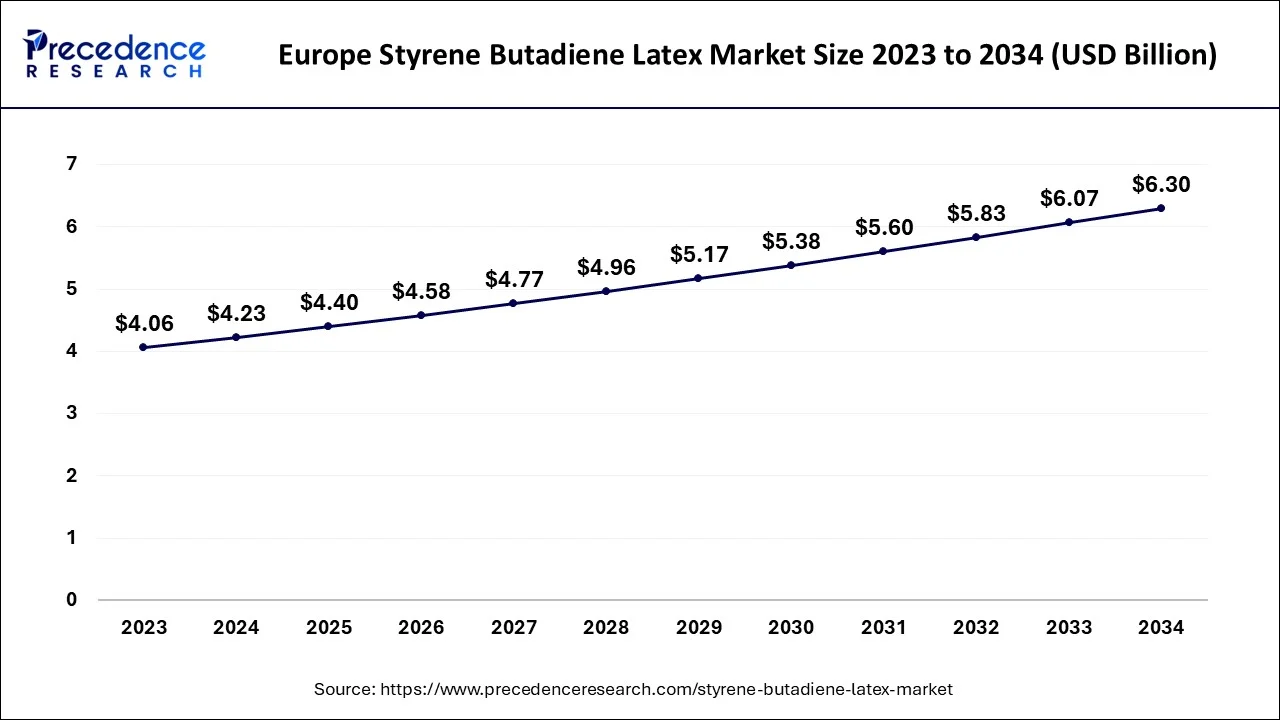

The Europe styrene butadiene latex market size was valued at USD 4.06 billion in 2023 and is expected to be worth around USD 6.30 billion by 2034, rising at a CAGR of 4.30% from 2024 to 2034.

