February 2025

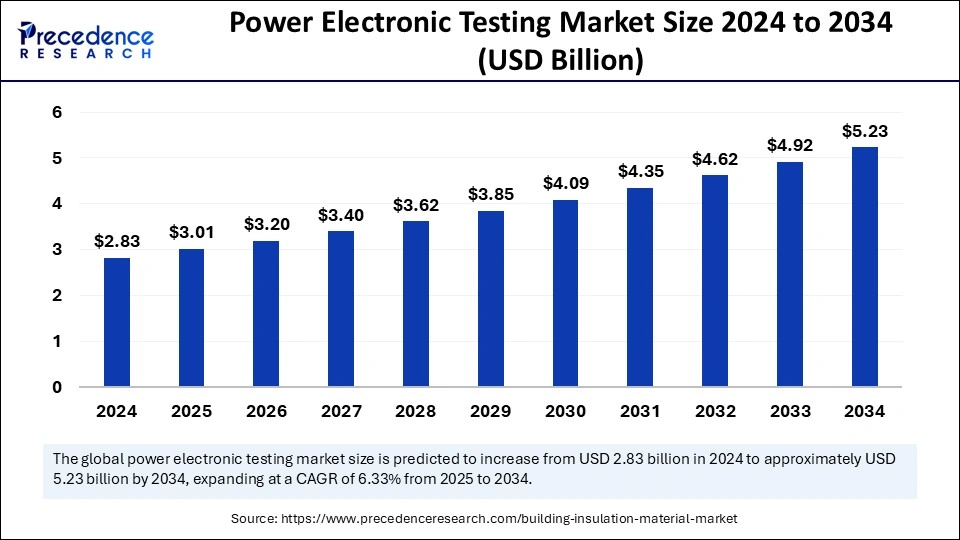

The global power electronic testing market size is calculated at USD 3.01 billion in 2025 and is forecasted to reach around USD 5.23 billion by 2034, accelerating at a CAGR of 6.33% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global power electronic testing market size accounted for USD 2.83 billion in 2024 and is predicted to increase from USD 3.01 billion in 2025 to approximately USD 5.23 billion by 2034, expanding at a CAGR of 6.33% from 2025 to 2034. The power electronic testing market is experiencing rapid growth due to the increasing focus on automation, renewable energy adoption, R&D investments, wide-bandgap semiconductor use, rising electric vehicle demand, and smart grid expansion.

The impact of artificial intelligence in power electronic testing is transformative, supporting data-driven diagnostics, real-time monitoring, and predictive maintenance. AI algorithms can also process complex waveform data to identify early-stage faults at the inverter, IGBT, and SiC component levels; this is especially pertinent in sufficiently demanding domains such as EV and aerospace applications. While conventional testing methods are more perceived and reliant on experience, AI demonstrates proposed methods to complete pattern recognition and anomaly detection rapidly and accurately, with reduced false positives and enhanced up-time production.

AI also supports and drives adaptive testing environments where systems adapt their stress levels or load conditions based on real-time feedback. In manufacturing (testing), AI-based testers can also contribute to improved end-of-line inspection and promote production optimization. AI can also efficiently use digital twins to shorten the time of failure or maintenance events. As power electronics dominate electronic platforms, AI will provide intelligent and scalable testing solutions that will support reliability-testing regimes to ensure that future quality and performance requirements are met.

Power electronic testing is focused on components that conduct power conversions, such as inverters, converters, and power modules. Testing components to make sure they meet reliability, safety, and performance standards under different conditions is essential. Power electronics have become integral to renewable energy, electric vehicles (EVs), and automation. Therefore, testing plays a key role in validating the system conditions prior to deployment. The introduction of wide-bandgap materials, for example, SiC and GaN, with different testing attributes, will increase scope and testing complexity and support the demand for high frequency and high voltage testing of power conversion devices.

