May 2024

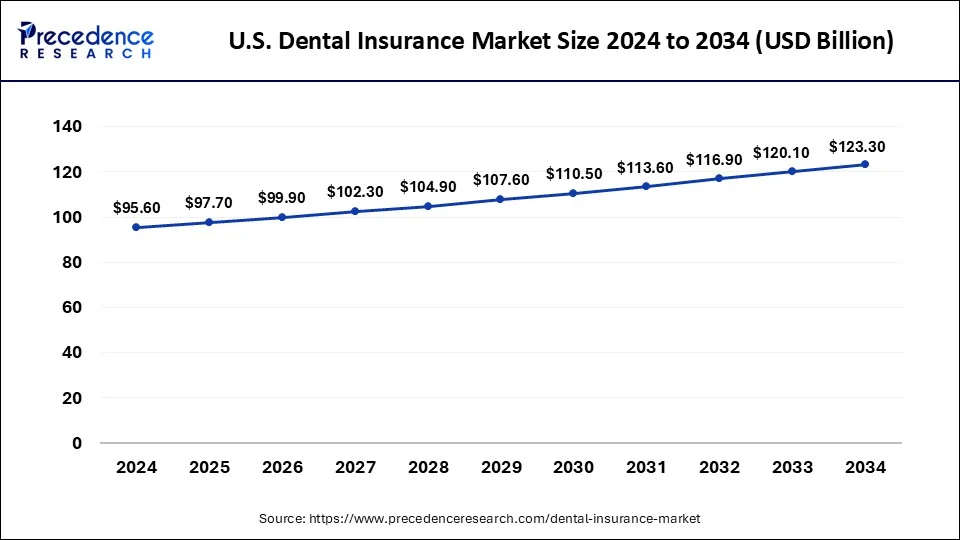

The U.S. dental insurance market size is calculated at USD 97.7 billion in 2025 and is forecasted to reach around USD 123.3 billion by 2034, accelerating at a CAGR of 2.62% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The U.S. dental insurance market size was estimated at USD 95.6 billion in 2024 and is predicted to increase from USD 97.7 billion in 2025 to approximately USD 123.3 billion by 2034, expanding at a CAGR of 2.62% from 2025 to 2034. The increasing awareness regarding the healthcare policies are driving the expansion of the market.

Dental insurance is the one of the part of the medical insurance that used in the treatment and medicational procedures of the dental care. Dental insurance is works on the way, in return of the premium payments, it will pay a certain cost of the treatment of the dental procedures. Dental insurance is generally covered preventive care like emergency treatment, cleansing, and examination, X-rays, and fillings. Dental insurance will pay the cost of the treatment or procedures directly to the hospitals, clinics, or service providers which is totally depends upon the terms and conditions of the policy.

There are several type of the dental insurance coverages includes PPOs, indemnity plans, and HMOs. Dental insurance helps in the coverage the cost of the individual and families treatment. The rising prevalence of the dental problems in the Unites States due to the aging population and the acceptance of sedentary lifestyle are driving the growth of the U.S. dental insurance market.

| Report Coverage | Details |

| Market Size in 2024 | USD 95.6 Billion |

| Market Size in 2025 | USD 97.7 Billion |

| Market Size by 2034 | USD 123.3 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 2.62% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Coverage, By Procedure, By Demographics, and By End-user |

The increase in trend in the healthcare coverages

The rise in the trend in the healthcare coverages and the increasing awareness regarding the dental treatment and beneficial properties of the dental insurance are driving the growth of the market. In the United States there are approximately 90% of the population are covered with some kind of the healthcare insurance coverage. The rising trend in the healthcare coverage improve the access of the better health outcomes, lower death rates, and improved productivity. U.S, residents are mostly covered with some variety of coverages from public or private sources. Some are purchased by the individual markets like Medicaid, Medicare, or Veterans Affairs programs (public sources) and some are covered through their employers. In the recent year, there are 20 million individuals are newly covered by some type of the healthcare insurance coverage. Thus the rising awareness about the healthcare coverages are driving the expansion of the U.S. dental insurance market.

