March 2025

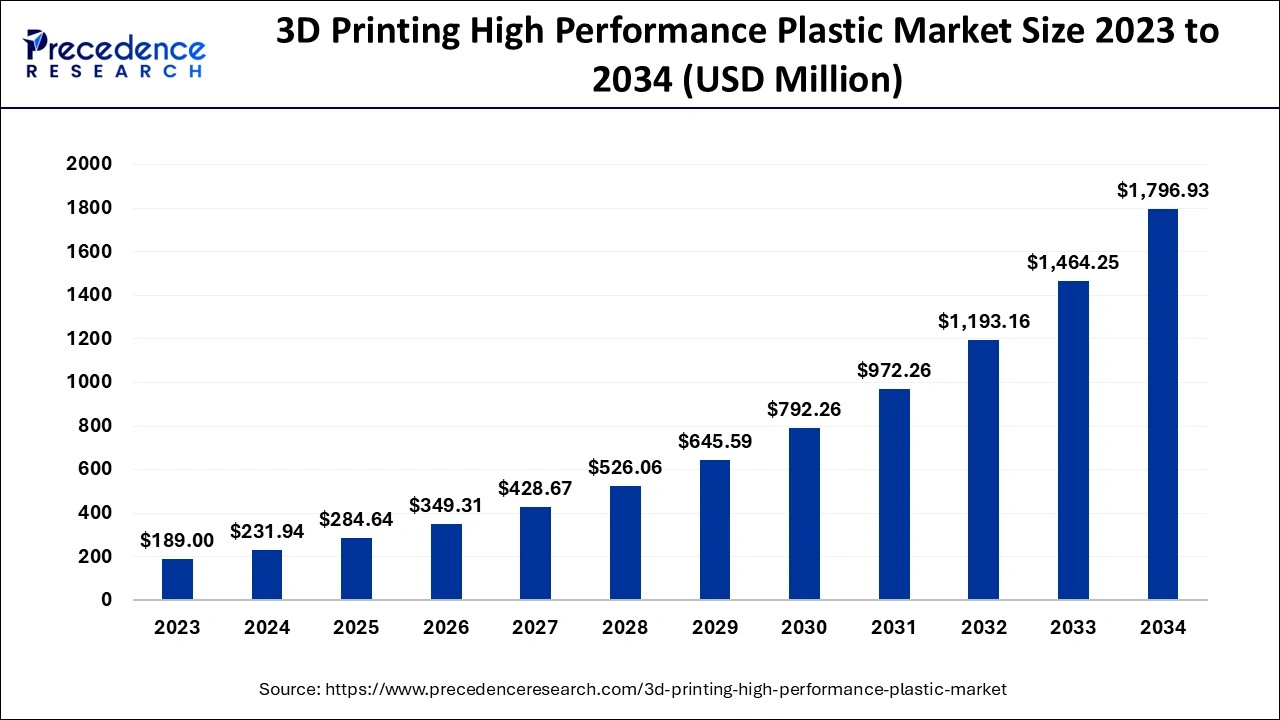

The global 3D printing high performance plastic market size is calculated at USD 231.94 million in 2024, grew to USD 284.64 million in 2025 and is anticipated to reach around USD 1,796.93 million by 2034. The market is expanding at a healthy CAGR of 22.72% between 2024 and 2034. The North America 3D printing high performance plastic market size is evaluated at USD 97.41 million in 2024 and is expected to grow at a CAGR of 22.85% during the forecast year.

The global 3D printing high performance plastic market size accounted for USD 231.94 million in 2024 and is expected to exceed around USD 1,796.93 million by 2034, growing at a double-digit CAGR of 22.72% from 2024 to 2034. The high demand for high performance 3D printing is fast growing due to the improvement in technology, the development of new materials, and the popularity of the market across various industries such as aerospace, automotive, and healthcare.

Artificial Intelligence (AI) processes establish and monitor patterns and variables of previous data and current data to complete manufacturing tasks more efficiently with increased productivity in the 3D printing high performance plastic market. Artificial intelligence is improving 3D printing technology in areas such as designs and manufacturing procedures. Generative design allows the creation of complex forms that have been difficult to construct using conventional processes due to the availability of AI-enhanced design options. These tools rely on artificial intelligence to efficiently use the material while still providing for the sturdiness of the parts that make up the structure.

