January 2025

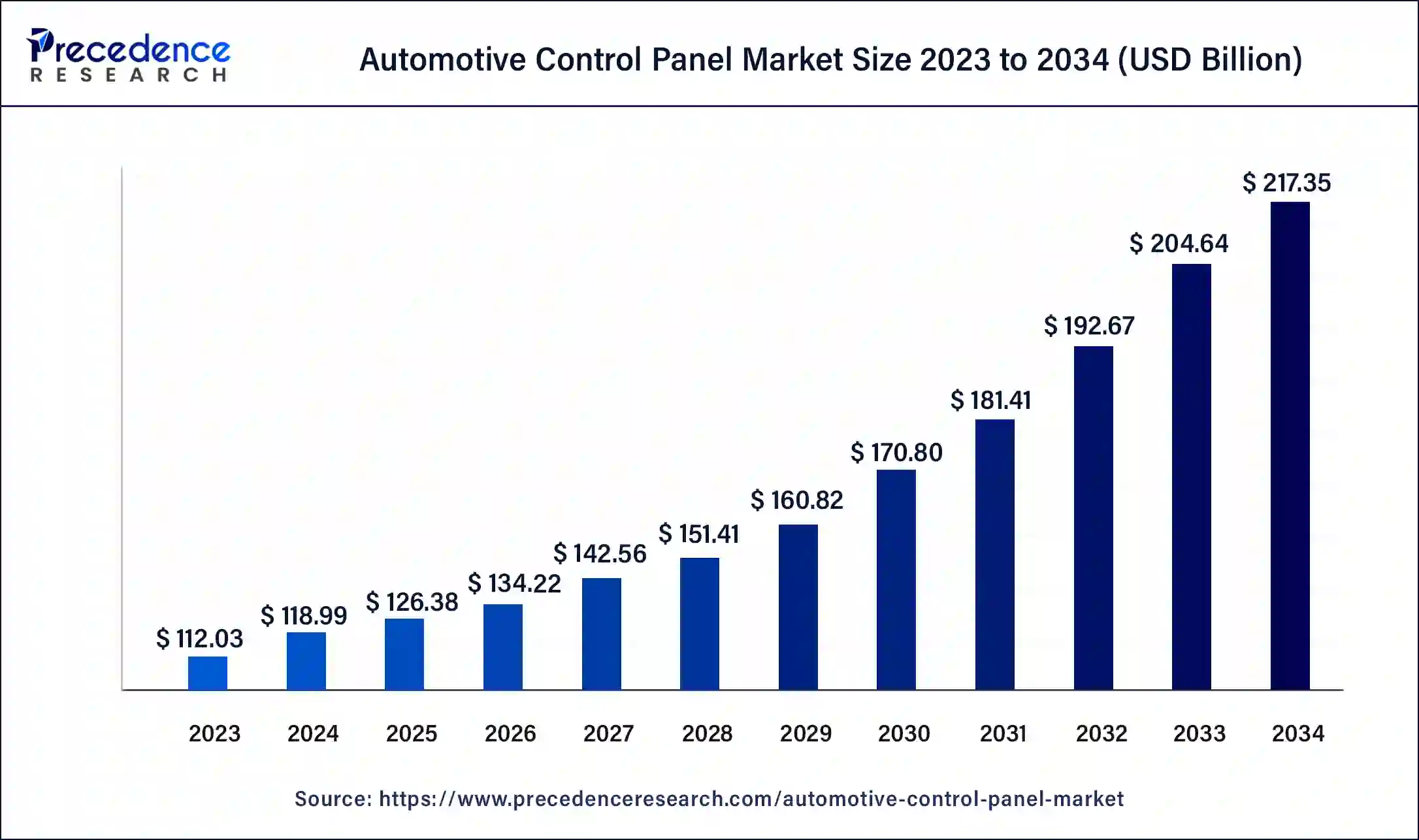

The global automotive control panel market size was USD 112.03 billion in 2023, calculated at USD 118.99 billion in 2024 and is expected to be worth around USD 217.35 billion by 2034. The market is slated to expand at 6.21% CAGR from 2024 to 2034.

The global automotive control panel market size is projected to be worth around USD 217.35 billion by 2034 from USD 118.99 billion in 2024, at a CAGR of 6.21% from 2024 to 2034. The growing development in the automotive industry has driven the growth of the automotive control panel market. Also, the rising demand for passenger cars boosts industrial growth. Additionally, the advancements in automotive technologies propel the market growth.

