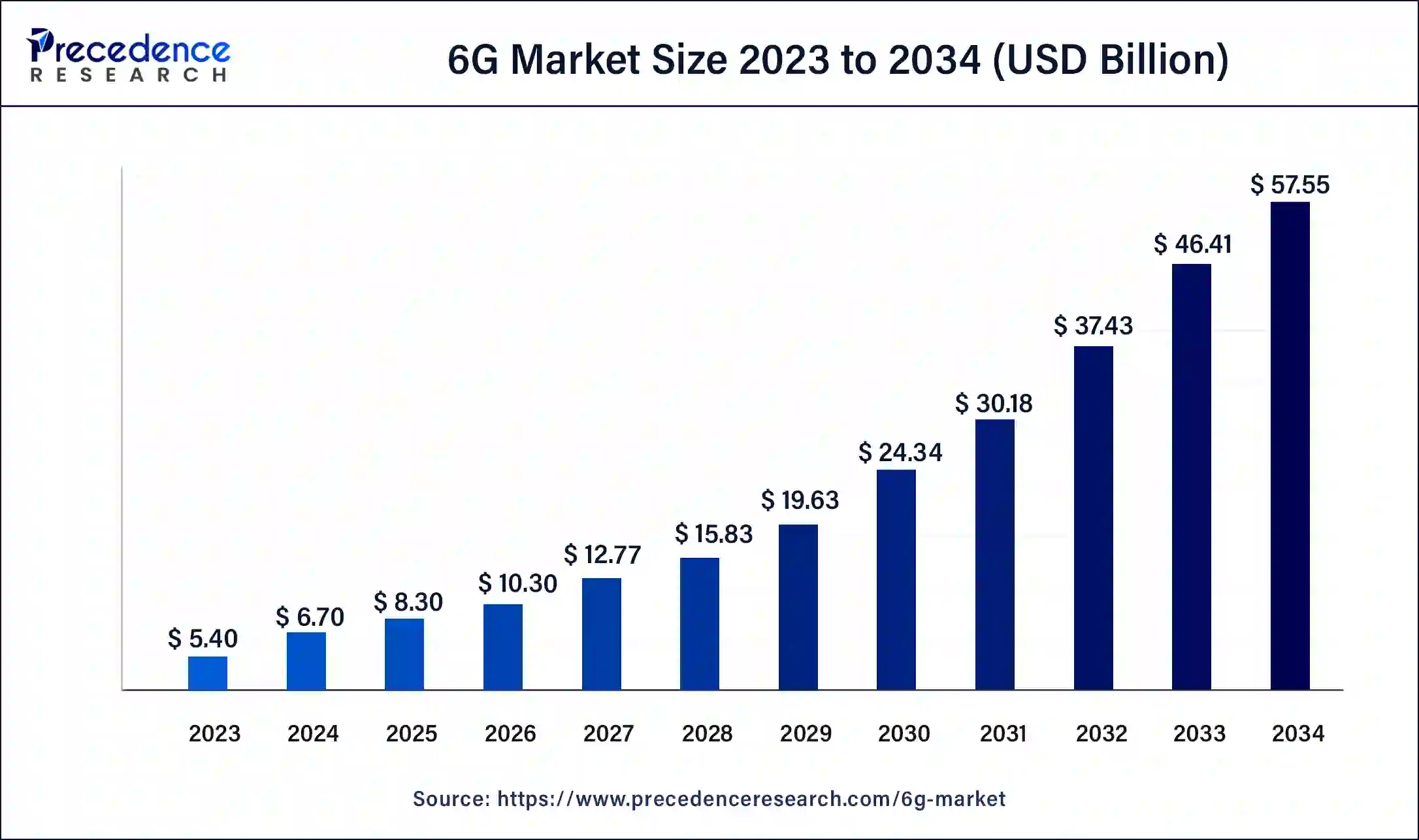

The global 6G market size was USD 5.40 billion in 2023, calculated at USD 6.70 billion in 2024 and is expected to reach around USD 57.55 billion by 2034, expanding at a CAGR of 24% from 2024 to 2034.

