February 2025

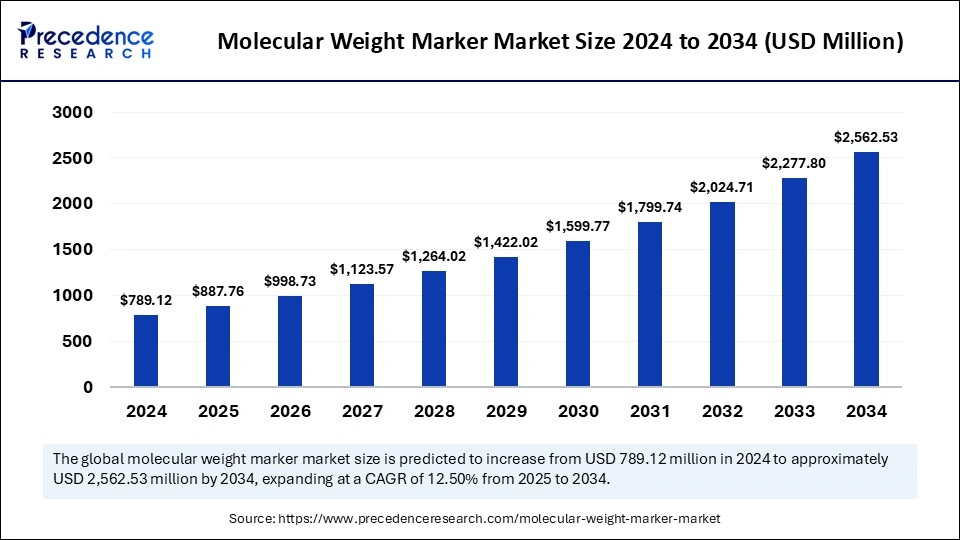

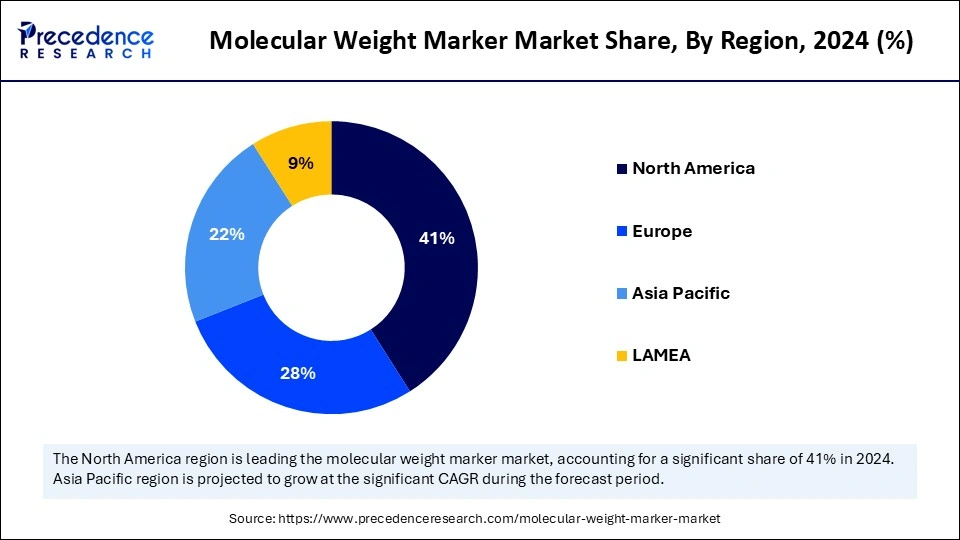

The global molecular weight marker market size is calculated at USD 887.76 million in 2025 and is forecasted to reach around USD 2,562.53 million by 2034, accelerating at a CAGR of 12.50% from 2025 to 2034. The North America market size surpassed USD 323.54 million in 2024 and is expanding at a CAGR of 12.63% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Million), with 2024 as the base year.

