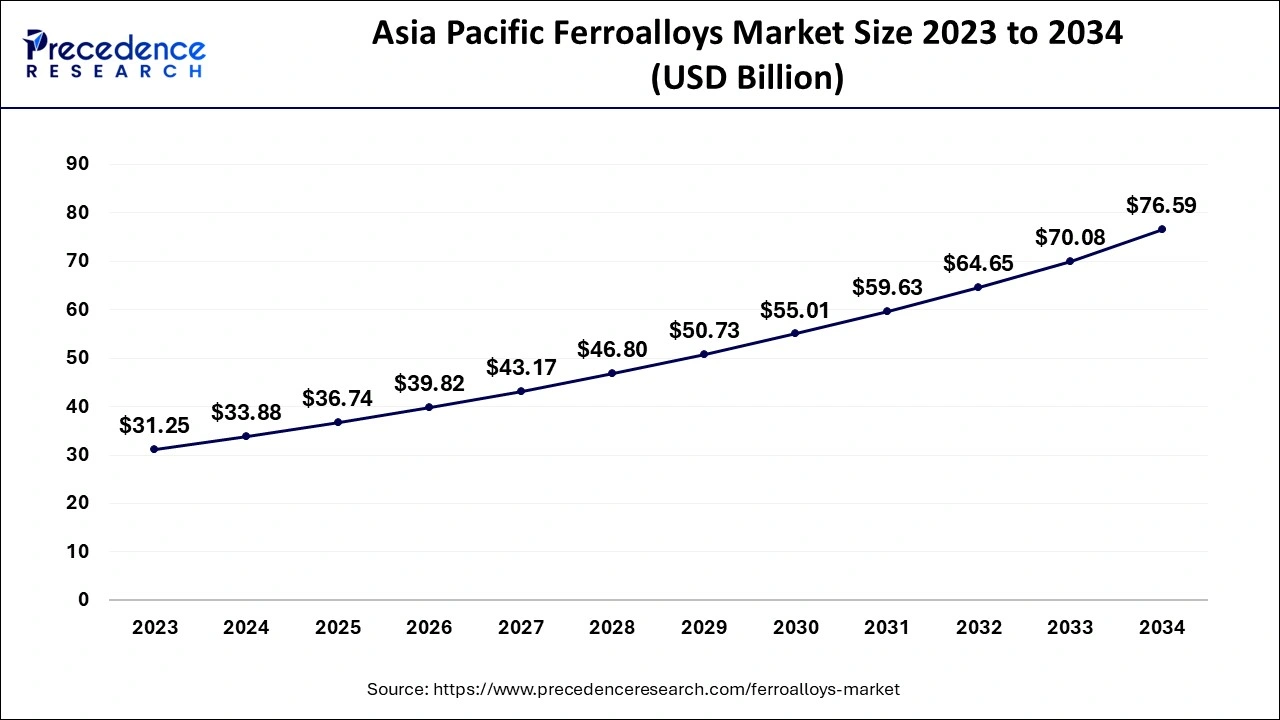

The global ferroalloys market size accounted for USD 54.65 billion in 2024, grew to USD 59.25 billion in 2025 and is expected to be worth around USD 122.54 billion by 2034, registering a CAGR of 8.41% between 2024 and 2034. The Asia Pacific ferroalloys market size is evaluated at USD 33.88 billion in 2024 and is expected to grow at a CAGR of 8.49% during the forecast year.

The global ferroalloys market size is calculated at USD 54.65 billion in 2024 and is predicted to surpass around USD 122.54 billion by 2034, registering at a CAGR of 8.41% from 2024 to 2034. The increasing demand for steel and other metals with corrosion resistance properties by the various end-use applications is driving the growth of the ferroalloys market.

The Asia Pacific ferroalloys market size is exhibited at USD 33.88 billion in 2024 and is projected to be worth around USD 76.59 billion by 2034, expanding at a CAGR of 8.49% from 2024 to 2034.

