September 2024

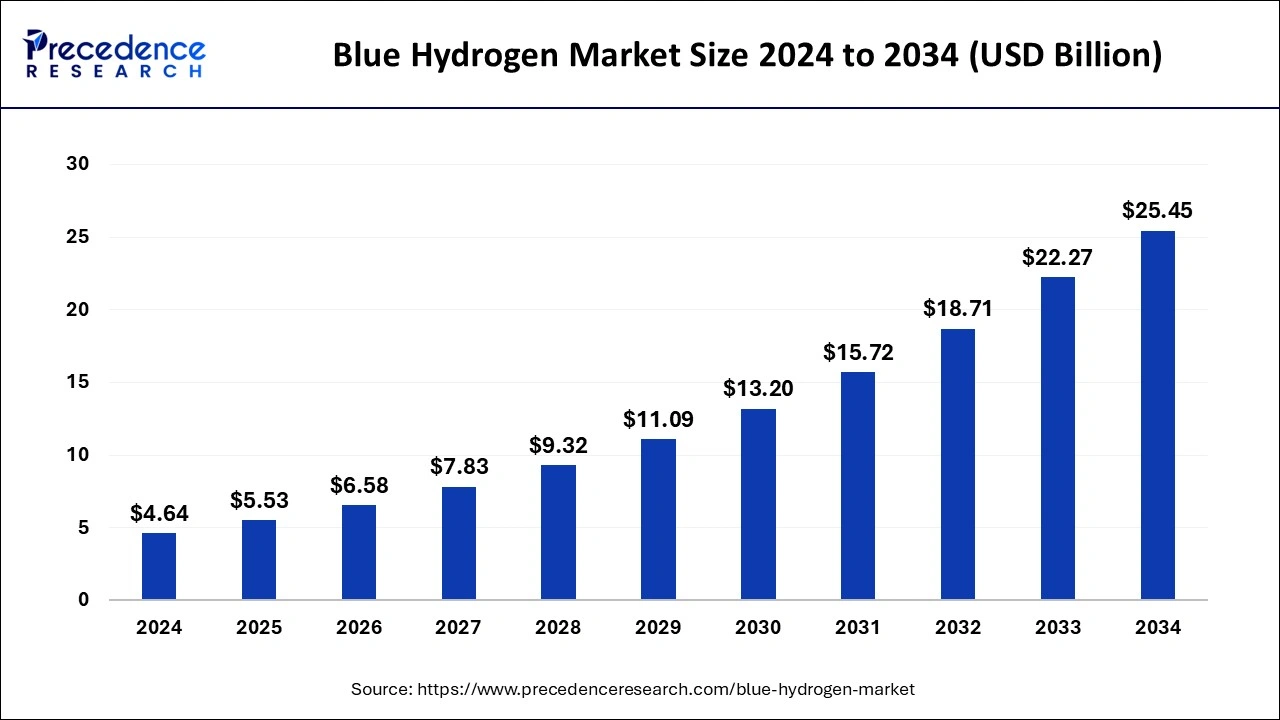

The global blue hydrogen market size is calculated at USD 5.53 billion in 2025 and is forecasted to reach around USD 25.45 billion by 2034, accelerating at a CAGR of 18.55% from 2025 to 2034. The Middle East & Africa blue hydrogen market size surpassed USD 1.94 billion in 2025 and is expanding at a CAGR of 18.75% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global blue hydrogen market size was estimated at USD 4.64 billion in 2024 and is predicted to increase from USD 5.53 billion in 2025 to approximately USD 25.45 billion by 2034, expanding at a CAGR of 18.55% from 2025 to 2034. This market is driven by several countries setting targets for reducing carbon and greenhouse gas (GHG) emissions by adopting hydrogen as an alternative in the energy transition.

