January 2025

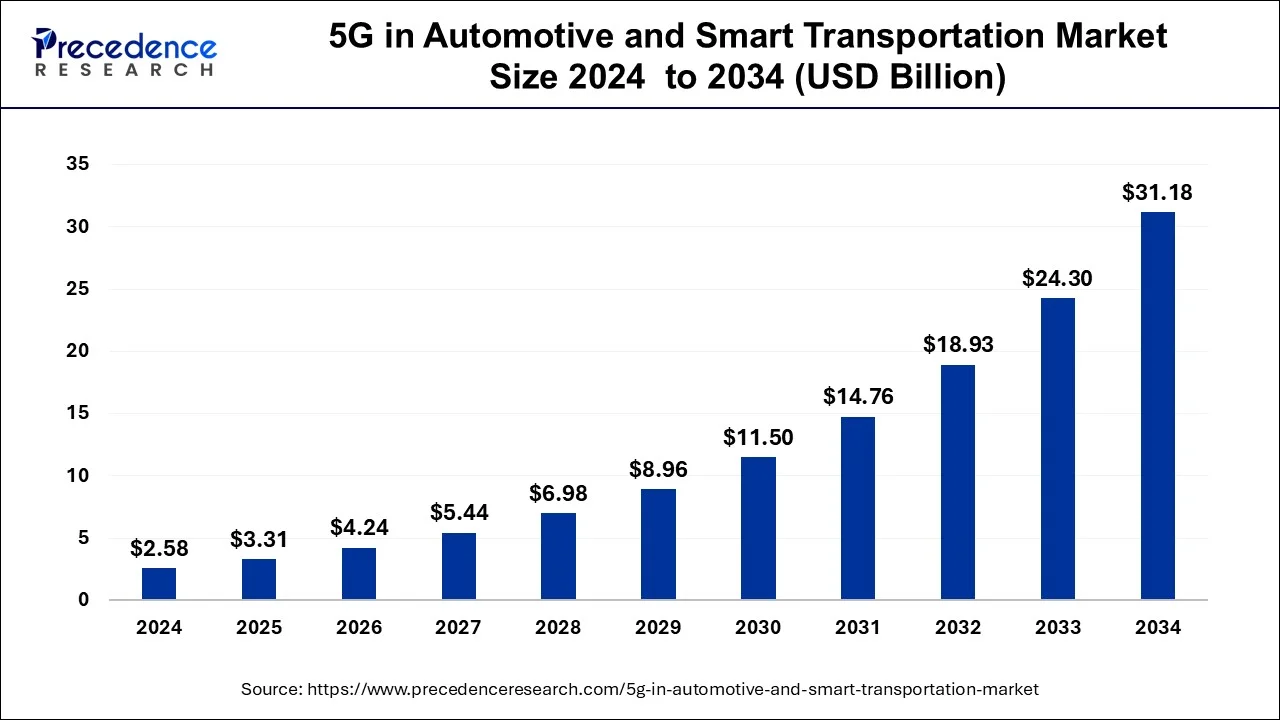

The global 5G in automotive and smart transportation market size is accounted at USD 3.31 billion in 2025 and is forecasted to hit around USD 31.18 billion by 2034, representing a double-digit CAGR of 28.32% from 2025 to 2034. The Asia Pacific market size was estimated at USD 830 million in 2024 and is expanding at a CAGR of 28.43% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global 5G in automotive and smart transportation market size was calculated at USD 2.58 billion in 2024 and is predicted to reach around USD 31.18 billion by 2034, expanding at a healthy CAGR of 28.32% from 2025 to 2034. The 5G in automotive and smart transportation market is witnessed to fuel with the requirement of increased connectivity, the working on the autonomous car, and safety provisions.

Artificial intelligence in the 5G automotive and smart transportation market involves the integration of fifth-generation wireless technology in vehicle transportation systems to enhance communication and connectivity to support functions such as self-driven cars and smart transportation systems. The application of artificial intelligence (AI) in automotive manufacturing companies, as well as machine learning (ML), is rapidly changing the manufacturing process since it allows maintenance and process predictions. In transportation, it can be used to power self-driving cars that can exchange information with the environment in real time to reduce accidents and congestion. In manufacturing, it can be used to predict when equipment will have to be maintained, and the quality check can also be conducted in real time.