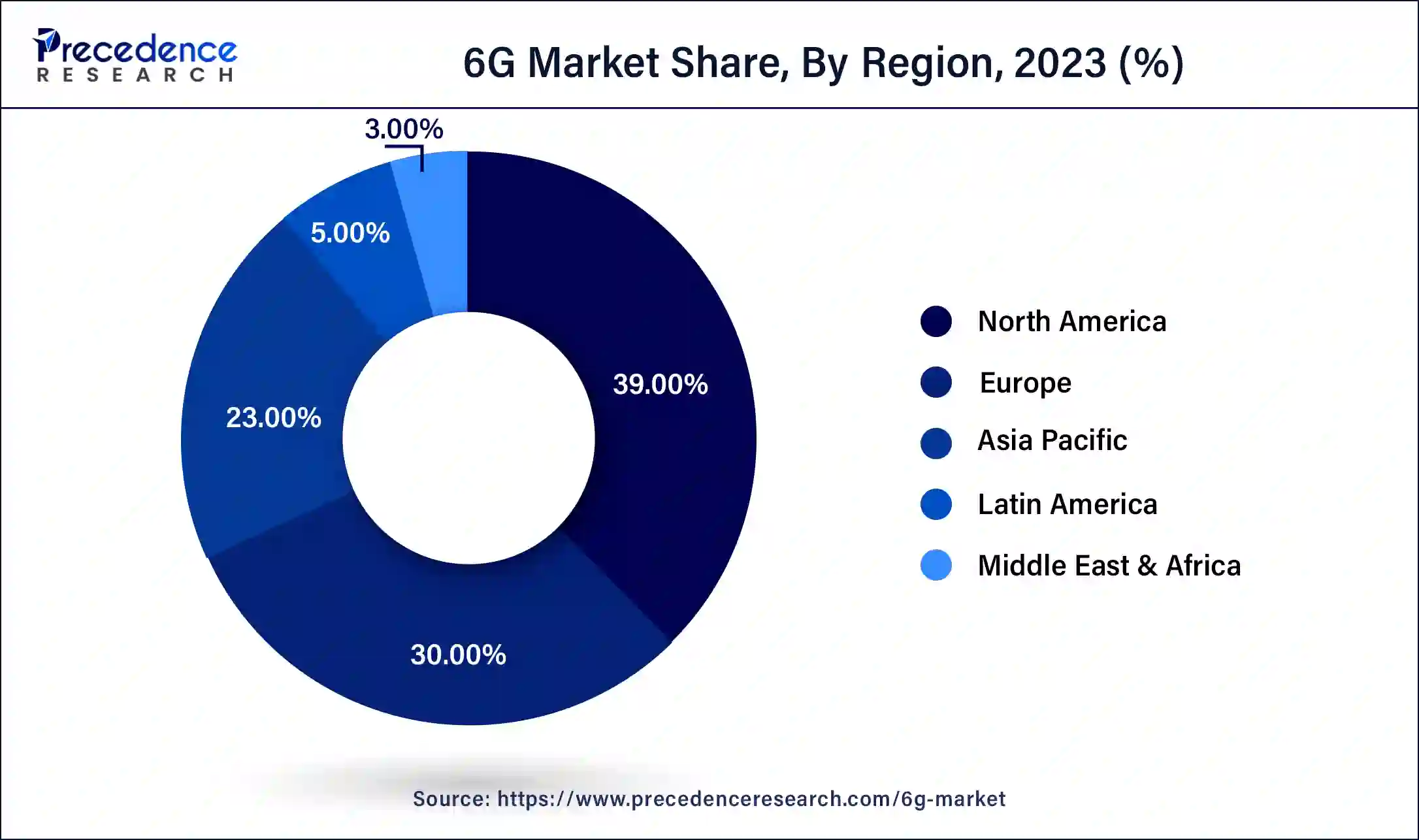

The global 6G market size accounted for USD 6.70 billion in 2024 and is expected to reach around USD 57.55 billion by 2034, expanding at a CAGR of 24% from 2024 to 2034. The North America 6G market size reached USD 2.11 billion in 2023. The growing need for faster and more reliable networks with lower latency supports 6G evolution and thus is the major driver of the market.

