July 2024

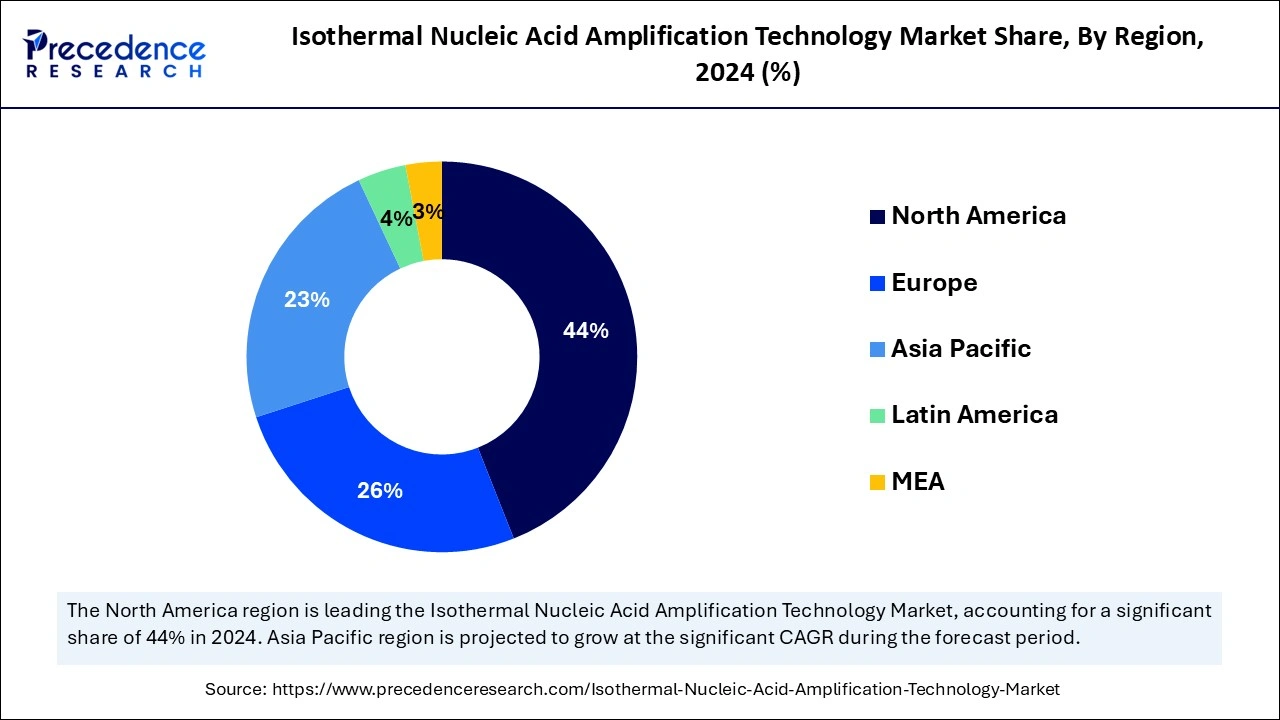

The global isothermal nucleic acid amplification technology market size is evaluated at USD 6.06 billion in 2025 and is forecasted to hit around USD 17.26 billion by 2034, growing at a CAGR of 12.34% from 2025 to 2034. The North America market size was accounted at USD 2.37 billion in 2024 and is expanding at a CAGR of 12.47% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

