October 2023

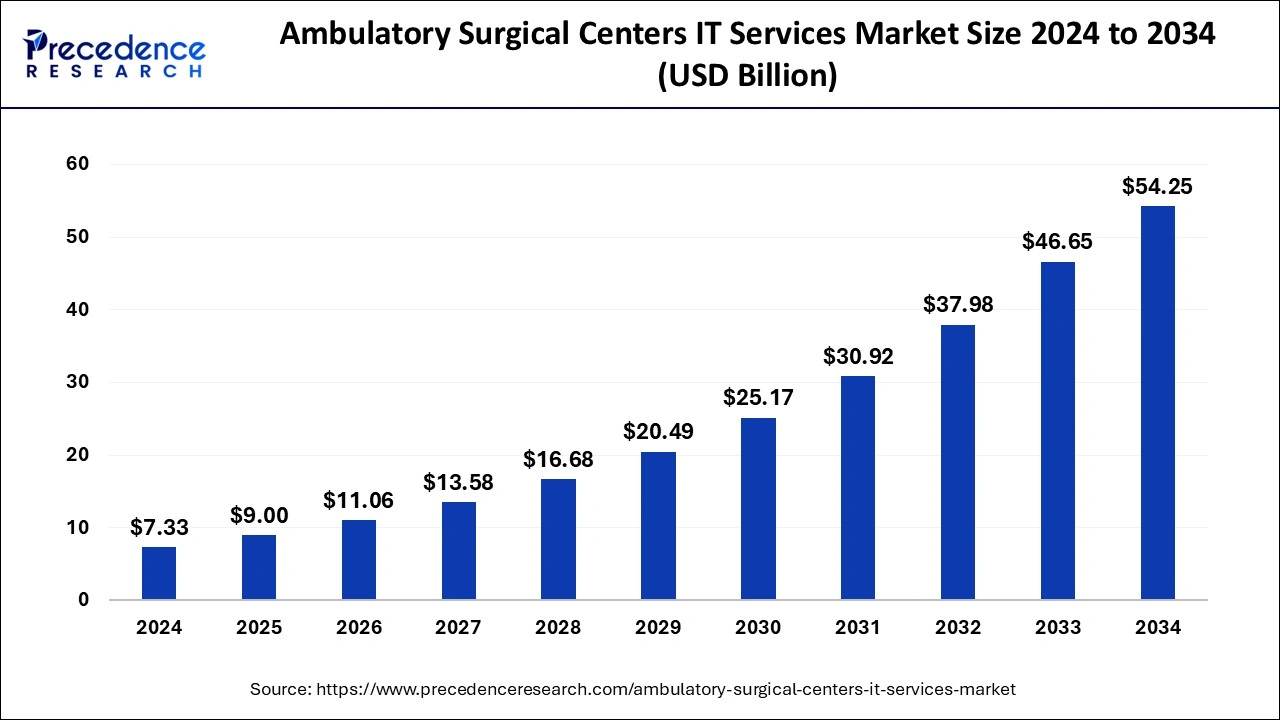

The global ambulatory surgical centers IT services market size is calculated at USD 9 billion in 2025 and is forecasted to reach around USD 54.25 billion by 2034, accelerating at a CAGR of 22.16% from 2025 to 2034. The North America ambulatory surgical centers IT services market size surpassed USD 4.25 billion in 2024 and is expanding at a CAGR of 22.20% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global ambulatory surgical centers IT services market size was estimated at USD 7.33 billion in 2024 and is predicted to increase from USD 9 billion in 2025 to approximately USD 54.25 billion by 2034, expanding at a CAGR of 22.16% from 2025 to 2034. IT services reduce human errors and increase overall operational efficiency by streamlining administrative activities, patient data management, scheduling, billing, and inventory management.