The global power electronic testing market is being driven by more electrification, digital control, and efficiency from applying power electronic devices, resulting in more automated, real-time, and precise testing systems. Device architectures of power electronic devices are becoming smaller and more powerful, and hence, there is a continued need for modular, scalable testing platforms. In light of this, there is also pressure for compliance with stringent regulations and the expectation to simulate extreme operating conditions, which will only drive greater change for testing technologies.

| Report Coverage | Details |

| Market Size by 2034 | USD 5.23 Billion |

| Market Size in 2025 | USD 3.01 Billion |

| Market Size in 2024 | USD 2.83 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.33% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Device Type, Application, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Adoption of Hybrid and Electric Vehicles

The rapid uptake of electric and hybrid vehicles continues to be a primary driver behind the growth of the power electronic testing market. Since electric vehicles (EVs) and hybrid-electric vehicles depend on advanced power electronic components, including battery management, energy conversion, and propulsion, ensuring the safety, reliability, and efficiency of these systems is critical. This leads to increased demand for power electronics testing. The rising focus on existing vehicle electrification further drives the market growth. As OEMs (original equipment manufacturers) build high-performance EVs, the need for comprehensive power electronics testing will continue to grow, highlighting the fundamental role of testing in enabling innovation and safety in the next generation of mobility.

High Cost of Testing Infrastructure

The power electronic testing market is struggling with the considerable upfront cost of establishing sophisticated testing facilities. Equipment such as programmable power sources, high-voltage probes, and thermal chambers are expensive, creating a significant barrier for smaller companies. For instance, a small startup creating electric vehicle (EV) inverters may need specialized high-voltage testing to calibrate its units. For many startups, acquiring this equipment is not possible without funding. Companies in developing markets, where budgets are more limited and government funding is a rarity, experience even more hardship with this issue. For example, in India, many small companies in the solar sector are simply unable to access certified labs to conduct needed testing, leaving product launches postponed and profits unrealized.

Rapid Shift Towards Renewable Energy

The rapid shift toward renewable energy presents a significant growth opportunity for the power electronic testing market. In 2024, renewable energy was responsible for more than 90% of new global power capacity, with 585 GW of new renewable energy added, bringing total renewable capacity to 4,448 GW, a 15.1% annual growth rate. This increase was driven by China, which added 278 GW of solar capacity, nearly 64% of the new capacity added worldwide, indicating rapid growth in global investment in clean energy.

With the rising installation of renewable energy systems, there is an increased need for sophisticated power electronics systems to support efficient energy conversion, grid integration, and reliability. With the added complexity of renewable energy technologies, the need for special testing services and general testing services is increasing rapidly. Renewable energy systems require regular testing to ensure optimal performance, enhance safety, and meet regulatory compliance.

The power discrete devices segment held the largest share of the power electronic testing market in 2024. These devices are widely used in various industries due to their low cost. Power discrete devices provide discrete power switching, protection, and control for applications, including automotive and industrial power systems. A broader application domain (from automotive to renewable energy systems) also increases the popularity of power discrete devices as engineers develop systems to optimize costs and quality. The adaptability and ability of these devices to respond to different power needs across power fields further boost their adoption.

The power modules segment is anticipated to grow at the highest CAGR during the forecast period. The segment growth can be attributed to the increasing adoption of these devices in various applications, especially those requiring high efficiency, such as electric and hybrid vehicles, renewable energy systems, and modern industrial machinery. Power modules consist of a combination of several power devices within a single enclosure, providing a higher level of performance and compactness, which is important in fields that require miniaturization and high-power efficiency. The rising production of EVs and a growing reliance on renewable energy systems further drive segmental growth.

The automotive segment dominated the power electronic testing market with the largest share in 2024 and is likely to continue its growth trajectory in the coming years. This is mainly due to the increasing electric vehicle (EV) production and emphasis on power management systems. Governments and industries are now focusing on cleaner transportation solutions, boosting the need for efficient power electronics to control energy flow, enhance battery performance, and provide greater energy efficiency. The automotive sector is witnessing rapid innovations in EV technology. Power electronic testing plays a key role in improving the performance and efficiency of vehicles.