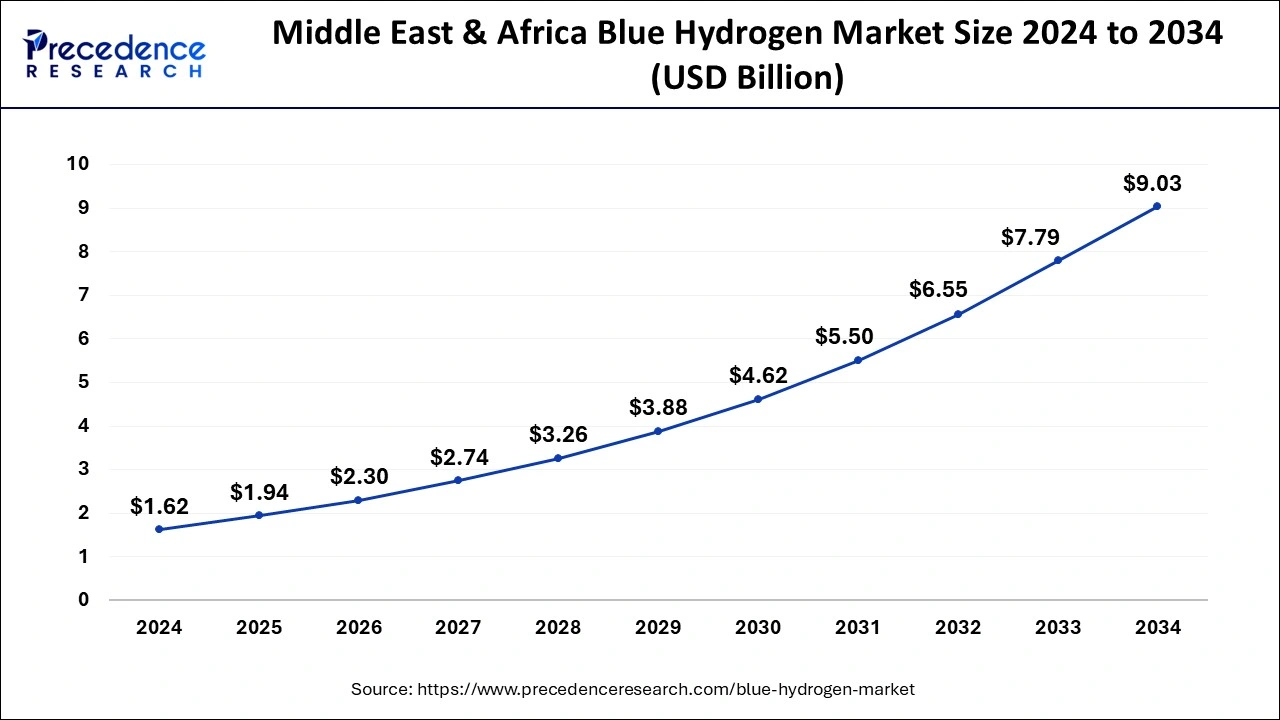

The Middle East & Africa blue hydrogen market size was exhibited at USD 1.62 billion in 2024 and is projected to be worth around USD 9.03 billion by 2034, growing at a CAGR of 18.75% from 2025 to 2034.