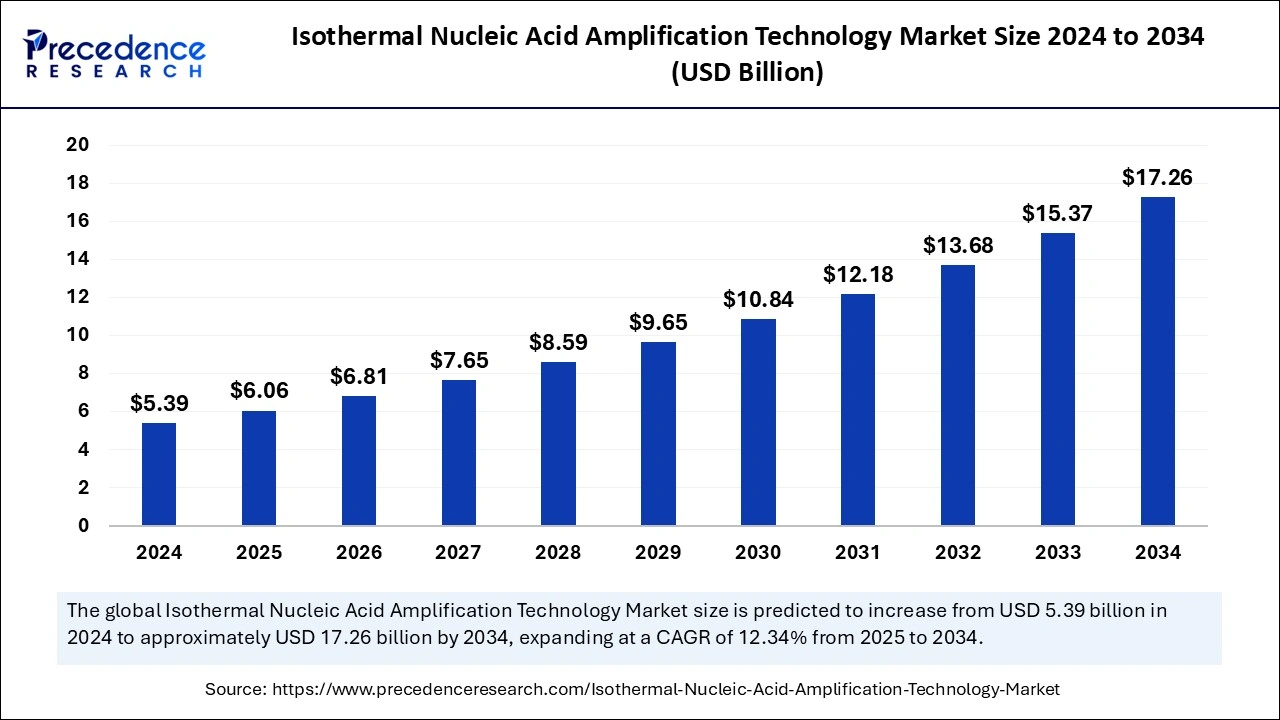

The global isothermal nucleic acid amplification technology market size was estimated at USD 5.39 billion in 2024 and is predicted to increase from USD 6.06 billion in 2025 to approximately USD 17.26 billion by 2034, expanding at a CAGR of 12.34% from 2025 to 2034. The demand for point-of-care testing has been increasing, leading to the drive for the isothermal nucleic acid amplification technology market. The growing adoption of molecular diagnostics, as well as the need for rapid, more accurate, and sensitive diagnostic testing, are fueling the adoption of isothermal nucleic acid amplification technologies.

Artificial intelligence is playing a spectacular role in the isothermal nucleic acid amplification technology market performance and advancements. The integration of AI with isothermal nucleic acid amplification technology is no exception. AI is significantly transforming the INAAT market by enabling advanced and automated features to advance speed, accuracy, cost-effectiveness, and activity. The adoption of AI to create portable technologies is heightening the market. The growing need for accurate, advanced diagnostic tools and improved result interpretation and patient outcomes is further enhancing the importance of AI in amplification technologies.

The increased need for point-of-care testing is becoming easier thanks to AI integration with technology to provide user-friendly and sensitive solutions. The ability of AI algorithms to analyze real-time data from technology allows rapid and more precise detections. The integration of AI with the isothermal nucleic acid amplification technology market allows novel approaches to high-speed, modular, and portable diagnostic testing. The ability of AI to improve detection sensitivity, POC settings, and real-time optimizations is expected to shape the future of isothermal nucleic acid amplification technologies and innovations as well as developments.