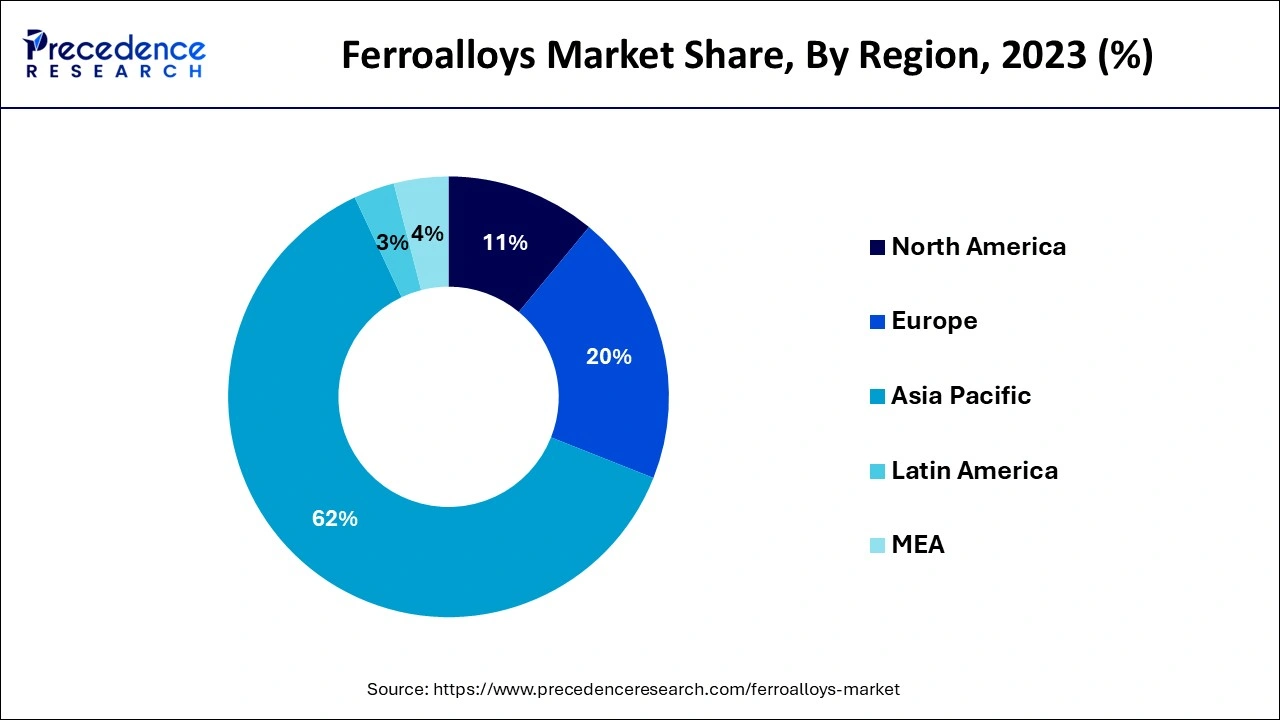

Asia Pacific dominated the ferroalloys market in 2023. The growth of the market is attributed to the rising industrialization, and the demand for steel material products from the various end-use industries is driving the growth of the market. The rising investment and the development of the steel industries in countries like India and China are driving the demand for ferroalloys. The rising demand for steel in construction and consumer products due to the rising population is contributing to the growth of the ferroalloys market in the region.

North America has anticipated significant growth during the forecast period. The growth of the market is owing to the rising construction industry, and the demand for steel in the various end-use industries is driving the expansion of the steelmaking industry, causing a higher demand for ferroalloys. Regional countries like the United States and Canada are economically developed region that boosts industrialization and infrastructural development in the countries that collectively drive the growth of the ferroalloys market across the region.

The ferroalloys are generally known as the mixture or alloy of various other elements than carbon. The ferroalloys contain iron in high proportion. The ferroalloys also contain elements, including manganese, chromium, or aluminum. Ferroalloys are specially used in the production of metal, and the steel industry is known as the largest consumer of ferroalloys due to its high corrosion resistance, which makes it ideal for the manufacturing of steel and stainless steel. It is made in an electric arc furnace. There are different types, including ferrochrome, ferromanganese, ferromolybdenum, ferrosilicon, ferronickel, ferrotitanium, ferrotungsten, and ferrovanadium.

How Can AI Impact the Ferroalloys Market?

Artificial intelligence (AI) plays a significant role in ferroalloys production and manufacturing with higher precision. Artificial intelligence helps in the production of ferroalloys in a shorter time. The AI algorithms analyze the mineralogical and chemical composition of size, raw material, and humidity of particles that help in the perfect mixture of ferroalloys that can be used in various end-use industries.

| Report Coverage | Details |

| Market Size by 2034 | USD 122.54 Billion |

| Market Size in 2024 | USD 54.65 Billion |

| Market Size in 2025 | USD 59.25 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 8.41% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Rise in the construction industry

The rising population and the demand for the construction industry for residential and commercial purposes are anticipated to contribute to the expansion of the steel manufacturing plants and industries that accelerate the demand for the ferroalloys market. Ferroalloys are highly used in steel making due to their several benefits, such as corrosion resistance properties, durability, high tensile strength, weldability, and toughness, which makes them the ideal choice for building the structure. The rising construction industry and further investment in infrastructural development drive the growth of the ferroalloys market.

Fluctuating prices

The manufacturing of the ferroalloys depends upon several other raw materials, which face continuous fluctuations in cost that directly affect the cost and manufacturing of the ferroalloys, limiting the growth of the ferroalloys market.

Advancement in the use of ferroalloys

The ongoing research and development programs in the ferroalloys industries are driving the opportunities in the ferroalloys market. The innovation in ferroalloys and their substitutes and their expanding use in various end-use industries and applications such as automobiles, turbines, aircraft engines, and others. Its lightweight and bio-compatibility make it ideal for the making of various end-use applications and products.