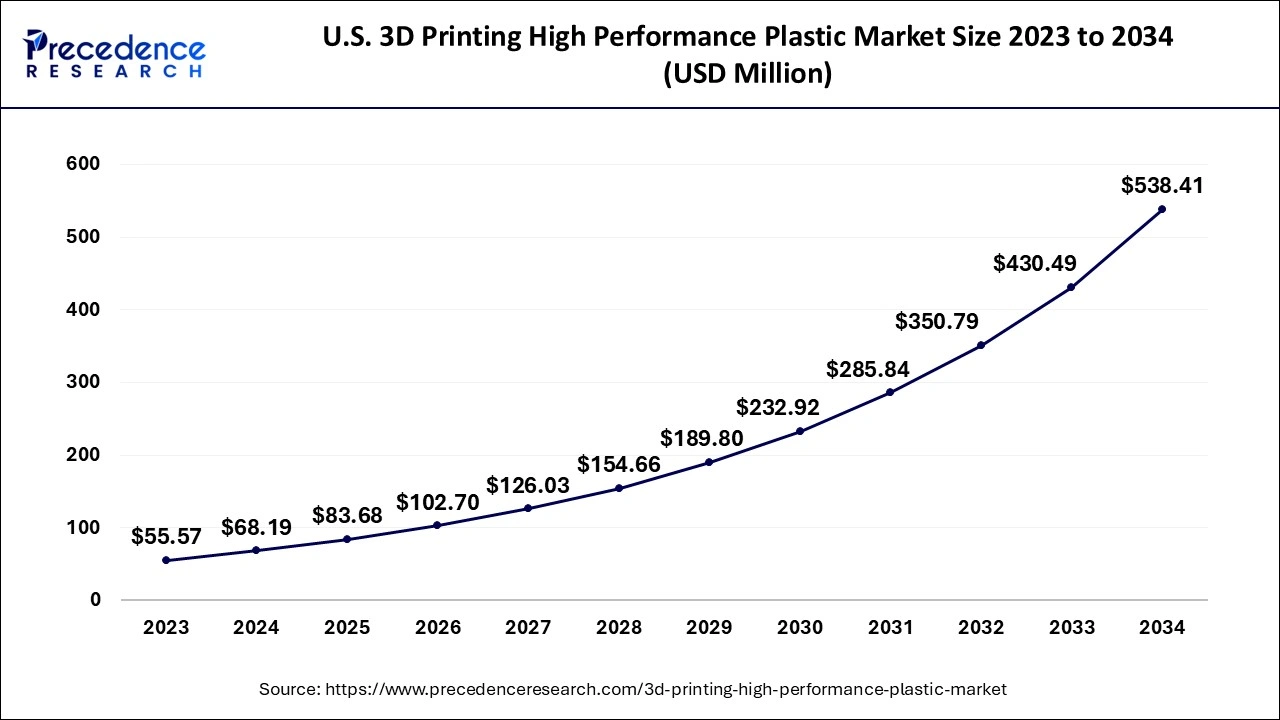

The U.S. 3D printing high performance plastic market size is exhibited at USD 68.19 million in 2024 and is projected to be worth around USD 538.41 million by 2034, growing at a CAGR of 22.93% from 2024 to 2034.