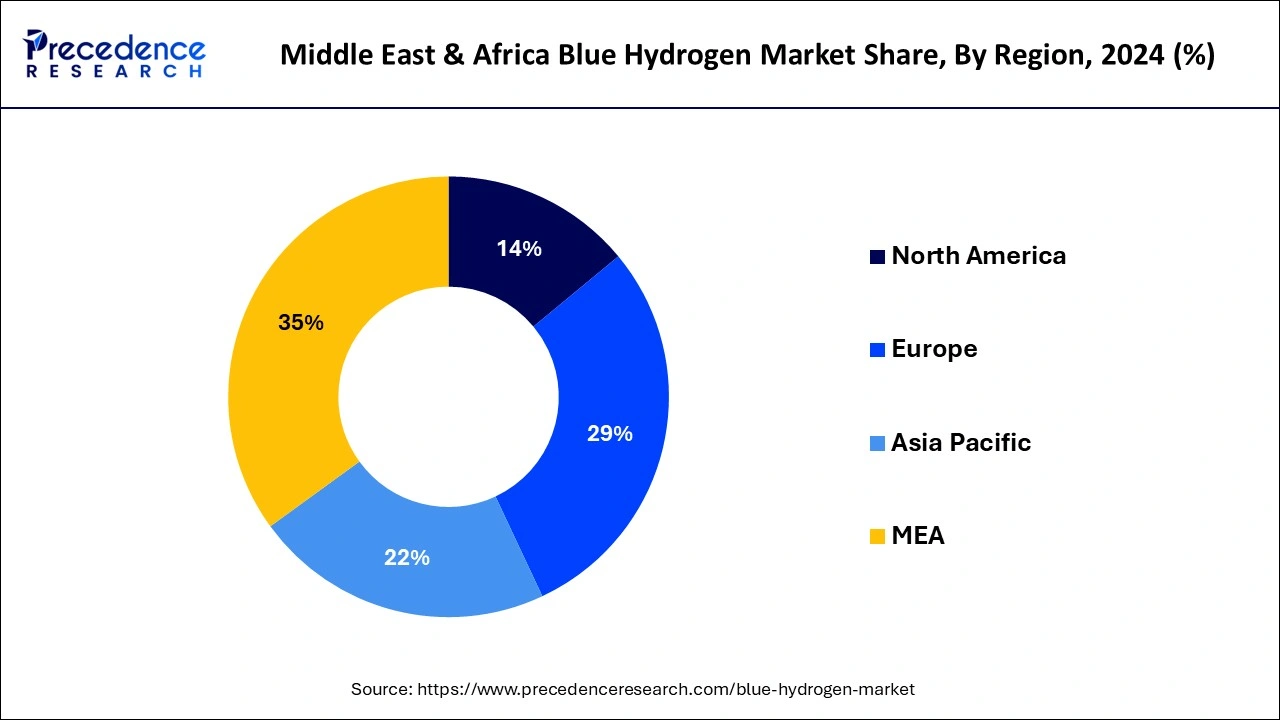

Middle East & Africa dominated the blue hydrogen market in 2024. African countries like Egypt, Mauritania, Morocco, and South Africa will be key contributors to the emerging hydrogen market in the MEA. These countries are leveraging their renewable energy resources to produce green hydrogen for both domestic use and to meet the increasing demand in markets such as Europe. Several large-scale low-carbon hydrogen projects are in the pipeline for the region, enhancing its position in the global hydrogen market.

Europe is projected to hold the fastest-growing blue hydrogen market during the forecast period. The European blue hydrogen market is anticipated to grow due to the rising demand for fuel cell-based electric vehicles and a transition toward a hydrogen-based economy. This growth is further supported by favorable government initiatives and the increased adoption of blue hydrogen across the region.

Blue hydrogen, produced from natural gas and supported by carbon capture and storage, is a low-carbon alternative that eliminates CO2 emissions. The entities involved in the development, production, and commercialization of this compound, along with the end users, from the blue hydrogen market. Various technologies are currently used to produce hydrogen, such as steam methane reforming, partial oxidation of oil, coal gasification, and auto-thermal reforming.

