January 2025

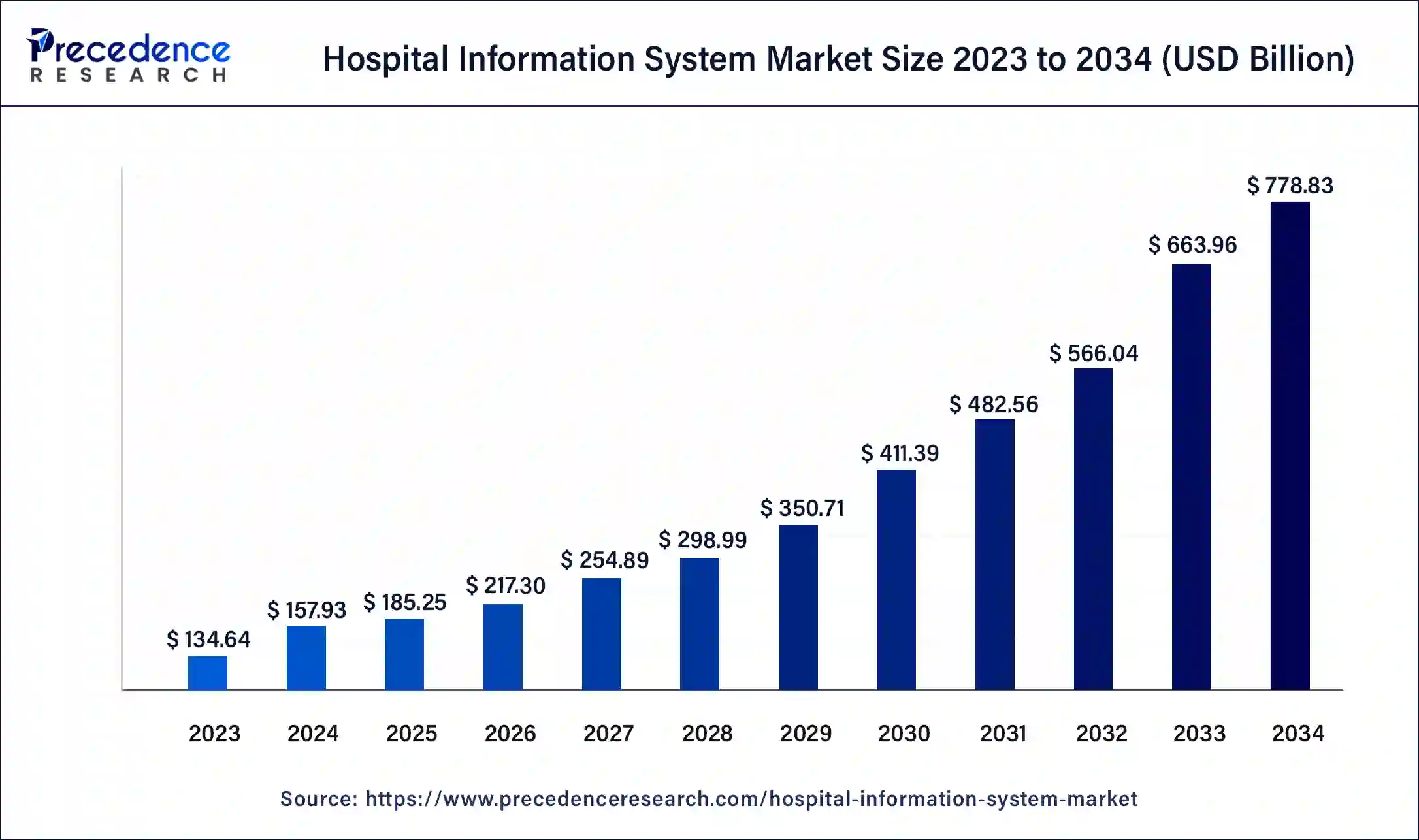

The global hospital information system market size was USD 157.93 billion in 2024, and is calculated at USD 185.25 billion in 2025, and is expected to reach around USD 778.83 billion by 2034. The market is expanding at a solid CAGR of 17.30% over the forecast period 2025 to 2034.