High expenses of dental insurances

Dental insurances are generally costlier in the United States which creates a hindering factor for the U.S. dental insurance market to grow. High insurance premiums may attract regulatory scrutiny, especially if they are deemed to be unfairly pricing out certain demographic groups or contributing to healthcare access disparities. This can result in increased regulatory pressure on insurers and potential changes to pricing practices. Expensive insurance premiums may contribute to market saturation, where only a portion of the population can afford or are willing to pay for dental insurance. This limits the potential for market expansion and competition, as insurers may struggle to attract new customers or retain existing ones.

Integration of digital health

The rising shift of the digital infrastructure in the healthcare insurance market for the improvization of facilities and accessibility of the insurance benefits creates an opportunity for the U.S dental insurance market to grow. The digital tools are playing an important role in the promotion of healthcare insurance. The integration of machine learning and analytics improves the engagement of the proactive members of the insurance, serves the service demand, solves issues, and communication gaps before awareness about the problems. The integration of the technologies such as artificial intelligence, and automation in the insurance market by the major healthcare insurance players in the United States are contributing to the revolutionizing the shape of the health insurance market.

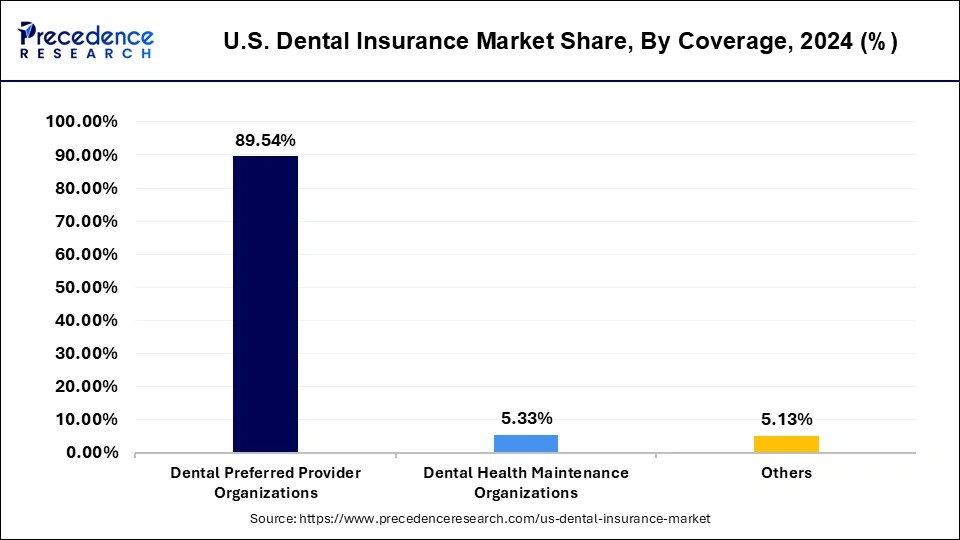

The dental preferred provider organizations segment dominated the U.S. dental insurance market with the highest share in 2023. The dental PPOs (preferred provider organizations) are one of the most commonly used dental insurance that is made to help with the higher cost of the dental treatment and procedures. The preferred provider organizations provide several dental insurance plans which offer the low cost of the insurance and give preferable choices in the selection of dentists. It is the insurance plans that cover the wide network of dental professionals or dentists which offer the treatment at discounted prices.

The dental health maintenance organizations segment is expected to be the fastest growing in the market during the forecast period. The DHMOs (dental health maintenance organizations) are one of the most reputed dental insurance plans with the coverage of various discounted dental insurance policies and the wider network of dentists. The dental health maintenance organizations are also known as the Capitalization Plan and the least expensive dental insurance plan.

