September 2024

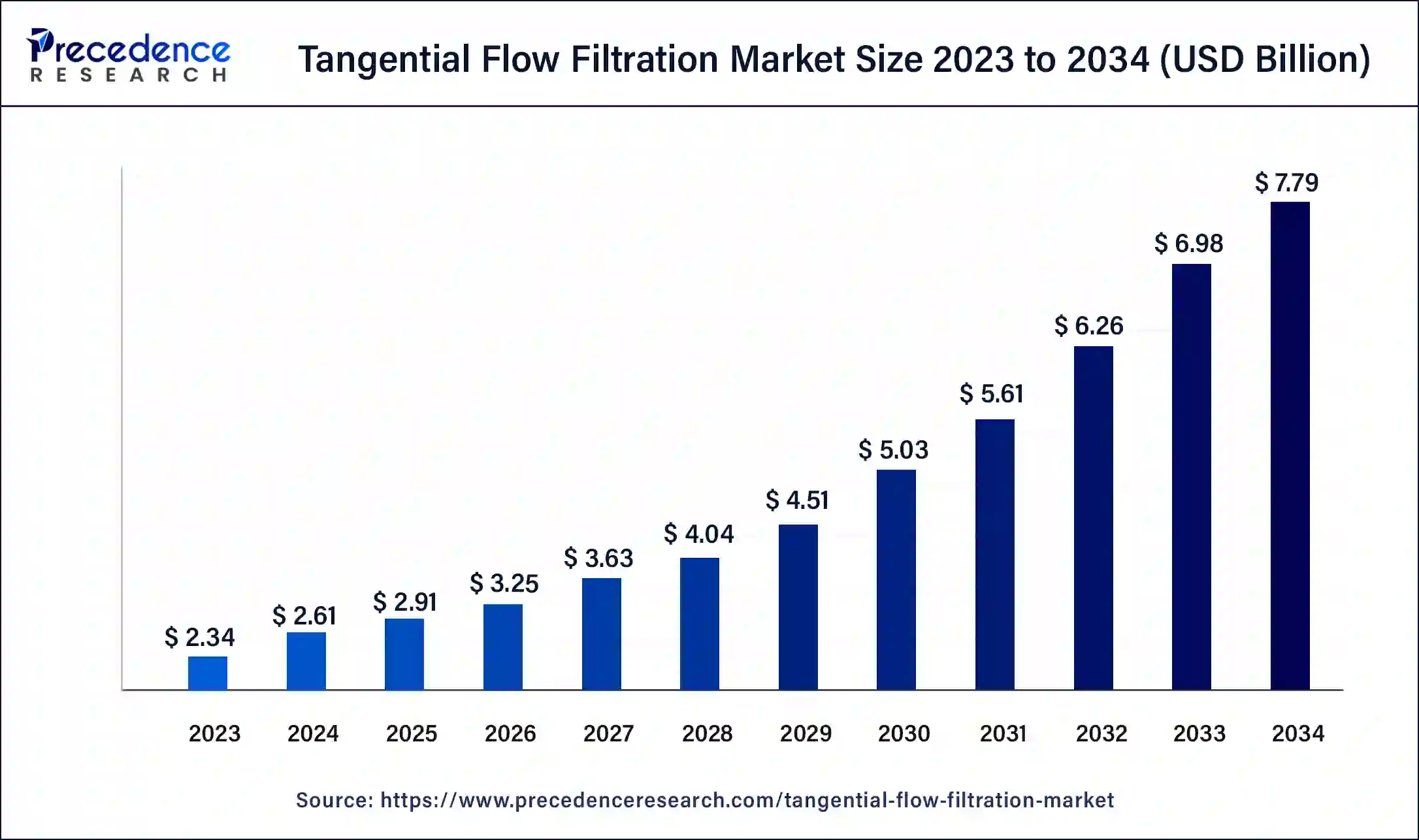

The global tangential flow filtration market is worth around USD 2.61 billion in 2024 and is expected to reach around USD 7.79 billion by 2034, representing a healthy CAGR of 11.54% during the forecast period from 2024 to 2034.