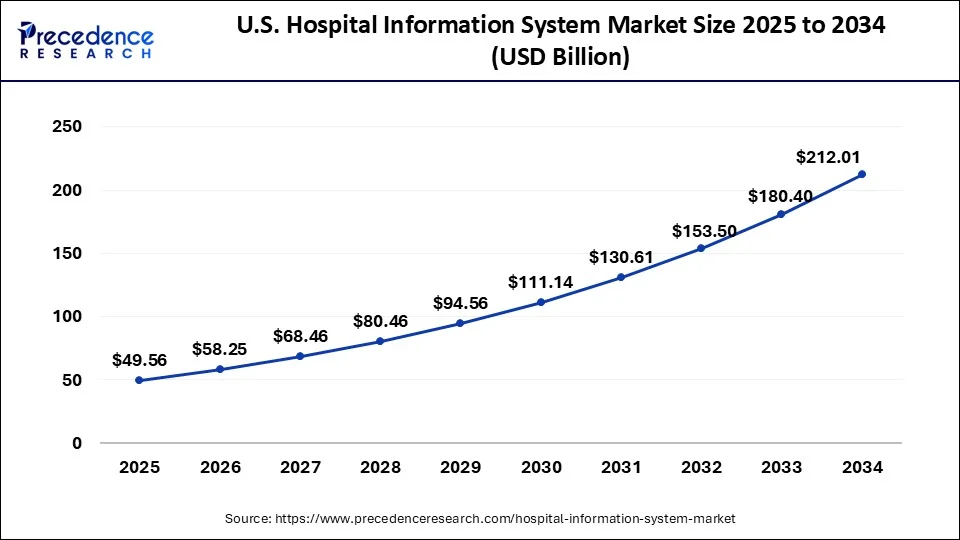

The U.S. hospital information system market size was estimated at USD 42.17 billion in 2024 and is predicted to be worth around USD 212.01 billion by 2034, at a CAGR of 17.50% from 2025 to 2034.

