December 2024

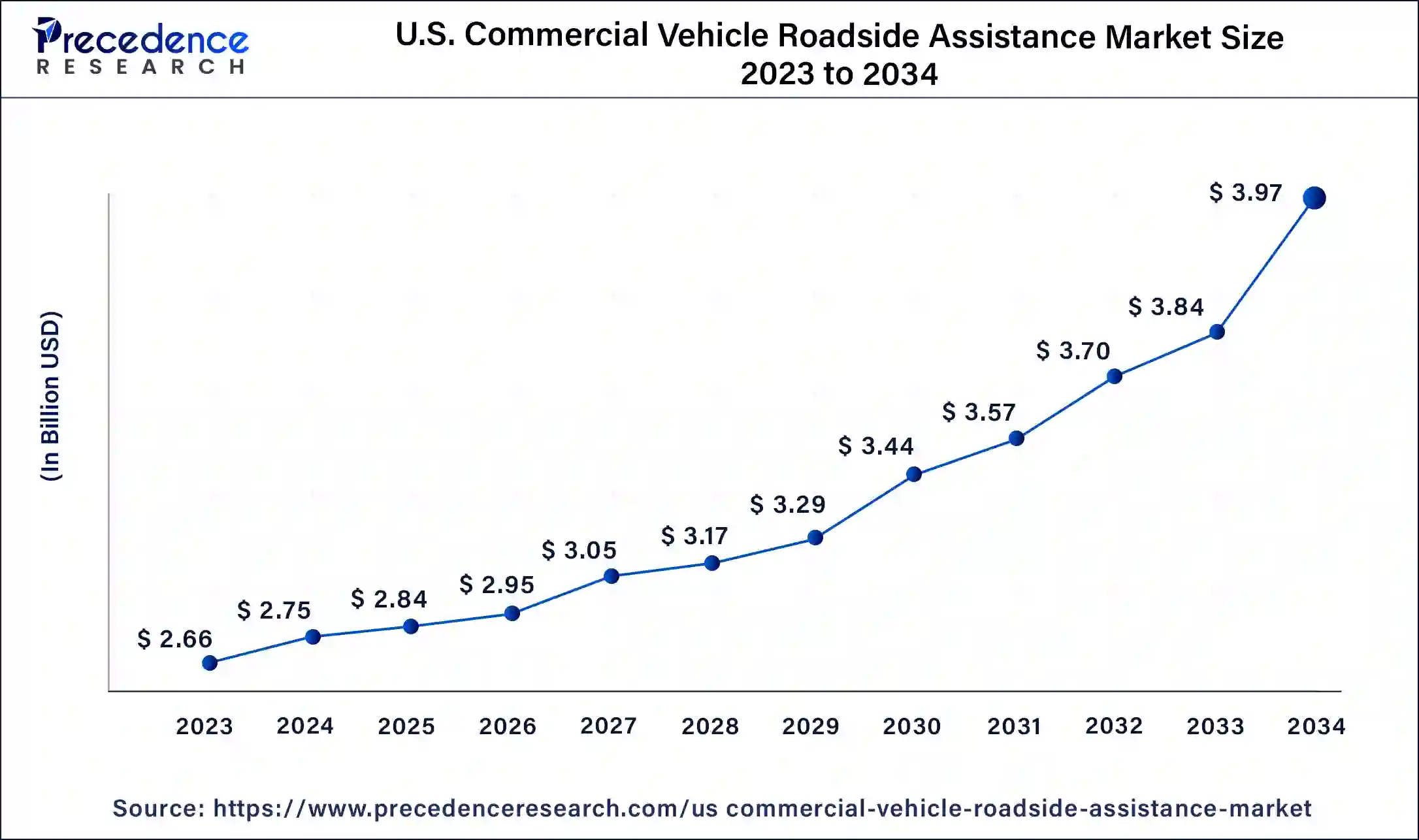

The U.S. commercial vehicle roadside assistance market size was USD 2.66 billion in 2023, calculated at USD 2.75 billion in 2024 and is expected to be worth around USD 3.97 billion by 2034. The market is slated to expand at 3.70% CAGR from 2024 to 2034.

