April 2025

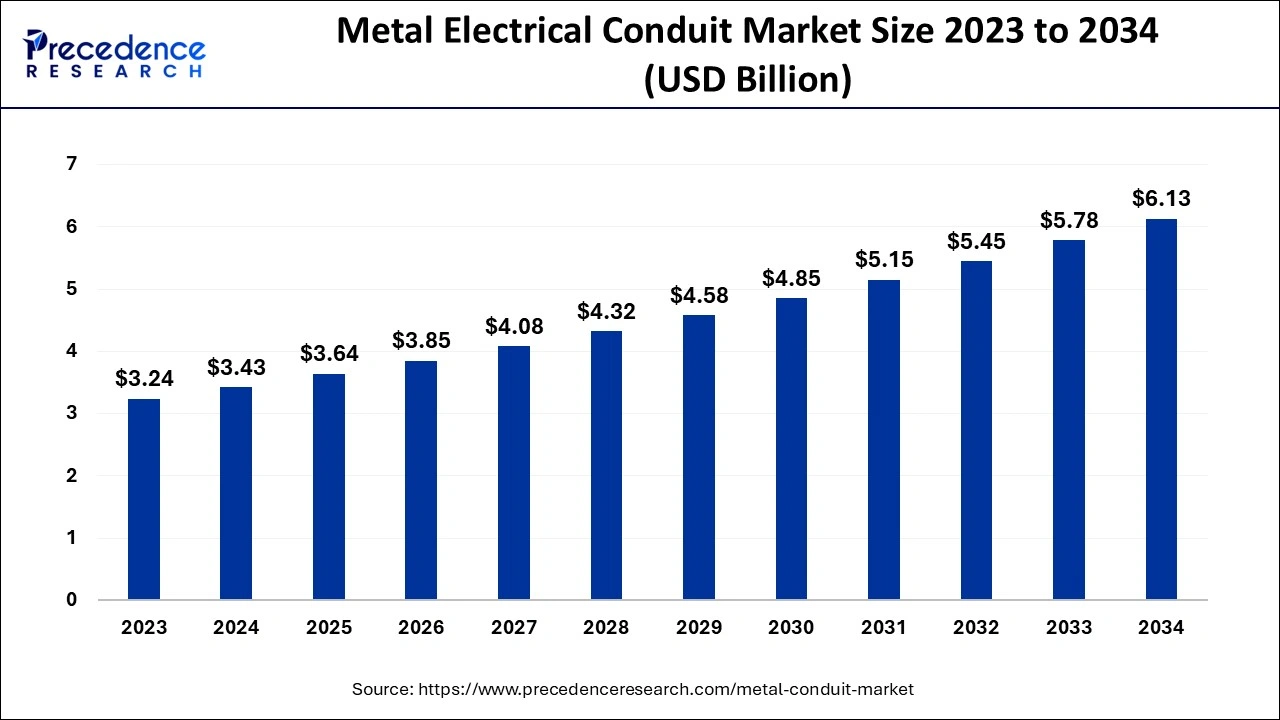

The global metal electrical conduit market size accounted for USD 3.43 billion in 2024, grew to USD 3.64 billion in 2025 and is projected to surpass around USD 6.13 billion by 2034, representing a CAGR of 5.96% between 2024 and 2034.

The global metal electrical conduit market size is worth around USD 3.43 billion in 2024 and is expected to hit around USD 6.13 billion by 2034, growing at a CAGR of 5.96% from 2024 to 2034. The rising construction activities are the key factor driving the growth of the metal electrical conduit market. Also, Strict regulations regarding electrical safety coupled with the rising investments in smart city projects can fuel market growth further.

Artificial intelligence uses the insights gained for precise marketing, forecasting, and decision-making. AI reduces manual efforts by optimizing processes and enhancing productivity. Which in turn decreases the cost and time required to complete a project. Furthermore, AI enables personalized interactions with customers, improving the delivery of these services with loyalty. Hence, markets working in the metal electrical conduit market should harness the power of AI for greater efficiency of the whole process.

