August 2024

Wheat Protein Market (By Product: Wheat Gluten, Wheat Protein Isolate, Textured Wheat Protein, Hydrolyzed Wheat Protein, Others; By Form: Dry, Liquid; By Concentration: 75% Concentration, 80% Concentration, 95% Concentration; By Application: Bakery & Confectionery, Animal Feed, Dairy, Personal Care, Sports & Nutrition) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

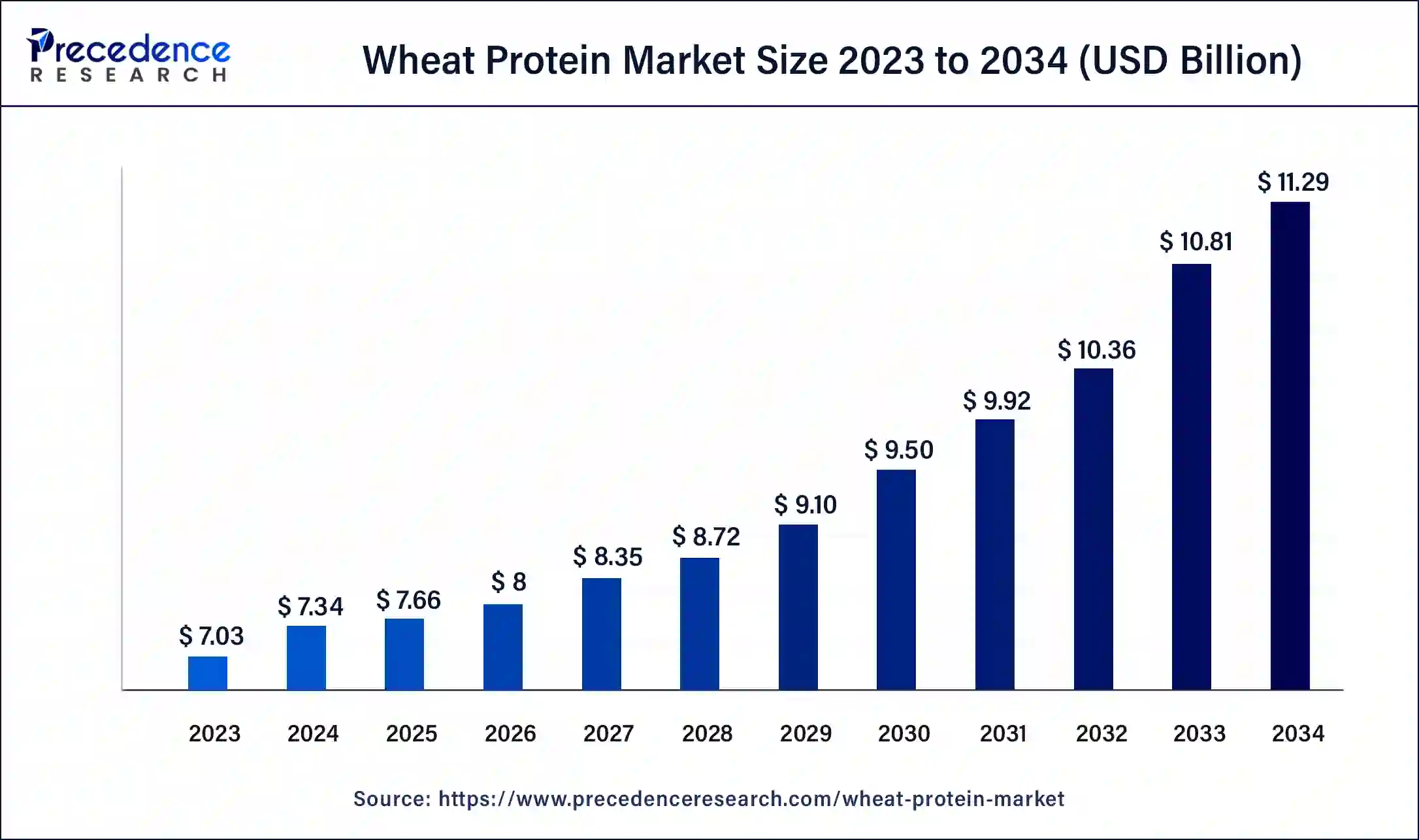

The global wheat protein market size was USD 7.03 billion in 2023, accounted for USD 7.34 billion in 2024, and is expected to reach around USD 11.29 billion by 2034, expanding at a CAGR of 4.4% from 2024 to 2034. The North America wheat protein market size reached USD 2.39 billion in 2023. Growing demand for plant-based proteins, fueled by health consciousness and sustainability concerns, is a major driver in the wheat protein market. Additionally, advancements in food processing technology, expansion of the functional food sector, and rising consumer interest in clean label and plant-based products contribute to market growth.