The U.S. commercial vehicle roadside assistance market size is expected to worth USD 2.75 billion in 2024 and is anticipated to reach around USD 3.97 billion by 2034, growing at a solid CAGR of 3.70% over the forecast period 2024 to 2034. The market is driven by customer preferences for fuel-efficient and safe vehicles, e-commerce sector growth, and infrastructure development.

The U.S. commercial vehicle roadside assistance market involves offering 24/7 roadside assistance services to commercial vehicles. Commercial vehicles like trucks transport goods and logistics from one destination to another. These vehicles need timely intervention and repair in case of breakdowns. Roadside assistance plays a vital role by offering a rapid-response solution and minimizing downtime by addressing mechanical issues on the spot. It ensures the protection of the vehicle and goods so that they reach the destination on time. Some roadside services provided include a flat battery to resolve issues in a battery, spare keys, flat tire, towing facilities, minor repairs, fuel assistance, load shifts, transfer, etc. For commercial vehicles, roadside assistance is an essential strategic requirement. In 2022, there were 1.85 million new commercial registrations in the US, a 4% rise from the previous year, 2021. The number of operating vehicles increased further, reaching 30.1 million commercial vehicles by 2022.

How is AI Changing the U.S. Commercial Vehicle Roadside Assistance Market?

Technological advancements like artificial intelligence are a boon to roadside assistance services. It enables service providers to deliver faster and more efficient services to customers. One of the widespread applications of AI is the use of mobile apps and software to connect service providers whenever needed.

Another advancement is automated customer recognition via biometrics, ensuring greater safety and security. In case of emergencies, AI can feature voice assistants for immediate services. Additionally, it can estimate the cost of repair and accelerate the repair process. Furthermore, AI can enable real-time data collection through road infrastructure that simplifies incident management and improves traffic and travel times, which can significantly reduce road accidents.

| Report Coverage | Details |

| Market Size by 2034 | USD 3.97 Billion |

| Market Size in 2023 | USD 2.66 Billion |

| Market Size in 2024 | USD 2.75 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 3.70% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Service, Provider, Vehicle |

Rising road accidents

Commercial vehicles require emergency roadside services in case of a major breakdown or an accident. The rising number of road accidents in the US demand roadside assistance services for commercial vehicles. According to a Forbes report, approximately 5,930,496 car accidents were reported in 2022. In the majority of cases, commercial vehicles need to be towed from the accident site to help the driver transport the vehicle to a garage and to reduce traffic, allowing way for other vehicles. Other services include tire replacement, fuel delivery, and locksmith service. Additionally, several car insurance policies, including roadside assistance policies, facilitate demand in the U.S. commercial vehicle roadside assistance market.

The major limitation in the U.S. commercial vehicle roadside assistance market is the cost of the service. The high cost of roadside assistance depends on the provider and the coverage offered by different companies. Some companies may provide limited services like towing to a certain distance. Additionally, calling a roadside service could be difficult in areas with limited mobile networks. Another huge risk is the accidents of road assistance workers by either car passing while they work or hitting a car from behind.

Rise in the Use of Electric Vehicles

The advancements in technology favor the use of electric vehicles (EVs) for commercial purposes. According to Cox Automotive, nearly 577,000 electric vehicles were sold in the US in the first half of 2023. EVs offer several advantages as they are efficient and cost-effective. Even though EVs do not require petrol or diesel, they are machines and are prone to breakdown. The common issues that need to be resolved in an EV through roadside assistance include dead battery. The lithium-ion battery can sometimes need to be changed as it may be degraded after long-term use. Other problems encountered in an EV include brake problems, flat tires, and lock and key assistance.