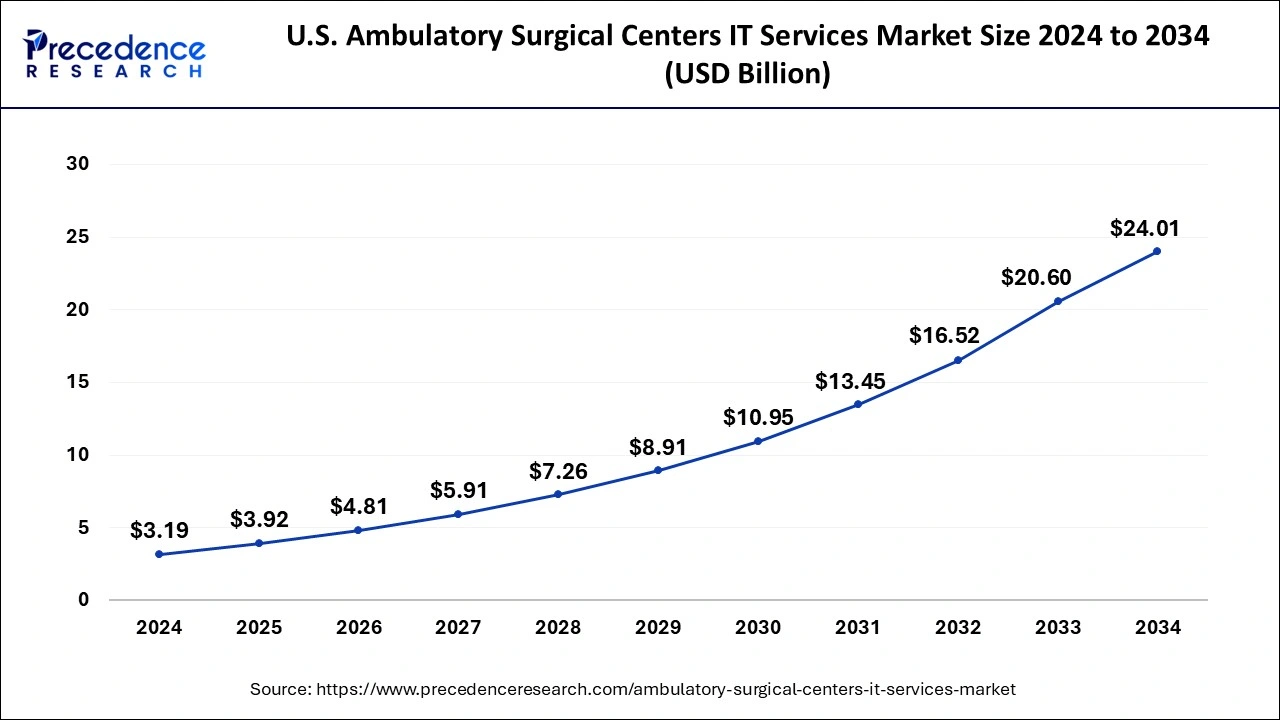

The U.S. ambulatory surgical centers IT services market size was estimated at USD 3.19 billion in 2024 and is predicted to be worth around USD 24.01 billion by 2034 at a CAGR of 22.37% from 2025 to 2034.