The global molecular weight marker market size was estimated at USD 789.12 million in 2024 and is predicted to increase from USD 887.76 million in 2025 to approximately USD 2,562.53 million by 2034, expanding at a CAGR of 12.50% from 2025 to 2034. The market growth is attributed to increasing demand for proteomics and genomics research and expanding applications in drug discovery and clinical diagnostics.

The application of artificial intelligence delivers better efficiency together with improved accuracy and enhanced innovative capabilities in the production process of molecular weight markers. The application of advanced algorithms advances both gel electrophoresis and chromatography processing methods, which results in enhanced molecular weight measurements.

Automating the analysis of images shortens the time required for interpreting results while reducing both human mistakes and improvement of repeatability. Furthermore, the AI predictive modeling models to develop markers achieve design optimization for research markers by producing exact and adjustable solutions for researchers.

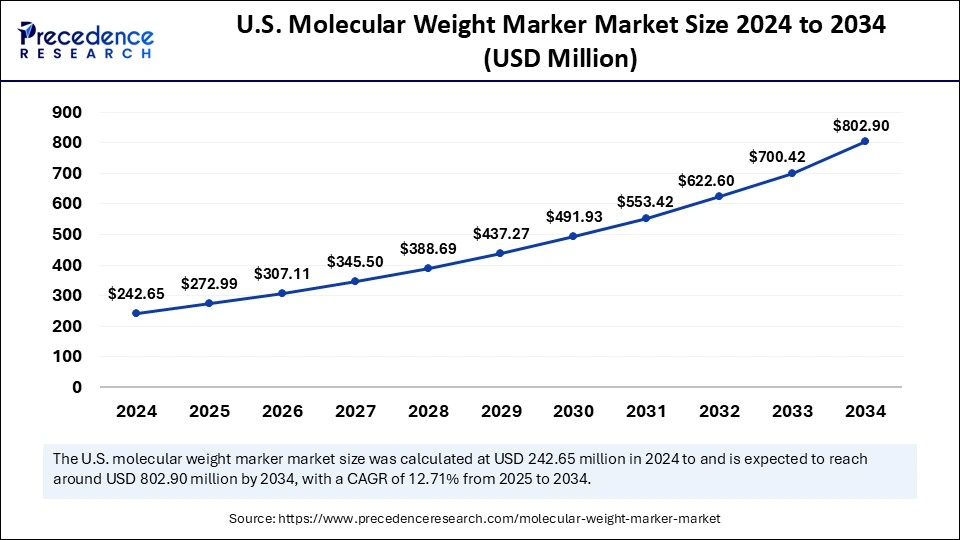

The U.S. molecular weight marker market size was evaluated at USD 242.65 Million in 2024 and is projected to be worth around USD 802.90 Million by 2034, growing at a CAGR of 12.71% from 2025 to 2034.

North America dominated the global molecular weight marker market in 2024 due to strong technological advancements in research and development combined with its well-developed biotechnology industry. The directed financial support enabled researchers to execute genomic and proteomic investigations, which elevated the necessity of molecular weight markers across numerous applications. Market growth received additional support from the advanced healthcare facilities combined with multiple academic and research institutions located in the region.

Life sciences investments in Canada strengthened regional development while the government dedicated USD 2.2 Million from its Strategic Innovation Fund toward biomanufacturing and health research initiatives in 2023. The new Genome Canada initiatives, along with other genomics research program expansions, have elevated the market need for precise molecular weight markers. Furthermore, the growing number of partnerships between Canadian academic institutions and worldwide biotech corporations drives sustained market opportunities by intensifying research operations.

Asia Pacific is projected to host the fastest-growing molecular weight marker market in the coming years., as it benefits from swift biotechnology advances together with sustained research and development funding. Research institutions and biotechnology firms were established, with increased funding, which boosted the market demand for molecular weight markers. The expansion of the market benefits from government programs that foster scientific innovations and research development. The 14th Five-Year Plan of China dedicated its attention to biotechnology and life sciences development, which generates positive market conditions for growth.

