April 2025

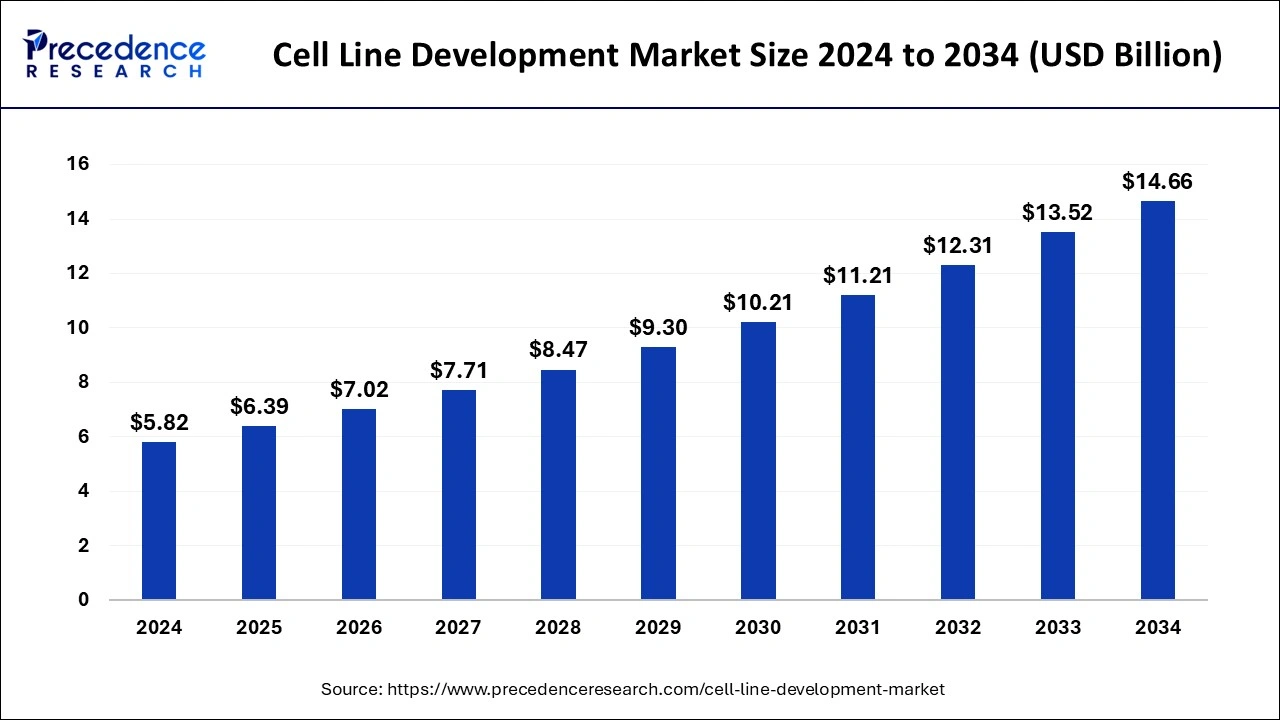

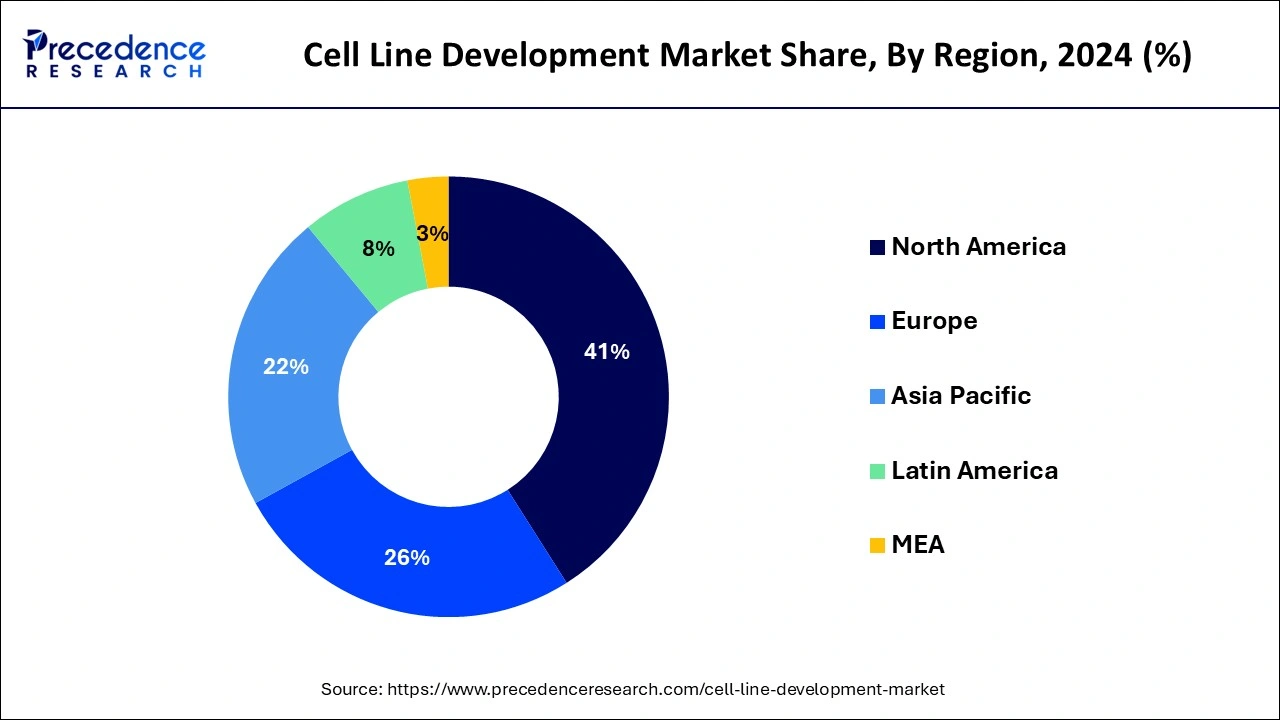

The global cell line development market size is calculated at USD 6.39 billion in 2025 and is forecasted to reach around USD 14.66 billion by 2034, accelerating at a CAGR of 9.68% from 2025 to 2034. The North America cell line development market size surpassed USD 2.39 billion in 2024 and is expanding at a CAGR of 9.70% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global cell line development market size was estimated at USD 5.82 billion in 2024 and is predicted to increase from USD 6.39 billion in 2025 to approximately USD 14.66 billion by 2034, expanding at a CAGR of 9.68% from 2025 to 2034. The availability of enhanced technologies to manufacture novel cell lines and an increase in demand for monoclonal antibodies and cancer therapies are projected to drive market expansion in the coming years.

