September 2024

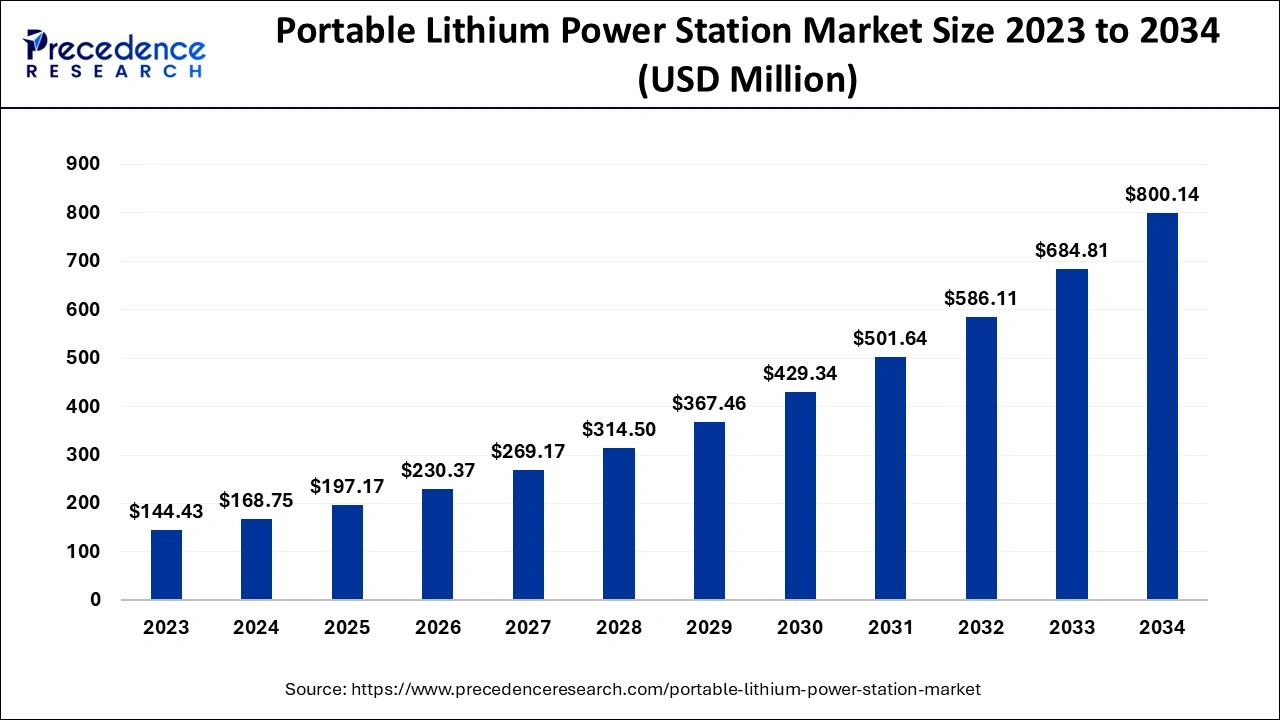

The global portable lithium power station market size accounted for USD 168.75 million in 2024, grew to USD 197.17 million in 2025 and is expected to be worth around USD 800.14 million by 2034, registering a notable CAGR of 16.84% between 2024 and 2034. The North America portable lithium power station market size is evaluated at USD 72.56 million in 2024 and is expected to grow at a CAGR of 16.96% during the forecast year.

The global portable lithium power station market size is calculated at USD 168.75 million in 2024 and is predicted to reach around USD 800.14 million by 2034, expanding at a CAGR of 16.84% from 2024 to 2034. The portable lithium power station market growth is attributed to the increased adoption of portable energy systems for both recreational and emergency use.

Such artificial intelligence (AI) tools are used by companies to work through huge amounts of data, thus facilitating improved patronage and demand prediction. They make work easier in areas, such as stock control, pricing, and even in the entire supply chain. AI-enabled technologies also help make new generations of features, including smart energy management systems, as people search for green and efficient technologies. Furthermore, the adoption of AI is expected to boost the growth of the portable lithium power station market through stimulating innovation and enhancing operational efficiency.

