List of Contents

What is the Zero-Emission Aircraft Market Size?

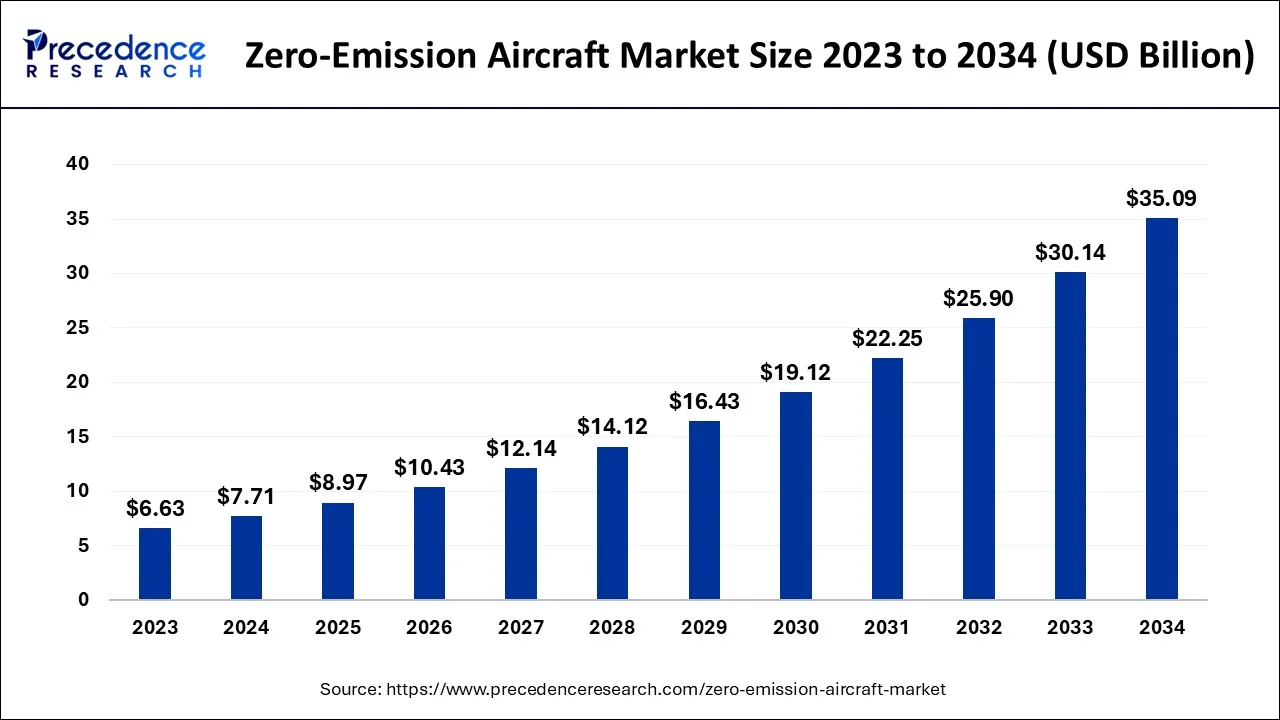

The global zero-emission aircraft market size is valued at USD 8.97 billion in 2025 and is predicted to increase from USD 10.43 billion in 2026 to approximately USD 35.09 billion by 2034, expanding at a CAGR of 16.36% from 2025 to 2034.