US Commercial Roadside Assistance Market Revenue, By Service 2019-2030

| By Service | 2020 | 2021 | 2022 | 2023 |

| Tyre Replacement | 410 | 440 | 460 | 470 |

| Towing | 780 | 840 | 860 | 890 |

| Jump Start/Pull Start | 290 | 320 | 330 | 340 |

| Fuel Delivery | 130 | 140 | 140 | 150 |

| Lockout/ Replacement Key Services | 170 | 180 | 190 | 190 |

| Battery Assistance | 190 | 210 | 210 | 220 |

| Winch | 080 | 090 | 090 | 090 |

| DPF Regen/ Computer Assisted Regen | 110 | 120 | 120 | 130 |

| DPF Regen/ Computer Assisted Regen | 170 | 180 | 180 | 180 |

The towing segment dominated the U.S. commercial vehicle roadside assistance market in 2023. Towing assists a driver in transporting a vehicle from one place to another in case of a breakdown or accident. The vehicle needs to be loaded onto the tow truck in cases of engine failure or collision damage using specialized equipment like winches or cranes. The towed vehicle is transported either to an auto repair shop or any other location specified by the driver. Hence, towing services help drivers safely remove their vehicles from crowded roads and highways, thereby decreasing the likelihood of more accidents or traffic disruptions.

The tyre replacement segment is estimated to grow at the fastest rate in the U.S. commercial vehicle roadside assistance market during the forecast period. The tires in commercial vehicles need to be checked frequently for wear and tear and to avoid overuse. The Department of Transportation (DOT) issues several guidelines and safety regulations for commercial vehicles' tires.

According to the Commercial Vehicle Safety Alliance (CVSA), tire issues are the second most common issue in commercial vehicles. The tire flat or audible leak violation is the most common violation every year. The road assistance service helps the driver by replacing the tires according to their requirements. Continental AG, a German tire manufacturer, predicted that commercial vehicle replacement tire sales in North America will rise between 2% and 4% year-over-year in 2024.