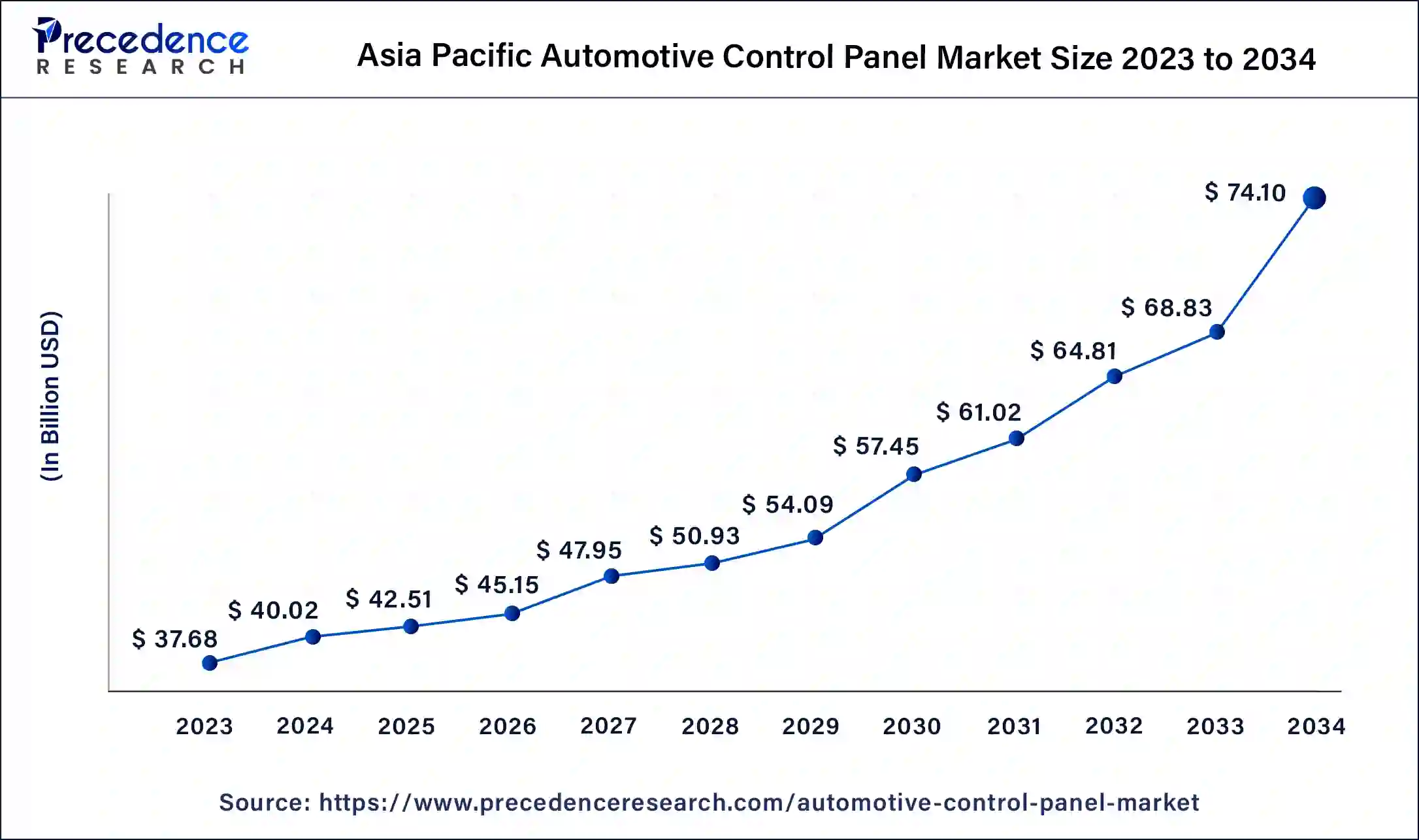

The Asia Pacific automotive control panel market size was exhibited at USD 37.68 billion in 2023 and is projected to be worth around USD 74.10 billion by 2034, poised to grow at a CAGR of 6.34% from 2024 to 2034.