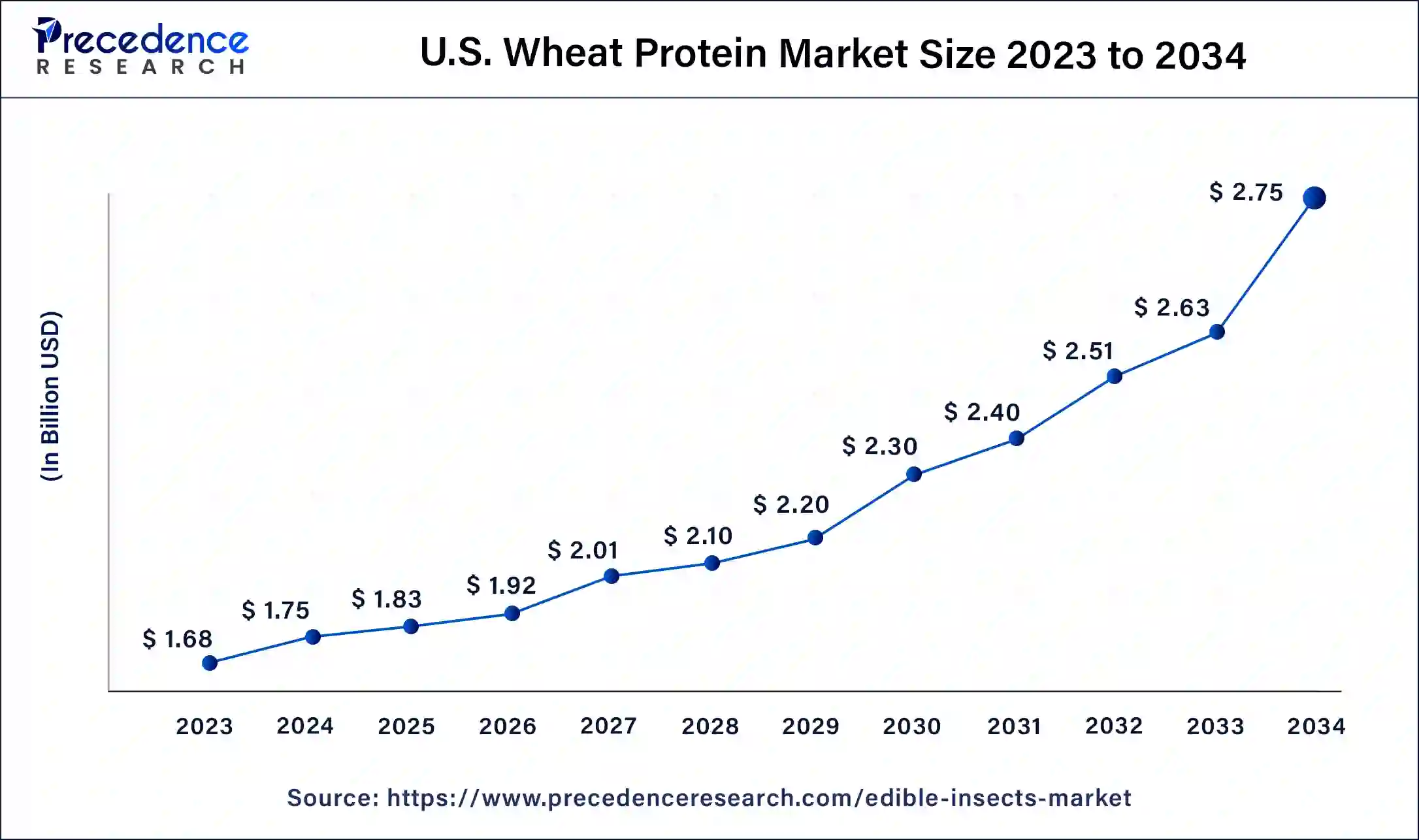

The U.S. wheat protein market size was estimated at USD 1.68 billion in 2023 and is predicted to be worth around USD 2.75 billion by 2034, at a CAGR of 4.6% from 2024 to 2034.

