January 2025

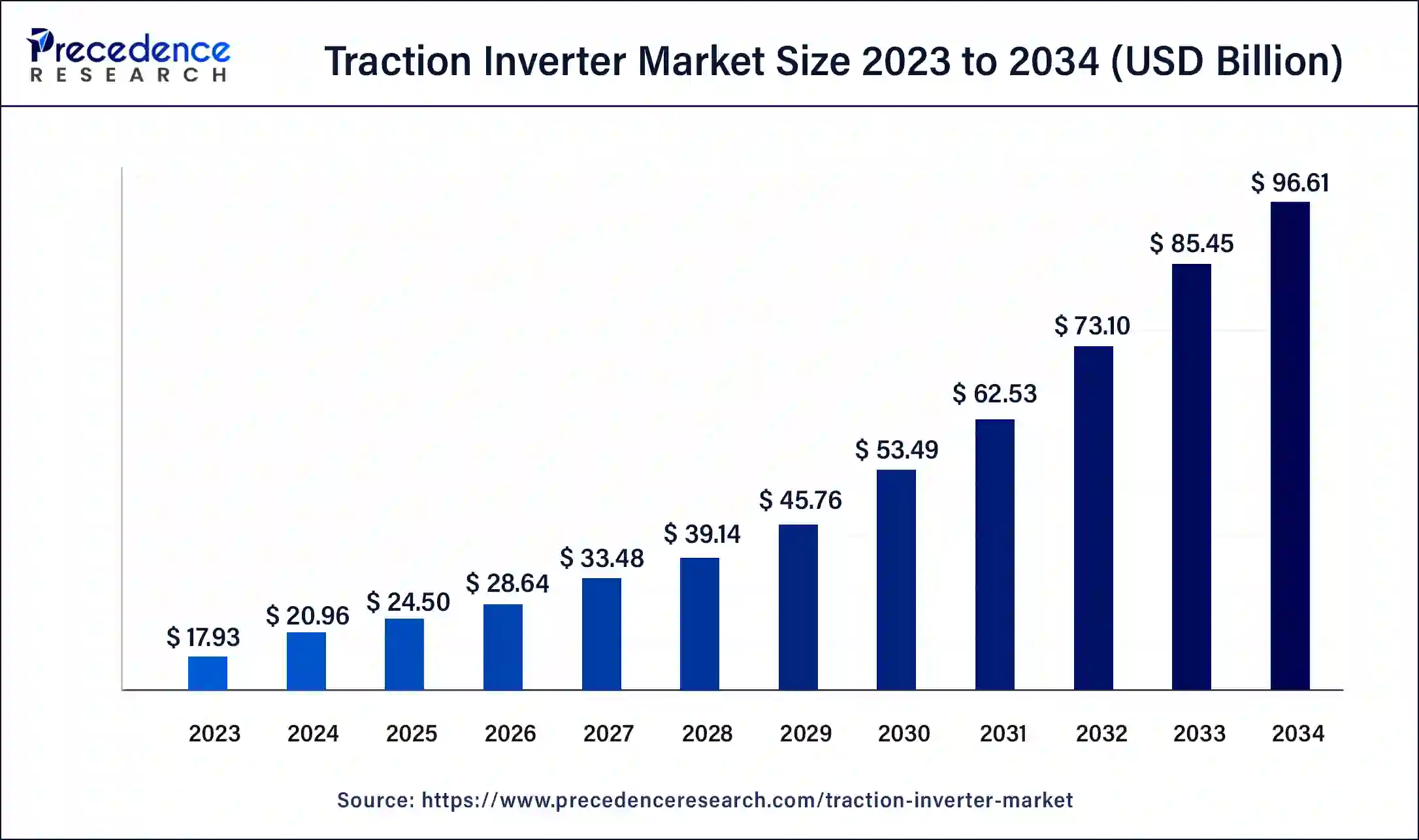

The global traction inverter market size was USD 17.93 billion in 2023, estimated at USD 20.96 billion in 2024 and is anticipated to reach around USD 96.61 billion by 2034, expanding at a CAGR of 16.51% from 2024 to 2034.

The global traction inverter market size accounted for USD 20.96 billion in 2024 and is predicted to reach around USD 96.61 billion by 2034, growing at a CAGR of 16.51% from 2024 to 2034.