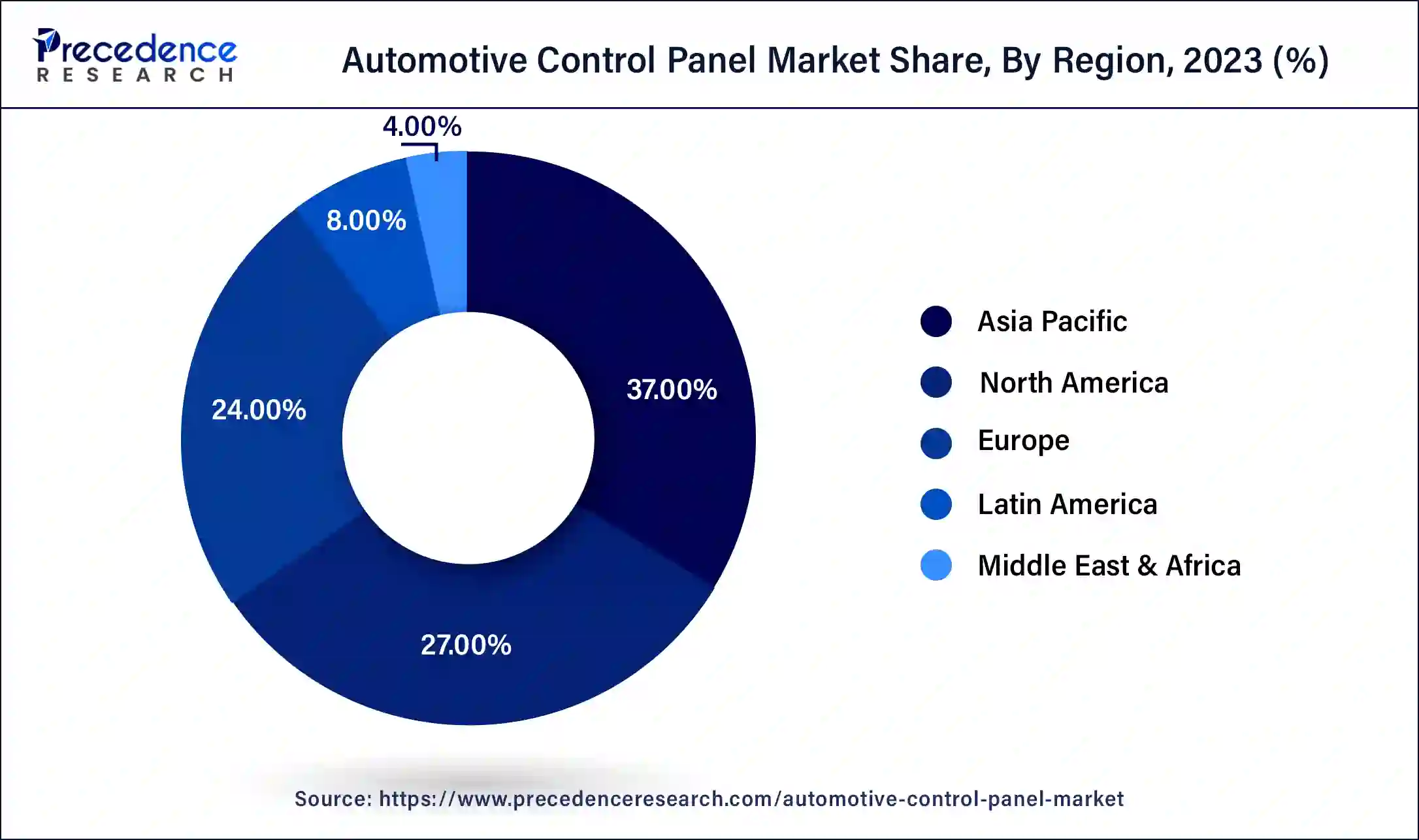

Asia Pacific held the dominant share of the automotive control panel market in 2023. The increasing demand for affordable cars and advancements in automotive technology drive the market growth. Also, the rising development in the automotive industry, along with several companies such as Tata, Maruti, BYD, Xiaomi, Toyota, Hyundai, Mitsubishi, and others, has contributed to market growth. The development of EV infrastructure in several countries such as India, China, Japan, South Korea, Thailand, Taiwan, and Singapore due to investments from private sector enterprises has contributed to industrial growth. Moreover, the rising preference for compact SUVs, along with the availability of automotive electronic components in China and Japan, has boosted the automotive control panel market growth.