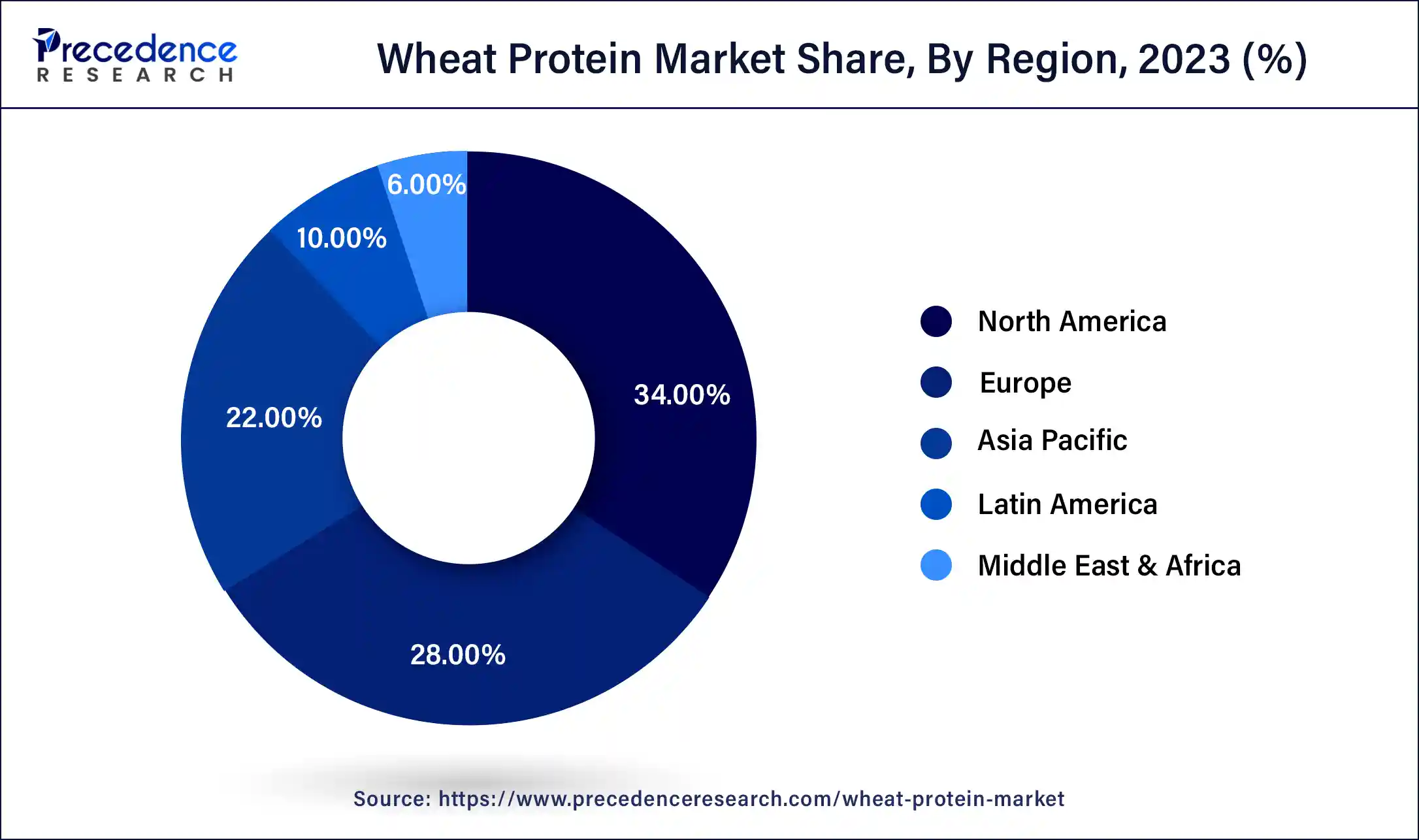

North America held the largest market share of 34% in 2023. This region stands as a dominant force in the global market, driven by several factors. Firstly, the region boasts a well-established food and beverage industry with a strong focus on product innovation and consumer demand for healthier alternatives.

