January 2025

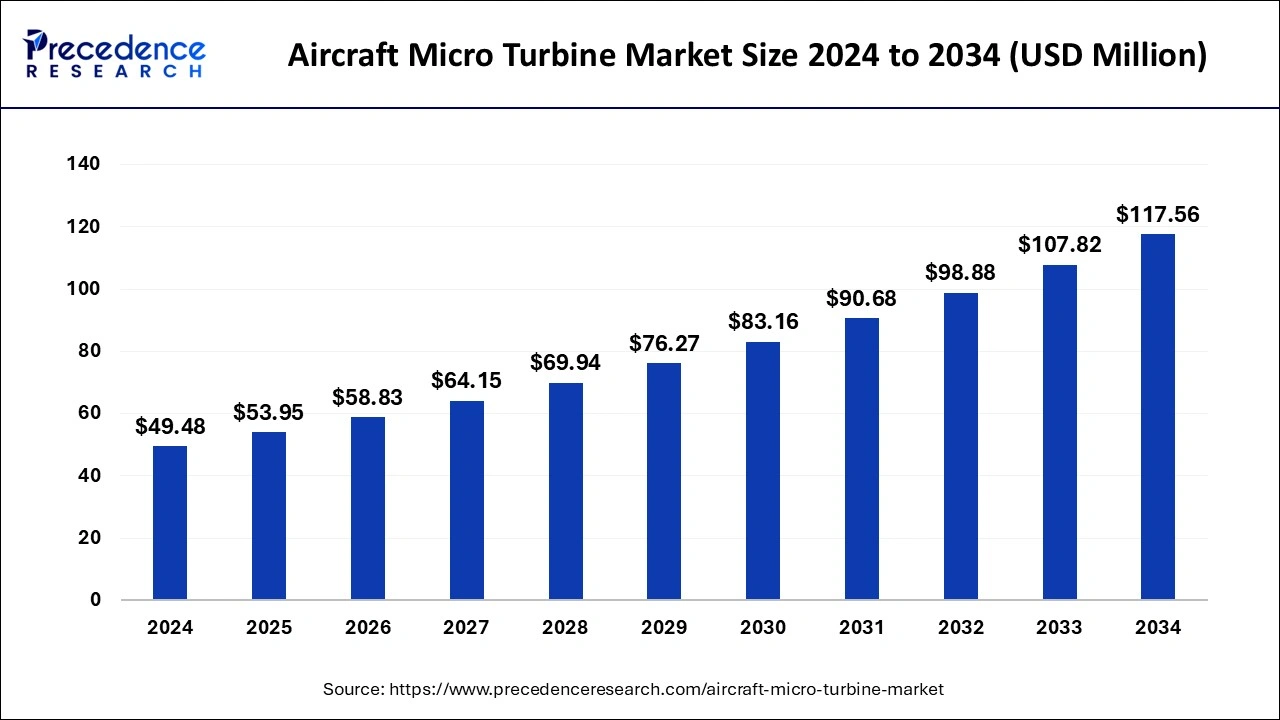

The global aircraft micro turbine market size is calculated at USD 53.95 million in 2025 and is forecasted to reach around USD 117.56 million by 2034, accelerating at a CAGR of 9.04% from 2025 to 2034.

The global aircraft micro turbine market size accounted for USD 49.48 million in 2024 and is expected to exceed around USD 117.56 million by 2034, growing at a CAGR of 9.04% from 2025 to 2034. The rising demand for a promising technology that offers distributed power generation with broad utility is increasing the adoption of aircraft micro turbine market.

The integration of artificial intelligence into the aircraft micro turbine market holds the potential to optimize performance and prepare a database of full-load operation. The database is utilized to train an artificial neural network (ANN), which helps predict the engine component’s health parameters under degradation. Artificial intelligence is designed with a diagnostics scheme that detects faults and has isolation capability in a wide range of operating part loads. In recent years, researchers have replaced human expertise with AI for decision-making in the field of aerodynamics. AI in turbomachinery aerodynamics comprises the design, validation, and maintenance of the compressors and turbines.