Zero-Emission Aircraft Market Key Takeaways

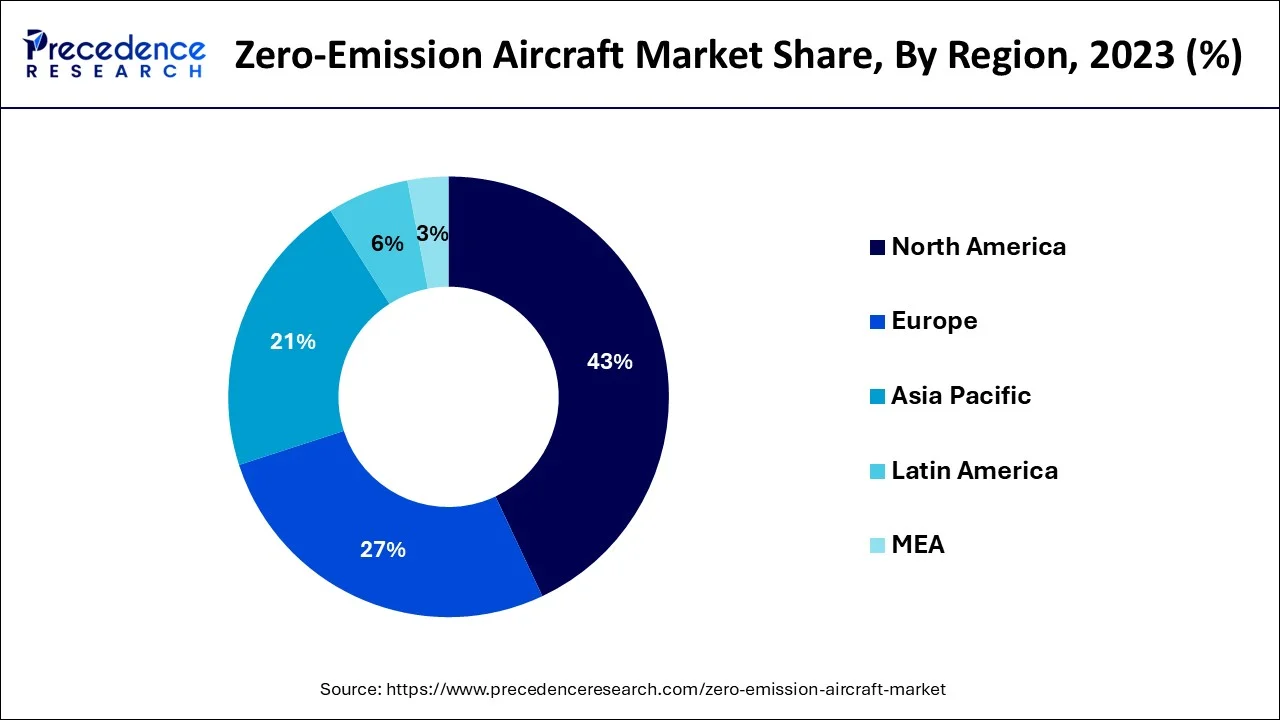

- North America dominated the zero-emission market with the largest share of 43% in 2024.

- Asia-Pacific region will grow at the highest CAGR from 2025 to 2034.

- By type, the turbofan system segment is expected to hit remarkable growth between 2025 to 2034.

- By range type, the short-haul segment had the largest market share in 2025.

Market Overview

Traditional airplanes, which contribute significantly to the release of carbon dioxide from the combustion of enormous amounts of aviation fuel, significantly influence the levels of many other chemicals and contaminants in the environment. Sulfur particle releases, freshwater chemtrails, and lengthy increases in ozone concentrations are all caused by the discharge of these dangerous chemicals. These contaminants' emissions have a big global warming effect. These impact possible prompt attention from the representatives of the aviation sector (Boeing, Airbus) toward switching to alternative energy (hydrocarbons or rechargeable batteries); from the government agencies to start creating regulatory requirements to monitor the gases generated by current aircraft, and from the initiatives to foster the impending introduction of fuel airframe.

Governments all around the world are preparing paper maps to limit emissions generated by gasoline aviation effort to control increasing levels of CO2 as well as other toxic pollutants from existing industrial aviation. For example, nations including South Korea, France, the United States, and Germany had created planning again to switch to aviation powered by electricity or protons. Additionally, numerous businesses worldwide are developing airplanes using solar energy, hydrocarbons, battery, and electric drivetrains (electric and hydrocarbons). Within a few decades, seamless metropolitan transport will be available thanks to systems like a jet (for example, CityHawk from Urban Aviation) and negligible jets powered by these sources of energy. The introduction of these jets can pave the way for new sustainable alternative opportunities while reducing our fossil fuel dependence throughout time.