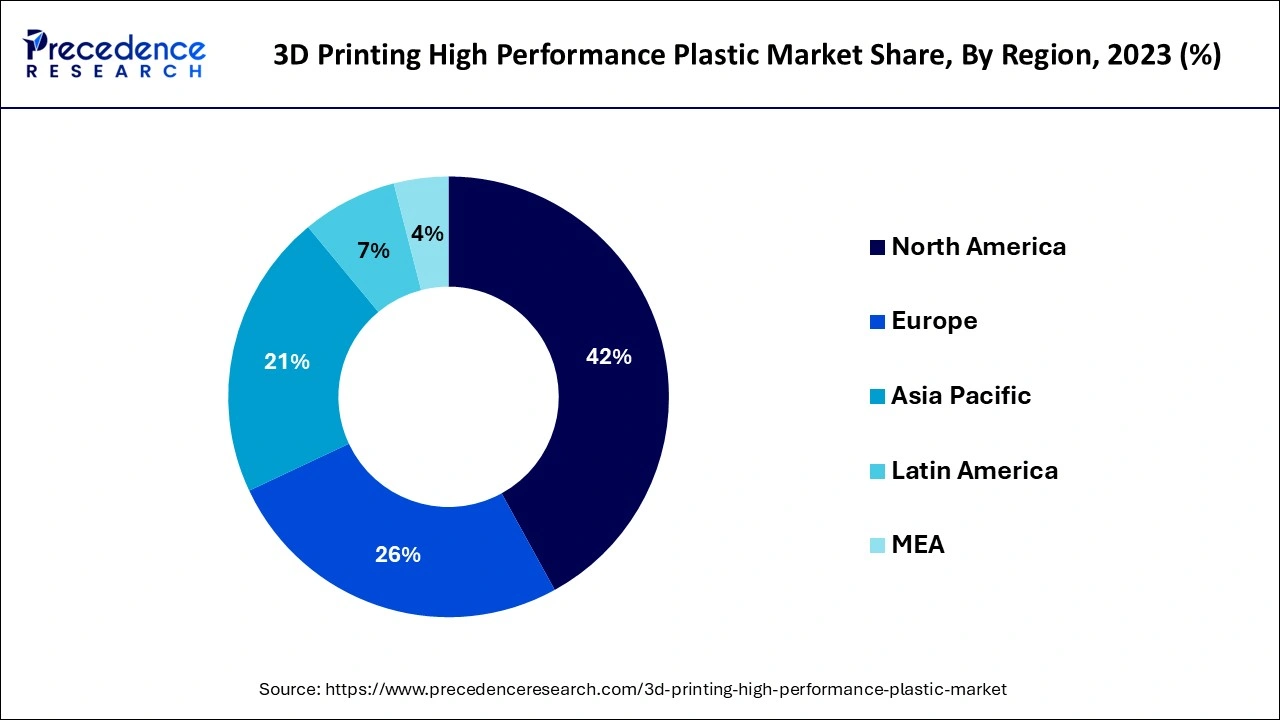

North America led the global 3D printing high performance plastic market in 2023. The region constitutes large industries, including aerospace, automotive, and source sectors, the industries where high-performance materials like titanium, Inconel, and PEEK are implemented. North America continues to be ahead of this growing market with perfect and stable infrastructure to enhance the scalability of key industries. Also, North America is the most advanced in research and development, with a high investment in innovation and manufacturing proficiency, which accelerates the use of high-performance 3D printing materials.

Asia Pacific is anticipated to grow notably the 3D printing high performance plastic market during the forecast period. The Asia Pacific market is on the rise, as are improvements in technology and growth in the manufacturing industries. Some of the drivers are cutting down material expenses in a product and the further enhancement in a procedure that is well made for 3D printing plastics good for the automotive, aerospace, and healthcare industries.

Currently, China, India, and Japan are the most active nations in adopting the 3D printing high performance plastic market technologies. While. India is looking forward to this technology to enhance its manufacturing effectiveness in the global market. They include active government engagement through launching the campaign, namely Made in India.

3D printing plastic materials, commonly known as additive manufacturing materials, are used to create components and functional parts with superior performance in numerous industries. 3D printing is a material with specific mechanical characteristics for the application of high-quality part material in unique and specific end uses. These can be polymers, metals, or technical ceramics. In 3D printing, high-performance materials could be incorporated to make hard structures, especially with low-performance materials.

The 3D printing high performance plastic market has been growing rapidly because of its rising use in the aerospace, automotive, medical, and electronics sectors. These materials provide enhanced mechanical features including increased strength, thermal stability, and endurance, and are significant to manufacture components that can function in high-performance devices.

| Report Coverage | Details |

| Market Size by 2034 | USD 1,796.93 Million |

| Market Size in 2024 | USD 231.94 Million |

| Market Size in 2025 | USD 284.64 Million |

| Market Growth Rate from 2024 to 2034 | CAGR of 22.72% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Form, Application, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, and Africa |

Application in diverse sectors of the industry

Industrial 3D printing has evolved to offer significant value to various business fields. Such benefits include conserved material usage, minimized cost, and speed increase in production. It also allows designers and engineers to create everything from tooling like jigs and fixtures to visualization tools. These trends have been nurturing the 3D printing high performance plastic market, especially in different industries, including the consumer goods value chain. The medical industry also exploits the capabilities of additive manufacturing for several reasons. Medical devices like prosthetics, implants, or medical aids may also be developed according to the patient's needs. There was a growing interest in 3D printing in different fields. They have several advantages this unique technology has for architecture, automotive, construction, engineering, and industrial design.