The industrial segment is expected to expand at a significant rate over the projection period due to the rising adoption of automation solutions. Industries have begun to evolve rapidly with electric drives, robotics, and other power electronic-based systems. Much of the automated power electronics in the industry require rigorous testing protocols to ensure reliability, safety, and optimal performance. As industries move toward Industry 4.0 and smart factories, the demand for power electronics in machinery and automated systems for enhancing operation efficiency is increasing. The evolution of industries with new technologies and applications continues to increase demand for effective and precise power electronic testing.

The direct sales segment led the market in 2024. Direct sales are the most prevalent distribution channel in the power electronic testing market because they provide a more personal, customized approach to address the client's specific needs. Manufacturers and service providers offer specialized, customized solutions and engage directly with clients to better understand and address all of their technical needs. This distribution channel fosters long-term relationships and after-sales support, which are particularly important in the power electronics industry where the technical requirements are high. Although other distribution channels are growing, the complexity of power electronics and the need for specialized support will keep direct sales a leader in the market.

The online sales segment is expected to expand at the fastest CAGR over the studied period. New developments in digitalizing businesses and industries have led to a need for convenient, affordable options. As businesses and industries invest in digitalization, online platforms become convenient for customers to purchase testing services, monitor progress, and obtain real-time data. Additionally, online platforms often show competitive pricing models. The continued growth of e-commerce and digitizing services in the power electronics market are leading the charge.

North America: A Dominant Force in Power Electronics Testing

North America dominated the power electronic testing market in 2024. This is mainly due to its technological leadership, innovation, and strong industrial base. The region's interest in smart grids, renewable energy, and energy storage systems significantly contributes to the demand for advanced testing services. The ongoing market growth is supported by significant investments in clean energy initiatives, EV infrastructure, and semiconductor research from both the government and private sector. In addition, new trends such as AI-driven energy management systems and next-gen power devices provide new opportunities for advanced testing techniques and methods.

The U.S. stands out as the leader in power electronics testing in North America, thanks to a robust national push towards clean energy and sustainable technologies, as demonstrated by a range of federal and state grants and programs that prioritize clean energy technologies. The country is also leading the development of semiconductors with the major vendor pursuits to innovate [cut-through] research abundantly supported by federal and state initiatives. Finally, a new solution for power testing is required for the evolving automotive sector with rapid EV development and autonomous technologies. Innovative solutions in power electronics and energy management systems have been developed in collaboration with leading technology companies across the globe that further persist the country’s position in the market.

Asia Pacific: The Fastest-Growing Region

Asia Pacific is expected to witness the fastest growth due to the rapid industrialization, urbanization, and expansion of the consumer electronics sector. Rapidly developing countries like China and India are at the forefront of developing consumer electronics, with huge investments in infrastructure development and technology. In addition, the rapid shift toward srenewable energy and electric vehicles (EVs) is boosting the demand for efficient testing of power electronics. Governments supporting semiconductor manufacture and green technologies are further increasing the market dynamics in the region. China plays a major role in the Asia Pacific power electronic testing market. The country is known for its thriving semiconductor manufacturing industry and focus on efficient power management. The country is the world’s largest producer of consumer electronics. This reinforces and solidifies China's position in the market.

Europe: A Notably Growing Area

Europe is considered to be a notably growing area. Europe's power electronics testing sector is thriving, spurred by a strong commitment to clean energy and sustainability. The focus on energy efficiency and renewable energy integration has increased the usage of testing solutions. The European Union's commitment to carbon-free projects adds urgency for rigorous power electronics testing in multiple uses. Government spending on smart grid technology and the rise of electric mobility have contributed to a favorable business environment.

Germany leads the way in the European power electronic testing market due to its large industrial base and strong automotive and manufacturing sectors. Germany's commitment to sustainability drives demand for power management systems. In addition, Germany's commitment to innovation ensures a continuous need for testing solutions. Collaborations with global tech companies and energy leaders continue to encourage new developments and innovations in power electronics testing processes.

By Device Type

By Application

By Distribution Channel

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

December 2024

August 2024

December 2024