U.S. Dental Insurance Market Revenue, By Coverage, 2022-2024 (USD Billion)

| Coverage | 2022 | 2023 | 2024 |

| Dental Preferred Provider Organizations | 82.1 | 83.8 | 85.6 |

| Dental Health Maintenance Organizations | 4.9 | 5 | 5.1 |

| Others | 4.8 | 4.8 | 4.9 |

The preventive segment dominated the U.S. dental insurance market in 2023. Preventive dental care comprises proactive measures taken by patients to prevent oral diseases and ensure a lifelong healthy smile. This includes daily practices such as brushing with fluoride toothpaste, regular flossing, maintaining a balanced diet, and scheduling routine oral exams and professional cleanings.

Dental insurance plans prioritize preventive dental care due to its crucial role in oral health. Consequently, these services are often covered at 100 percent with minimal or no deductibles or co-pays, resulting in minimal out-of-pocket costs for policyholders. Preventive services are not subtracted from the annual maximum benefit in certain plans, emphasizing the significance of encouraging regular preventive dental practices among policyholders.

Dental X-ray costs vary based on the specific type required, typically between $100 and $200. Considering a preventive measure guarding against more intricate and costly treatments like root canals or cavity treatments, dental insurance plans often cover at least one routine X-ray annually. Additionally, many plans cover X-rays prescribed by another healthcare professional. However, elective X-rays chosen by the patient as add-ons are less likely to be covered by insurance policies. Understanding these coverage nuances helps patients make informed decisions about their dental care.

The major segment is expected to experience the fastest growth rate in the market during the forecast period. Major dental services encompass complex procedures and surgeries, such as dental implants, which are extensive treatments addressing issues that could have been prevented or mitigated with earlier preventive care. These services often involve lengthy or intricate procedures. Typically, if a dental procedure requires anesthesia surgery or falls within the realm of orthodontics, it is categorized as a major dental service. These comprehensive procedures are essential for addressing significant dental concerns, requiring specialized skills and expertise.

U.S. Dental Insurance Market Revenue, By Procedure, 2022-2024 (USD Billion)

| Procedure | 2022 | 2023 | 2024 |

| Major | 19.3 | 19.7 | 20.2 |

| Basic | 26.7 | 27.3 | 27.9 |

| Preventive | 45.8 | 46.6 | 47.5 |

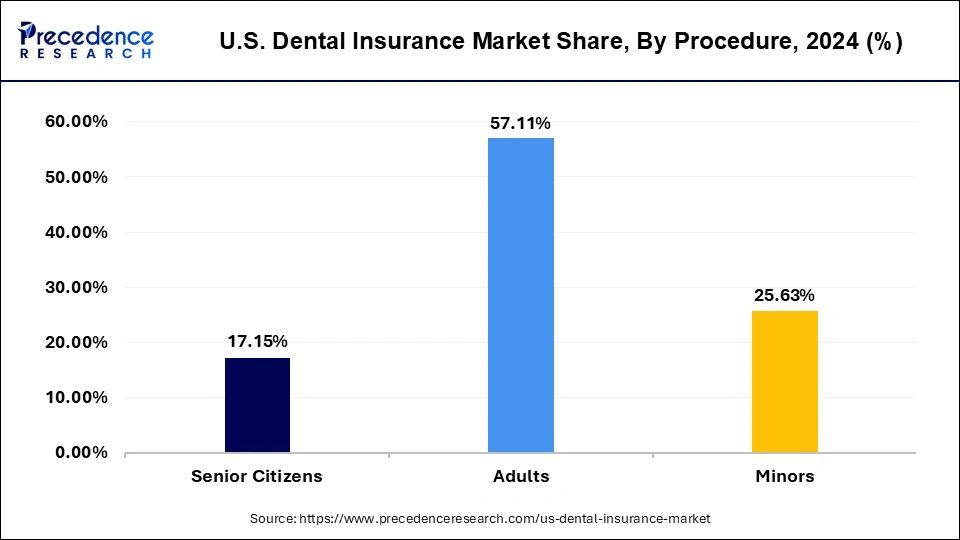

The adults segment dominated the U.S. dental insurance market with the largest share in 2023. The increasing prevalence of dental treatment in adults due to the shift in lifestyle that may cause the increasing number of dental problems in the adult population. The higher purchase rate of the dental insurance policies by the adults in any type of medium like public or private or purchase by the individuals or the employers that contributing to the expansion of the U.S. dental insurance market.