Wheat protein, particularly in the form of wheat gluten and hydrolyzed wheat protein, finds extensive use in a wide range of food applications, including bakery, snacks, cereals, and meat substitutes, catering to the diverse dietary preferences of consumers. Moreover, the region’s robust infrastructure, advanced food processing technologies, and stringent regulatory standards contribute to the growth of the wheat protein market by ensuring product quality, safety, and compliance.

Asia Pacific is expected to witness the fastest rate of growth in the wheat protein market during the forecast period. The region presents emerging opportunities in the market, fueled by shifting dietary habits, rising disposable incomes, and increasing health awareness among consumers. While traditionally a major consumer of rice and other grains, Asia Pacific countries are witnessing a growing demand for wheat-based products, including those fortified with wheat protein ingredients.

Additionally, the region’s large population, particularly in countries like China and India, offers a vast and untapped market for wheat protein manufacturers looking to expand their footprint. As dietary preferences evolve and consumer awareness regarding the health benefits of wheat protein increases, Asia Pacific is poised to emerge as a significant growth market for wheat protein in the coming years.

The wheat protein market has witnessed significant growth in recent years, driven by the rising demand for plant-based protein sources, increasing health consciousness among consumers, and the growing trend of veganism and vegetarianism. Wheat protein, derived from wheat grains, is a valuable source of essential amino acids, making it a popular choice for food manufacturers looking to enhance the nutritional profile of their products. It finds extensive applications across various industries, including food and beverages, dietary supplements, animal feed, cosmetics, and pharmaceuticals.

In the food and beverage industry, wheat protein is widely used as a functional ingredient in the production of meat substitutes, bakery products, snacks, and beverages. Its unique ability to improve texture, enhance moisture retention, and provide structure makes it a versatile ingredient in the formulation of plant-based alternatives to traditional animal-derived products. Additionally, wheat protein is utilized in dietary supplements for its high protein content and amino acid profile, catering to the growing demand for protein-rich supplements among fitness enthusiasts and health-conscious consumers.

The wheat protein market finds applications in the cosmetic industry for its emulsifying and film-forming properties, serving as a natural alternative to synthetic additives in skincare and haircare products. Overall, the wheat protein market is poised for continued growth, fueled by evolving consumer preferences towards healthier and sustainable dietary choices.

| Report Coverage | Details |

| Global Market Size in 2023 | USD 7.03 Billion |

| Global Market Size in 2024 | USD 7.34 Billion |

| Global Market Size by 2034 | USD 11.29 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 4.4% |

| U.S. Market Size in 2023 | USD 1.68 Billion |

| U.S. Market Size by 2034 | USD 2.75 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Product, By Form, By Concentration, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising health consciousness and demand for plant-based proteins

With increasing health consciousness among consumers globally, there’s a growing demand for plant-based protein sources like wheat protein. Consumers are increasingly adopting vegetarian, vegan, or flexitarian diets for health, ethical, and environmental reasons.

The wheat protein market offers sustainable and nutritious alternatives to animal-derived proteins, catering to this trend. Its high protein content, complete amino acid profile, and gluten-free options make it particularly appealing to health-conscious consumers seeking to meet their dietary protein needs while aligning with their lifestyle choices.

Expansion of functional food and beverage market

The functional food and beverage industry is experiencing rapid growth, driven by consumer demand for products that offer added health benefits beyond basic nutrition. Wheat protein’s functional properties include its ability to improve texture, enhance moisture retention, and provide structure, making it a valuable ingredient in the formulation of functional food and beverage products.

As manufacturers in the wheat protein market continue to innovate and develop new functional food and beverage formulations targeting specific health concerns such as weight management, digestive health, and sports nutrition, the demand for wheat protein as a key ingredient is expected to increase further, driving market growth.

Wheat protein-related allergic reactions

One significant restraint of the wheat protein market is the prevalence of gluten-related disorders, such as celiac disease and gluten sensitivity, among a segment of the population. Wheat protein naturally contains gluten, which can trigger adverse reactions in individuals with these conditions, leading to digestive discomfort, inflammation, and other health issues. As a result, the presence of gluten in wheat protein restricts its consumption among individuals with gluten-related disorders, limiting the market’s potential reach and growth.

Concerns regarding allergenicity and food intolerances associated with wheat protein consumption pose challenges for market penetration. Some consumers may be allergic to wheat or intolerant to specific wheat proteins, leading to adverse reactions upon consumption. These concerns contribute to consumer hesitancy and may deter certain demographic segments from purchasing wheat protein-based products, thus restraining the growth of the wheat protein market.