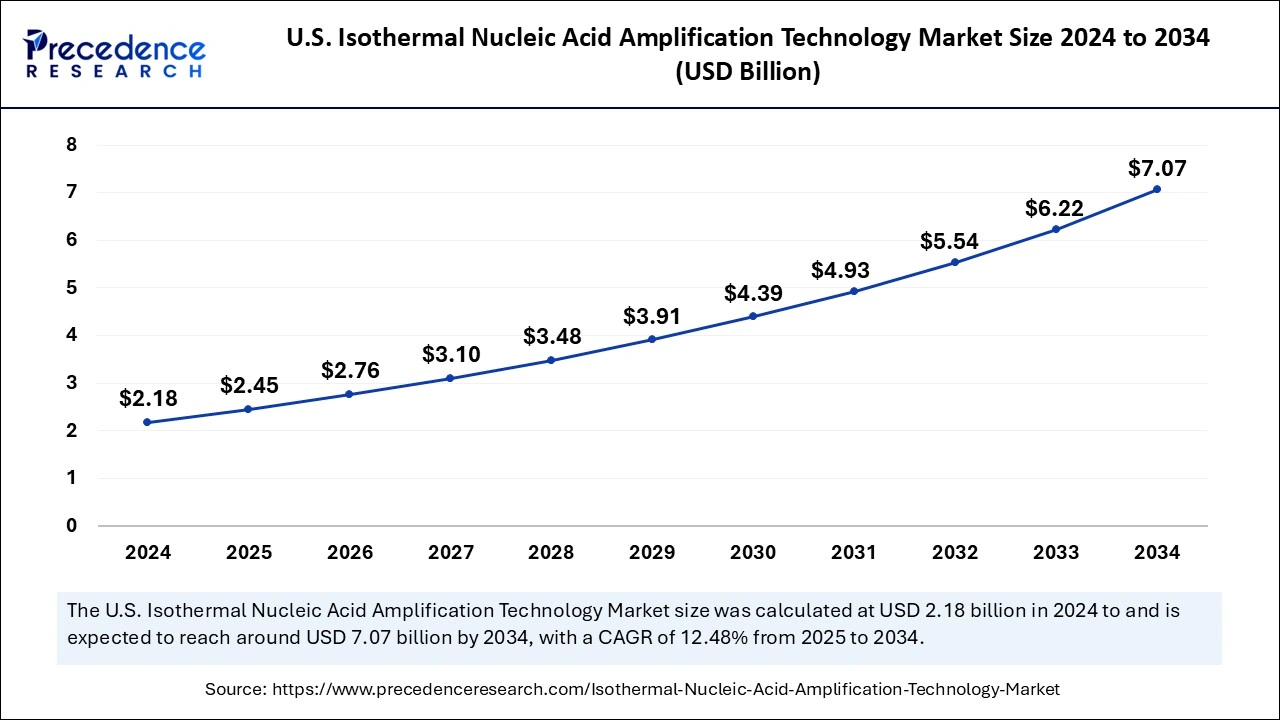

The U.S. isothermal nucleic acid amplification technology market size was exhibited at USD 2.18 billion in 2024 and is projected to be worth around USD 7.07 billion by 2034, growing at a CAGR of 12.48% from 2025 to 2034.

North America led the global isothermal nucleic acid amplification technology market with the highest market share in 2024 due to the region's well-established and rich R&D infrastructure and the presence of key pharmaceutical companies. The expanded advanced healthcare expenditure is playing a favorable role in the adoption of cutting-edge technologies, including isothermal nucleic acid amplification in the region. The growing prevalence of diseases such as HIV, infectious diseases, cancer, and tuberculosis is driving the surge in the development of advanced INAAT.

Strong government and regulatory support and investments in the research & development sector contribute a favorable share to the market growth. The United States is leading the regional market with strong approvals from regulatory authorities for innovation and development of advanced technologies. Furthermore, there is a high adoption of molecular diagnosis in hospitals in the country.

Asia Pacific will expand the fastest CAGR in the isothermal nucleic acid amplification technology market between 2025 and 2034 because of the region's rapidly expanding healthcare infrastructure and advancements in pharmaceutical companies. Government funding for R&D is also playing a major role in this growth. The growing incidence of HIV, hepatitis, and tuberculosis, especially in the aging population, is driving a surge in the development as well as the adoption of thermal nucleic acid amplification technologies.

Countries like China, India, Japan, South Korea, and Indonesia are playing a crucial role in the market expansion. China is leading the regional market due to a large aging population pool and the prevalence of chronic disease. Furthermore, countries' government investments in the adoption of cutting-edge technologies allow them to shape the market in China.

On the other hand, Japan is the second largest country leading the regional market due to the rising prevalence of chronic disease and demand for rapid and accurate diagnostic testing. India and South Korea are stepping toward success with government support and funding for R&D infrastructures in these countries.