Zero-Emission Aircraft Market Outlook

- Industry Growth Overview: From 2025 to 2034, the zero-emission aircraft market is projected to expand quickly. This growth is driven by stricter environmental regulations, increased air traffic, volatile fuel prices, and the global movement toward sustainable transportation. Major high-growth segments include urban air mobility (UAM) and regional short-haul flights with electric and hydrogen-powered aircraft.

- Major Trends: Key trends include the development of hydrogen propulsion systems for longer-range flights and advancements in high-energy-density batteries for electric aircraft. The industry is also investing heavily in sustainable aviation fuels (SAF) as an immediate solution for existing fleets.

- Global Expansion:The market is expanding worldwide, with particular emphasis on Asia-Pacific, driven by large-scale hydrogen investments and rapid infrastructure development. There is a significant potential for market expansion across the world due to the growing aerospace industry and supportive R&D funding.

- Major Investors:Private equity, venture capital, and strategic investors are actively funding the sector, drawn by significant government support and the long-term potential for high-impact solutions. Major players like Airbus and Boeing, along with investors such as Bill Gates' Breakthrough Energy Ventures and the Amazon Climate Pledge Fund, are channeling substantial R&D capital.

- Startup Ecosystem:The startup ecosystem is maturing with a focus on disruptive technologies such as hydrogen-electric powertrains and eVTOL (electric vertical takeoff and landing) designs. Emerging firms like ZeroAvia and Heart Aerospace are attracting significant VC funding by demonstrating scalable, certifiable solutions for regional and urban air mobility applications.

Zero-Emission Aircraft Market Growth factors

Owing to traveling limitations, this COVID-19 epidemic impacted the corporate and commercial aircraft markets. Additionally, it affected the effect on wages, which led to some aircraft businesses pausing funding for creative initiatives. Such choices have momentarily slowed the market expansion for relatively low airplanes. But throughout the projection timeframe, there is going to be a considerable increase in spending, development, and acceptance of all aviation while airline companies try to cut their operating emissions and costs. Businesses have shifted to a negligible strategy as a result of stringent emissions requirements. For the transport sector to transition towards the paradigm shift, motor makers would be crucial. Since the fact that firms including Boeing and Airplane aim to operate all of their flights using sustainable jet fuel. SAF also serves as a significant component of an aircraft company's reduction of CO2 emissions strategy.

An aircraft company's shift would necessitate changes to the legislative and technical environments in addition to technological hurdles. To reduce construction and operating costs, merger cooperation would be necessary. This will be advantageous to both parties and hasten the construction of a zero-emission jet. The light aircraft industry has been impacted by aircraft engines. Therefore, despite significant advancements anticipated during the second half of such a projected timeframe, their implementation in lengthy passenger airliners remains a considerable distance from being actuality anytime shortly the near future.

- Government-led decarbonisation targets and subsidy schemes.

- Expansion of EV manufacturing and public transport electrification.

- Adoption of clean hydrogen and offshore wind technologies.

- Public-private partnerships and global collaborations for R&D.

Market Trends

The zero-emission market is experiencing a rapid transformation as governments and consumers collectively strive towards a carbon-neutral future. This shift is driven by growing environmental awareness, strict regulatory frameworks, and innovation in clean technologies. From electric vehicles (EVs) and hydrogen fuel cells to renewable energy integrations and low-emission industrial solutions, the market is embracing sustainable alternatives at an accelerated pace. Electrification of transport and clean energy generation now serve as the cornerstones of decarbonization strategies across key industries, with increasing investment flowing into R&D, infrastructure development, and green partnerships.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 35.09 Billion |

| Market Size in 2026 | USD 10.43 Billion |

| Market Size in 2025 | USD 8.97 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 16.36% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Source, Range, Application, Type, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Source Insights

Due to their low overhead expenses, lack of carbon dioxide emissions, and their ability to run on renewable energy sources such as sunlight and hydrocarbons fuel, lower aviation has great potential. Technicians must develop novel methods to address important difficulties linked to the mass to-power proportions associated with power jets, the reduced renewable radiation collected by solar panels hung on such a solar aircraft, and thus the poor stability of hydrocarbons, even though they are receiving enormous funding from governments and organizations around the globe. The elevation at which the sunlight strikes the photovoltaic power of solar aviation is incredibly erratic because the sunlight and also the jet are constantly moving through the environment. This is one reason why photovoltaic arrays don't gather a large amount of energy.