The global tangential flow filtration market size is worth around USD 4.53 billion in 2024 and is anticipated to reach around USD 7.33 billion by 2034, growing at a solid CAGR of 4.92% over the forecast period 2024 to 2034. The North America tangential flow filtration market size reached USD 960 million in 2023. The shift towards personalized medicine and complex biologic therapies has fueled investments in TFF technologies and is projected to accelerate the growth of the tangential flow filtration market during the forecast period.

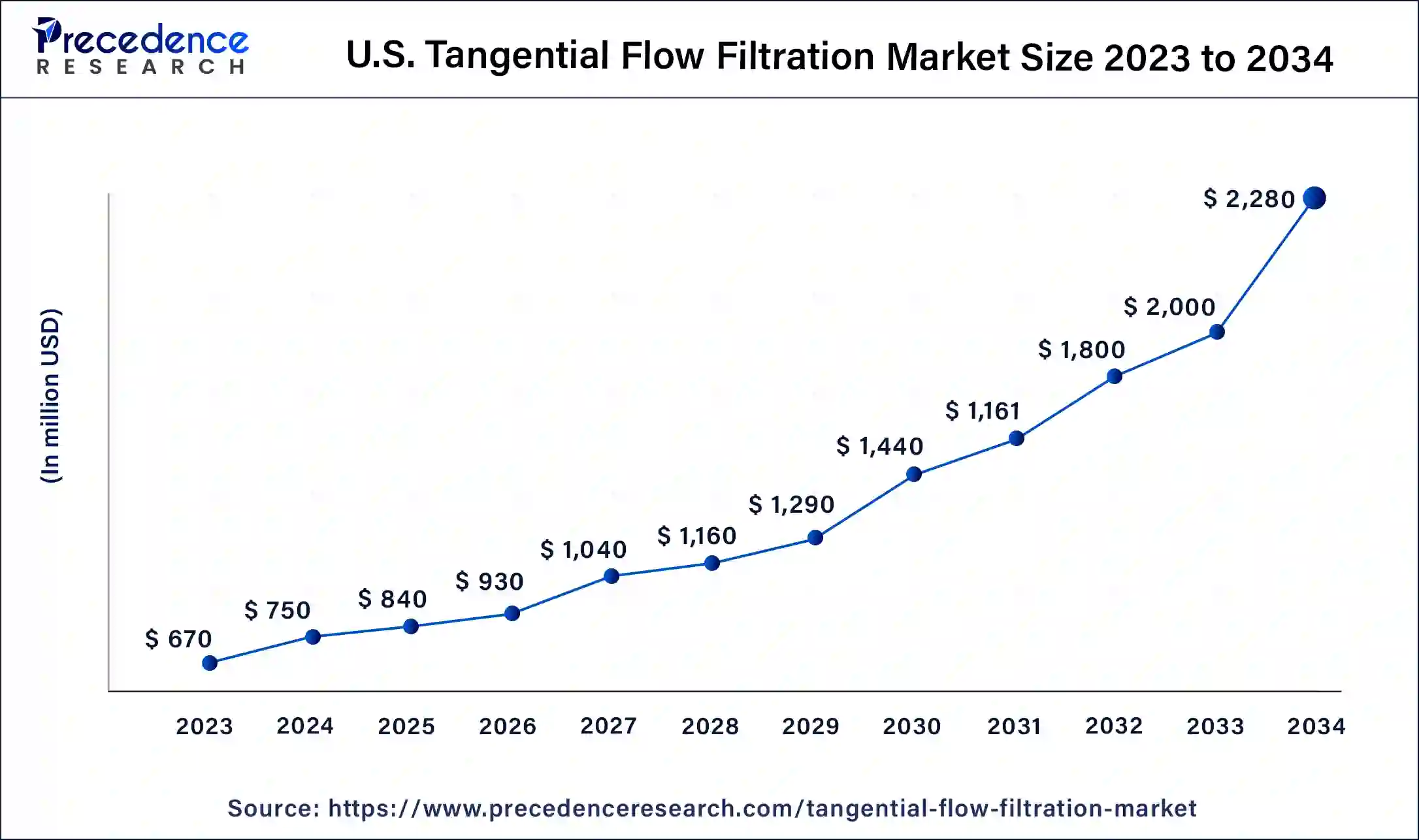

The U.S. tangential flow filtration market size was exhibited at USD 670 million in 2023 and is projected to be worth around USD 2,280 million by 2034, poised to grow at a CAGR of 11.77% from 2024 to 2034.