The increased adoption of molecular testing to reduce the rising prevalence of chronic disease is the major driver for the market. The increased prevalence of chronic disease and adoption of nucleic acid amplification technologies, including infectious disease diagnostics, oncology, and genetic testing, are driving demand for advanced technologies like isothermal nucleic acid amplification technologies. Ongoing research in biotechnology and molecular biology has increased the need for nucleic acid amplification technologies (NAATs) to develop with more efficiency, sensitivity, and specific protocol-compliant technologies. The surge for portable technologies and high-throughput analyses are emerging advancements in nucleic acid amplification technologies (NAATs).

The isothermal nucleic acid amplification technologies can amplify specific DNA or RNA sequences at a constant temperature, which offers fast and efficient detection of nucleic acid and rapid detection & diagnostics of disease. The demand for point-of-care testing and rapid and accurate diagnostic tools is encouraging innovation and the development of advanced isothermal nucleic acid amplification technologies. Advancements in technologies, including loop-mediated isothermal amplification (LAMP), strand displacement amplification (SDA), and recombinase polymerase amplification (RPA), enable rapid, accurate, and cost-effective diagnostic amplification solutions.

| Report Coverage | Details |

| Market Size by 2034 | USD 17.26 Billion |

| Market Size by 2025 | USD 6.06 Billion |

| Market Size in 2024 | USD 5.39 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 12.34% |

| Leading Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Technology, Application, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising incidence of chronic disease

The growing prevalence of chronic diseases, including infectious diseases, chronic diseases, HIV, tuberculosis, hepatitis, influenza, and cancer, is driving the need for molecular diagnostic testing for early detection and monitoring of the disease. The growing demand for rapid and accurate diagnostic testing like LAMP and TMA is robustly increasing the importance of the isothermal nucleic acid amplification technology market.

Furthermore, the increased demand for personalized medicines is driving the adoption of these technologies for the detection of specific genetic expressions, mutations, and biomarkers. The increased incidence of rare diseases has surged the need for point-of-care testing, improving the adoption of INAAT. The need for user-friendly, cost-effective, sensitive, and accurate diagnostic testing is the major factor driving the adoption of these technologies for treating chronic diseases.

Stringent regulations

The stringent regulation requirements for instruments and reagents are the major restraints on the growth of the isothermal nucleic acid amplification technology market. The regulation requirements regarding INAAT-based diagnostic tests for clinical trials and performance evaluations are hampering the development of the technology tools. These regulations are responsible for increased costs of diagnostic tools and delays in the process, making it difficult for manufacturers to keep up with market environments. The regulatory requirements in clinical trials further hinder researchers and pharmacists from adopting technology.

Development of advanced technologies

The development of new isothermal nucleic acid amplification technologies is holding great market potential. The rising incidence of chronic disease and the growing aging population require user-friendly, rapid, and accurate amplification technologies. The ongoing innovations in rapid amplification technologies, including loop-mediated isothermal amplification (LAMP) and transcription-mediated amplification (TMA), are enabling rapid and accurate detection of nucleic acids.

Newly developed diagnostic tools such as loop-mediated isothermal amplification (LAMP) microfluidic chip-based nucleic acid analyzers are advantages to leverage LAMP with microfluidic technology and improve their sensitivity, affordability, and rapid nucleic acid amplification at a steady temperature. Furthermore, with growing innovations and the development of INAAT-based point-of-care testing, single-primer isothermal amplification (SPIA), helicase-dependent amplification (HAD), and nucleic acid sequence-based amplification (NASBA) are enabling advanced features of the technologies for rapid and accurate diagnostic solutions.

