November 2024

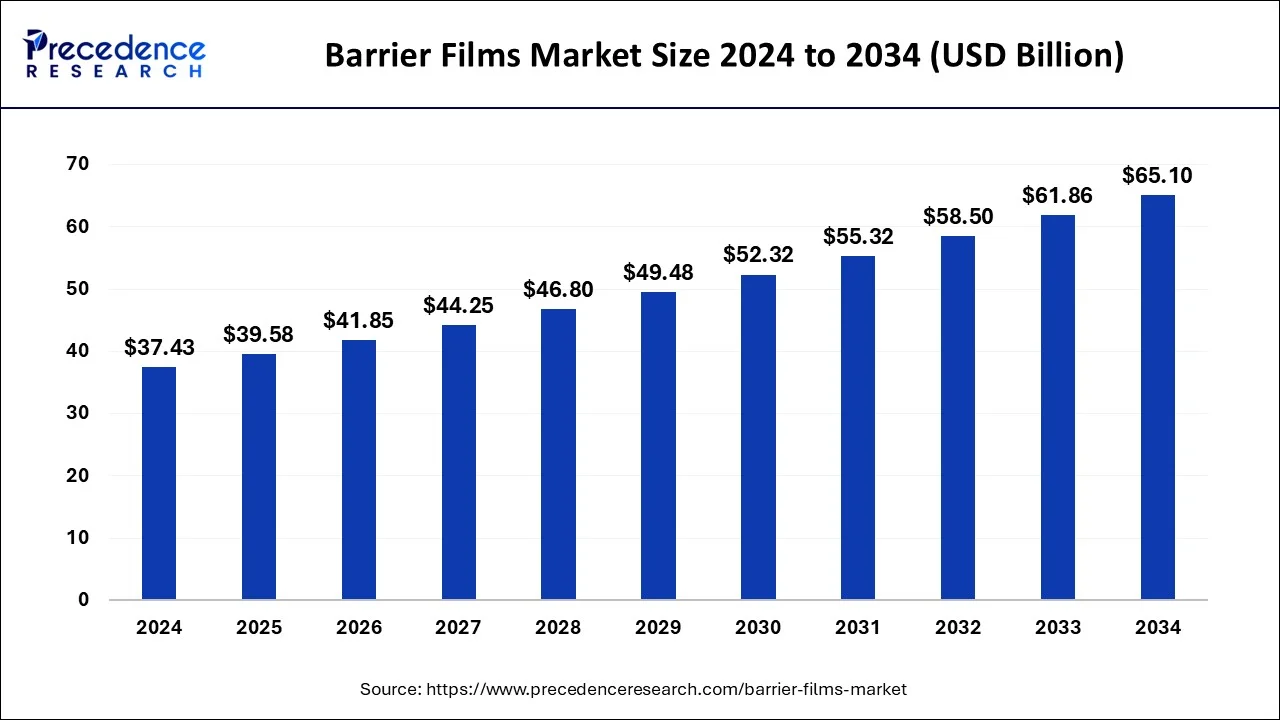

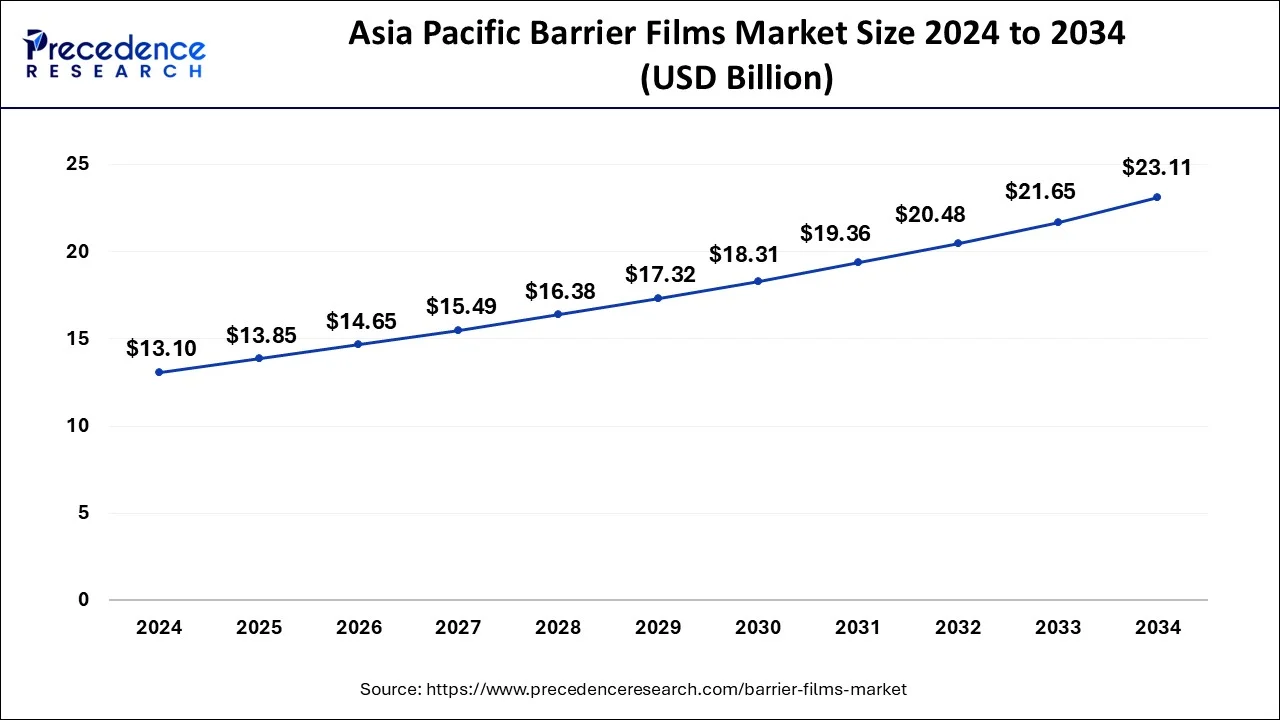

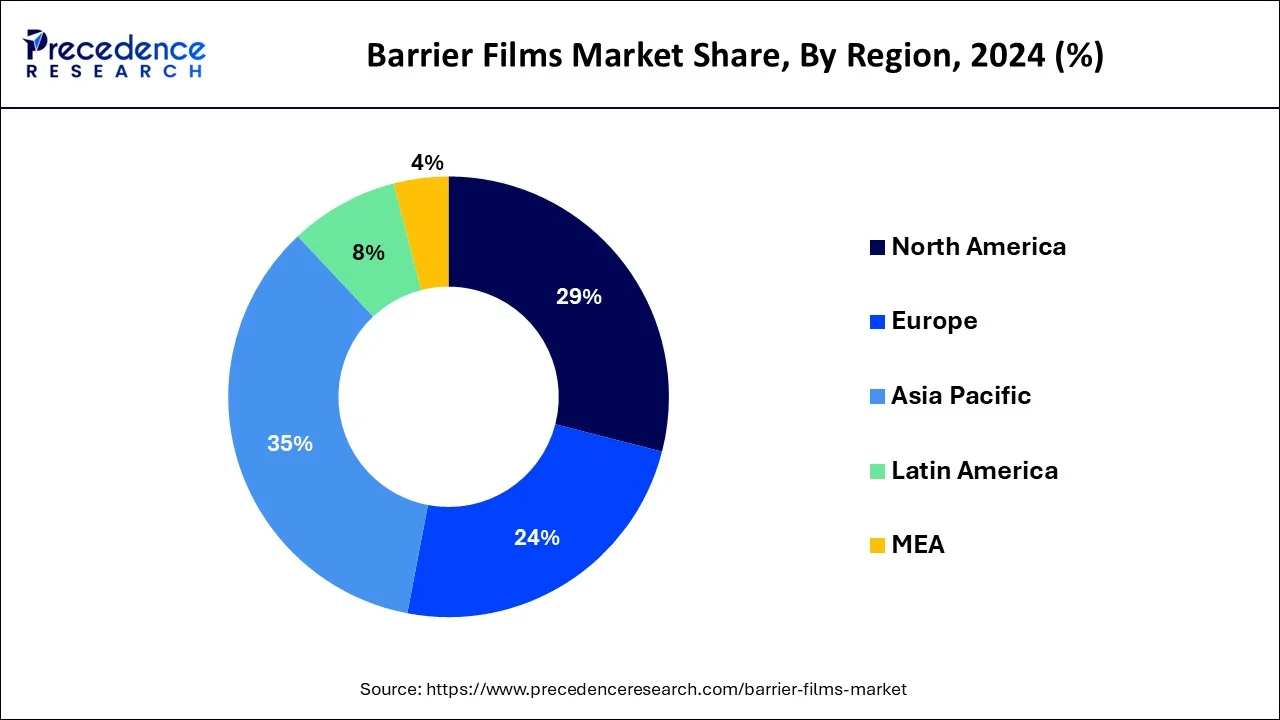

The global barrier films market size is calculated at USD 39.58 billion in 2025 and is forecasted to reach around USD 65.10 billion by 2034, accelerating at a CAGR of 5.69% from 2025 to 2034. The Asia Pacific barrier films market size surpassed USD 13.85 billion in 2025 and is expanding at a CAGR of 5.84% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global barrier films market size was estimated at USD 37.43 billion in 2024 and is predicted to increase from USD 39.58 billion in 2025 to approximately USD 65.10 billion by 2034, expanding at a CAGR of 5.69% from 2025 to 2034. Consumers, who are increasingly concerned about food safety, want packaging solutions that guarantee the integrity and freshness of food items. These factors drive the growth of the barrier films market.

The Asia Pacific barrier films market size was estimated at USD 13.10 billion in 2024 and is predicted to hit around USD 23.11 billion by 2034 at a CAGR of 5.84% from 2025 to 2034.

Asia Pacific held the largest share in the barrier films market in 2024. The region's market is steadily expanding, mostly due to rising demand from a variety of sectors, including agriculture, electronics, food packaging, and pharmaceuticals. In order to prolong the shelf life of items, barrier films are specialized packaging materials made to shield contents from outside elements like moisture, oxygen, light, and gases.

Due to changes in dietary preferences, increased disposable incomes, and population growth, the food and beverage business has experienced tremendous growth in Asia Pacific. The need for barrier films in this industry is fueled by the necessity of shielding medications, medical equipment, and other healthcare supplies from moisture, oxygen, and other environmental variables.