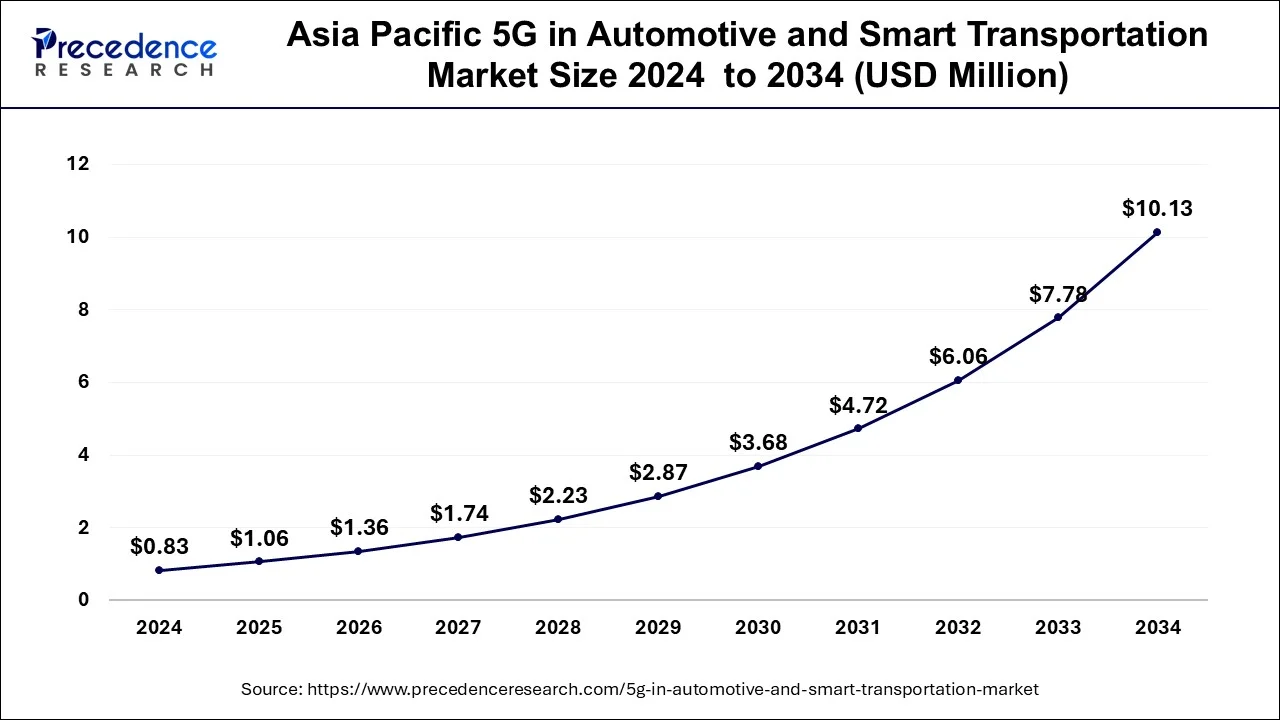

The Asia Pacific 5G in automotive and smart transportation market size was evaluated at USD 0.83 billion in 2024 and is projected to be worth around USD 10.13 billion by 2034, growing at a CAGR of 28.43% from 2025 to 2034.