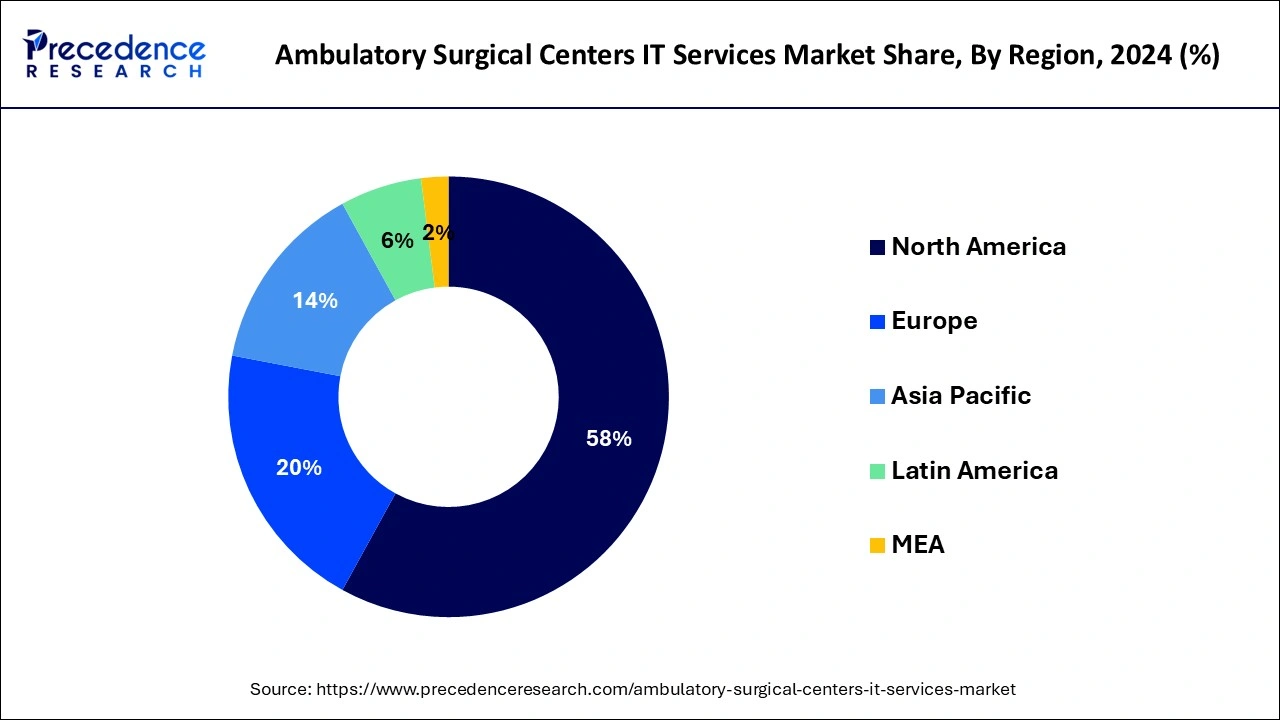

North America dominated the global ambulatory surgical centers IT services market in 2024. The necessity for effective patient data management and healthcare processes, as well as the growing demand for outpatient treatments, have all contributed to the expansion of the ambulatory surgery centers (ASCs) IT services market in North America. ASC IT services are a fiercely competitive business in North America, where a number of well-known companies provide a broad range of products and services that are specifically designed to meet the requirements of ambulatory surgery centers. In addition, a wave of creative entrepreneurs and digital companies have entered the market, offering specialized solutions to deal with new problems in the healthcare sector.

Asia Pacific is expected to grow at a significant rate in the global ambulatory surgical centers IT services market. The region's market is changing quickly as a result of a number of factors, including rising healthcare costs, advances in technology, and an increase in the demand for outpatient surgical operations. ASCs are growing in popularity because they are convenient, economical, and effective at providing surgical treatment. ASCs are spending money on practice management software to better manage administrative, billing, and scheduling duties. These software programs offer a smooth workflow by integrating with EHR systems. Healthcare IT must prioritize data security and adherence to laws like the Health Insurance Portability and Accountability Act. To protect patient data and make sure that regulations are followed, ASCs are investing in compliance and cybersecurity solutions.

IT services are being used by ASCs more frequently in order to improve patient care, streamline operations, and adhere to legal regulations. This trend is being driven by technological advancements like telemedicine, cloud computing, electronic health records (EHR), and mobile health applications. ASCs can enhance staff communication, automate administrative duties, and allocate resources optimally with the use of IT services. Because ASCs are able to function more efficiently with fewer resources, this ultimately results in enhanced efficiency and cost savings. The telehealth services industry, especially ASCs, has benefited from the COVID-19 epidemic by growing in popularity. ASCs can provide patients with remote consultations, pre-operative evaluations, and post-operative care thanks to IT technologies that make it easier to integrate telehealth systems.

The ambulatory surgical centers IT services market is getting more and more competitive as more vendors provide customized products made to meet the particular requirements of ASCs. Larger healthcare IT companies are acquiring smaller businesses to increase their services and market share, which is another factor contributing to market consolidation. There is an increasing tendency toward outpatient operations, which are usually less expensive than those carried out in traditional hospital settings, as healthcare prices continue to climb. This rise is largely driven by ASCs, and IT services are critical to handling the rising number of patients and procedures. ASCs must adhere to a number of regulations, such as Meaningful Use standards and HIPAA (Health Insurance Portability and Accountability Act).