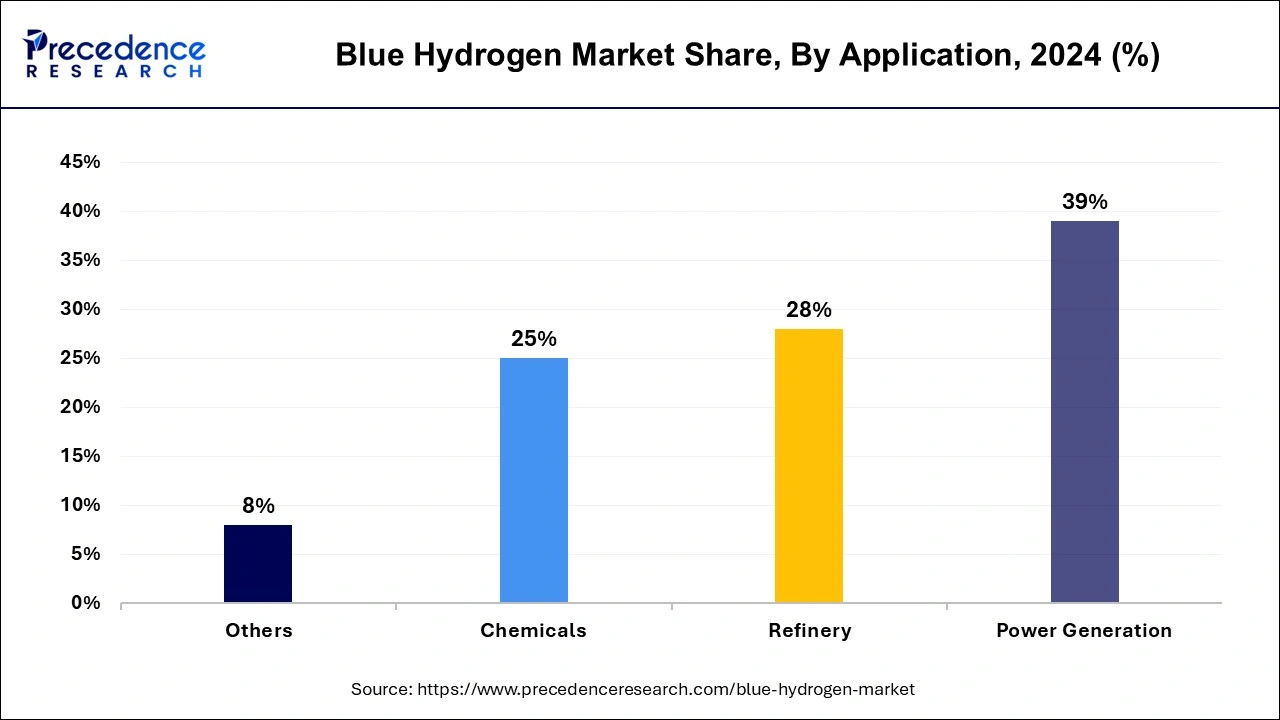

Today, most hydrogen is derived from fossil fuel reforming, primarily used in petroleum refineries and fertilizer manufacturing. However, this method emits CO2, giving limited climate benefits. Hydrogen has diverse applications, from industrial feedstock to fuel cell vehicles and energy storage. The rapid development and innovation in green hydrogen technology could hinder market growth despite its numerous applications.

| Report Coverage | Details |

| Market Size in 2025 | USD 5.53 Billion |

| Market Size by 2034 | USD 25.45 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 18.55% |

| Largest Market | Middle East & Africa |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technology, Transportation Mode, Application and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Government initiatives and regulations

Government initiatives and regulations play a crucial role in driving the global blue hydrogen market. Many governments worldwide are implementing policies and regulations to promote the use of low-carbon fuels like hydrogen, addressing the challenges posed by climate change and air pollution. Measures such as carbon pricing and taxes are being introduced to incentivize the transition to low-carbon fuels. This has led to increased demand for blue hydrogen, which emits less carbon than traditional fossil fuels.

Policies that promote renewable energy sources such as wind and solar power are contributing to the growth of renewable energy. Additionally, blue hydrogen can be produced using renewable energy, further reducing its carbon footprint. Governments are offering various incentives to encourage the adoption of clean energy, including grants and tax credits for companies investing in hydrogen production or using hydrogen in their operations. These initiatives are essential in accelerating the shift towards cleaner energy solutions and reducing greenhouse gas emissions.

Presence of methane

The presence of methane, a potent greenhouse gas in natural gas, is a significant barrier to the profit growth of the blue hydrogen market. Methane leaks during blue hydrogen production contribute to global warming. Moreover, using natural gas to generate the substantial energy needed for manufacturing blue hydrogen results in carbon dioxide emissions, which limits revenue growth in the market. Additionally, the lack of infrastructure poses a particular challenge in developing countries. These regions often have limited access to the necessary technology, expertise, and funding required for the widespread adoption of blue hydrogen technologies.

Rising demand for cleaner energy

The growing demand for cleaner energy sources and clean hydrogen across various industries, including petroleum refining, power generation, chemical, and transportation, is a key driver of market growth. This demand is bolstered by the increasing adoption of hydrogen-powered fuel cells, which are lightweight, pollution-free, space-efficient, and offer higher energy storage density and longer range compared to traditional combustion technologies like lithium-ion batteries.

Fuel cell electric vehicles (FCEVs) are gaining popularity due to their low refueling and maintenance costs, as well as zero emissions, which is accelerating their adoption rates. Governments are further supporting this trend with favorable initiatives to promote fuel-cell vehicles, such as tax rebates and subsidies. These measures aim to reduce carbon emissions and decrease dependence on fossil fuels, which can contribute to the blue hydrogen market growth.

The steam methane reforming segment was the dominant technology in the blue hydrogen market in 2024. Steam methane reforming (SMR) is a method used to extract hydrogen from natural gas (methane), which is one of the most economical sources of industrial hydrogen. This process involves heating methane with steam and a catalyst, causing an endothermic reaction. This reaction breaks down the methane molecule into carbon monoxide and hydrogen. SMR is known for its cost-effectiveness and energy efficiency in producing high-purity hydrogen, which can then be collected using in-house pressure swing adsorption purification technology. The expected increase in the adoption of SMR is anticipated to drive market growth during the forecast period.

The auto thermal reforming segment is expected to grow at a significant rate in the blue hydrogen market over the forecast period. Autothermal reforming (ATR) is another technology used to produce blue hydrogen. It involves a combination of steam and oxygen to convert natural gas into hydrogen and carbon dioxide. ATR can achieve a higher purity of hydrogen compared to steam methane reforming (SMR), but it is more complex and costly.