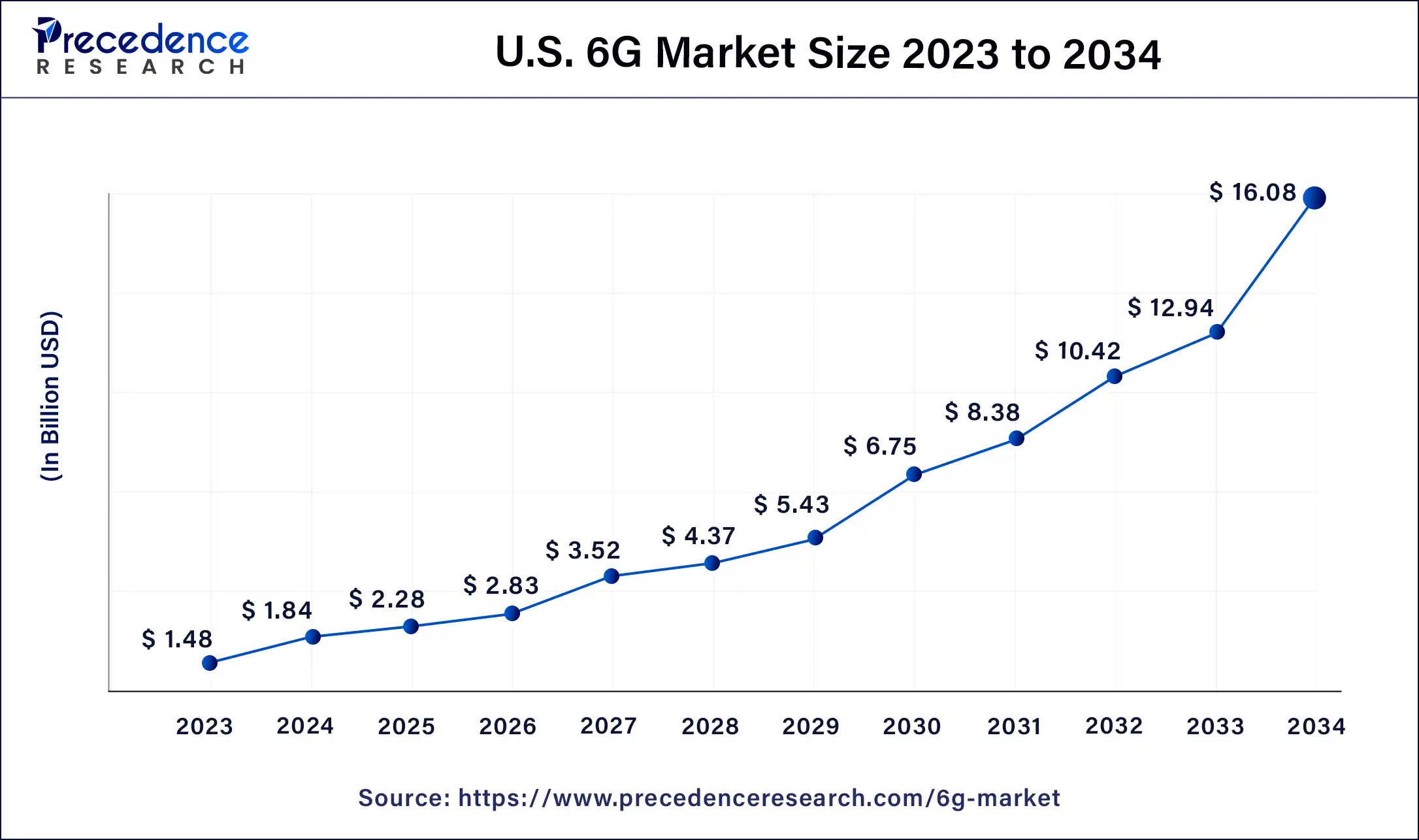

The U.S. 6G market size was estimated at USD 1.48 billion in 2023 and is predicted to be worth around USD 16.08 billion by 2034, at a CAGR of 24.2% from 2024 to 2034.

North America holds the largest share of the global 6G market. The market includes countries such as the United States and Canada, which are at the forefront of technological innovation and are expected to play a significant role in the development and adoption of 6G technology.

In the United States, major tech companies and telecommunications providers are investing heavily in research and development to advance 6G infrastructure and services. Similarly, Canada, which is known for its strong telecommunications industry, is also actively contributing to 6G research and development initiatives. Additionally, Mexico is emerging as a key player in the 6G market, with growing investments in telecommunications infrastructure and a burgeoning tech sector.