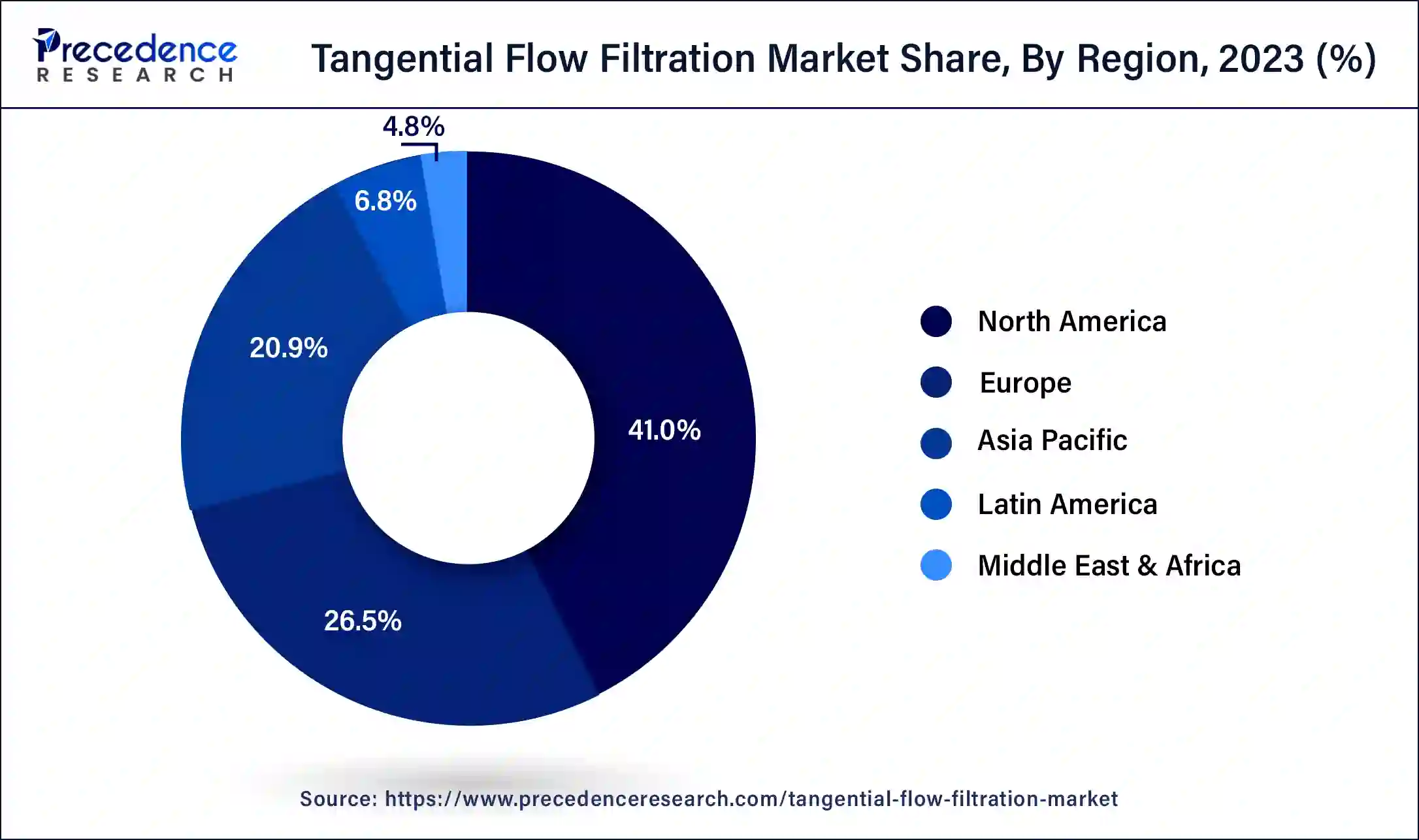

North America held the dominant share of the tangential flow filtration market in 2023 and is expected to witness prolific growth during the forecast period. The region is expected to witness significant growth during the forecast period owing to its well-established healthcare infrastructure, strong presence of TFF product manufacturers, increasing popularity of gene therapy, favorable government policies, rising focus on developing biosimilars and personalized medicine, increasing adoption of single-use TFF systems, and rising prevalence of chronic diseases and genetic disorders.