Today, approximately 10 to 20 percent of thermal light is captured by energy from the sun aircraft. Additionally, because renewables airplanes have vast longer arms with delicate, illumination photovoltaic cells, planes are very vulnerable to strong winds. The lack of a high-density battery represents one of the main problems concerning aircraft engines. Whereas commonly produced battery packs get a power density just at cellular levels of about 250 Wh/kg, aviation fuel has had a power density of roughly 12,000 Wh/kg. Just at the packing stage, energy content is typically 20% lower. Additionally, higher voltages are needed for electrical propulsion systems to reduce the size & weight of the system that distributes power.

The electrochemical method, which separates h2 and o2 molecules in liquid by running strong alternating energy through it, was typically used to remove protons (in gas form) from water. Due to the significant power costs involved, electrolytic is a somewhat pricey operation. The bulk & size demands for gas, in addition to energy storage and handling on board aircraft, provide difficulties for engineers. When compared to older kerosene-fueled aviation, hydrogen-fueled aircraft must carry a significantly greater amount of fuel because of the superior quantity characteristic of hydrogen. This increases air drags, therefore, reducing the plane's effectiveness.

Range Insights

During the projection timeframe, this medium-haul segment is anticipated to outperform others concerning revenue annual growth. The medium-distance flight that is continuous or straightforward about six hours fewer. As sunlight and electrical energy can able to travel fewer miles, a medium-haul could be advantageous in zero carbon aviation. As just a reason, using photovoltaic and electromagnetic power sources in medium-haul aviation won't cause pollution, which boosts the effectiveness of the jet.

As opposed to sustainable alternative fuels and aviation fuel, utilizing liquid hydrogen, electrical generation, and renewable power as a resource to electricity lowest airplanes would result in a significant decrease in greenhouse fume pollutants. There seem to be 2 techniques through which they can utilize protons as just a source of power. And with gasoline powering, only one air pollutants out from flight are liquid water, which is a consequence of both the process of generating energy. This development of this kind of minimal aviation is anticipated to lead to healthier, cleaner, and more operational processes for both the airline and aerospace industry in the future. In such a related manner, airplanes powered by a rechargeable battery and renewable power are also carbon-free in origin. Rising laws addressing the emission of hazardous pollutants by airplanes are the primary driver of an expansion in Investment in R&D towards identifying other sources of energy for aviation.

The U.S. Department of the Environment, for example, published their rulemaking on greenhouse effect emission regulations for large wind flights operated for corporate & commercial aircraft companies in Dec 2020. The EPA views this legislation as significant and anticipates that it will serve as a benchmark for aviation Gas (GHG) emissions. Additionally, the European Union is working with other nations to initiate policies with a worldwide reach to minimize pollution related to air transport in Europe. This same suggestion will form a component of an extensive European Green Agreement and is scheduled for release in the second half of 2021. Additionally, the Worldwide Civil Aviation Organization has predicted that global aircraft pollutants would triple before 2050 relative to 2015 levels. Even during the anticipated period, these variables are anticipated to accelerate the advancement of negligible aircraft innovations.

Application Insights

Based on the World Civil Aviation Organization Institution's monthly figures for the entire world, there were passengers transported on regular flights during 2019 an increase in percent from the year before. The Developing world saw the largest passenger numbers. The International Air Travel Association reported in October 2018 stated recent trends in aviation suggest that the number of passengers may double. Even though previously, in May 2021, the Worldwide Air Transport Association mentioned that now the scheduled international passenger numbers are anticipated to restore almost to 88 percent of which was before stages all through 2022, and therefore is predicted to surpass this amount throughout 2024, the COVID-19 global epidemic caused a significant decline in air transport statistics. This shows that there is a large market for air transport worldwide.