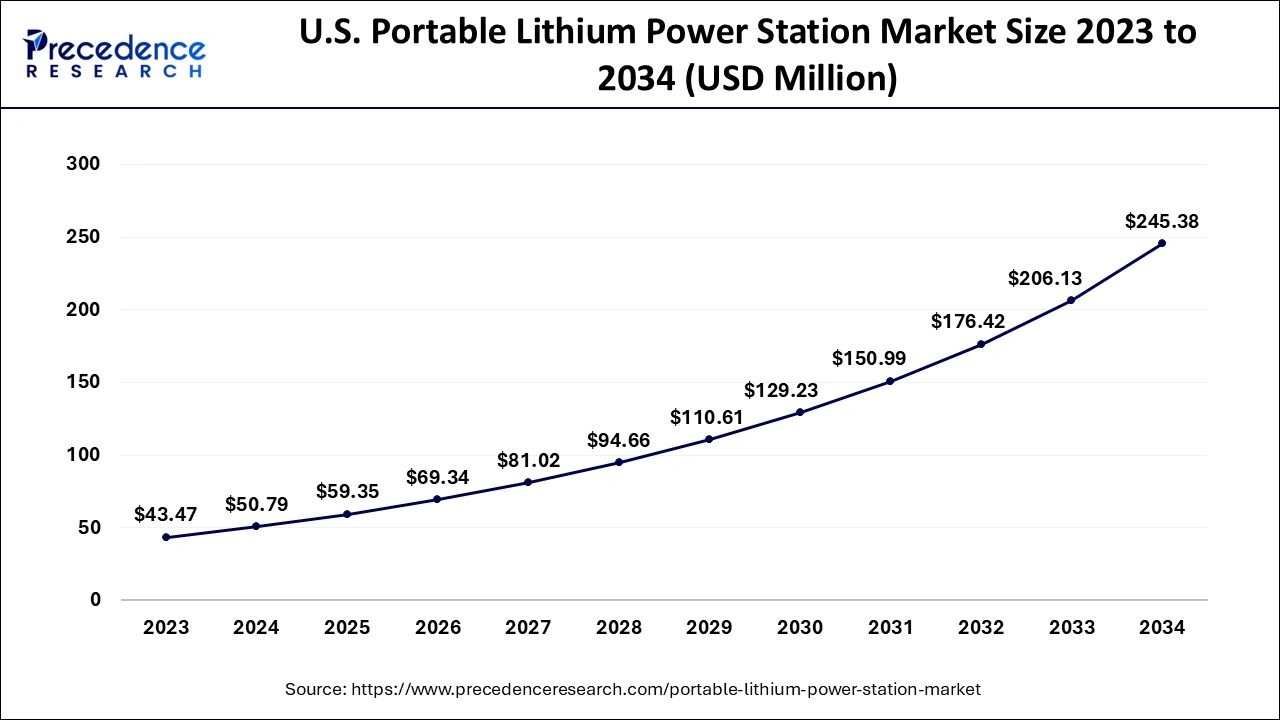

The U.S. portable lithium power station market size is exhibited at USD 50.79 million in 2024 and is projected to be worth around USD 245.38 million by 2034, growing at a CAGR of 17.04% from 2024 to 2034.