A microturbine is a small, compact gas turbine that generates power ranging from a few kilowatts to hundreds of kilowatts. This combustion turbine is used in automotive and truck turbochargers, auxiliary power units for aircraft, and small jet engines. They are comprised of a compressor, combustor, turbine, recuperator, alternator, and generator. The efficiency of microturbine ranges from 25% to 35%. Either diesel fuel or natural gas typically powers the engine. The success rate of a microturbine depends on its compact size, lower manufacturing cost, high efficiency, quiet operation, quick start-ups, and minimal emission. When all these factors are achieved, it makes a perfect fit for providing base load and cogeneration power for commercial customers. It is commonly designed from titanium, aluminum, and stainless steel alloy material.

| Report Coverage | Details |

| Market Size by 2024 | USD 49.48 Million |

| Market Size in 2025 | USD 53.95 Million |

| Market Size in 2034 | USD 117.56 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 9.04% |

| Dominating Region | North America |

| Fastest Growing Region | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Engine Type, Distribution Channel, Application, and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. |

Efficient power generation

The aircraft micro turbine market plays a crucial role in the aerospace sector. With the help of the unique characteristics of microturbine engines, the aircraft at present have higher performance in terms of endurance and stealth. The microturbine offers enlarged power generation units at a lower cost price, which is highly demanded by electric power companies. The microturbines are used domestically and commercially with low emissions. A simple micro-turbine has an energy conversion efficiency of 15%. Small turbine engines are efficient when used as a recuperator or regenerator, which increases the efficiency by 20-30%and they can reach up to 85% combined with thermal-electrical efficiency in cogeneration.

High temperature

The high temperature of the microturbine directly impacts the efficiency and operation in the aircraft micro turbine market. Additionally, high temperature has the potential to cause intergranular cracks in turbine blades. The rising temperature decreases air density, which reduces the efficiency and power of turbines. The high temperature and speeds of the microturbines make it impractical for oil lubrication and ball bearing. Instead of that, air bearings or magnetic bearings are used. The temperature of the microturbine reaches as high as 1600K.

Hybrid electric power generation technology

This technology is a combination of multiple types of energy generation and storage, which uses two or more kinds of fuel to power a generator. The hybrid power technology is an integrated renewable energy generation technology with other energy generation systems; this technology has the potential to reduce risk for investors and ensure reliability and affordability. Hybrid energy power generation technology in aircraft offers better energy management and reduces fuel consumption by 5% compared to standard flights.