According to the numbers presented previously, global aviation traffic volumes have increased over time. Petroleum, a diesel generator, powers the current fleet of airplanes, and so as airline passenger numbers have increased, so has jet fuel usage. This necessitates the research for alternate sources of energy for operating the young leaders of airplanes, including such energy and gas. Because of its remarkable characteristics as such a power source for use in aircraft including its low environmental impact, lightweight, universal availability, and safety hydrogen is ideal jet fuel.

Airplanes driven by energy or batteries are near silent than those fueled by fuel, cost very little to build and operate and provide faster, better enjoyable flights. Because gasoline and rechargeable batteries aircraft don't produce carbon pollution, using these techniques can be advantageous for both the aviation sector and the ecology. Consequently, it is projected that throughout the projection period, an increase in air passengers will fuel the demand for negligible aviation.

Type Insights

Due to the continuing development of commercial airplane operations, the turbofan sector is expected to represent again for three biggest income shares during the projection timeframe. Turbofans are utilized in corporate commercial airliners because they weigh less than transport aircraft and can therefore travel at incredible velocities.

In contrast, the plane's turbofan is superior to certain other motors for operating with a great inclination, produces less pollution than some other motors, and therefore is inexpensive, making it perfect for a long journey. Additionally, due to their great reliability and fuel efficiency, turbofans are found in the majority of commercial airliners.