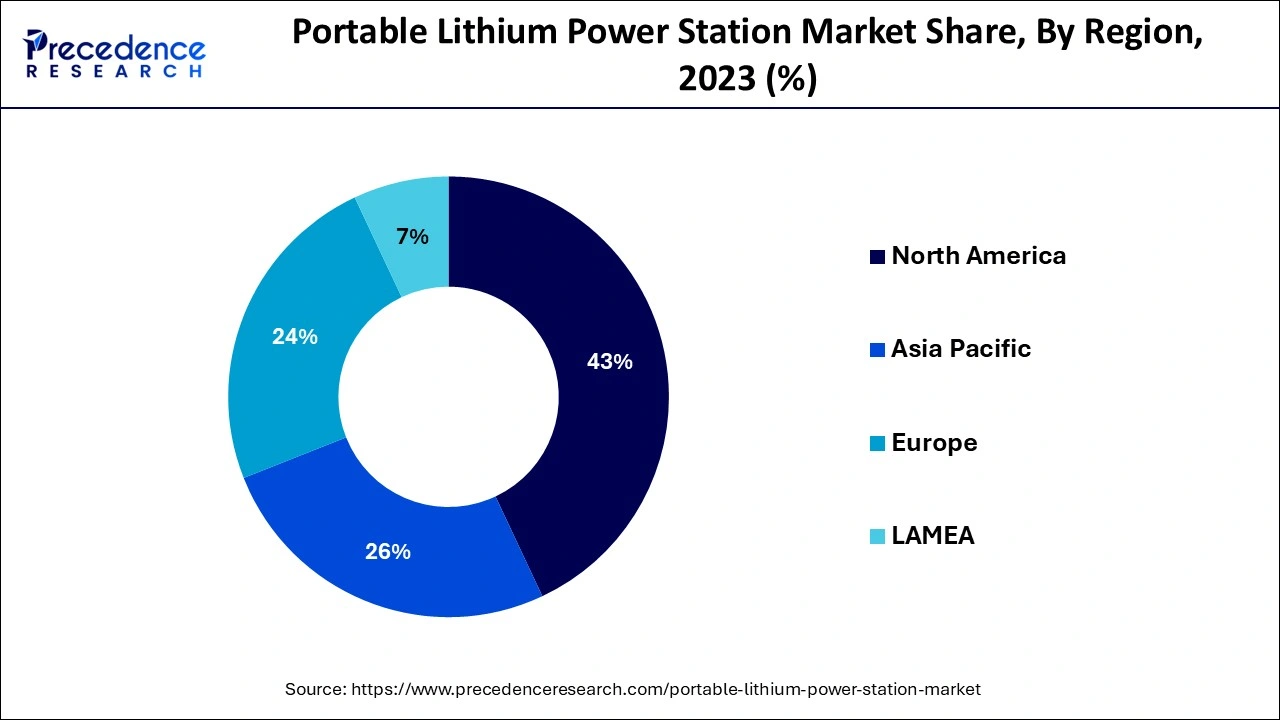

North America dominated the global portable lithium power station market in 2023, capturing the largest revenue share in 2023 due to the increasing demand by consumers for green and decentralized power products. Additionally, the increased focus of the region on the uptake of renewable energy sources and the surge in interest in activities such as camping and recreational vehicle use further boost the demand for portable power stations in this region.

Asia Pacific is projected to host the fastest-growing portable lithium power station market in the coming years, owing to the large population, a growing urbanization rate, and rising energy consumption. The region is transitioning towards sustainable energy and off-grid solutions, leading to increased sales of portable lithium power stations. China, Japan, and India, as leading manufacturers and purchasers of lithium-ion batteries, are among those nations that are heavily investing in renewable energy solutions. Moreover, there is a growing electric power infrastructure in the remote rural areas of developing countries.

The growing need for renewable off-grid power facilitates the portable lithium power station market. These power stations use lithium-ion technology as one of the most innovative, renewable, and efficient sources of power essential for backup power and off-grid solutions. Lithium-ion batteries have become the most sought-after because of properties such as their lightweight, long cycle life, and higher energy density.

Additionally, an increase in the development and application of solar energy technologies is putting pressure on the portable lithium power station market. Portable systems are commonly used, as they offer clean energy to users when they are outdoors or engaging in outdoor activities while at the same time pulling down their carbon footprint.

| Report Coverage | Details |

| Market Size by 2034 | USD 800.14 Million |

| Market Size in 2024 | USD 168.75 Million |

| Market Size in 2025 | USD 197.17 Million |

| Market Growth Rate from 2024 to 2034 | CAGR of 16.84% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Capacity, Sales Channel, Application, End-User, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, and Africa |

Growing demand for clean energy solutions

Growing demand for clean energy solutions is anticipated to drive market growth in the coming years. The demand for clean energy solutions has been steadily increasing. This growth fuels the demand for portable lithium power stations because such products support sustainability as they are eco-friendly and have zero emissions. They are compatible with solar panels to make them attractive to consumers with a concern for the environment. The recently launched Green Deal by the European Commission and the U.S.’s Inflation Reduction Act further facilitate the portable power station market. Additionally, the sales of electric vehicles also reached 2023 over 3.5 million higher than in 2022 worldwide, thus driving the portable lithium power stations market.

Competition from alternative energy storage technologies

Rising competition from alternative energy storage technologies, such as hydrogen fuel cells and advanced lead-acid batteries, is expected to hamper market growth. These technologies provide improvements, such as better performance, durability, or cost compared to the lithium-ion schemes dominating the present market. Advanced innovations in these types of alternatives, which have been spurred by government funding and private investments, take the competition to another level.

Advancements in battery technology

Rising technological advancements in battery efficiency, especially in lithium-ion technology, represent a significant opportunity for the portable lithium power station market. Advancements, including energy density, weight loss, and lifespan, are revolutionizing the application of portable power options. The expanded sector inspired by electric cars and renewable power storage shows that battery technology is relevant in various fields.

The United States Department of Energy provided a significant sum of money towards battery R&D with an emphasis on lightweight and high-capacity batteries. These developments are consistent with estimates for the portable lithium power station market moving towards contributing to portable activities, outdoor uses, backup needs, or integration with renewable energy sources. Furthermore, the power management systems and fast charge capability have been incorporated.

