December 2024

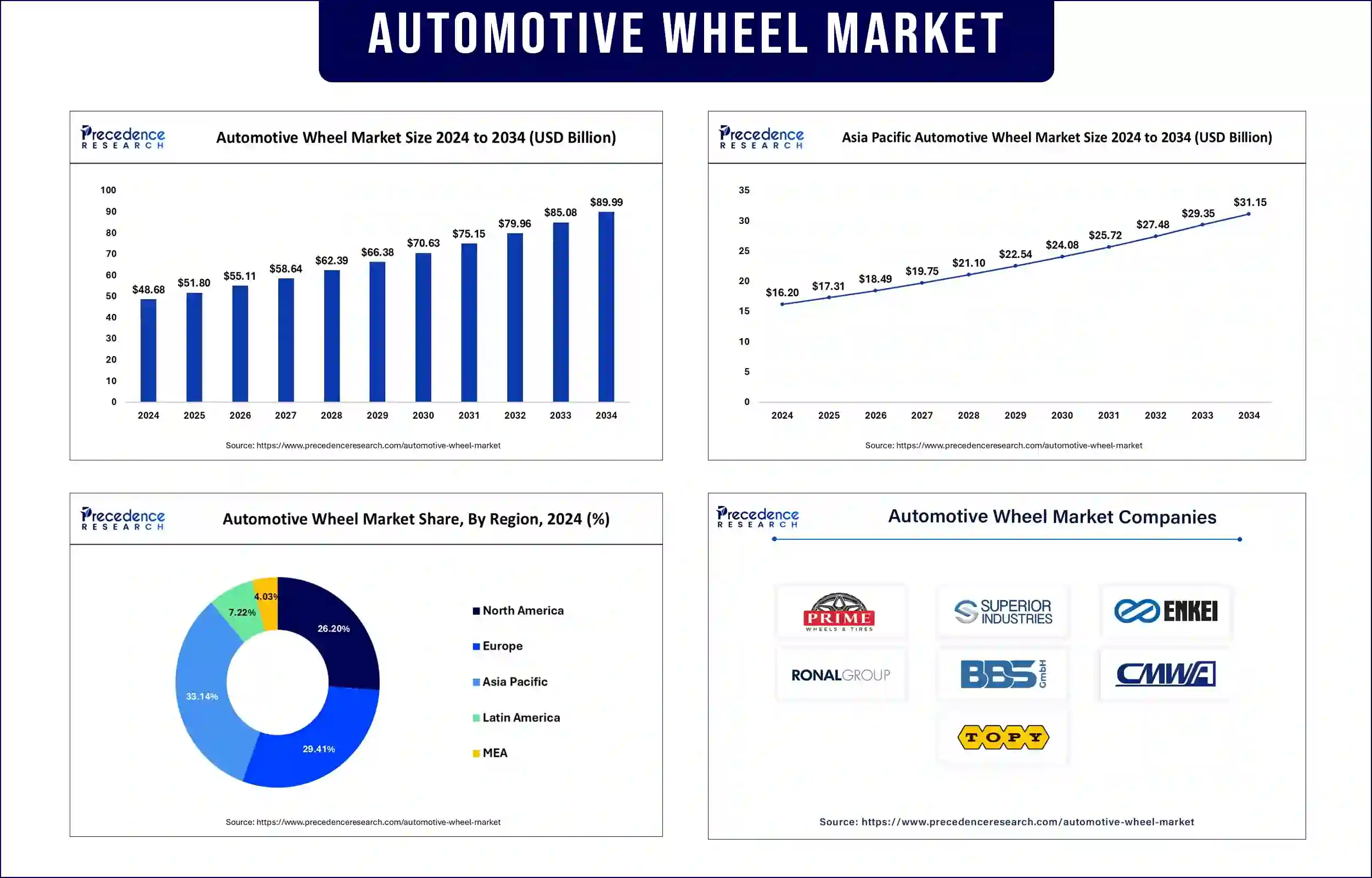

The global automotive wheel market revenue reached USD 51.80 billion in 2025 and is predicted to attain around USD 85.08 billion by 2033 with a CAGR of 6.34%. Stringent government regulations on vehicle efficiency and sustainability are pushing automakers to adopt energy-efficient wheels, supporting overall market growth.

Automotive wheels have an essential position in vehicle performance improvement and energy efficiency enhancements, and safety requirements due to their critical market significance. Manufacturers work on aluminium alloys combined with carbon fiber composites to achieve lightweight materials that improve fuel mileage and cut down environmental discharges. The market push for electric vehicles (EVs) alongside high-performance sports cars drives wheel innovations through aerodynamic development together with advanced coating advancements.