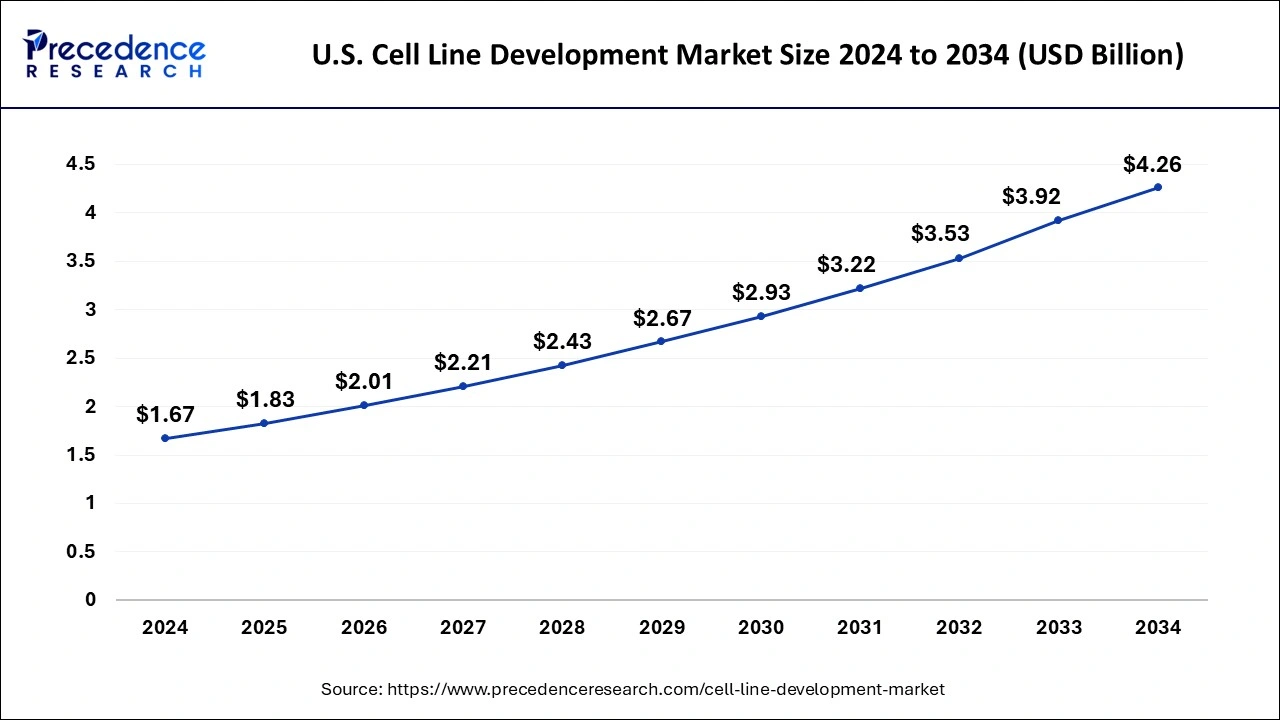

The U.S. cell line development market size was estimated at USD 1.67 billion in 2024 and is predicted to be worth around USD 4.26 billion by 2034 with a CAGR of 9.82% from 2025 to 2034.

North America dominated the cell line development market in 2024. North America, particularly the U.S., leads the cell line development market due to several factors. The presence of large pharmaceutical companies engaged in researching new drugs and vaccines using this method is a significant driver. The region benefits from improved healthcare infrastructure, which enhances affordability and access to advanced medical treatments. Additionally, the availability of skilled professionals who specialize in cancer diagnosis and regenerative treatments boosts the adoption of cell line development technologies. Moreover, the increasing government funding and research projects in North America reflect a growing awareness of the potential of regenerative medicines.

Asia Pacific is expected to hold the fastest-growing cell line development market over the forecast period. The rapid growth of the cell line development (CLD) market can be attributed to several key factors. Firstly, there are significant untapped opportunities in the market, driven by economic development and the improving healthcare infrastructure globally. Governments and biotechnology sector manufacturers are also implementing favorable initiatives that support market expansion. Also, the increasing median age of the population is contributing to the growth, as there is a rising demand for vaccines, therapeutic proteins, and other biologics.