This region comprises several local manufacturers of automotive control panels, such as MinebeaMitsumi Inc., Hyundai Mobis Co., Ltd., Calsonic Kansei Corporation, Toyota Boshoku Corporation, and some others are continuously engaged in developing high-quality control panels and software for automotive in this region, which in turn is expected to propel the growth of the automotive control panel market.

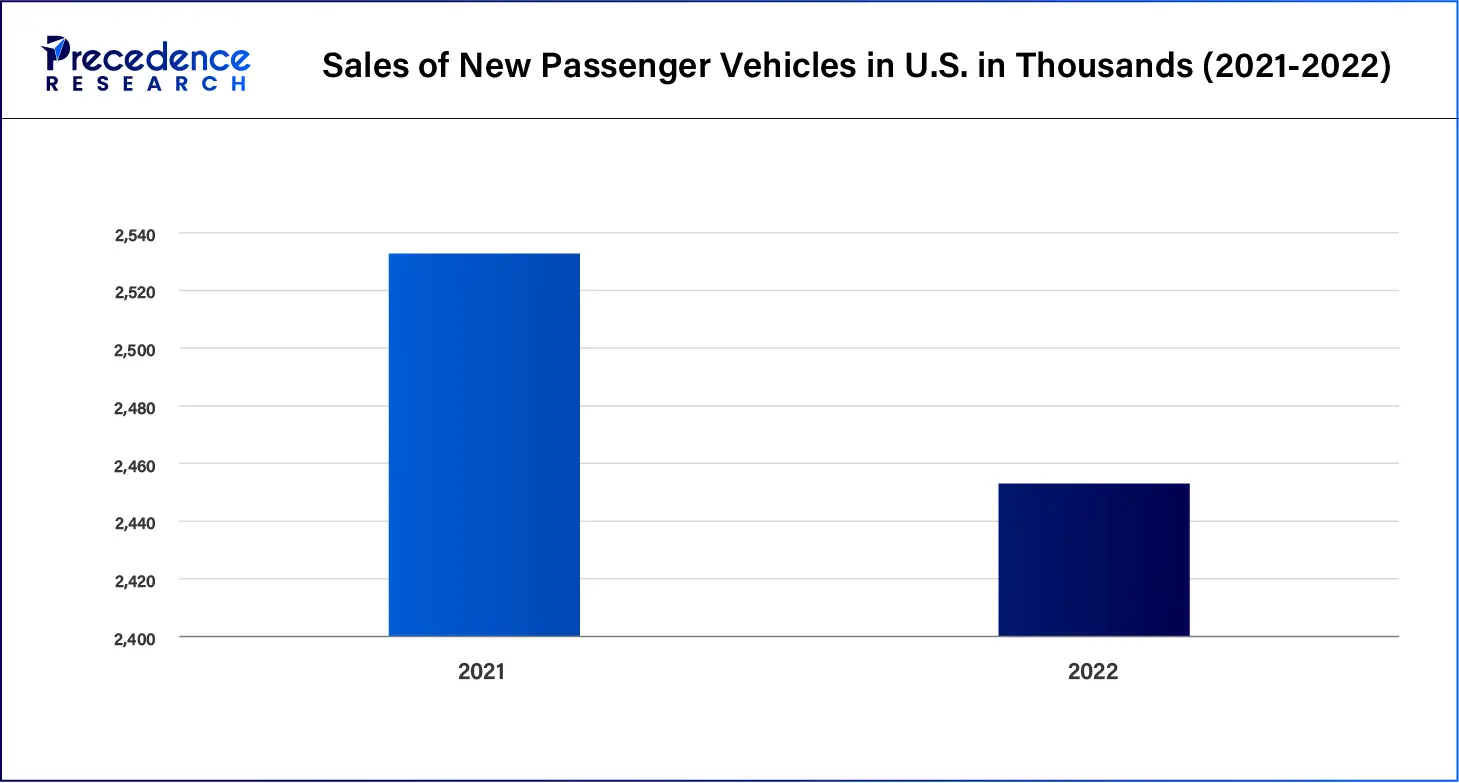

North America is expected to grow at a significant CAGR during the forecast period. The rising advancements in the automotive sector in countries such as Canada and the U.S. have contributed to the development of the automotive control panel market. Also, the rising consumer preference towards luxury cars, along with the rise in the automotive software industry, is crucial for industrial growth. There are several automotive companies, such as Tesla, Ford, GM, Rivian, Cadillac, Chevrolet, Stellantis NV, and some others, that have increased the demand for various types of automotive control panels. Also, the growing demand for SUVs for off-roading purposes, along with the increasing trend of aesthetics and modern features in vehicles, is positively impacting the market.