The senior citizens segment is expected to be the fastest growing in the market during the forecast period. The increasing cases of the dental problems in the geriatric population or the senior citizens due to the aging factors that are driving the demand for the dental insurance for aiming to reduce the treatment and procedural cost in the dental care. The increasing availability of the low-cost insurance coverages for the senior citizens are further propelling the growth of the market.

U.S. Dental Insurance Market Revenue, By Demographics, 2022-2024 (USD Billion)

| Demographics | 2022 | 2023 | 2024 |

| Senior Citizens | 15.7 | 16 | 16.4 |

| Adults | 52.3 | 53.4 | 54.6 |

| Minors | 23.7 | 24.1 | 24.5 |

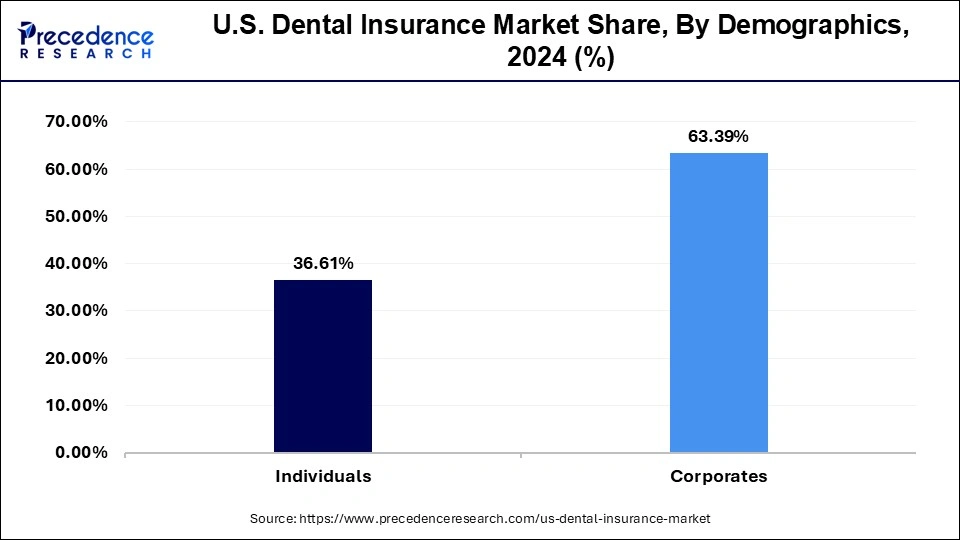

The corporates segment dominated the market with the largest share in the market in 2023. Corporate dental insurance is designed to help and cover the treatment plans for the company team members. The corporate insurance comes from the employee beneficiaries and improves the staff’s wellbeing and maintains the company culture.

The corporate dental insurance covers preventive treatment such as routine examinations, virtual routine examinations, teeth scale and polishes and x-ray scans. Restorative treatment, orthodontic treatment, emergency treatments such as treatment for severe pain, treatment if patients are unable to eat, treatment for conditions that pose a health threat, prescription charges, emergency call out fees. Injury treatment, and oral cancer are also covered under the segment.

U.S. Dental Insurance Market Revenue, By End-user, 2022-2024 (USD Billion)

| End-user | 2022 | 2023 | 2024 |

| Individuals | 33.5 | 34.3 | 35 |

| Corporates | 58.2 | 59.3 | 60.6 |

By Coverage

By Procedure

By Demographics

By End-user

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

May 2024

July 2024

April 2025

February 2025