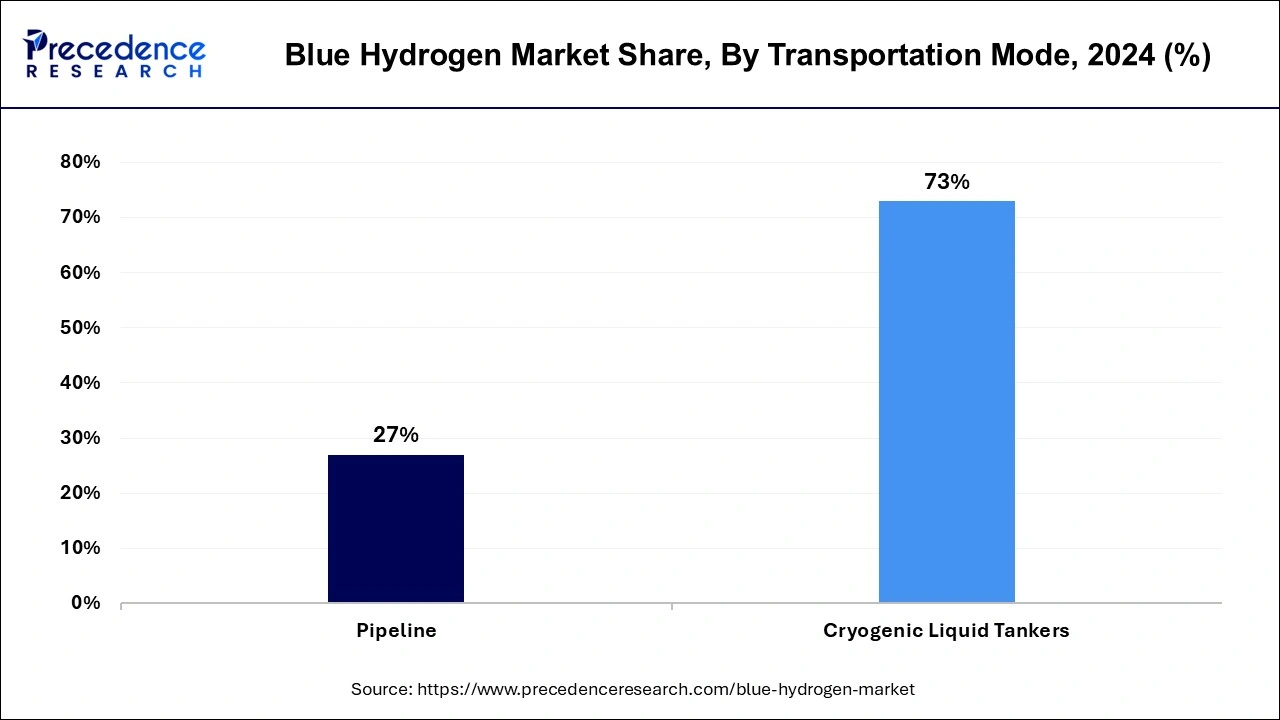

The pipeline segment dominated the blue hydrogen market in 2024. The growth of this segment of the blue hydrogen market is driven by the transportation of large volumes in gaseous form through pipelines, which provide cost-effective and long-distance coverage. These pipelines are typically situated in regions with high concentrations of large consumers of blue hydrogen, such as chemical manufacturing units, refineries, and power generation plants.

The cryogenic liquid tankers segment is expected to grow at the fastest rate during the forecast period. Cryogenic tanks are specifically designed for the storage and transportation of liquefied gases like liquefied natural gas (LNG), liquid oxygen, liquid nitrogen, and liquid argon. These tanks, which number over 250,000 units, can store gases at very low temperatures, below -150 degrees, and at high pressures.

The power generation segment dominated the blue hydrogen market in 2024. Around 96% of the world's hydrogen is produced from fossil fuels like coal, oil, and natural gas using a technique called reforming, which involves heating these fuels with steam to approximately 800°C. Hydrogen fuel cells generate energy by combining hydrogen and oxygen atoms in an electrochemical reaction similar to that of a battery, resulting in electricity, water, and a small amount of heat. Unlike fossil fuels, hydrogen fuel cells do not produce greenhouse gases during their operation, which is expected to drive the demand for blue hydrogen in power generation and contribute to market revenue growth.

The refinery segment is anticipated to grow at the fastest rate in the blue hydrogen market over the projected period. This method produces carbon dioxide as a byproduct. To achieve their sustainability goals, these companies are adopting sustainable production processes by installing carbon capture storage systems to store the carbon dioxide produced during hydrogen generation. Several petrochemical companies, such as Exxon Mobil Corp., generate hydrogen for their oil and petroleum refineries using steam methane reforming technology. This transformation helps convert their grey hydrogen into sustainable blue hydrogen with zero carbon emissions and drives the demand for blue hydrogen generation in the refinery industry.

By Technology

By Transportation Mode

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

February 2025

October 2024

February 2025