Regional Insights

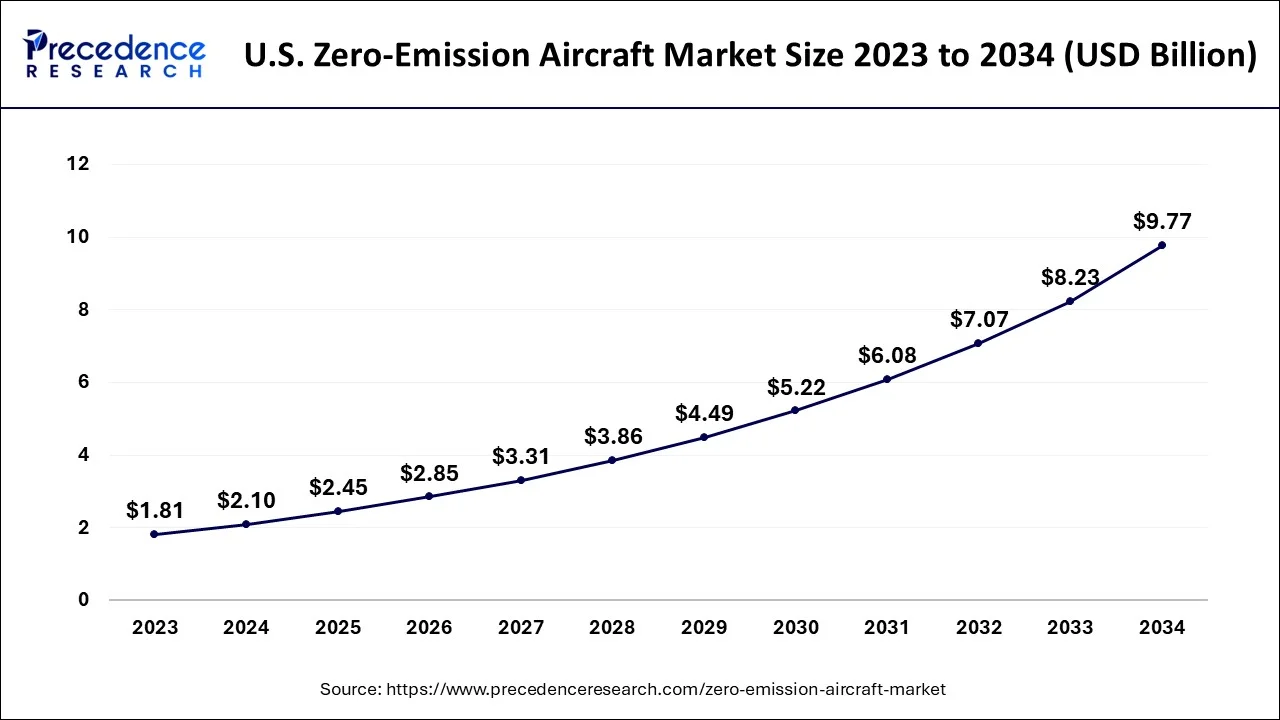

U.S. Zero-Emission Aircraft Market Size and Growth 2025 to 2034

The U.S. zero-emission aircraft market size is evaluated at USD 2.45 billion in 2025 and is predicted to be worth around USD 9.77 billion by 2034, rising at a CAGR of 16.62% from 2025 to 2034.

The aerospace industries are developed in North America and Europe. Owing to their closeness to significant aviation OEMs, those areas are home to several number of aerospace businesses. The development of both the market for negligible aviation will be aided by the participation of industry heavyweights like Airbus, NASA, Rolls Royce, Boeing, and many others. The United States and Eu were home to more than a 90percent of businesses developing the negligible idea. Several proposals for negligible commercial airliners that would be in operation before 2035 were unveiled by Airbus in Sept 2020. Those ideas all depend on helium as their main source of electricity. Previously, Wraps disclosed its intention to spend £80 million in the coming ten years on technologies for energy storage.

What Factors Support North America's Dominance in the Zero-Emission Aircraft Market?

North America continues to dominate the zero-emission market, owing to aggressive policy reforms, large-scale funding, and active industrial participation. The United States has launched comprehensive initiatives like the Inflation Reduction Act, which offers substantial incentives for clean energy and electric vehicles. The Environmental Protection Agency (EPA) has tightened vehicle emission norms, pushing automakers toward zero-emission fleets. Canada, similarly, is targeting net-zero emissions by 2050 and has pledged billions in clean tech investment. Its Incentives for Zero-Emission Vehicles (iZEV) programme and clean hydrogen strategy are notable government efforts.

Key contributing countries in North America include the United States with spearheading EV infrastructure expansion and climate-friendly legislation, and Canada is promoting clean hydrogen, green transit, and net-zero industrial processes. Together, these countries form a powerful triad, accelerating the region's leadership in green innovation and policy advocacy.

What Makes Asia Pacific the Fastest-Growing Area?

Asia-Pacific is emerging as the fastest-growing region in the zero-emission market, propelled by rapid industrialization, urbanization, and government mandates targeting climate resilience. Countries like China, Japan, South Korea, India, and Australia are actively scaling up zero-emission mobility, renewable energy capacities, and clean industrial operations. For instance, China's dominance in electric vehicle EV manufacturing and battery supply chains, Japan's innovation in hydrogen fuel cell technology, and India's focus on solar and green mobility missions are fueling regional growth.

India Zero-Emission Aircraft Market Trends

India is emerging as a key player in the global zero-emission aircraft market, especially in the development and adoption of Sustainable Aviation Fuel (SAF). Leveraging its extensive agricultural resources, India plans to become a major producer and exporter of SAF, aligning with its Atmanirbhar Bharat initiative for self-reliance. The government is rolling out a national policy that sets SAF blending targets for international flights, while domestic airlines and oil companies are working together on research, production, and demonstration flights.

How is the Opportunistic Rise of Europe in the Zero-Emission Aircraft Market?

Europe is experiencing notable growth in the market, mainly driven by strict environmental regulations, bold decarbonization targets, and a strong research and development ecosystem. The region acts as an innovation hub, with major manufacturers like Airbus and Rolls-Royce, as well as many startups such as Lilium, Heart Aerospace, and ZeroAvia, heavily investing in electric and hydrogen-powered aircraft for short- and medium-haul flights. Robust government incentives, R&D funding, and collaborative efforts among industry players and research institutions further boost this growth.