Expansion of functional food and beverage segment

One significant opportunity for growth in the wheat protein market lies in the expansion of the functional food and beverage segment. As consumers increasingly prioritize health and wellness, there is a growing demand for functional products that offer additional nutritional benefits beyond basic sustenance. Wheat protein, with its functional properties such as texture enhancement, moisture retention, and emulsification, is well-positioned to meet this demand.

Manufacturers can capitalize on this opportunity by incorporating wheat protein into a variety of functional food and beverage formulations, including protein bars, shakes, fortified snacks, and meal replacements. By promoting the health-enhancing properties of these products, companies can attract health-conscious consumers and drive sales growth in the wheat protein market.

Rising interest in clean-label and plant-based products

Another opportunity for the wheat protein market lies in the increasing consumer preference for clean-label and plant-based products. Clean label refers to products made with simple, recognizable ingredients and minimal processing, catering to consumers’ desire for transparency and naturalness in their food choices. Wheat protein, being a naturally derived ingredient, aligns well with clean-label trends and can serve as a key ingredient in clean-label food and beverage formulations.

The growing popularity of plant-based diets, driven by concerns over sustainability, animal welfare, and health, presents a significant opportunity for wheat protein manufacturers. By promoting the plant-based nature of their products and highlighting the environmental and ethical benefits of choosing plant-derived proteins over animal-based alternatives, companies can appeal to a broader consumer base and drive demand for the wheat protein market.

The wheat gluten segment dominated the wheat protein market share of 46% in 2023. Wheat gluten is a key segment in the market due to its widespread applications across various industries. It is primarily used as a functional ingredient in the food industry, where it serves as a binder, stabilizer, and texturizer in a wide range of products such as bread, pasta, baked goods, and meat analogs. Additionally, wheat gluten finds extensive use in the production of vegetarian and vegan meat substitutes, where it helps improve texture and mouthfeel, making it a popular choice among manufacturers looking to cater to the growing demand for plant-based protein alternatives.

The hydrolyzed wheat protein segment is observed to witness the fastest rate of expansion during the forecast period. Hydrolyzed wheat protein is another important segment in the wheat protein market, valued for its unique functional properties and versatility. It is produced by enzymatic hydrolysis of wheat protein, resulting in smaller peptide fragments that offer enhanced solubility and bioavailability compared to intact proteins. Hydrolyzed wheat protein finds widespread applications in the food, beverage, cosmetic, and pharmaceutical industries, where it is used as a flavor enhancer, emulsifier, and nutrient supplement. Its ability to improve texture, enhance moisture retention, and provide nutritional benefits makes it a valuable ingredient in a variety of consumer products, driving demand and market growth.

The dry segment of form led the market with the largest share in 2023 in the wheat protein market. Dry wheat protein aligns with consumer preferences for clean label and natural ingredients. Many dry wheat protein products are minimally processed and free from additives, appealing to health-conscious consumers seeking wholesome and transparent food options. Dry wheat protein is easier to handle and process during manufacturing compared to liquid forms. Its powdered or granular form allows for precise measurement and uniform dispersion within formulations, contributing to consistent product quality and texture.

The wheat protein market was dominated by the 75% concentration segment in 2023. The rising demand for 75% concentrated wheat protein in the nutraceutical sector is observed to create a significant driver for the segment. The 75% concentrated wheat protein materials are less expensive than other forms, this makes it even more cost-effective for product development. This is observed to promote the segment’s expansion in the upcoming period.