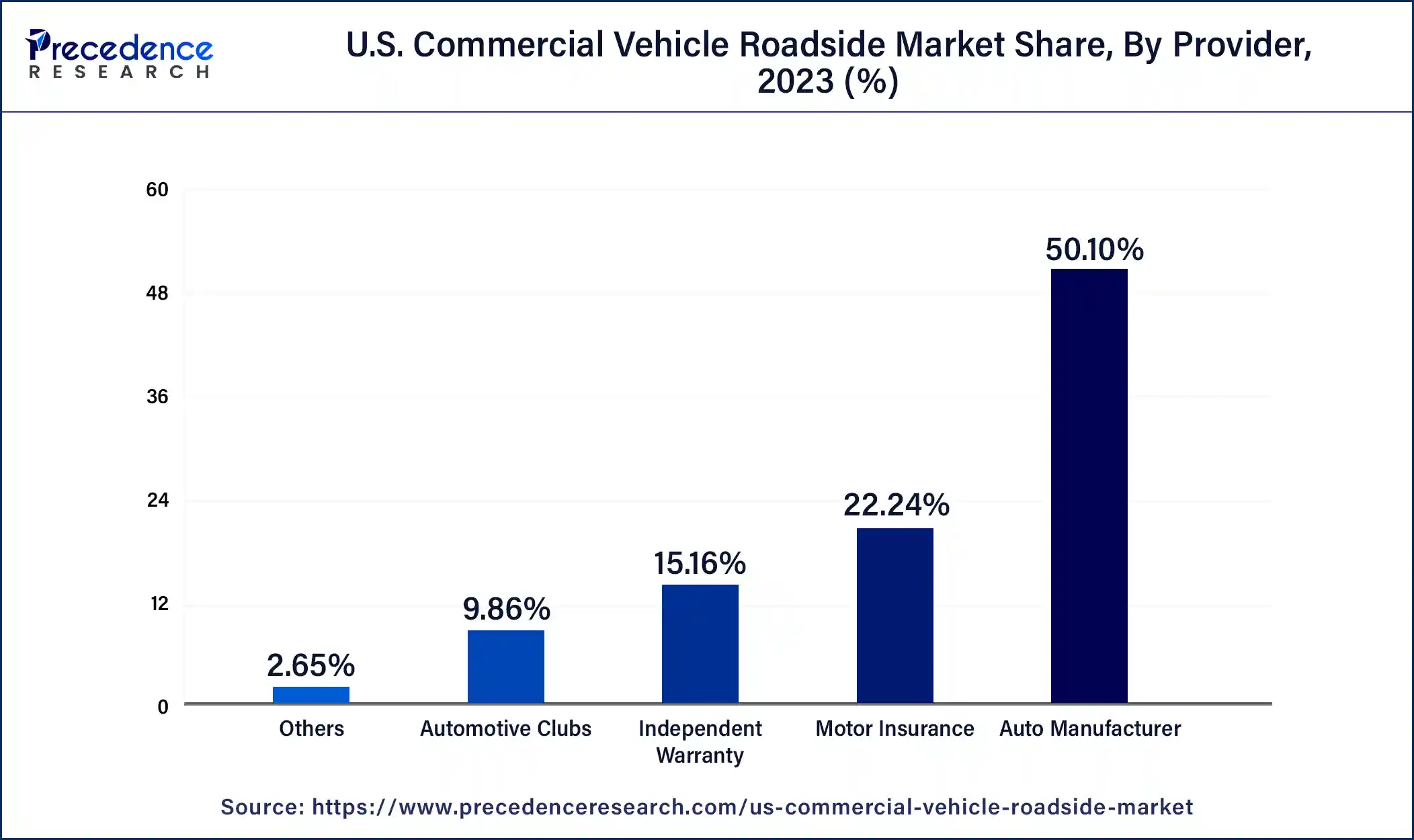

The auto manufacturer segment held a dominant presence in the U.S. commercial vehicle roadside assistance market in 2023. Auto manufacturers provide after-sales services like warranties facilitating their demand. Many auto manufacturers also provide roadside assistance services for their commercial vehicles. These services are either free of cost or at a very reasonable rate for the predetermined period. The service period and cost depend on different manufacturers. Auto manufacturers like BMW, Ford, Tesla, Mercedes-Benz, etc provide roadside assistance. The roadside assistance includes tire replacement, jump-start, locksmith services, fuel requirements, and towing. Some companies also offer reimbursement policies to enable owners to reconfigure their travel plans.

The motor insurance segment is projected to expand at the fastest rate in the U.S. commercial vehicle roadside assistance market over the coming years. Roadside assistance is an add-on feature that can be included in a car insurance policy. Additionally, some insurance companies provide roadside assistance as a standalone option without adding it to the car insurance policy. It provides access to emergency services in the event of a breakdown or other mishap. The high costs of roadside assistance services can limit the affordability of the owners. According to Forbes, companies like Erie, Geico, Good Sam, and Nationwide offer the best insurance plans for roadside assistance.