The direct power segment held a dominant presence in the portable lithium power station market in 2023, as they are widely used for emergency backup services and power provision in off-grid areas. These devices provide reliability and are very easy to use, therefore making them the best solution for powering up accessories, such as phones and laptops, as well as some medical equipment. The higher frequency of power blackouts and increasing dependency on reliable energy have given a boost to the industry in North America and Europe.

The solar power segment is expected to grow at the fastest rate in the portable lithium power station market during the forecast period of 2024 to 2034, owing to the emerging tendencies in utilizing renewable energy sources around the world. The government’s promotion of incentives and subsidies for the production of solar energy products makes solar-powered power stations more conducive to consumers. Furthermore, lithium stations that come with solar panels give consumers an off-grid renewable power source suitable for the outdoors and people living in rural areas. This makes consumers lean towards using products that make minimal impact on the climate as the global focus shifts to climate change, thus creating a continual demand for solar systems.

The less than 500 WH segments accounted for a considerable share of the portable lithium power station market in 2023 due to their relatively low cost and small size. Such units mainly operate for personal electronic devices, such as smartphones, laptops, and small apparatuses. This makes them appealing to individuals and small firms in need of portable power supplies. The increased interest in portable generators for the powering of equipment during outdoor activities and emergencies.

The 500 WH to 900 WH segment is anticipated to grow with the highest CAGR in the portable lithium power station market during the studied years, owing to the multifunctional and increased power density. Such factors as the flexibility to ‘work from anywhere’ and increased encouragement for outdoor activities, including usage of electricity for activities in mid-range power stations of this capacity, encourage the achievement of this capacity. Furthermore, remote workers and RV owners always need a mobile power supply.

The e-commerce segment led the global portable lithium power station market in 2023 due to its advantages, which include easy access to or reach by target consumers. Portable power stations are now purchased online through e-commerce platforms, as buyers are able to compare various products, read other customers’ comments, and make their own decisions without physically searching for the stations. Major online retailers, such as Amazon and Walmart, have easy access to all forms of portable lithium power stations, in addition to some complex platforms, including Goal Zero and Jackery.

The brick and mortar segment is projected to expand rapidly in the portable lithium power station market in the coming years, owing to the rising popularity of such aspects as the ability to touch, feel, and experience an object and its simultaneous availability. Store experience for many consumers remains important, particularly when purchasing high-ticket items, including portable lithium power stations. Real space for the stores provides the consumers with the option to make purchases for the products they need on the same day or within the shortest time possible in emergencies. Furthermore, the idea of omnichannel retailing, which is the ongoing implementation of both online and offline selling, is also expected to help stimulate store-based sales.

The emergency power segment dominated the global portable lithium power station market in 2023 due to the growth in the occurrence of natural calamities and power failures in pockets. Because hurricane events, wildfires, and floods are becoming increasingly common due to climate change, the demand for backup power solutions has increased. Portable lithium power stations are advantageous over general generators. They are efficient and also safe for the environment as compared to the common generators that are very noisy, produce toxic gases, and need a lot of maintenance.

The off-grid segment is projected to grow at the fastest rate in the portable lithium power station market in the future years, owing to the growing need for effective, clean, and self-regulated energy, especially for such hard-to-reach regions as rural ones. Reliability from off-grid power generation is thus quite crucial to the user when no dependable electrical grid is available. Portable lithium power stations provide power to homes, cabins, and businesses when not connected to the grid. They also support a sustainable off-grid lifestyle when combined with renewable sources, including solar power systems, thus fuelling the demand for these types of power station solutions.

The residential segment dominated the global portable lithium power station market during the forecasting period due to the increasing demand for non-GRID connected energy systems and emergency power supply across households. Working and even residential users are now employing portable lithium power stations to supply them with power during blackouts and calamities or to minimize the usage of standard grid electricity.

The commercial segment is projected to grow rapidly in the portable lithium power station market in the future years, owing to the escalating demand for efficient, competent, and inexpensive energy solutions by various organizations. Portable lithium power stations are, of late, being embraced by commercial buildings, such as retail shops, restaurants, offices, and hotels, as standby power sources. These systems offer a backup requirement every time there is a problem with electrical power. Furthermore, there are increasing concerns over the availability of clean power and the commercial entities’ efforts to adopt sustainable solutions.

By Type

By Capacity

By Sales Channel

By Application

By End-User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

October 2024

February 2024

August 2024