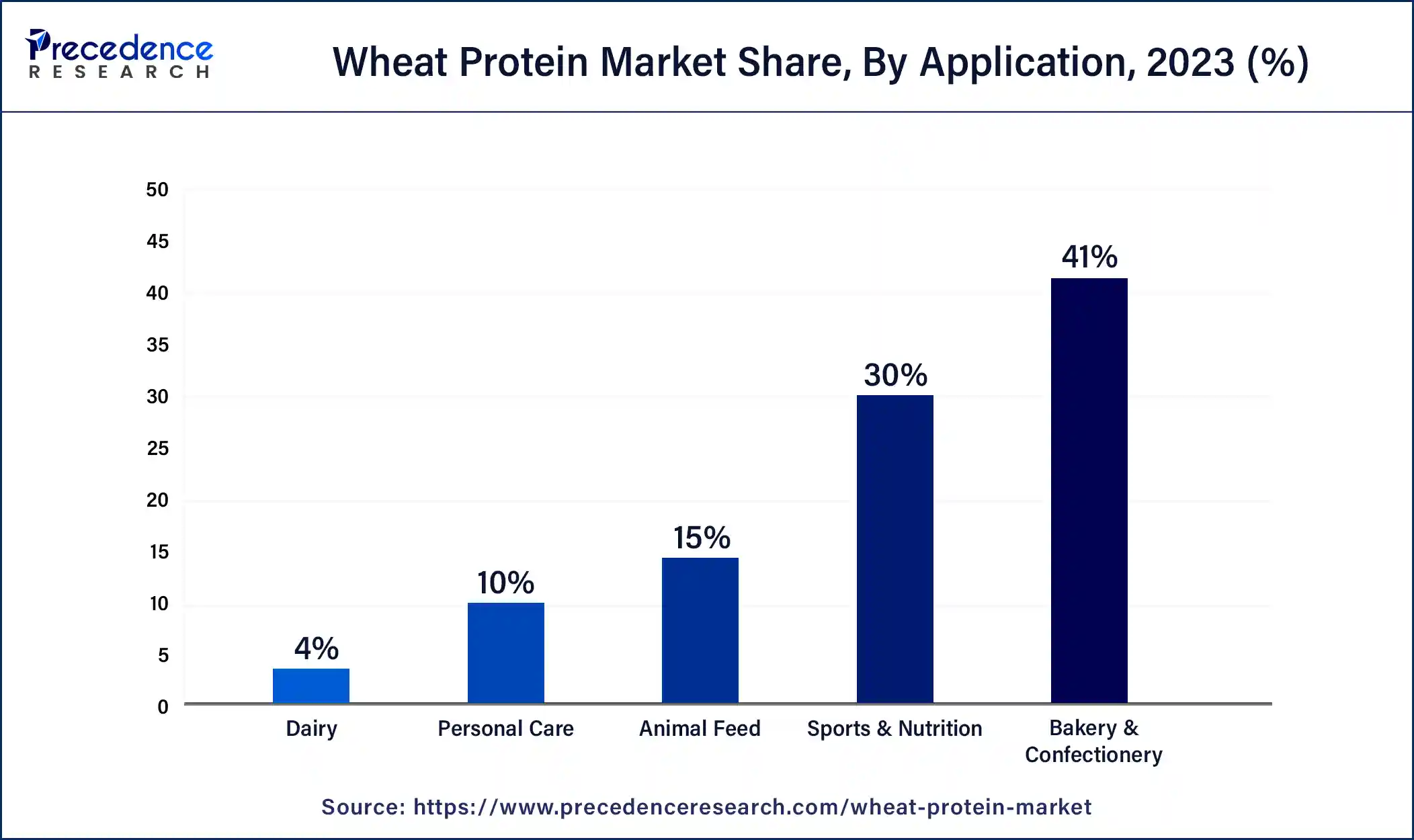

The bakery & confectionery segment accounted for the largest market share of 41% in 2023. This dominance in the wheat protein market is due to the widespread use of plant protein ingredients in these product categories. Wheat protein, particularly wheat gluten, serves as a vital component in bakery formulations, contributing to dough elasticity, structure, and volume in bread, cakes, pastries, and other baked goods. Additionally, hydrolyzed wheat protein is utilized as a functional ingredient in confectionery products, enhancing texture, mouthfeel, and shelf life. With the growing consumer demand for healthier and plant-based bakery and confectionery options, the use of wheat protein ingredients is expected to continue to expand in this segment.

The dairy segment is expected to show significant growth in the wheat protein market during the forecast period. The increasing demand for dairy alternatives and fortified dairy products drives this segment. Wheat protein, particularly hydrolyzed wheat protein, is utilized in the formulation of dairy analogs such as plant-based milk, yogurt, cheese, and ice cream. It serves as a functional ingredient, providing emulsification, texture enhancement, and nutritional fortification to dairy alternatives. As consumers seek plant-based protein options and lactose-free alternatives, the demand for wheat protein in the dairy segment is expected to rise, driving innovation and market growth in this category.

Segments Covered in the Report

By Product

By Form

By Concentration

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024

April 2025

August 2024

December 2024