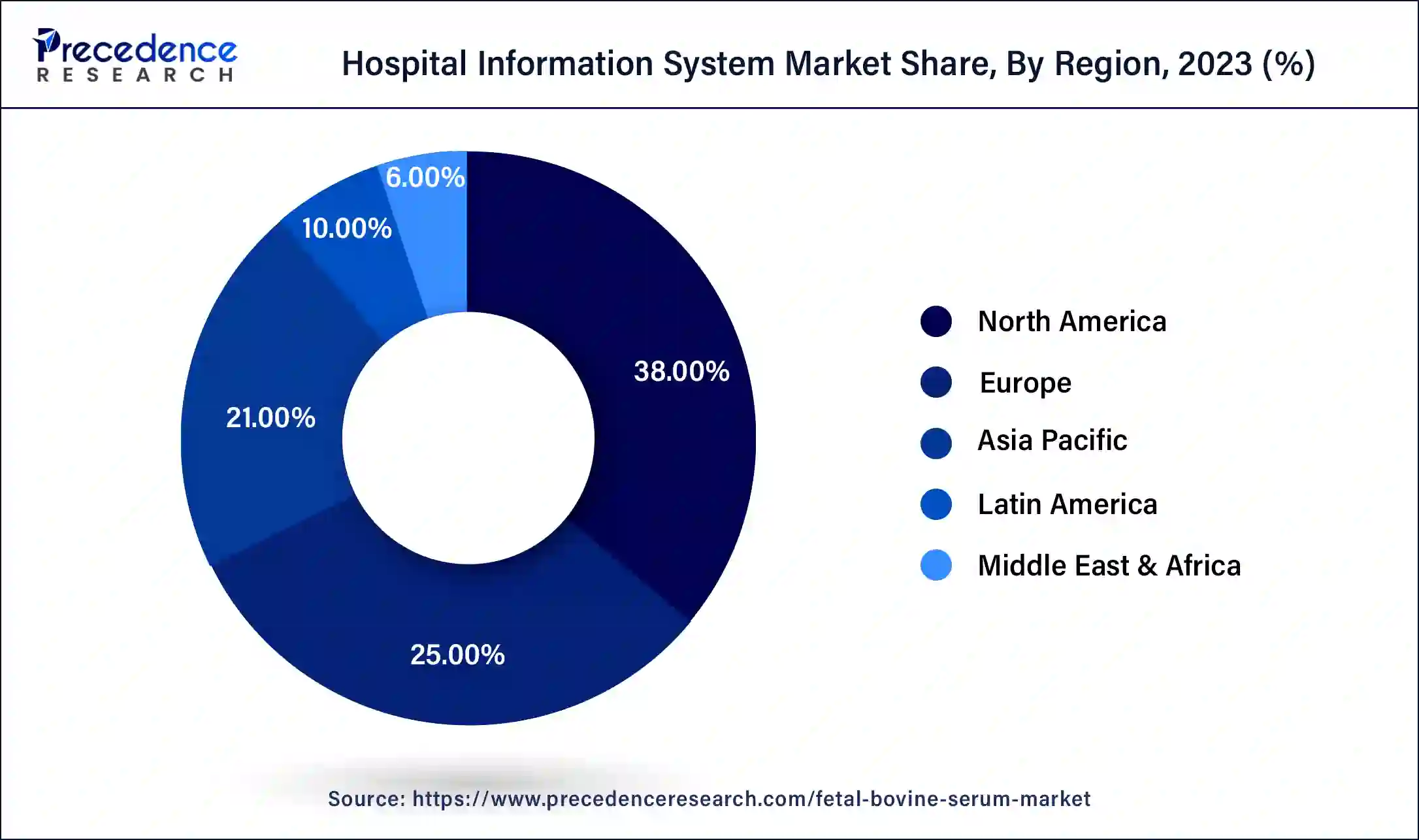

North America has held the largest market share of 38% in 2024. The North America hospital information system market is characterized by a high level of technology adoption, a well-established healthcare infrastructure, and a focus on improving patient care and operational efficiency. Moreover, it boasts a highly developed healthcare infrastructure, with many hospitals and healthcare providers adopting advanced technologies, including HIS, to enhance their operations. Also, the shift toward patient-centric care is driving the adoption of HIS that prioritizes accessibility, patient engagement, and personalized healthcare delivery.

Asia-Pacific is estimated to observe the fastest expansion. The Asia-Pacific hospital information system market is driven by a rapidly evolving healthcare landscape, increasing healthcare IT adoption, and a focus on digital transformation. Many countries in the Asia-Pacific region are experiencing rapid economic development and investing in healthcare infrastructure.

The expansion of hospitals and healthcare facilities is driving the demand for HIS to enhance operational efficiency and patient care. Several governments in the region have initiated programs and policies to promote the adoption of healthcare information technology. These initiatives often include incentives for hospitals to implement HIS to improve data management, patient outcomes, and overall healthcare delivery.

The hospital information system market in Europe is driven by a strong emphasis on healthcare digitization, interoperability, and improving patient outcomes. Many European countries have implemented digital health strategies and initiatives to enhance healthcare delivery. The adoption of HIS is a key component of these strategies, aiming to improve efficiency, patient safety, and overall healthcare quality. The region has witnessed continuous advancements in healthcare information technology. Hospitals are adopting HIS with advanced features, such as electronic health records (EHRs), decision support systems, and data analytics, to enhance clinical workflows and decision-making.

A Hospital Information System (HIS) is a comprehensive and integrated information management system designed to handle various aspects of hospital operations, administration, and patient care. The primary objective of a hospital information system is to streamline processes, improve efficiency, enhance patient care, and facilitate communication and information flow within a healthcare institution. Therefore, the implementation of a hospital information system aims to improve overall patient care, enhance operational efficiency, reduce errors, and ensure compliance with regulatory requirements in the healthcare industry. The market for hospital information system encompasses the supply and demand for software, hardware, and services related to these systems.

The HIS market involves the development, implementation, and maintenance of software solutions that help healthcare institutions streamline their workflows, improve efficiency, and enhance patient care. These systems typically include modules for patient registration, appointment scheduling, billing and invoicing, electronic health records (EHR), laboratory information management, pharmacy management, radiology information system, and more. The market has been growing in response to the increasing need for efficient healthcare management, digitalization of health records, and the desire to improve patient outcomes.

With advancements in technology, HIS solutions are evolving to incorporate features such as interoperability, data analytics, and artificial intelligence to further enhance healthcare delivery. The market includes various players, ranging from large healthcare IT companies to specialized vendors offering specific modules or services. The adoption of HIS solutions varies globally, influenced by factors such as healthcare infrastructure, regulatory environment, and economic conditions.

| Report Coverage | Details |

| Market Size by 2034 | USD 778.83 Billion |

| Market Size in 2025 | USD 185.25 Billion |

| Market Size in 2024 | USD 157.93 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 17.30% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Deployment, Component and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Improved operational efficiency

The demand for hospital information systems (HIS) is significantly driven by the imperative need for improved operational efficiency within healthcare institutions. As healthcare organizations grapple with the complexities of managing patient data, administrative tasks, and clinical workflows, HIS emerges as a transformative solution. These systems streamline various aspects of hospital operations, from appointment scheduling and billing to electronic health records (EHR) management and inventory control. By automating time-consuming processes and reducing manual errors, HIS enhances the overall efficiency of healthcare delivery.

Moreover, one key aspect contributing to the demand is the ability of HIS to centralize and digitize patient records, providing healthcare professionals with quick and secure access to comprehensive medical histories. This facilitates faster decision-making, accurate diagnoses, and personalized treatment plans, ultimately improving patient care. Additionally, the automation of administrative tasks, such as billing and appointment scheduling, allows healthcare staff to allocate more time to direct patient care.