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 22.16% |

| Market Size in 2025 | USD 9 Billion |

| Market Size by 2034 | USD 54.25 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Service, By Solution, and By Deployment Mode |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Remote monitoring and telehealth

Sophisticated remote monitoring and telehealth solutions have been made possible by technological advancements, especially in the areas of data analytics, wearables, and telephony. Because they are more affordable, more convenient, and offer specialized care, ambulatory surgical centers are fast becoming the go-to option for numerous surgical procedures. Through the remote monitoring of patient's vital signs, medication compliance, and post-operative recovery status, these services assist healthcare providers in the early detection of potential issues, minimize needless hospital readmissions, and maximize resource efficiency. However, legal obstacles, including licensing requirements, payment guidelines, and privacy issues with data, still affect how widely these services are used in ambulatory surgery facilities.

Interoperability issues

The ambulatory surgical centers IT services market can face substantial challenges in terms of interoperability due to the complex nature of healthcare systems and the wide variety of technology employed by various providers. The various IT systems utilized in ASCs don't have standardized data formats, protocols, or interfaces. It is challenging for systems to interchange information without interruption due to this lack of consistency. ASCs frequently use a variety of software programs for a range of functions, including practice administration, electronic health records (EHR), scheduling, billing, and billing. Ineffective communication between these systems might result in data silos and inefficiencies.

Data analytics and business intelligence

ASCs can examine their operational data, including patient flow, resource usage, and inventory control, with the use of BI and data analytics technologies. ASCs can enhance patient throughput, cut expenses, and optimize their processes by identifying inefficiencies or bottlenecks. ASC revenue cycle management procedures can be streamlined with the use of data analytics. ASCs can detect coding problems, monitor reimbursement trends, and maximize revenue collection by examining billing and claims data. ASCs may guarantee that resources are allocated effectively to satisfy patient demands while eliminating waste by evaluating past data and projecting future demand. ASCs can monitor adherence to accreditation standards and regulatory obligations with the use of BI technologies. ASCs can find non-compliance issues and take corrective action to reduce risks by gathering and evaluating compliance data.

The electronic health record holds the largest share of the global ambulatory surgical centers IT services market as a result of a number of factors, including the desire for better patient care and operational efficiency, as well as regulatory mandates and technological improvements. EHR systems are essential for improving clinical workflows, expediting documentation procedures, and promoting provider communication in the ASC-serving IT services industry. Numerous clinical processes in ASCs, including patient registration, pre-operative evaluations, intraoperative recording, post-operative care, and billing, are automated and streamlined by EHR systems. EHR systems produce an abundance of data that can be used for quality improvement projects, performance monitoring, and clinical decision-making.

The clinical documentation segment is expected to grow the fastest in the ambulatory surgical centers IT services market. Effective clinical documentation is essential in ASCs to guarantee fast and accurate patient treatment, regulatory compliance, and good provider-to-provider communication. Electronic health record system implementation and customization to meet ASC needs. Typically, these systems have tools for recording treatment plans, demographics, medical histories, prescriptions, and progress notes for each patient. Created and modified templates and forms in EHR/EMR systems to record particular data items needed by ASCs, like anesthetic records, operating notes, postoperative instructions, and preoperative assessments.