Automakers adopt energy-efficient wheels due to the government's sustainability and efficiency rules, which support the automotive wheel market growth. The development of lightweight aerodynamic wheels remains crucial, as it aids both emission reduction and improves total vehicle efficiency. Such innovations implemented by the automotive industry help enhance public health results while supporting environmental sustainability goals.

Growing Demand for Lightweight Wheels

Automakers are increasingly adopting lightweight wheels to enhance fuel efficiency and performance. Materials, including aluminum, magnesium, and carbon fiber composites, are gaining traction due to their high strength-to-weight ratio. The implementation of lightweight wheels among vehicle components leads to substantial reductions in fuel consumption and emission production.

Lightweight materials stand essential in reaching higher vehicle fuel efficiency levels combined with lower emissions outputs. Lightweight wheels lead to enhanced performance in vehicle handling as well as braking, which results in better safety metrics. The automotive wheel market now faces elevated importance of weight reduction strategies because environmental regulations continue to strengthen across different territories.

Rising Popularity of Custom Wheels

The automotive wheel market customers actively seek performance and customized wheels as demand for the industry continues to rise. Vehicle buyers select products that enhance exterior appearance and offer large wheel dimensions, along with specialty finishes, which enable them to customize their vehicles according to personal preferences. The National Highway Traffic Safety Administration (NHTSA) serves as an authority that emphasizes the safety risks associated with aftermarket changes that alter vehicle dynamics while urging both wheel manufacturers and automakers to establish proper safety and fuel efficiency balances and standards.

The durability and resistance to corrosion of custom wheels improve significantly as advanced developments in powder coating and electroplating technologies make them perform better in harsh weather environments. Aftermarket wheels continue to experience strong demand because vehicle owners have increasing disposable income and stronger interests in vehicle personalization.

Advancements in Manufacturing Technologies

Innovations such as flow forming, forged wheel production, and 3D printing are revolutionizing the wheel manufacturing process, offering improved strength, reduced weight, and cost efficiency. Automotive regulatory bodies work for sustainability through new eco-friendly manufacturing processes that optimize material utilization and enable effective scrap metal recycling to reduce carbon emissions. The advancements in wheel production become strategic drivers of market evolution since they enhance automobile performance and support worldwide environmental targets.

Increasing EV Adoption

The shift toward electric mobility is driving the development of aerodynamically optimized wheels that contribute to battery efficiency and extended range. The study proves that wheel design is essential to electric vehicle effectiveness. The rapidly growing electric vehicle adoption drives manufacturers to create wheel designs that fulfill efficiency standards and performance needs, along with attractive aesthetic value for advancing consumer preferences.

Asia Pacific

Asia Pacific is projected to dominate the market in the coming years. The fastest-growing region, fueled by the expanding automotive industry in China, India, and Japan. The combination of government efforts that back electric vehicle manufacturing with growing investments in lightweight materials stimulates rapid market expansion in this region.

Japan's Ministry of Economy Trade and Industry (METI) executed an increase in funding which directed toward studies of future materials specifically for light weight high-strength alloys intended for electric vehicle usage. Regional partnerships between automobile manufacturers and material science companies are speeding up the advancement of carbon fiber and magnesium wheel technologies to boost market growth in this region.

Europe

Europe is anticipated to grow at the fastest rate in the automotive wheel market during the forecast period. Strong regulatory policies on vehicle emissions and sustainability, coupled with a high penetration of premium and sports cars, are boosting the demand for advanced wheel technologies. The successful achievement of EU climate neutrality targets by 2050 depends heavily on wheel designs that minimize resistance and optimize aerodynamics.

The council passed the Euro 7 regulation in April 2024 that strengthens emission standards for cars, vans, and trucks, thus creating a necessity for components that minimize vehicle emissions. The European Parliament and Council united in 2023 to modernize COâ‚‚ emission performance standards for new passenger cars and vans that lead to the total elimination of new vehicle emissions by 2035. The newly acquired investments lead to multiple wheel design advancements and material innovations, which improve both vehicle efficiency and performance attributes.

| Report Attribute | Key Statistics |

| Market Revenue in 2025 | USD 51.80 Billion |

| Market Revenue by 2033 | USD 85.08 Billion |

| CAGR | 6.34% |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | North America |

| Base Year | 2024 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

By Material Type

By Vehicle Type

By End User

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape

overview @ https://www.precedenceresearch.com/sample/1473

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com| +1 804 441 9344

December 2024

January 2025

April 2025

January 2025