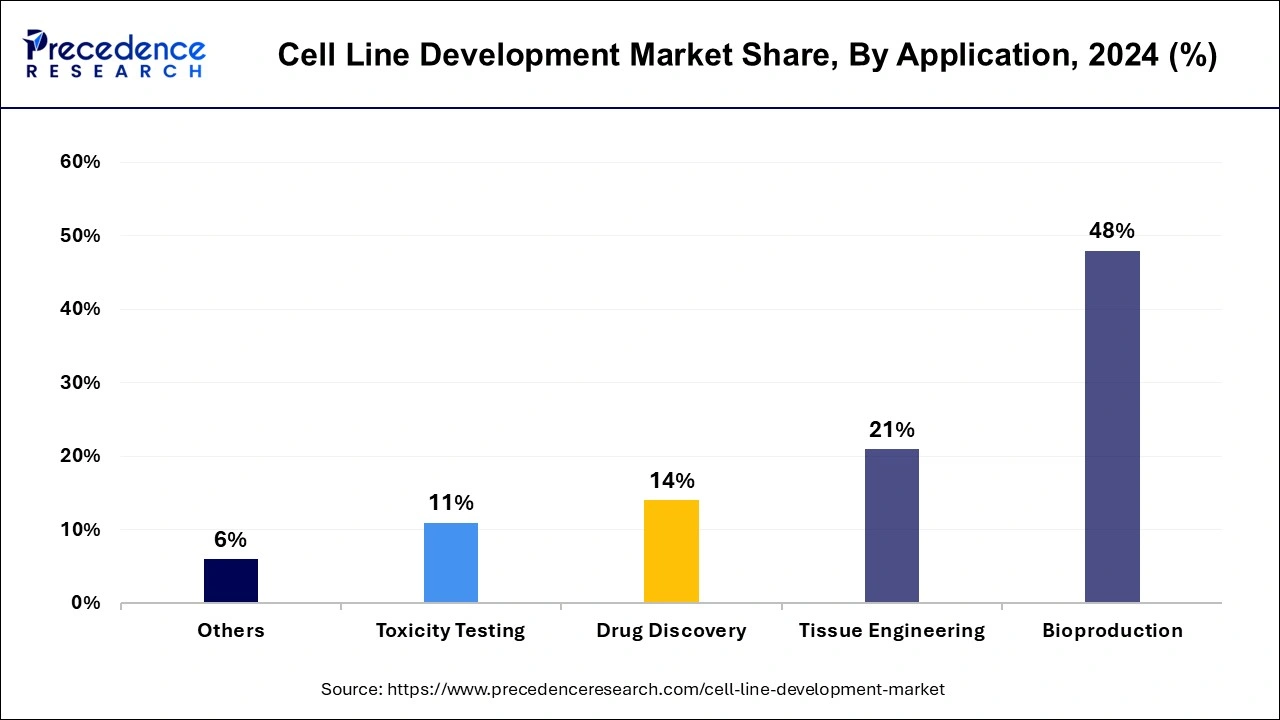

One of the most important markets in the biotechnology and pharmaceutical sectors is cell line development. The development of cell lines, which are utilized in bioproduction, drug discovery, and toxicity testing, is the main emphasis of this market. Effective and superior cell lines are becoming more and more necessary due to the increased incidence of chronic illnesses and the expanding market for biologics. Advances in gene editing technologies, including CRISPR, are improving cell line development's accuracy and productivity. The market is expanding as a result of pharmaceutical and biotechnology businesses investing more in research and development. Specialized cell lines are becoming more and more in demand as the fields of gene therapy and regenerative medicine expand.

The cell line development market is expected to increase significantly due to the convergence of technological developments, growing demand for biologics, and rising applications across many industries. To keep a competitive edge, businesses in this industry are concentrating on innovation, forming strategic alliances, and growing the range of services they offer. Synthetic biology techniques are used to create cell lines with the necessary characteristics. In order to lower the danger of contamination and increase flexibility, single-use bioreactors, and other disposable systems are being used more frequently. Technical difficulties arise when developing cell lines and trying to achieve uniformity and scalability. Cell lines need to be developed and maintained, which involves large financial outlays.

| Report Coverage | Details |

| Market Size in 2025 | USD 6.39 Billion |

| Market Size by 2034 | USD 14.66 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 9.68% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product & Service, Source, Type of Cell Lines, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising research and development in the pharmaceutical and biotechnology industries

The increasing R&D in the pharmaceutical and biotechnology industries, driven by the rising need to treat various chronic diseases, is amplifying the use of cell line development equipment. In research projects, cells serve as model systems to study cell chemistry and biology, helping researchers understand interactions between cells and infectious agents like viruses and bacteria. Additionally, cells are utilized in drug screening to observe the effects of drugs on human cells.

The cell line development market is growing due to increased investment in healthcare research. Additionally, expanding research and development in the pharmaceutical and biotechnology industries has driven the advancement of automated cell culture equipment. This innovation is anticipated to further boost the cell line development sector.

High capital requirement

The high capital requirements associated with cell line development present a significant challenge to the cell line development market growth. This process incurs substantial expenses, including regulatory approvals, facility resources, costs of reagents, equipment, personnel, clinical trials, etc. Budget constraints can adversely affect the scope and duration of projects. Furthermore, the drugs derived from monoclonal antibodies (mAbs) for treating diseases such as cancer, leukemia, and lymphoma are notably expensive. Producing cancer mAbs involves costly biological and chemical materials, extensive clinical trials, and rigorous quality tests.