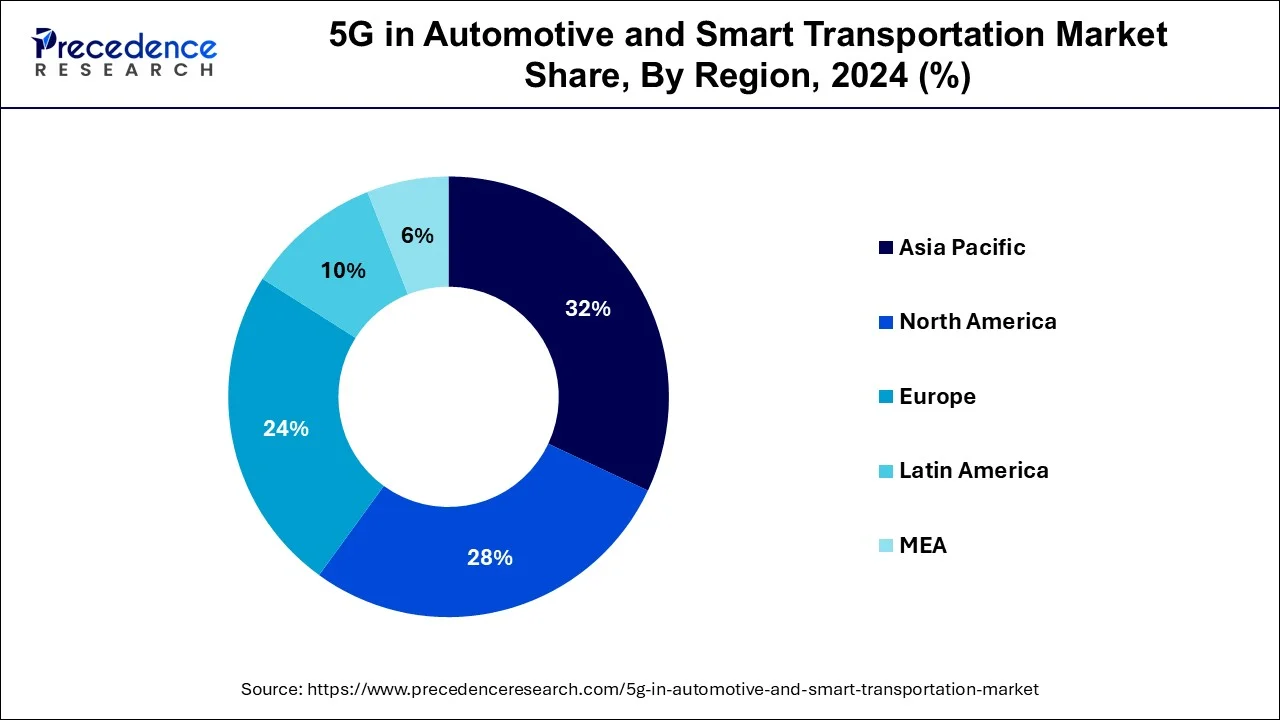

Asia Pacific accounted for the largest 5G in automotive and smart transportation market share in 2023. The growth is fueled by rapid urbanization and technological advancements in countries like China, Japan, and South Korea. These nations are spending on smart city networks and associated auto tech related to self-driving cars, all of which are boosting the demand for 5G applications. The demand for sustainable public transport solutions, as well as the demand for intelligent traffic control, thereby driving 5G technologies. China is a major consumer of automobiles and also the largest automotive maker in the world. Growing government policies in favor of 5G technology and consistently rising investment in the development of smart transportation structures are expected to drive 5G growth in the automotive and smart transportation market in the country.

North America is anticipated to witness the fastest growth in the 5G in automotive and smart transportation market during the forecasted years. 5G has been well adopted in the United States and Canada, and the use of connected car technology has also increased among consumers in the United States as this technology is favored by consumers in the nation. Promotion of improving the communication systems of vehicles and general transport as well as the upgrade of efficiency towards the increased relevance of 5G in this region. The Government funding also propels 5G in the automotive and smart transportation market. The focus on reducing emissions and promoting sustainable transportation solutions in the region corresponds with the achievable capabilities of 5G technology.

5G in automotive and smart transportation is the adaptation of the 5G technology into vehicles and transportation. It has led to the enhancement of features like advanced driver assistance system (ADAS), fuel monitoring, real-time and wireless communication, speed and cruising control, entertainment components, and enhanced fleet management. 5G technology in automotive and smart transport vehicle innovation enhances communication, productivity, and security. This market growth is due to increasing innovations in urban infrastructures, the reduction of emissions of greenhouse gases, and the need for technology in traffic control systems.