Asia Pacific is currently the fastest-growing market for 6G technology globally due to the presence of economically emerging countries like India, Japan, and Korea. In an effort to further strengthen the market, the government is encouraging local companies to manufacture and supply materials, parts, and equipment for this technology within the country. Additionally, an open radio access network (RAN) will be developed, which can be used with any mobile device, allowing mobile carriers and enterprises to provide flexible services as per their needs.

Countries such as China, Japan, South Korea, India, and many others hold immense significance in the 6G market. China, with its massive market size and strong government support for technological advancement, is expected to lead the way in 6G research, development, and deployment. Japan and South Korea, renowned for their advanced technology sectors, are also key players in driving 6G innovation, with major telecommunications companies actively investing in next-generation networks and services.

Korea plans to launch the sixth-generation network service in 2028, two years earlier than its original schedule, in a bid to secure an early dominance of the future wireless frequencies.

India, with its rapidly growing digital economy, is poised to embrace 6G technology to meet the increasing demands for high-speed connectivity and digital services. Other countries in Asia Pacific, such as Singapore and Taiwan, are also actively participating in 6G research and development efforts, contributing to the region's pivotal role in shaping the future of wireless communication. The commercial rollout for 5G is yet to begin in the country.

A renowned Indian company, Reliance Jio’s Estonia unit (Jio Estonia OÜ), is partnering with the University of Oulu to explore 6G, the upcoming next generation of telecom technology after 5G. According to an official announcement by the company, 6G is supposed to build on the capabilities of 5G, which will have higher capacities and bring new advancements. According to the company, the partnership with the university will foster entrepreneurship by bringing together expertise from both industry and academia in the fields of aerial and space communication, holographic beamforming, 3D connected intelligence in cybersecurity, microelectronics, and photonics.

The 6G market is poised for exponential growth, building upon the foundations of 5G technology. Anticipated to revolutionize connectivity, 6G aims to deliver unprecedented speeds, ultra-low latency, and seamless integration of AI and IoT. It was basically a planned successor after the 5th Generation. Numerous tech giants and research institutes are contributing to fulfilling the requirements to adopt a 6G, while many researchers are showcasing a concern for it due to its high-frequency uses ranging from 100GHZ to 3 THZ, as these fall under the unexplored energy spectrum. However, the frequency bands used to operate 6G have not yet been decided.

Industries like healthcare, transportation, and manufacturing are expected to benefit greatly from its capabilities and efficiency. It helps enable advancements such as remote surgery, autonomous vehicles, and smart factories. With research and development already underway, major players in telecommunications and technology are investing heavily to lead in 6G innovation. However, challenges such as spectrum availability, standardization, and infrastructure development remain possible hurdles to overcome. Despite this, the 6G market holds immense potential to transform industries and enhance the digital landscape in the forecasted years and will dominate the global market for 6G.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 24% |

| Global Market Size in 2023 | USD 5.40 Billion |

| Global Market Size in 2024 | USD 6.70 Billion |

| Global Market Size by 2034 | USD 57.55 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Vertical, By Application, By Deployment Device, By Communication Infrastructure, and By Component |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The new currency is DATA

The proliferation of smartphones, tablets, wearables, IoT devices, and other connected gadgets generates vast amounts of data. This is a major driver of the 6G market. As more devices come online, the need for high-speed and reliable connectivity to transmit and process this data becomes critical. Consumers expect instant access to content and services anytime, anywhere, putting pressure on networks to deliver high-speed and seamless connectivity.

The adoption of bandwidth-intensive applications such as streaming video, online gaming, virtual reality, and augmented reality continues to rise. These applications require high data transfer rates and low latency to deliver smooth and immersive user experiences. The expansion of digital services, including online shopping, social media, digital entertainment, and cloud-based applications, is driving the need for robust data connectivity.

Data-driven technologies such as artificial intelligence, machine learning, big data analytics, and cloud computing are becoming increasingly prevalent across industries. These technologies rely on massive datasets for training algorithms, making real-time decisions, and extracting valuable insights. The proliferation of IoT devices in various sectors, including smart homes, smart cities, healthcare, transportation, and manufacturing, is generating a deluge of sensor data. These IoT devices require constant connectivity to transmit data to centralized servers for processing and analysis.