Adoption of laboratory automation

The growing use of laboratory automation significantly impacts the growth of the cell line development market. As the need to lower lab costs rises, profitability per test is decreasing, prompting laboratories to prioritize volume over value. Moreover, the demand for high-quality, error-free results is driving labs to adopt more automated systems with efficient workflows.

In the U.S., the heavy influx of patients with insurance coverage encourages laboratories to adopt automation. Recent technological advancements have led to the rapid adoption of automated systems in various applications. Studies have demonstrated that these technologies enhance health and research centers by providing models for cancer research, screening anti-cancer drugs, studying the effects of cytotoxicity, and more.

The reagents & media segment dominated the cell line development market in 2024. During cell line development and maintenance, various essential tools are used, each selected based on the specific needs of the cultured and proliferating cells. Important equipment includes refrigerators, freezers, autoclaves, incubators, centrifuges, microscopes, cell counters, and cell culture hoods. These instruments play vital roles throughout the cell line development process. While the choice of equipment depends on the cells' specific requirements, these fundamental tools are crucial for ensuring successful development and maintenance.

The services segment is expected to experience the fastest growth in the cell line development market over the forecast period. The demand for CLD (cell line development) services is anticipated to increase over time due to several key factors. These include the growing need for monoclonal antibodies, the expiration of patents for blockbuster biologics, and the rising demand for effective cancer therapeutics. Technological advancements in CLD are also contributing to this growth. The increasing trend of biologics outsourcing, along with the rising approval and demand for biologics and biosimilars, is providing the market with significant growth opportunities.

The mammalian cell line segment dominated the cell line development market in 2024. This dominance is attributed to research into developmental biology and gene and protein interactions. The adoption of mammalian cell lines is expected to drive market growth over the projection period due to their compatibility with human tissues and biological components and the lower risk of infection. Furthermore, advances in cell line development technologies and the increased use of mammalian cell lines for research, clinical, and pharmaceutical applications are anticipated to bolster the growth of this segment during the forecast period.

The recombinant cell lines segment dominated the cell line development market in 2024. Recombinant cell lines, which have had recombinant DNA introduced, enable the production of recombinant proteins. Creating these cell lines involves using an expression vector to deliver the recombinant DNA, followed by transfecting it into the host system. A rigorous selection and evaluation process is used to isolate and propagate only the transfected cells. The growing demand for recombinant proteins and the use of recombinant cell lines for biotherapeutics are key factors driving this segment's growth.

The hybridomas segment is expected to witness the fastest growth in the cell line development market during the forecast period. The market for hybridomas is anticipated to experience significant growth over the forecast period, primarily due to the advantages they offer, such as their continuous growth capability, the combination of two different cell types, and the large-scale production of pure antibodies. Moreover, continuous advancements in hybridoma technology, such as the use of feeder layers composed of murine peritoneal cells and macrophages derived from mice, are expected to drive market growth during the forecast period.

The bioproduction segment dominated the cell line development market in 2024. This growth is attributed to the heightened demand for drug and vaccine production. The bioproduction technology sector encompasses the creation of biologics-based therapeutic drugs, including vaccines, therapeutic proteins, cell therapies, and gene therapies. Bioproduction is most employed in the production of biologics and vaccines. The demand for these products is anticipated to rise significantly in the future due to the increasing prevalence of viral and communicable diseases, particularly in developing countries.

In the cell line development market, the tissue engineering segment is anticipated to grow at the fastest rate during the studied period. The rapid growth of tissue engineering is driven by the increasing applications of cell line development equipment in regenerative medicine. This field aims to repair, replace, or regenerate tissues or organs through cell lines. Cell lines are crucial in tissue engineering for developing new treatments for degenerative and age-related diseases.

By Product & Service

By Source

By Type of Cell Lines

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

August 2024

October 2024

January 2025