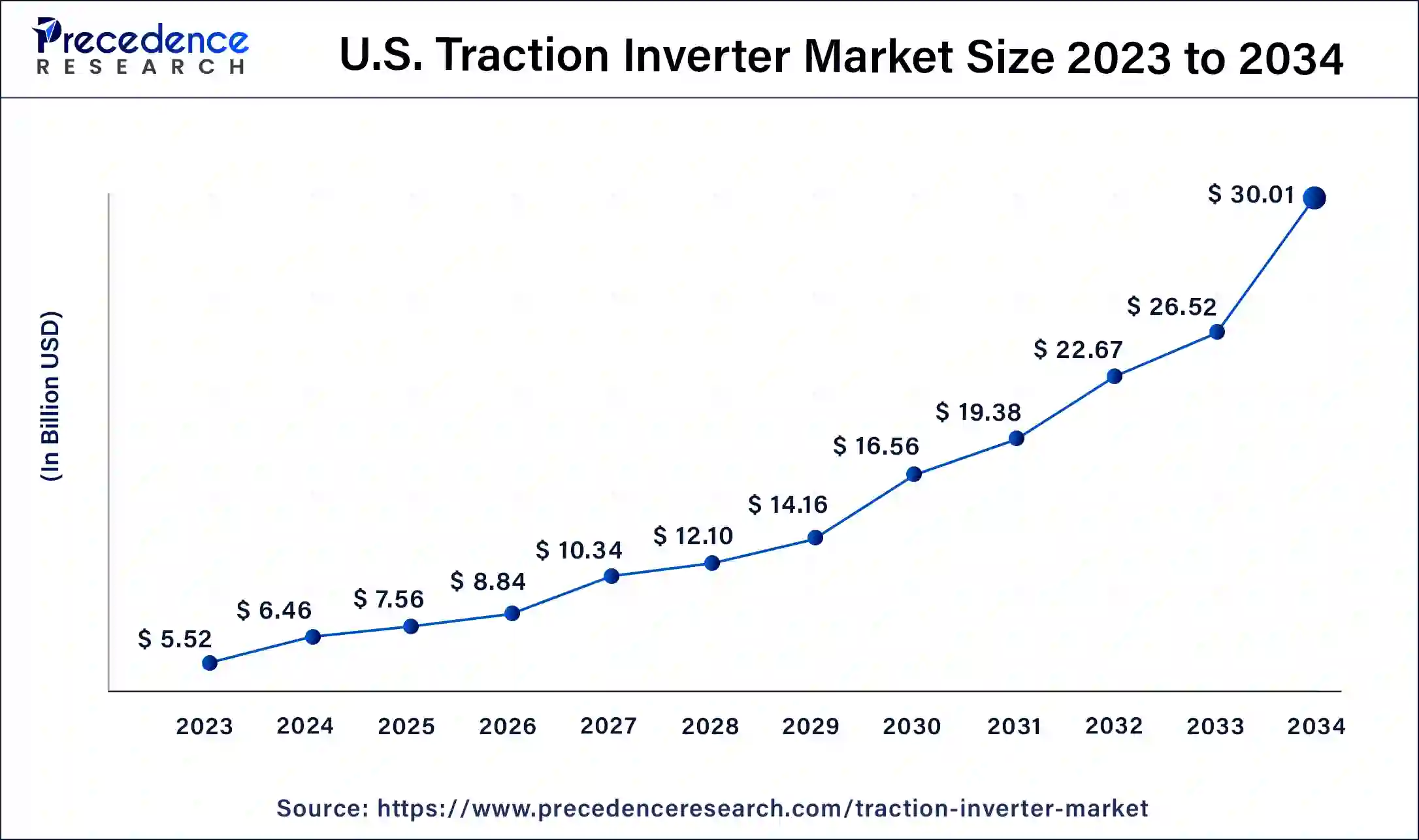

The U.S. traction inverter market size was valued at USD 5.52 billion in 2023 and is expected to be worth around USD 30.01 billion by 2034 rising at a CAGR of 16.60% from 2024 to 2034.