North America consists of various market players in automotive control panels, including Johnson Controls, Inc., Magna, Lear, and others, which are constantly developing automotive control panels and software associated with them. Also, these companies are adopting several strategies, such as partnerships, acquisitions, collaborations, launches, and business expansions, that are driving the growth of the automotive control panel market in this region.

The automotive control panel market is an important industry in the automotive sector. This industry deals with manufacturing and distributing automotive control panels for different automotive companies. This market is generally driven by the rising trend of sports cars along with the advancements in-car infotainment systems. The automotive control panel industry deals in developing different types of panels, including manual control panels, touchscreen control panels, and push-button control panels. This industry manufactures several components such as rotary switches, side mirrors, and others. These control panels find applications in vehicles such as passenger cars, heavy commercial vehicles (HCV), and light commercial vehicles (LCVs). This industry is expected to grow exponentially with the development of the automotive industry.

What is the role of AI in Automotive Control Panel Market?

The automotive industry has developed rapidly with the advancements in technologies associated with it. Automotive companies are integrating technologies such as AI, Blockchain, Big Data, Machine Learning, and others to improve the efficiency of workers and increase overall productivity. Nowadays, OEMs of automotive control panels have started using AI in their manufacturing process and have integrated AI in control panels to optimize several features of the vehicles. The integration of AI in car control panels helps detect anomalies in vehicles, enhances driving capabilities, and simplifies complex features and other functions.

Top 10 Automotive Companies

| Report Coverage | Details |

| Market Size by 2034 | USD 217.35 Billion |

| Market Size in 2023 | USD 112.03 Billion |

| Market Size in 2024 | USD 118.99 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 6.21% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Growing trend of electric vehicles (EVs)