Germany Zero-Emission Aircraft Market Trends

Germany holds a leading position in the European zero-emission aircraft market, leveraging its strong engineering and manufacturing capabilities, as well as the presence of major aerospace companies and suppliers. The country plays an important role in advancing both hydrogen fuel cell and eVTOL technologies, with companies like Lilium developing electric jets and Airbus testing hydrogen fuel cell platforms. The German government actively supports the industry through R&D initiatives, demonstrating the nation's commitment to broader EU climate objectives.

What Potentiates the Growth of the Latin America Zero-Emission Aircraft Market?

The market in Latin America is increasingly driven by a focus on environmental sustainability and the need to control air pollution. While the region continues to expand traditional air travel connectivity, countries such as Brazil, Chile, and Mexico are starting to invest in research and development of sustainable aviation technologies. The near-term priority is mainly on developing and adopting SAF, using abundant feedstocks like sugarcane and palm oil to meet net-zero goals. Initial efforts in zero-emission propulsion are likely to target short-haul and regional routes.

Brazil Zero-Emission Aircraft Market Trends

Brazil emerges as a key player in the Latin American zero-emission aviation market, mainly due to its strong domestic aerospace industry, led by companies like Embraer, and its significant capacity for SAF production from existing ethanol infrastructure. The national strategy focuses on using SAF for domestic flights, with any surplus potentially allocated to international aviation. Besides biofuels, Brazilian companies are exploring advanced air mobility solutions, with Embraer forming partnerships to develop electric vertical takeoff and landing (eVTOL) aircraft for urban transportation.

How Big is the Opportunity for the Zero-Emission Aircraft Market in the Middle East and Africa?

The Middle East & Africa region is emerging as a significant, though still nascent, market for zero-emission aviation, driven by alignment with global sustainability goals and efforts to diversify economies away from fossil fuels. Current strategies focus on adopting sustainable aviation fuels (SAF) and improving fleet efficiency through modern, fuel-efficient aircraft. Governments and private companies are investing in local bio-refineries and e-fuel production to build sustainable supply chains, paving the way for future adoption of advanced technologies such as electric and hydrogen-powered aircraft for regional connectivity.

Saudi Arabia Zero-Emission Aircraft Market Trends

Saudi Arabia's approach to zero-emission aviation plays a key role in its ambitious Vision 2030 and Saudi Green Initiative. This plan includes investing in highly fuel-efficient aircraft like the A321neo and Boeing 787 Dreamliner while also leading the development of zero-emission solutions. A major part of this effort is the partnership between the national carrier Saudia and German startup Lilium, which intends to purchase up to 100 eVTOL jets to create a zero-emission air taxi service that promotes sustainable tourism.

Value Chain Analysis

- Raw Material & Energy Supply

Securing green electricity and producing green/blue hydrogen are the first steps.

Key Players: Air Liquide, ACWA Power, and H2 Green Steel. - Research and Development (R&D) & Component Design

Focuses on creating core technologies like advanced batteries, fuel cells, electric motors, and lightweight materials.

Key Players: Airbus, Boeing, ZeroAvia and Heart Aerospace.

Manufacturing and Production

Involves large-scale production and assembly of aircraft components and the final aircraft, requiring high aerospace quality standards.

Key Players: Airbus, Boeing, Heart Aerospace and Rolls-Royce. - Certification and Regulation

New aircraft must undergo rigorous testing and secure approval from aviation authorities like the FAA and EASA.

Key Players: ZeroAvia, Federal Aviation Administration (FAA), European Union Aviation Safety Agency (EASA). - Distribution, Sales, and Operations

Involves selling or leasing aircraft to airlines and operating flights, requiring new charging/refueling infrastructure at airports.

Key Players: Commercial and cargo airlines, urban air mobility services, and airports investing in new infrastructure. - Maintenance, Repair, and Overhaul (MRO) & End-of-Life

Covers fleet support, maintenance, and eventually, recycling of components like batteries.

Key Players: Lufthansa Technik AG, GE Aviation, Airbus.

Zero-Emission Aircraft Market Companies

- AeroDelft – Develops electric aircraft prototypes and sustainable aviation technologies for urban and regional air mobility.

- Airbus S.A.S. – Designs hydrogen-powered and electric aircraft concepts, including the ZEROe project for zero-emission commercial aviation.