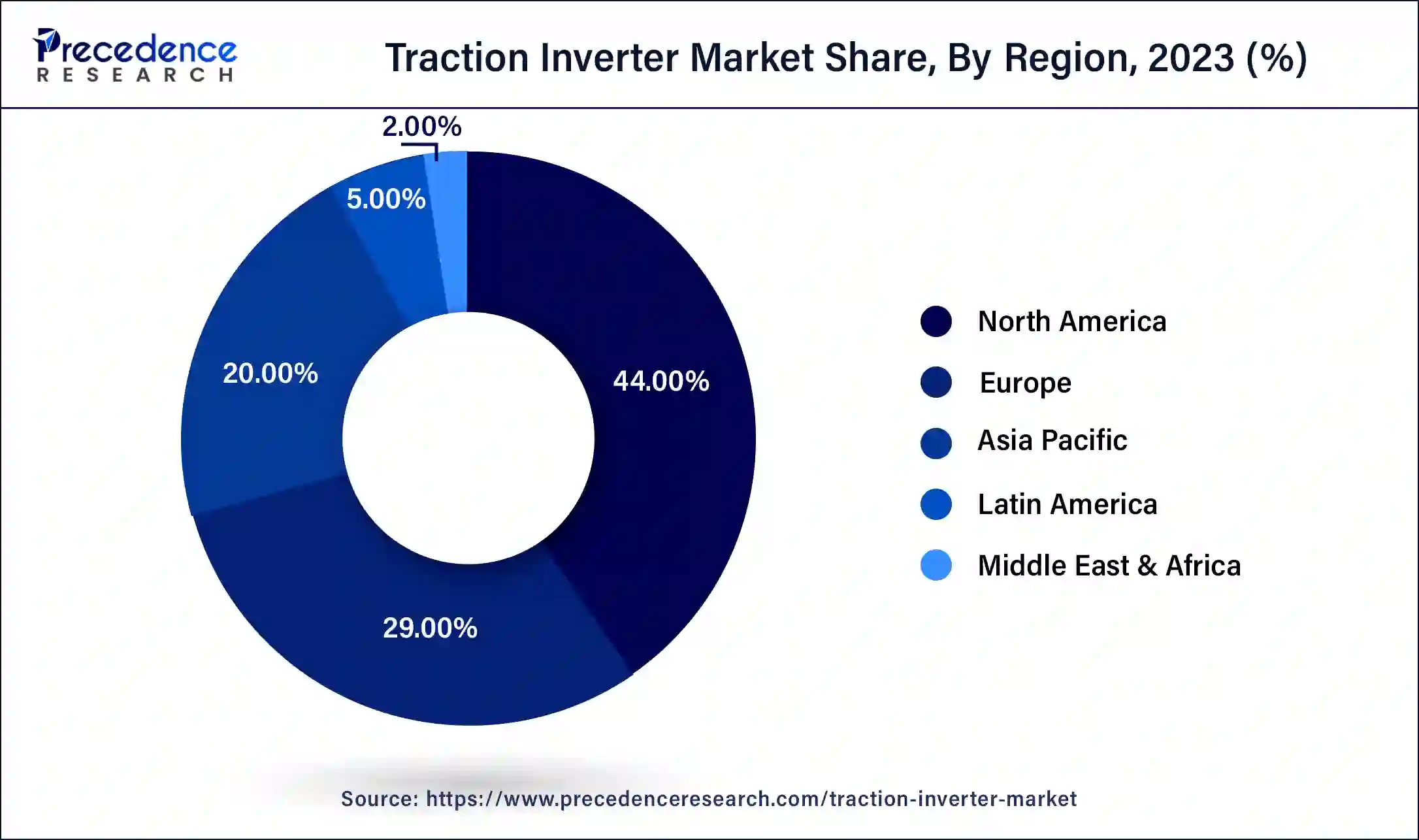

North America has held the largest revenue share of 44% in 2023. North America holds a major share in the traction inverter market due to a robust adoption of electric vehicles (EVs) and supportive government initiatives promoting clean mobility. The region witnesses significant investments in EV infrastructure, including charging networks, fostering increased demand for traction inverters. Moreover, a proactive approach from automakers in introducing electric models and a well-established automotive industry contribute to North America's prominent position in the traction inverter market, reflecting a strong commitment to sustainable transportation and technological innovation.