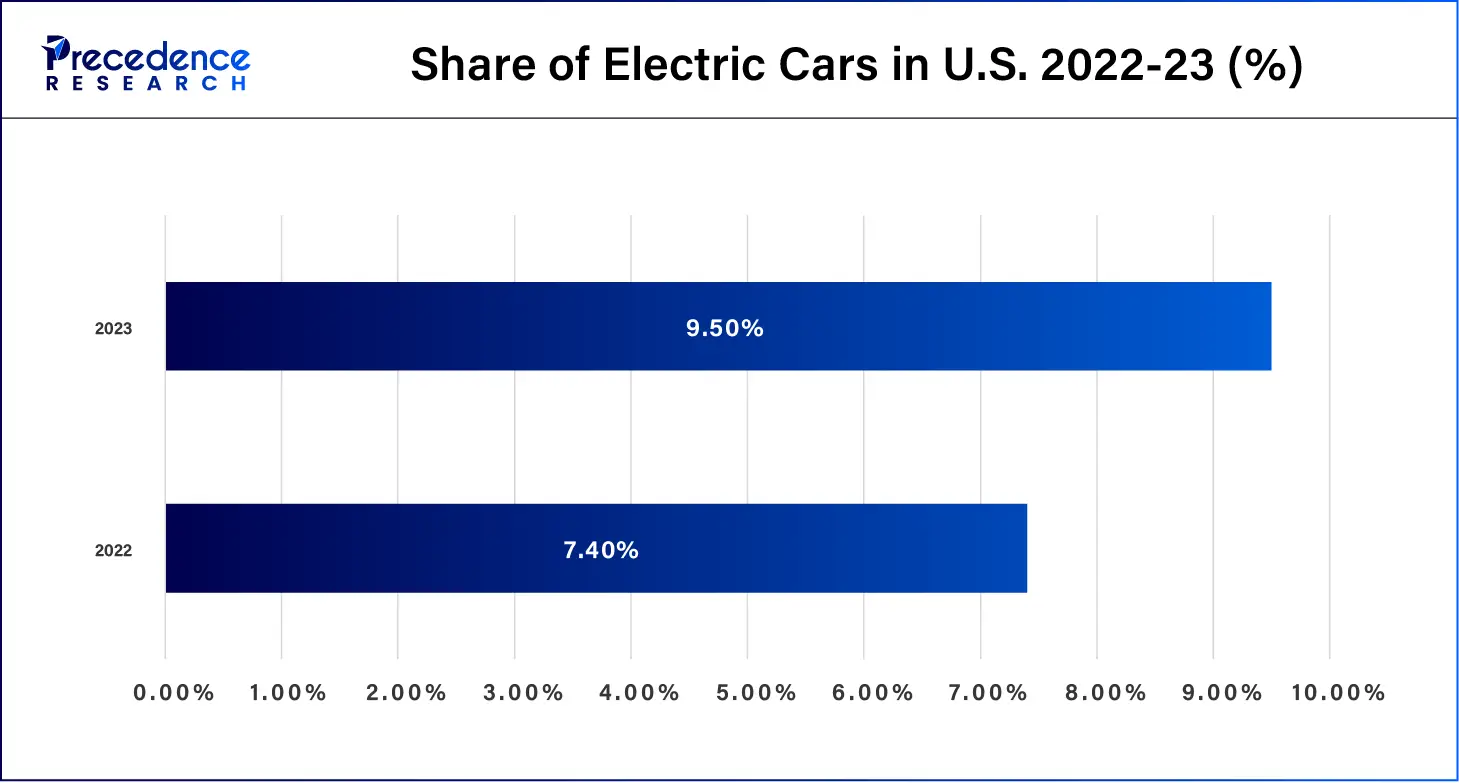

The EV industry is one of the fastest-growing industries in the world. The trend of EVs has grown rapidly among consumers due to rising awareness regarding environmental protection along with increased prices of fuels across the world. Also, the government of various countries such as the U.S., India, Norway, Denmark, Netherlands, and some others have increased their emphasis on the development of EV infrastructure. Moreover, several governments have started providing subsidies for transitioning towards electric vehicles. Additionally, private companies' development of EV charging infrastructure, along with advancements in electric vehicle battery technologies, is crucial for the electric vehicle industry. Thus, with the rising trend of EVs, the applications of automotive control panels are likely to increase drastically.

Software bugs and misleading information

The automotive control panel industry experiences various problems in its daily operations. Some control panels come with numerous sensors that might lack consistency in providing information regarding the functioning of vehicles. Also, the software-related issues in control panels might lead to incorrect information that can deteriorate the overall driving experience. Thus, the lack of consistent performance and misleading information is expected to restrain the growth of the automotive control panel market during the forecast period.

Developments in autonomous vehicles

The automotive control panel industry has developed rapidly with the advancements in the overall automotive sector. Automotive companies such as Tesla, BMW, Waymo, Ford, General Motors (GM), Baidu, Toyota, and Volkswagen have increased their emphasis on autonomous driving technology to attract customer attraction. The demand for autonomous vehicles is expected to increase due to advancements in technologies along with enhanced road safety and environmental benefits. With the growing demand for autonomous vehicles, the application of control panels increases. Thus, development in autonomous vehicles is expected to create growth opportunities for market players in the coming days.

The manual control panel segment dominated the automotive control panel market in 2023. The application of manual control panels in affordable vehicles has increased due to their cost-effectiveness and simplicity. Also, the increased preference for traditional feeling in cars, along with the interest of people towards physical buttons, switches, knobs, and others in vehicles, has contributed to the market growth. Moreover, the rising demand for manual control panels due to less maintenance and easy functioning has gained prominent interest from the automotive industry.

The touchscreen control panel segment is anticipated to grow at a significant rate during the forecast period. The growing demand for aesthetic looks and modern features in vehicles has increased the application of touch control panels. Also, the rising consumer preference for luxury features in vehicles has increased the demand for touch control panels. Moreover, the increasing use of touch control panels in sports cars to operate FATC-HVAC systems and other functions is expected to proliferate the automotive control panel market development.