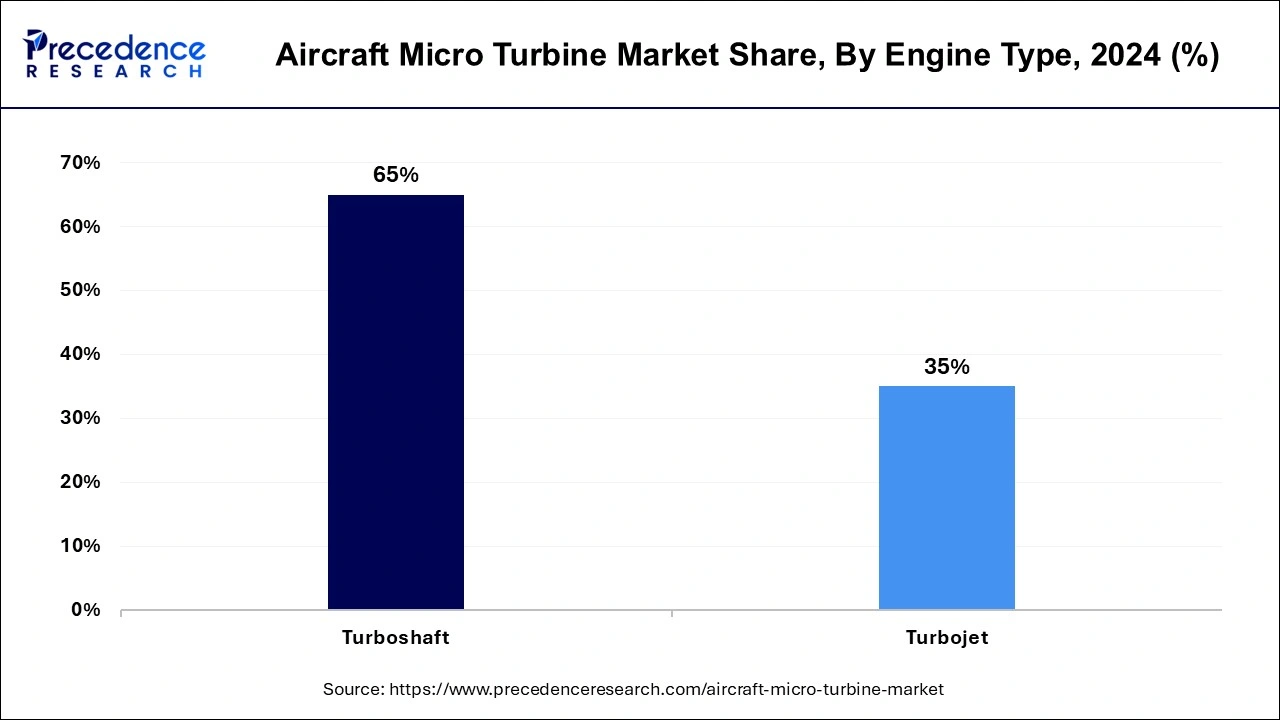

The turboshaft segment contributed the highest share of the aircraft micro turbine market in 2024. The dominance of this segment is observed as it is used in aircraft, particularly in helicopters, hovercraft, and UAVs. The function of a turboshaft is similar to a turboprop engine. It has the ability to take off and land vertically, which makes it highly valuable in places with limited possibilities for landing and in emergency rescue services. The turboshaft engine application is commonly used for rescue services, police, and reconnaissance purposes, as well as for agriculture. The small installation dimensions, low weight, and high static performance features offer capacity for high flight levels up to 29,520 ft. and a maximum starting height of 19.680 ft.

The turbojet segment is expected to grow at the fastest CAGR in the aircraft micro turbine market during the forecast period. The expansion of this segment is due to the application of turbojet engines for many types of aircraft, especially for those that fly at high speed, such as fighter jets, cruise missiles, and some high-speed unmanned aerial vehicles (UAVs). They are ideal for rapid deployment and long-range missions. At present times, turbojets are primarily used in military aviation. For the modern jet charter planes, the companies are manufacturing turbofans and turboprops instead of turbojets as they offer better fuel efficiency.

The OEM segment captured the biggest aircraft micro turbine market share in 2024. The dominance of this segment is observed as OEM is the primary distributor/supplier of microturbine engines for aircraft manufacturing. The OEM ensures that the turbines are equipped with fire suppression systems. According to the Renewable Energy Loss Adjuster (RELA) turbine fire is caused by technical and electrical faults, and OEM is responsible for the fire safety of the turbines.

The aftermarket segment is projected to expand rapidly in the aircraft micro turbine market over the studied period. The aftermarket for the micro turbine is primarily aimed at replacing the Auxiliary Power Units (APUs) in the aging fleet. The research excludes platforms including light aircraft, advanced air mobility, and military UAVs. The market is anticipated to have advanced development regarding the aftermarket segment in terms of engine technology.

The civil segment held the largest share of the aircraft micro turbine market in 2024. The microturbine engine in aircraft is extensively used in civil aviation and commercial aircraft due to its compact size, creating enough space for other components, and high power-to-weight ratio, which makes it suitable for longer-distance travel with heavy load, efficiency, and low maintenance. The smallest jet engine available is PBS TJ80, which is designed for manned and unmanned aerial vehicles and target drones. It weighs 12.5 kg, including the accessories and thrust of 900N.

The defense segment is projected to grow at the fastest CAGR in the aircraft micro turbine market in the future years. The growth of this segment is owed to the increasing application of microturbine engines in military and defense and unmanned aerial systems and drones, which have the ability to provide high thrust-to-weight ratios that are ideal for surveillance, combat missions, and reconnaissance. The reliable, lightweight, and high-performance properties of microturbine engines for aircraft that run on heavy fuels make them highly demanding in the defense sector.