The increase in the implementation of modern technologies, including 5G and the Internet of Things (IoT), in the automotive and transport industries will influence the growth of the market. Moreover, growth in smart cities and intelligent transportation systems, deployment of a large volume of sensors, and optimization of the flow have put a faster pace for 5G in automotive and smart transportation market. In addition, a rise in expenditure towards research and development and high levels of use of communication technology are also expected to raise the demand for 5G in the automobile and smart transport segment.

| Report Coverage | Details |

| Market Size by 2024 | USD 2.58 Billion |

| Market Size in 2025 | USD 3.31 Billion |

| Market Size in 2034 | USD 31.18 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 28.32% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Solution, Application, End-user, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing Demand for Connected Vehicles

The more consumers are becoming aware of technology, the need for vehicles with more connectivity features has soared. 5G and gaming vehicles are set to revolutionize the automotive and Smart Transport sector by offering increased data rate, reduced response time, and high connection dependability. It has the potential to increase safety, productivity, and directions of transportation and get smarter and more sustainable mobility. The need for connectivity in cars to support various applications leads to real-time information such as traffic updates, integrated media and entertainment systems, remote software updates of vehicle systems, and improved navigation, all increasing the value for consumers and safety. The shift in consumer preference towards smart vehicles creates demand for 5G in automotive and smart transportation market solutions that allow auto manufacturers to improve their product range.

High Costs of Integration

The adoption of 5G technology in the automotive and smart transportation sector results in increased costs to manufacturers and increases the overall cost. The primary limitation of 5G in automotive and smart transport is its expensive nature due to a technology of the fifth generation of cellular mobile communications known as 5G. The integration of smart transportation and automotive applications with 5G technology leads to increased costs for the manufacturer, leading to a higher total cost for the goods. That impacts manufacturers’ profit margins and costs consumers’ spending, resulting in hindering the 5G in automotive and smart transportation market growth.

Expansion of IoT solutions

Integration of IoT devices that support 5G will revolutionize transport systems since it will allow for new applications and services to be developed and improve interconnectivity between vehicles, infrastructures, and other devices, leading to improved traffic control, maintenance, and even diagnostics through real-time services and advanced analytics. IoT sensors on the 5G in automotive and smart transportation market allow for real-time infrastructure management for efficient traffic flows and safety. Smart city development and smart parking systems focus on IoT and 5G; thus, developing IoT solutions through 5G connectivity promises considerable growth and innovation.

The hardware segment noted the largest share of the 5G in automotive and smart transportation market in 2024. The basic and crucial hard components needed for the construction of connected automobiles and smart transportation are the 5G sensors, communication devices, as well as superior onboard units. The segment includes user equipment, radio access points, and base stations, which are critical to the deployment of 5G networks. Additionally, the need for high bandwidth with the advanced requirement in connectivity and transport has further boosted demand in the hardware section of 5G in the automotive and smart transportation market. These components help in handling real-time data exchange, which defines vehicle-to-everything communication (V2X), and also helps in advancing driver assistance systems (ADAS), for which a good quality and reliable hardware system is needed.

The vehicle-to-everything (V2X) segment has contributed the largest 5G in automotive and smart transportation market share in 2024. V2X technology is becoming a popular option to eliminate accidents from transportation systems using vehicle-to-everything communication. The V2X segment has been such a strong segment where road safety and efficient transport systems have become a concern. Vehicle-to-vehicle (V2V) communication technology increases automotive safety by enabling vehicles and other structures to communicate and avoid incidents. In addition to sharing information between vehicles and infrastructure, including traffic signals, road signs, and Global Positioning System (GPS), V2X technology improves the safety of roads and decreases traffic density. V2X technology is emerging as a key driver of market growth due to the increasing demand for instantaneous Road Safety Solutions, Smart City Solutions, and Autonomous Vehicle.

The automotive segment contributed the largest share of the 5G in automotive and smart transportation market in 2024. 5G in automotive and smart transportation means the integration of the fifth generation of wireless networks in automotive and smart transportation. The automotive sector has been leading the implementation of 5G for advancements like autonomous driving, ADAS, and V2X communication. The automotive industry is shifting towards smarter automobiles with more connectivity, and autonomous driving is becoming the new focus. The 5G is needed to meet consumers ‘expectations of more complex car features such as route optimization, over-the-air software updates, and vehicle-to-vehicle communication.

By Solution

By Application

By End-user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

December 2024

December 2024

August 2024