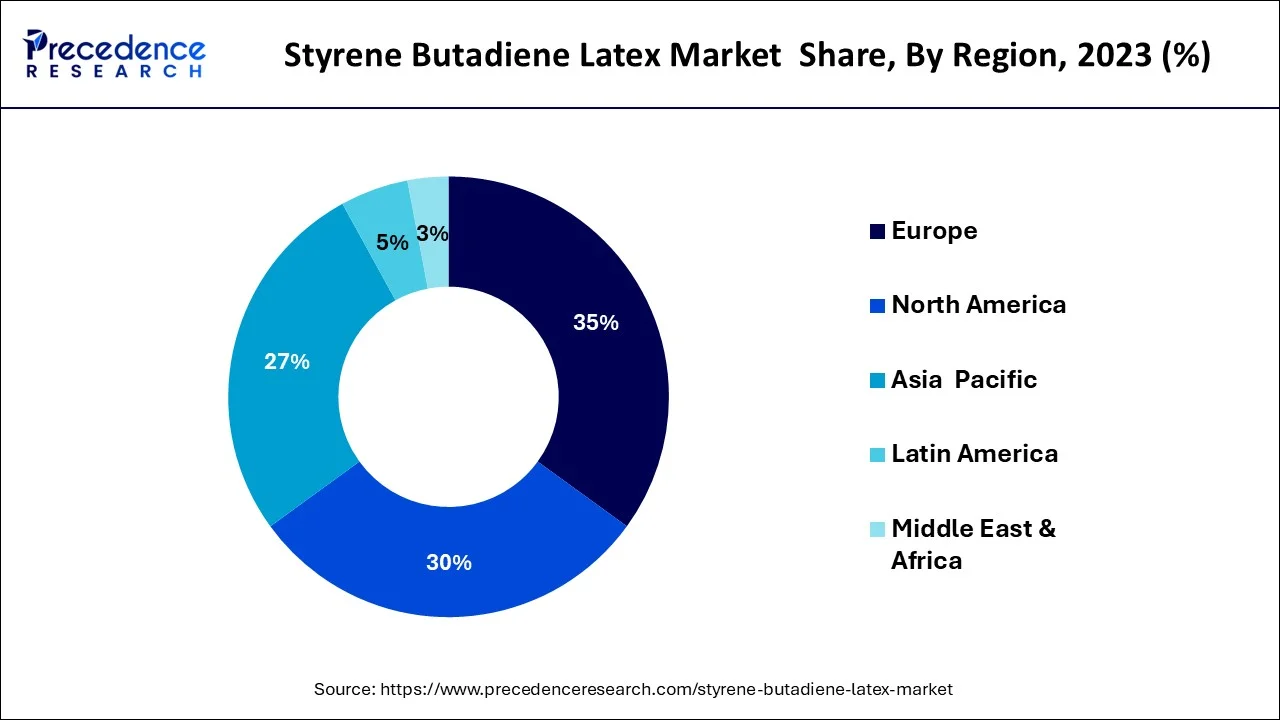

Europe has held the largest revenue share 35% in 2023. Europe holds a major share in the styrene butadiene latex market due to robust demand across diverse industries and a well-established infrastructure. The region's emphasis on sustainable construction and stringent environmental regulations favors the adoption of SBL, known for its eco-friendly characteristics. Additionally, the thriving automotive and textile sectors contribute to the substantial market share, with European industries valuing SBL for its versatility in applications such as adhesives, coatings, and sealants, thereby driving the sustained prominence of SBL in the European market.

North America is estimated to observe the fastest expansion. North America holds a major growth in the styrene butadiene latex market due to robust demand across diverse industries. The region's thriving construction sector, coupled with a well-established automotive and textiles industry, drives significant utilization of SBL in applications such as adhesives, coatings, and carpet backing.

Moreover, stringent environmental regulations promoting water-based and low-VOC materials further contribute to the dominance of SBL in North America, reflecting a preference for sustainable and eco-friendly solutions in the market.

Styrene butadiene latex (SBL) is a synthetic polymer emulsion that combines the strength of styrene with the flexibility of butadiene. This unique blend results in a versatile latex with excellent adhesion, abrasion resistance, and water resistance. SBL is widely utilized in the production of coatings, adhesives, sealants, and paints owing to its ability to create durable and elastic films on surfaces.

Its application extends to paper coatings, where it improves print quality and enhances paper strength. SBL is also a popular choice for carpet backings, providing stability and durability to the end product. Its cost-effectiveness and wide range of uses make styrene butadiene latex an essential component in various industries, contributing to the creation of high-performance materials in diverse sectors.

| Report Coverage | Details |

| Market Size in 2023 | USD 11.30 Billion |

| Market Size in 2024 | USD 12.08 Billion |

| Market Size by 2034 | USD 18 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 4.07% |

| Largest Market | Europe |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Application, Butadiene Content, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Construction boom and green building trends

The construction boom and green building trends synergistically propel the demand for styrene butadiene latex (SBL) in the market. As the construction industry experiences robust growth globally, SBL finds extensive use in various construction materials such as adhesives, sealants, and coatings. Its unique properties contribute to the durability and resilience of these materials, meeting the stringent requirements of modern construction projects.