Personalized medicine practices, together with rising genomics research in the region, drive marker adoption as molecular weight markers become essential to these applications. The government initiative known as the Biotechnology Industry Research Assistance Council (BIRAC) has strengthened research facilities that drive up demand for molecular weight markers. Moreover, India's expanding pharmaceutical exports of biosimilars and vaccines require precise protein and nucleic acid analytical methods, thus creating higher market requirements.

The molecular weight marker market has expanded substantially at present with extensive funding in research and development activities. The global trend shows that nations spend more of their GDP on scientific research through increased research and development spending. Gel electrophoresis analyzes DNA, RNA, or protein molecules through the use of essential molecular weight markers, which are commonly known as DNA ladders or protein ladders and serve to estimate molecular weights. Furthermore, the research conducted in genomics and proteomics drives an elevated need for molecular weight markers, as scientists need exact molecular sizing measurements to make progress in their work.

| Report Coverage | Details |

| Market Size by 2034 | USD 2,562.53 Million |

| Market Size in 2025 | USD 887.76 Million |

| Market Size in 2024 | USD 789.12 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 12.50% |

| Leading Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Type, Application, End-User, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising investments in proteomics and genomics research

Increasing demand for proteomics and genomics research is expected to drive market expansion. Super-resolution microscopy, together with next-generation CRISPR-based gene editing therapies, have created extensive cellular understanding through biomolecular discovery. Thus, increasing the necessity for precise molecular weight measurements in protein and nucleic acid research.

Researchers earned the award for developing AlphaFold AI during the 2024 Nobel Prize in Chemistry competition because this tool predicted protein structures, illustrating the fundamental value of precise molecular weight markers for structural biology. Moreover, the academic and industrial laboratories require high-quality markers since life sciences research receives increasing financial investments.

Alternative molecular weight determination techniques

Technological advancements in molecular biology introduce alternative methods for protein and nucleic acid size determination, reducing dependence on conventional molecular weight markers, which further hinders the market. The combination of mass spectrometry with capillary electrophoresis provides highly precise molecular analysis, thus replacing gel-based markers in select applications.

Teams working in high-throughput proteomics and genomics develop label-free quantification methods, which drive the market to redirect toward non-traditional marker-based methods. The preference shifts toward digital imaging systems running automated molecular weight analysis, decreasing the requirement for manual marker interpretation. Furthermore, the use of AI-based computational modeling restricts research facilities to conventional markers in their weight prediction strategies.

Increasing investments in biotechnology and life sciences

Increasing investments in biotechnology and life sciences research are projected to create immense opportunities for market growth. The financial support from governments and private organizations speeds up molecular biology research development, which creates new business prospects for marker manufacturers. Next-generation sequencing and protein characterization techniques operated by research organizations depend on high-quality reference standards for their development.

New research establishments in emerging economies focus on scientific progress, which drives up the need for dependable molecular weight markers due to their newly built facilities. Furthermore, the increased funding supplied by new biotechnology startup government initiatives enables more laboratory and research center operations, further fueling the market.

The DNA markers segment held a dominant presence in the molecular weight marker market in 2024 due to its extensive applications in genomic research and diagnostic and forensic fields. The adoption of PCR and NGS and gel electrophoresis use by scientists helped expand their market control. Clinical laboratories, together with research facilities, increased their need for DNA markers, as their focus on genetic disorders, precision medicine, and hereditary disease screening. The market uptake increased because of new developments in whole genome sequencing and dropping DNA analysis prices. The market dominance of DNA markers received support from increasing biotechnology research activity and state backing of genetic studies.

The protein markers segment is expected to grow at the fastest rate during the forecast period of 2025 to 2034, as proteomics and biopharmaceutical research fields have received growing investments. The market demand for protein therapeutic agents, such as monoclonal antibodies and recombinant proteins, requires precise molecular weight determination to expand. Moreover, the increasing application of AI models and automated proteomic systems for protein modeling drive up demand for precise molecular weight markers in the coming years.

The prestained markers segment accounted for a considerable share of the molecular weight marker market in 2024 due to their direct observation capabilities during gel electrophoresis, combined with ease of use essential. Research communities selected such markers, as they permitted online electrophoretic separation inspection while improving workflow efficiency through reduced post-staining procedures. Additionally, the application of prestained markers extends to all molecular biology protocols despite limited market share data availability from government sources, as they offer efficiency improvements alongside reliability increases.