North America's extensive research and development activities in biopharmaceuticals, strong commitment to innovation, and rising adoption of advanced filtration technologies are anticipated to drive the market’s growth. The United States is the major contributor to the market due to the presence of advanced biopharmaceutical production capabilities, increasing demand for innovative filtration technologies, and increasing demand for medical treatments and therapies. Furthermore, the rapid expansion of bioprocessing facilities fulfills the demand for biotherapeutics.

Asia Pacific is observed to expand notably in the tangential flow filtration market during the forecast period. The region’s growth is driven by the substantial investment in the healthcare sector, rising demand for biologics and drugs, increasing incidences of chronic diseases, supportive Government framework, rising demand for biologics and drugs, increasing focus on the innovation of new treatments, and growing demand for low-cost therapeutics.

Rising investments from foreign and domestic companies and increasing CMOs in emerging economies such as Japan, China, India, and South Korea are expected to accelerate the growth of the tangential flow filtration market in the Asia Pacific region. China has a strong presence in the bioprocessing industry and is gaining significant momentum through rapid investments in the life sciences and biopharmaceuticals sectors.

Tangential flow filtration (TFF) is also popularly known as crossflow filtration. TFF has increasingly gained prominence in bioprocessing. It plays a crucial role in applications such as protein purification, virus filtration, and other downstream processing tasks. TFF is a rapid, cost-effective, and efficient method for separating and purifying biomolecules by utilizing ultrafiltration membranes.

Tangential flow filtration is a technique that is most widely utilized for separating and purifying proteins and other biological molecules from mixtures such as cell culture media or lysates. Tangential flow filtration enables the efficient processing of large volumes of solution while minimizing sample loss and assisting in preserving the integrity of sensitive molecules. TFF allows immunology, microbiology, and biochemistry researchers to remove impurities and assist in retaining the desired molecules.

Technological Impacts on Biopharmaceutical Filtration Process

The rising adoption of single-use technologies in the biopharmaceutical industry positively impacts the growth of the tangential flow filtration market. Single-use technology offers several benefits throughout the entire manufacturing process. It has significantly transformed biopharmaceutical manufacturing by introducing cost-effective, convenient, contamination-reducing solutions. Moreover, the rapid innovation in TFF technology, including the development of new materials, membranes, and automation systems, is enhancing the efficiency, performance, and reliability of TFF systems.

| Report Coverage | Details |

| Market Size by 2034 | USD 7.79 Billion |

| Market Size in 2024 | USD 2.61 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 11.54% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, Technology, Application, End-user, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Expansion of the biopharmaceutical industry

The rapid expansion of the biopharmaceutical industry is expected to boost the growth of the tangential flow filtration market during the forecast period. TFF plays an integral part role in applications such as virus filtration, protein purification, and other downstream processing tasks. Single-use TFF systems are increasingly gaining momentum as these systems assist in reducing the risk of cross-contamination, offering flexibility, and lowering operational costs, which makes them a preferred choice in biopharmaceutical manufacturing.

The tangential flow filtration market has witnessed an increasing demand for biopharmaceutical products, such as recombinant proteins, monoclonal antibodies, and vaccines. Tangential flow filtration (TFF) is extensively utilized in the biopharmaceutical industry for the purification and concentration of these products. Additionally, biopharmaceutical companies are highly investing in innovative filtration solutions, which are anticipated to propel the growth of the market and maintain their crucial role in the future of bioprocessing.