The metal electrical conduit market encompasses the production, distribution, and use of metallic conduits created to safeguard electrical wiring in many applications. Metallic conduits are generally made of materials such as Aluminum, Copper, and steel that provide durability and compliance with regulatory standards. They are important elements of electrical infrastructure across commercial, residential, and industrial sectors. The market also involves the associated accessories needed for installation and maintenance.

World Electricity Consumption (2022)

| Country | Final Consumption (TWh) |

| China | 7,214 |

| United State | 4,272 |

| India | 1,403 |

| Japan | 1,132 |

| Russia | 934 |

| WORLD | 24,398 |

| Report Coverage | Details |

| Market Size by 2034 | USD 6.13 Billion |

| Market Size in 2024 | USD 3.43 Billion |

| Market Size in 2025 | USD 3.64 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 5.96% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Configuration, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising demand for electrical infrastructure

The surging population across the globe is fuelling the demand for advanced electrical infrastructure like metal electrical conduits. These metallic conducts are important for the efficient and safe distribution of electricity in industrial and building facilities. In addition, the increasing demand for electricity raises the need for metal electrical conduits to support the modernization and expansion of the electrical grid.

Fluctuations in raw material prices

Raw materials, like plastics - e.g., polyvinyl chloride (PVC), polyethylene, and metals - e.g., steel, and aluminum are the main components used in the production of electrical conduits. Frequent changes in the prices of these materials can cause unwanted manufacturing costs for conduit manufacturers. However, a Surge in the prices of raw materials can substantially increase product expenses, impacting pricing strategies and profit margins and potentially constraining the metal electrical conduit market growth.

The increasing integration of renewable energy sources

The metal electrical conduit market is witnessing significant growth due to the rising integration of renewable energy sources like wind and solar power. The world is shifting more towards eco-friendly energy solutions. Hence, the requirements for reliable and efficient electrical systems are at an all-time high, leading to market growth. Furthermore, the global transition to electric vehicles also supports this demand. The combination of renewable energy grids and electric vehicles can substantially improve energy storage and distribution, which makes the whole electrical infrastructure more tolerant.

The intermediate metal (IMC) segment dominated the metal electrical conduit market in 2023. The dominance of the segment can be attributed to its suitability and strength for commercial and industrial applications. The demand for intermediate products is rising because they are more cost-effective than the RMC, giving better performance and lighter weight. Additionally, increasing demand for coated and corrosion resistance conducts and propels market diversification. Market players are focusing more on customization, innovation, and sustainability to fulfill specific customer demands while sticking to safety regulations.

The rigid metal (RMC) segment is anticipated to grow at the fastest rate in the metal electrical conduit market over the forecast period. The growth of the segment can be linked to the resistance provided by them from the corrosion and other environmental factors. This is particularly important in commercial, industrial, and residential settings where promising electrical protection is essential. However, the use of rigid metal conduits is mandated by safety regulations in areas such as manufacturing and construction to ensure a safe pathway.

The rail infrastructure segment dominated the metal electrical conduit market in 2023. The dominance of the segment can be driven by the increasing utilization of metal electrical conduits in rail infrastructure to protect the various equipment in the rail facilities from fire hazards. Furthermore, rail infrastructure requires high electrification owing to the smooth transit of all rail activities, such as freight terminals shunting yards, and other supportive equipment.

The energy sector segment is expected to show the fastest growth in the metal electrical conduit market during the forecast period. This growth is credited to the growing demand for safe and reliable electrical systems in various energy projects. Also, the growth of smart grid infrastructure, along with the integration of innovative energy monitoring systems, negates the need for standard-quality conduits to support tedious electrical networks.

Asia Pacific dominated the metal electrical conduit market in 2023. The growth of the region can be linked to the burgeoning infrastructural development and rapid industrialization in emerging economies such as China and India. Furthermore, increasing demand for smart grids, renewable energy projects, and energy-efficient construction projects boost the demand for durable conduits.

North America is anticipated to grow at the fastest rate in the metal electrical conduit market over the projected period. The dominance of the region can be attributed to the development of infrastructure, especially in the residential, commercial, and industrial sectors. Also, the region is witnessing rapid growth and urbanization owning to strategic initiatives by market players. Moreover, increasing awareness about regulatory standards and rising investments in smart city projects.

By Configuration

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

January 2025

January 2025

September 2024