Asia-Pacific is estimated to observe the fastest expansion. Asia-Pacific dominates the traction inverter market due to the region's leadership in electric vehicle (EV) adoption. Governments in countries like China, Japan, and South Korea are actively promoting EVs, driving the demand for traction inverters. Favorable policies, extensive charging infrastructure development, and strong collaborations between automotive manufacturers and technology companies contribute to the region's market share. Additionally, the presence of key traction inverter manufacturers in Asia-Pacific further solidifies its significant position in the global market.

A traction inverter is a crucial component in electric and hybrid vehicles, responsible for turning the battery's direct current (DC) into the alternating current (AC) needed to power the electric motor. This conversion is essential for driving the vehicle. The traction inverter plays a vital role in managing power flow, controlling motor speed, and optimizing energy use.

Modern traction inverters feature sophisticated power electronics and control systems, ensuring precise control over AC output for seamless acceleration and deceleration. These inverters are also equipped with safety mechanisms, such as overcurrent and overvoltage protection, to safeguard the vehicle's electrical system. As the electric mobility landscape expands, the efficiency and dependability of traction inverters become increasingly significant, contributing to overall vehicle performance and advancing sustainable transportation by reducing reliance on traditional internal combustion engines.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 16.51% |

| Market Size in 2023 | USD 17.93 Billion |

| Market Size in 2023 | USD 20.96 Billion |

| Market Size by 2034 | USD 96.61 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Propulsion, Voltage, Technology, Vehicle, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Expansion of charging infrastructure and advancements in power electronics

The expansion of electric vehicle (EV) charging infrastructure and advancements in power electronics are two pivotal factors driving the surging demand for the traction inverter market. The widespread deployment of charging stations globally addresses a critical barrier to EV adoption, alleviating concerns about range anxiety and bolstering consumer confidence. As charging infrastructure becomes more accessible and efficient, the demand for electric vehicles rises, consequently increasing the need for high-performance traction inverters.

Simultaneously, advancements in power electronics play a crucial role in enhancing the efficiency and capabilities of traction inverters. Ongoing technological developments lead to more compact, lightweight, and energy-efficient inverters, contributing to improved overall EV performance. The synergy between an expanding charging infrastructure and sophisticated power electronics creates a mutually reinforcing cycle, fostering a robust market demand for traction inverters as the automotive industry embraces the shift towards electrification and sustainable transportation.

Range limitations

Range limitations in electric vehicles (EVs) pose a notable restraint on the growth of the traction inverter market. The driving range of an electric vehicle is intrinsically linked to the energy capacity and efficiency of the traction inverter. Consumers often perceive limited range as a significant drawback, contributing to hesitancy in adopting electric vehicles. While traction inverters play a critical role in optimizing energy use, challenges in battery technology and energy density directly impact the vehicle's range.

Concerns about the availability of charging infrastructure further exacerbate range anxiety. Potential EV buyers are deterred by the fear of being stranded due to insufficient charging stations, creating a psychological barrier to widespread adoption. Overcoming these range limitations requires advancements in both traction inverter efficiency and battery technology, as well as the continued expansion of charging infrastructure to address consumer concerns and promote confidence in electric vehicle ownership.

Integration of smart grid technologies

The integration of smart grid technologies presents a significant opportunity for the traction inverter market. Smart grid integration enhances the capabilities of traction inverters by enabling more sophisticated energy management in electric vehicles (EVs). Traction inverters, when synchronized with smart grids, can actively respond to real-time energy demands and fluctuations, optimizing the use of power during charging and discharging cycles. This not only contributes to grid stability but also improves the overall efficiency of EVs.

Moreover, the interaction between traction inverters and smart grids facilitates vehicle-to-grid (V2G) connectivity. This two-way communication allows EVs to not only draw power from the grid but also feed excess energy back, acting as mobile energy storage units. The evolving landscape of smart grid technologies creates a mutually beneficial relationship, offering opportunities for enhanced energy efficiency, reduced operational costs, and increased grid reliability in the traction inverter market.