Simultaneously, the emphasis on green building practices aligns perfectly with SBL's environmentally friendly characteristics. Green building trends prioritize sustainable and eco-friendly construction materials, and SBL, being water-based and having a lower environmental impact, emerges as a preferred choice. As architects and developers increasingly prioritize sustainability in construction projects, the demand for SBL is on the rise, reflecting a harmonious relationship between the construction boom and the growing preference for environmentally conscious building solutions.

Competition from alternatives

Competition from alternative products serves as a significant restraint on the growth of the styrene butadiene latex market. Various latex alternatives, including acrylic, vinyl, and polyurethane-based formulations, offer competing properties and may be preferred by industries based on factors such as cost-effectiveness, performance attributes, or environmental considerations. Customers seeking specific characteristics, such as enhanced durability or reduced environmental impact, may opt for alternatives that align more closely with their requirements.

Moreover, advancements in technology continually introduce new formulations and materials that challenge the market position of SBL. As industries become increasingly focused on sustainability and eco-friendly solutions, alternatives that boast superior environmental profiles may gain traction, posing a threat to SBL's market share. To address this challenge, SBL manufacturers must emphasize innovation, efficiency, and differentiation to maintain their competitive edge in an evolving landscape of latex-based products.

Infrastructure development in emerging markets

Infrastructure development in emerging markets is a key catalyst for creating opportunities in the styrene butadiene latex market. As these markets experience rapid urbanization and industrialization, there is a growing demand for construction materials, including adhesives, coatings, and sealants, where SBL finds versatile applications. The expansion of transportation networks, residential complexes, and commercial spaces in emerging economies provides a substantial platform for the use of SBL in various construction projects.

Additionally, the development of infrastructure-related industries, such as manufacturing and automotive, further amplifies the demand for SBL in adhesives and sealants. By tapping into these opportunities, SBL manufacturers can establish a strong foothold in emerging markets, contributing to both the economic development of these regions and the global growth of the styrene butadiene latex market.