High initial investment

The high initial investment associated with the tangential flow filtration is anticipated to hamper the tangential flow filtration market growth. Significant capital expenditure is required to set up new production facilities. Small and medium-sized companies are discouraged from adopting TFF technology due to budget constraints. In addition, the easy availability of product substitutes is widely accepted in the market.

Increasing demand for gene therapy

The rising demand for gene therapy is expected to boost the growth of the tangential flow filtration market during the forecast period. The production of viral vectors is the most important step in gene therapy and vaccine manufacturing. Tangential flow filtration is an integral technology widely used in the downstream processing of viral vectors. The use of the right technologies ensures an efficient, optimized, and predictable process.

The microfiltration segment led the global tangential flow filtration market in 2023. The segment is majorly driven by the increasing use of microfiltration technology during cell separation processes. In microfiltration, suspended solids are removed from the fluid using microporous media, and the pore size is in the range of 0.1 to 1 micron. Microfiltration is widely used for various applications such as cold sterilization of beverages and pharmaceutical products, separation of bacteria from water, and others. Microfiltration membranes offer effective solutions for challenges such as microbial removal, protein fractionation, and treatment of other membranes.

The nanofiltration segment is expected to grow at a notable rate in the tangential flow filtration market during the forecast period. Nanofiltration technology is widely utilized in the selective ion separation and end-stage sterilization process. Nanofiltration allows small ions to pass through while excluding larger ions and most organic components such as fats, proteins, bacteria, gums, spores, sugars, and others. In nanofiltration, the pore size of the membrane ranges from 1 to 10 nm. These membranes significantly use less energy while producing a high flux at low pressures.

The protein purification segment held the largest share of the tangential flow filtration market in 2023 and is expected to sustain its position throughout the forecast period owing to the rising production of therapeutic proteins that employ TFF during manufacturing. In several biomanufacturing industries, tangential flow filtration has eliminated the use of centrifugation. Moreover, there is a significant rise in the adoption of recombinant protein-based therapeutics.

The vaccine & viral vectors segment is expected to grow significantly in the tangential flow filtration market during the forecast period. The segment’s growth is majorly driven by the rising need for preventative treatment during the pandemic, such as COVID-19 vaccines. The extensive use of tangential flow filtration technology in the downstream process is anticipated to accelerate the segment’s growth. TFF plays an important role in the clarification of vaccines. Additionally, TFF is most commonly used in viral vector manufacturing for two major purposes, defiltration and volume reduction, prior to the capture chromatography stage. Before the last sterile filtering, the final concentration is exchanged with the formulation buffer.