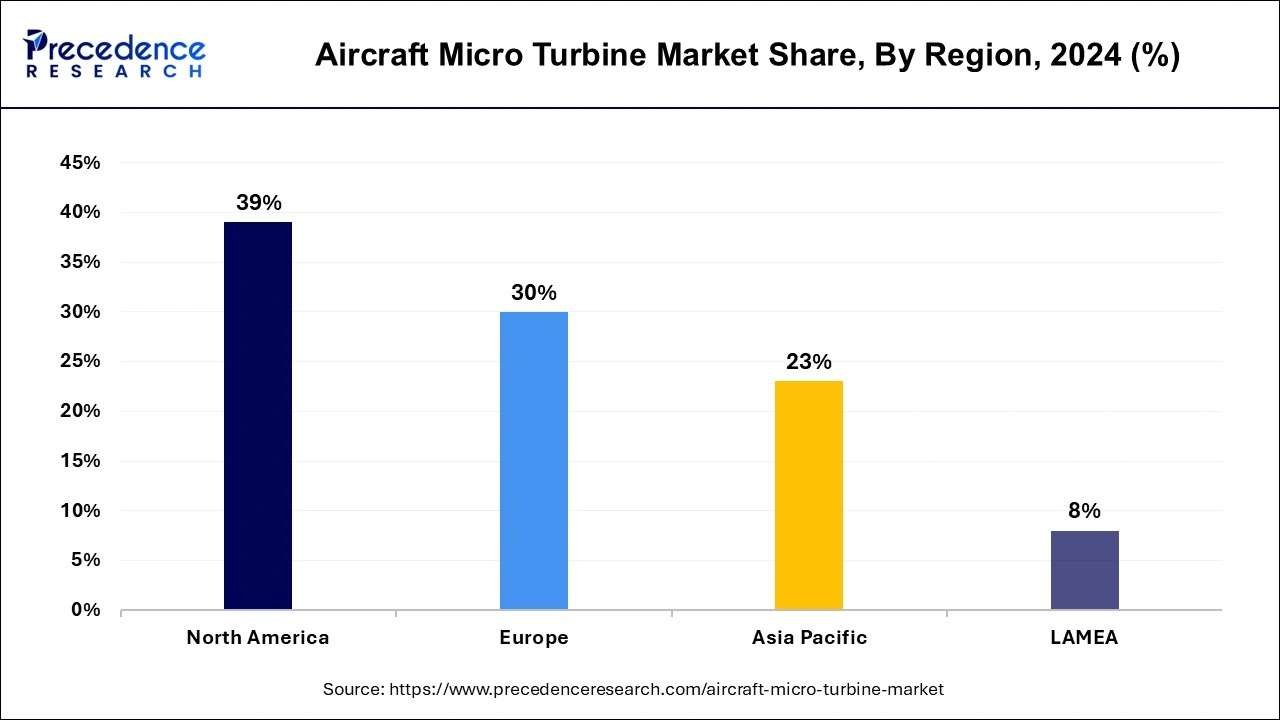

North America dominated the global aircraft microturbine market in 2024. The microturbine technology is well understood and has been implemented in several applications around the United States. North America has a strong aerospace sector with robust aviation and rising demand for expert aircraft platforms, urban mobility solutions, and unmanned aerial vehicles. This aerospace industry in North America has impressive economic influence, employment, and extensive manufacturing due to the presence of top-tier industry leaders. Nearly 60% of jobs in the aerospace industry are related to the supply chain, which has increased to 1,298,036 jobs. Additionally, the commercial aerospace field makes up 47% of the industry’s employment and defense, and the national security sector consists of the remaining 53%.

Europe is projected to witness significant growth in the aircraft micro turbine market in the coming years. The expansion of aircraft microturbines is anticipated to grow in Europe at an extensive rate due to the rising demand for stealth and durable aerial vehicles for military operations purposes. The rising need for stealth combat drones contributes to the technological and operational superiority of the European Air Force. The strategic Air Forces and Air and Space Forces are collaborating in aeronautics to offer highly complex fields and innovations built for a better experience. European Union seeks to strengthen its defensive capabilities. Countries including France, Italy, Germany, and the UK are the main users and industry leaders in terms of operational requirements and the development of cooperative technologies.

By Engine Type

By Application

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

October 2024

August 2024

January 2025