North America is also expected to hold the largest share during the forecast period. The market in North America has been steadily expanding due to a number of causes, including the growing popularity of packaged foods, increased awareness of food safety and hygiene, and technological developments in barrier film materials. Barrier films have become more and more popular in North America, especially in the United States and Canada, where packaged and convenient meals are becoming more and more popular.

The increasing demand from consumers for products with longer shelf lives, better freshness, and more safety is pushing manufacturers to use more sophisticated packaging techniques. As manufacturers concentrate on product innovation, sustainability, and satisfying changing consumer needs for safer and more convenient packaging solutions, the barrier films market in North America is anticipated to continue expanding.

The demand for packaged and convenient foods has increased due to changing lifestyles and rising urbanization. By shielding these goods from moisture, oxygen, and other outside influences, barrier films help to prolong their shelf life while preserving their freshness and quality. As consumers' concerns about the safety and quality of the food they eat grow, packaging solutions that maintain product integrity and hygiene are becoming more and more important. Significant developments in materials science and production technology have benefited the barrier films business, creating high-performance films with improved barrier qualities.

The barrier films market has applications in the food packaging industry and the pharmaceutical, electronics, and agricultural sectors. It is anticipated that as these industries expand, there will be a greater need for specialty barrier films made to fit particular specifications. Flexible packaging solutions are becoming increasingly popular since they are lightweight, affordable, and have a smaller environmental impact than conventional rigid packaging formats. The market for barrier films is extremely competitive, with numerous small and medium-sized businesses and international organizations fighting for market share. Businesses are spending money on R&D to create new goods and obtain a competitive advantage in functionality, affordability, and sustainability.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 5.69% |

| Market Size in 2025 | USD 39.58 Billion |

| Market Size by 2034 | USD 65.10 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Material, By Packaging Type, and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growing emphasis on flexible packaging

Flexible packaging options are becoming more and more popular in the barrier films market because of their capacity to offer strong barriers against environmental elements like light, moisture, and oxygen that can deteriorate product quality. This is especially crucial for goods that must be kept fresh and have a long shelf life, such as food, medications, and personal hygiene products. Compared to rigid options, flexible packaging typically utilizes less material, which reduces waste production.

The development of biodegradable and recyclable materials is also accelerating the use of flexible packaging solutions. Convenient and portable packaging alternatives that suit busy lifestyles are in high demand from consumers. Reusable bags and stand-up pouches are two examples of flexible packaging that satisfies these requirements and improves user experience.

Limited recyclability

Environmental concerns cause significant hindrances in the barrier films market. Barrier films are frequently made up of several layers of various materials, each selected for its unique strength, barrier qualities, or other attributes. Polymers, including polyethylene (PE), polypropylene (PP), polyethylene terephthalate (PET), and others, together with other materials like aluminum foil or ethylene vinyl alcohol (EVOH), may be present in these layers. Barrier films may get polluted while being used by food or chemical residues from the products they shield.