The BEV segment had the highest market share of 44% in 2023. Electric Vehicles Battery (EVB) operate solely on electric power, relying on rechargeable batteries for propulsion. In the traction inverter market, the BEV segment is witnessing significant growth as automakers increasingly prioritize electric mobility. Trends include a demand for high-efficiency traction inverters to enhance the performance of BEVs, improve range, and reduce charging times. Innovations focus on compact, lightweight designs and integration with advanced battery management systems, reflecting a commitment to advancing BEV technology and addressing the evolving needs of electric vehicle consumers.

The PHEV segment is anticipated to expand at a significant CAGR of 17.2% during the projected period. In the realm of traction inverters, the Plug-in Hybrid Electric Vehicle (PHEV) category refers to cars that can operate on both electricity and traditional fuel. Traction inverters in PHEVs manage the transfer of power between the electric motor and the internal combustion engine. The latest trends indicate a rising need for smaller, more efficient traction inverters to meet the growing demand for PHEVs, highlighting the significance of seamlessly navigating between electric and hybrid modes for optimal dual-powertrain performance.

The 200 to 900V segment has held a 38% revenue share in 2023. The 200 to 900V segment in the traction inverter market specifically refers to the voltage range of traction inverters utilized in electric vehicles. This category covers a wide range of applications, spanning from everyday cars to commercial and high-performance vehicles. A notable trend within this voltage range is the industry's movement towards higher voltages, driven by the goal to enhance power efficiency and overall performance in electric vehicles. This shift underscores the automotive sector's commitment to developing more potent and technologically advanced traction inverters for improved driving range and capabilities in electric vehicles.

The 900V and above segment is anticipated to expand fastest over the projected period. The 900V and above segment in the traction inverter market refers to high-voltage systems primarily utilized in electric vehicles. This segment is witnessing significant growth due to the increasing demand for electric mobility and the pursuit of higher power efficiency. Trends indicate a shift towards higher voltage systems to meet the demands of next-generation electric vehicles, enabling faster charging, improved performance, and increased overall efficiency. The 900V and above segment reflects the industry's trajectory towards advanced power electronics to address the evolving needs of electric vehicle technology.

According to the technology, the MOSFET segment has held 46% revenue share in 2023. In the Traction Inverter market, the Metal-Oxide-Semiconductor Field-Effect Transistor (MOSFET) segment refers to the use of MOSFET technology in the construction of power inverters. MOSFETs offer advantages such as high switching speeds, low on-resistance, and efficient power handling, making them ideal for traction inverters in electric vehicles.

A trend in this segment involves continuous improvements in MOSFET technology to enhance power density, increase energy efficiency, and meet the evolving demands of the electric mobility sector, contributing to the overall advancement of traction inverter capabilities.

The IGBT segment is anticipated to expand fastest over the projected period. Insulated Gate Bipolar Transistor (IGBT) is a semiconductor device crucial in the traction inverter market. It serves as a switch, controlling the flow of electrical power in the conversion of direct current to alternating current for electric vehicles. In recent trends, IGBT modules are witnessing advancements such as higher voltage ratings and improved thermal performance, enhancing the efficiency of traction inverters. This technology evolution aligns with the increasing demand for high-performance electric vehicles and contributes to the overall growth and competitiveness of the traction inverter market.

According to the vehicle, the commercial vehicles has held 42% revenue share in 2023. The commercial vehicles segment in the traction inverter market refers to electric powertrains used in buses, trucks, and other industrial vehicles. A notable trend in this segment is the increasing electrification of commercial fleets to reduce carbon emissions and operational costs. Traction inverters for commercial vehicles are evolving to meet the unique demands of heavy-duty applications, emphasizing durability, efficiency, and integration with smart fleet management systems. As governments worldwide introduce stringent emission regulations, the demand for traction inverters in the commercial vehicle sector is expected to witness continued growth.

The passenger cars segment is anticipated to expand fastest over the projected period. The passenger cars segment in the traction inverter market refers to the application of traction inverters in electric and hybrid passenger vehicles. This includes sedans, hatchbacks, and SUVs that rely on traction inverters to convert and regulate power from the vehicle's battery to drive the electric motor. Trends in this segment include a growing demand for compact and lightweight inverters, increased focus on energy efficiency, and advancements in power electronics to support the expanding market share of electric passenger cars worldwide.

Segments Covered in the Report

By Propulsion

By Voltage

By Technology

By Vehicle

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

September 2024

December 2024