- Blue Origin Federation, LLC– Focuses on aerospace innovation and propulsion technologies that support sustainable aerospace systems.

- Boeing Aerospace(NYSE: BA) – Invests in electric and hybrid-electric propulsion research and sustainable aviation fuel integration for aircraft.

- Bye Aerospace – Develops all-electric and hybrid-electric aircraft for training and regional transport applications.

- Eviation Aircraft – Manufactures the fully electric Alice aircraft for regional passenger transport with zero operational emissions.

- HES Energy Systems – Provides advanced energy storage and electric propulsion systems for zero-emission aircraft applications.

- Joby Aviation– Designs electric vertical takeoff and landing (eVTOL) aircraft for urban air mobility with zero-emission propulsion.

- Lilium– Develops eVTOL jets powered entirely by electric batteries for sustainable urban and regional air transport.

- Lockheed Martin Corporation(NYSE: LMT) – Explores hybrid-electric and electric propulsion technologies for military and commercial aviation.

- Northrop Grumman Corporation (NYSE: NOC) – Develops advanced aerospace systems, including electric and hybrid propulsion technologies for aircraft.

- Pipistrel d.o.o– Produces light electric aircraft for training, leisure, and regional transport with zero-emission operation.

- Reaction Engines – Innovates in advanced propulsion systems, including environmentally friendly engines for aerospace applications.

- Rolls-Royce Holdings PLC– Develops electric, hybrid, and hydrogen-powered propulsion systems for commercial and regional aircraft.

- SpaceX Aerospace Company– Focuses on next-generation aerospace technologies with potential applications for sustainable propulsion and fuel efficiency.

- Thales SA– Designs avionics and energy management systems to optimize electric and hybrid-electric aircraft performance.

- Wright Electric– Develops fully electric commercial aircraft for short-haul routes to reduce carbon emissions.

- ZeroAvia, Inc. – Specializes in hydrogen-electric powertrain solutions for zero-emission regional aircraft.

Recent Developments

- In May 2025, multiple significant developments signalled the continued momentum in the zero-emission market. A leading electric vehicle manufacturer announced the launch of a next-gen solid-state battery EV, offering extended range and zero emissions, set to redefine urban mobility standards.

- 18 March 2021, the initial in-flight pollution investigation of broad industrial passenger jetsbroad industrial passenger jets utilizing only sustainability jet fuel has been started by a group of aviation experts. Together, Siemens and German research center Rolls-Royce, DLR, and SAF manufacturer Neste have launched the ground-breaking "Emissionsth and Environmental Effect of Alternative Energy sources" (ECLIF3) research, which examines how 100percentage SAF impacts airplane pollutants & productivity.

- This one will allow the firm to develop chances in commercial and collaboration with facilities, aircraft producers, and aircraft, inside the Netherland & larger European Union. With this new invention, ZeroAvia can further the advancement of fuel cells with hydrogen rocket technology.

- Rolls-Royce will launch some all aircraft with a record-breaking goal performance of 300+ MPH On April 19, 2021.

- Opportunities for both existing companies as well as those looking to break into the sector have been addressed by Visiongain.

- Airbus Helicopters flew a comprehensive prototype of its electrified aircraft in July 2021. The cross design of CityAirbus includes four ducting elevated motor engines. To provide a minimal sound impact, its 8 shafts are propelled by electric engines rotating at about 950 rpm.

- Beta Technologies accomplished the 205-mile-long highest manned test launch of their Alia jet in Jul 2021. (330 kilometers). Merely 3 of Alia's 5 rechargeable batteries were being used when the device was in airplane mode.

Segments are covered in the report

By Source

- Hydrogen

- Electric

- Solar

By Range

- Short-Haul

- Medium-Haul

- Long-Haul

By Application

- Passenger Aircraft

- Cargo Aircraft

By Type

- Turboprop Rear Bulkhead

- Turbofan System

- Blended Wing Body

By Region

- North America

- Latin America

- Europe

- Asia-pacific

- Middle and East Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client