Organizations across industries are undergoing digital transformation initiatives to improve efficiency, productivity, and customer experience. These initiatives often involve the adoption of cloud-based services, digital platforms, and data-driven technologies, driving the demand for high-speed and reliable data connectivity. The increasing demand for data is a significant driver of the 6G market, prompting the development of advanced networking technologies capable of meeting the evolving needs of consumers, businesses, and industries.

Challenge regarding infrastructure

One major restraint of the 6G market could be the challenge of infrastructure deployment and its scalability. Implementing 6G networks requires a substantial investment in building new infrastructure, including upgrading existing telecommunications infrastructure and deploying new base stations, antennas, and backhaul networks.

Additionally, scaling up 6G networks to support a growing number of users and connected devices while maintaining performance and reliability could be the reason for logistical and technical challenges. This restraint may slow down the widespread adoption of the 6G market, especially in regions with regulatory hurdles as well as limited resources.

Industrial applications

The 6G market opens opportunities for emerging industries and applications that require ultra-fast, reliable, and low-latency connectivity. Industries such as autonomous vehicles, smart cities, remote healthcare, highly immersive entertainment, and advanced manufacturing can leverage 6G to tap new capabilities and business models.

6G networks can enable real-time communication between autonomous vehicles and infrastructure, support remote robotic surgery with minimal data transfer delay terms as latency in the telecommunication sector, and deliver immersive virtual experiences with augmented reality.

Emerging global connectivity

The 6G market has the potential to bridge the digital divide and connect underserved or remote regions with high-speed internet access. Deploying 6G networks in rural areas, developing countries, and underserved communities can improve access to education, healthcare, economic opportunities, and government services.

Additionally, 6G satellite networks can provide global coverage, offering connectivity to remote areas that are difficult to reach with conventional terrestrial networks. This opportunity not only expands market reach but also contributes to socioeconomic development and digital inclusion on a global scale.

The manufacturing segment held the largest share of the global 6G market in 2023. The manufacturing segment of the market is surrounded by the production of equipment and devices essential to deploying 6G technology. This includes manufacturing next-generation wireless communication infrastructure such as antennas, transmitters, and receivers. Additionally, it includes the fabrication of advanced semiconductors, processors, and other components necessary for 6G networks.

Manufacturers in this segment focus on innovating to meet the increasing demands for faster speeds, lower latency, and higher capacity in communication networks. As 6G technology evolves, the manufacturing segment will play a crucial role in driving its development and deployment worldwide. Moreover, the pivotal role that will be played by the manufacturing of the Internet of Things in the 6G market is to provide seamless connectivity between various components of the 6G transmission.

The multisensory extended segment dominated the market in 2023. The multi-sensory extended segment in the 6G market refers to integrating advanced sensory technologies into wireless communication systems, enabling immersive and interactive experiences beyond conventionally featured audio and visual capabilities. This segment includes applications such as feedback mechanisms, stimulation for senses like taste augmentation, and spatial awareness, creating a truly multi-dimensional communication environment.

With 6G's ultra-low latency and high bandwidth capabilities, users can experience virtual environments with lifelike sensations, interact with remote objects through touch and motion, and even perceive scents and flavors in augmented reality settings. Industries such as gaming, healthcare, education, and entertainment stand to benefit from the multi-sensory extended capabilities of 6. It helps revolutionize how a human consciousness perceives and interacts with digital information and its environments.

The smartphone segment dominates the 6G market by deployment devices due to its huge number of users and features. The smartphone segment in the deployment of 6G technology involves the creation and distribution of cutting-edge mobile devices capable of harnessing the full potential of 6G networks. These smartphones will feature advanced processors, antennas, and connectivity modules optimized for ultra-fast data transfer, minimal latency, and enhanced capacity.

They will support innovative features such as holographic displays, augmented reality, and artificial intelligence integration, revolutionizing how users interact with their devices and the world around them. Manufacturers in this segment will focus on designing sleek, user-friendly devices that leverage the capabilities of 6G to deliver unparalleled connectivity and functionality to consumers.

Segments Covered in the Report

By Vertical

By Application

By Deployment Device

By Communication Infrastructure

By Component

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client