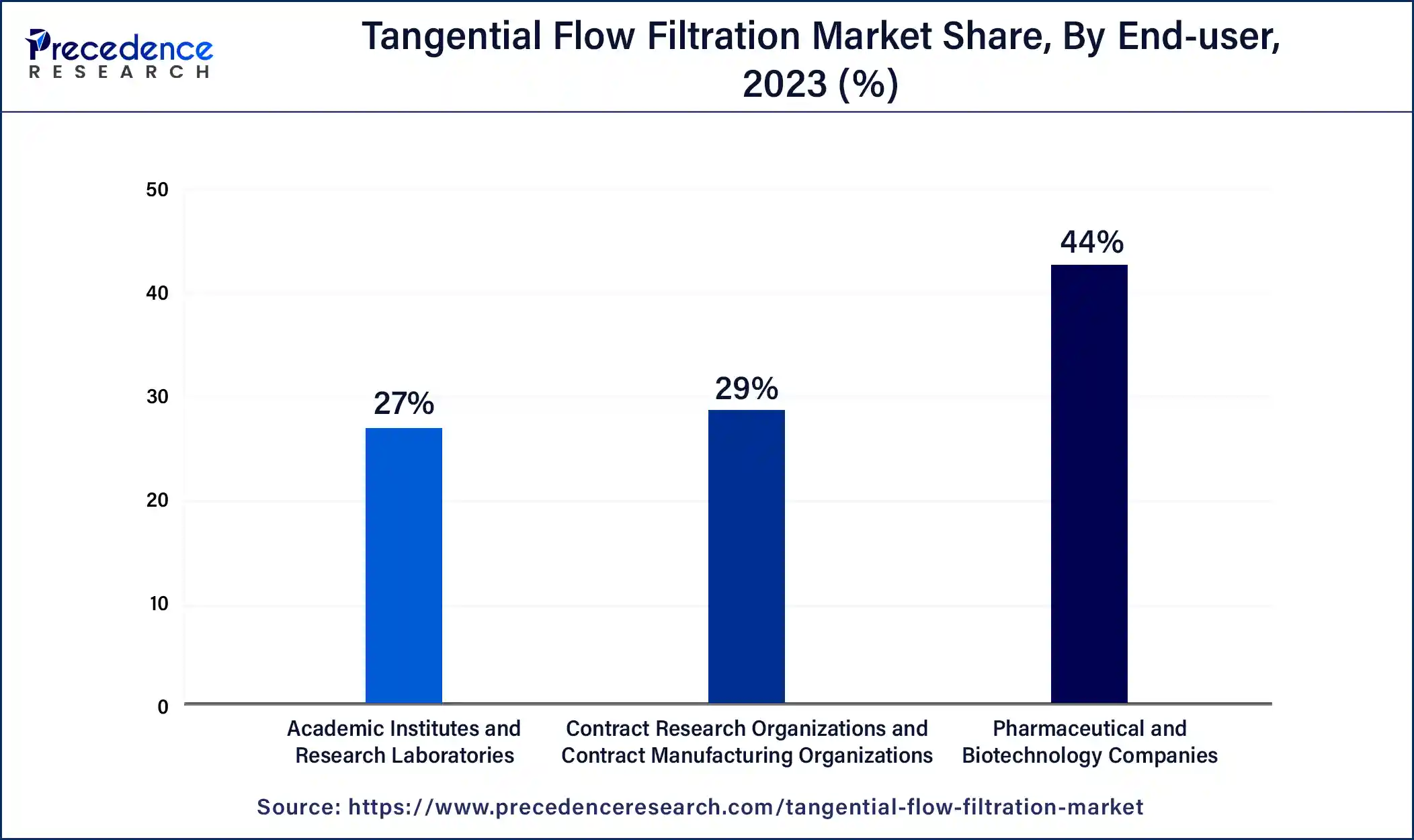

The pharmaceutical & biotechnology companies segment held the largest share of the tangential flow filtration market in 2023. The rising incidence of chronic diseases increases the need for effective therapeutics, which compels pharmaceutical and biotechnology companies to adopt advanced filtration systems. These companies are highly investing to support their R&D efforts. Moreover, the COVID-19 vaccine production by pharmaceutical and biotechnological companies has significantly contributed to this segment’s revenue generation.

The contract research organizations (CROs) & contract manufacturing organizations (CMOs) segment is expected to grow at the fastest rate in the tangential flow filtration market during the forecast period owing to the increasing demand for biopharmaceutical products, rising investment, and the increasing adoption of single-use technologies. Tangential flow filtration systems offer contract research organizations (CROs) and contract manufacturing organizations (CMOs) the required flexibility, save operating time, and enhance efficiency in the manufacturing process. This also enables these entities to produce biopharmaceutical products with high speed for commercialization.

The membrane filters segment led the global tangential flow filtration market in 2023 and is projected to continue its dominance over the forecast period. There are four most common types of membrane filtration: reverse osmosis, ultrafiltration, nanofiltration, and microfiltration. Factors such as the wide adoption of filtration systems by several industries, the rising awareness regarding the benefits of the TFF system over normal flow filtration, and rising accessibility to different filter types, including PES, PCTE, and PVDF.

The single-use tangential flow filtration systems segment will witness considerable growth in the tangential flow filtration market over the forecast period owing to the increasing demand for single-use technologies by contract organizations, pharmaceutical and biopharmaceutical industry, and research institutes. There are several benefits offered by single-use TFF systems, such as the elimination of cross-contamination, smaller footprints, and rapid processing times. In addition, technological improvements are expected to enhance the efficiency and scalability of single-use TFF systems, making them a pivotal tool in downstream processing.

Segments Covered in the Report

By Product

By Technology

By Application

By End-user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

February 2025

August 2024

December 2024