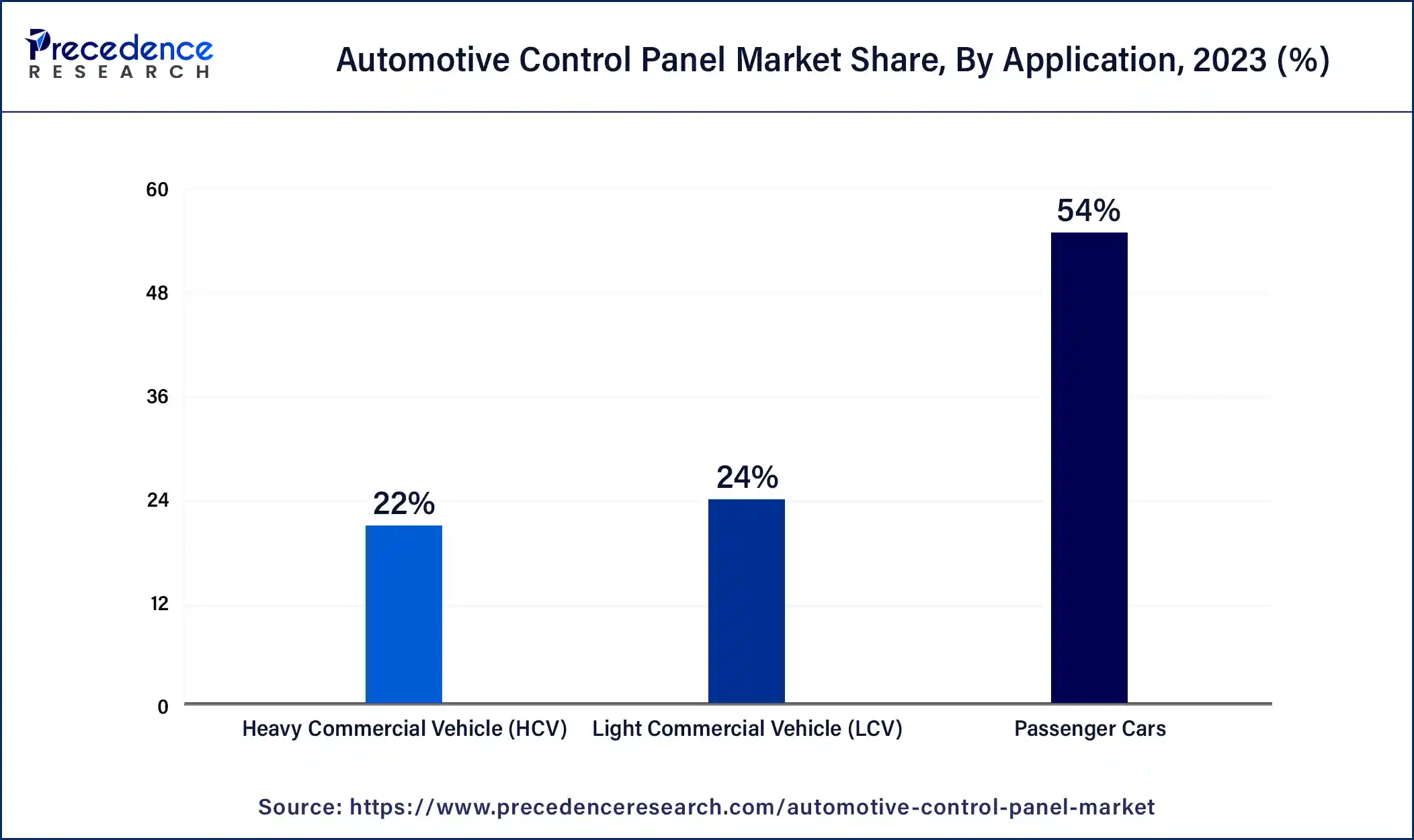

The passenger cars segment held the dominant share of the automotive control panel market in 2023. This segment is generally driven by the rising preference for sedans among enthusiast drivers, along with the growing integration of modern features in vehicles. Nowadays, high-end SUVs are integrated with touchscreen control panels to operate numerous features on a single screen, which is an important contributor to the automotive control panel market growth. The increasing trend of electric vehicles has further increased the demand for several types of control panels for controlling functions such as AC control, range detection, performance monitoring, operating lights, and some other features. Moreover, the integration of advanced driver assistance systems (ADAS) in modern vehicles has increased the applications of control panels for assisting in collision avoidance, adaptive cruise control, lane departure warning, satellite navigation, and some other functions.

The light commercial vehicle (LCV) segment is expected to grow at a significant growth rate in the automotive control panel market during the forecast period. The rising demand for light commercial vehicles (LCV) due to the rise in logistics operations has increased in recent times. Also, the application of manual control panels in light commercial vehicles has increased for operating several features, such as light control and lifting carriage space. Moreover, the growing use of manual control panels in LCVs for cost cuttings and less maintenance has contributed to the market growth of automotive control panels.

Segments Covered in the Report

By Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

April 2025

January 2024

January 2025