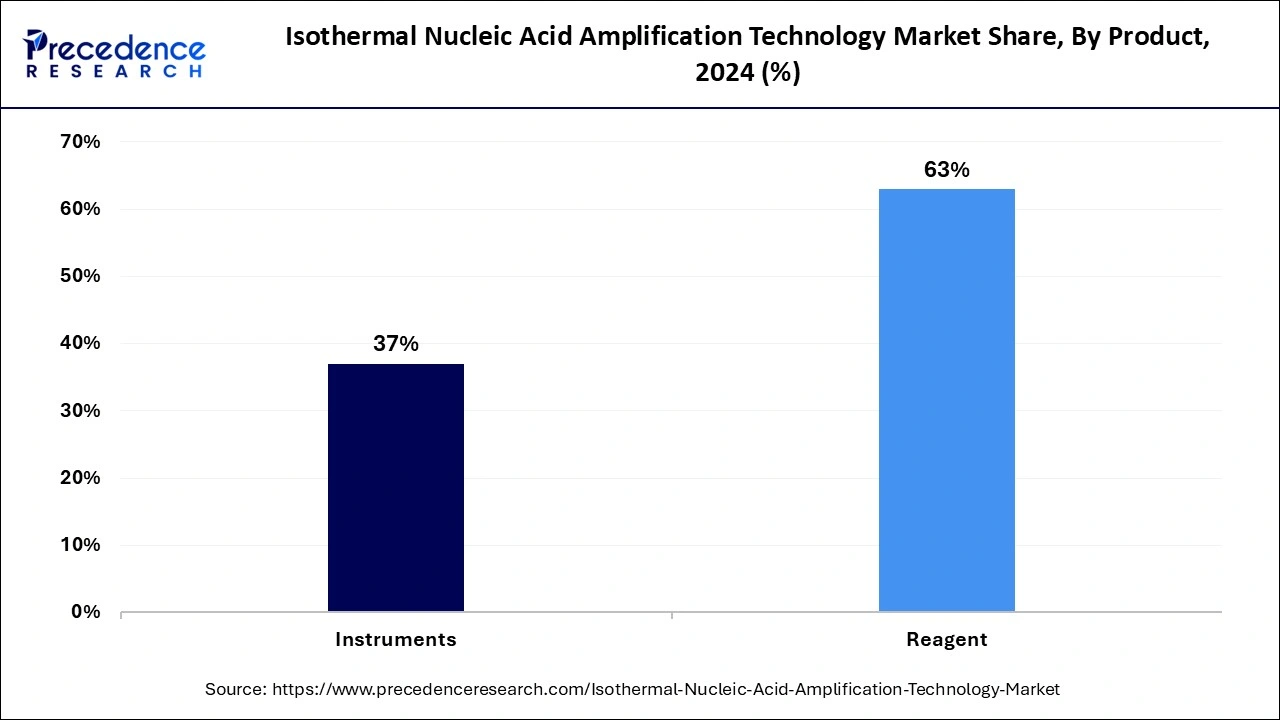

The reagents segment captured the biggest share of the isothermal nucleic acid amplification technology market in 2024 due to the wide use of reagents in hospitals and primary healthcare settings. Reagents, including a strand-displacing DNA polymerase (like Bst DNA polymerase), primers specific to the target nucleic acid sequence, nucleotides, and a reaction buffer, have increased due to the rising penetration of isothermal nucleic acid amplification technology diagnostics. The growing adoption of point-of-care diagnosis is further driving demand for user-friendly and affordable reagents.

On the other hand, the instrument segment is expected to expand at a notable CAGR over the projected period, mainly due to rising key companies' focus and investments in the development of effective, advanced, and cost-effective instruments. The rising availability of portable, cost-effective, user-friendly, durable, quick, and accurate instruments is attracting healthcare professionals. The rising demand for rapid testing solutions is fueling the segment expansion.

The loop-mediated isothermal amplification (LAMP) segment held the largest isothermal nucleic acid amplification technology market share in 2024. The segment growth is anticipated due to the increased utilization of LAMP for rapid DNA amplification. LAMP technology can amplify DNA within 30-60 minutes. The growing need for point-of-care diagnostics is driving the adoption of this technology. The adoption of LAMP technology has witnessed further growth due to its sensitivity, specification, and cost-effectiveness.

The transcription-mediated amplification (TMA) technology segment is anticipated to grow at a remarkable CAGR between 2025 and 2034 due to its suitability for rapid amplification efficiency, sensitivity, and point-of-care diagnostics. TMA is preferred by researchers due to its ability to perform nucleic acid tests (NAT) with fewer steps in clinical laboratories. The ability of TMA to provide applications like infectious disease diagnosis, cancer detection, and genetic testing makes them popular.

The infectious disease application segment held a dominant presence in the isothermal nucleic acid amplification technology market in 2024 due to the rising prevalence of infectious diseases, including influenza, HIV, tuberculosis, and hepatitis A & B. This growing incidence requires rapid diagnosis, early detection, and treatment. Isothermal nucleic acid amplification technologies like LAMP and TMP are sensitive detective technologies for infectious diseases. The segment is further growing due to increased concerns about antimicrobial resistance and advancements in INAAT technologies.