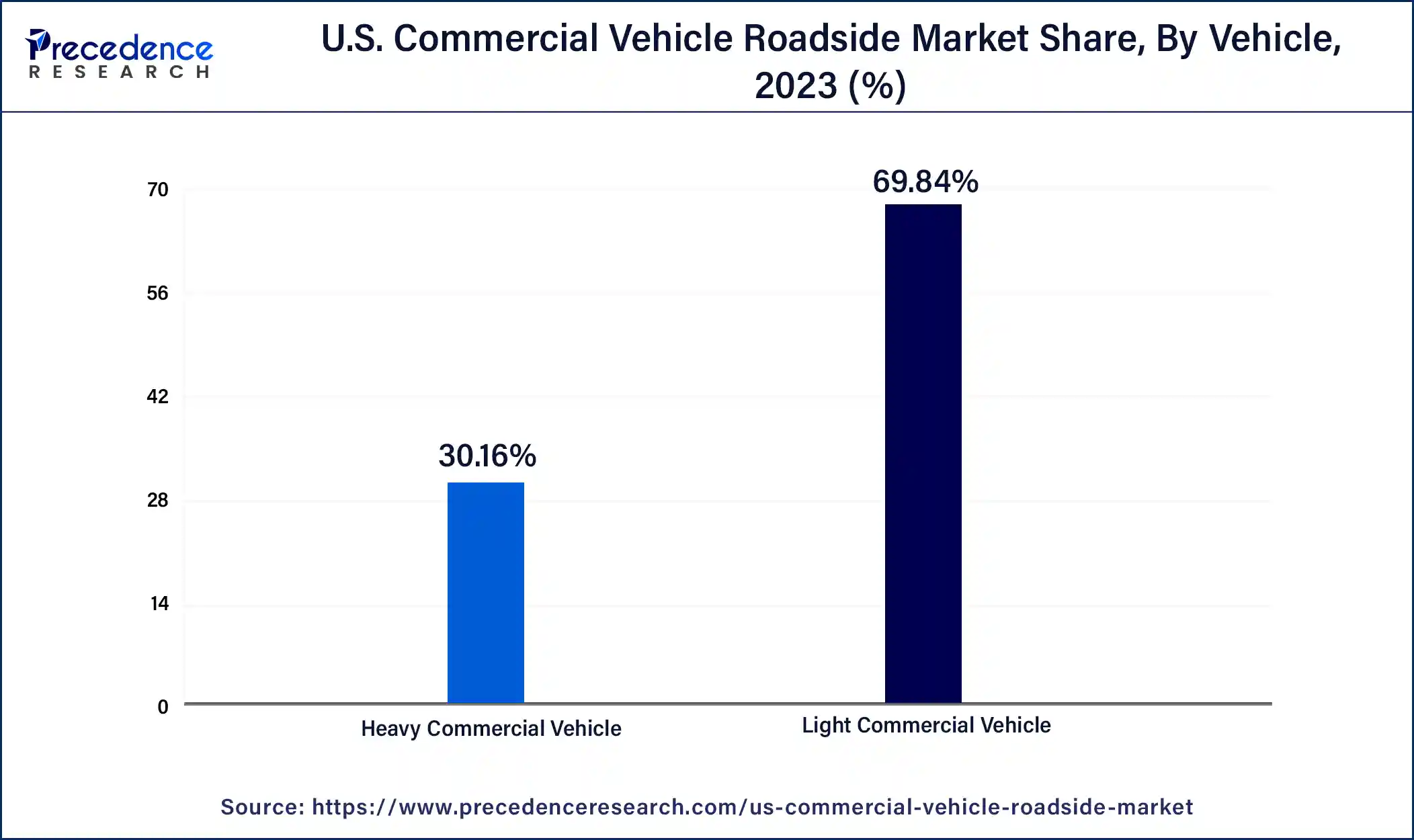

The light commercial vehicles segment held the largest share of the U.S. commercial vehicle roadside assistance market in 2023. Alternative fuel vehicles and electric and hybrid powertrains are examples of light commercial vehicles. The demand for light commercial vehicles is increasing due to the growing e-commerce sector for last-mile delivery.

The heavy commercial vehicles segment is estimated to grow at the fastest rate in the U.S. commercial vehicle roadside assistance market during the forecast period. Heavy vehicles require roadside assistance services like towing, winching, battery jump-start, fuel and fluid delivery, locksmith service, and flat tire service. Heavy commercial vehicles are primarily used for the transportation of goods from one place to another.

Segments Covered in the Report

By Service

By Provider

By Vehicle

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

December 2024

March 2025

July 2024

May 2024