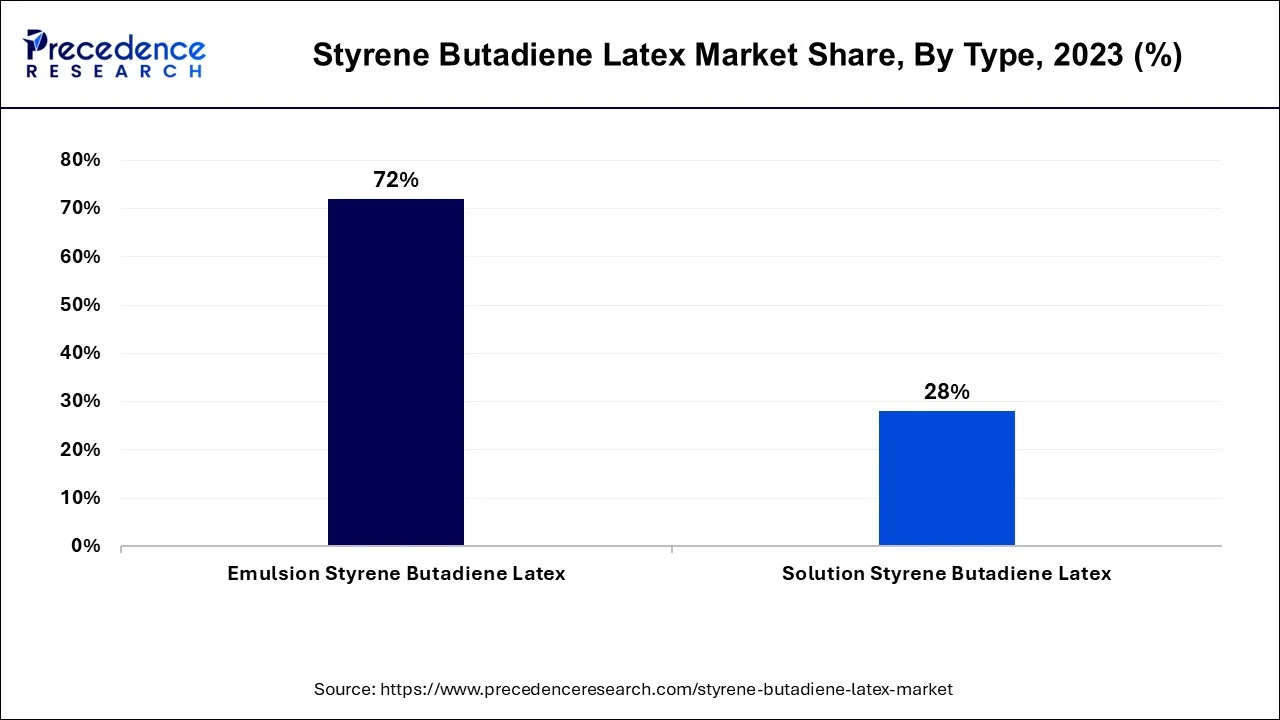

In 2023, the emulsion styrene butadiene latex segment had the highest market share of 72% based on the type. Emulsion styrene butadiene latex (ESBL) is a type within the styrene butadiene latex market, characterized by its polymer emulsion formulation of styrene and butadiene. ESBL offers enhanced stability, excellent adhesion, and versatility, making it a preferred choice in applications like paints, coatings, adhesives, and paper coatings.

A notable trend in the ESBL segment includes the increasing demand for environmentally friendly water-based coatings, aligning with the broader market shift towards sustainable solutions, particularly in the construction and packaging industries. This trend underscores the prominence of ESBL in meeting both performance and eco-conscious criteria.

The solution styrene butadiene latex segment is anticipated to expand at a significant CAGR of 5.9% during the projected period. Solution styrene butadiene latex (S-SBL) is a type within the styrene butadiene latex market characterized by a homogeneous liquid state. This form offers advantages such as improved stability, higher solids content, and better film-forming properties compared to its counterparts.

In recent trends, there is a noticeable increase in the demand for solution styrene butadiene latex, driven by its application versatility in paints, coatings, adhesives, and sealants. The market trend reflects a preference for S-SBL due to its superior performance characteristics in various end-use industries.

According to the application, the paper processing segment has held a 28% revenue share in 2023. The paper processing segment in the styrene butadiene latex market involves the application of SBL in coatings for paper products. SBL is utilized to enhance print quality, improve paper strength, and provide water resistance to paper coatings. A notable trend in this segment is the increasing demand for eco-friendly and sustainable paper solutions. As environmental concerns rise, SBL's water-based nature and lower environmental impact make it an attractive choice, aligning with the growing preference for greener alternatives in the paper processing industry.

The mortar additives segment is anticipated to expand fastest over the projected period. In the styrene butadiene latex market, the mortar additives segment involves the incorporation of SBL into mortar formulations to enhance performance. This application enhances mortar's adhesive properties, flexibility, and durability. A notable trend in this segment is the increasing demand for SBL-based mortar additives in the construction industry, driven by the pursuit of high-performance building materials. The trend reflects a shift towards more advanced and reliable mortar formulations, addressing the evolving needs of the construction sector for improved adhesion and flexibility in various building applications.

According to the butadiene content, the low segment has held a 38% revenue share in 2023. In the styrene butadiene latex market, the low butadiene content segment refers to formulations with a lower proportion of butadiene relative to styrene. This segment is characterized by improved hardness and abrasion resistance, making it suitable for applications requiring enhanced durability, such as carpet backing and paper coatings. The trend in this segment involves a growing demand for cost-effective solutions without compromising on performance, driving manufacturers to develop SBL formulations with optimized butadiene content to meet the specific needs of industries seeking durable and resilient materials.

The high segment is anticipated to expand fastest over the projected period. In the styrene butadiene latex market, the high segment is defined by latex formulations with elevated butadiene content. This segment is characterized by increased flexibility and resilience, making it suitable for applications demanding superior durability. Trends in this high butadiene content segment involve a growing demand for specialty coatings, adhesives, and sealants in industries like automotive and construction. As end-users seek enhanced performance and versatility, the high butadiene content in SBL formulations continues to drive innovation, aligning with evolving market preferences for robust and flexible materials.

Segments Covered in the Report

By Type

By Application

By Butadiene Content

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

July 2024

October 2024

December 2023