The specialty markers segment is projected to grow rapidly in the coming years, as molecular biology research has grown demanding through specific requirements. Specialized markers are designed to serve particular bioanalytical applications that require high-performance nucleic acid separation or accurate protein dimension assessment to meet research-specific needs. Furthermore, the research into complex biomolecular interactions drives increasing market demand for enhanced resolution and specificity markers.

The nucleic acid application segment led the global molecular weight marker market in 2024 due to increased investments in genomic diagnostics and research. The National Institutes of Health (NIH) released a robust proteogenomic dataset meant to support cancer researchers exploring complex molecular structures while demonstrating the essential position of nucleic acid applications for personalized medicine. Furthermore, the speed of infectious disease surveillance program funding has created increased adoption of nucleic acid detection technologies, which strengthens dependence on molecular weight ma.

The protein segment will grow rapidly in the coming years as proteomics advances and protein therapeutic development keeps proceeding. The NIH released a comprehensive dataset containing proteomic and genomic data to help cancer researchers investigate molecular dynamics in disease research. Furthermore, the premier AI-driven structure modeling for proteins improves research effectiveness, which drives markets to prefer top-quality protein molecular weight markers.

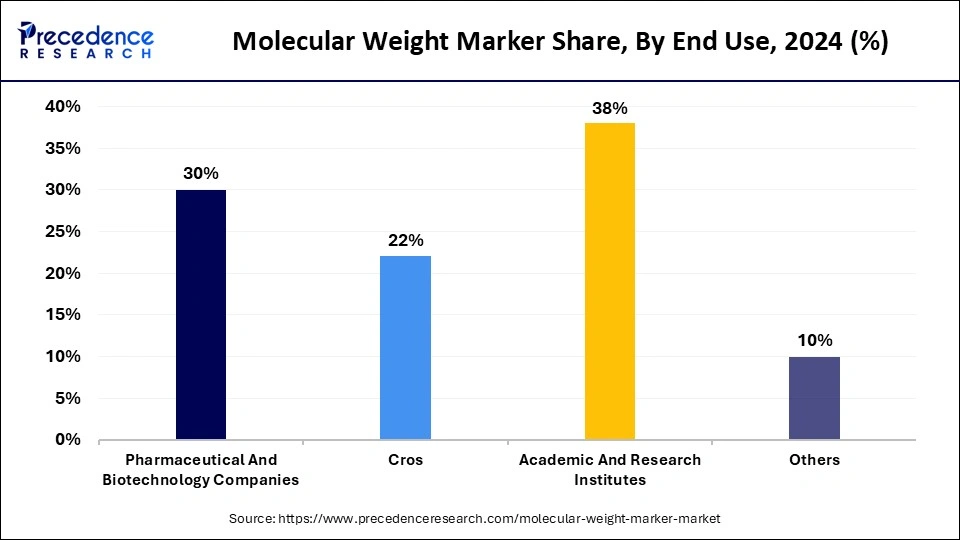

The academic and research institutes segment dominated the global molecular weight marker market in 2024, as these organizations conduct a large number of molecular biology research activities. Research facilities at these academic and research institutions carried out detailed DNA, RNA, and protein analysis work that required molecular weight markers for precision measurement in electrophoresis operations. Furthermore, academic research institutions boosted their marker demand by adopting PCR along with DNA sequencing and blotting techniques.

The pharmaceutical and biotechnology segment is projected to expand rapidly in the market in the coming years, owing to its amplified research and development practices. OECD data demonstrate R&D spending growth by releasing information showing business enterprises, including pharmaceutical and biotechnology groups, make essential financial contributions. Different companies depend on molecular weight markers to validate their experimental results and specifically to characterize biomolecules accurately. Additionally, the expanding biotechnology domain through biologics development and personalized medicine pushed up the demand for exact molecular weight measurement techniques.

By Product

By Type

By Application

By End Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

December 2024

January 2025

February 2025