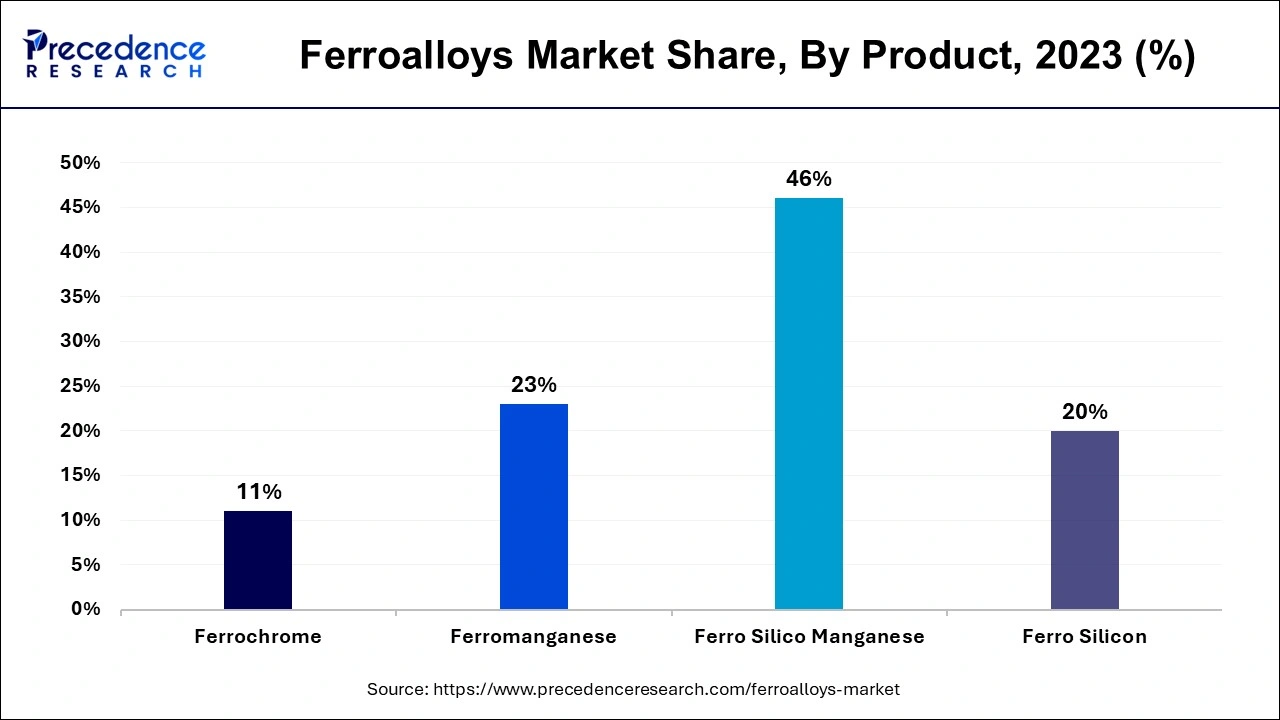

The ferro silico manganese segment dominated the market in 2023. The rising demand for ferro silico manganese in the steel industry and the increasing demand for steel in day-to-day life and industrial activities are driving the expansion of ferro silico manganese. Ferro silicon manganese is the alloy or mixture of iron and manganese that contains about 80% of manganese. The Ferro silico manganese has metallurgical properties, including increased strength, toughness, hardness, and hardenability. The increasing consumption of steel and the demand for stainless steel from the various end-use industries such as automobile, consumer goods, electronics, and others, and the rising investment in the expansion of the steel industries in the various regional countries are accelerating the growth of the ferro silico manganese segment.

The ferrosilicon segment is expected to grow substantially during the predicted period. The ferrosilicon is the alloy of the silicon and iron. Steel chips, coke, and quartz are raw materials smelted by the iron silicon alloy’s electric furnace. The ferrosilicon is highly used in the steelmaking industry. The ferrosilicon in the steelmaking industry is used for diffusion deoxidation and precipitation deoxidation. It has properties such as high corrosion resistance and high temperature resistance.

The carbon and low alloy steel segment held a dominant presence in the ferroalloys market in 2023. Carbon and low-alloy steel have several leading properties in the mechanical world. Carbon and low alloy steel have great technological properties, such as hot and cold processing and heat treatment, and it is highly in demand from end-use industries such as ships, engineering plants, buildings, automobiles, and others. They have increased strength, welding properties, corrosion resistance, and others.

The cast iron segment is expected to grow the fastest in the market over the forecast period. Cast iron is known as the class of iron-carbon alloys with more than 2% of the carbon content and around 1-3% of the silicon content. Cast iron is known as one of the oldest ferrous metals, and it is used in indoor or outdoor ornament and construction. Cast iron is composed of carbon, iron, silicon, and small traces of manganese, sulfur, and phosphorus, which also have 2% to 5% of the carbon content. Cast iron has good properties of compression. Cast iron is majorly used in the consumer goods industry, such as in the making of cookware, due to its superior heat retention, versatility in cooking, longevity, and durability, non-stick properties, economically, affordable, ease of cleaning and maintenance, lightweight, and aesthetic look in the kitchen.

Segments Covered in the Report

By Product

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client