However, the blood screening segment is expected to grow at the fastest rate during the forecast period due to the rising prevalence of blood transfusion disease and demands for blood safety. The growing prevalence of cancers is further demanding accurate blood screening technologies. The increased developments and utilization of technologies for the detection of human papillomavirus (HPV) and the creation of point-of-care (POC) tests for cervical cancer screening are transforming the segment's growth.

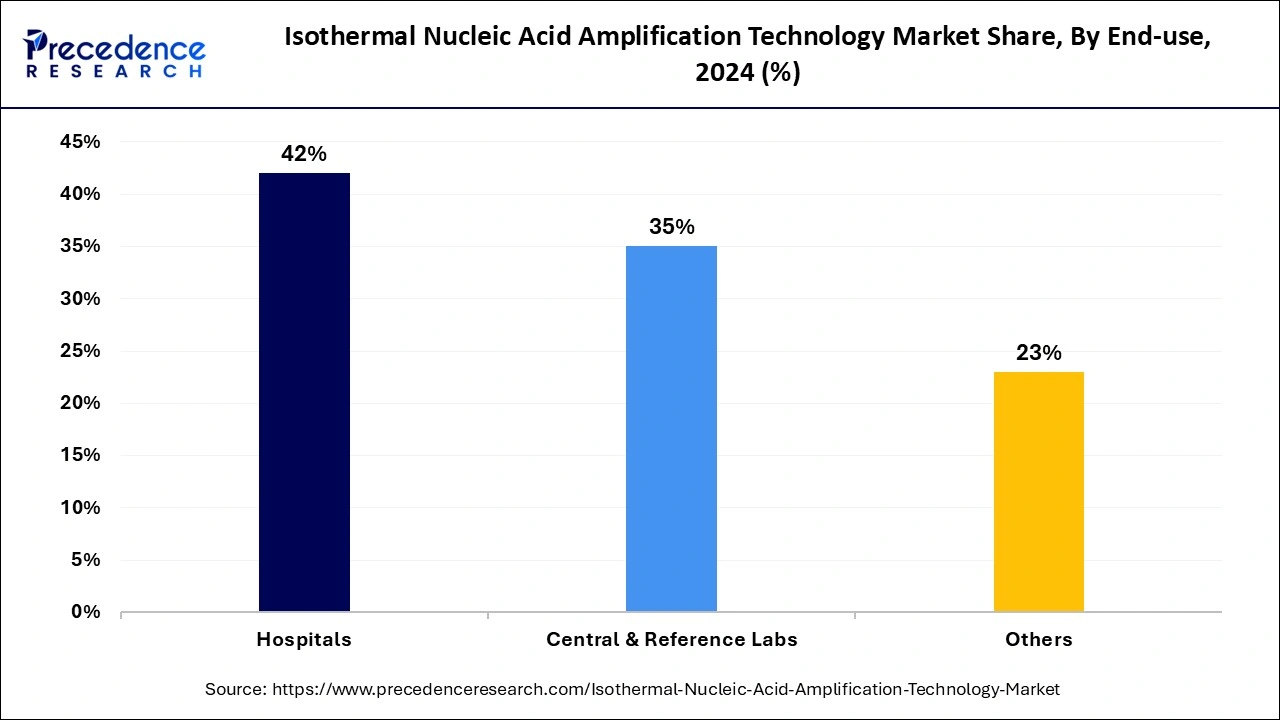

The hospital's segment led the global isothermal nucleic acid amplification technology market in 2024. This growth is attributed to rising patient admissions in hospitals and demands for cutting-edge technologies, including INAAT, by healthcare professionals. The rapid utilization of INAAT kits for diagnosis and the need to improve patient outcomes is further fueling the adoption rate of INAAT in hospitals. Adoption of miniaturized point-of-care (POC) instruments, enabling ways for these technologies in hospital settings.

The central and reference laboratories segment is projected to expand rapidly in the coming years due to the increased adoption of molecular diagnostic techniques. The rapid amplification and accurate diagnostic technologies, especially for infectious diseases, are fueling the segment growth. The ability of INAAT to provide quick results and user-friendly behaviors makes them suitable for laboratories. Furthermore, the rising government funding in laboratories is allowing for the full filing of demand for advanced diagnostic technologies.

By Product

By Technology

By Application

By End-use

By Regions

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

July 2024

April 2025

January 2025

October 2023