Furthermore, HIS systems often incorporate advanced technologies like data analytics and artificial intelligence, offering predictive insights and decision support tools. This not only augments clinical decision-making but also contributes to proactive and preventive healthcare measures. The quest for improved operational efficiency, cost-effectiveness, and enhanced patient outcomes collectively propels the demand for HIS in the dynamic landscape of modern healthcare.

Complex implementation processes

The demand for hospital information systems (HIS) faces a notable restraint in the form of complex implementation processes, which can potentially deter healthcare institutions from embracing these systems. The integration of HIS is a multifaceted undertaking involving intricate data migration, system customization, and comprehensive staff training. The complexity of these implementation processes can lead to extended timelines, resource-intensive efforts, and operational disruptions within healthcare settings.

The challenges associated with data migration from legacy systems to HIS platforms pose a significant hurdle. Ensuring the accurate transfer of vast amounts of patient data while maintaining data integrity requires meticulous planning and execution. The customization of HIS to align with the unique workflows and requirements of different healthcare facilities adds another layer of complexity. Tailoring the system to accommodate diverse processes and preferences demands careful consideration and may result in prolonged implementation periods.

Furthermore, staff training emerges as a critical aspect of HIS implementation. The need to familiarize healthcare professionals with new digital workflows and functionalities requires dedicated time and resources. Resistance to change among staff members may further impede the smooth adoption of HIS, hindering the realization of its benefits. As healthcare providers weigh the potential advantages against the complexities involved, the intricate implementation processes stand as a significant factor restraining the widespread demand for hospital information systems in the healthcare industry.

Adoption of cloud-based HIS solutions

Cloud technology offers a paradigm shift, providing healthcare providers with scalable, flexible, and cost-effective solutions to manage patient information and streamline operations. The opportunity lies in the ability of cloud-based HIS to overcome traditional infrastructure limitations, enabling seamless data access and collaboration across healthcare settings.

One key advantage is the accessibility of health information from any location with an internet connection, allowing healthcare professionals to retrieve real-time data efficiently. This facilitates improved care coordination, especially in scenarios where multiple stakeholders are involved in a patient's treatment. The scalability of cloud solutions ensures that healthcare organizations can adjust their computing resources based on fluctuating demand, avoiding the need for significant upfront investments in hardware.

Furthermore, cloud based HIS solutions enhance data security by leveraging advanced encryption and compliance measures provided by reputable cloud service providers. This address concerns related to data protection and privacy, contributing to increased trust in adopting digital health technologies. The opportunity for innovation extends to the integration of advanced technologies like artificial intelligence and analytics within cloud-based HIS. These technologies can offer predictive insights, personalized treatment approaches, and data-driven decision support, ultimately improving patient outcomes.

In essence, the adoption of cloud-based HIS solutions open doors to a more connected, agile, and technologically advanced healthcare ecosystem, fostering improved patient care, operational efficiency, and overall responsiveness to the dynamic needs of modern healthcare delivery.

The population health management segment has held the highest revenue share of 45% in 2024. Population health management solutions focus on analyzing and managing the health outcomes of a specific population. These systems use data analytics to identify health trends, assess risk factors, and implement interventions to improve the overall health of a community. Population health management is crucial for preventive care and addressing public health challenges.

The web-based segment had the highest market share of 49% in 2024. Web-based deployment, also known as client-server deployment, allows users to access the HIS through a web browser. The software is hosted on a centralized server, and users can log in from different locations. This model offers greater accessibility and flexibility compared to on-premise solutions, as it reduces the dependency on specific physical locations for system access.

The cloud-based segment is anticipated to expand at a CAGR of 18.3% over the projected period. Cloud-based deployment involves hosting the HIS on remote servers managed by third-party cloud service providers. This model offers scalability, flexibility, and cost-effectiveness, as healthcare organizations can leverage computing resources on a pay-as-you-go basis. Cloud-based HIS solutions provide accessibility from anywhere with an internet connection and often include features like automatic updates and data backups.

The software segment had the highest market share of 50% in 2024. The software component is the core element of the HIS, encompassing a range of applications and modules designed to address specific healthcare management functions. This includes electronic health records (EHRs), laboratory information systems, billing and invoicing software, pharmacy management software, and other modules that collectively contribute to the efficient operation of a healthcare institution. The software is designed to streamline administrative processes, improve clinical workflows, and enhance overall patient care.

The services segment is anticipated to expand at a CAGR of 18% over the projected period. The services component includes a range of professional services offered to healthcare organizations during the planning, implementation, and ongoing maintenance of the HIS. These services may encompass system customization, training for healthcare staff, technical support, software updates, and consulting services to optimize the use of the HIS. Services are essential for ensuring a smooth transition to digital systems, maximizing the benefits of the HIS, and addressing any issues that may arise during the system's lifecycle.

By Type

By Deployment

By Component

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2024

September 2024

January 2025