High initial investments

High initial investments are perceived to be the most substantial limitation for the embracing of this technology. It was recognized that high-performance plastics have unique cooling requirements and high melting temperatures which in some cases may need special equipment and temperature management. This can cause increased rates for maintenance, training, and costly quality control. Compared to the earlier traditional prints, the 3-dimensional system needs capital and resources to be put in place to make the entire production, making the whole process costly.

Automotive industries shift towards lightweight material

3D printing deals with the capacity to produce lightweight parts with complex geometries that traditional manufacturing methods. This capability is very important in the development of cars for high performance, where weight is a sensitive factor. The automotive industry is continually demanding to lessen the overall weight of its parts and designs. 3D printers enhance this strength by creating light materials, such as engineered plastics and composite materials. This implies that there will be a caliber that decreases vehicle weight, a better fuel economy, and relatively less greenhouse gas emissions.

The PEEK & PEKK segment accounted for the biggest share of the 3D printing high performance plastic market in 2023. Both PEEK and PEKK, through 3-D printing, are applied in medical fields, the aircraft industry, automobiles and energy industries, and the like. It also has a chemical-proof nature because it does not respond to water and other severe conditions like high temperatures. These are applied in healthcare & medical centers, the automotive industry, the aircraft engine area, and the oil & gas.

The polyamide/nylon segment is expected to witness significant growth in the 3D printing high performance plastic market during the forecast period. This polyamide is synthesized from lactic acid derived from the fermentation of carbohydrate feedstock, including sugar cane and starch. PLA is used most frequently when practicing FDM technology of 3D printing. It is also a thermoplastic element that can be melted and remolded over and over again. It also exhibits good mechanical properties that can be compared to polypropylene and polyurethane.

The FDM/FFF segment dominated the 3D printing high performance plastic market in 2023. Fused Deposition Modeling (FDM), or Fused Filament Fabrication (FFF), is the most well-known technology. FDM printers use an inkjet-head tool to deposit a thermoplastic material that is built up by fusing layers of material one on top of another, as layers are deposited perpendicular to the build plate. The major driver to the advancement of FDM is its operational simplicity and benefits linked with the technology. FFF is also used in manufacturing in industries such as aerospace, automotive, construction, electronics, energy, pharmaceutical & medicine, sports, textile and toys industries, and many others. This technology is highly utilized in generating durable, strong, and dimensionally stable parts.

The prototyping segment dominated the 3D printing high performance plastic market in 2023. Product prototyping assists companies in experiencing improved accuracy and delivering constant/concrete final products. It assists in creating three-dimensional CAD models and mock-up apparatus. Moreover, the large-scale adoption of this technology for manufacturing high and low-volume products will drive the growth of this segment. The automotive, aerospace, and defense industries are the largest consumers of prototyping, mainly for creating precise parts, components, and even systems. This application has been designed in such a way that it can quickly and at a low cost produce physical models of designs.

The medical & healthcare segment held the largest share of the 3D printing high performance plastic market in 2023. 3D Printing provides a high-speed and inexpensive model of medical devices. This technology can allow for the replication of a geometry/ feature specific to a certain patient’s body. They are implant, instrumentation, and external prosthesis devices that are used in dental implant surgery. The increasing requirement to design and develop end-use parts/open mold applications creates a significant demand for high-performance plastics for applications in 3D printers. The application of 3D printing technology using high-performance plastics helps in the generation of patient solutions that improve the outcomes of treatments. It also revolutionized conventional manufacturing by manufacturing exact models, patterns, cast, and dies for the molding and casting machinery for production line manufacturing.

The aerospace & defense segment is expected to grow at the fastest rate in the 3D printing high performance plastic market over the forecast period. 3D printing is ideal for prototyping in the aerospace and aviation industries. Aerospace is among the industries that have been affected by 3D printing. Supplier aerospace firms are increasingly relying on 3D printing to make components for a particular mission or model. Performance plastics allow designers the freedom to engineer lightweight, high-strength components that precisely suit the function intended for the part. Valuable varieties such as PEEK are modular to manufacture light but strong aerospace products like interior fittings, clamps, and ducts.

By Type

By Form

By Application

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2025

March 2025

December 2024

November 2024