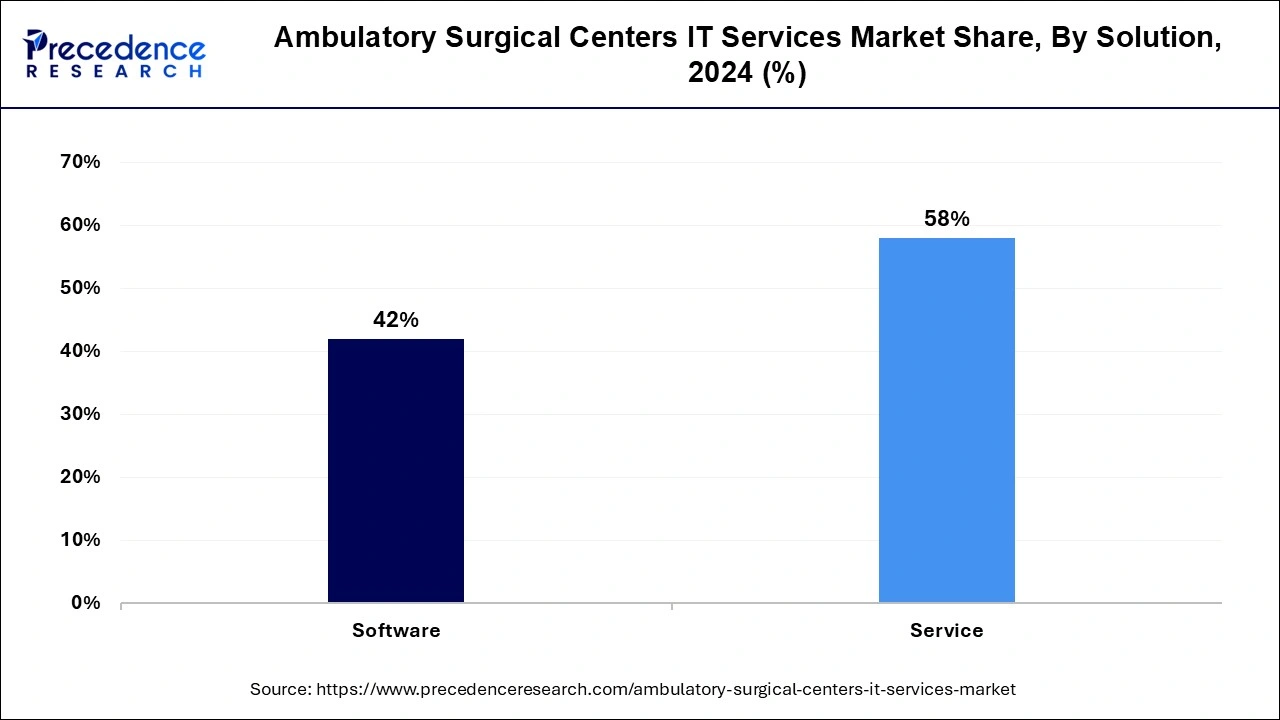

The service segment held the largest share of the ambulatory surgical centers IT services market in 2024 and is expected to grow further during the forecast period. In the market for IT services for ambulatory surgical centers (ASCs), the service sector usually consists of a variety of products and services designed to satisfy the unique technical requirements of ASCs. These services are intended to increase operational effectiveness, optimize workflows, guarantee regulatory compliance, and enhance patient care in the context of ambulatory surgery. Delivering thorough training courses to ASC employees to guarantee their competence in utilizing IT technologies. This could involve instructional materials, online classes, and on-site training. Continuous technical support services to handle concerns, solve issues, and guarantee the efficient operation of IT systems.

The software segment is expected to show the fastest growth in the ambulatory surgical centers IT services market over the forecast period. The software segment usually includes a range of software solutions that are customized to meet the unique requirements of ASCs. In ASCs, these software programs are essential for optimizing workflow, increasing productivity, guaranteeing legal compliance, and boosting patient care. Digital patient records, which include prescriptions, treatment plans, medical histories, and other pertinent data, are kept up to date with the aid of EHR systems made specifically for ASCs. Practice management software helps ASCs handle administrative duties like appointment scheduling, invoicing and billing, processing insurance claims, and inventory control. Specialized software programs called surgical management systems are made to make it easier for ASCs to plan, schedule, and coordinate surgical procedures.

The cloud-based segment dominated the ambulatory surgical centers IT services market in 2024. In the ambulatory surgical centers IT services market, the term "cloud-based segment" designates a particular class of IT services and solutions that are accessible and provided through cloud computing infrastructure. Cloud-based IT services are advantageous in the context of ASCs, which are medical institutions that perform surgery on an outpatient basis. Staff members at ASC may access vital data and apps remotely thanks to cloud-based solutions, which are accessible from any location with an internet connection. Pay-per-use or subscription models are common for cloud-based systems, which do not require significant upfront infrastructure costs. This can be very helpful for ASCs, as they could have small IT budgets.

The on-premise is expected to grow rapidly in the ambulatory surgical centers IT services market in the upcoming years. The on-premise segment relates to the deployment approach in which the IT infrastructure and applications are set up and maintained locally on the ASC's property. According to this arrangement, the ASC normally buys or licenses the software, installs it on their own computers or servers, and oversees the whole IT infrastructure either internally or with the assistance of outside vendors. This section contrasts with Software as a Service (SaaS) or cloud-based products, where the software is hosted online and accessed via a web browser. Although on-premise solutions provide more flexibility and control, they frequently come with a higher initial cost for software licenses, hardware, and IT staff for upkeep and updates.

By Service

By Solution

By Deployment Mode

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

October 2023

September 2024

March 2025

November 2024