The recycling process may become more challenging if there is contamination since it may be more difficult to properly clean or separate the materials. The many components found in these films frequently make it difficult for current recycling techniques to successfully separate and recover, resulting in recovered materials of lower quality or even making them unrecyclable.

Smart packaging

In the barrier films market, smart packaging refers to the use of cutting-edge technologies in packaging materials to improve their usefulness, economy, and aesthetic appeal. More and more, barrier films with greater mechanical strength, improved barrier performance, and increased flexibility are being created using nanotechnology. Packaging can include NFC tags and QR codes to give customers access to details about the product, such as where it came from, what's in it, when it expires, and how to use it. Augmented reality (AR) and gamification are two examples of interactive packaging aspects that are used to engage customers and improve their entire product experience. For instance, you might be able to access promotions or interactive information by scanning the QR code on the box.

The organic coating segment held the largest share of the barrier films market in 2024. In the packaging industry, the use of organic coatings in barrier films is a major trend, especially in industries where maintaining freshness, prolonging shelf life, and shielding items from moisture, oxygen, and light are essential. Barrier films are given organic coatings to increase their barrier qualities and add features like heat sealing, printability, and better aesthetics.

The increasing demand from consumers for environmentally friendly packaging solutions is met by organic coatings, which are frequently made from renewable resources or biodegradable materials. Because of this, brands aiming to accomplish sustainability objectives and lessen their environmental impact find them appealing.

By adding another barrier against smells, moisture, oxygen, and other impurities, organic coatings can strengthen the barrier qualities of films. By doing this, packaged goods' shelf life is increased, and their quality and freshness are sustained throughout time. Because organic coatings are versatile in both formulation and application, manufacturers can customize barrier films to meet unique packaging needs. They can be designed to offer variable degrees of barrier protection, substrate compatibility, and desired features, including UV resistance, anti-fogging, and antibacterial qualities because organic coatings can improve the visual appeal of packaging because they offer a glossy, smooth surface and make it possible to print graphics, branding elements, and product information in high quality.

The pouches segment had the largest share of the barrier films market in 2024. In the barrier film industry, pouch packaging has grown and been used much more recently. Barrier films are perfect for keeping freshness and prolonging the shelf life of different items since they are specifically designed to shield contents from external influences, including moisture, oxygen, light, and scents. The food and beverage, pharmaceutical, cosmetic, and home goods industries are among those with a growing need for pouch packaging that uses barrier films. Pouches provide the portable, lightweight, and handy packaging options that consumers are increasingly choosing. By prolonging the shelf life of products, pouch packaging with barrier films lowers food waste and improves product quality.

Pouch packaging can be customized to satisfy the unique needs of various goods. Barrier films are available in a range of thicknesses and compositions, so producers can select the best one for their product depending on how sensitive it is to outside influences. Pouch packaging has many advantages for ease of use, including lightweight construction, reseal ability and simple opening. Because of these characteristics, pouches are especially well-liked for single-serve and on-the-go products. Pouch packaging gives producers plenty of room for branding and product details, enabling them to interact with customers more successfully and set their items apart on the shelf. The visual appeal of pouches is further enhanced by custom printing and design options, which can help to increase customer interaction and brand identification.

The agriculture segment held the largest share of the barrier films market in 2024 and is expected to sustain the position throughout the forecast period. The necessity for efficient packaging solutions to preserve and protect agricultural goods is the main driver of the agriculture segment's growth in the barrier films market. Barrier coatings are essential to agriculture because they prolong the shelf life of perishable items and shield them from environmental elements such as moisture, air, light, and microbial contamination. In agriculture, barrier films are widely used to package fresh goods like grains, fruits, and vegetables. When produce is being stored, transported, and distributed, these films aid in preserving its quality and freshness. The shelf life of agricultural products can be prolonged by using barrier films to create a barrier against moisture and oxygen.

By shielding agricultural products from outside elements like dust, UV rays, and pollutants, barrier films maintain the nutritional content and integrity of the items. In MAP systems, where the environment inside the packaging is altered to slow down the ripening process and prevent microbial growth, barrier films are frequently utilized. Fruits and vegetables can retain their freshness for longer thanks to this technique. In agriculture, there is a growing need for sustainable packaging options due to growing environmental consciousness. Recyclable, biodegradable, and renewable resource-based barrier films are becoming more and more common.

By Material

By Packaging Type

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

January 2025

October 2024

February 2025